Edge AI Software Market by Offering (Solutions (Standalone and Integrated) and Services), Data Type (Video & Image Data, Audio Data, Text & Language Data, Biometric Data, and Multi-modal Data), Vertical and Region - Global Forecast to 2028

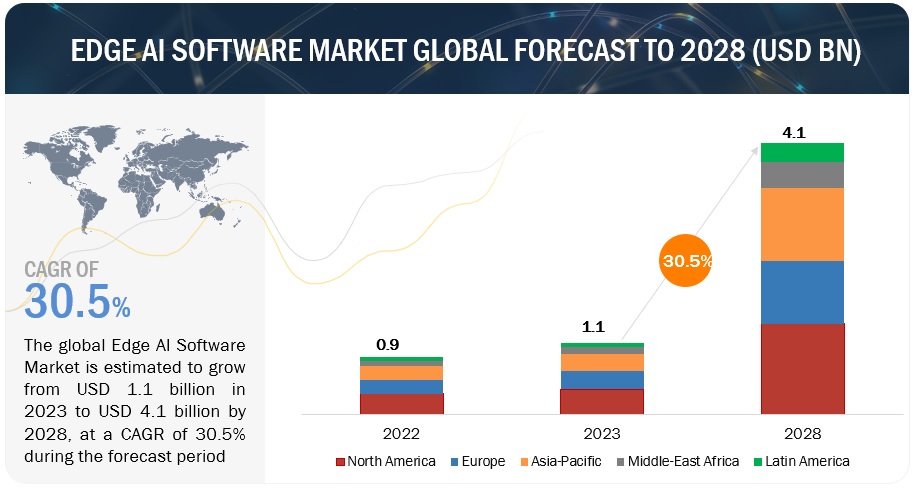

[330 Pages Report] The global Edge Al Software Market is projected to grow from USD 1.1 billion in 2023 to USD 4.1 billion by 2028, at a CAGR of 30.5% during the forecast period. The adoption of Edge AI software globally is being driven by several factors, including the increasing adoption of IoT devices, the need for real-time data processing, and the emergence of 5G networks. The market is expected to continue to grow as more organizations adopt edge computing and AI technologies to improve their operations and gain insights from data collected by edge devices. The growth of the Edge AI market is also driven by increased usage of social media and e-commerce platforms, integration of AI into edge ecosystems, and growing enterprise workloads on the cloud.

Technology Roadmap of Edge AI Software till 2028

The Edge AI software market report covers the technology roadmap till 2028, with insights into short-term, mid-term, and long-term developments.

Short-term roadmap (2023-2025)

- Focus on lower latency to enable real-time decision-making for critical applications, reducing delays and enhancing efficiency.

- Significant advancements in technologies leading to a 10 times boost in edge device processing power, enabling faster real-time AI at the edge.

- Ethical AI ensures fairness, accountability, and transparency in AI decision-making.

Mid-term roadmap (2025-2028)

- Quantum computing is set to drastically enhance AI processing power and capabilities..

- Compliance with ethical AI standards ensures responsible AI development and deployment.

- Seamless integration between edge and cloud services, enabling the coexistence of local and cloud AI.

Long-term roadmap (2029-2030)

- Cognitive AI represents AI systems with human-like adaptability and learning.

- Fully autonomous AI systems capable of making decisions independently, marking a significant milestone in AI maturity.

- 6G integration will enable faster and more reliable edge AI communication.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

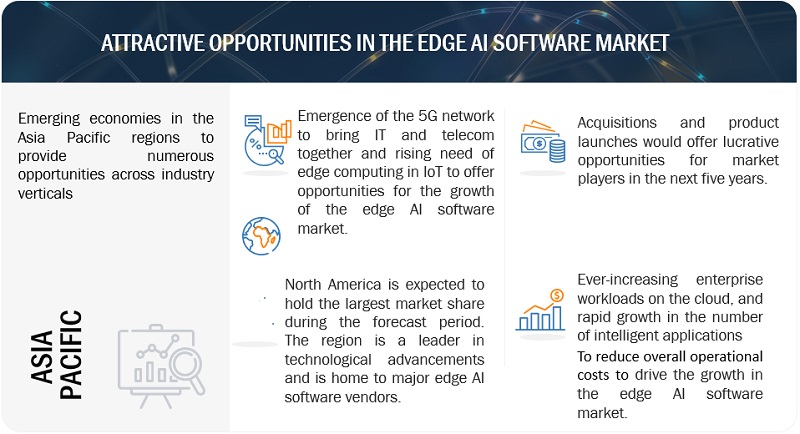

Driver: Rising Introduction of 5G Network to Boost Market Growth

The increasing adoption of 5G network technology across the globe is expected to drive market growth significantly in the upcoming years. The implementation of 5G networks is set to revolutionize the way IT and telecommunications converge, opening new avenues for high-end applications and reducing computational complexity. With the deployment of 5G networks, data centres can be organized at edge configurations, and industry-specific platforms can be implemented in standard ecosystems using software-defined connectivity fundamentals and virtual machines. The high speed and low latency of 5G networks offer tremendous opportunities for businesses to develop innovative solutions and services, thereby increasing their competitiveness in the market.

Restraint: Complexity and cost of deploying edge AI software

The complexity and cost of deploying edge AI software is a major challenge that is hindering the adoption of edge AI technologies. Edge AI software requires specialized hardware and software infrastructure to deploy and operate, which can be complex and expensive, especially for small and medium-sized businesses. Additionally, there is a lack of standardized tools and frameworks for deploying edge AI software, which can make it difficult to manage and scale deployments. Edge AI software can be computationally demanding, requiring specialized hardware such as GPUs and FPGAs, which can be a major barrier for businesses that do not have the necessary IT infrastructure in place.

Opportunity: Exploring Emerging Applications in Various Fields

Edge AI software is the driving force behind transformative applications in autonomous vehicles, smart cities, and industrial automation. In autonomous vehicles, it enable real-time decision-making and heightened safety through the analysis of sensor data. Edge AI also plays a critical role in smart cities, reducing latency by processing data at the edge and enabling intelligent traffic management, energy-efficient lighting, and more. As this technology advances, it continues to shape the future of these sectors by enhancing efficiency and innovation, ultimately revolutionizing transportation, urban living, and industrial processes.

Challenge: Integration complexities with existing IT infrastructure and systems

Integrating edge AI software with existing IT infrastructure and systems is a complex and challenging task. Edge AI systems are often heterogeneous, storing data in silos, and raising security and privacy concerns. Existing IT systems are typically more homogenous and centralized, with stricter security and privacy controls in place. There are no standard ways to integrate edge AI software with existing IT infrastructure and systems, which can make it difficult and expensive for businesses to adopt edge AI solutions.

Edge AI software market Ecosystem

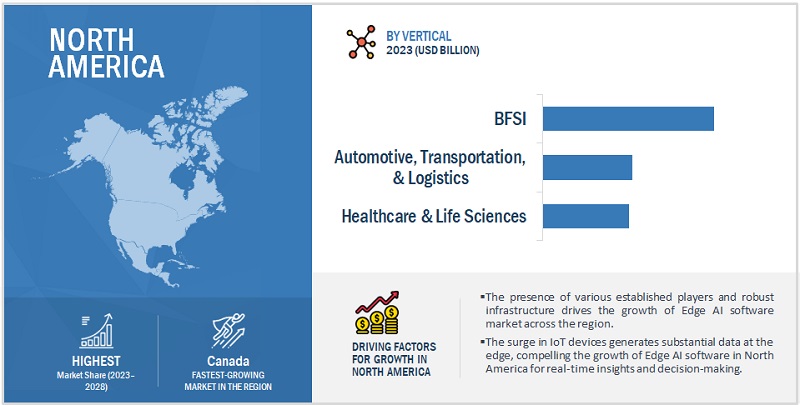

By vertical, BFSI accounts for the largest market size during the forecast period.

Edge AI software is rapidly being adopted by the BFSI industry to improve efficiency, security, and customer experience. It enables real-time data processing and decision-making on devices at the edge of the network, rather than relying on centralized cloud computing. This can significantly reduce latency and improve performance, particularly in areas such as fraud detection, risk management, and customer personalization.

Based on the data type, audio data to hold the highest CAGR during the forecast period.

Edge AI software is the implementation of artificial intelligence in an edge computing environment, which allows computations to be done close to where data is created. Audio data is one type of data that can be processed using edge AI software. Audio data is being used in edge AI software for generative AI for audio and music, environmental sounds and sound effects, speech recognition, and audio processing for IoT devices. By processing data locally, edge AI can reduce latency, increase privacy, and improve the efficiency of AI applications.

By deployment, cloud accounts for the largest market size during the forecast period.

Cloud is expected to account for the largest market share in edge AI software due to its scalability, flexibility, cost-effectiveness, performance, reliability, and security features. Additionally, cloud providers offer a variety of edge AI services and platforms that make it easier for businesses to get started with edge AI without having to invest in their own infrastructure. Some of the leading cloud providers that support edge AI deployments include AWS, Microsoft, and Google.

North America to account for the largest market size during the forecast period.

North America is expected to account for the largest market size in the edge AI software market due to its early adoption of edge AI technology, the presence of leading-edge AI software vendors, and the strong demand for edge AI solutions in key North American industries. The increasing adoption of IIoT devices, the growing demand for real-time data processing and decision-making, the need to improve operational efficiency and productivity, and the rising concerns about data privacy and security are some of the key factors driving the growth of the edge AI software market in North America.

Key Market Players

The Edge AI software vendors have implemented various types of organic and inorganic growth strategies, such as partnerships and agreements, new product launches, product upgrades, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global market for Edge AI software include Microsoft (US), IBM (US), Google (US), AWS (US), Nutanix (US), Synaptics (US), TIBCO (US), Octonion (Switzerland), Imagimob (Sweden), Anagog (Israel), Veea (US), Gorilla Technology (China), Azion (US), Bragi (Germany), Tact.ai (US), Ekinops (France), Clearblade (US), Alef Edge (US), Adapdix (US), byteLAKE (Poland), Reality Al (US), Deci (Israel), Edgeworx (US), Swim (US), Invision Al (Canada), Horizon Robotics (China), Kneron (US), DeepBrainz (India), Johnson Controls(Ireland), and Blaize(US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2018–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

USD Billion |

|

Segments Covered |

Offering, Data Type, Verticals, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

Microsoft (US), IBM (US), Google (US), AWS (US), Nutanix (US), Synaptics (US), TIBCO (US), Octonion (Switzerland), Imagimob (Sweden), Anagog (Israel), Veea (US), Gorilla Technology (China), Azion (US), Bragi (Germany), Tact.ai (US), Ekinops (France), Clearblade (US), Alef Edge (US), Adapdix (US), byteLAKE (Poland), Reality Al (US), Deci (Israel), Edgeworx (US), Swim (US), Invision Al (Canada), Horizon Robotics (China), Kneron (US), DeepBrainz (India), Johnson Controls(Ireland), and Blaize(US). |

This research report categorizes the edge AI software market based on Offering, Data Type, Verticals, and Region.

By Offering:

-

Solutions

-

By Type:

- Standalone

- Integrated

-

By Deployment:

- Cloud

- On-premises

-

By Type:

-

Services

-

Professional Services

- Consulting Services

- Deployment and Integration

- Support and Maintenance

- Managed Services

-

Professional Services

By Data Type:

- Video and Image Data

- Audio Data

- Text and Language Data

- Environmental and Location Data

- Biometric Data

- Multi-Modal Data

By Vertical:

- Banking, Financial Services, and Insurance

- Government & Public Sector

- Healthcare & Life Sciences

- Telecommunications

- Energy & Utilities

- Manufacturing

- Automotive, Transportations, and Logistics

- Media & Entertainment

- Other Verticals

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Beneux

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- ANZ

- ASEAN

- Rest of Asia Pacific

-

Middle East & Africa

- UAE

- Kingdom of Saudi Arabia

- Qatar

- Turkey

- South Africa

- Rest of the Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

Recent Developments:

- Microsoft has partnered with Fungible to accelerate datacenter innovation. Fungible is a company that develops data processing units (DPUs) that are optimized for AI workloads. Microsoft plans to use Fungible's DPUs to accelerate the performance of Azure IoT Edge and other edge AI solutions.

- Cisco and Nutanix have formed a global strategic partnership to accelerate hybrid multicloud deployments by offering a hyperconverged IT modernization and business transformation solution.

- IBM and Bharti Airtel have formed a partnership. The partnership will enable Indian enterprises to access secured edge cloud services, which will help them to accelerate innovation, improve efficiency, and reduce costs.

- Google and Amazon Web Services (AWS) have partnered to make it easier for developers to build and deploy edge AI applications. The two companies have integrated their edge AI platforms, so that developers can use the same tools and APIs to build and deploy edge AI applications on both Google Cloud and AWS.

- Energous and Veea have partnered to enable complete wireless power deployments, integrating Energous PowerBridges and Veea's Edge Platform with Wiliot IoT Pixels. The partnership aims to enable the next generation of real-time asset tracking applications in industrial, logistics, and retail applications.

Frequently Asked Questions (FAQ):

What is Edge AI software?

Edge AI is a system using ML algorithms for processing data generated by a hardware device at the local level. The device does not need to be connected to the Internet to process such data and make decisions in real-time, in a matter of milliseconds. Hence, it reduces the communication costs derived from the cloud model. Which countries are considered in the European region?

The report includes an analysis of the UK, Germany, France, Benelux, Spain, and Italy in the European region.

Which countries are considered in the European region?

The report includes an analysis of the UK, Germany, France, Spain, and Italy in the European region.

Which are key verticals adopting Edge AI software?

Key verticals adopting Edge AI software include BFSI, media & entertainment, government & public sector, healthcare & life sciences, telecom, manufacturing, automotive, transportation & logistics, energy and utilities, and other verticals (agriculture, education, real estate & construction).

Which are the key drivers supporting the market growth for Edge AI software?

The key drivers supporting the market growth for the Edge AI software market include Ever-increasing enterprise workloads on the cloud, Rapid growth in the number of intelligent applications, Exponentially growing data volume and network traffic, Increasing Use of IoT Driving Demand for Edge AI Software, Rising Introduction of 5G Network to Boost Market Growth.

Who are the key vendors in the market for Edge AI software?

The key vendors in the global Edge AI softwaremarket include Microsoft (US), IBM (US), Google (US), AWS (US), Nutanix (US), Synaptics (US), TIBCO (US), Octonion (Switzerland), Imagimob (Sweden), Anagog (Israel), Veea (US), Gorilla Technology (China), Azion (US), Bragi (Germany), Tact.ai (US), Ekinops (France), Clearblade (US), Alef Edge (US), Adapdix (US), byteLAKE (Poland), Reality Al (US), Deci (Israel), Edgeworx (US), Swim (US), Invision Al (Canada), Horizon Robotics (China), Kneron (US), DeepBrainz (India), Johnson Controls(Ireland), and Blaize(US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

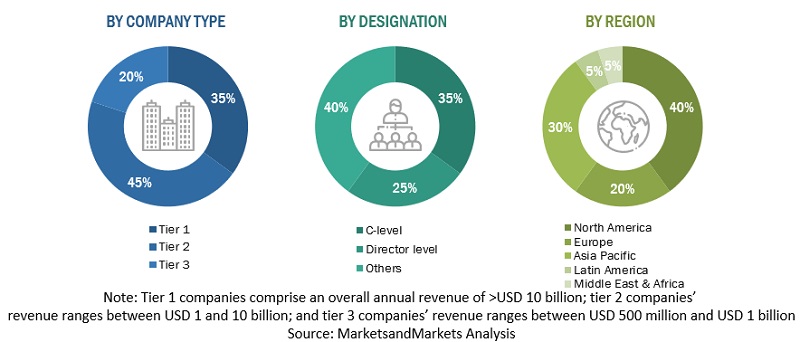

The research study for the edge AI software market involved the use of extensive secondary sources and directories, as well as various reputed open-source databases, to identify and collect information useful for this technical and market-oriented study. In-depth interviews were conducted with various primary respondents, including key opinion leaders, subject matter experts, high-level executives of multiple companies providing edge AI software offerings, and industry consultants to obtain and verify critical qualitative and quantitative information and assess the market prospects and industry trends.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as the Data Science Journal, Institute of Electrical and Electronics Engineers (IEEE) Journals and magazines, and other magazines. Secondary research was mainly used to obtain key information about the industry’s value chain and supply chain to identify key players based on solutions, services, and market classification and segmentation according to offerings of major players, industry trends related to offering, data type, verticals, and region, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from the supply and demand sides of the edge AI software market ecosystem were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors providing edge AI software offerings; associated service providers; and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

After the complete market engineering (including calculations for market statistics, market breakup, market size estimations, market forecast, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also undertaken to identify and validate the segmentation types; industry trends; key players; the market's competitive landscape, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

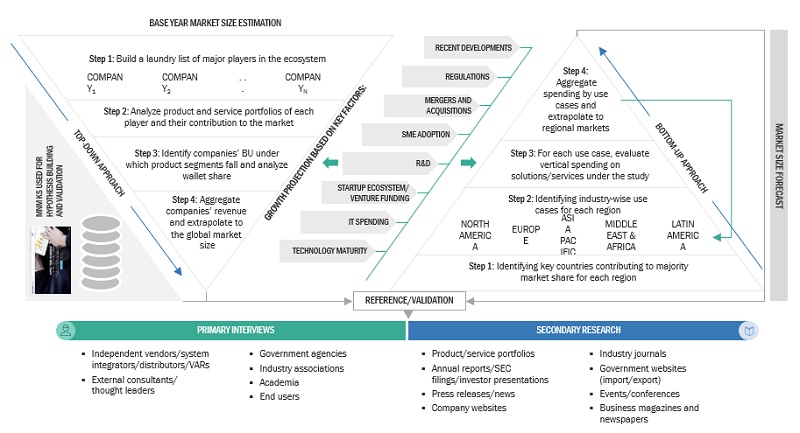

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecast for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to record the critical information/insights throughout the report.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For making market estimates and forecasting the edge AI software market and the other dependent submarkets, top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global edge AI software market, using the revenue from the key companies and their offerings in the market. With data triangulation and validation through primary interviews, this study determined and confirmed the exact value of the overall parent market size. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments.

The top-down approach prepared an exhaustive list of all the vendors offering edge AI software. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor’s offerings were evaluated based on the breadth of solution and service offerings, cloud types, organization sizes, and verticals. The aggregate of all the companies' revenues was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets repository for validation.

In the bottom-up approach, the adoption rate of edge AI software solutions, and services among different end-users in key countries with respect to their regions contributing the most to the market share was identified. For cross-validation, the adoption of edge AI software solutions, and services among industries, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

All the possible parameters that affect the market covered in the research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

- The pricing trend is assumed to vary over time.

- All the forecasts are made with the standard assumption that the accepted currency is USD.

- For the conversion of various currencies to USD, average historical exchange rates are used according to the year specified. For all the historical and current exchange rates required for calculations and currency conversions, the US Internal Revenue Service’s website is used.

- All the forecasts are made under the standard assumption that the globally accepted currency, USD, remains constant during the next five years.

- Vendor-side analysis: The market size estimates of associated solutions and services are factored in from the vendor side by assuming an average of licensing and subscription-based models of leading and innovative vendors.

- Demand/end-user analysis: End users operating in verticals across regions are analyzed in terms of market spending on edge AI software solutions and services based on some of the key use cases. These factors for the edge AI software tool industry per region are separately analyzed, and the average spending was extrapolated with an approximation based on assumed weightage. This factor is derived by averaging various market influencers, including recent developments, regulations, mergers and acquisitions, enterprise/SME adoption, startup ecosystem, IT spending, technology propensity and maturity, use cases, and the estimated number of organizations per region.

Market Size Estimation: Top Down And Bottom Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

As per Vector ITC, edge AI is a system using ML algorithms for processing data generated by a hardware device at the local level. The device does not need to be connected to the Internet to process such data and make decisions in real-time, in a matter of milliseconds. Hence, it reduces the communication costs derived from the cloud model. In other words, edge AI takes the data and its processing to the closest point of interaction with the user, whether it is a computer, an IoT device, or an edge server.

Key Stakeholders

- Edge AI software vendors

- Edge AI servvice vendors

- Managed service providers

- Support and maintenance service providers

- System Integrators (SIs)/migration service providers

- Value-Added Resellers (VARs) and distributors

- Distributors and Value-added Resellers (VARs)

- System Integrators (SIs)

- Independent Software Vendors (ISV)

- Third-party providers

- Technology providers

Report Objectives

- To define, describe, and predict the Edge AI software market by offering, data type, verticals, and region

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the Edge AI software market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American market for edge AI software

- Further breakup of the European market for edge AI software

- Further breakup of the Asia Pacific market for edge AI software

- Further breakup of the Latin American market for edge AI software

- Further breakup of the Middle East & Africa market for edge AI software

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Edge AI Software Market