Embolic Protection Devices Market by Type (Distal Filter, Distal Occlusion, Proximal Occlusion), Material (Nitinol, Polyurethane), Application (Cardiovascular, Neurovascular, Peripheral), Indication (PCI, SVD, TAVR) - Global Forecast to 2023

The global embolic protection devices market is projected to reach USD 604.9 Million by 2023, at a CAGR of 8.3%. Factors such as the rising incidence of cardiovascular and neurovascular diseases, growing funding and investments, launch of technologically advanced embolic protection devices, and rising demand for minimally invasive procedures are expected to drive the growth of the market. On the other hand, product failures and recalls may hinder the overall market growth to a certain extent during the forecast period.

Objectives of the Study

- To define, describe, and forecast the embolic protection devices market by product type & material, application, indication, end user, and region

- To provide detailed information about the major factors influencing market growth (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets1 with respect to the individual growth trends, prospects, and contributions to the overall market

- To analyze the market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments in North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To profile key players and comprehensively analyze their market shares and core competencies2 in the global market

- To track and analyze competitive developments such as partnerships, agreements, & collaborations; mergers & acquisitions; product developments; and geographical expansions in the global embolic protection devices market

Research Methodology

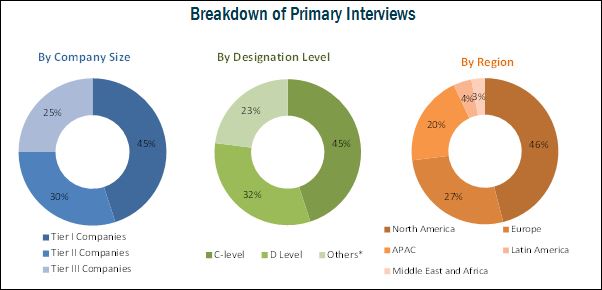

Top-down and bottom-up approaches were used to validate the size of the global market and estimate the size of various other dependent submarkets. Major players in the market were identified through secondary sources; directories; databases such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource, journals and their market revenues were determined through primary and secondary research. Secondary research included the study of the annual and financial reports of top market players, whereas primary research included extensive interviews with the key opinion leaders such as CEOs, directors, and marketing executives. The percentage splits, shares, and breakdowns of the product markets were determined using secondary sources and verified through primary sources. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

To know about the assumptions considered for the study, download the pdf brochure

The global market is consolidated in nature with the top four players, namely, Medtronic (Ireland), Abbott (US), Boston Scientific (US), Cordis (A Cardinal Health Company) (US) accounting for ~90% of the market share in 2017. The other players in this market include Allium Medical Solutions (Israel), Contego Medical (US), W.L. Gore & Associates (US), silk Road Medical (US), Claret Medical (US), and AngioSlide (Israel) who collectively accounted for a share of ~10% of the market in 2017.

Target Audience:

- Healthcare institutions (hospitals, medical schools, and outpatient clinics)

- Ambulatory care centers

- Market research and consulting firms

- Venture capitalists and investors

- Medical devices companies

- Embolic protection device manufacturers and distributors

Embolic Protection Devices Market Scope

The research report categorizes the global market into the following segments and subsegments:

By Type & Material

-

By Type

- Distal Filter Devices

- Distal Occlusion Devices

- Proximal Occlusion Devices

-

By Material

- Nitinol

- Polyurethane

By Application

- Cardiovascular Diseases

- Neurovascular Diseases

- Peripheral Diseases

By Indication

- Percutaneous Coronary Intervention

- Carotid Artery Diseases Saphenous Vein Graft Disease

- Transcatheter Aortic Valve Replacement

- Other Indications

By End User

- Hospitals

- Ambulatory Care Centers

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Spain

- Italy

- Rest of Europe

-

Asia-Pacific

- Japan

- China

- India

- Rest of Asia Pacific

- Latin America

- Middle East and Africa

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of top companies

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific embolic protection devices market into South Korea, Australia, New Zealand, and others

- Further breakdown of the Rest of Europe market into Belgium, Russia, the Netherlands, Switzerland, and others

- Further breakdown of the Rest of Latin America market into Argentina, Colombia, Chile, and others

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

In this report the global embolic protection device market is segmented on the basis of type & material, application, indication, end users and region. On the basis of type, the distal filter devices segment is expected to grow at the highest CAGR during the forecast period. The high growth of this segment can primarily be attributed to the procedural benefits distal filter devices offer, such as ease of use, enhanced visibility, and crossing profile of the device. On the basis of material, nitinol accounted for the largest share of the market. This segment is also expected to grow at the highest rate in the market. The super-elastic material and braided nitinol design provide full wall apposition and this quality is expected to drive the growth of nitinol in the global market during the forecast period.

On the basis of application, the embolic protection market is segmented into cardiovascular, neurovascular, and peripheral vascular diseases. According to this study, the neurovascular diseases segment is poised to grow at the fastest growth rate in the market. With the increasing target patient population, the demand for embolic protection devices for the treatment of neurovascular diseases is expected to increase during the forecast period.

Based on the indications, the embolic protection devices segment is further segmented into percutaneous coronary intervention, transcatheter aortic valve replacement (TAVR), carotid artery diseases, saphenous vein graft disease, and other indications. The percutaneous coronary intervention segment accounted for the largest share of the global market. The large share of this segment can primarily be attributed to the increasing prevalence of CAD and the rising preference for minimally invasive procedures.

Among end users, hospitals are the fastest growing end-user segment in the market during the forecast period. The market for this segment is mainly driven by factors such as the growing number of angioplasty procedures in hospitals, rising incidence of chronic vascular diseases, favorable reimbursement scenario in developed countries, increasing number of hospitals, and increasing government initiatives to provide quality treatment for cardiovascular diseases.

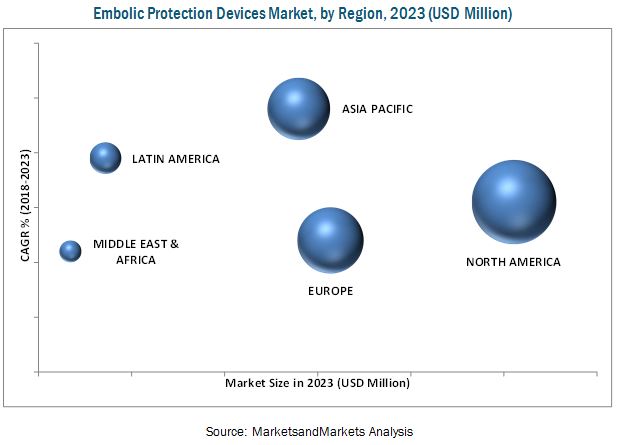

Geographically, the market is segmented into North America, Europe, Asia Pacific, Latin America and the Middle East and Africa. In 2017, North America dominated the global market. The rising geriatric population, prevalence of cardiovascular and neurovascular diseases, increasing adoption of minimally invasive techniques, increasing availability of funding, and presence of a large number of medical device product manufacturers are driving the growth of the market in North America. Asia Pacific, on the other hand, is expected to grow at the highest CAGR during the forecast period due to the growing number of prescriptions for people aged 65 or above, increasing healthcare spending, rising healthcare costs, and increasing target population.

Prominent players in the Embolic Protection Devices Market are Boston Scientific (US), Medtronic Ireland), Abbott (US), Cordis (A Cardinal Health Company) (US), Allium Medical Solutions (Israel), Contego Medical (US), W.L. Gore & Associates (US), Silk Road Medical (US), Claret Medical (US), and AngioSlide (Israel).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Definition

1.3 Market Scope

1.3.1 Markets Covered

1.4 Years Considered for the Study

1.5 Currency

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Sources

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Sources

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in the Embolic Protection Devices Market

4.2 APAC: Market, By Indication and Country

4.3 Geographic Snapshot of the Market

4.4 Market, By Type,

4.5 Market: Regional Mix

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Incidence of Cardiovascular & Neurovascular Diseases

5.2.1.2 Funding and Investments for R&D on Embolic Protection Devices

5.2.1.3 Technological Advancements

5.2.1.4 Rising Demand for Minimally Invasive Procedures

5.2.2 Restraint

5.2.2.1 Product Failure and Recalls

5.2.3 Opportunitie

5.2.3.1 Growth Opportunities in Emerging Markets

5.2.4 Challenges

5.2.4.1 Stringent Regulatory Scenario and Unfavorable Government Policies

5.2.4.2 Dearth of Skilled Professionals

6 Market, By Type & Material (Page No. - 44)

6.1 Embolic Protection Devices Market, By Type

6.1.1 Distal Filter Devices

6.1.2 Distal Occlusion Devices

6.1.3 Proximal Occlusion Devices

6.2 Market, By Material

6.2.1 Nitinol

6.2.2 Polyurethane

7 Market, By Application (Page No. - 56)

7.1 Introduction

7.2 Cardiovascular Diseases

7.3 Neurovascular Diseases

7.4 Peripheral Vascular Diseases

8 Market, By Indication (Page No. - 63)

8.1 Introduction

8.2 Percutaneous Coronary Intervention

8.3 Carotid Artery Diseases

8.4 Saphenous Vein Graft Disease

8.5 Transcather Aortic Valve Replacement

8.6 Other Indications

9 Market, By End User (Page No. - 70)

9.1 Introduction

9.2 Hospitals

9.3 Ambulatory Surgical Centers

10 Market, By Region (Page No. - 76)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.3 Europe

10.3.1 Germany

10.3.2 France

10.3.3 UK

10.3.4 Spain

10.3.5 Italy

10.3.6 Rest of Europe

10.4 Asia Pacific

10.4.1 Japan

10.4.2 China

10.4.3 India

10.4.4 Rest of Asia Pacific

10.5 Latin America

10.6 Middle East and Africa

11 Competitive Landscape (Page No. - 137)

11.1 Overview

11.2 Ranking for Players, 2017

11.3 Competitive Scenario

11.3.1 Acquisitions

11.3.2 Product Launches

11.3.3 Agreements, Partnerships, and Collaborations

11.3.4 Expansions

12 Company Profiles (Page No. - 142)

(Overview, Strength of Product Portfolio, Business Strategy Excellence, Products Offering, and Recent Developments)*

12.1 Medtronic

12.2 Abbott Laboratories

12.3 Boston Scientific

12.4 Cordis (A Cardinal Health Company)

12.5 Contego Medical

12.6 W. L. Gore & Associates

12.7 Silk Road Medical

12.8 Claret Medical

12.9 Allium Medical Solutions

12.10 Angioslide

*Details on Overview, Strength of Product Portfolio, Business Strategy Excellence, Products Offering, and Recent Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 161)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (127 Tables)

Table 1 Market: (Impact Analysis)

Table 2 Product Approvals in the Global Market, 2014–2017

Table 3 Product Recalls in the Global Market (2011–2016)

Table 4 Global Market, By Type, 2016–2023 (USD Million)

Table 5 Global Market, By Volume, 2016–2023 (Thousand Units)

Table 6 Applications and Advantages/Disadvantages of Distal Filter Devices

Table 7 Distal Filter Devices Market, By Country, 2016–2023 (USD Million)

Table 8 Distal Filter Devices Market, By Volume, 2016–2023 (Thousand Units)

Table 9 Applications and Advantages/Disadvantages of Distal Occlusion Devices

Table 10 Distal Occlusion Devices Market, By Country, 2016–2023 (USD Million)

Table 11 Distal Occlusion Devices Market, By Volume, 2016–2023 (Thousand Units)

Table 12 Applications and Advantages/Disadvantages of Proximal Occlusion Devices

Table 13 Proximal Occlusion Devices Market, By Country, 2016–2023 (USD Million)

Table 14 Proximal Occlusion Devices Market, By Volume, 2016–2023 (Thousand Units)

Table 15 Global Market, By Material, 2016–2023 (USD Million)

Table 16 Nitinol Embolic Protection Devices Market, By Country, 2016–2023 (USD Million)

Table 17 Polyurethane Embolic Protection Devices Market, By Country, 2016–2023 (USD Million)

Table 18 Global Market, By Application, 2016–2023 (USD Million)

Table 19 Embolic Protection Devices Used in the Treatment of Cardiovascular Diseases

Table 20 Market for Cardiovascular Diseases, By Country, 2016–2023 (USD Million)

Table 21 Embolic Protection Devices Used in the Treatment of Neurovascular Diseases

Table 22 Global Market for Neurovascular Diseases, By Country, 2016–2023 (USD Million)

Table 23 Embolic Protection Devices Used in the Treatment of Peripheral Vascular Diseases

Table 24 Global Market for Peripheral Vascular Diseases, By Country, 2016–2023 (USD Million)

Table 25 Global Market, By Indication, 2016–2023 (USD Million)

Table 26 Global Market for Percutaneous Coronary Intervention, By Country, 2016–2023 (USD Million)

Table 27 Global Market for Carotid Artery Diseases, By Country, 2016–2023 (USD Million)

Table 28 Market for Saphenous Vein Graft Disease, By Country, 2016–2023 (USD Million)

Table 29 Global Market for Tavr, By Country, 2016–2023 (USD Million)

Table 30 Global Market for Other Indications, By Country, 2016–2023 (USD Million)

Table 31 Global Market, By End User, 2016–2023 (USD Million)

Table 32 Global Market for Hospitals, By Country, 2016–2023 (USD Million)

Table 33 Global Market for Ambulatory Surgical Centers, By Country, 2016–2023 (USD Million)

Table 34 Global Market, By Region, 2016–2023 (USD Million)

Table 35 North America: Market, By Country, 2016–2023 (USD Million)

Table 36 North America: Market, By Type, 2016–2023 (USD Million)

Table 37 North America: Market, By Material, 2016–2023 (USD Million)

Table 38 North America: Market, By Application, 2016–2023 (USD Million)

Table 39 North America: Market, By Indication, 2016–2023 (USD Million)

Table 40 North America: Market, By End User, 2016–2023 (USD Million)

Table 41 US: Market, By Type, 2016–2023 (USD Million)

Table 42 US: Market, By Material, 2016–2023 (USD Million)

Table 43 US: Market, By Application, 2016–2023 (USD Million)

Table 44 US: Market, By Indication, 2016–2023 (USD Million)

Table 45 US: Market, By End User, 2016–2023 (USD Million)

Table 46 Canada: Market, By Type, 2016–2023 (USD Million)

Table 47 Canada: Market, By Material, 2016–2023 (USD Million)

Table 48 Canada: Market, By Application, 2016–2023 (USD Million)

Table 49 Canada: Market, By Indication, 2016–2023 (USD Million)

Table 50 Canada: Market, By End User, 2016–2023 (USD Million)

Table 51 Europe: Market, By Country, 2016–2023 (USD Million)

Table 52 Europe: Market, By Type, 2016–2023 (USD Million)

Table 53 Europe: Market, By Material, 2016–2023 (USD Million)

Table 54 Europe: Market, By Application, 2016–2023 (USD Million)

Table 55 Europe: Market, By Indication, 2016–2023 (USD Million)

Table 56 Europe: Market, By End User, 2016–2023 (USD Million)

Table 57 Germany: Embolic Protection Devices Market, By Type, 2016–2023 (USD Million)

Table 58 Germany: Market, By Material, 2016–2023 (USD Million)

Table 59 Germany: Market, By Application, 2016–2023 (USD Million)

Table 60 Germany: Market, By Indication, 2016–2023 (USD Million)

Table 61 Germany: Market, By End User, 2016–2023 (USD Million)

Table 62 France: Market, By Type, 2016–2023 (USD Million)

Table 63 France: Market, By Material, 2016–2023 (USD Million)

Table 64 France: Market, By Application, 2016–2023 (USD Million)

Table 65 France: Market, By Indication, 2016–2023 (USD Million)

Table 66 France: Market, By End User, 2016–2023 (USD Million)

Table 67 UK: Market, By Type, 2016–2023 (USD Million)

Table 68 UK: Market, By Material, 2016–2023 (USD Million)

Table 69 UK: Market, By Application, 2016–2023 (USD Million)

Table 70 UK: Market, By Indication, 2016–2023 (USD Million)

Table 71 UK: Market, By End User, 2016–2023 (USD Million)

Table 72 Spain: Embolic Protection Devices Market, By Type, 2016–2023 (USD Million)

Table 73 Spain: Market, By Material, 2016–2023 (USD Million)

Table 74 Spain: Market, By Application, 2016–2023 (USD Million)

Table 75 Spain: Market, By Indication, 2016–2023 (USD Million)

Table 76 Spain: Embolic Protection Devices Market, By End User, 2016–2023 (USD Million)

Table 77 Italy: Market, By Type, 2016–2023 (USD Million)

Table 78 Italy: Market, By Material, 2016–2023 (USD Million)

Table 79 Italy: Market, By Application, 2016–2023 (USD Million)

Table 80 Italy: Market, By Indication, 2016–2023 (USD Million)

Table 81 Italy: Market, By End User, 2016–2023 (USD Million)

Table 82 RoE: Market, By Type, 2016–2023 (USD Million)

Table 83 RoE: Market, By Material, 2016–2023 (USD Million)

Table 84 RoE: Market, By Application, 2016–2023 (USD Million)

Table 85 RoE: Market, By Indication, 2016–2023 (USD Million)

Table 86 RoE: Market, By End User, 2016–2023 (USD Million)

Table 87 APAC: Market, By Country, 2016–2023 (USD Million)

Table 88 APAC: Market, By Type, 2016–2023 (USD Million)

Table 89 APAC: Market, By Material, 2016–2023 (USD Million)

Table 90 APAC: Market, By Application, 2016–2023 (USD Million)

Table 91 APAC: Market, By Indication, 2016–2023 (USD Million)

Table 92 APAC: Market, By End User, 2016–2023 (USD Million)

Table 93 Japan: Embolic Protection Devices Market, By Type, 2016–2023 (USD Million)

Table 94 Japan: Market, By Material, 2016–2023 (USD Million)

Table 95 Japan: Market, By Application, 2016–2023 (USD Million)

Table 96 Japan: Market, By Indication, 2016–2023 (USD Million)

Table 97 Japan: Market, By End User, 2016–2023 (USD Million)

Table 98 China: Market, By Type, 2016–2023 (USD Million)

Table 99 China: Market, By Material, 2016–2023 (USD Million)

Table 100 China: Market, By Application, 2016–2023 (USD Million)

Table 101 China: Market, By Indication, 2016–2023 (USD Million)

Table 102 China: Market, By End User, 2016–2023 (USD Million)

Table 103 India: Market, By Type, 2016–2023 (USD Million)

Table 104 India: Market, By Material, 2016–2023 (USD Million)

Table 105 India: Market, By Application, 2016–2023 (USD Million)

Table 106 India: Market, By Indication, 2016–2023 (USD Million)

Table 107 India: Market, By End User, 2016–2023 (USD Million)

Table 108 RoAPAC: Embolic Protection Devices Market, By Type, 2016–2023 (USD Million)

Table 109 RoAPAC: Market, By Material, 2016–2023 (USD Million)

Table 110 RoAPAC: Market, By Application, 2016–2023 (USD Million)

Table 111 RoAPAC: Market, By Indication, 2016–2023 (USD Million)

Table 112 RoAPAC: Embolic Protection Devices Market, By End User, 2016–2023 (USD Million)

Table 113 Latin America: Market, By Type, 2016–2023 (USD Million)

Table 114 Latin America: Market, By Material, 2016–2023 (USD Million)

Table 115 Latin America: Market, By Application, 2016–2023 (USD Million)

Table 116 Latin America: Market, By Indication, 2016–2023 (USD Million)

Table 117 Latin America: Market, By End User, 2016–2023 (USD Million)

Table 118 Middle East & Africa: Market, By Type, 2016–2023 (USD Million)

Table 119 Middle East & Africa: Market, By Material, 2016–2023 (USD Million)

Table 120 Middle East & Africa: Market, By Application, 2016–2023 (USD Million)

Table 121 Middle East & Africa: Market, By Indication, 2016–2023 (USD Million)

Table 122 Middle East & Africa: Market, By End User, 2016–2023 (USD Million)

Table 123 Rank of Companies in the Global Embolic Protection Devices Market, 2017

Table 124 Key Acquisitions, January 2015 – December 2017

Table 125 Key Product Launches, January 2015– December 2017

Table 126 Key Agreements, Partnerships, and Collaborations, January 2015 – December 2017

Table 127 Key Expansions, January 2015 – December 2017

List of Figures (28 Figures)

Figure 1 Research Design

Figure 2 Data Triangulation

Figure 3 Market, By Product Type, 2018 vs 2023 (USD Million)

Figure 4 Global Market, By Product Material, 2018 vs 2023 (USD Million)

Figure 5 Global Market, By Application, 2018 vs 2023 (USD Million)

Figure 6 Percutaneous Coronary Intervention Segment to Dominate the Global Market During the Forecast Period

Figure 7 Global Market, By End User, 2018 vs 2023 (USD Million)

Figure 8 Geographical Snapshot of the Global Market

Figure 9 Rising Incidence of Cardiovascular and Neurovascular Diseases is Driving Market Growth

Figure 10 Japan Accounted for the Largest Market Share in 2017

Figure 11 The US Accounted for the Largest Share of the market in 2017

Figure 12 Distal Filter Devices Will Continue to Dominate the Embolic Protection Devices Market in 2018-2023

Figure 13 Asia Pacific to Register the Highest CAGR During the Forecast Period

Figure 14 Prevalence of Cardiovascular Diseases, 2015–2035

Figure 15 Distal Filter Devices to Dominate the Market During the Forecast Period

Figure 16 Nitinol is Projected to Dominate the Embolic Protection Devices Market During the Forecast Period

Figure 17 Cardiovascular Diseases to Dominate the Market During the Forecast Period

Figure 18 Percutaneous Coronary Intervention Segment to Dominate the Embolic Protection Devices Market During the Forecast Period

Figure 19 Embolic Protection Devices Market: Geographic Growth Opportunities

Figure 20 North America: Market Snapshot

Figure 21 Europe: Market Snapshot

Figure 22 APAC: Market Snapshot

Figure 23 Key Developments in the Market Between 2014 and 2017

Figure 24 Medtronic: Company Snapshot

Figure 25 Abbott Laboratories: Company Snapshot

Figure 26 Boston Scientific: Company Snapshot

Figure 27 Cardinal Health: Company Snapshot

Figure 28 Allium Medical Solutions: Company Snapshot

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Embolic Protection Devices Market