TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 51)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

TABLE 1 ELECTRIC SCOOTER AND MOTORCYCLE MARKET DEFINITION, BY VEHICLE TYPE

TABLE 2 ELECTRIC SCOOTER AND MOTORCYCLE MARKET DEFINITION, BY BATTERY TYPE

TABLE 3 ELECTRIC SCOOTER AND MOTORCYCLE MARKET DEFINITION, BY TECHNOLOGY TYPE

TABLE 4 ELECTRIC SCOOTER AND MOTORCYCLE MARKET DEFINITION, BY VEHICLE CLASS

TABLE 5 ELECTRIC SCOOTER AND MOTORCYCLE MARKET DEFINITION, BY USAGE

TABLE 1 ELECTRIC SCOOTER AND MOTORCYCLE MARKET DEFINITION, BY MOTOR TYPE

TABLE 1 ELECTRIC SCOOTER AND MOTORCYCLE MARKET DEFINITION, BY MOTOR POWER

1.2.1 INCLUSIONS AND EXCLUSIONS

TABLE 2 INCLUSIONS AND EXCLUSIONS FOR ELECTRIC SCOOTER AND MOTORCYCLE MARKET

1.3 MARKET SCOPE

FIGURE 1 ELECTRIC SCOOTER AND MOTORCYCLE MARKET SEGMENTATION

1.3.1 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 3 CURRENCY EXCHANGE RATES

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 59)

2.1 RESEARCH DATA

FIGURE 2 ELECTRIC SCOOTER AND MOTORCYCLE MARKET: RESEARCH DESIGN

FIGURE 3 RESEARCH METHODOLOGY MODEL

2.1.1 SECONDARY DATA

2.1.1.1 Key secondary sources

2.1.1.2 Key data from secondary sources

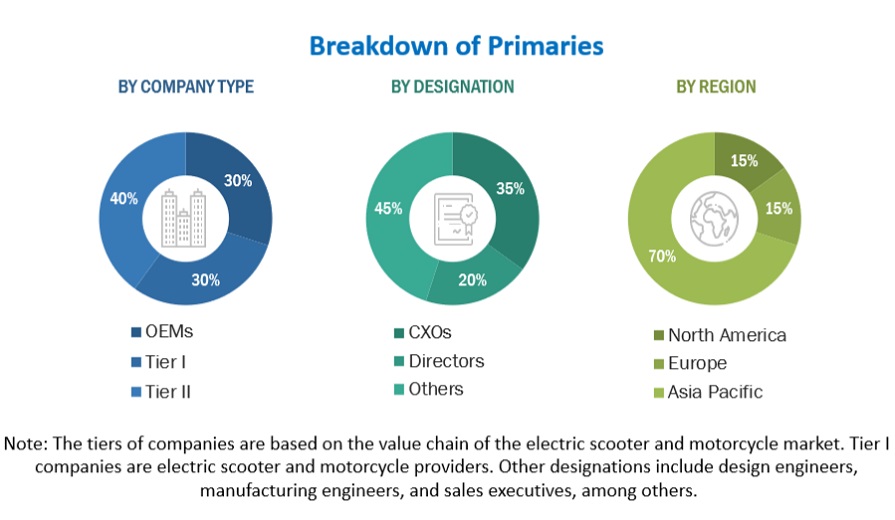

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 List of participating companies for primary research

2.1.2.3 Key industry insights

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.4 Major objectives of primary research

2.1.3 LIST PRIMARY PARTICIPANTS

2.2 MARKET ESTIMATION METHODOLOGY

FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.3 MARKET SIZE ESTIMATION

2.3.1 RECESSION IMPACT ANALYSIS

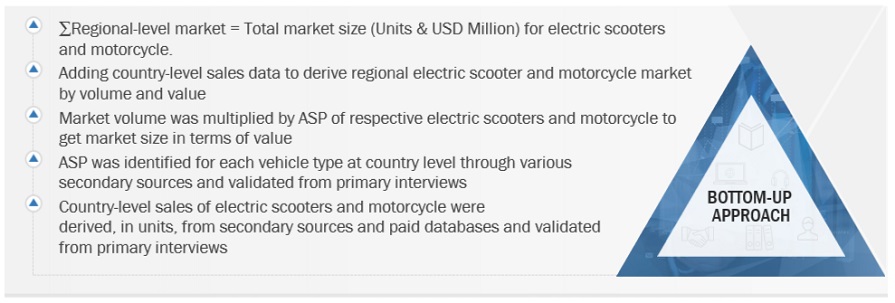

2.3.2 BOTTOM-UP APPROACH

FIGURE 6 BOTTOM-UP APPROACH: ELECTRIC SCOOTER AND MOTORCYCLE MARKET

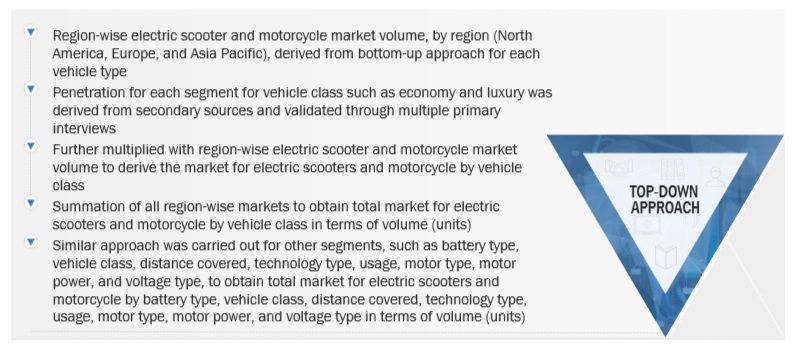

2.3.3 TOP-DOWN APPROACH

FIGURE 7 TOP-DOWN APPROACH: ELECTRIC SCOOTER AND MOTORCYCLE MARKET

FIGURE 8 ELECTRIC SCOOTER AND MOTORCYCLE MARKET: MARKET ESTIMATION NOTES

FIGURE 9 ELECTRIC SCOOTER AND MOTORCYCLE MARKET: RESEARCH DESIGN & METHODOLOGY – DEMAND SIDE

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 10 DATA TRIANGULATION

2.5 FACTOR ANALYSIS

2.5.1 MARKET GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS AND OPPORTUNITIES

FIGURE 11 MARKET GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS AND OPPORTUNITIES

2.6 RESEARCH ASSUMPTIONS

2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 76)

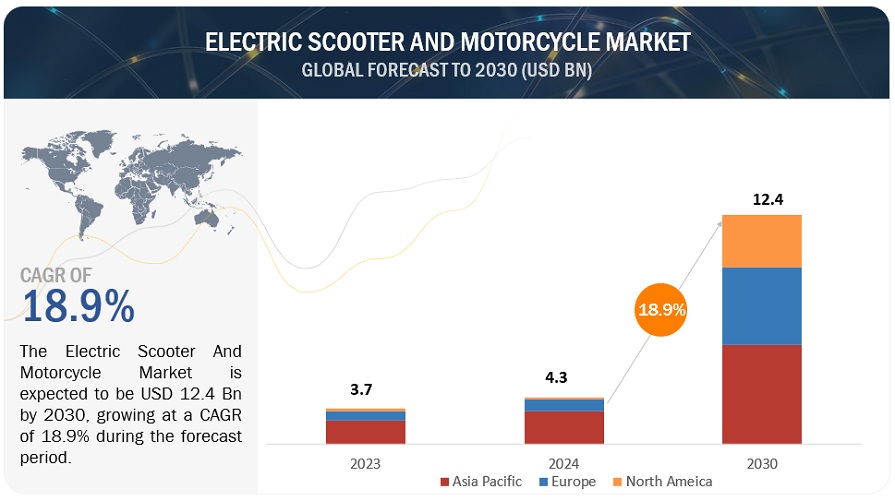

FIGURE 12 ELECTRIC SCOOTER AND MOTORCYCLE MARKET: MARKET OVERVIEW

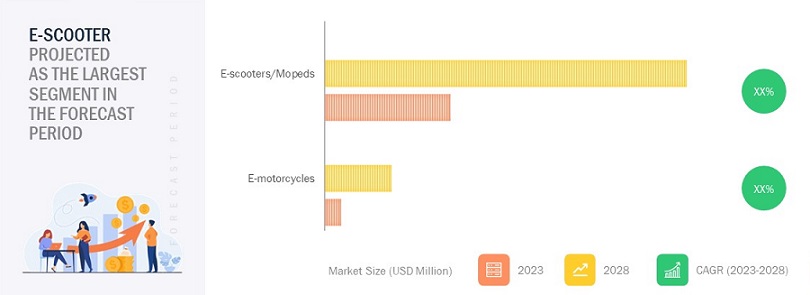

FIGURE 13 E-SCOOTERS/MOPEDS SEGMENT TO HAVE LARGER MARKET SHARE THAN E-MOTORCYCLES SEGMENT FROM 2023 TO 2028

FIGURE 14 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023–2028

4 PREMIUM INSIGHTS (Page No. - 80)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ELECTRIC SCOOTER AND MOTORCYCLE MARKET

FIGURE 15 INCREASING DEMAND FOR EFFICIENT AND EMISSION-FREE COMMUTES TO DRIVE MARKET GROWTH

4.2 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION

FIGURE 16 ASIA PACIFIC TO DOMINATE ELECTRIC SCOOTER AND MOTORCYCLE MARKET FROM 2023 TO 2028

4.3 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE

FIGURE 17 E-SCOOTERS/MOPEDS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

4.4 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY BATTERY TYPE

FIGURE 18 LITHIUM-ION SEGMENT TO REGISTER HIGHER CAGR THAN SEALED LEAD-ACID SEGMENT FROM 2023 TO 2028

4.5 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY DISTANCE COVERED

FIGURE 19 BELOW 75 MILES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

4.6 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VOLTAGE

FIGURE 20 60 V SEGMENT TO COMMAND HIGHEST MARKET DEMAND FROM 2023 TO 2028

4.7 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY TECHNOLOGY TYPE

FIGURE 21 PLUG-IN SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

4.8 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE CLASS

FIGURE 22 ECONOMY SEGMENT TO LEAD MARKET FROM 2023 TO 2028

4.9 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY USAGE

FIGURE 23 COMMERCIAL SEGMENT TO REGISTER HIGHER CAGR THAN PRIVATE SEGMENT DURING FORECAST PERIOD

4.10 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY MOTOR TYPE

FIGURE 24 MID-DRIVE MOTORS SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

4.11 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY MOTOR POWER

FIGURE 25 LESS THAN 1.5 KW TO HOLD PROMINENT MARKET SHARE DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 86)

5.1 INTRODUCTION

TABLE 4 IMPACT OF MARKET DYNAMICS

5.2 MARKET DYNAMICS

FIGURE 26 ELECTRIC SCOOTER AND MOTORCYCLE MARKET DYNAMICS

5.2.1 DRIVERS

FIGURE 27 FACTORS DRIVING ELECTRIC SCOOTER AND MOTORCYCLE MARKET

5.2.1.1 Low operating and maintenance costs

FIGURE 28 COST SAVING COMPARISON: ELECTRIC SCOOTERS VS PETROL SCOOTERS

FIGURE 29 COST DISTANCE RATIO ANALYSIS FOR ELECTRIC SCOOTER AND MOTORCYCLE MARKET

5.2.1.2 Government incentives and subsidies

FIGURE 30 ELECTRIFICATION TARGET BY COUNTRIES

TABLE 5 COUNTRY-WISE GOVERNMENT INCENTIVES AND SUBSIDIES

5.2.1.3 Advancements in battery technology

FIGURE 31 AVERAGE ENERGY DENSITY (WH/L) OF LI-ION BATTERIES, 2017–2031

TABLE 6 ELECTRIC SCOOTERS AND MOTORCYCLES WITH SIGNIFICANT RANGE AND BATTERY TYPE

5.2.1.4 Implementation of battery swapping technology

FIGURE 32 BATTERY SWAPPING SYSTEM

5.2.1.5 Rapid urbanization fueling need for convenient modes of transportation

FIGURE 33 SHARE OF URBAN POPULATION WORLDWIDE IN 2022, BY CONTINENT

5.2.2 RESTRAINTS

5.2.2.1 Lack of charging infrastructure

FIGURE 34 FAST PUBLICLY AVAILABLE CHARGERS, 2017–2022

5.2.2.2 Lack of power output and limited range

TABLE 7 MODEL-WISE DRIVING RANGE OF ELECTRIC SCOOTERS AND MOTORCYCLES

5.2.2.3 Battery heating issues and long charging time

TABLE 8 TIME REQUIRED TO CHARGE ELECTRIC SCOOTERS AND MOTORCYCLES

5.2.3 OPPORTUNITIES

FIGURE 35 OPPORTUNITIES FOR ELECTRIC SCOOTER AND MOTORCYCLE MARKET

5.2.3.1 Government bodies backing electric two-wheelers

TABLE 9 KEY INITIATIVES BY GOVERNMENT BODIES IN EMERGING MARKETS

5.2.3.2 Decreasing prices of batteries

FIGURE 36 LITHIUM-ION BATTERY PRICE TREND, 2013–2022 (USD/KWH)

5.2.3.3 New revenue pockets in Asia Pacific and Europe

5.2.3.4 Use of IoT and smart infrastructure in electric two-wheeler charging stations for load management

FIGURE 37 SMART IOT-BASED TECHNOLOGY USED IN ELECTRIC TWO-WHEELER CHARGING STATIONS

5.2.4 CHALLENGES

5.2.4.1 Initial investments and high cost of electricity

FIGURE 38 AVERAGE TOTAL COST OF CONVENTIONAL VS ELECTRIC TWO-WHEELERS (2022)

TABLE 10 GLOBAL AVERAGE ELECTRICITY COST, 2022

5.2.4.2 Lack of compatibility, interchangeability, and standardization

5.2.4.3 Technological barriers related to battery development

FIGURE 39 TECHNOLOGICAL BARRIERS FOR ELECTRIC TWO-WHEELERS

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 40 ELECTRIC SCOOTER AND MOTORCYCLE MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 11 ELECTRIC SCOOTER AND MOTORCYCLE MARKET: IMPACT OF PORTER’S FIVE FORCES

5.3.1 THREAT OF SUBSTITUTES

5.3.2 INTENSITY OF COMPETITIVE RIVALRY

5.3.3 BARGAINING POWER OF BUYERS

5.3.4 THREAT OF NEW ENTRANTS

5.3.5 BARGAINING POWER OF SUPPLIERS

5.4 MNM INSIGHTS ON OEM PLANNING AND DEVELOPMENTS

TABLE 12 OEM PLANNING AND DEVELOPMENTS

5.5 PRICING ANALYSIS

5.5.1 AVERAGE SELLING PRICE TRENDS, VEHICLE TYPE, 2022

FIGURE 41 AVERAGE SELLING PRICE TRENDS, VEHICLE TYPE

5.5.2 ELECTRIC SCOOTERS: AVERAGE SELLING PRICE, KEY PLAYERS

TABLE 13 ELECTRIC SCOOTERS: PRICING ANALYSIS

5.5.3 ELECTRIC MOTORCYCLES: AVERAGE SELLING PRICE, KEY PLAYERS

TABLE 14 ELECTRIC MOTORCYCLES: PRICING ANALYSIS

TABLE 15 ELECTRIC SCOOTERS AND MOTORCYCLES: PRICING ANALYSIS

TABLE 16 OEM ELECTRIC VEHICLE MODELS AVERAGE PRICE

5.6 ECOSYSTEM ANALYSIS

FIGURE 42 ELECTRIC SCOOTER AND MOTORCYCLE MARKET: ECOSYSTEM ANALYSIS

TABLE 17 ELECTRIC SCOOTER AND MOTORCYCLE MARKET: ROLE OF COMPANIES IN ECOSYSTEM

5.7 MACROECONOMIC INDICATORS

5.7.1 GDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

TABLE 18 GDP TRENDS AND FORECAST, BY MAJOR ECONOMIES, 2018–2026 (USD BILLION)

TABLE 19 REAL GDP GROWTH RATE (ANNUAL PERCENTAGE CHANGE AND FORECAST), BY MAJOR ECONOMIES, 2022–2026

TABLE 20 GDP PER CAPITA TRENDS AND FORECAST, BY MAJOR ECONOMIES, 2018–2026 (USD)

5.8 VALUE CHAIN ANALYSIS

FIGURE 43 VALUE CHAIN ANALYSIS: ELECTRIC SCOOTER AND MOTORCYCLE MARKET

5.9 CASE STUDY ANALYSIS

5.9.1 ATHER ENERGY CASE STUDY

5.9.2 HERO ELECTRIC CASE STUDY

5.9.3 GENZE CASE STUDY

5.9.4 CASE STUDY ON OFFICIAL POSTAL SERVICE OF TAIWAN

5.10 PATENT ANALYSIS

TABLE 21 PATENT REGISTRATIONS RELATED TO ELECTRIC SCOOTER AND MOTORCYCLE MARKET

FIGURE 44 GLOBALLY PUBLISHED PATENTS FOR ELECTRIC SCOOTER AND MOTORCYCLE MARKET (2017–2022)

5.11 TECHNOLOGY ANALYSIS

5.11.1 BATTERY SWAPPING IN ELECTRIC SCOOTERS

FIGURE 45 TCO OF ICE VS BATTERY SWAPPING POWERED VEHICLES, 2022

5.11.2 IOT IN ELECTRIC TWO-WHEELERS

5.11.3 REGENERATIVE BRAKING

5.11.4 SHARED MOBILITY

5.11.5 SOLID-STATE BATTERIES

5.11.6 SMART CHARGING SYSTEMS

FIGURE 46 SMART EV CHARGING SYSTEM

5.11.7 BATTERY RELATED SERVICES

5.12 REGULATORY OVERVIEW

TABLE 22 REGULATORY ENVIRONMENT

TABLE 23 CENTRAL AND STATE TAXES AND FEES IN INDIA FOR VEHICLES SELECTED

5.12.1 COUNTRY-WISE TARIFF AND REGULATORY OVERVIEW

5.12.1.1 India

5.12.1.2 Indonesia

5.12.1.3 China

5.12.1.4 France

5.12.1.5 Germany

5.12.1.6 Spain

5.12.1.7 Austria

5.12.1.8 US

5.12.2 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 24 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 25 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 26 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.13 KEY CONFERENCES AND EVENTS IN 2022–2023

TABLE 27 ELECTRIC SCOOTER AND MOTORCYCLE MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 47 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

TABLE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

5.14.2 BUYING CRITERIA

5.14.2.1 Food delivery

5.14.2.2 Postal services

5.14.2.3 Municipal services

FIGURE 48 KEY BUYING CRITERIA

TABLE 29 KEY BUYING CRITERIA

5.15 TRENDS AND DISRUPTIONS

FIGURE 49 TRENDS AND DISRUPTIONS

TABLE 30 IMPLICATIONS OF FUTURE HOTBEDS IN ELECTRIC SCOOTER AND MOTORCYCLE MARKET

5.16 RECESSION IMPACT ANALYSIS

TABLE 31 ELECTRIC SCOOTER AND MOTORCYCLE SALES, BY KEY COUNTRIES, 2021–2022

5.17 SCENARIO ANALYSIS, 2023 - 2028

5.17.1 MOST LIKELY SCENARIO

TABLE 32 MOST LIKELY SCENARIO: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023–2028 (USD MILLION)

5.17.2 OPTIMISTIC SCENARIO

TABLE 33 OPTIMISTIC SCENARIO: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023–2028 (USD MILLION)

5.17.3 PESSIMISTIC SCENARIO

TABLE 34 PESSIMISTIC SCENARIO: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023–2028 (USD MILLION)

6 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY BATTERY TYPE (Page No. - 146)

6.1 INTRODUCTION

FIGURE 50 LITHIUM-ION BATTERY VS LEAD-ACID BATTERY

FIGURE 51 LITHIUM-ION BATTERY SEGMENT PROJECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 35 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY BATTERY TYPE, 2018–2022 (THOUSAND UNITS)

TABLE 36 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY BATTERY TYPE, 2023–2028 (THOUSAND UNITS)

TABLE 37 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY BATTERY TYPE, 2018–2022 (USD MILLION)

TABLE 38 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY BATTERY TYPE, 2023–2028 (USD MILLION)

6.1.1 OPERATIONAL DATA

TABLE 39 POPULAR ELECTRIC SCOOTERS/MOPEDS/MOTORCYCLES AND THEIR BATTERIES

TABLE 40 ADVANTAGES AND DISADVANTAGES OF LEAD-ACID BATTERIES

TABLE 41 ADVANTAGES AND DISADVANTAGES OF LITHIUM-ION BATTERIES

6.1.2 ASSUMPTIONS

TABLE 42 ASSUMPTIONS, BY BATTERY TYPE

6.1.3 RESEARCH METHODOLOGY

6.2 SEALED LEAD-ACID

6.2.1 LOW COST OF LEAD-ACID BATTERIES TO DRIVE MARKET

TABLE 43 SEALED LEAD-ACID BATTERY: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

TABLE 44 SEALED LEAD-ACID BATTERY: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

TABLE 45 SEALED LEAD-ACID BATTERY: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 46 SEALED LEAD-ACID BATTERY: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023–2028 (USD MILLION)

6.3 LITHIUM-ION

6.3.1 ASIA PACIFIC TO LEAD LITHIUM-ION BATTERY SEGMENT DUE TO GROWING USAGE OF MODERN ELECTRIC TWO-WHEELERS

FIGURE 52 CHEMISTRIES OF CATHODES

FIGURE 53 LITHIUM-ION BATTERY CELL PRODUCTION CAPACITY, BY REGION, 2022

TABLE 47 LITHIUM-ION BATTERY: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

TABLE 48 LITHIUM-ION BATTERY: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

TABLE 49 LITHIUM-ION BATTERY: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 50 LITHIUM-ION BATTERY: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023–2028 (USD MILLION)

6.4 NICKEL METAL HYDRIDE BATTERY

6.5 SODIUM-ION BATTERY

6.6 KEY PRIMARY INSIGHTS

7 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY DISTANCE COVERED (Page No. - 160)

7.1 INTRODUCTION

FIGURE 54 KEY MANUFACTURERS AND THEIR VEHICLE MODELS WITH RANGE

FIGURE 55 75–100 MILES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 51 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY DISTANCE COVERED, 2018–2022 (THOUSAND UNITS)

TABLE 52 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY DISTANCE COVERED, 2023–2028 (THOUSAND UNITS)

TABLE 53 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY DISTANCE COVERED, 2018–2022 (USD MILLION)

TABLE 54 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY DISTANCE COVERED, 2023–2028 (USD MILLION)

7.1.1 OPERATIONAL DATA

TABLE 55 POPULAR ELECTRIC SCOOTERS/MOPEDS AND MOTORCYCLES WITH RANGE

7.1.2 ASSUMPTIONS

TABLE 56 ASSUMPTIONS, BY DISTANCE COVERED

7.1.3 RESEARCH METHODOLOGY

7.2 BELOW 75 MILES

7.2.1 ASIA PACIFIC TO HOLD MAJOR MARKET SHARE IN BELOW 75 MILES SEGMENT

TABLE 57 BELOW 75 MILES: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

TABLE 58 BELOW 75 MILES: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

TABLE 59 BELOW 75 MILES: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 60 BELOW 75 MILES: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023–2028 (USD MILLION)

7.3 75–100 MILES

7.3.1 IMPROVING BATTERY TECHNOLOGIES TO DRIVE DEMAND FOR 75–100 MILES RANGE ELECTRIC TWO-WHEELERS

TABLE 61 75–100 MILES: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

TABLE 62 75–100 MILES: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

TABLE 63 75–100 MILES: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 64 75–100 MILES: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023–2028 (USD MILLION)

7.4 ABOVE 100 MILES

7.4.1 DEVELOPMENTS IN BATTERY TECHNOLOGY TO BOOST DEMAND FOR HIGH-RANGE ELECTRIC SCOOTERS AND MOTORCYCLES

TABLE 65 ABOVE 100 MILES: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

TABLE 66 ABOVE 100 MILES: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

TABLE 67 ABOVE 100 MILES: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 68 ABOVE 100 MILES: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023–2028 (USD MILLION)

7.5 KEY PRIMARY INSIGHTS

8 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VOLTAGE TYPE (Page No. - 172)

8.1 INTRODUCTION

FIGURE 56 ELECTRIC SCOOTERS AND MOTORCYCLES OFFERED BY OEMS, BY VOLTAGE TYPE

FIGURE 57 60 V SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 69 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VOLTAGE TYPE, 2018–2022 (THOUSAND UNITS)

TABLE 70 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VOLTAGE TYPE, 2023–2028 (THOUSAND UNITS)

TABLE 71 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VOLTAGE TYPE, 2018–2022 (USD MILLION)

TABLE 72 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VOLTAGE TYPE, 2023–2028 (USD MILLION)

8.1.1 OPERATIONAL DATA

TABLE 73 POPULAR E-SCOOTER/MOPED AND E-MOTORCYCLE MODELS AND THEIR BATTERY VOLTAGE

8.1.2 ASSUMPTIONS

TABLE 74 ASSUMPTIONS, BY VOLTAGE TYPE

8.1.3 RESEARCH METHODOLOGY

8.2 36 V

8.2.1 RISING DEMAND FOR DAILY SHORT-DISTANCE TRAVEL TO DRIVE SEGMENT

TABLE 75 36 V: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

TABLE 76 36 V: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

TABLE 77 36 V: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 78 36 V: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023–2028 (USD MILLION)

8.3 48 V

8.3.1 RISING DEMAND FOR 48 V-POWERED ELECTRIC SCOOTERS AND MOTORCYCLES FOR SHORT MOBILITY PURPOSES

TABLE 79 48 V: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

TABLE 80 48 V: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

TABLE 81 48 V: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 82 48 V: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023–2028 (USD MILLION)

8.4 60 V

8.4.1 GROWING NEED FOR HIGH-PERFORMANCE ELECTRIC TWO-WHEELERS TO DRIVE SEGMENT

TABLE 83 60 V: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

TABLE 84 60 V: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

TABLE 85 60 V: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 86 60 V: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023–2028 (USD MILLION)

8.5 72 V

8.5.1 ADVANCEMENTS IN BATTERY TECHNOLOGY AND GROWING DEMAND FOR HIGH-PERFORMANCE TWO-WHEELERS TO DRIVE MARKET

TABLE 87 72 V: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

TABLE 88 72 V: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

TABLE 89 72 V: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 90 72 V: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023–2028 (USD MILLION)

8.6 ABOVE 72 V

8.6.1 ADVANCEMENTS IN BATTERY TECHNOLOGY FOR HIGH-PERFORMANCE MOTORCYCLES TO DRIVE SEGMENT

TABLE 91 ABOVE 72 V: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

TABLE 92 ABOVE 72 V: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

TABLE 93 ABOVE 72 V: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 94 ABOVE 72 V: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023–2028 (USD MILLION)

8.7 KEY PRIMARY INSIGHTS

9 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY TECHNOLOGY TYPE (Page No. - 189)

9.1 INTRODUCTION

FIGURE 58 PLUG-IN SEGMENT TO HOLD LARGER MARKET SHARE THAN BATTERY SEGMENT DURING FORECAST PERIOD

TABLE 95 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY TECHNOLOGY TYPE, 2018–2022 (THOUSAND UNITS)

TABLE 96 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY TECHNOLOGY TYPE, 2023–2028 (THOUSAND UNITS)

TABLE 97 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY TECHNOLOGY TYPE, 2018–2022 (USD MILLION)

TABLE 98 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY TECHNOLOGY TYPE, 2023–2028 (USD MILLION)

9.1.1 OPERATIONAL DATA

TABLE 99 POPULAR E-SCOOTER/MOPED AND E-MOTORCYCLE MODELS

9.1.2 ASSUMPTIONS

TABLE 100 ASSUMPTIONS, BY TECHNOLOGY TYPE

9.1.3 RESEARCH METHODOLOGY

9.2 PLUG-IN

9.2.1 INCREASING PUBLIC FAST-CHARGING STATIONS FOR ELECTRIC TWO-WHEELERS TO DRIVE SEGMENT

TABLE 101 PLUG-IN: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

TABLE 102 PLUG-IN: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

TABLE 103 PLUG-IN: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 104 PLUG-IN: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023–2028 (USD MILLION)

9.3 BATTERY

9.3.1 INITIAL COST-BENEFIT ON PURCHASE OF BATTERY SWAPPING SCOOTERS AND MOTORCYCLES TO DRIVE MARKET

FIGURE 59 BATTERY-POWERED ELECTRIC SCOOTER AND MOTORCYCLE BUSINESS MODEL

TABLE 105 BATTERY: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

TABLE 106 BATTERY: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

TABLE 107 BATTERY: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 108 BATTERY: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023–2028 (USD MILLION))

9.4 KEY PRIMARY INSIGHTS

10 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE CLASS (Page No. - 199)

10.1 INTRODUCTION

FIGURE 60 LUXURY SEGMENT TO REGISTER HIGHER CAGR THAN ECONOMY SEGMENT FROM 2023 TO 2028

TABLE 109 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE CLASS, 2018–2022 (THOUSAND UNITS)

TABLE 110 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE CLASS, 2023–2028 (THOUSAND UNITS)

TABLE 111 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE CLASS, 2018–2022 (USD MILLION)

TABLE 112 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE CLASS, 2023–2028 (USD MILLION)

10.1.1 OPERATIONAL DATA

TABLE 113 E-SCOOTER/MOPED AND E-MOTORCYCLE MODELS WORLDWIDE

10.1.2 ASSUMPTIONS

TABLE 114 ASSUMPTIONS, BY VEHICLE CLASS

10.1.3 RESEARCH METHODOLOGY

10.2 ECONOMY

10.2.1 INCREASED SALES OF ELECTRIC SCOOTERS IN ASIA PACIFIC TO DRIVE SEGMENT

TABLE 115 ECONOMY: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

TABLE 116 ECONOMY: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

TABLE 117 ECONOMY: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 118 ECONOMY: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023–2028 (USD MILLION))

10.3 LUXURY

10.3.1 RISING ADOPTION OF LUXURY-CLASS ELECTRIC TWO-WHEELERS TO DRIVE SEGMENT

TABLE 119 LUXURY: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

TABLE 120 LUXURY: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

TABLE 121 LUXURY: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 122 LUXURY: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023–2028 (USD MILLION)

10.4 KEY PRIMARY INSIGHTS

11 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE (Page No. - 209)

11.1 INTRODUCTION

FIGURE 61 TECHNICAL SPECIFICATIONS FOR CONVENTIONAL AND BATTERY ELECTRIC TWO-WHEELERS IN 2022

FIGURE 62 E-MOTORCYCLES SEGMENT TO REGISTER HIGHER CAGR THAN E-SCOOTERS/MOPEDS DURING FORECAST PERIOD

TABLE 123 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (THOUSAND UNITS)

TABLE 124 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (THOUSAND UNITS)

TABLE 125 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (USD MILLION)

TABLE 126 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

11.1.1 OPERATIONAL DATA

TABLE 127 POPULAR E-SCOOTER/MOPED AND E-MOTORCYCLE MODELS WORLDWIDE

TABLE 128 KEY OEMS AND THEIR PRODUCTION CAPACITY IN INDIA

11.1.2 ASSUMPTIONS

TABLE 129 ASSUMPTIONS, BY VEHICLE TYPE

11.1.3 RESEARCH METHODOLOGY

11.2 E-SCOOTERS/MOPEDS

11.2.1 GROWING GOVERNMENT INITIATIVES TO ENHANCE E-MOBILITY

TABLE 130 E-SCOOTERS/MOPEDS MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

TABLE 131 E-SCOOTERS/MOPEDS MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

TABLE 132 E-SCOOTERS/MOPEDS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 133 E-SCOOTERS/MOPEDS MARKET, BY REGION, 2023–2028 (USD MILLION))

11.3 E-MOTORCYCLES

11.3.1 RISING DEMAND FOR HIGH-PERFORMANCE ELECTRIC MOTORCYCLES TO DRIVE MARKET

TABLE 134 E-MOTORCYCLES MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

TABLE 135 E-MOTORCYCLES MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

TABLE 136 E-MOTORCYCLES MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 137 E-MOTORCYCLES MARKET, BY REGION, 2023–2028 (USD MILLION))

11.4 KEY PRIMARY INSIGHTS

12 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY USAGE (Page No. - 223)

12.1 INTRODUCTION

FIGURE 63 ELECTRIC TWO-WHEELER USER CATEGORIES AND CHARGING INFRASTRUCTURE

FIGURE 64 PRIVATE SEGMENT TO REGISTER HIGHER CAGR THAN COMMERCIAL SEGMENT DURING FORECAST PERIOD

TABLE 138 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY USAGE, 2018–2022 (THOUSAND UNITS)

TABLE 139 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY USAGE, 2023–2028 (THOUSAND UNITS)

TABLE 140 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY USAGE, 2018–2022 (USD MILLION)

TABLE 141 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY USAGE, 2023–2028 (USD MILLION)

12.1.1 OPERATIONAL DATA

TABLE 142 POPULAR E-SCOOTER/MOPED AND E-MOTORCYCLE MODELS BY USAGE

12.1.2 ASSUMPTIONS

TABLE 143 ASSUMPTIONS, BY USAGE

12.1.3 RESEARCH METHODOLOGY

12.2 PRIVATE

12.2.1 VARIED RANGE OF PRODUCTS CLUBBED WITH GOVERNMENT INCENTIVES AND REDUCING PRICES TO DRIVE SEGMENT

TABLE 144 PRIVATE: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

TABLE 145 PRIVATE: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

TABLE 146 PRIVATE: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 147 PRIVATE: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023–2028 (USD MILLION))

12.3 COMMERCIAL USE

12.3.1 HIGH INITIAL COST OF OWNERSHIP AND LOW OPERATIONAL AND MAINTENANCE COSTS TO DRIVE SEGMENT

TABLE 148 COMMERCIAL: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

TABLE 149 COMMERCIAL: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

TABLE 150 COMMERCIAL: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 151 COMMERCIAL: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023–2028 (USD MILLION))

12.4 KEY PRIMARY INSIGHTS

13 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY MOTOR TYPE (Page No. - 232)

13.1 INTRODUCTION

FIGURE 65 MID-DRIVE MOTORS SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 152 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY MOTOR TYPE, 2018–2022 (THOUSAND UNITS)

TABLE 153 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY MOTOR TYPE, 2023–2028 (THOUSAND UNITS)

TABLE 154 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY MOTOR TYPE, 2018–2022 (USD MILLION)

TABLE 155 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY MOTOR TYPE, 2023–2028 (USD MILLION)

13.1.1 OPERATIONAL DATA

TABLE 156 POPULAR E-SCOOTER/MOPED AND E-MOTORCYCLE MODELS, BY MOTOR TYPE

13.1.2 ASSUMPTIONS

TABLE 157 ASSUMPTIONS, BY MOTOR TYPE

13.1.3 RESEARCH METHODOLOGY

13.2 MID-DRIVE MOTORS

13.2.1 RISING DEMAND FOR HIGH TORQUE AND PERFORMANCE TO DRIVE SEGMENT

TABLE 158 MID-DRIVE MOTORS: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

TABLE 159 MID-DRIVE MOTORS: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

TABLE 160 MID-DRIVE MOTORS: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2018-2022 (USD MILLION)

TABLE 161 MID-DRIVE MOTORS: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023-2028 (USD MILLION)

13.3 HUB MOTORS

13.3.1 INCREASED SALES OF ELECTRIC TWO WHEELERS TO DRIVE DEMAND

TABLE 162 HUB MOTORS: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

TABLE 163 HUB MOTORS: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

TABLE 164 HUB MOTORS: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2018-2022 (USD MILLION)

TABLE 165 HUB MOTORS: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023-2028 (USD MILLION)

13.4 KEY PRIMARY INSIGHTS

14 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY MOTOR POWER (Page No. - 241)

14.1 INTRODUCTION

FIGURE 66 LESS THAN 1.5 KW TO HOLD PROMINENT MARKET SHARE DURING FORECAST PERIOD

TABLE 166 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY MOTOR POWER, 2018–2022 (THOUSAND UNITS)

TABLE 167 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY MOTOR POWER, 2023–2028 (THOUSAND UNITS)

TABLE 168 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY MOTOR POWER, 2018–2022 (USD MILLION)

TABLE 169 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY MOTOR POWER, 2023–2028 (USD MILLION)

14.1.1 OPERATIONAL DATA

TABLE 170 POPULAR E-SCOOTER/MOPED AND E-MOTORCYCLE MODELS, BY MOTOR POWER

14.1.2 ASSUMPTIONS

TABLE 171 ASSUMPTIONS: BY MOTOR POWER

14.1.3 RESEARCH METHODOLOGY

14.2 LESS THAN 1.5 KW

14.2.1 RISING DEMAND WITH INCREASED ELECTRIC TWO-WHEELER SALES

TABLE 172 LESS THAN 1.5 KW: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

TABLE 173 LESS THAN 1.5 KW: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

TABLE 174 LESS THAN 1.5 KW: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 175 LESS THAN 1.5 KW: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023–2028 (USD MILLION)

14.3 1.5–3 KW

14.3.1 RISE IN SALES OF HIGH-POWER ELECTRIC TWO WHEELERS TO SUPPORT SEGMENT GROWTH

TABLE 176 1.5–3 KW: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

TABLE 177 1.5–3 KW: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

TABLE 178 1.5–3 KW: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 179 1.5–3 KW: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023–2028 (USD MILLION)

14.4 ABOVE 3 KW

14.4.1 DEMAND FOR HIGH-RANGE AND MORE EFFICIENT ELECTRIC TWO WHEELERS TO IMPACT MARKET GROWTH

TABLE 180 ABOVE 3 KW: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

TABLE 181 ABOVE 3 KW: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

TABLE 182 ABOVE 3 KW: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 183 ABOVE 3 KW: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023–2028 (USD MILLION)

14.5 KEY PRIMARY INSIGHTS

15 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION (Page No. - 252)

15.1 INTRODUCTION

FIGURE 67 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023 VS. 2028

TABLE 184 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

TABLE 185 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

TABLE 186 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 187 ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY REGION, 2023–2028 (USD MILLION)

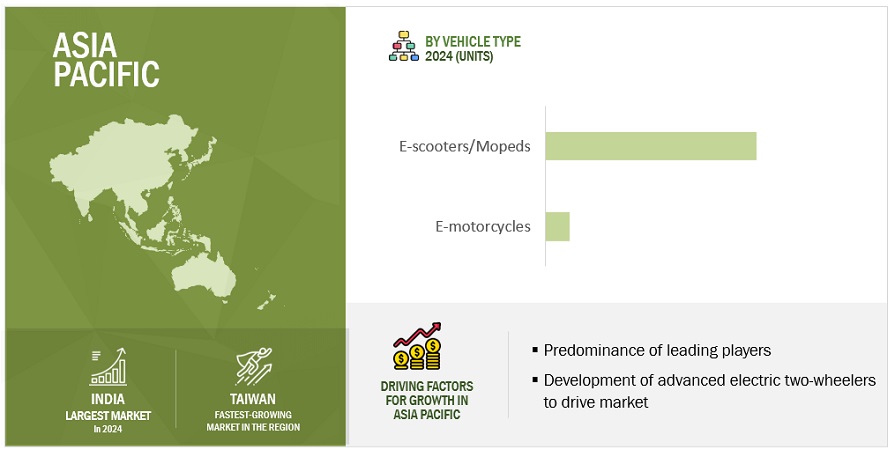

15.2 ASIA PACIFIC

15.2.1 ASIA PACIFIC: RECESSION IMPACT

FIGURE 68 ASIA PACIFIC: ELECTRIC SCOOTER AND MOTORCYCLE MARKET SNAPSHOT

TABLE 188 ASIA PACIFIC: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY COUNTRY, 2018–2022 (THOUSAND UNITS)

TABLE 189 ASIA PACIFIC: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY COUNTRY, 2023–2028 (THOUSAND UNITS)

TABLE 190 ASIA PACIFIC: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 191 ASIA PACIFIC: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

15.2.2 CHINA

15.2.2.1 China to be largest market for e-scooters/mopeds globally

FIGURE 69 MARKET GROWTH OF ELECTRIC MOTORCYCLES AND SCOOTERS IN CHINA, 2015–2024

TABLE 192 CHINA: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (UNITS)

TABLE 193 CHINA: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (UNITS)

TABLE 194 CHINA: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (USD MILLION)

TABLE 195 CHINA: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

15.2.3 JAPAN

15.2.3.1 Renowned manufacturers to develop advanced electric two-wheelers in Japan

TABLE 196 ELECTRIC TWO-WHEELER IMPORT DATA OF JAPAN

TABLE 197 JAPAN: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (UNITS)

TABLE 198 JAPAN: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (UNITS)

TABLE 199 JAPAN: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (USD MILLION)

TABLE 200 JAPAN: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

15.2.4 INDIA

15.2.4.1 Shift of focus from ICE two-wheelers to electric two-wheelers to reduce pollution

TABLE 201 KEY PLANNED INVESTMENTS IN INDIA BATTERY MANUFACTURING SPACE, 2022

FIGURE 70 INDIA: ANNUAL ELECTRIC TWO-WHEELER SALES PROJECTION, 2018–2025

TABLE 202 INDIA: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (UNITS)

TABLE 203 INDIA: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (UNITS)

TABLE 204 INDIA: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (USD MILLION)

TABLE 205 INDIA: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

15.2.5 SOUTH KOREA

15.2.5.1 South Korean automotive industry to develop electric two-wheelers

TABLE 206 SOUTH KOREA: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (UNITS)

TABLE 207 SOUTH KOREA: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (UNITS)

TABLE 208 SOUTH KOREA: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (USD MILLION)

TABLE 209 SOUTH KOREA: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

15.2.6 TAIWAN

15.2.6.1 Expanding charging solution networks in Taiwan to boost market

FIGURE 71 TAIWAN: E-SCOOTER MARKET SHARE, 2022

FIGURE 72 TAIWAN: BATTERY SWAPPING NETWORK BY GOGORO, 2022

FIGURE 73 TAIWAN: ELECTRIC SCOOTER REGISTRATIONS BY BRAND, 2022

TABLE 210 TAIWAN: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (UNITS)

TABLE 211 TAIWAN: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (UNITS)

TABLE 212 TAIWAN: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (USD MILLION)

TABLE 213 TAIWAN: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

15.2.7 THAILAND

15.2.7.1 Need to curb emissions to create more opportunities for electric two-wheelers

TABLE 214 THAILAND: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (UNITS)

TABLE 215 THAILAND: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (UNITS)

TABLE 216 THAILAND: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (USD MILLION)

TABLE 217 THAILAND: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

15.2.8 INDONESIA

15.2.8.1 Government initiatives and strong local demand to boost market

FIGURE 74 INDONESIA: EXISTING POLICIES FOR ELECTRIC VEHICLES

TABLE 218 INDONESIA: OEM SALES (UNITS), 2022

TABLE 219 ELECTRIC TWO/THREE-WHEELERS AVAILABLE FOR SALE IN INDONESIAN MARKET

TABLE 220 INDONESIA: ELECTRIC TWO-WHEELERS, BY PRICE

TABLE 221 INDONESIA: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (UNITS)

TABLE 222 INDONESIA: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (UNITS)

TABLE 223 INDONESIA: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (USD MILLION)

TABLE 224 INDONESIA: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

15.2.9 MALAYSIA

15.2.9.1 Increasing technological development and emergence of electric mobility-as-a-service to drive market

TABLE 225 MALAYSIA: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (UNITS)

TABLE 226 MALAYSIA: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (UNITS)

TABLE 227 MALAYSIA: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (USD MILLION)

TABLE 228 MALAYSIA: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

15.2.10 PHILIPPINES

15.2.10.1 Increasing industrialization to drive market

TABLE 229 PHILIPPINES: ELECTRIC SCOOTER AND MOTORCYCLE PRICES

TABLE 230 PHILIPPINES: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (UNITS)

TABLE 231 PHILIPPINES: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (UNITS)

TABLE 232 PHILIPPINES: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (USD MILLION)

TABLE 233 PHILIPPINES: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

15.2.11 VIETNAM

15.2.11.1 Focus on reducing GHG emissions to drive market

TABLE 234 VIETNAM: ELECTRIC SCOOTER AND MOTORCYCLE PRICES

TABLE 235 VIETNAM: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (UNITS)

TABLE 236 VIETNAM: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (UNITS)

TABLE 237 VIETNAM: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (USD MILLION)

TABLE 238 VIETNAM: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

15.3 EUROPE

15.3.1 EUROPE: RECESSION IMPACT

FIGURE 75 EUROPE: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY COUNTRY, 2023 VS. 2028 (USD MILLION)

TABLE 239 EUROPE: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY COUNTRY, 2018–2022 (THOUSAND UNITS)

TABLE 240 EUROPE: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY COUNTRY, 2023–2028 (THOUSAND UNITS)

TABLE 241 EUROPE: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 242 EUROPE: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

15.3.2 FRANCE

15.3.2.1 Purchase grants by French government to boost demand

TABLE 243 FRANCE: EV CHARGING INFRASTRUCTURE TARGETS

TABLE 244 FRANCE: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (UNITS)

TABLE 245 FRANCE: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (UNITS)

TABLE 246 FRANCE: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (USD MILLION)

TABLE 247 FRANCE: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

15.3.3 GERMANY

15.3.3.1 Leading players from Germany to enter electric two-wheeler segment

FIGURE 76 GERMANY: SCOOTER-SHARING PROVIDERS

TABLE 248 GERMANY: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (UNITS)

TABLE 249 GERMANY: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (UNITS)

TABLE 250 GERMANY: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (USD MILLION)

TABLE 251 GERMANY: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

15.3.4 SPAIN

15.3.4.1 Increasing government investments in charging infrastructure to fuel market

TABLE 252 SPAIN: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (UNITS)

TABLE 253 SPAIN: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (UNITS)

TABLE 254 SPAIN: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (USD MILLION)

TABLE 255 SPAIN: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

15.3.5 AUSTRIA

15.3.5.1 Development of performance e-motorcycles to drive market

TABLE 256 AUSTRIA: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (UNITS)

TABLE 257 AUSTRIA: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (UNITS)

TABLE 258 AUSTRIA: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (USD MILLION)

TABLE 259 AUSTRIA: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

15.3.6 UK

15.3.6.1 Investments in ultra-low emission vehicles to drive market

TABLE 260 UK: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (UNITS)

TABLE 261 UK: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (UNITS)

TABLE 262 UK: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (USD MILLION)

TABLE 263 UK: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

15.3.7 ITALY

15.3.7.1 Italian market driven by performance e-scooters and e-motorcycles

TABLE 264 ITALY: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (UNITS)

TABLE 265 ITALY: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (UNITS)

TABLE 266 ITALY: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (USD MILLION)

TABLE 267 ITALY: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

15.3.8 BELGIUM

15.3.8.1 Development of advanced charging infrastructure by Belgian government to promote electric two-wheelers

TABLE 268 BELGIUM: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (UNITS)

TABLE 269 BELGIUM: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (UNITS)

TABLE 270 BELGIUM: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (USD MILLION)

TABLE 271 BELGIUM: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

15.3.9 NETHERLANDS

15.3.9.1 Plan to phase out conventional ICE two-wheelers to drive market

TABLE 272 NETHERLAND: ELECTRIC SCOOTER IMPORT DATA (2022)

TABLE 273 NETHERLANDS: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (UNITS)

TABLE 274 NETHERLANDS: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (UNITS)

TABLE 275 NETHERLANDS: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (USD MILLION)

TABLE 276 NETHERLANDS: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

15.3.10 POLAND

15.3.10.1 Green commuting to raise market demand

FIGURE 77 POLAND: MARKET SHARE OF ELECTRIC SCOOTER SERVICE PROVIDERS (2022)

TABLE 277 POLAND: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (UNITS)

TABLE 278 POLAND: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (UNITS)

TABLE 279 POLAND: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (USD MILLION)

TABLE 280 POLAND: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

15.3.11 DENMARK

15.3.11.1 Government promotion of private infrastructure to positively affect market

TABLE 281 DENMARK: TOP CITIES WITH EV CHARGING STATIONS (2022)

TABLE 282 DENMARK: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (UNITS)

TABLE 283 DENMARK: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (UNITS)

TABLE 284 DENMARK: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (USD MILLION)

TABLE 285 DENMARK: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

15.4 NORTH AMERICA

15.4.1 NORTH AMERICA: RECESSION IMPACT

FIGURE 78 NORTH AMERICA: ELECTRIC SCOOTER AND MOTORCYCLE MARKET SNAPSHOT

TABLE 286 NORTH AMERICA: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY COUNTRY, 2018–2022 (THOUSAND UNITS)

TABLE 287 NORTH AMERICA: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY COUNTRY, 2023–2028 (THOUSAND UNITS)

TABLE 288 NORTH AMERICA: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 289 NORTH AMERICA: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

15.4.2 US

15.4.2.1 Government initiatives to control increasing pollution to push market demand

TABLE 290 US: POPULAR ELECTRIC TWO-WHEELER OEMS, BY AVERAGE PRICE RANGE

TABLE 291 US: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (UNITS)

TABLE 292 US: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (UNITS)

TABLE 293 US: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (USD MILLION)

TABLE 294 US: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

15.4.3 CANADA

15.4.3.1 Government funding for charging infrastructure to be key to market growth

TABLE 295 AVERAGE COST PENETRATION, BY VEHICLE USE, 2022

TABLE 296 CANADA: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (UNITS)

TABLE 297 CANADA: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (UNITS)

TABLE 298 CANADA: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2018–2022 (USD MILLION)

TABLE 299 CANADA: ELECTRIC SCOOTER AND MOTORCYCLE MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

16 COMPETITIVE LANDSCAPE (Page No. - 311)

16.1 OVERVIEW

TABLE 300 OEM SALES DATA FOR INDIA, 2022

16.2 MARKET SHARE ANALYSIS FOR ELECTRIC SCOOTER AND MOTORCYCLE MARKET

TABLE 301 MARKET SHARE ANALYSIS, 2022

FIGURE 79 MARKET SHARE ANALYSIS, 2022

16.2.1 YADEA TECHNOLOGY GROUP CO., LTD.

16.2.2 JIANGSU XINRI E-VEHICLE CO., LTD.

16.2.3 NIU INTERNATIONAL

16.2.4 HERO ELECTRIC

16.2.5 OKINAWA AUTOTECH INTERNATIONALL PRIVATE LIMITED

16.3 KEY PLAYER STRATEGIES 2019–2023

TABLE 302 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN ELECTRIC SCOOTER AND MOTORCYCLE MARKET

16.4 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS, 2021

FIGURE 80 TOP PUBLIC/LISTED PLAYERS DOMINATING ELECTRIC SCOOTER AND MOTORCYCLE MARKET DURING LAST 5 YEARS

16.5 COMPETITIVE SCENARIOS AND TRENDS

16.5.1 PRODUCT LAUNCHES

TABLE 303 ELECTRIC SCOOTER AND MOTORCYCLE MARKET: PRODUCT LAUNCHES, MAY 2019–JANUARY 2023

16.5.2 DEALS

TABLE 304 ELECTRIC SCOOTER AND MOTORCYCLE MARKET: DEALS, MAY 2019–FEBRUARY 2023

16.5.3 EXPANSIONS

TABLE 305 ELECTRIC SCOOTER AND MOTORCYCLE MARKET: EXPANSIONS, APRIL 2019–JANUARY 2023

16.6 COMPANY EVALUATION MATRIX

16.6.1 STARS

16.6.2 EMERGING LEADERS

16.6.3 PERVASIVE PLAYERS

16.6.4 PARTICIPANTS

FIGURE 81 ELECTRIC SCOOTER AND MOTORCYCLE MARKET: COMPANY EVALUATION MATRIX, 2022

TABLE 306 ELECTRIC SCOOTER AND MOTORCYCLE MARKET: COMPANY FOOTPRINT, 2022

TABLE 307 ELECTRIC SCOOTER AND MOTORCYCLE MARKET: PRODUCT FOOTPRINT, 2022

TABLE 308 ELECTRIC SCOOTER AND MOTORCYCLE MARKET: REGIONAL FOOTPRINT, 2022

16.7 START-UP/SME EVALUATION MATRIX

16.7.1 PROGRESSIVE COMPANIES

16.7.2 RESPONSIVE COMPANIES

16.7.3 DYNAMIC COMPANIES

16.7.4 STARTING BLOCKS

FIGURE 82 ELECTRIC SCOOTER AND MOTORCYCLE MARKET (START-UPS/SMES): COMPANY EVALUATION MATRIX, 2022

TABLE 309 ELECTRIC SCOOTER AND MOTORCYCLE MARKET: LIST OF KEY START-UPS/SMES

TABLE 310 ELECTRIC SCOOTERS AND MOTORCYCLE MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [START-UPS/SMES]

17 COMPANY PROFILES (Page No. - 335)

(Business overview, Products offered, Recent Developments, MnM view, Key strengths, Strategic choices, Weaknesses and competitive threats) *

17.1 KEY PLAYERS

17.1.1 YADEA TECHNOLOGY GROUP CO., LTD.

TABLE 311 YADEA TECHNOLOGY GROUP CO., LTD.: BUSINESS OVERVIEW

FIGURE 83 YADEA TECHNOLOGY GROUP CO., LTD. .: COMPANY SNAPSHOT

FIGURE 84 YADEA TECHNOLOGY GROUP CO., LTD.: SALES NETWORK, 2022

FIGURE 85 YADEA TECHNOLOGY GROUP CO., LTD.: REVENUE GENERATED BY PRODUCT TYPE, 2020 & 2021

TABLE 312 YADEA TECHNOLOGY GROUP CO., LTD.: PRODUCTS OFFERED

TABLE 313 YADEA TECHNOLOGY GROUP CO., LTD.: NEW PRODUCT DEVELOPMENTS

TABLE 314 YADEA TECHNOLOGY GROUP CO., LTD.: DEALS

TABLE 315 YADEA TECHNOLOGY GROUP CO., LTD.: OTHERS

17.1.2 NIU INTERNATIONAL

TABLE 316 NIU INTERNATIONAL: BUSINESS OVERVIEW

FIGURE 86 NIU INTERNATIONAL: COMPANY SNAPSHOT

FIGURE 87 NIU INTERNATIONAL: ORGANIZATIONAL STRUCTURE

TABLE 317 NIU INTERNATIONAL: PRODUCTS OFFERED

TABLE 318 NIU INTERNATIONAL: NEW PRODUCT DEVELOPMENTS

TABLE 319 NIU INTERNATIONAL: DEALS

17.1.3 SILENCE URBAN ECOMOBILITY

TABLE 320 SILENCE URBAN ECOMOBILITY: BUSINESS OVERVIEW

FIGURE 88 SILENCE URBAN ECOMOBILITY: COMPANY SNAPSHOT

TABLE 321 SILENCE URBAN ECOMOBILITY: PRODUCTS OFFERED

TABLE 322 SILENCE URBAN ECOMOBILITY: NEW PRODUCT DEVELOPMENTS

TABLE 323 SILENCE URBAN ECOMOBILITY: DEALS

TABLE 324 SILENCE URBAN ECOMOBILITY: OTHERS

17.1.4 HERO ELECTRIC

TABLE 325 HERO ELECTRIC: BUSINESS OVERVIEW

FIGURE 89 HERO ELECTRIC: COMPANY ANNUAL GROWTH

TABLE 326 HERO ELECTRIC: PRODUCTS OFFERED

TABLE 327 HERO ELECTRIC: NEW PRODUCT DEVELOPMENTS

TABLE 328 HERO ELECTRIC: DEALS

TABLE 329 HERO ELECTRIC: OTHERS

17.1.5 JIANGSU XINRI E-VEHICLE CO., LTD.

TABLE 330 JIANGSU XINRI E-VEHICLE CO., LTD.: BUSINESS OVERVIEW

FIGURE 90 JIANGSU XINRI E-VEHICLE CO., LTD.: COMPANY SNAPSHOT

TABLE 331 JIANGSU XINRI E-VEHICLE CO., LTD.: PRODUCTS OFFERED

TABLE 332 JIANGSU XINRI E-VEHICLE CO., LTD.: NEW PRODUCT DEVELOPMENTS

TABLE 333 JIANGSU XINRI E-VEHICLE CO., LTD.: DEALS

TABLE 334 JIANGSU XINRI E-VEHICLE CO., LTD.: OTHERS

17.1.6 VMOTO LIMITED

TABLE 335 VMOTO LIMITED: BUSINESS OVERVIEW

FIGURE 91 VMOTO LIMITED: COMPANY SNAPSHOT

FIGURE 92 VMOTO LIMITED: ELECTRIC MOTORCYCLE/MOPED SALES BY QUARTER, 2020–2022

TABLE 336 VMOTO LIMITED: PRODUCTS OFFERED

TABLE 337 VMOTO LIMITED: NEW PRODUCT DEVELOPMENTS

TABLE 338 VMOTO LIMITED: DEALS

TABLE 339 VMOTO LIMITED: OTHERS

17.1.7 ENERGICA MOTOR COMPANY S.P.A.

TABLE 340 ENERGICA MOTOR COMPANY S.P.A: BUSINESS OVERVIEW

FIGURE 93 ENERGICA MOTOR COMPANY S.P.A.: COMPANY SNAPSHOT

TABLE 341 ENERGICA MOTOR COMPANY S.P.A.: PRODUCTS OFFERED

TABLE 342 ENERGICA MOTOR COMPANY S.P.A.: NEW PRODUCT DEVELOPMENTS

TABLE 343 ENERGICA MOTOR COMPANY S.P.A.: DEALS

TABLE 344 ENERGICA MOTOR COMPANY S.P.A.: OTHERS

17.1.8 ASKOLL EVA S.P.A.

TABLE 345 ASKOLL EVA S.P.A.: BUSINESS OVERVIEW

FIGURE 94 ASKOLL EVA S.P.A.: COMPANY SNAPSHOT

FIGURE 95 ASKOLL EVA S.P.A.: COMPANY BUSINESS LINE SNAPSHOT

TABLE 346 ASKOLL EVA S.P.A.: PRODUCTS OFFERED

TABLE 347 ASKOLL EVA S.P.A.: NEW PRODUCT DEVELOPMENTS

TABLE 348 ASKOLL EVA S.P.A.: DEALS

17.1.9 GOGORO

TABLE 349 GOGORO: BUSINESS OVERVIEW

FIGURE 96 GOGORO: COMPANY SNAPSHOT

TABLE 350 GOGORO: PRODUCTS OFFERED

TABLE 351 GOGORO: NEW PRODUCT DEVELOPMENTS

TABLE 352 GOGORO: DEALS

17.1.10 OKINAWA AUTOTECH INTERNATIONALL PVT. LTD.

TABLE 353 OKINAWA AUTOTECH PVT. LTD.: BUSINESS OVERVIEW

TABLE 354 OKINAWA AUTOTECH PVT. LTD.: PRODUCTS OFFERED

TABLE 355 OKINAWA AUTOTECH INTERNATIONALL PVT. LTD.: NEW PRODUCT DEVELOPMENTS

TABLE 356 OKINAWA AUTOTECH INTERNATIONALL PVT. LTD.: DEALS

TABLE 357 OKINAWA AUTOTECH INTERNATIONALL PVT. LTD.: OTHERS

17.1.11 ZHEJIANG LUYUAN ELECTRIC VEHICLE CO., LTD.

TABLE 358 ZHEJIANG LUYUAN ELECTRIC VEHICLE CO., LTD.: BUSINESS OVERVIEW

TABLE 359 ZHEJIANG LUYUAN ELECTRIC VEHICLE CO., LTD.: PRODUCTS OFFERED

TABLE 360 ZHEJIANG LUYUAN ELECTRIC VEHICLE CO., LTD.: NEW PRODUCT DEVELOPMENTS

TABLE 361 ZHEJIANG LUYUAN ELECTRIC VEHICLE CO., LTD.: DEALS

TABLE 362 ZHEJIANG LUYUAN ELECTRIC VEHICLE CO., LTD.: OTHERS

17.1.12 ZERO MOTORCYCLES, INC.

TABLE 363 ZERO MOTORCYCLES, INC.: BUSINESS OVERVIEW

TABLE 364 ZERO MOTORCYCLES, INC.: PRODUCTS OFFERED

TABLE 365 ZERO MOTORCYCLES, INC.: NEW PRODUCT DEVELOPMENTS

TABLE 366 ZERO MOTORCYCLES, INC.: DEALS

17.1.13 GOVECS

TABLE 367 GOVECS: BUSINESS OVERVIEW

TABLE 368 GOVECS: PRODUCTS OFFERED

TABLE 369 GOVECS: NEW PRODUCT DEVELOPMENTS

TABLE 370 GOVECS: DEALS

TABLE 371 GOVECS CORPORATION: OTHERS

*Details on Business overview, Products/Solutions/Services offered, Recent Developments, MnM view, Key strengths, Strategic choices, Weaknesses and competitive threats might not be captured in case of unlisted companies.

17.2 OTHER PLAYERS

17.2.1 ULTRAVIOLETTE AUTOMOTIVE

TABLE 372 ULTRAVIOLETTE AUTOMOTIVE: BUSINESS OVERVIEW

17.2.2 REVOLT INTELLICORP PRIVATE LIMITED (REVOLT MOTORS)

TABLE 373 REVOLT INTELLICORP PRIVATE LIMITED (REVOLT MOTORS): BUSINESS OVERVIEW

17.2.3 ATHER ENERGY

TABLE 374 ATHER ENERGY: BUSINESS OVERVIEW

17.2.4 OLA ELECTRIC MOBILITY PVT. LTD.

TABLE 375 OLA ELECTRIC MOBILITY PVT LTD.: BUSINESS OVERVIEW

17.2.5 Z ELECTRIC VEHICLE

TABLE 376 Z ELECTRIC VEHICLE: BUSINESS OVERVIEW

17.2.6 CAKE

TABLE 377 CAKE: BUSINESS OVERVIEW

17.2.7 LIGHTNING MOTORCYCLES

TABLE 378 LIGHTNING MOTORCYCLES: BUSINESS OVERVIEW

17.2.8 JOHAMMER

TABLE 379 JOHAMMER: BUSINESS OVERVIEW

17.2.9 PIAGGIO GROUP

TABLE 380 PIAGGIO GROUP: BUSINESS OVERVIEW

17.2.10 KTM AG

TABLE 381 KTM AG: BUSINESS OVERVIEW

17.2.11 HARLEY DAVIDSON

TABLE 382 HARLEY DAVIDSON: BUSINESS OVERVIEW

17.2.12 BMW GROUP

TABLE 383 BMW GROUP: BUSINESS OVERVIEW

17.2.13 AIMA TECHNOLOGY GROUP CO., LTD.

TABLE 384 AIMA TECHNOLOGY GROUP CO., LTD.: BUSINESS OVERVIEW

17.2.14 HONDA MOTOR CO., LTD.

TABLE 385 HONDA MOTOR CO., LTD.: BUSINESS OVERVIEW

17.2.15 GREAVES ELECTRIC MOBILITY PRIVATE LIMITED (AMPERE VEHICLES)

FIGURE 97 GREAVES ELECTRIC MOBILITY PRIVATE LIMITED: COMPANY REVENUE SNAPSHOT

TABLE 386 GREAVES ELECTRIC MOBILITY PRIVATE LIMITED (AMPERE VEHICLES): BUSINESS OVERVIEW

17.2.16 DONGGUAN TAILING ELECTRIC VEHICLE CO., LTD.

TABLE 387 DONGGUAN TAILING ELECTRIC VEHICLE CO., LTD.: BUSINESS OVERVIEW

17.2.17 CEZETA

TABLE 388 CEZETA: BUSINESS OVERVIEW

17.2.18 TERRA MOTORS CORPORATION

TABLE 389 TERRA MOTORS CORPORATION: BUSINESS OVERVIEW

17.2.19 SHANDONG INCALCU ELECTRIC VEHICLE CO., LTD.

TABLE 390 SHANDONG INCALCU ELECTRIC VEHICLE CO., LTD.: BUSINESS OVERVIEW

17.2.20 NEXZU MOBILITY LTD. (AVAN MOTORS INDIA)

TABLE 391 NEXZU MOBILITY LTD. (AVAN MOTORS INDIA): BUSINESS OVERVIEW

17.2.21 EMFLUX MOTORS

TABLE 392 EMFLUX MOTORS: BUSINESS OVERVIEW

17.2.22 TVS MOTOR COMPANY

TABLE 393 TVS MOTOR COMPANY: BUSINESS OVERVIEW

17.2.23 BAJAJ AUTO LTD.

TABLE 394 BAJAJ AUTO LTD.: BUSINESS OVERVIEW

17.2.24 MAHINDRA & MAHINDRA LTD.

TABLE 395 MAHINDRA & MAHINDRA LTD.: BUSINESS OVERVIEW

17.2.25 DAMON MOTORS INC.

TABLE 396 DAMON MOTORS INC.: BUSINESS OVERVIEW

17.2.26 VIAR MOTOR INDONESIA

TABLE 397 VIAR MOTOR INDONESIA: BUSINESS OVERVIEW

17.2.27 SELIS

TABLE 398 SELIS: BUSINESS OVERVIEW

17.2.28 GESITS

TABLE 399 GESITS: BUSINESS OVERVIEW

17.2.29 UNITED MOTOR

TABLE 400 UNITED MOTOR: BUSINESS OVERVIEW

17.2.30 ELVINDO

TABLE 401 ELVINDO: BUSINESS OVERVIEW

17.2.31 RAKATA MOTORCYCLE

TABLE 402 RAKATA MOTORCYCLE: BUSINESS OVERVIEW

17.2.32 KWANG YANG MOTOR CO., LTD.

TABLE 403 KWANG YANG MOTOR CO., LTD.: BUSINESS OVERVIEW

17.2.33 SMOOT ELEKTRIK

TABLE 404 SMOOT ELEKTRIK : BUSINESS OVERVIEW

17.2.34 PT VOLTA INDONESIA SEMESTA (VOLTA)

TABLE 405 PT VOLTA INDONESIA SEMESTA (VOLTA): BUSINESS OVERVIEW

17.2.35 ALVA

TABLE 406 ALVA: BUSINESS OVERVIEW

17.2.36 NUSA MOTORS

TABLE 407 NUSA MOTORS: BUSINESS OVERVIEW

17.2.37 OYIKA

TABLE 408 OYIKA: BUSINESS OVERVIEW

17.2.38 MIGO EBIKE

TABLE 409 MIGO EBIKE: BUSINESS OVERVIEW

17.2.39 BF GOODRICH

TABLE 410 BF GOODRICH: BUSINESS OVERVIEW

17.2.40 ROBERT BOSCH GMBH

TABLE 411 ROBERT BOSCH GMBH: BUSINESS OVERVIEW

17.2.41 NIDEC CORPORATION

TABLE 412 NIDEC CORPORATION: BUSINESS OVERVIEW

17.2.42 CONTINENTAL AG

TABLE 413 CONTINENTAL AG: BUSINESS OVERVIEW

17.2.43 VALEO

TABLE 414 VALEO: BUSINESS OVERVIEW

17.2.44 SEG AUTOMOTIVE

TABLE 415 SEG AUTOMOTIVE: BUSINESS OVERVIEW

18 RECOMMENDATIONS BY MARKETSANDMARKETS (Page No. - 428)

18.1 RISING DEMAND FOR ELECTRIC SCOOTERS AND MOTORCYCLES MARKET IN ASIA PACIFIC

18.2 TECHNOLOGICAL ADVANCEMENTS TO HELP DEVELOP MARKET FOR BATTERY SWAPPING

18.3 CONCLUSION

19 APPENDIX (Page No. - 430)

19.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

19.2 DISCUSSION GUIDE

19.3 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

19.4 CUSTOMIZATION OPTIONS

19.5 RELATED REPORTS

19.6 AUTHOR DETAILS

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Electric Scooter and Motorcycle Market

What are Electric Scooter and Motorcycle Market Newer business models like sustainable and profitable revenue streams in the future?