Managed Domain Name System (DNS) Market by DNS Service, DNS Server (Primary Servers and Secondary Servers), Cloud Deployment, End User, Enterprise (BFSI, Retail & eCommerce, Media & Entertainment, Healthcare) and Region - Global Forecast to 2028

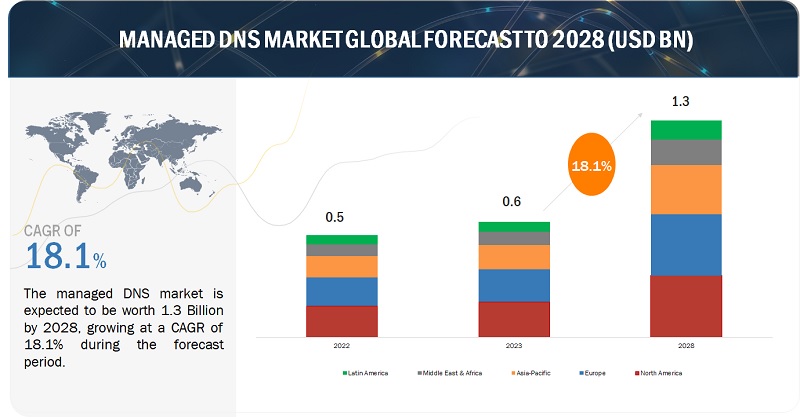

[247 Pages Report] MarketsandMarkets forecasts that the managed DNS market size is projected to grow from USD 0.6 billion in 2023 to USD 1.3 billion by 2028, at a CAGR of 18.1% during the forecast period. Improving customer experience is a priority for telecom operators. With the escalating frequency and sophistication of cyber threats, organizations have shown a heightened interest in secure and resilient DNS solutions to protect against DNS-based attacks like DDoS (Distributed Denial of Service) attacks. The increasing use of mobile devices for internet access has led to a surge in DNS queries from various locations and devices, driving the need for responsive and reliable managed DNS.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Managed DNS Market Dynamics

Driver: High return on investment and enhanced customer experience

DNS plays a vital role when it comes to the reliability and performance of cloud and web applications. Enterprises require a higher CAPEX for setting up and managing DNS infrastructure, which acts as a central system to run the internet ecosystem. Owning the DNS server provides a business with more control as its network administrator can manage, configure, and secure the DNS. However, ownership of DNS servers comes with several disadvantages such as maintaining in-house IT teams, continuous updating of DNS networks, vulnerabilities, and higher CAPEX investment. As a result, enterprises prefer managed DNS which comes with benefits such as a global anycast network, a dedicated team of experts for DNS management, scalability, reliability, security, and availability. The majority of DNS providers offer cloud-based services that reduce the overall CAPEX and OPEX with faster TTM. The simple nature of DNS services with 24*7 support services significantly drives demand for managed DNS across SMEs and large enterprises. The competitive environment and global economic situation have accelerated the adoption of cost-effective measures to restructure business models. The increasing shift of enterprises toward digital transformation and accelerating customer experience is also leading to the adoption of DNS services that ultimately reduce enterprise costs. The cloud offers the pay-as-you-go model, which enables enterprises to pay as per their usage of DNS services, leading to reduced costs. Consumer behavior and demands have been evolving tremendously in recent years. The rising customer expectations and growing competition among the leading market players are increasing the demand for cost-effective measures to enhance operational efficiencies. Enterprises cannot afford to have a lower customer experience due to the unavailability of their websites. 24*7*365 availability of websites and cloud applications with 99.999% SLA uptime helps enterprises engage with their employees and customers and improve workplace productivity.

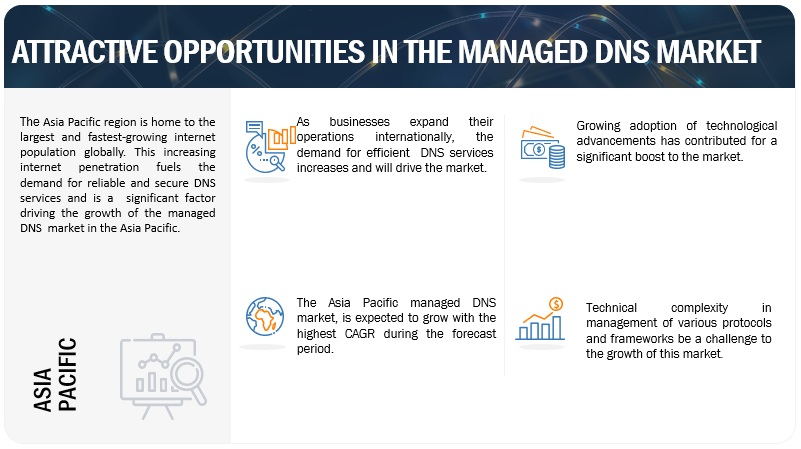

Restraint: Technological complexities

The technological complexity within the domain name system (DNS) services market presents a multifaceted challenge for providers. As the DNS ecosystem undergoes continuous evolution with the introduction of technologies such as IPv6, DNS Security Extensions (DNSSEC), and advanced routing protocols, service providers must grapple with seamless integration. The implementation of DNSSEC, aimed at enhancing security through cryptographic signatures, demands meticulous configuration. Additionally, the transition to IPv6 and the coexistence of IPv4 and IPv6 addresses introduce intricacies in configuration and management. In the context of multi-cloud environments, DNS services must adeptly integrate with diverse infrastructures and service offerings. The growing emphasis on automation and orchestration in IT operations necessitates providers to navigate the complexities of automated workflows while minimizing the risk of errors. Scalability challenges, particularly in handling increased volumes of DNS queries, and the intricacies of DNS load balancing further contribute to the technological intricacies. Successful providers must invest in research and development, maintain a skilled workforce, and adopt advanced technologies to effectively navigate and overcome these complexities, ensuring the delivery of reliable and innovative managed DNS in a competitive market.

Opportunity: The increasing online presence of various businesses across different verticals

Sectors such as retail and eCommerce, media and entertainment, and BFSI follow the customer-centric business model, which ensures higher customer experience. eCommerce companies such as Amazon, Walmart, Flipkart, and Alibaba have started big billion shopping days that lead to higher revenue and humongous web traffic. Over the last few years, retailers have worked on delivering the best end-to-end experience to users. The eCommerce sector has been growing at an unprecedented rate in developed and developing economies. The growing online customer base is compelling retailers to enhance customer experience through safeguarding web infrastructure. DNS service providers help retail and eCommerce companies safeguard DNS infrastructure from DDoS attacks. The COVID-19 pandemic has created huge opportunities for eCommerce businesses in the coming years. The following table depicts the sector-wise use cases/application areas that will increase DNS usage, in turn creating opportunities for managed DNS service providers.

Challenge: Market competition

In the realm of managed DNS, market competition emerges as a formidable challenge, shaping the strategies and operations of service providers. The landscape is characterized by intense rivalry, prompting providers to navigate several critical factors. Pricing pressures create a dynamic where providers must find a delicate equilibrium between offering competitive rates and maintaining the quality and features of their DNS services. Innovation becomes paramount as companies strive to differentiate themselves, requiring ongoing investment in research and development to introduce new features and stay ahead of technological trends. Quality of service stands as a non-negotiable criterion, with providers needing to ensure low latency, high reliability, and robust security to retain and attract clientele. The global reach of network infrastructure, customer support excellence, and transparent Service Level Agreements (SLAs) are pivotal elements in this competitive landscape. Marketing and branding strategies play a crucial role in establishing a distinct identity while addressing concerns related to vendor lock-in becomes essential for customer retention. Regulatory compliance, potential mergers and acquisitions, and a continuous adaptation to market dynamics further contribute to the intricate challenges posed by competition.

Managed DNS market Ecosystem

Prominent companies in this market include a well-established, financially stable provider of the managed DNS market. These companies have innovated their offerings and possess a diversified product portfolio, state-of-the-art technologies, and marketing networks. Prominent companies in this market include AWS (US), Cloudflare (US), DNS Made Easy (US), GoDaddy (US), Vercara (US), Akamai (US), CDNetworks (US), Microsoft (US), NS1 (US), Oracle (US).

By enterprise, the education segment is expected to grow with the highest CAGR during the forecast period

In the education industry, managed DNS offers benefits such as load balancing to handle peak traffic on educational websites, DDoS mitigation to safeguard against cyber threats, and geographical load balancing for global institutions seeking optimized content delivery. With user-friendly interfaces and customization options, managed DNS facilitates easy domain management, including the creation of custom records and configurations. The redundancy and failover capabilities ensure uninterrupted access to critical learning platforms, while support for SPF and DKIM enhances email security, a vital aspect of communication in educational settings. Scalability features enable institutions to adapt to changing demands, and analytics tools contribute to proactive monitoring and optimization of DNS performance

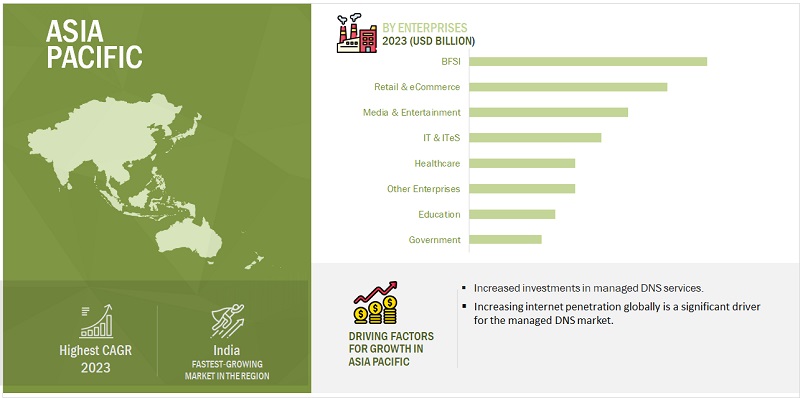

By enterprise, the BFSI segment holds the largest market size during the forecast period

BFSI is a vital industry vertical, as it deals with financial data. The changes in economics significantly affect banks, insurance firms, and other players in the financial sector. The management in this vertical is under constant pressure to meet the required targets, and thus, needs a network that is more reliable and robust. Therefore, advanced technologies and various software and solutions can help BFSI companies prioritize their actions to manage their network smoothly.

Based on region, North America holds the largest market size during the forecast period

The managed DNS market in North America has been experiencing significant growth and development. The managed DNS market in North America is characterized by a dynamic interplay of factors that shape its landscape. With the pervasive increase in internet usage for diverse activities, the demand for reliable DNS services has grown substantially. Security concerns remain a pivotal driver, compelling businesses to seek managed DNS providers offering robust protection against cyber threats. Cloud adoption trends contribute significantly to the market, favoring providers with seamless integration capabilities. Performance optimization is a focal point, emphasizing features like low latency and effective

Market Players:

The major players in the Managed DNS market are AWS (US), Cloudflare (US), DNS Made Easy (UK), GoDaddy (US), and Akamai (Spain). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches, product enhancements, and acquisitions to expand their footprint in the managed DNS market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2018-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) Million/Billion |

|

Segments Covered |

DNS Service (Anycast Network, Distributed Denial of Service Protection, GeoDNS, Other DNS Services), DNS Server (Primary DNS Servers, Secondary DNS Servers), Cloud Deployment (Public Cloud, Private Cloud, Hybrid Cloud), End User (Service Providers, Enterprises), Enterprise (BFSI, Retail & eCommerce, Media & Entertainment, Healthcare, IT & ITeS, Government, Education, Other Enterprises), and Region |

|

Region covered |

North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

|

Companies covered |

AWS (US), Cloudflare (US), DNS Made Easy (US), GoDaddy (US), Vercara (US), Akamai (US), CDNetworks (US), Microsoft (US), NS1 (US), Oracle (US), CloudfloorDNS (US), Google (US), F5 (US), No-IP (US), Netriplex (US), easyDNS (Canada), ClouDNS (Bulgaria), DNSimple (US), EuroDNS (Luxembourg), Gransy (Czech Republic), BlueCat (Canada), NuSEC (US), Rage4 (Ireland), StackPath (US), Total Uptime (US), PowerDNS (Netherlands) |

This research report categorizes the managed DNS market based on DNS service, DNS server, cloud deployment, end user, enterprise, and region.

Based on DNS Service:

- Anycast Network

- Distributed Denial of Service Protection

- GeoDNS

- Other DNS Services

Based on DNS Server:

- Primary DNS Servers

- Secondary DNS Servers

Based on Cloud Deployment

- Public Cloud

- Private Cloud

- Hybrid Cloud

Based on End User

- Service providers

- Enterprises

Based on Enterprise:

- BFSI

- Retail & eCommerce

- Media & Entertainment

- Healthcare

- IT & ITeS

- Government

- Education

- Other Enterprises

Based on the region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Spain

- Italy

- Nordic Countries

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia & New Zealand (ANZ)

- Southeast Asia

- Rest of Asia Pacific

-

Middle East & Africa

-

GCC Countries

- UAE

- KSA

- Rest of GCC Countries

- South Africa

- Rest of Middle East & Africa

-

GCC Countries

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In April 2023, IBM acquired NS1. With the acquisition, IBM is adding core networking services, including NS1’s managed DNS capabilities, to its growing portfolio of network automation software.

- In February 2023, CDNetworks announced support for QUIC and HTTP/3, to enhance the company’s capabilities in web application performance and improve the efficiency of network transmissions.

- In February 2022, Cloudflare acquired Vectrix, to help businesses gain visibility and control of their applications. V Citrix enhances Cloudflare’s existing Zero Trust platform, Cloudflare One, by allowing security teams to scan third-party tools–including Google Workspace, GitHub, and AWS–to detect and mitigate issues such as inappropriate file sharing and user permission misconfigurations.

- In July 2022, NS1 announced two new supports for DNS record types: SVCB (“service binding”) and HTTPS (Hypertext Transfer Protocol Secure).

- In September 2022, Cloudflare announced Turnstile, a simple, private way to replace CAPTCHA (Completely Automated Public Turing test to tell Computers and Humans Apart) and help validate humanity across the Internet.

Frequently Asked Questions (FAQ):

What is the definition of the managed DNS market?

Managed DNS refers to the storage of DNS records on an authoritative DNS server hosted by DNS service providers. Enterprises and service providers can use managed DNS service providers to access websites and email services, as well as scale and support businesses' DNS infrastructure. These services include primary and secondary DNS servers, DNS failover, GeoDNS, Domain Name System Security Extensions (DNSSEC), Distributed Denial of Service (DDoS) protection, load balancing, and 99.999% service availability.

What is the market size of the managed DNS market?

The managed DNS market size is projected to grow from USD 0.6 billion in 2023 to USD 1.3 billion by 2028, at a CAGR of 18.1% during the forecast period.

What are the major drivers in the managed DNS market?

The major drivers of the managed DNS market are securing websites from DDoS attacks, low cost associated with managed DNS, high return on investment, and enhanced customer experience.

Who are the key players operating in the managed DNS market?

The major players in the managed DNS market are AWS (US), Cloudflare (US), DNS Made Easy (US), GoDaddy (US), Vercara (US), Akamai (US), CDNetworks (US), Microsoft (US), NS1 (US), Oracle (US), CloudfloorDNS (US), Google (US), F5 (US), No-IP (US), Netriplex (US), easyDNS (Canada), ClouDNS (Bulgaria), DNSimple (US), EuroDNS (Luxembourg), Gransy (Czech Republic), BlueCat (Canada), NuSEC (US), Rage4 (Ireland), StackPath (US), Total Uptime (US), PowerDNS (Netherlands).

What are the opportunities for new market entrants in the managed DNS market?

The major opportunities of the managed DNS market are growth in cloud computing, increasing online presence of retail & eCommerce, media & entertainment, & BFSI businesses. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

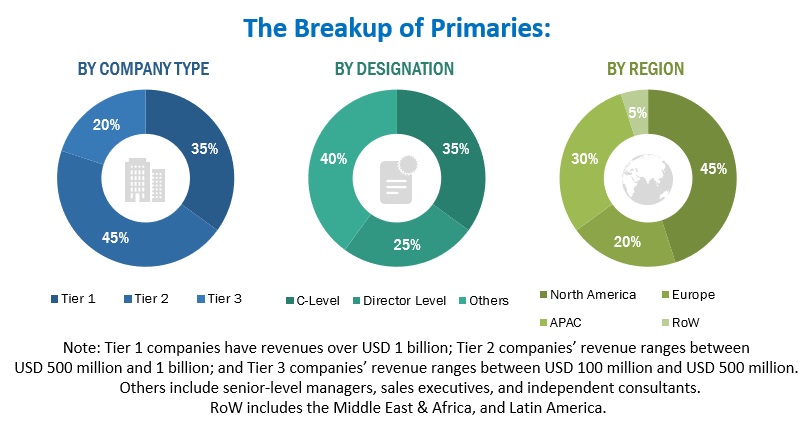

The study involved four major activities in estimating the current size of the global managed DNS market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total managed DNS market size. After that, the market breakup and data triangulation techniques were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Bloomberg and BusinessWeek, have been referred to identify and collect information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers; and journals, such as Linux Journal and Container Journal, and articles from recognized authors, directories, and databases.

Primary Research

Various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Marketing Officers (CMO), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the managed DNS market along with the associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. Following is the breakup of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

Designation |

|

GoDaddy |

Senior Manager |

|

BlueCat |

VP |

|

Cloudflare |

Business Executive |

Market Size Estimation

For making market estimates and forecasting the managed DNS market, and other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global managed DNS market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the Managed DNS market have been identified through extensive secondary research.

- The market size, in terms of value, has been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Managed DNS market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Managed DNS market Size: Top-Down Approach

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

Managed DNS refers to the storage of DNS records on an authoritative DNS server hosted by DNS service providers. Enterprises and service providers can use managed DNS service providers to access websites and email services, as well as scale and support businesses' DNS infrastructure. These services include primary and secondary DNS servers, DNS failover, GeoDNS, Domain Name System Security Extensions (DNSSEC), Distributed Denial of Service (DDoS) protection, load balancing, and 99.999% service availability.

Key Stakeholders

- Managed DNS service providers

- Web hosting providers

- DNS security providers

- Domain name registrars

- Mobile Network Operators (MNOs)

- Independent Software Vendors (ISVs)

- Communication Service Providers (CSPs)

- Content Delivery Network (CDN) Providers

- System Integrators (SIs)

- Resellers

- Value-added Resellers (VARs)

- Managed Service Providers (MSPs)

- Compliance regulatory authorities

- Government authorities

- Investment firms

- Cloud service providers

- Technology vendors

Report Objectives

- To determine, segment, and forecast the global managed DNS market based on DNS service, DNS server, cloud deployment, end user, enterprise, and region in terms of value.

- To forecast the size of the market segments to five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the market.

- To study the complete value chain and related industry segments and perform a value chain analysis of the market landscape.

- To strategically analyze the macro and micro markets to individual growth trends, prospects, and contributions to the total market.

- To analyze the industry trends, pricing data, patents, and innovations related to the market.

- To analyze the opportunities for stakeholders by identifying the high-growth segments of the market.

- To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies.

- To track and analyze competitive developments, such as mergers & acquisitions, product launches & developments, partnerships, agreements, collaborations, business expansions, and Research & Development (R&D) activities.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of an additional two market players

Growth opportunities and latent adjacency in Managed Domain Name System (DNS) Market