Drug Discovery Services Market by Process (Target Selection, Hit-to-lead), Type (Chemistry, Biology), Drug Type (Small Molecule, Biologics), Therapeutic Area (Oncology, Neurology, Infectious), End User (Pharma, Biotech, Academic) & Region - Global Forecast to 2028

Updated on : June 15, 2023

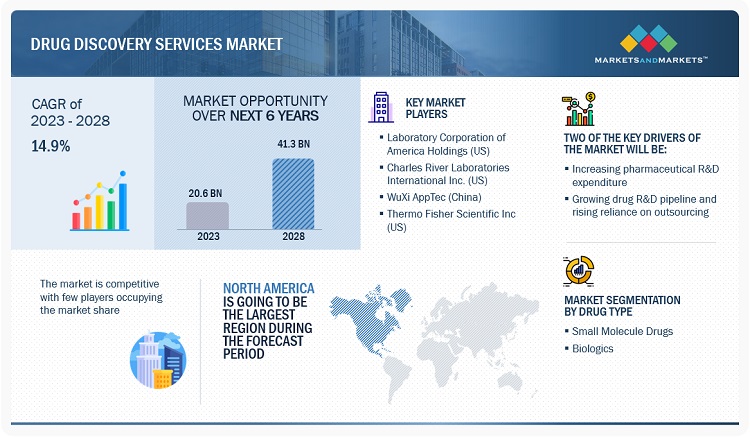

The global drug discovery services market in terms of revenue was estimated to be worth $20.6 billion in 2023 and is poised to reach $41.3 billion by 2028, growing at a CAGR of 14.9% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. Increasing research and development investments made by pharmaceutical and biopharmaceutical companies, growing R&D pipeline for pharmaceutical drugs influencing the growth in demand for outsourcing the analytical testing services, global initiatives made for research on rare disease and orphan drugs, and maximized cost of in-house development of drugs are driving the growth for market. Also, technological advancements, the introduction of new drug discovery techniques, the expiry of patents, and rising demand for specialized testing services among end users are expected to offer growth opportunities to players in this market. However stringent regulation concerning animal use for drug discovery and the shortage of skilled professionals prove to be an restraint and challenge for drug discovery service providers.

Attractive Opportunities in the Drug Discovery Services Market

To know about the assumptions considered for the study, Request for Free Sample Report

Drug Discovery Services Market Dynamics

DRIVER: Growing R&D Expenditure in Pharma-Biotech Sector

Drug discovery and development have seen significant growth over the last decade in terms of clinical studies and the introduction of novel drug molecules. As per ClinicalTrials.gov, the number of registered studies went up from 32,517 in 2019 to 36,770 in 2022, at a CAGR of 4.2%. Companies operating in the Pharmaceutical and biopharmaceutical industry invest laboriously in developing novel drugs. Biopharmaceutical companies spend resources for research and development to deliver high-quality and innovative products to gain market capital. After studying the recent industry trends, it was observed that the leading pharma companies are increasing their R&D capabilities through significant R&D investments to see capital returns in long term and through collaborative R&D efforts. In a recent study published by Evaluate Pharma, the worldwide pharmaceutical R&D spending was valued at USD 144 billion in 2014, and this figure is estimated to reach USD 285 billion by 2028.

The growing R&D spending by pharmaceutical and biopharmaceutical companies is encouraging them to go for fully integrated or functional outsourcing services for drug discovery and development, from the early development stage to the late-stage development phase. The pharmaceutical companies have budget constraints and need to contain fixed costs, hence outsourcing has evolved as a strategic alternative to overcome the lack of in-house resources required for new product development. Major pharma companies are transitioning to a leaner business model that is dependent heavily on outsourcing. Many pharmaceutical and biopharmaceutical companies prefer to outsource their testing functions during R&D to improve profitability, meet the timelines involved in drug development, and save costs. This can be confirmed from the recent agreements by major pharmaceutical companies with CROs providing drug discovery and development services. Thus, increasing pharmaceutical R&D expenditure supports the growth of the market.

RESTRAINT: Stringent regulations governing drug discovery and animal usage

The major focus of regulatory authorities during drug approval is securing safety and efficacy. Even if these approaches confirm the quality of the products launched in the market, they significantly increase the cost of drug development process of the final product. For regions with price-sensitive emerging markets, this factor can significantly impact the uptake of a particular drug. Aside from this, multiple legislations that ensure the quality of the product (such as GMP and GLP) usually increases the manufacturing costs.

Also, there are strict guidelines govern the usage of animals in drug discovery. Mice, rats, fish, amphibians, and reptiles are the most used animals in any research. Scrutiny regarding the ethical use of animals in research has pushed governments to introduce legislation for animal safety and use, which presents several challenges to the smooth functioning of drug discovery research, and this has reinforced companies to implement other techniques to minimize animal use. For example, Novo Nordisk uses biosimulation, which uses computer models to simulate human biology. However, this has not been fully adopted across the industry.

Computer modeling is another new technology used to predict drug metabolism. However, this computer modeling technique, in silico, is still gaining support and remains in the early phase of industry adoption. It is being tested and is not expected to surpass animal testing during the forecast period fully. The viability of these AI models compared to animal models is being studied; hence, while animal usage concerns may be bypassed in the future, they are expected to restrain the market over the forecast period.

OPPORTUNITY: Technological advancements and new drug discovery techniques

Technological innovations play a significant role in increasing the efficiency and time-to-market for new drugs that are being discovered. Larger CROs have been at the forefront of this innovation. Some prominent solutions have been listed below:

- Next-generation proteomics: Proteomics technologies such as mass spectrometry are being considered powerful tools to deliver significant insights across every stage of the oncology drug discovery pipeline—for instance, helping uncover and validate novel drug targets, helping to understand drug mechanisms of action, and helping identify novel diagnostic, prognostic, or predictive biomarkers, etc.

- 3D-bioprinting to create advanced drug models: 3D-bioprinting technology is considered a powerful tool for building tissue and organ structures for drug discovery. In general, bioprinting uses a 3D printer to accurately deposit cells and biomaterials into precise geometries to create anatomically correct biological structures. While traditional 3D printing uses metals, plastics, and polymers, bioprinting deals with living cells and biological matrices. Hence, there are significant challenges to transitioning from traditional 3D printing to bioprinting and ultimately achieving functional outcomes in bioprinted tissues.

- Lab robotization and automation: Several companies are investigating lab automation and robotization with the help of AI for drug discovery. These include Strateos (US), Emerald Cloud Lab (US), and Arctoris Pte Ltd (Singapore), which are focused on AI-driven automated and robotized labs for drug discovery.

- Quantum theory and quantum computing: The traditional computational method for modeling in synthetic and organic chemistry, medicinal chemistry, and drug design is molecular mechanics (MM). However, molecular mechanics has some limitations when studying electron-based properties within the drug-receptor microenvironment. Quantum mechanical (QM) methods substantially increase the accuracy of predictions and provide much more relevant models of chemical and biological objects and their interactions, but QM methods are costlier.

- Cell-free DNA for drug discovery & Development: Cell-free DNA (cfDNA) will be central in identifying protein targets in the oncology area, assessing the efficacy of drugs targeting them in clinical trials, and identifying optimal combination therapies.

Such advancements in technology will significantly drive the market for drug discovery services.

CHALLENGE: Shortage of Skilled Personnel

The pharmaceutical and biopharmaceutical industry is constantly evolving at a fast pace and professionals need to keep pace with the dynamic changes in the pharmaceutical R&D technologies and methodologies, provide quality services, and comply with good laboratory practices. The drug discovery service providers face problems in gaining and retaining well trained and skilled professionals as they compete with pharmaceutical and biotechnology companies and academic and research institutions for qualified and experienced scientists.

To compete efficiently, companies have to offer higher compensations and other benefits; this may affect the finances and results of operations of players, especially small-scale analytical testing providers. Thus, shortage of skilled professionals may hamper the adoption of new technologies and methodologies and inhibit the growth of the market in the coming years.

Drug Discovery Services Market Ecosystem

The market ecosystem comprises raw material suppliers, drug discovery service providers, and end users such as pharmaceutical & biotech companies, academic institutes, small CROS, and clinical laboratories. Raw material suppliers and service providers offer various supplies and services, such as instruments, consumables, assays, kits, and accessories for drug discovery studies such as PK/PD, ADME, DMPK, and other studies. CROs partner with their clients to create a trial design, implementation, and management strategy. This long-term relationship enables the partners to conduct trials successfully and bring new products into the market. Over time, the volume of work contracted out can be expanded, depending on how comfortable both partners are about taking the partnership forward.

The prominent drug discovery service providers are Laboratory Corporation of America Holdings (US), Eurofins Scientific SE (Germany), Charles River Laboratories International, Inc. (US), Evotec SE (Germany), Wuxi AppTec (China), Syngene International Limited (India), Curia Global Inc. (US), Pharmaron Beijing Co., Ltd. (China), Piramal Enterprises Limited (India), Thermo Fisher Scientific Inc. (US), Jubilant Pharmova Limited (India), GenScript Biotech Corporation (US), Shanghai Medicilon Inc. (China), and Frontage Holdings Corporation (US).

Ecosystem Analysis: Drug Discovery Services Market

Source: Annual Reports, SEC Filings, Investor Presentations, Expert Interviews, and MarketsandMarkets Analysis

Based on type, Chemistry Services segment accounted for the largest market share of the drug discovery services industry

Based on type, the drug discovery services market is segmented into chemistry services and biology services. The chemistry services segment commanded the largest share of this market in 2022. Growth in this market segment is largely due to the widespread application of chemistry services in various early drug development phases to deliver robust drug candidates. The extensive chemistry usage in academics, biotechnology companies, and large pharmaceutical companies also supports market growth. Biology services are expected to grow at a slower rate over the forecast period.

Based on drug type, small molecule drugs segment accounted for the largest market share of the drug discovery services industry

Based on drug type, the drug discovery services market is segmented into small-molecule drugs and biologics based on drug type. Small-molecule drugs commanded the largest share of the market in 2022. The large share of this segment can be attributed to the ease of working with small molecules, their low cost, and the increasing number of start-ups and new entrants focusing on developing small-molecule drugs.

Based on therapeutic area, oncology segment accounted for the largest market share of the drug discovery services industry

Based on the therapeutic area, the drug discovery services market is broadly segmented into oncology, infectious diseases, neurological diseases, immunological diseases, endocrine and metabolic diseases, respiratory diseases, digestive system diseases, cardiovascular diseases, genitourinary diseases and women’s health, and other therapeutic areas. Oncology is the largest segment in this market owing to the high incidence of cancer, a growing number of research studies on cancer therapeutics, and the focus on bringing innovative cancer drugs into the market.

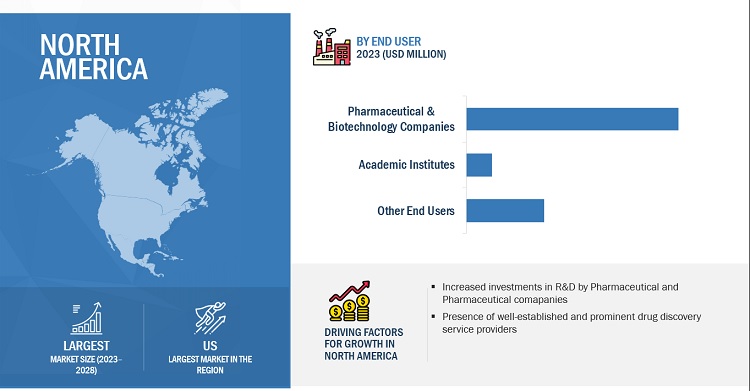

The North American market is projected to contribute the largest share for the drug discovery services industry.

The global drug discovery services market is segmented into five major regions—North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. North America is the largest regional market for drug discovery services, with an estimated share in 2022, while Europe is the second-largest market. A well-established pharmaceutical industry, ongoing R&D studies, high R&D expenditure, growth in the biosimilars and generics markets, and the rising outsourcing of R&D services by pharmaceutical and biopharmaceutical companies in the region are driving the market growth. North America is the largest pharmaceutical market in the world, with many global pharmaceutical and biopharmaceutical giants headquartered in the region, such as Laboratory Corporation of America Holdings (US), Charles River Laboratories International, Inc. (US), Thermo Fisher Scientific (US), Frontage Holdings (US), Pfizer, Inc. (US), AbbVie, Inc. (US), Abbott Laboratories (US), and Johnson & Johnson (US). These companies outsource their drug discovery and drug development services to reduce the cost and time of drug development. This is indicative of the growth opportunities in the North American market.

To know about the assumptions considered for the study, download the pdf brochure

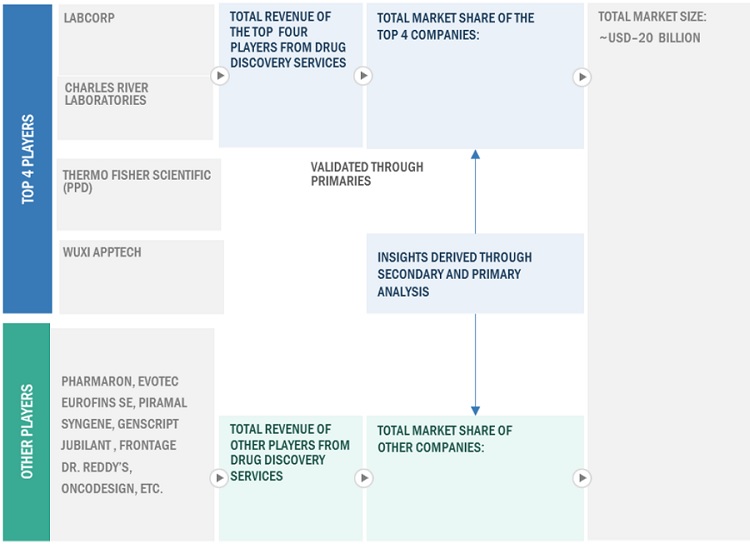

The drug discovery services market is dominated by a few globally established players such as Laboratory Corporation of America Holdings (US), Charles River Laboratories International Inc. (US), WuXi AppTec (China), and Thermo Fisher Scientific Inc (US), among others, are the key service providers that provided drug discovery services in last few years. Major focus was given to the deals, expansions, and new service launches due to the changing requirements of pharmaceutical and biopharmaceutical companies, academic and research institutes, and other end users across the world.

Scope of the Drug Discovery Services Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$20.6 billion |

|

Projected Revenue by 2028 |

$41.3 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 14.9% |

|

Market Driver |

Growing R&D Expenditure in Pharma-Biotech Sector |

|

Market Opportunity |

Technological advancements and new drug discovery techniques |

This report categorizes the drug discovery market to forecast revenue and analyze trends in each of the following submarkets:

By Process

- Target Selection

- Target Validation

- Hit-to-Lead identification

- Lead Optimization

- Candidate Validation

By Type

- Chemistry Services

- Biology Services

By Drug Type

- Small-molecule drugs

- Biologics

By Therapeutic Area

- Oncology oncology, infectious diseases, neurological diseases, immunological diseases, endocrine and metabolic diseases, respiratory diseases, digestive system diseases, cardiovascular diseases, genitourinary diseases and women’s health

- Infectious diseases

- Neurological diseases

- Immunological diseases

- Endocrine and metabolic diseases

- Respiratory diseases

- Digestive System diseases

- Cardiovascular diseases

- Genitourinary diseases

- Other Therapeutic Area (psychiatry, dermatology, ophthalmology, and orphan and rare diseases)

By End user

- Pharmaceutical & Biotechnology companies

- Academic Institutes

- Other End Users (small CROs, IVD companies, and clinical laboratories)

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific (APAC)

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific (RoAPAC)

-

Latin America (LATAM)

- Brazil

- RoLATAM

- Middle East and Africa (MEA)

Recent Developments of Drug Discovery Services Industry

- In February 2023, Charles River Laboratories (US) announced a multi-program agreement with Pioneering Medicines, an initiative of Flagship Pioneering (US), allowing access to its Logica AI platform to discover small-molecule drugs.

- In February 2023, Evotec SE (Germany) and Related Sciences (US) expanded their partnership for an integrated multi-target drug discovery agreement. The two companies aimed to select, discover, and develop precisely targeted medicines for unmet patient needs.

- In January 2023, Charles River Laboratories (US) acquired SAMDI Tech, Inc. (US), which offers label-free HTS solutions for drug discovery research. The acquisition offered CRL expertise in label-free HTS MS platforms and created a comprehensive library of drug discovery solutions.

- In April 2022, Charles River Laboratories (US) and Valo Health, a data-driven AI company, launched Logica, an AI-powered drug discovery services

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global drug discovery services market?

The global drug discovery services market boasts a total revenue value of $41.3 billion by 2028.

What is the estimated growth rate (CAGR) of the global drug discovery services market?

The global drug discovery services market has an estimated compound annual growth rate (CAGR) of 14.9% and a revenue size in the region of $20.6 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

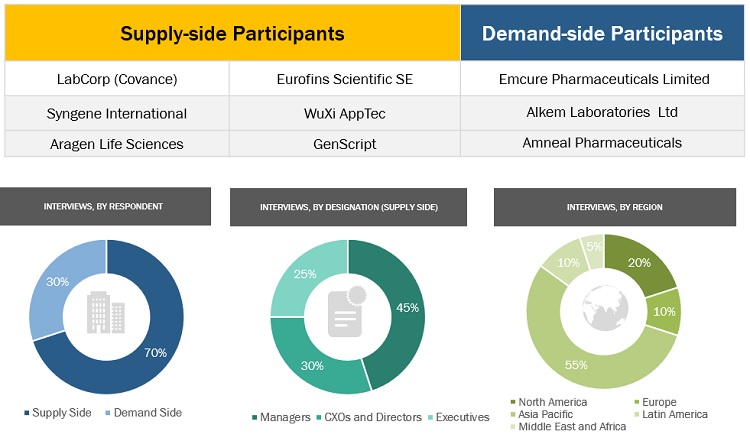

This research study involved the extensive use of secondary sources, directories, and databases to identify and collect valuable information for the analysis of the global drug discovery services market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess growth prospects of the market. The global market size estimated through secondary research was then triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

The secondary sources referred to for this research study include publications from government sources, such as Association of International Contract Research Organizations (AICROS), American Association of Pharmaceutical Scientists (AAPS), Clinical and Contract Research Association (CCRA), Association of Clinical Research Organizations (ACRO), Clinical Research Society (CRS), Pharmaceutical Research and Manufacturers of America (PhRMA), National Center for Biotechnology Information (NCBI), Food and Drug Administration (FDA). Secondary sources also include corporate and regulatory filings, such as annual reports, SEC filings, investor presentations, and financial statements; business magazines & research journals; press releases; and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall size of the global market, which was validated through primary research.

Primary Research

Extensive primary research was conducted after acquiring basic knowledge about the global market scenario through secondary research. Several primary interviews were conducted with market experts from the demand side, such as personnel from pharmaceutical and biopharmaceutical industries, CDMOs and CROs, academic & research institutes, and experts from the supply side, such as C-level and D-level executives, product managers, marketing & sales managers of key manufacturers, distributors, and channel partners. These interviews were conducted across four major regions, including North America, Europe, the Asia Pacific, Latin America, and Middle East and Africa. Approximately 70% and 30% of primary interviews were conducted with supply-side and demand-side participants, respectively. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The global size of the drug discovery services market was estimated through multiple approaches. A detailed market estimation approach was followed to estimate and validate the value of the market and other dependent submarkets. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive primary and secondary research.

- The revenues generated from the drug discovery services business of leading players have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Bottom-up approach: Company Revenue Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Approach 2: Secondary Research

- The size of the drug discovery services market was obtained from secondary sources.

- The shares of various drug discovery services in the overall market were obtained from secondary data and validated through primary participants to arrive at the total market.

- Primary participants validated the numbers.

Data Triangulation

After arriving at the market size from the market size estimation process explained above, the total market was divided into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments.

Market Definition:

Drug discovery is the process of developing a therapeutically active substance for a defined target molecule. Drug discovery is the early phase in which target identification, target validation, hit to lead identification, lead optimization, and candidate validation take place to deliver any suitable molecule or candidate for drug development. Drug discovery services are provided by contract research organizations (CROs) to pharmaceutical companies.

Key Stakeholders

- Research Institutes

- Pharmaceutical and Biotechnology Companies

- Drug Discovery Service Providers

- Venture Capitalists and Investors

- Contract Research Organizations

- Government Associations

- Healthcare Associations/Institutes

- Business Research & Consulting Service Providers

Report Objectives

- To define, describe, and forecast the drug discovery services market by type, drug type, process, end user, and region

- To provide detailed information about the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to the individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments in North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyze their market shares and core competencies in the global market

- To track and analyze competitive developments such as product & service launches, partnerships, collaborations, agreements, expansions, and acquisitions in the global market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Geographical Analysis

- Further breakdown of the RoE market, by country

- Further breakdown of the RoAPAC market, by country

- Further breakdown of the RoLA and MEA market, by country

Company Information

- Detailed analysis and profiling of additional market players (Up to five)

Segment Analysis

- Further breakdown of the therapeutic area segment as per the service portfolio of prominent players operating in the market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Drug Discovery Services Market