Endoluminal Suturing Devices Market Size, Growth by Application (Bariatric, Gastrointestinal, Gastroesophageal Reflux Disease), End User (Hospitals, Clinics, Ambulatory Surgical Centers), Technology Analysis, Regulatory Landscape, Trends - Global Forecasts to 2027

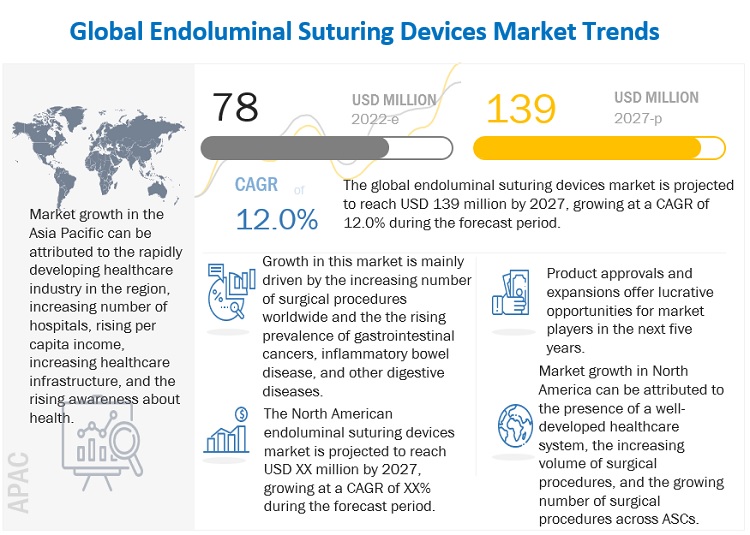

The global endoluminal suturing devices market in terms of revenue was estimated to be worth $78 million in 2022 and is poised to reach $139 million by 2027, growing at a CAGR of 12.0% from 2022 to 2027. Growth in this market is majorly driven by the rising prevalence of gastrointestinal cancers, inflammatory bowel disease, and other digestive diseases and the increasing number of surgical procedures worldwide.

To know about the assumptions considered for the study, Request for Free Sample Report

Endoluminal Suturing Devices Market Growth Dynamics

Drivers: Increasing number of surgical procedures worldwide

Endoluminal suturing devices are widely used in open surgeries, abdominal surgeries, endoscopy, and other gastrointestinal surgeries. Over the years, the affordability and accessibility to surgical care have increased, leading to a significant rise in the number of surgical procedures performed utilizing suturing devices. The increasing prevalence of lifestyle diseases and the subsequent rise in surgical procedures have further increased the demand for advanced surgical equipment, including suturing devices.

Restraints: Presence of alternative wound care management products

Wound closure devices such as staplers, ligating clips, and wound closure strips and sealing agents, skin adhesives, and hemostats are prominent alternatives associated with certain advantages to surgical sutures. For instance, stapling is quicker than suturing. Due to their efficiency and benefits over surgical sutures, the availability of alternatives is a key restraint for the market.

Opportunities: High growth opportunities in emerging markets

Emerging countries (such as China, Brazil, Mexico, and India) present significant growth opportunities for players in the market. The demand for endoluminal suturing devices in these countries is increasing owing to the rapid growth in the healthcare infrastructure, increasing public and private healthcare expenditure, and growth in medical tourism. Additionally, the rising number of skilled surgeons and a sharp rise in gastrointestinal surgical procedures across these countries contribute to overall demand growth. Other emerging countries are also witnessing rapid modernization in their healthcare facilities and the expansion of their healthcare infrastructure. This factor contributes to the increasing procurement of medical devices and surgical instruments.

Rising medical tourism in the emerging countries, due to the low cost of surgical treatment options, also presents new growth avenues for endoluminal suturing device providers.

Challenges: Shortage of skilled personnel

Skilled surgeons and physicians are required for the effective use of suturing devices during endoluminal surgeries. Improper use of these products can lead to complications in patients. Currently, the lack of skilled surgeons in developed and developing economies is one of the major factors limiting the adoption of endoluminal suturing devices. While the demand for surgeons is steadily increasing, the supply of future surgeons is not rising at the same rate. Therefore, this shortage will likely reduce the number of surgeries performed annually, negatively impacting the adoption of endoluminal suturing devices.

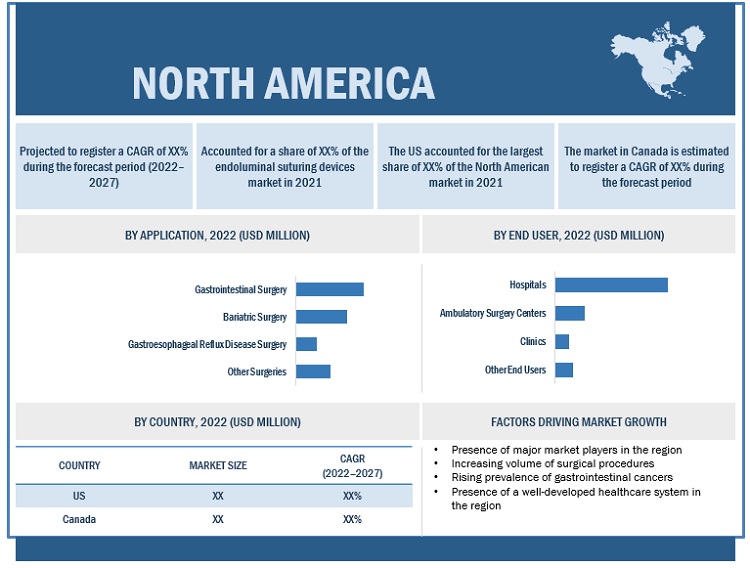

The gastrointestinal surgery segment accounted for the largest share of the endoluminal suturing devices market, by application

Based on application, the market is segmented into bariatric surgery, gastrointestinal surgery, gastroesophageal reflux disease surgery, and other surgeries. The largest share of the gastrointestinal surgery segment can be attributed to the growing adoption of endoluminal suturing devices for the growing number of gastrointestinal cancer cases worldwide and the increasing prevalence of gastrointestinal disorders.

The hospitals segment accounted for the largest share of the endoluminal suturing devices market, by end user in 2021

Based on end user, the market is segmented into hospitals, clinics, ambulatory surgery centers, and other end users. The large share of the hospitals segment can be attributed to the growing number of hospitals worldwide and increasing number of surgical procedures globally.

North America accounted for the largest share of the endoluminal suturing devices market in 2021

In 2021, North America accounted for the largest share of the market. Market growth in this region is characterized by the presence of a well-developed healthcare system, increasing volume of surgical procedures, the growing number of surgical procedures across ASCs, and the presence of leading market players in the region.

North America: Endoluminal suturing devices market snapshot

To know about the assumptions considered for the study, download the pdf brochure

Major players in the endoluminal suturing devices market are Apollo Endosurgery, Inc. (US), Johnson & Johnson (US), Medtronic Plc (Ireland), Cook Group Incorporated (US), USGI Medical (US), Ovesco Endoscopy AG (Germany), Endo Tools Therapeutics S.A. (Belgium), ErgoSuture (US), and Sutrue Ltd. (UK).

Endoluminal Suturing Devices Market Report Scope:

|

Report Metric |

Details |

|

Market size available for years |

2020–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

Application, and End User |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, and Middle East and Africa |

|

Companies covered |

Apollo Endosurgery, Inc. (US), Johnson & Johnson (US), Medtronic Plc (Ireland), Cook Group Incorporated (US), USGI Medical (US), Ovesco Endoscopy AG (Germany), Endo Tools Therapeutics S.A. (Belgium), ErgoSuture (US), and Sutrue Ltd. (UK) |

The study categorizes the global endoluminal suturing devices market based on application, end user and regional level.

By Application

- Bariatric Surgery

- Gastrointestinal Surgery

- Gastroesophageal Reflux Disease Surgery

- Other Surgeries

By End User

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Rest of APAC

- Latin America

- Middle East and Africa

Recent Developments:

- In 2022, Ovesco Endoscopy AG received ANVISA approval for the OTSC System in Brazil.

- In 2022, Endo Tools Therapeutics S.A. received 510(k) clearance from the FDA for the Endomina System.

- In 2021, Johnson & Johnson (Ethicon) announced the opening of its state-of-the-art and fully functional surgical lab on wheels that will travel to hospitals in 70 locations across the US providing surgeons and other healthcare professionals the opportunity for hands-on learning experiences and demonstrations with the newest technologies for colorectal, bariatric, gynecological, and thoracic procedures. This will lead to improved surgical technologies and will increase the number of surgeries carried outIntegra LifeSciences acquired Rebound Therapeutics to develop innovative products to address the unmet needs in neurosurgery.

- In 2019, Ovesco Endoscopy AG received marketing approval for the OTSC System in Indonesia. It will be available through its distributor, ANSr SDN BHD (Malaysia).

Frequently Asked Questions (FAQ):

What is the projected market value of the global endoluminal suturing devices market?

The global market of endoluminal suturing devices is projected to reach USD 139 million.

What is the estimated growth rate (CAGR) of the global endoluminal suturing devices market for the next five years?

The global endoluminal suturing devices market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.0% from 2022 to 2027.

What are the major revenue pockets in the endoluminal suturing devices market currently?

In 2021, North America accounted for the largest share of the market. Market growth in this region is characterized by the presence of a well-developed healthcare system, increasing volume of surgical procedures, the growing number of surgical procedures across ASCs, and the presence of leading market players in the region.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.2.2 MARKETS COVERED

FIGURE 1 ENDOLUMINAL SUTURING DEVICES MARKET SEGMENTATION

1.2.3 YEARS CONSIDERED

1.3 CURRENCY CONSIDERED

TABLE 1 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

1.4 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 23)

2.1 RESEARCH APPROACH

2.2 RESEARCH DESIGN

FIGURE 2 MARKET: RESEARCH DESIGN

2.2.1 SECONDARY RESEARCH

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

FIGURE 3 PRIMARY SOURCES

2.2.2.1 Key data from primary sources

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.3 MARKET SIZE ESTIMATION

FIGURE 5 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 6 REVENUE SHARE ANALYSIS ILLUSTRATION

FIGURE 7 TOP-DOWN APPROACH

FIGURE 8 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 9 CAGR PROJECTIONS

2.4 DATA TRIANGULATION APPROACH

FIGURE 10 DATA TRIANGULATION METHODOLOGY

2.5 MARKET SHARE ESTIMATION

2.6 ASSUMPTIONS

2.7 LIMITATIONS

2.7.1 METHODOLOGY-RELATED LIMITATIONS

2.7.2 SCOPE-RELATED LIMITATIONS

2.8 RISK ASSESSMENT

TABLE 2 RISK ASSESSMENT: MARKET

3 EXECUTIVE SUMMARY (Page No. - 35)

FIGURE 11 ENDOLUMINAL SUTURING DEVICES MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 12 MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

FIGURE 13 GEOGRAPHIC SNAPSHOT OF MARKET

4 PREMIUM INSIGHTS (Page No. - 38)

4.1 MARKET OVERVIEW

FIGURE 14 RISING NUMBER OF SURGICAL PROCEDURES PERFORMED TO DRIVE GROWTH

4.2 ASIA PACIFIC: MARKET, BY APPLICATION AND COUNTRY (2021)

FIGURE 15 GASTROINTESTINAL SURGERIES ACCOUNTED FOR LARGEST SHARE OF ASIA PACIFIC MARKET IN 2021

4.3 MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 16 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

4.4 MARKET, BY REGION (2020–2027)

FIGURE 17 NORTH AMERICA TO DOMINATE MARKET IN 2027

5 MARKET OVERVIEW (Page No. - 42)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 ENDOLUMINAL SUTURING DEVICES MARKET: KEY DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing number of surgical procedures worldwide

TABLE 3 NUMBER OF SURGICAL PROCEDURES, BY COUNTRY, 2020

5.2.1.2 Rising prevalence of gastrointestinal cancers, inflammatory bowel disease, and other digestive diseases

TABLE 4 GLOBAL INCIDENCE OF COLORECTAL CANCER, 2020

TABLE 5 GLOBAL GASTROINTESTINAL CANCER INCIDENCE, 2020

5.2.1.3 Favorable reimbursement scenario

5.2.2 RESTRAINTS

5.2.2.1 Presence of alternative wound care management products

5.2.3 OPPORTUNITIES

5.2.3.1 High-growth opportunities in emerging markets

TABLE 6 AVERAGE SURGICAL PROCEDURE COSTS (2021)

5.2.3.2 Increasing adoption of outpatient surgeries

5.2.4 CHALLENGES

5.2.4.1 Shortage of skilled personnel

5.3 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 7 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.4 REGULATORY ANALYSIS

5.4.1 NORTH AMERICA

5.4.1.1 US

TABLE 8 US FDA: MEDICAL DEVICE CLASSIFICATION

TABLE 9 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

5.4.1.2 Canada

TABLE 10 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

5.4.2 EUROPE

5.4.3 ASIA PACIFIC

5.4.3.1 Japan

TABLE 11 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PMDA

5.4.3.2 China

TABLE 12 CHINA: CLASSIFICATION OF MEDICAL DEVICES

5.4.3.3 India

5.5 PORTER’S FIVE FORCES ANALYSIS

TABLE 13 PORTER’S FIVE FORCES ANALYSIS

5.5.1 THREAT FROM NEW ENTRANTS

5.5.2 THREAT FROM SUBSTITUTES

5.5.3 BARGAINING POWER OF SUPPLIERS

5.5.4 BARGAINING POWER OF BUYERS

5.5.5 INTENSITY OF COMPETITIVE RIVALRY

5.6 VALUE CHAIN ANALYSIS

FIGURE 19 VALUE CHAIN ANALYSIS: MAXIMUM VALUE IS ADDED DURING MANUFACTURING PHASE

5.7 INDUSTRY TRENDS

5.7.1 MINIMALLY INVASIVE SURGERY

5.8 TECHNOLOGY ANALYSIS

5.8.1 ROBOTIC SUTURING SYSTEMS

5.9 ECOSYSTEM ANALYSIS

FIGURE 20 SURGICAL SUTURES MARKET: ECOSYSTEM MAP (2021)

5.10 PATENT ANALYSIS

5.10.1 PATENT PUBLICATION TRENDS FOR ENDOLUMINAL SUTURING DEVICES

FIGURE 21 PATENT PUBLICATION TRENDS (JANUARY 2011–JULY 2022)

5.10.2 INSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

FIGURE 22 TOP PATENT APPLICANTS AND OWNERS (COMPANIES/INSTITUTES) FOR ENDOLUMINAL SUTURING DEVICES (JANUARY 2011–JULY 2022)

FIGURE 23 TOP APPLICANT JURISDICTIONS FOR ENDOLUMINAL SUTURING DEVICE PATENTS (JANUARY 2011–JULY 2022)

TABLE 14 LIST OF PATENTS IN MARKET, 2020–2022

6 ENDOLUMINAL SUTURING DEVICES MARKET, BY APPLICATION (Page No. - 61)

6.1 INTRODUCTION

TABLE 15 MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

6.2 BARIATRIC SURGERY

6.2.1 GROWING PREVALENCE OF OBESITY TO DRIVE MARKET GROWTH

TABLE 16 NUMBER OF BARIATRIC SURGERIES PERFORMED GLOBALLY (2018)

TABLE 17 US: NUMBER OF BARIATRIC SURGERIES, 2011–2020

TABLE 18 ENDOLUMINAL SURGICAL DEVICES MARKET FOR BARIATRIC SURGERY, BY COUNTRY, 2020–2027 (USD THOUSAND)

6.3 GASTROINTESTINAL SURGERY

6.3.1 GROWING BURDEN OF COLON CANCER TO INCREASE DEMAND FOR GASTROINTESTINAL SURGERY

TABLE 19 ESTIMATED NEW GI CANCER CASES AND DEATHS IN US, 2021

TABLE 20 ENDOLUMINAL SURGICAL DEVICES MARKET FOR GASTROINTESTINAL SURGERY, BY COUNTRY, 2020–2027 (USD THOUSAND)

6.4 GASTROESOPHAGEAL REFLUX DISEASE SURGERY

6.4.1 IMPROVING DIETS AND LIFESTYLE CHANGES TO RESTRAIN MARKET GROWTH

TABLE 21 ENDOLUMINAL SURGICAL DEVICES MARKET FOR GASTROESOPHAGEAL REFLUX DISEASE SURGERY, BY COUNTRY, 2020–2027 (USD THOUSAND)

6.5 OTHER SURGERIES

TABLE 22 ENDOLUMINAL SURGICAL DEVICES MARKET FOR OTHER SURGERIES, BY COUNTRY, 2020–2027 (USD THOUSAND)

7 ENDOLUMINAL SUTURING DEVICES MARKET, BY END USER (Page No. - 70)

7.1 INTRODUCTION

TABLE 23 MARKET, BY END USER, 2020–2027 (USD MILLION)

7.2 HOSPITALS

7.2.1 GROWING NUMBER OF HOSPITALS WORLDWIDE TO PROPEL MARKET GROWTH

TABLE 24 NUMBER OF HOSPITALS, BY COUNTRY, 2010–2021

TABLE 25 MARKET FOR HOSPITALS, BY COUNTRY, 2020–2027 (USD THOUSAND)

7.3 CLINICS

7.3.1 QUICKER CONSULTATION SERVICES AND MINIMAL PATIENT STAYS—KEY ADVANTAGES DRIVING MARKET GROWTH

TABLE 26 MARKET FOR CLINICS, BY COUNTRY, 2020–2027 (USD THOUSAND)

7.4 AMBULATORY SURGERY CENTERS

7.4.1 COST-EFFECTIVE TREATMENTS IN AMBULATORY CENTERS TO DRIVE DEMAND FOR THESE FACILITIES

TABLE 27 MARKET FOR AMBULATORY SURGERY CENTERS, BY COUNTRY, 2020–2027 (USD THOUSAND)

7.5 OTHER END USERS

TABLE 28 MARKET FOR OTHER END USERS, BY COUNTRY, 2020–2027 (USD THOUSAND)

8 ENDOLUMINAL SUTURING DEVICES MARKET, BY REGION (Page No. - 78)

8.1 INTRODUCTION

FIGURE 24 MARKET: GEOGRAPHIC SNAPSHOT (2021)

TABLE 29 MARKET, BY REGION, 2020–2027 (USD MILLION)

8.2 NORTH AMERICA

TABLE 30 NORTH AMERICA: GASTROINTESTINAL CANCER INCIDENCE, ESTIMATED DEATHS, AND FIVE-YEAR PREVALENCE (2020)

FIGURE 25 NORTH AMERICA: MARKET SNAPSHOT

TABLE 31 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD THOUSAND)

TABLE 32 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

TABLE 33 NORTH AMERICA: MARKET, BY END USER, 2020–2027 (USD THOUSAND)

8.2.1 US

8.2.1.1 US to dominate North American market during forecast period

TABLE 34 US: GASTROINTESTINAL CANCER INCIDENCE, ESTIMATED DEATHS, AND FIVE-YEAR PREVALENCE (2020)

TABLE 35 US: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

TABLE 36 US: MARKET, BY END USER, 2020–2027 (USD THOUSAND)

8.2.2 CANADA

8.2.2.1 Increasing volume of surgeries to fuel demand for endoluminal suturing devices in Canada

TABLE 37 CANADA: GASTROINTESTINAL CANCER INCIDENCE, ESTIMATED DEATHS, AND FIVE-YEAR PREVALENCE (2020)

TABLE 38 CANADA: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

TABLE 39 CANADA: MARKET, BY END USER, 2020–2027 (USD THOUSAND)

8.3 EUROPE

TABLE 40 EUROPE: GASTROINTESTINAL CANCER INCIDENCE, ESTIMATED DEATHS, AND FIVE-YEAR PREVALENCE (2020)

TABLE 41 EUROPE: ENDOLUMINAL SUTURING DEVICES MARKET, BY COUNTRY, 2020–2027 (USD THOUSAND)

TABLE 42 EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

TABLE 43 EUROPE: MARKET, BY END USER, 2020–2027 (USD THOUSAND)

8.3.1 GERMANY

8.3.1.1 High penetration of health insurance makes Germany largest market for endoluminal suturing devices in Europe

TABLE 44 GERMANY: GASTROINTESTINAL CANCER INCIDENCE, ESTIMATED DEATHS, AND FIVE-YEAR PREVALENCE (2020)

TABLE 45 GERMANY: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

TABLE 46 GERMANY: MARKET, BY END USER, 2020–2027 (USD THOUSAND)

8.3.2 FRANCE

8.3.2.1 Well-established healthcare system and growing procedural volume boost market growth

TABLE 47 FRANCE: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

TABLE 48 FRANCE: MARKET, BY END USER, 2020–2027 (USD THOUSAND)

8.3.3 UK

8.3.3.1 Growing volume of hernia repair and bowel cancer surgeries will stimulate market growth

TABLE 49 UK: GASTROINTESTINAL CANCER INCIDENCE, ESTIMATED DEATHS, AND FIVE-YEAR PREVALENCE (2020)

TABLE 50 UK: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

TABLE 51 UK: MARKET, BY END USER, 2020–2027 (USD THOUSAND)

8.3.4 ITALY

8.3.4.1 Initiatives to build awareness about digestive health to increase adoption of endoluminal suturing devices

TABLE 52 ITALY: GASTROINTESTINAL CANCER INCIDENCE, ESTIMATED DEATHS, AND FIVE-YEAR PREVALENCE (2020)

TABLE 53 ITALY: ENDOLUMINAL SUTURING DEVICES MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

TABLE 54 ITALY: MARKET, BY END USER, 2020–2027 (USD THOUSAND)

8.3.5 SPAIN

8.3.5.1 Growing healthcare budget to drive growth in Spain

TABLE 55 SPAIN: GASTROINTESTINAL CANCER INCIDENCE, ESTIMATED DEATHS, AND FIVE-YEAR PREVALENCE (2020)

TABLE 56 SPAIN: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

TABLE 57 SPAIN: MARKET, BY END USER, 2020–2027 (USD THOUSAND)

8.3.6 REST OF EUROPE

TABLE 58 REST OF EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

TABLE 59 REST OF EUROPE: MARKET, BY END USER, 2020–2027 (USD THOUSAND)

8.4 ASIA PACIFIC

TABLE 60 ASIA PACIFIC: GASTROINTESTINAL CANCER INCIDENCE, ESTIMATED DEATHS, AND FIVE-YEAR PREVALENCE (2020)

FIGURE 26 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 61 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD THOUSAND)

TABLE 62 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

TABLE 63 ASIA PACIFIC: MARKET, BY END USER, 2020–2027 (USD THOUSAND)

8.4.1 JAPAN

8.4.1.1 Strong healthcare system in Japan supports growth of endoluminal suturing devices market

TABLE 64 JAPAN: GASTROINTESTINAL CANCER INCIDENCE, ESTIMATED DEATHS, AND FIVE-YEAR PREVALENCE (2020)

TABLE 65 JAPAN: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

TABLE 66 JAPAN: MARKET, BY END USER, 2020–2027 (USD THOUSAND)

8.4.2 CHINA

8.4.2.1 Growing number of hospitals and increased prevalence of obesity to propel growth in China

TABLE 67 CHINA: GASTROINTESTINAL CANCER INCIDENCE, ESTIMATED DEATHS, AND FIVE-YEAR PREVALENCE (2020)

TABLE 68 CHINA: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

TABLE 69 CHINA: MARKET, BY END USER, 2020–2027 (USD THOUSAND)

8.4.3 INDIA

8.4.3.1 Increasing prevalence of gastrointestinal disorders and favorable government support to drive market in India

TABLE 70 INDIA: GASTROINTESTINAL CANCER INCIDENCE, ESTIMATED DEATHS, AND FIVE-YEAR PREVALENCE (2020)

TABLE 71 INDIA: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

TABLE 72 INDIA: MARKET, BY END USER, 2020–2027 (USD THOUSAND)

8.4.4 REST OF ASIA PACIFIC

TABLE 73 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

TABLE 74 REST OF ASIA PACIFIC: MARKET, BY END USER, 2020–2027 (USD THOUSAND)

8.5 LATIN AMERICA

8.5.1 GROWING MEDICAL TOURISM IN LATIN AMERICAN COUNTRIES TO PROPEL MARKET

TABLE 75 LATIN AMERICA: GASTROINTESTINAL CANCER INCIDENCE, ESTIMATED DEATHS, AND FIVE-YEAR PREVALENCE (2020)

TABLE 76 BRAZIL: GASTROINTESTINAL CANCER INCIDENCE, ESTIMATED DEATHS, AND FIVE-YEAR PREVALENCE (2020)

TABLE 77 LATIN AMERICA: ENDOLUMINAL SUTURING DEVICES MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

TABLE 78 LATIN AMERICA: MARKET, BY END USER, 2020–2027 (USD THOUSAND)

8.6 MIDDLE EAST & AFRICA

8.6.1 MIDDLE EAST & AFRICA—SMALLEST REGIONAL MARKET FOR ENDOLUMINAL SUTURING DEVICES

TABLE 79 MIDDLE EAST & AFRICA: GASTROINTESTINAL CANCER INCIDENCE (2020)

TABLE 80 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

TABLE 81 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2020–2027 (USD THOUSAND)

9 COMPETITIVE LANDSCAPE (Page No. - 113)

9.1 OVERVIEW

9.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

9.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 27 REVENUE ANALYSIS OF KEY PLAYERS IN ENDOLUMINAL SUTURING DEVICES MARKET

9.4 MARKET SHARE ANALYSIS

FIGURE 28 MARKET SHARE, BY KEY PLAYER, 2021

TABLE 82 MARKET: DEGREE OF COMPETITION

9.5 COMPETITIVE BENCHMARKING

TABLE 83 MARKET: COMPETITIVE BENCHMARKING

9.6 COMPANY FOOTPRINT

TABLE 84 FOOTPRINT OF COMPANIES IN MARKET

9.6.1 APPLICATION FOOTPRINT

TABLE 85 APPLICATION FOOTPRINT OF COMPANIES

9.6.2 END-USER FOOTPRINT

TABLE 86 END-USER FOOTPRINT OF COMPANIES

9.6.3 REGIONAL FOOTPRINT

TABLE 87 REGIONAL FOOTPRINT OF COMPANIES

9.7 COMPANY EVALUATION QUADRANT

9.7.1 STARS

9.7.2 EMERGING LEADERS

9.7.3 PERVASIVE PLAYERS

9.7.4 PARTICIPANTS

FIGURE 29 ENDOLUMINAL SUTURING DEVICES MARKET: COMPANY EVALUATION QUADRANT (2021)

9.8 COMPETITIVE SCENARIO

9.8.1 PRODUCT LAUNCHES

TABLE 88 PRODUCT LAUNCHES (JANUARY 2019–JULY 2022)

9.8.2 OTHER DEVELOPMENTS

TABLE 89 OTHER DEVELOPMENTS (JANUARY 2019–JULY 2022)

10 COMPANY PROFILES (Page No. - 122)

10.1 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

10.1.1 APOLLO ENDOSURGERY, INC.

TABLE 90 APOLLO ENDOSURGERY, INC.: BUSINESS OVERVIEW

FIGURE 30 APOLLO ENDOSURGERY, INC.: COMPANY SNAPSHOT (2021)

10.1.2 JOHNSON & JOHNSON (ETHICON, INC.)

TABLE 91 JOHNSON & JOHNSON: BUSINESS OVERVIEW

FIGURE 31 JOHNSON & JOHNSON: COMPANY SNAPSHOT (2021)

10.1.3 MEDTRONIC PLC

TABLE 92 MEDTRONIC, INC.: BUSINESS OVERVIEW

FIGURE 32 MEDTRONIC PLC: COMPANY SNAPSHOT (2022)

10.1.4 COOK GROUP INCORPORATED

TABLE 93 COOK GROUP INCORPORATED: BUSINESS OVERVIEW

10.1.5 USGI MEDICAL

TABLE 94 USGI MEDICAL: BUSINESS OVERVIEW

10.1.6 OVESCO ENDOSCOPY AG

TABLE 95 OVESCO ENDOSCOPY AG: BUSINESS OVERVIEW

10.1.7 ENDO TOOLS THERAPEUTICS S.A.

TABLE 96 ENDO TOOLS THERAPEUTICS S.A.: BUSINESS OVERVIEW

10.1.8 ERGOSUTURE

TABLE 97 ERGOSUTURE: BUSINESS OVERVIEW

10.1.9 SUTRUE LTD.

TABLE 98 SUTRUE LTD.: BUSINESS OVERVIEW

*Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 139)

11.1 INSIGHTS FROM INDUSTRY EXPERTS

11.2 DISCUSSION GUIDE

11.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.4 CUSTOMIZATION OPTIONS

11.5 RELATED REPORTS

11.6 AUTHOR DETAILS

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, key players, competitive landscape of the endoluminal suturing devices market, and key market dynamics, such as drivers, restraints, opportunities, challenges, and key strategies.

Secondary Research

This research study involved the use of widespread secondary sources; directories; databases such as D&B, Bloomberg Business, and Factiva; white papers; annual reports; and company house documents. Secondary research was used to identify and collect information for this extensive, technical, market-oriented, and commercial study of the endoluminal suturing devices market. It was also used to obtain important information about the top players, market classification and segmentation according to industry trends to the bottom-most level, geographic markets, technology perspectives, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

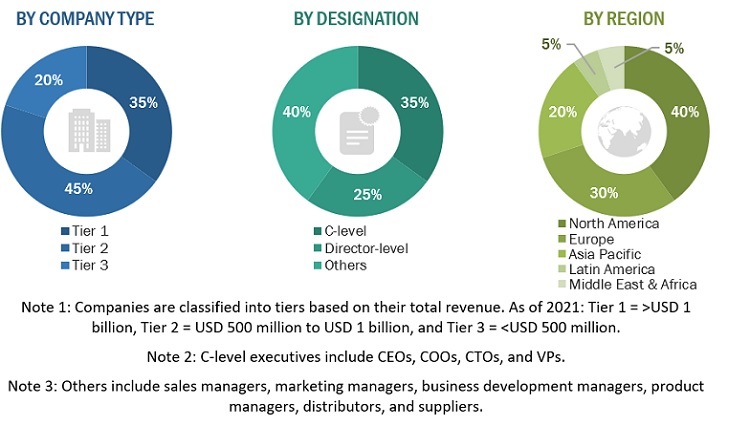

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side and demand side are detailed below. Industry experts such as CEOs, presidents, vice presidents, directors, marketing directors, marketing managers, and related executives from various key companies and organizations in the endoluminal suturing device industry were interviewed to obtain and verify both the qualitative and quantitative aspects of this research study. A robust primary research methodology has been adopted to validate the contents of the report and fill in the gaps. Telephonic and electronic communications were adopted to conduct interviews. Questionnaires were designed and sent to primary participants at their convenience.

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the endoluminal suturing devices market was arrived at after data triangulation from different approaches. After each approach, the weighted average of the approaches was taken based on the level of assumptions used in each approach.

Data Triangulation

After arriving at the market size, the total market was divided into several segments and subsegments. Data triangulation and market breakdown procedures were employed wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The following figure shows the market validation, source structure, and data triangulation methodology implemented in the market engineering process.

Objectives of the Study

- To define, describe, segment, and forecast the endoluminal suturing devices market by application, end user, and region

- To provide detailed information about the factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market in five main regions (along with their respective key countries): North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players in the market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as product approvals, expansions and R&D activities of the leading players in the market

- To benchmark players within the endoluminal suturing devices market using the Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offerings

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of each company

Geographic Analysis

- Further breakdown of the Rest of Europe market into Switzerland, the Netherlands, Belgium, and others

- Further breakdown of the Latin American market into Mexico, Brazil, and others

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Endoluminal Suturing Devices Market