Environment, Health, and Safety Market by Offering (Software and Services (Analytics, Project Deployment and Implementation, Audit, Assessment, and Regulatory Compliance, Certification)), Application, Vertical & Region - Global Forecast to 2029

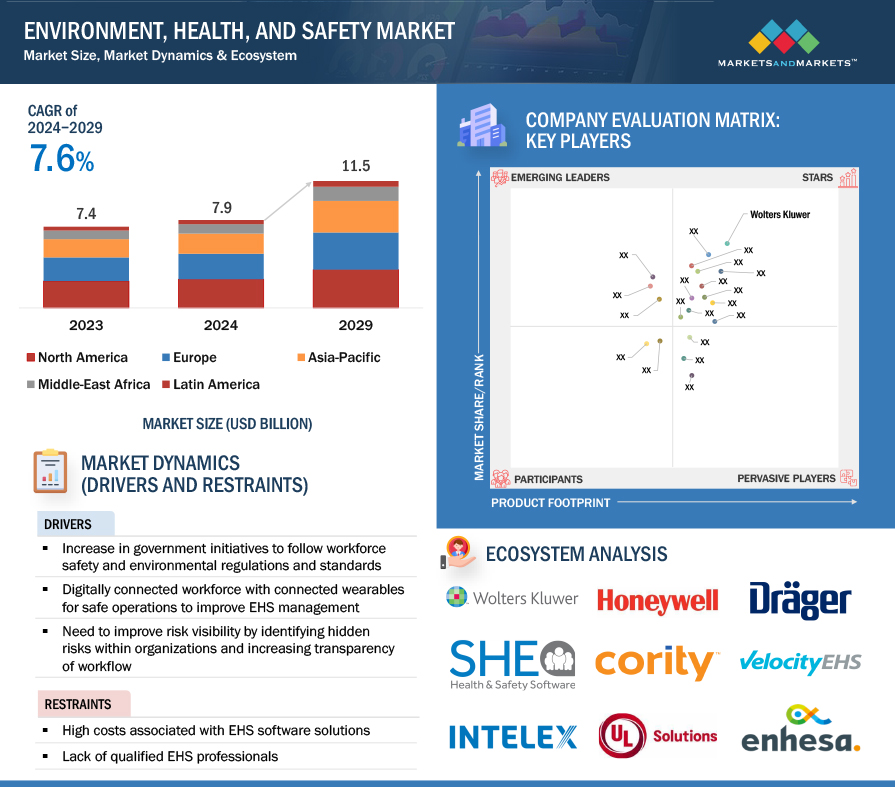

[252 Pages Report] The environment, health, and safety market size is projected to grow from USD 7.9 billion in 2024 to USD 11.5 billion by 2029 at a CAGR of 7.6% during the forecast period. Governments around the world are enacting stricter environmental and safety regulations to protect workers and the environment. This necessitates compliance by businesses, leading them to invest in EHS solutions.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Environment, health, and safety Market Dynamics

Driver: Digitally connected workforce with connected wearables for safe operations to improve EHS management

Every industry has its set of risks associated with its operations, and the management must take steps to address and mitigate them. Industries are empowering miners with a new wearable device. Wearable technology adoption is poised to revolutionize productivity and occupational health and safety for workers. These devices, often integrated with advanced electrical components and IoT connectivity, come in various apparel and accessory forms. While initially popular for personal fitness, wearables are increasingly used to monitor health risks and enhance occupational safety.

In the past few years, there has been tremendous growth and rapid change in connected worker solution technologies and market adoption. Industries use digital technologies to increase data flow, information, insights, and actions throughout operations to make processes safer and more efficient. In 2020, workplace safety emerged at the forefront during the COVID-19 pandemic. EHS software is a form of data management built to help users avoid workplace incidents, maintain regulatory compliance, and track untoward incidents. It covers many functions that mostly center on compliance and security, such as safety data sheet management, health and safety management programs, EHS training, emissions tracking management, entry permits management for confined spaces, spill response management, and incident investigations management.

Restraint: Data silos and information gaps

Integrating EHS software with existing enterprise systems, such as ERP or legacy data management systems, presents significant challenges due to the complexity and disparate nature of these systems. Data integration can be complex and time-consuming, requiring coordination between various departments, IT teams, and software vendors. Integrating EHS software with existing systems may lead to the creation of data silos, where EHS data is segregated from other organizational data sources, hindering the flow of crucial information for comprehensive EHS management. Data silos can result in fragmented insights, duplication of efforts, and inconsistencies in reporting, undermining the organization's ability to make informed decisions and effectively manage EHS risks. Overcoming data integration challenges requires careful planning, collaboration between stakeholders, and leveraging integration tools and technologies to ensure seamless connectivity and data exchange between EHS software and other enterprise systems.

Opportunity: Modernization of industry infrastructure for low carbon emissions

Technology companies are exploring ways to reduce the energy consumption of their products. Companies focus on designing energy-efficient products, power supplies, and integrated circuits to be energy-efficient and creating cooperative solutions to help customers reduce their carbon emissions. Environment-friendly corporate practices minimize business risks, improve reputation, and generate enormous market opportunities in the EHS market. In the recent wireless era, numerous devices use wireless technology in their day-to-day activities; these devices consume an extensive amount of energy and emit considerable carbon during usage. Technological companies are presented with an opportunity to reduce the energy consumption of these wireless devices and minimize the amount of carbon they emit.

Challenge: Lack of skills and end-to-end solutions

Although there is an increase in the number of EHS software solution users, more technical expertise is needed to operate and maintain these solutions. Organizations need to recognize the importance of EHS software solutions proactively. This has led to inadequate professional knowledge in handling EHS software solutions, as technological skill sets are required to handle complex EHS software solutions. Due to insufficient end-to-end solutions, organizations use multiple software to generate the required output. Regarding software, an end-to-end solution describes a system that addresses all business needs and processes in one centralized hub. Hence, the concerns related to the availability of technical expertise and end-to-end solutions are restraining the adoption and growth of the global EHS market.

Ecosystem Of Environment, Health, and Safety Market

The construction and engineering vertical registered the highest CAGR in the environment, health, and safety market during the forecast period.

The construction and engineering sector of EHS focuses on ensuring safety in construction projects and engineering operations. This sector relies on five key solutions: incident management, audit and inspection, waste management, on-demand training, and compliance management. Demand for EHS services in this sector is driven by stringent regulations, public concern for safety and the environment, and technological advancements. EHS initiatives aim to prevent accidents, injuries, and environmental damage through safety protocols, risk assessments, and compliance with regulations. Technology like digital monitoring systems and wearable safety devices is revolutionizing safety practices in the industry.

Project deployment and implementation services are expected to hold the largest market size during the forecast.

Project deployment and implementation services in the EHS domain are crucial for integrating EHS software effectively within organizations. These services, which include project planning, system configuration, data migration, training, and support, are driven by the growing recognition of the importance of robust EHS management systems in enhancing workplace safety, environmental sustainability, and regulatory compliance. As companies prioritize risk mitigation, operational efficiency, and corporate responsibility, they seek expert assistance in deploying EHS software. Additionally, evolving regulatory requirements and the need to align with industry standards contribute to the demand for these services. With digital transformation initiatives on the rise, specialized expertise is increasingly sought to navigate the complexities of EHS software deployment and ensure seamless integration with existing IT infrastructure.

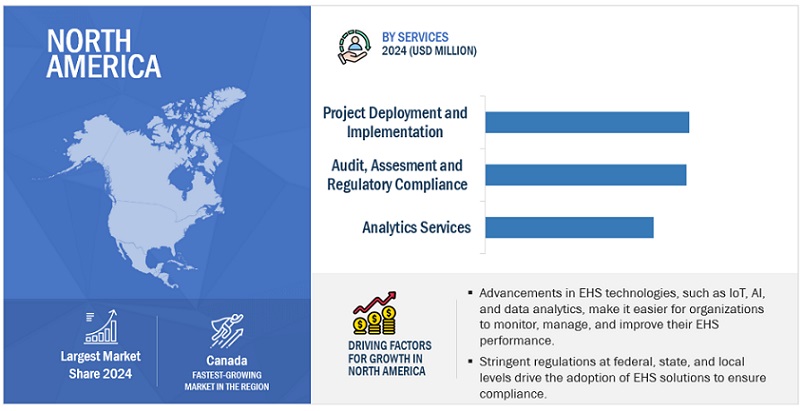

Based on region, North America is expected to hold the largest market size during the forecast.

North America, encompassing countries like the US and Canada, boasts well-developed infrastructures that fuel a significant demand for EHS solutions. Contributions from leading nations such as the US and Canada primarily drive the EHS market in North America. These countries' robust economies facilitate substantial investments in cutting-edge technologies, further enhancing their market dominance. The stringent regulatory frameworks upheld by the US and Canadian governments are a crucial catalyst for the EHS market's growth. The US's EHS department, for instance, oversees the development and enforcement of safety programs aimed at safeguarding the well-being of workers and the environment, covering areas like chemical safety, occupational safety, and hazardous waste management.

Market Players:

The major vendors in this market include VelocityEHS (US), Wolters Kluwer (Netherlands), Intelex Technologies (Canada), Benchmark ESG (US), Cority Software Inc. (Canada), Sphera (US), Intertek (UK), Quentic (Germany), UL Solutions (US), Ideagen (UK). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and product enhancements, and acquisitions to expand their footprint in the environment, health, and safety market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2018-2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Value (USD) Million/Billion |

|

Segments Covered |

By Offering (software and services), Application, Vertical and Region |

|

Region covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

The major players in the environment, health, and safety market are VelocityEHS (US), Wolters Kluwer (Netherlands), Intelex Technologies (Canada), Benchmark ESG (US), Cority Software Inc. (Canada), Sphera (US), Intertek (UK), Quentic (Germany), UL Solutions (US), Ideagen (UK), SAP (Germany), IBM (US), Evotix (UK), EcoOnline (Norway), Diligent Corporation (US), ETQ (US), 3E (US), Dakota Software Corporation (US), IsoMetrix (US), Enhesa (US), VisiumKMS (US), SafetyCulture (Australia), TextContext (Canada), ComplianceQuest (US), Pro-Sapien (UK), SHEQX (Australia), CMO Software (UK), Indus Environmental Services (India), Inicia (Japan), ASK-EHS Engineering (India), SHE Group (South Africa), and EHS Brazil (Brazil). |

This research report categorizes the environment, health, and safety market to forecast revenues and analyze trends in each of the following submarkets:

Based on Offering:

- Software

-

Services

- Analytics Services

- Project Deployment and Implementation Services

- Business Consulting and Advisory Services

- Audit, Assessment, and Regulatory Compliance Services

- Certification Services

- Training and Support services

Based on Application:

- Health Safety Management

- Environmental & Sustainability Management

- Waste Management

- Energy & Water Management

- Air Quality & Compliance Management

- Incident & Risk Management

- Other Applications

Based on Vertical:

- Energy and Utilities

- Chemicals and Materials

- Healthcare and Lifesciences

- Construction and Engineering

- Food and Beverage

- Government and Defense

- Other Vertical

By Region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- France

- Italy

- Spain

- Nordic

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia & New Zealand

- South Korea

- Southeast Asia

- Rest of Asia Pacific

-

Middle East and Africa

-

GCC Countries

- UAE

- KSA

- Rest of GCC Countries

- South Africa

- Rest of the Middle East & Africa

-

GCC Countries

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In February 2024, VelocityEHS acquired Contractor Compliance, a Canadian-based enterprise safety and risk management software solution provider. The deal adds innovative third-party contractor and vendor compliance capabilities to the award-winning VelocityEHS Accelerate Platform.

- In August 2023, UL Solutions announced the acquisition of CERE, a privately owned, Madrid-based third-party testing, simulation, and certification company.

- In May 2023, Cority announced the acquisition of Greenstone, a UK-headquartered software company with a suite of sustainability solutions for enterprises, supply chains, and asset managers. This marks the third sustainability-focused acquisition for Cority in the past two years, including WeSustain and Reporting 21.

- In January 2023, Wolters Kluwer Legal & Regulatory announced it had acquired Della AI Ltd., a provider of leading AI technology based on advanced NLP. This technology was expected to allow legal professionals to review contracts in multiple languages by simply asking questions.

Frequently Asked Questions (FAQ):

What is environment, health, and safety?

Environment, Health, and Safety (EHS) is a discipline focused on safeguarding people, the environment, and communities during industrial activities. It involves identifying and mitigating risks related to environmental impact, workplace safety, and health hazards. EHS aims to prevent accidents, injuries, and ecological harm while ensuring compliance with regulations. Key elements include risk assessment, hazard identification, emergency planning, and regulatory compliance. Organizations implement EHS programs to protect employees, conserve resources, and meet legal requirements.

What is the market size of the environment, health, and safety market?

The environment, health, and safety market size is projected to grow from USD 7.9 billion in 2024 to USD 11.5 billion by 2029 at a CAGR of 7.6% during the forecast period.

What are the major drivers in the environment, health, and safety market?

The major drivers in the environment, health, and safety market are an increase in government initiatives to follow workforce safety and environmental regulations and standards, a digitally connected workforce with connected wearables for safe operations to improve EHS management, the need to enhance risk visibility by identifying hidden risks within organizations and increasing transparency of workflow, the proliferation of software-as-a-service deployment model, and growing recognition of EHS as a strategic business imperative.

Who are the key players operating in the environment, health, and safety market?

The key vendors operating in the environment, health, and safety market include VelocityEHS (US), Wolters Kluwer (Netherlands), Intelex Technologies (Canada), Benchmark ESG (US), Cority Software Inc. (Canada), Sphera (US), Intertek (UK), Quentic (Germany), UL Solutions (US), Ideagen (UK), SAP (Germany), IBM (US), Evotix (UK), EcoOnline (Norway), Diligent Corporation (US), ETQ (US), 3E (US), Dakota Software Corporation (US), IsoMetrix (US), Enhesa (US), VisiumKMS (US), SafetyCulture (Australia), TextContext (Canada), ComplianceQuest (US), Pro-Sapien (UK), SHEQX (Australia), CMO Software (UK), Indus Environmental Services (India), Inicia (Japan), ASK-EHS Engineering (India), SHE Group (South Africa), and EHS Brazil (Brazil).

What are the opportunities for new market entrants in the environment, health, and safety market?

Newcomers in the EHS market have ample opportunities to thrive. With increasing regulations and sustainability initiatives, there's a demand for innovative solutions. Emerging sectors like renewable energy and construction offer niches for specialized services. Moreover, the trend toward digitalization creates space for technology-driven startups to provide advanced tools and analytics platforms. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

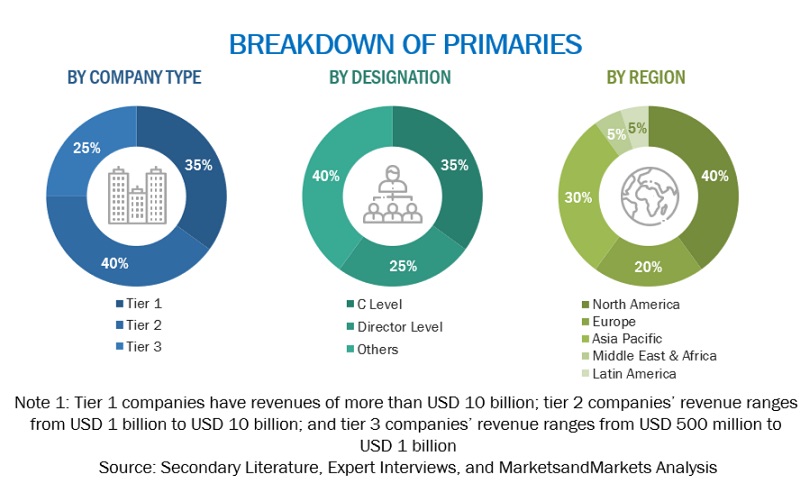

The research study involved four major activities in estimating the environment, health, and safety market size. Exhaustive secondary research has been done to collect important information about the market and peer markets. The next step has been to validate these findings and assumptions and size them with the help of primary research with industry experts across the value chain. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

The market size of the companies offering environment, health, and safety to various end users was arrived at based on the secondary data available through paid and unpaid sources and by analyzing the product portfolios of major companies in the ecosystem and rating the companies based on their performance and quality. In the secondary research process, various sources were referred to identify and collect information for the study. The secondary sources included annual reports, best practices, international organization websites and resources (UN-Habitat, Zero Waste Europe, Global Carbon Project, Emissions Database for Global Atmospheric Research (EDGAR), International Energy Agency (IEA), United Nations Framework Convention on Climate Change (UNFCC), Union of Concerned Scientists, U.S. Green Building Council, and Environmental Protection Agency), press releases and investor presentations of companies, white papers, journals, and certified publications and articles from recognized authors, directories, and databases.

Secondary research was used to obtain critical information about the industry’s supply chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from market- and technology-oriented perspectives, all of which were further validated by primary sources.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the environment, health, and safety market.

Primary interviews were conducted to gather insights, such as market statistics, data on revenue collected from software and services, market breakups, market size estimations, market forecasts, and data triangulation. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Finance Officers (CFOs), Chief Strategy Officers (CSOs), and the installation team of end users who use environment, health, and safety, were interviewed to understand buyers’ perspectives on suppliers, products, service providers, and their current usage of environment, health, and safety solution and services, which is expected to affect the overall environment, health, and safety market growth.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, the top-down and bottom-up approaches were used along with multiple data triangulation methods to estimate and validate the size of the environment, health, and safety market, as well as other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Initially, MarketsandMarkets focuses on top-line investments and spending in the ecosystems. Further, significant developments in the critical market area have been considered.

- Tracking the recent and upcoming developments in the environment, health, and safety market that include investments, R&D activities, product launches, collaborations, mergers and acquisitions, and partnerships, as well as forecasting the market size based on these developments and other critical parameters.

- Conduct multiple discussions with key opinion leaders to learn about the diverse types of authentications and brand protection offerings used and the applications for which they are used to analyze the breakdown of the scope of work carried out by major companies.

- Segmenting the market based on technology types concerning applications wherein the types are to be used and deriving the size of the global application market.

- Segmenting the overall market into various market segments

- Validating the estimates at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts at MarketsandMarkets

Market Size Estimation Methodology-Bottom-up approach

To know about the assumptions considered for the study, Request for Free Sample Report

Market Size Estimation Methodology-top-down approach

Data Triangulation

After arriving at the overall market size from the above estimation process, the environment, health, and safety market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments, data triangulation and market breakdown procedures have been used, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides.

The environment, health, and safety market size has been validated using top-down and bottom-up approaches.

Market Definition

An EHS system streamlines EHS management by automating safety program management and simplifying government regulatory compliance. It prioritizes greater user engagement and collaboration to reduce operational risks and improve health and safety performance while achieving corporate sustainability goals. The EHS market includes software and services that aim to reduce environmental pollution (including air, water, and soil) and protect workers' health, thereby improving ergonomics and confirming a risk-free workplace. This EHS software has various features, such as environment and sustainability management, waste management, health and safety management, industrial hygiene management, energy and water management, incident and risk management, and air quality and compliance management.

Stakeholders

- EHS Software Providers

- EHS Service Providers

- System Integrators

- Consultancy and Advisory Firms

- Certification and Training Firms

- Regulatory Agencies

- Governments

- Chief Technology And Data Officers

- Workplace Safety Service Professionals

- Business Analysts

- Information Technology (IT) Professionals

- Investors and Venture Capitalists

- Third-party Providers

- Managed And Professional Service Providers

Report Objectives

- To determine and forecast the global environment, health, and safety market by offering (software and services), application, vertical, and region from 2024 to 2029, and analyze the various macroeconomic and microeconomic factors affecting market growth.

- To forecast the size of the market segments concerning five central regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America.

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market.

- Analyze each submarket concerning individual growth trends, prospects, and contributions to the overall market.

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the environment, health, and safety market.

- To profile the key market players; provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the market’s competitive landscape.

- Track and analyze competitive developments in the market, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities.

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further break-up of the Asia Pacific market into countries contributing 75% to the regional market size

- Further break-up of the North American market into countries contributing 75% to the regional market size

- Further break-up of the Latin American market into countries contributing 75% to the regional market size

- Further break-up of the Middle East African market into countries contributing 75% to the regional market size

- Further break-up of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Environment, Health, and Safety Market

Interested in HSE market in UAE

Interested in industry overview and market analysis in SHEQ for global and South African Market

Interested in market eatimation of EHS for US market.

Interested in market segmentation of EHS solution.