EliSpot and FluoroSpot Assay Market by Product (Assay kit (Technique, Utility, Analyte (T Cell and B Cell assay)), Analyzer), Application (Transplants, Infectious Diseases, Vaccine Development, Cancer Research), End User & Region - Global Forecast to 2028

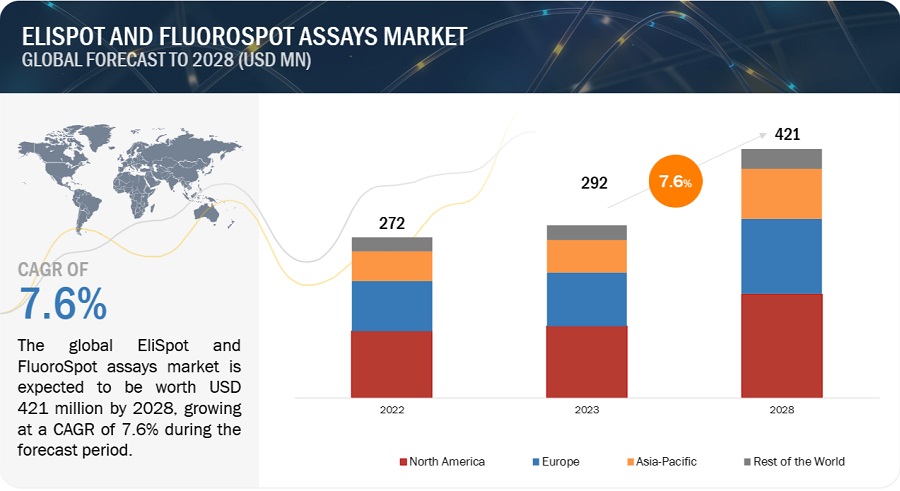

The global elispot and fluorospot assay market in terms of revenue was estimated to be worth $292 million in 2023 and is poised to reach $421 million by 2028, growing at a CAGR of 7.6% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

The expansion of this market is majorly due to upsurging cases of chronic diseases such as cancer as well as growing Growth in biotechnology and biopharmaceutical industries. However, availability of other detection technologies is one of the challenge for which may inhibit the growth of this market.

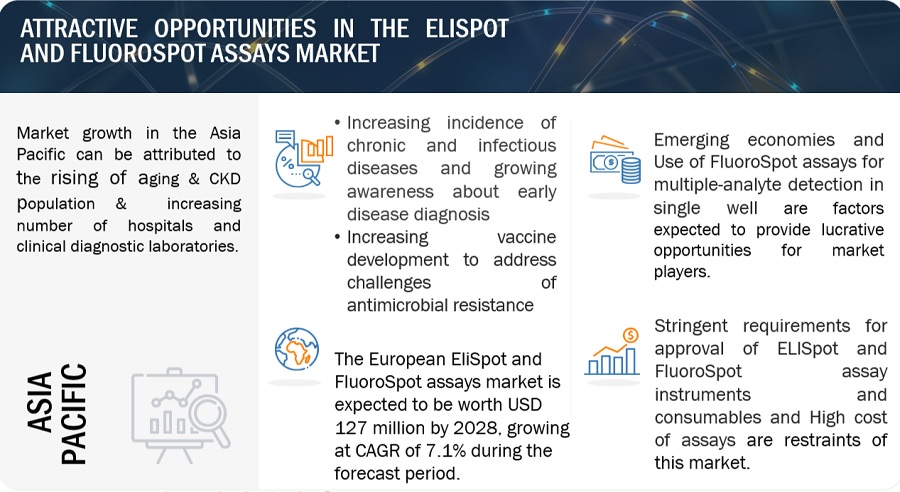

Attractive Opportunities in the ELISpot and FluoroSpot Assays Market

To know about the assumptions considered for the study, Request for Free Sample Report

Global ELISpot and FluoroSpot Assays Market Dynamics

Driver: Increasing Incidence of Chronic and Infectious Diseases and Growing Awareness About Early Disease Diagnosis

The increasing incidences of chronic and infectious diseases is a significant driver for the EliSpot and FluoroSpot Assays Market. EliSpot and FluoroSpot assays are used to assess immune responses, making them valuable tools in understanding how the immune system reacts to various diseases. In the context of infectious diseases, these assays can provide insights into the specific immune responses against pathogens. The ability of these assays to provide detailed insights into immune responses makes them valuable tools in a variety of disease contexts. As the incidence of chronic and infectious diseases continues to rise globally, the demand for advanced diagnostic technologies like EliSpot and FluoroSpot assays is likely to grow Likewise, As awareness continues to grow, individuals and healthcare providers are likely to place greater emphasis on early disease diagnosis as a key component of proactive healthcare strategies. The demand for advanced diagnostic assays that facilitate early detection, such as EliSpot and FluoroSpot assays, is expected to align with this trend.

Restraints: High Cost Of Assays Kits And Analyzers

The initial purchase and ongoing use of ELISpot and FluoroSpot assay kits, reagents, and analyzers can be expensive. The cost of acquiring the necessary equipment and maintaining a consistent supply of kits and reagents can present financial barriers, particularly for smaller research labs or resource-constrained settings. Similarly, these assays can be expensive in terms of reagents, equipment, and specialized knowledge. For researchers and laboratories with limited budgets, the high upfront costs can be a deterrent. Research projects that require frequent and extensive use of ELISpot and FluoroSpot assays can quickly accumulate substantial costs, including expenses related to assay kits, reagents, and maintenance of analyzers. This can limit the scope of research activities. For instance, a Human Cytokine FluoroSpot Kit can cost up to USD 1,110 per kit. Likewise, an ELISpot reader is priced at around USD 25,000.

The high cost of ELISpot and FluoroSpot assay kits, reagents, and analyzers acts as a restraint for the growth and adoption of these assays in various research and clinical settings. While cost can be a significant restraint, it is important to weigh the potential benefits of ELISpot and FluoroSpot assays, such as their ability to provide valuable insights into immune responses and their role in advancing research, clinical diagnostics, and personalized medicine. Balancing cost considerations with the value of the information these assays provide is crucial for decision-making in their adoption.

Opportunity: Use Of Fluorospot Assays For Multiple-Analyte Detection In Single Well

The FluoroSpot assay enables the measurement of different analytes secreted at the single-cell level. This highly sensitive cellular assay is robust, easy to perform, and suitable for both single tests and large-scale screening. Analytes range from cytokines to immunoglobulins. As a result, performing a single FluoroSpot assay to assess multiple analytes is more efficient and resource-friendly compared to running multiple individual assays. This streamlines laboratory workflows, saves time, and conserves precious samples.

The analysis of single analytes from T- or B-cells is well established. However, since the total surface area of the plate is large and analyte concentrations are low, there is a growing demand for multiple-analyte detection (from a single cell) in the same well. This can be achieved by using FluoroSpot assays, where different secondary antibodies are tagged using different dyes. The reader detects fluorescence through specific filters for the dyes. For instance, in 2021, Mabtech (Sweden) launched the IRISTM ELISpot/FluoroSpot reader, which utilizes RAWspot technology for the accurate identification of spot centers and spot numbers. It also provides information on relative spot volume.

Multiple-analyte detection reduces the cost of the overall assay and thus presents huge opportunities for players to expand their product portfolios. Currently, FluoroSpot accounts for a smaller share of the total market. However, many companies have started providing 2-, 3-, and 4-color FluoroSpot assay kits. The ability to measure multiple analytes simultaneously enables researchers to obtain a more comprehensive and detailed profile of the immune response. This is particularly valuable in immunology research, vaccine development, and autoimmune disease studies, where various cytokines play distinct roles. For instance, autoimmune diseases affect around 10% of the global population, with 13% of women and 7% of men being affected (Source: Neuroscience 2023). Owing to this, FluoroSpot assays are expected to present high-growth opportunities for players in the coming years.

Challenge: Dearth Of Skilled Professionals

The dearth of skilled professionals can indeed pose challenges in the EliSpot and FluoroSpot Assays Market. Skilled professionals are needed for the optimization and standardization of EliSpot and FluoroSpot assays. Likewise, they are needed for the continuous innovation and development of new assays or improvements to existing ones. A shortage of skilled researchers may slow down advancements in the field. IN addition, The lack of expertise can lead to variations in assay performance and results, impacting the reliability and reproducibility of the tests. The Gatsby Foundation stated in 2019 that over 1.5 million people serve in the health, engineering, science, and technology domains. Over 50,000 retire every year, and 700,000 technicians will be required to meet the soaring demands in the next decade. The Duquesne University School of Nursing has stated that by 2025, there will be a shortage of over 29,400 nurse practitioners and more than 400,000 home health aides.

Addressing the shortage of skilled professionals in the EliSpot and FluoroSpot Assays Market may require collaborative efforts from educational institutions, industry stakeholders, and regulatory bodies to promote training programs, certification initiatives, and workforce development. This can contribute to the sustained growth and adoption of these diagnostic technologies.

Ecosystem Analysis of Elispot and Fluorospot Assays Market

Source: MarketsandMarkets Analysis

An ecosystem analysis of the EliSpot and FluoroSpot assays market involves examining the interconnected network of entities, activities, and factors that influence the development, adoption, and utilization of these immunological assays. The ecosystem encompasses various stakeholders, including manufacturers, research institutions, healthcare providers, regulatory bodies, and end-users.

China is anticipated to account the largest share of Apac ELISpot and FluoroSpot Assays Industry

Based on the Apac region, the ELISpot and FluoroSpot Assays Market is divided into China, Japan, and India. China is expected to account the largest share of ELISpot and FluoroSpot Assays Market. The rising burden of infectious diseases and chronic conditions in China underscores the importance of advanced diagnostic tools for disease monitoring and research. EliSpot and FluoroSpot assays can be valuable in this context. Likewise, China has been increasing its investments in healthcare infrastructure and services. The expansion of healthcare facilities and laboratories provides opportunities for the implementation of advanced diagnostic technologies. In addition, China has witnessed substantial growth in its biotechnology and pharmaceutical industry. The industry's focus on drug development, vaccine research, and immunotherapy aligns with the applications of EliSpot and FluoroSpot assays in immunological research.

Germany is forecasted as the fastest growing country of ELISpot and FluoroSpot Assays Industry in Europe.

Based on the Europe region, the ELISpot and FluoroSpot Assays Market is divided into Germany, UK, Italy, Spain, France, and RoE. Germany is forecasted to the fastest growing market of ELISpot and FluoroSpot Assays Market in Europe. Germany is known for its strong biomedical research community, including leading universities, research institutes, and healthcare facilities. The country's commitment to scientific research contributes to the demand for advanced diagnostic technologies like EliSpot and FluoroSpot assays. Likewise, Germany has a well-developed pharmaceutical and biotechnology industry that actively engages in research and development. The industry's focus on drug discovery, vaccine development, and immunotherapy aligns with the applications of EliSpot and FluoroSpot assays in assessing immune responses. In addition, Germany has a robust healthcare infrastructure, which includes advanced laboratories and diagnostic facilities. The availability of well-equipped healthcare institutions supports the implementation and utilization of sophisticated diagnostic technologies.

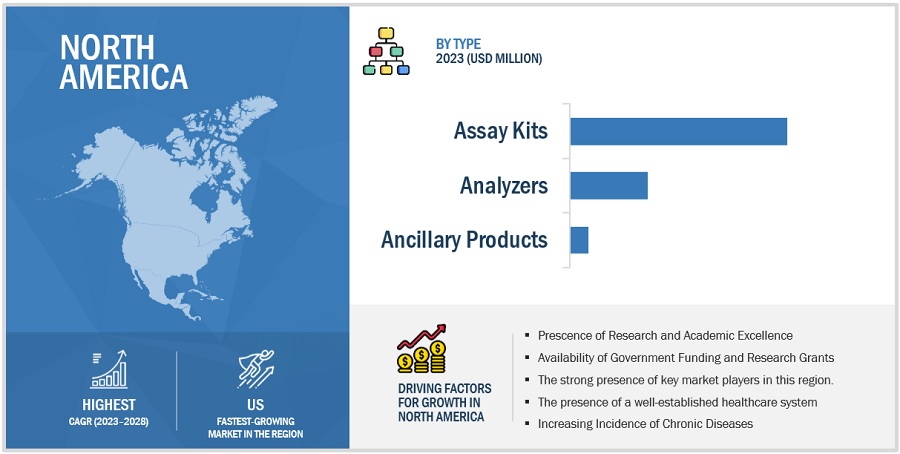

North America dominates the global ELISpot and FluoroSpot Assays Industry

Based on the region, the ELISpot and FluoroSpot Assays Market is segmented into North America, Europe, Asia Pacific, and the Rest of the World (RoW). North America is expected to dominate the ELISpot and FluoroSpot Assays Market. Growth in the North American market is mainly driven by the factors such as North America, boasts an advanced and well-established healthcare infrastructure. The presence of state-of-the-art laboratories, research institutions, and healthcare facilities provides a conducive environment for the adoption of advanced diagnostic technologies like EliSpot and FluoroSpot assays. Similarly, The region is home to some of the world's leading research institutions and academic centers. These institutions are often at the forefront of biomedical research, including studies related to immunology and infectious diseases, driving the demand for advanced diagnostic assays. In addition, North America has a robust biotechnology and pharmaceutical industry that actively engages in research and development activities. The industry's focus on drug discovery, vaccine development, and immunotherapy drives the demand for assays that assess immune responses, such as EliSpot and FluoroSpot assays.

To know about the assumptions considered for the study, download the pdf brochure

Some of the players operating in North American market are Cellular Technology Limited (US), Becton, Dickinson and Company (US), Bio-Techne. (US), Jackson ImmunoResearch Inc (US), and Anogen-Yes Biotech Laboratories Ltd (Canada).

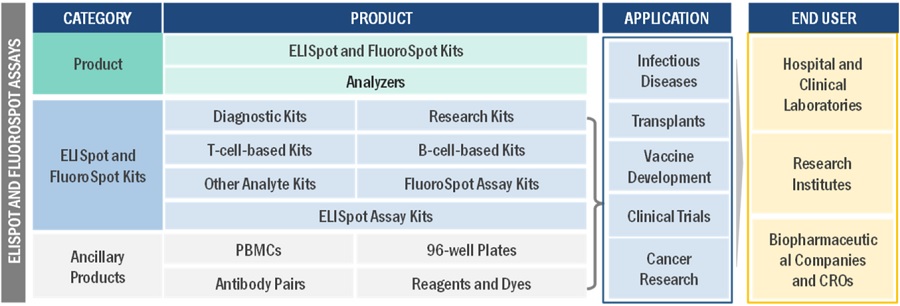

T cell-based kits in the analytes kit segment of the ELISpot and FluoroSpot Assays Industry to witness the highest shares during the forecast period.

Based on the Analyte, the ELISpot and FluoroSpot Assays Market is classified into T-Cell-based Kits, B-cell-based Kits, Other analyte Kits. The T-Cell-based Kits segment is expected to dominate. The growth of this market is driven by due to its wide applications such as T cells play a central role in the adaptive immune response, and their activation is crucial for an effective immune response against infections, cancers, and other diseases. T cell-based kits are essential tools for studying and understanding T cell responses in various research areas. Likewise, T cell-based assays are commonly used in infectious disease research to assess the immune response against pathogens such as viruses and bacteria. Understanding T cell activation and cytokine production provides insights into the body's defense mechanisms. In addition, T cell-based assays are crucial for assessing the immune response to cancer cells. These assays are used to monitor T cell activity in patients undergoing immunotherapies, providing insights into treatment efficacy.

Infectious diseases in the diagnostic’ application segment of the ELISpot and FluoroSpot Assays Industry to witness the highest shares during the forecast period.

Based on the Diagnostic Applications, the ELISpot and FluoroSpot Assays Market is classified into Infectious diseases, and Transplants. infectious diseases may dominate in terms of market size due to their global prevalence, transplant diagnostics using EliSpot and FluoroSpot assays have a crucial and growing role in a specialized clinical niche. Market shares are influenced by factors such as disease burden, clinical applications, technological advancements, and regulatory approvals in each respective area.

Scope of the ELISpot and FluoroSpot Assays Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$292 million |

|

Projected Revenue by 2028 |

$421 million |

|

Revenue Rate |

Poised to Grow at a CAGR of 7.6% |

|

Market Driver |

Increasing Incidence of Chronic and Infectious Diseases and Growing Awareness About Early Disease Diagnosis |

|

Market Opportunity |

Use Of Fluorospot Assays For Multiple-Analyte Detection In Single Well |

This research report categorizes the ELISpot and FluoroSpot Assays Market to forecast revenue and analyze trends in each of the following submarkets:

|

By Region |

|

|

By product |

|

|

By Application |

|

|

By End User |

|

Recent Developments of ELISpot and FluoroSpot Assays Industry

- In 2022, The company Mabtech (Sweden) had made ELISpot kits available in a 100-plate format. Pre-coated plates are also included to save time and reduce assay variability. In 2022, The company also made available the Human IL-21 analyte in two colors in its FluoroSpot Flex platform.

- In 2021, The company Cellular Technology Limited (CTL) (US) launched ImmunoSpot kits that contain precoating quality controlled (PCQC) plates, thereby adding an essential audit trail to ELISPOT analysis.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global elispot and fluorospot assay market?

The global elispot and fluorospot assay market boasts a total revenue value of $421 million by 2028.

What is the estimated growth rate (CAGR) of the global elispot and fluorospot assay market?

The global elispot and fluorospot assay market has an estimated compound annual growth rate (CAGR) of 7.6% and a revenue size in the region of $292 million in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the current size of the ELISpot and FluoroSpot Assays Market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to eastimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

Extensive primary research was conducted after acquiring knowledge about the global market scenario through secondary research. Primary interviews were conducted from both the demand (Doctors, Surgeons) and supply sides (ELISpot and FluoroSpot manufacturers and distributors).

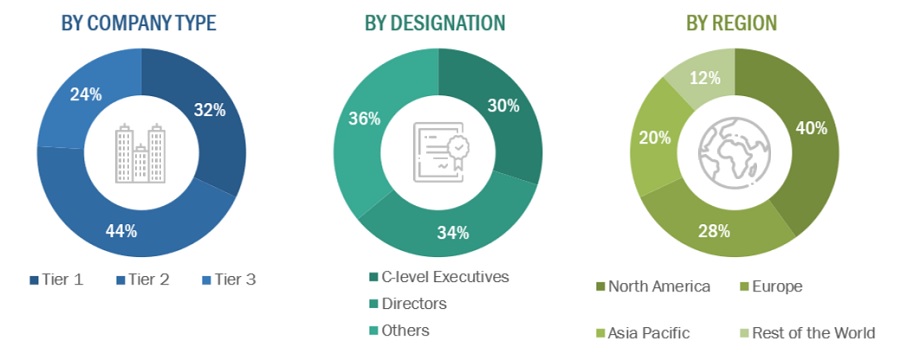

The following is a breakdown of the primary respondents:

Breakdown of Primary Participants:

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2. Tiers of companies are defined based on their total revenue. As of 2021: Tier 1 = >USD 5 billion, Tier 2 = USD 500 million to USD 5 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the ELISpot and FluoroSpot Assays Market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the ELISpot and FluoroSpot Assays Market industry.

Market Definition

ELISpot (enzyme-linked immunospot) and FluoroSpot assays are used for the detection of analytes from immune cells. ELISpot assays are extensively used for monitoring immune responses, such as the quantification of cytokine or antibody-secreting cells. FluoroSpot assays, on the other hand, are a modification of the T-cell ELISpot assay. They are used for the detection of two cytokines released by a single T-cell. The FluoroSpot assay is based on the use of fluorescent conjugates, which can be visualized by fluorescence microscopy by an ELISpot reader equipped with a fluorescent light source.

These assays are used widely in immune monitoring and vaccine development. The analytes include T-cell-based cytokines (such as interferon-gamma, interleukins, and B-cell-based antibodies) and other analytes (such as granzymes from NK cells and macrophages). ELISpot and FluoroSpot analyzers examine the spots based on their color and size.

Market Stakeholders

- Research and Consulting Companies

- Hospital and Diagnostic Laboratories

- Government Associations

- Hospitals, Diagnostic Centers, and Medical Colleges

- Teaching Hospitals and Academic Medical Centers

- Venture Capitalists and Investors

- Manufacturers and Vendors of ELISpot and FluoroSpot Kits, Analyzers, and Ancillary Products

- Distributors of ELISpot and FluoroSpot Kits, Analyzers, and Ancillary Products

- Healthcare Institutes

- Pharmaceutical and Biopharmaceutical Companies

- Diagnostic Associations

- Research Institutes

- Clinical Laboratories

- Contract Research Manufacturers of ELISpot and FluoroSpot Assays

Report Objectives

- To define, describe, and forecast the global ELISpot and FluoroSpot Assays Market based on product, Application, End User and Region.

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of market segments with respect to four main regions—North America, Europe, Asia Pacific and the Rest of the World (RoW)

- To strategically profile key players and comprehensively analyze their product portfolios, market shares, and core competencies

- To track and analyze competitive developments such as acquisitions, expansions, new product launches, and partnerships in the ELISpot and FluoroSpot Assays Market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

- Product Analysis: Product matrix, which gives a detailed comparison of the product portfolios of each company

- Geographic Analysis: Further breakdown of the European ELISpot and FluoroSpot Assays Market into specific countries.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in EliSpot and FluoroSpot Assay Market