Emulsion Adhesives Market by Resin Type (Acrylic Polymer, PVA, VAE, Lattices, Polyurethane Dispersion), Application (Packaging, Woodworking, Tapes & Labels, Construction, Automotive & Transportation), and Region - Global Forecast to 2022

The emulsion adhesives market is projected to reach USD 17.28 Billion by 2022, at a CAGR of 5.9%. The base year considered for this study is 2016 and the forecast period is from 2017 to 2022.

Emulsion Adhesives Market Report Objectives of the Study

- To define, segment, and forecast the emulsion adhesive market, in terms of value and volume

- To provide detailed information regarding factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To define, describe, and forecast the emulsion adhesives market based on resin type and application

- To analyze and forecast the market size, with respect to 5 main regions, namely, North America, Europe, APAC, the Middle East & Africa, and South America

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze competitive developments such as capacity expansions, new product launches, alliances, joint ventures, and mergers & acquisitions

- To analyze opportunities in the market for stakeholders and provide details of a competitive landscape for market leaders

- To strategically profile key players in the market and comprehensively analyze their core competencies

Both, top-down and bottom-up approaches were used to estimate and validate the size of the emulsion adhesives market, and to estimate the size of various other dependent submarkets. The research study involved extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg, Chemical Weekly, Factiva, ICIS, and Securities and Exchange Commission (SEC), among other government and private websites, to identify and collect information useful for a technical, market-oriented, and commercial study of the emulsion adhesives market.

To know about the assumptions considered for the study, download the pdf brochure

The emulsion adhesives market has a diversified and established ecosystem of upstream players, such as raw material suppliers, and downstream stakeholders, such as manufacturers, vendors, end users, and government organizations. Key players operating in the market include Arkema (Bostik), H.B. Fuller (US), Henkel (Germany), Ashland (US), Wacker Chemie (Germany) and 3M (US).

Key Target Audience in Emulsion Adhesives Market

- Manufacturers of Emulsion Adhesives

- Raw Material Suppliers

- Traders, Distributors, and Suppliers of Emulsion Adhesives

- Government & Regional Agencies and Research Organizations

- Investment Research Firms

Emulsion Adhesives Market Report Scope

The emulsion adhesives market has been segmented as follows:

Emulsion Adhesives Market, By Resin Type:

- Acrylic Polymer Emulsion

- Polyvinyl Acetate (PVA) Emulsion

- Vinyl Acetate Ethylene (VAE) Emulsion

- SBC Latex

- PU Dispersion

- Others

Emulsion Adhesive Market, By Application:

- Paper & Packaging

- Woodworking

- Tapes & Labels

- Construction

- Automotive & Transportation

- Others

Emulsion Adhesives Market, By Region:

- APAC

- North America

- Europe

- Middle East & Africa

- South America

The market has been further analyzed for key countries in each of these regions.

Emulsion Adhesives Market Report Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to the specific needs of companies. The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the emulsion adhesives market based on resin type and application

Company Information:

- Detailed analysis and profiles of additional market players

The increasing use of eco-friendly adhesives in end-use industries is one of the most significant factors projected to drive the growth of the emulsion adhesives market. This market is estimated to be USD 12.98 Billion in 2017 and is projected to reach USD 17.28 Billion by 2022, at a CAGR of 5.9% between 2017 and 2022. Emerging countries such as India, Brazil, Turkey, and Colombia are witnessing a rise in commercial and residential construction activities, which, in turn, is contributing to the growth of the emulsion adhesive market.

Emulsion adhesives are manufactured by the emulsification and polymerization of resins, such as PVA, VAE, and acrylic in water. They are generally free of solvents, and hence, are not flammable and non-toxic. These adhesives are mainly used for porous materials, such as paper, cloth, and wood. As emulsion adhesives are free of solvents, they are considered to be environment-friendly. Emulsion adhesives are used in various applications that include furniture, woodworking, decorated plywood, paper working, packaging, composite members, and panels.

The acrylic polymer emulsion segment is projected to be the largest and the fastest-growing resin type segment of the emulsion adhesives market. Acrylic polymer emulsions are environment-friendly adhesives and provide an adequate balance among shear, tack, and peel strength of the bond.

The automotive & transportation segment is projected to be the fastest-growing application segment of the emulsion adhesives market. This growth can be attributed to the expansion of the automotive industry in the APAC region, which has led to a rise in the production of automobiles. Emulsion adhesives are used in the manufacturing of various automobile components that include tail lights, headliners, and interior trims.

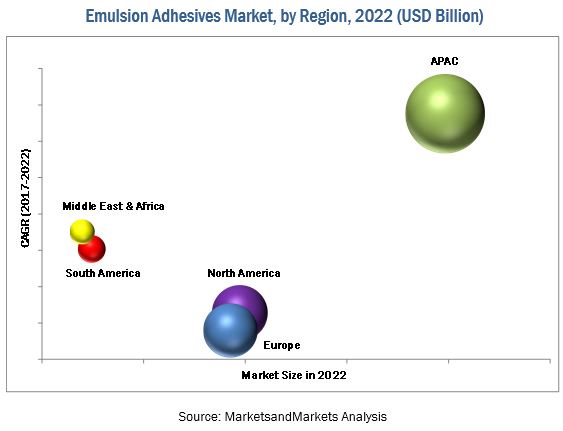

The emulsion adhesives market in the APAC region is projected to grow at the highest CAGR during the forecast period both, in terms of value and volume. The demand for emulsion adhesives from China and India, and policies mandating the use of environment-friendly and low-VOC products are key factors contributing to the growth of the emulsion adhesive market in this region.

However, performance issues of emulsion adhesives in high-strength applications are expected to restrain the growth of the emulsion adhesives market.

Key Players in Emulsion Adhesives Market

Key manufacturers of emulsion adhesives include Arkema (Bostik), H.B. Fuller (US), Henkel (Germany), Ashland (US), Wacker Chemie (Germany) and 3M (US).

Frequently Asked Questions (FAQ):

How big is the Emulsion Adhesive Market industry?

The emulsion adhesives market is projected to grow from USD 12.98 Billion in 2017 to USD 17.28 Billion by 2022, at a CAGR of 5.9% between 2017 and 2022.

Who leading market players in Emulsion Adhesive industry?

Key companies operating in the emulsion adhesives market include Arkema (Bostik), H.B. Fuller (US), Henkel (Germany), Ashland (US), Wacker Chemie (Germany) and 3M (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

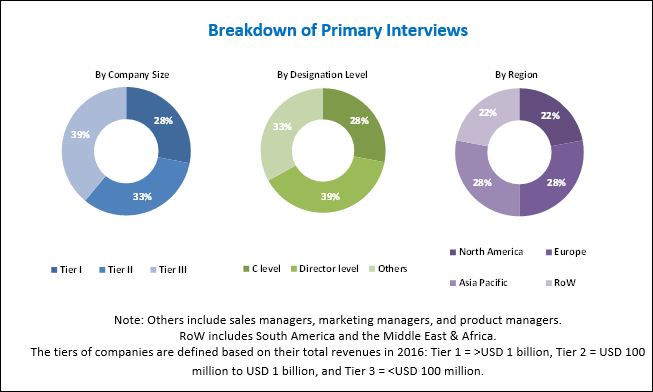

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 22)

4 Premium Insights (Page No. - 26)

4.1 Attractive Opportunities for Market Players

4.2 Emulsion Adhesives Market: By Resin Type

4.3 Emulsion Adhesive Market in APAC

4.4 Global Emulsion Adhesives Market

4.5 Emulsion Adhesive Market: Developed vs Developing Nations

4.6 Emulsion Adhesives Market: Growing Demand From APAC

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rise in Demand for Acrylic Emulsion Adhesives in APAC Region

5.2.1.2 Rising Demand From Developing Countries

5.2.1.3 Growing Demand for ECO-Friendly Adhesives

5.2.2 Restraints

5.2.2.1 Performance Issues in High Strength Applications

5.2.3 Opportunities

5.2.3.1 Innovations in Emulsion Adhesives

5.2.3.2 Opportunities in High-End Applications

5.2.4 Challenges

5.2.4.1 Stringent Regulatory Approvals Required for Production

5.2.4.2 Competition From Other Solvent-Less and Hot-Melt Adhesives

5.3 Porter’s Five Forces Analysis

5.3.1 Intensity of Competitive Rivalry

5.3.2 Bargaining Power of Buyers

5.3.3 Bargaining Power of Suppliers

5.3.4 Threat of Substitutes

5.3.5 Threat of New Entrants

5.4 Macroeconomic Overview and Key Indicators

5.4.1 Introduction

5.4.2 Global GDP Trends and Forecasts

5.4.3 Forecast of the Construction Industry

5.4.4 Growth Indicators in the Automotive Industry

6 Emulsion Adhesives Market, By Type (Page No. - 41)

6.1 Introduction

6.2 Acrylic Polymer Emulsion

6.3 Lattices

6.4 Vinyl Acetate Ethylene (VAE) Emulsion

6.5 Polyurethane Dispersion (PUD)

6.6 Polyvinyl Acetate (PVA) Emulsion

6.7 Others

7 Emulsion Adhesive Market, By Application (Page No. - 50)

7.1 Introduction

7.2 Tapes & Labels

7.3 Paper & Packaging

7.4 Construction

7.5 Automotive & Transportation

7.6 Woodworking

7.7 Others

8 Emulsion Adhesives Market, By Region (Page No. - 60)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.2 Canada

8.2.3 Mexico

8.3 Europe

8.3.1 Germany

8.3.2 France

8.3.3 Italy

8.3.4 UK

8.3.5 Russia

8.3.6 Turkey

8.3.7 Rest of Europe

8.4 APAC

8.4.1 China

8.4.2 India

8.4.3 Japan

8.4.4 South Korea

8.4.5 Taiwan

8.4.6 Thailand

8.4.7 Indonesia

8.4.8 Rest of APAC

8.5 South America

8.5.1 Brazil

8.5.2 Argentina

8.5.3 Rest of South America

8.6 Middle East & Africa

8.6.1 Saudi Arabia

8.6.2 Africa

8.6.3 Rest of Middle East & Africa

9 Competitive Landscape (Page No. - 91)

9.1 Overview

9.2 Competitive Scenario

9.3 New Product Launch

9.4 Merger & Acquisition

9.4.1 Expansion

10 Company Profiles (Page No. - 94)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

10.1 Wacker Chemie

10.2 Ashland Inc.

10.3 Henkel

10.4 H.B. Fuller

10.5 3M Company

10.6 Pidilite Industries Ltd.

10.7 Arkema (Bostik)

10.8 The DOW Chemical Company

10.9 Cemedine Co., Ltd.

10.10 Paramelt B.V.

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

10.11 Other Key Companies

10.11.1 STI Polymer

10.11.2 Tailored Chemical Products

10.11.3 Halltech Inc.

10.11.4 Stanchem Polymers

10.11.5 Falcon Chemicals LLC

10.11.6 Melton Adhesives

10.11.7 Star Bond (Thailand) Company Limited

10.11.8 Sika

10.11.9 Franklin International

10.11.10 Lord Corporation

10.11.11 Mapei S.P.A.

11 Appendix (Page No. - 119)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.3 Introducing RT: Real Time Market Intelligence

11.4 Available Customizations

11.5 Related Reports

11.6 Author Details

List of Tables (75 Tables)

Table 1 Emulsion Adhesives Market Snapshot (2017 vs 2022)

Table 2 GDP Trends and Forecasts, 2016–2022 (USD Billion)

Table 3 North America: Construction Industry, 2015–2022 (USD Billion)

Table 4 Europe: Construction Industry, 2015–2022 (USD Billion)

Table 5 APAC: Construction Industry, 2015–2022 (USD Billion)

Table 6 Middle East & Africa: Construction Industry, 2015–2022 (USD Billion)

Table 7 Latin America: Construction Industry, 2015–2022 (USD Billion)

Table 8 Global Automotive Production, 2011–2016 (Million Units)

Table 9 Emulsion Adhesives Market Size, By Resin Type, 2015–2022 (USD Million)

Table 10 Market, By Resin Type, 2015–2022 (Kiloton)

Table 11 Acrylic Polymer Emulsion Adhesive Market Size, By Region, 2015–2022 (USD Million)

Table 12 Acrylic Polymer Market Size, By Region, 2015–2022 (Kiloton)

Table 13 Lattices Emulsion Adhesives Market Size, By Region, 2015–2022 (USD Million)

Table 14 Lattices Market Size, By Region, 2015–2022 (Kiloton)

Table 15 VAE Emulsion Adhesives Market Size, By Region, 2015–2022 (USD Million)

Table 16 VAE Market Size, By Region, 2015–2022 (Kiloton)

Table 17 PUD Emulsion Adhesive Market Size, By Region, 2015–2022 (USD Million)

Table 18 PUD Market Size, By Region, 2015–2022 (Kiloton)

Table 19 PVA Emulsion Adhesives Market Size, By Region, 2015–2022 (USD Million)

Table 20 PVA Market Size, By Region, 2015–2022 (Kiloton)

Table 21 Other Emulsion Adhesive Market Size, By Region, 2015–2022 (USD Million)

Table 22 Other Market Size, By Region, 2015–2022 (Kiloton)

Table 23 Emulsion Adhesives Market Size, By Application, 2015–2022 (USD Million)

Table 24 Market Size, By Application, 2015–2022 (Kiloton)

Table 25 Market Size in Tapes & Labels, By Region, 2015–2022 (USD Million)

Table 26 Emulsion Adhesives Market Size in Tapes & Labels, By Region, 2015–2022 (Kiloton)

Table 27 Market Size in Paper & Packaging, By Region, 2015–2022 (USD Million)

Table 28 Market Size in Paper & Packaging, By Region, 2015–2022 (Kiloton)

Table 29 Emulsion Adhesives Market Size in Construction, By Region, 2015–2022 (USD Million)

Table 30 Market Size in Construction, By Region, 2015–2022 (Kiloton)

Table 31 Market Size in Automotive & Transportation, By Region, 2015–2022 (USD Million)

Table 32 Emulsion Adhesives Market Size in Automotive & Transportation, By Region, 2015–2022 (Kiloton)

Table 33 Market Size in Woodworking, By Region, 2015–2022 (USD Million)

Table 34 Market Size in Woodworking, By Region, 2015–2022 (Kiloton)

Table 35 Emulsion Adhesives Market Size in Other Applications, By Region, 2015–2022 (USD Million)

Table 36 Market Size in Other Applications, By Region, 2015–2022 (Kiloton)

Table 37 Market Size, By Region, 2015–2022 (USD Million)

Table 38 Emulsion Adhesives Market Size, By Region, 2015–2022 (Kiloton)

Table 39 North America: Market Size, By Country, 2015–2022 (USD Million)

Table 40 North America: Market Size, By Country, 2015–2022 (Kiloton)

Table 41 North America: Market Size, By Resin Type, 2015–2022 (USD Million)

Table 42 North America: Market Size, By Resin Type, 2015–2022 (Kiloton)

Table 43 North America: Market Size, By Application, 2015–2022 (USD Million)

Table 44 North America: Market Size, By Application, 2015–2022 (Kiloton)

Table 45 US: Emulsion Adhesives Market Size, By Application, 2015–2022 (USD Million)

Table 46 US: Market Size, By Application, 2015–2022 (Kiloton)

Table 47 Europe: Market Size, By Country, 2015–2022 (USD Million)

Table 48 Europe: Market Size, By Country, 2015–2022 (Kiloton)

Table 49 Europe: Market Size, By Resin Type, 2015–2022 (USD Million)

Table 50 Europe: Market Size, By Resin Type, 2015–2022 (Kiloton)

Table 51 Europe: Market Size, By Application, 2015–2022 (USD Million)

Table 52 Europe: Market Size, By Application, 2015–2022 (Kiloton)

Table 53 APAC: Market Size, By Country, 2015–2022 (USD Million)

Table 54 APAC: Market Size, By Country, 2015–2022 (Kiloton)

Table 55 APAC: Market Size, By Resin Type, 2015–2022 (USD Million)

Table 56 APAC: Market Size, By Resin Type, 2015–2022 (Kiloton)

Table 57 APAC: Market Size, By Application, 2015–2022 (USD Million)

Table 58 APAC: Market Size, By Application, 2015–2022 (Kiloton)

Table 59 China: Market Size, By Application, 2015–2022 (USD Million)

Table 60 China: Market Size, By Application, 2015–2022 (Kiloton)

Table 61 South America: Emulsion Adhesives Market Size, By Country, 2015–2022 (USD Million)

Table 62 South America: Market Size, By Country, 2015–2022 (Kiloton)

Table 63 South America: Market Size, By Resin Type, 2015–2022 (USD Million)

Table 64 South America: Market Size, By Resin Type, 2015–2022 (Kiloton)

Table 65 South America: Market Size, By Application, 2015–2022 (USD Million)

Table 66 South America: Market Size, By Application, 2015–2022 (Kiloton)

Table 67 Middle East & Africa: Market Size, By Country, 2015–2022 (USD Million)

Table 68 Middle East & Africa: Market Size, By Country, 2015–2022 (Kiloton)

Table 69 Middle East & Africa: Emulsion Adhesives Market Size, By Resin Type, 2015–2022 (USD Million)

Table 70 Middle East & Africa: Market Size, By Resin Type, 2015–2022 (Kiloton)

Table 71 Middle East & Africa: Market Size, By Application, 2015–2022 (USD Million)

Table 72 Middle East & Africa: Market Size, By Application, 2015–2022 (Kiloton)

Table 73 New Product Launches, 2012–2017

Table 74 Mergers & Acquisitions, 2012–2017

Table 75 Expansions, 2012–2017

List of Figures (34 Figures)

Figure 1 Emulsion Adhesives Market Segmentation

Figure 2 Emulsion Adhesive Market: Research Design

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Emulsion Adhesives Market: Data Triangulation

Figure 6 APAC to Dominate the Emulsion Adhesive Market

Figure 7 Automotive & Transportation to Be the Fastest-Growing End-Use Industry for Emulsion Adhesives

Figure 8 Acrylic Polymer Emulsion Adhesives: the Most Preferred Segment to Invest

Figure 9 APAC Was the Largest Emulsion Adhesives Market in 2016

Figure 10 Emerging Economies to Offer Lucrative Growth Opportunities to Market Players

Figure 11 Acrylic Polymer Emulsion Adhesive Market to Register the Highest CAGR

Figure 12 Tapes & Labels Segment Was the

Largest Consumer of Emulsion Adhesives

Figure 13 India Emerging as A Lucrative Market for Emulsion Adhesives

Figure 14 Snapshot of Developing Nations vs Developed Nations

Figure 15 India to Witness Highest Growth Rate in the Next Five Years

Figure 16 Drivers, Restraints, Opportunities & Challenges for Emulsion Adhesives Market

Figure 17 Porter’s Five Forces Analysis

Figure 18 Acrylic Polymer to Dominate Emulsion Adhesive Market, By Resin Type, 2017 vs 2022 (USD Million)

Figure 19 Growth of Major Applications Will Continue to Drive the Market

Figure 20 APAC to Be Fastest-Growing Emulsion Adhesives Market, 2017–2022

Figure 21 APAC to Witness Highest-Growth in Most Emulsion Adhesive Market Segment

Figure 22 North America: Emulsion Adhesives Market Snapshot

Figure 23 Europe: Emulsion Adhesive Market Snapshot

Figure 24 APAC: Emulsion Adhesives Market Snapshot

Figure 25 Companies Adopted New Product Launches and Mergers & Acquisitions as Key Growth Strategies Between 2012 and 2017

Figure 26 Wacker Chemie: Company Snapshot

Figure 27 Ashland Inc.: Company Snapshot

Figure 28 Henkel: Company Snapshot

Figure 29 H.B. Fuller: Company Snapshot

Figure 30 3M Company: Company Snapshot

Figure 31 Pidilite Industries Ltd.: Company Snapshot

Figure 32 Arkema (Bostik): Company Snapshot

Figure 33 The DOW Chemical Company: Company Snapshot

Figure 34 Cemedine Co., Ltd.: Company Snapshot

Growth opportunities and latent adjacency in Emulsion Adhesives Market