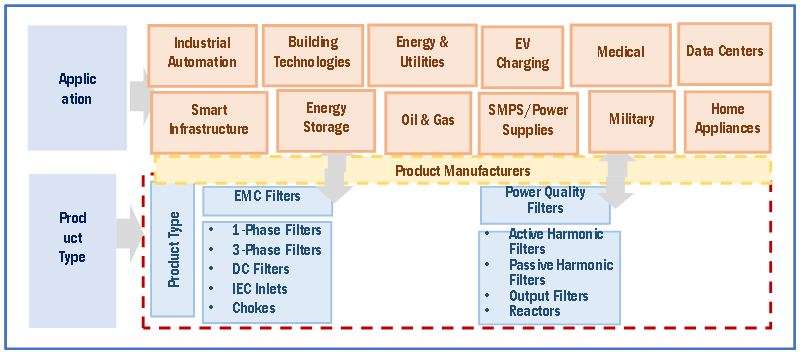

EMC Filtration Market by Insertion Loss, EMC Filters (1-Phase EMC Filters, 3-Phase EMC Filters, DC Filters, IEC Inlets, Chokes), Power Quality Filters (Passive Harmonic Filters, Active Harmonic Filters, Output Filters, Reactors) - Global Forecast to 2028

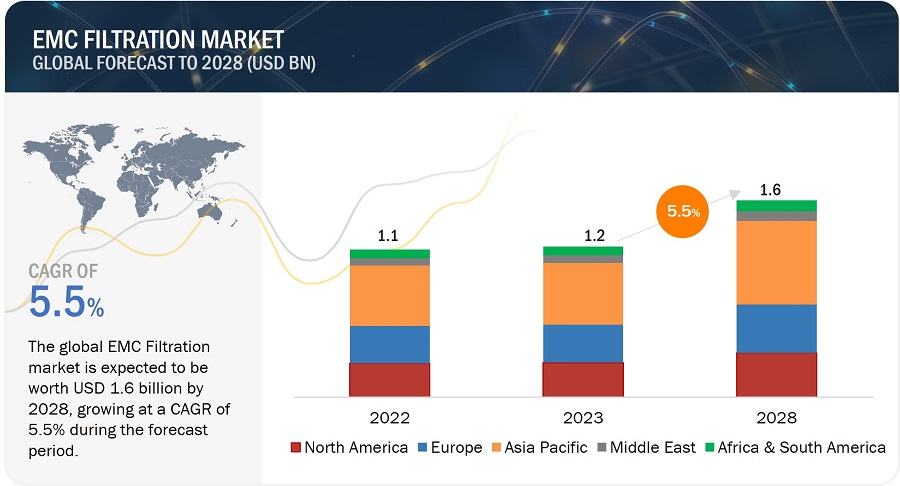

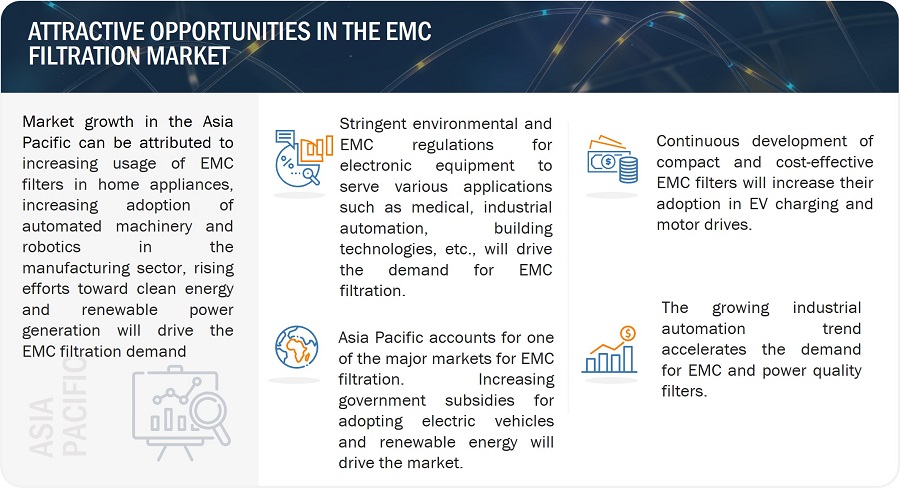

[294 Pages Report] The EMC Filtration market is projected to grow from USD 1.2 billion in 2023 to USD 1.6 billion by 2028; it is expected to grow at a CAGR of 5.5% from 2023 to 2028. Increasing government efforts for electronic components and equipment manufacturers to comply with stringent EMC regulations will drive the EMC filtration market growth in the coming years. The rise in the usage of EMC filtration products in home appliances, data centers, building technologies, and many other fields will drive the growth of this market. Considering the health risks caused by electromagnetic frequencies, various developing countries are inclined towards deploying EMC regulations, further strengthening the EMC filtration market.

EMC Filtration Market Forecast to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

EMC Filtration Market Dynamics

Drivers: Rising demand for power electronics

EMC filtration is a vital aspect of the power electronics industry, playing a critical role in addressing issues related to electromagnetic interference (EMI) and radio frequency interference (RFI), which can potentially impact the performance and reliability of electronic devices. Incorporating EMC filters in power electronics systems is imperative, as they ensure that the electromagnetic emissions from the system comply with the regulatory limits stipulated by various standards organizations. In the absence of proper EMC filtration, the power electronics system may emit electromagnetic interference, resulting in malfunctions or damage to other electronic devices in the vicinity. Moreover, EMC filtration helps to enhance the overall efficiency of power electronics systems by minimizing the noise and ripple in the power supply. This is particularly significant in applications such as renewable energy, where power generation can be intermittent and unstable. Furthermore, the surging demand for power electronics in diverse industries such as automotive, renewable energy, and industrial automation has increased the need for EMC filters. The adoption of EMC filters in power electronics systems is anticipated to grow as the demand for dependable and efficient power electronics systems escalates.

Restraint: Rise in the alternative competitive technologies

There are several alternative technologies that can be used to mitigate electromagnetic interference (EMI) and radio-frequency interference (RFI) besides EMC filtration. Alternative technologies to EMC filtration are common, such as shielding, grounding, isolation, filtering, and signal integrity design. Shielding, for instance, is done by covering electronic devices or equipment with conductive materials such as copper or aluminum to either block or redirect electromagnetic waves. Grounding, on the other hand, involves linking electronic devices or equipment to the earth using conductive wires or cables to reduce the accumulation of static electricity and dissipate any electromagnetic waves produced. Isolation involves physically separating electronic components to prevent interference while filtering employs passive LC filters or ferrite bead filters to suppress specific frequencies of electromagnetic interference. Signal integrity design reduces EMI/RFI production by optimizing the layout and routing of signal traces, minimizing the use of vias, and reducing the loop area of sensitive circuits. Even though these alternatives are not as effective as EMC filtration, small manufacturers who cannot comply with EMC filtration's regulatory standards opt for them, limiting the growth of this market.

Opportunity: Increasing demand in the telecom sector

In the telecom industry, the functioning and reliability of telecommunication equipment and devices are crucial, as the industry heavily relies on electronic devices like servers, routers, and switches to manage network traffic and data transmission. These electronic devices generate EMI and RFI, which can cause disruptions in communication and signal quality. EMC filtration prevents such disorders by reducing the levels of EMI and RFI in the electromagnetic spectrum. This is essential in the telecom industry, where any communication disruption can have severe financial consequences and impact public safety. Filters, chokes, capacitors, and other passive electronic components are used as EMC filtration solutions in the telecom industry to suppress EMI and RFI and provide a reliable and stable signal. These solutions also assist telecom companies in meeting regulatory requirements and compliance standards, such as the Federal Communications Commission (FCC) regulations in the United States, which mandate using EMC filters in telecom equipment to reduce EMI and RFI.

Challenge: Rapid technological developments in EMC Filtration

Rapid technological changes can significantly impact the growth of the EMC filtration market. The emergence of new technologies, such as 5G networks and the Internet of Things (IoT), has increased demand for advanced EMC filtration solutions. However, these technological advancements can also lead to new EMI/RFI challenges, necessitating the development of updated filtration solutions. Keeping pace with the rapid rate of technological change can prove challenging for companies in the EMC filtration market. It can result in longer development cycles, higher costs, and a more complex regulatory environment, making it difficult to develop new solutions that meet changing needs. On the other hand, rapid technological changes can also provide growth opportunities for the EMC filtration market. The emergence of new technologies can lead to an increased demand for advanced EMC filtration solutions, creating new markets and revenue streams.

EMC Filtration Market Ecosystem

The prominent players in the EMC Filtration market are Schaffner Holding AG (Switzerland), TE Connectivity (Switzerland), TDK Corporation (Japan), Delta Electronics (Taiwan), Littlefuse, Inc. (US), Schurter Global (Switzerland), Astrodyne TDI (US), Soshin Electric Co., Ltd. (Japan), Sinexcel (China), MORNSUN Guangzhou Science & Technology Co., Ltd. (China). These companies not only boast a comprehensive product portfolio but also have a strong geographic footprint.

3-phase EMC filters to grow at a high CAGR during the forecast period

3-phase EMC filters are experiencing increasing demand for high-power applications such as test equipment and industrial machinery. These 3-phase EMC filters help reduce unwanted electromagnetic interference within the conducted area of electromagnetic susceptibility of various applications such as motor drives, machine tools, and frequency converters. The general requirements for a 3-phase EMC filter design include line voltage, input currents, insertion loss, and size limitation. The market players are developing next-generation 3-phase EMC filters with optimized packaging for new designs and technology used in industrial machines. The new compact designs of 3-phase EMC filters help reduce carbon footprint significantly and allow the integration of connection terminals within the filter cubical. Three-phase EMC filters are widely used in industrial and commercial applications requiring reliable and stable electrical systems.

Home Appliances applications to grow at a significantly higher CAGR during the forecast period

EMC filtration is necessary in-home appliances to minimize the impact of EMI and ensure the reliable operation of the devices. EMC filters can help to filter out unwanted signals and provide a clean power supply to electronic components, reducing the impact of EMI on the accuracy of data transmission, audio and video quality, and the performance of other electronic equipment in the same environment. Additionally, EMC filtration is critical in ensuring the safety and health of consumers, as certain types of EMI can interfere with the operation of pacemakers and other medical devices. With the increasing usage of appliances such as televisions, smartphones, refrigerators, washing machines, air conditioners etc., will tend to increase the scope of growth of this segment in the coming years.

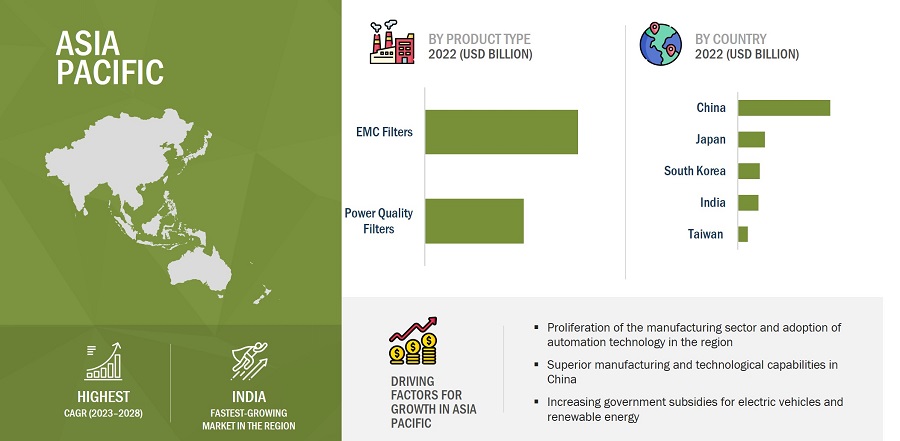

Asia Pacific accounted for the largest share of the EMC Filtration market in 2022

Asia Pacific accounted for the largest share of the EMC Filtration market in 2022. The increasing technological advancements, increasing government regulations, and the increase in the manufacturing and usage of electrical and electronic devices owing to the increasing population will tend the market in this region to be the largest in 2022 and throughout the forecast period. China is likely to dominate EMC filtration market in Asia Pacific between 2023 and 2028. China is well known for its manufacturing industry globally. According to the National Bureau of Statistics of China, the factory wages in the country are rising at double digits, fueling the demand for industrial robots and automation technology. Both domestic and foreign-based manufacturers in China are endeavoring to boost their productivity using automation technologies. Subsequently, increasing government initiatives and subsidies to accelerate the manufacturing sector will increase the demand for EMC and power quality filters.

EMC Filtration Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The major players in the EMC Filtration market are Schaffner Holding AG (Switzerland), TE Connectivity (Switzerland), TDK Corporation (Japan), Delta Electronics (Taiwan), and Schurter Global (Switzerland). These companies have used both organic and inorganic growth strategies such as product launches, acquisitions, and partnerships to strengthen their position in the market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2019—2027 |

|

Base year |

2022 |

|

Forecast period |

2023—2028 |

|

Units |

Value (USD Million/USD Billion), Volume (Thousand Units) |

|

Segments covered |

Product Type, Insertion Loss, Application, and Geography |

|

Geographic regions covered |

North America, Europe, Asia Pacific, Middle East, and RoW |

|

Companies covered |

Schaffner Holdings AG (Switzerland), Delta Electronics (Taiwan), TE Connectivity (Switzerland), TDK Corporation (Japan), Littelfuse, Inc (US), Sinexcel (China), Schurter Global (Switzerland), AstrodyneTDI (US), Soshin electric Co., Ltd. (Japan), Mornsun Guangzhou Science & Technology Co. Ltd. (China) are the major players in the market. |

EMC Filtration Market Highlights

This report categorizes the EMC Filtration market based on product type, insertion loss, application, and geography.

|

Segment |

Subsegment |

|

By Product Type: |

|

|

By Insertion Loss: |

|

|

By Application: |

|

|

By Region: |

|

Recent Developments

- In April 2023, TDK Corporation launched its new EPCOS 3-line EMC filters for converter applications with high currents. These EMC filters have exceptional attenuation characteristics from 9 kHz upwards. It caters to various applications such as frequency converters for motor drives, wind turbines and power supplies.

- In March 2023, TDK Corporation announced the release of KCZ1210DH800HRTD25 common mode filter for deployment in ultra-high-speed automotive interfaces. It enables substantial enhancements in noise control functions compared to conventional filters. Despite its small size, it is suitable for automotive EMC components automotive power supply lines and achieves a rated current of 12A.

- In January 2023, Capvis AG, a Swiss investor with expertise in midcap investments, acquired the majority of the interest of Schurter Holding AG.

- In December 2022, AstrodyneTDI introduced a new line of high-performance EMI/EMC filters that are specifically designed for fast and ultra-fast DC chargers. The RP695H DC EMI filters are designed to provide superior performance while maintaining a compact form factor. These high-performance filters can help DC charger OEMs to reduce costs and accelerate time-to-market.

- In October 2022, Schaffner Holding AG launched FN3287 & FN3288 EMC filter series up to 230 A. These extend the range of EMC solutions to drive ratings up to 135 kW. The favored advantages of the current series are carried over to the subsequent versions: With a range of performance levels, sturdy safety connecting blocks, and a tiny footprint. There are also versions with controlled leakage current levels as low as 0.1 mA.

- In June 2022, DIN rail mounting kits have been introduced by Schurter to facilitate the prompt and effortless installation of panel-mount filters within control cabinets. These kits have been made accessible for various Schurter's existing 1- and 3-phase filters in their portfolio.

- In May 2022, TE Connectivity acquired Kemtron Ltd, a UK-based leading player and provider of EMI/RFI shielding, environmental sealing, gaskets and components. The company can significantly increase customer value by combining TE Connectivity's expertise in heat shrink tubing, manufacturing scale, and distribution with Kemtron Ltd's reputation for offering top-notch and market-leading EMI/RFI solutions.

Frequently Asked Questions (FAQs):

Which are the major companies in the EMC filtration market? What are their major strategies to strengthen their market presence?

Schaffner Holding AG (Switzerland), Delta Electronics, Inc. (Taiwan), TDK Corporation (Japan), TE Connectivity (Switzerland), Littelfuse, Inc (US), are the top players in the market. These companies have adopted organic as well as inorganic growth strategies such as product launch, acquisitions, and partnerships to gain a competitive advantage in the market.

Which is the potential market for EMC and power quality filters in terms of the region?

North America has high growth opportunities owing to advancements in industrial automation in the region. Several standards related to emissions from electronics and susceptibility levels has accelerated the demand for EMC and power quality filters in the region.

What are the opportunities for new market entrants?

Factors such as the deployment of EMC and power quality filters in electric vehicle charging station and renewable power generation are accelerating new product innovation and creating opportunities for the players in the market

Which applications will drive the market's growth in the next six years?

Industrial automation is expected to remain the primary application driving significant demand for EMC and power quality filters. The rising trend towards digitalization and Industrial Internet of Things (IIoT) in the manufacturing sector has accelerated the adoption of new industrial machinery and robots, which will drive growth opportunities for EMC filtration solutions. Additionally, the increasing adoption of SMPS in various modern electronic systems owing to their high-efficiency power conversion will boost the demand for EMC and power quality filters in the forecast period.

What is the current size of the global EMC Filtration market?

The EMC filtration market is projected to grow from USD 1.1 Billion in 2022 to USD 1.6 Billion by 2028; it is expected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% from 2023 to 2028. Increasing government efforts for electronic components and equipment manufacturers to comply with stringent EMC regulations will drive the EMC filtration market growth in the coming years.

What are the major strategies adopted by market players?

The key players have adopted product launches, acquisitions, and partnerships to strengthen their position in EMC Filtration market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

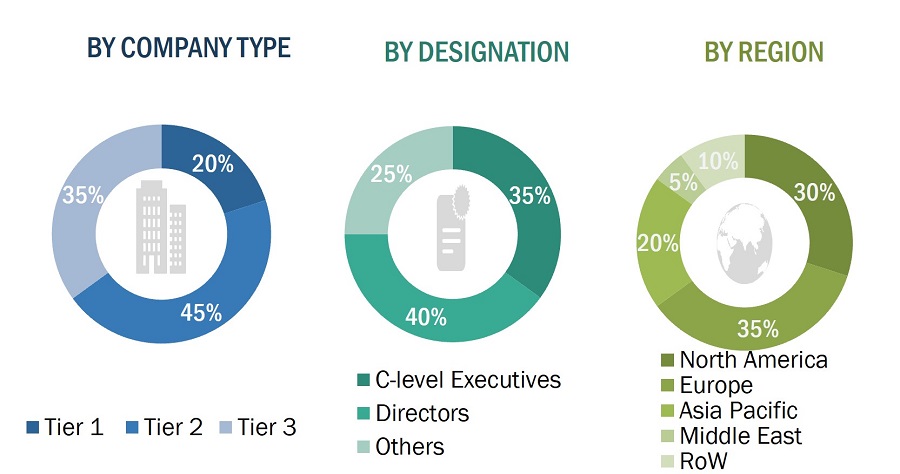

The research process for this study included the systematic gathering, recording, and analysis of data about customers and companies operating in the EMC filtration market. This research study involved the extensive use of secondary sources, directories, and databases (Factiva, Oanda, and OneSource) for identifying and collecting valuable information for this extensive, technical, market-oriented, and commercial study of the EMC filtration market. In-depth interviews were conducted with various primary respondents, including experts from core and related industries and preferred manufacturers, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects. Key players in the EMC filtration market were identified through secondary research, and their market rankings were determined through primary and secondary research. This research included studying annual reports of top players and interviewing key industry experts, such as CEOs, directors, and marketing executives.

Secondary Research

In the secondary research, various sources were referred to for identifying and collecting information important for this study. Secondary sources included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, EMC filtration products related journals, and certified publications; articles by recognized authors; directories; and databases.

Secondary research was conducted to obtain key information about the industry supply chain, market value chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments from both market- and technology-oriented perspectives. Data from secondary research was collected and analyzed to determine the overall market size, which was further validated by primary research.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain the qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and key executives from major companies and organizations operating in the EMC filtration market.

After going through the entire market engineering (which includes calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers obtained. Primary research was conducted to identify segmentation types, industry trends, key players, competitive landscape, and key market dynamics such as drivers, restraints, opportunities, and challenges, along with the key strategies adopted by players operating in the market.

To know about the assumptions considered for the study, download the pdf brochure

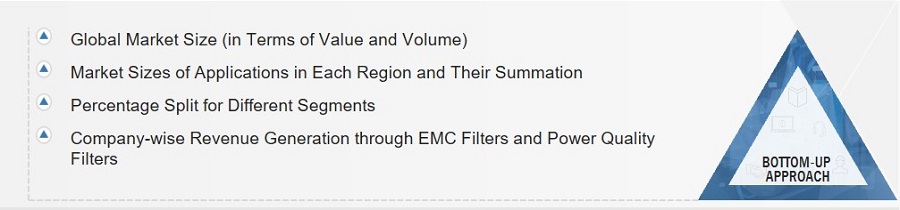

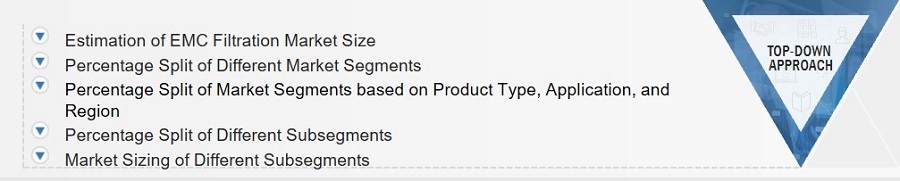

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches were used, along with several data triangulation methods, to estimate and forecast the size of the market and its segments and subsegments listed in the report. Extensive qualitative and quantitative analyses were carried out on the complete market engineering process to list the key information/insights pertaining to the EMC filtration market.

The key players in the market were identified through secondary research, and their rankings in the respective regions were determined through primary and secondary research. This entire procedure involved the study of the annual and financial reports of top players, as well as interviews with industry experts such as chief executive officers, vice presidents, directors, and marketing executives for both quantitative and qualitative key insights. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in this report.

EMC Filtration Market: Bottom-Up Approach

EMC Filtration Market: Top-Down Approach

Data Triangulation

After arriving at the overall size of the EMC filtration market from the market size estimation process explained above, the total market was split into several segments and subsegments. The market breakdown and data triangulation procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using top-down and bottom-up approaches.

Market Definition

- Electromagnetic interference (EMI) is considered one of the fundamental issues associated with electronic devices and components. Electromagnetic compatibility (EMC) is defined as the ability of an electrical device to work efficiently in an electromagnetic environment without being affected by or influencing the other devices present in its vicinity.

- All electronics circuits have the possibility of radiating or picking up unwanted electrical interference, which can compromise the operation of the circuits. Therefore, EMC filters are used to ensure that the electrical or electronic equipment does not generate nor is affected by electromagnetic disturbance.

Key Stakeholders

- Associations and Regulatory Authorities related to EMC Filters

- Government Bodies, Venture Capitalists, and Private Equity Firms

- Original Equipment Manufacturers (OEMs)

- Electronic Device Manufacturers

- EMC and Power Quality Filters Distributors and Sales Firms

- Research Institutes and Organizations

The main objectives of this study are as follows:

- To define and forecast the size of the EMC filtration market based on product type, application, and region in terms of value and volume

- To describe and forecast the size of EMC filters and power quality filters used in the EMC filtration market

- To describe and forecast the size of the EMC filtration market in five key regions, namely, North America, Europe, Asia Pacific, the Middle East, and the Rest of the World (RoW), along with their respective countries

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a comprehensive overview of the value chain of the EMC filtration market ecosystem

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies and provide a detailed competitive landscape of the market

- To analyze competitive developments, such as product launches, acquisitions, and partnerships, in the EMC filtration market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in EMC Filtration Market