Exosome Research Market by Product & Service (Kits, Reagents (Antibodies, Isolation Purification), Instruments), Indication (Cancer, Infectious Diseases), Application (Biomarkers, Vaccines), Manufacturing Services (Stem cell) - Global Forecast to 2028

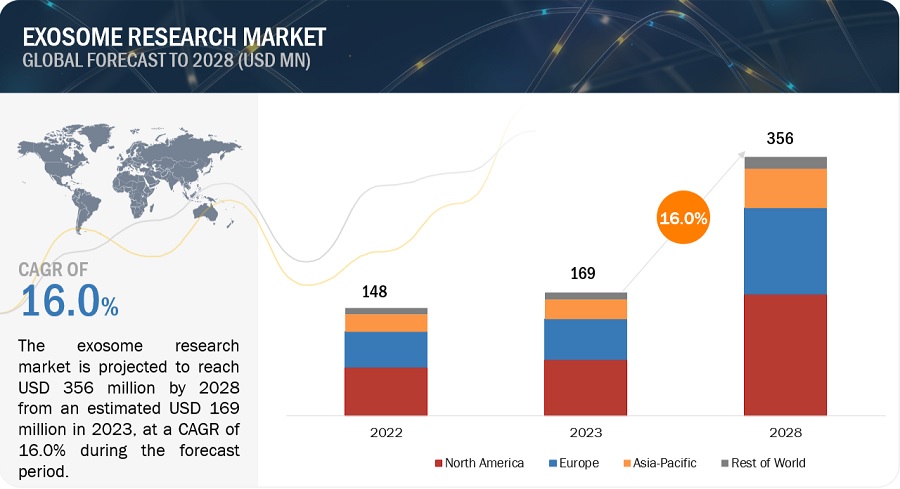

The global exosome research market in terms of revenue was estimated to be worth $169 million in 2023 and is poised to reach $356 million by 2028, growing at a CAGR of 16.0% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The growth of the market is largely driven by the growing investments in biomedical research, both from the public and private sectors, which provide substantial financial support for exosome-related studies. Research grants, collaborations, and funding initiatives further propel advancements in understanding exosome functions and applications.

Exosome Research Market- Global Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Attractive Opportunities In The Exosome Research Market

Global Exosome Research Market Dynamics

DRIVER: Rising cancer prevalence

As the prevalence of cancer diseases continues to rise, there is a growing demand for innovative therapies to address them. This surge in demand has put exosome based technologies at the forefront of cancer research and treatment. The concept of liquid biopsy, which involves analyzing biomarkers in bodily fluids such as blood, urine, or saliva, is gaining prominence in cancer diagnostics. Exosomes, being stable carriers of molecular information, are ideal candidates for liquid biopsy approaches. Researchers are exploring the use of exosomal biomarkers for monitoring disease progression, treatment response, and detecting minimal residual disease.

RESTRAINT: Technical complexity of exosome isolation and technological limitations

Exosomes exhibit heterogeneity in terms of size, composition, and cargo. The technical challenge lies in isolating exosomes with high purity and specificity, distinguishing them from other extracellular vesicles and contaminants present in biological samples. The lack of standardized isolation methods can lead to variability in experimental outcomes and hinder comparability between studies. Further, the isolation of exosomes from biological samples can be technically demanding due to the presence of other extracellular vesicles and contaminants. Achieving pure and high-yield exosome isolation requires sophisticated techniques, and variations in isolation methods can affect the quality and consistency of obtained exosome samples.

OPPORTUNITY: Increasing demand for personalized medicine

The rising demand for precision medicine presents a significant opportunity for exosome research due to the unique characteristics of exosomes and their potential applications in tailoring medical treatments to individual patients. Exosomes are implicated in the development of drug resistance in various diseases. Studying the content and function of exosomes shed by resistant cells can contribute to the identification of mechanisms underlying resistance. This information is crucial for devising personalized treatment strategies that overcome or circumvent resistance.

CHALLENGE: Limited understanding of cargo loading

The limited understanding of cargo loading into exosomes is a notable challenge in exosome research. The cargo loading process involves the selective packaging of specific biomolecules, such as proteins, nucleic acids, and lipids, into exosomes. The mechanisms that govern the selective loading of cargo into exosomes are not fully understood. It is unclear how certain molecules are preferentially sorted and enriched within exosomes, while others are excluded. Elucidating the selective packaging mechanisms is crucial for manipulating cargo content and optimizing exosomes for therapeutic applications. Strategies to engineer exosomes for specific cargo loading profiles require a deeper understanding of the underlying biological mechanisms.

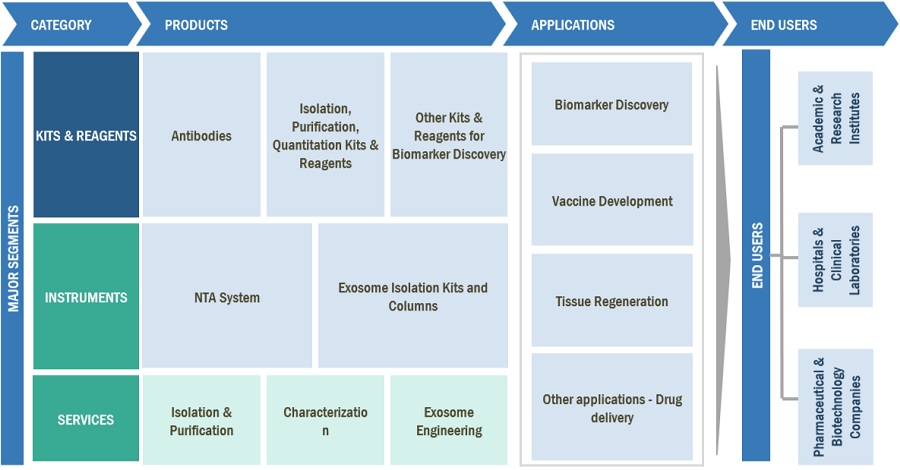

Global Exosome Research Market Ecosystem Analysis

The ecosystem of exosome research consists of end users from pharmaceutical & biotechnology companies, academic & research institutes, and hospital & clinical laboratories. Exosome research product and service providers, reagent & kits suppliers, technology providers, data management & analysis providers, regulatory authorities (ensuring compliance and safety), and collaborative networks promoting knowledge sharing and collaboration. These stakeholders interact and collaborate to drive the advancement of base editing products and services, enhance drug discovery processes, and develop new therapeutics.

Note: this report also provides market sizing and forecast for Exosomes Manufacturing services for end products as an additional separate chapter at global level.

Reagents & Kits held a dominant share in the product & service segment in the exosome research industry.

By products & services, the exosome research market has been categorized in reagents & kits, instruments, and services. The kits and reagents segment is further categorized as antibodies, isolation, purification, quantitation kits & reagents, and other kits & reagents. In 2022, reagents & kits accounted for the largest share of the market. Kits and reagents are designed to be scalable, accommodating varying sample sizes and experimental needs. This scalability makes them suitable for both small-scale studies in academic research and large-scale applications in pharmaceutical and biotechnology industries.

The academic & research institute segment of exosome research industry is expected to register the fastest growth during the forecast period.

Based on the end user, the exosome research market has been segmented into academic & research institutes, pharmaceutical & biotechnology companies, and hospitals & clinical testing laboratories. In 2022, academic & research institutes accounted for the largest share. This can be attributed to the fact that exosomes hold immense potential in diagnostics and therapeutics, including drug delivery and regenerative medicine. The enthusiasm surrounding these potential applications has fueled increased research efforts within academic and research institutions. Researchers are exploring exosomes as biomarkers for various diseases and as vehicles for targeted drug delivery, leading to a surge in research initiatives.

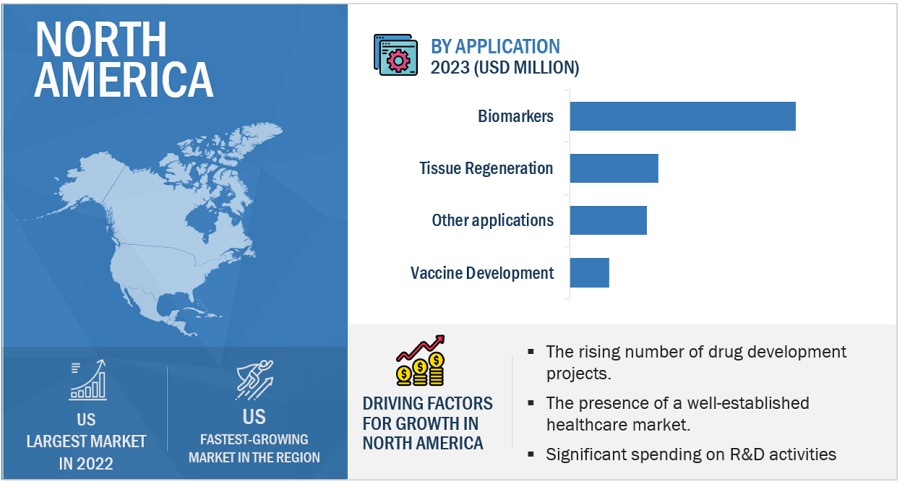

North America accounted for the largest share in Exosome research industry in 2022.

To know about the assumptions considered for the study, download the pdf brochure

Geographically, the exosome research market is segmented into North America, Europe, Asia Pacific, and Rest of World. North America held the dominant share followed by Europe. North America has a well-established infrastructure for funding research and development initiatives, providing financial support to companies working on exosome research. Moreover, the regulatory environment in North America is often supportive of innovation in the life sciences sector.

Key players in the global Exosome research market include Thermo Fisher Scientific, Inc. (US), Bio-Techne (US), System Biosciences, LLC (US), QIAGEN (Germany), Lonza (Switzerland), NX Pharmagen (US), NanoSomiX (US), Miltenyi Biotech (Germany), Norgen Biotek Corp. (Canada), AMSBio (UK), Aethlon Medical, Inc. (US), Anjarium Biosciences AG (UK), Ciloa (France), InnovaPrep LLC (US), Creative Medical Technologies Holdings, Inc. (US), ILIAS Biologics, Inc. (South Korea), Unchained Labs (US), Rion, Inc. (US), Cell Guidance System, LLC (UK), INOVIQ (Australia), Danaher Corporation (US), Exopharm (Australia), Everzom (France), RoosterBio, Inc. (US), and Creative Biolabs (US).

Scope of the Exosome Research Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$169 million |

|

Projected Revenue by 2028 |

$356 million |

|

Revenue Rate |

Poised to Grow at a CAGR of 16.0% |

|

Market Driver |

Rising cancer prevalence |

|

Market Opportunity |

Increasing demand for personalized medicine |

This report categorizes the exosome research market to forecast revenue and analyze trends in each of the following submarkets:

By Product & Service

-

Kits & Reagents

- Antibodies

- Isolation, Purification, Quantitation Kits, and reagents

- Other kits & reagents

- Instruments

- Services

By Indication

-

Cancer Indication

- Lung Cancer

- Breast Cancer

- Prostate Cancer

- Colorectal Cancer

- Other Cancers

- Neurodegenerative Diseases

- Cardiovascular Diseases

- Infectious Diseases

- Other Diseases

By Application

- Biomarkers

- Vaccine Development

- Tissue Regeneration

- Other applications

By Manufacturing Service

- Stem cell-derived exosome manufacturing services

- Dendritic cell-derived exosome manufacturing services

- Other manufacturing services

By End User

- Academic & Research Institutes

- Pharmaceutical & Biotechnology Companies

- Hospitals & Clinical Laboratories

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Rest of Europe (RoE)

-

Asia Pacific (APAC)

- Japan

- China

- Rest of Asia Pacific (RoAPAC)

- Rest of World

Recent Developments of Exosome Research Industry

- In February 2022, Bio-Techne entered an exclusive agreement with Thermo Fisher Scientific to develop and commercialize the ExoTRU kidney transplant rejection test designed by Bio-Techne. This liquid biopsy test offers allograft health information suitable for clinical and research applications.

- In November 2020, Lonza acquired an exosome manufacturing facility from Codiak BioSciences. The latter retained its pipeline of therapeutic candidates and exosome drug-loading technologies while receiving manufacturing services from Lonza.

- In September 2020, The entities extended their non-exclusive partnership to co-market exosome technology. Their existing customers include biopharma partners and the joint development of new exosome-based products. This granted QIAGEN a non-exclusive development license to exosome technology (manufactured by Bio-Techne) to develop companion in vitro diagnostic products (CDX-IVD).

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global exosome research market?

The global exosome research market boasts a total revenue value of $356 million by 2028.

What is the estimated growth rate (CAGR) of the global exosome research market?

The global exosome research market has an estimated compound annual growth rate (CAGR) of 16.0% and a revenue size in the region of $169 million in 2023. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

12 COMPETITIVE LANDSCAPE (Page No. - 182)

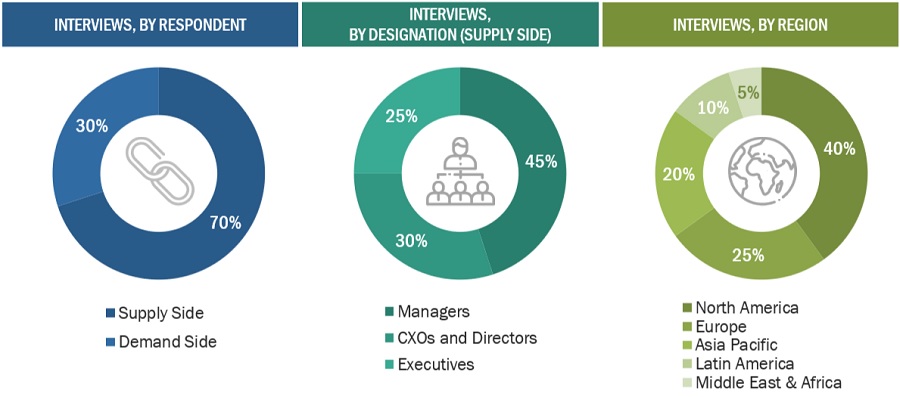

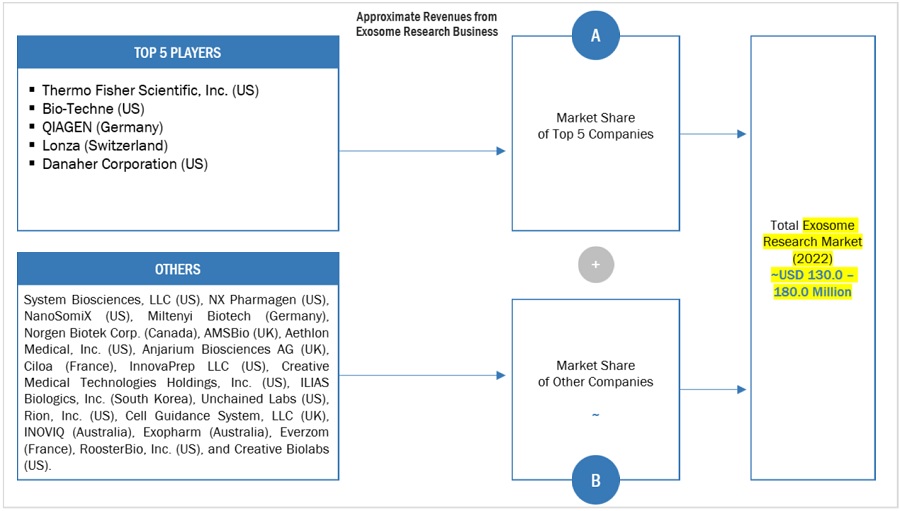

This research study involved the extensive use of secondary sources, directories, and databases to identify and collect valuable information for the analysis of the global exosome research market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the growth prospects of the market. The global market size estimated through secondary research was then triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the Exosome research market. The secondary sources used for this study include the Food and Drug Administration (FDA), Centers for Disease Control and Prevention (CDC), International Society for Extracellular Vesicles (ISEV), and UK Regenerative Medicine Platform (UKRMP), National Human Genome Research Institute (NHGRI), Asia Pacific Society of Human Genetics (APSHG), Genetics Society of America (GSA), European Society of Human Genetics (ESHG), Centers for Common Disease Genomics (CDDG), Center for Cellular and Molecular Biology (CCMB) (India). The Scientist Magazine, ScienceDirect, research journals; corporate filings such as annual reports, SEC filings, investor presentations, and financial statements; press releases; trade, business, professional associations, and others. These sources were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

Extensive primary research was conducted after acquiring basic knowledge about the global exosome research market scenario through secondary research. Several primary interviews were conducted with market experts from the demand side, such as pharmaceutical and biopharmaceutical companies, CROs, and academic & research institutes, and experts from the supply side, such as C-level and D-level executives, product managers, marketing & sales managers of key manufacturers, distributors, and channel partners. These interviews were conducted across five major regions, including the Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa. Approximately 70% and 30% of the primary interviews were conducted with supply-side and demand-side participants, respectively. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

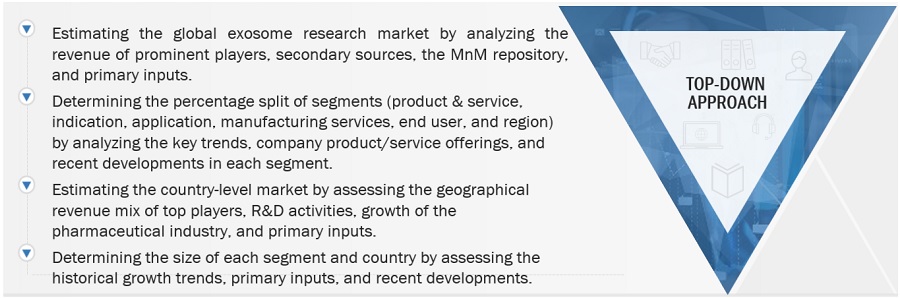

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the exosome research market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Bottom-up Approach

- The key players in the industry and market have been identified through extensive secondary research.

- The revenues generated from the exosome related business of leading players have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, Request for Free Sample Report

Top-down Approach

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments.

Data Triangulation

To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

In the process of data triangulation, we employed a multifaceted approach, incorporating primary data collection methods, analysis of the MarketsandMarkets (MnM) repository, and a comprehensive examination of company shares. By integrating insights from these diverse sources, we derived a meticulously validated and reliable estimate for the final market size.

Market Definition

Exosomes are biomembrane-like vesicles containing protein, miRNA, and lipids that can be delivered to the extracellular milieu (ECM). Exosomes are naturally produced within the body and could be utilized in cell-to-cell communication, molecular therapy for cancer treatment, and diagnosis of skeletal disorders. They have several advantages in cell-based treatment, which has brought attention to R&D in this field.

Stakeholders

- Exosome research product manufacturers/contract research organizations (CROs)

- Pharmaceutical and biopharmaceutical companies

- Academic and research institutes

- Venture capitalists and investors

- Market research and consulting firms

- Government associations

- Medical institutions and universities

Report Objectives

- To define, describe, segment, and forecast the exosome research market by product & service, indication, application, manufacturing service, end-user, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze micro markets with respect to individual growth trends, prospects, and contributions to the overall exosome research market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the exosome research market in five main regions: North America, Europe, Asia Pacific, Rest of the World, along with their respective key countries

- To profile the key players in the exosome research market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments, such as product & service launches, acquisitions, expansions, collaborations, agreements, and partnerships of the leading players in the exosome research market

- To benchmark players within the exosome research market using the ‘Competitive Leadership Mapping’ framework, which analyzes market players based on various parameters within the broad categories of business and product strategy

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Portfolio Assessment

- Product Matrix, which gives a detailed comparison of the product portfolios of the top three companies.

Company Information

- Detailed analysis and profiling of additional market players (up to three).

Geographical Analysis

- A further breakdown of the Rest of the Asia Pacific exosome research market into other Rest of Asian countries

- A further breakdown of the Rest of European exosome research market into other Rest of European countries

- A further breakdown of the Rest of World exosome research market into other Rest of World countries

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Exosome Research Market