Fats and Oils Market by Type (Vegetable Oils (Palm, Soybean, Rapeseed, Sunflower, and Olive), Fats (Butter, Tallow, and Lard)), Application (Food and Industrial), Source (Vegetables and Animals), Form, and Region - Global Forecast to 2026

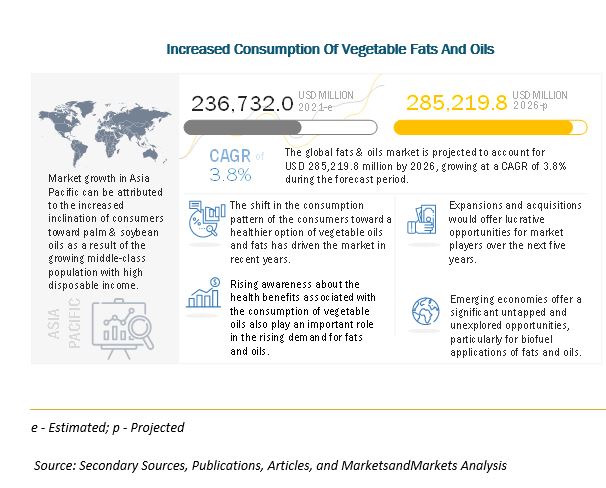

The fats and oils market size is projected to reach USD 285.22 billion by 2026, recording a CAGR of 3.8% during the forecast period. The global market was estimated to be valued at USD 236.7 billion in 2021. It Fats and oils are simple or mixed glyceryl esters of various organic acids, which belong to the fatty acid series; they are derived from plant or animal sources. Primary sources of fats and oils include plant sources, such as soybean, palm, rapeseed, olive oil, and sunflower oil; animal sources include butter & margarine, tallow, and lard. Apart from food uses, vegetable fats and oils are also increasingly used for industrial applications, such as soaps, detergents, paints, oleochemicals, the major one of them being biodiesel.

The fats and oils market has been growing steadily in developed countries and emerging countries, such as the US, Brazil, China, India, and Indonesia. Among vegetable oils, palm oil remained the most popular with around 30% of the market share. Animal fats find major applications in pet food, animal feed, and other industrial purposes such as biodiesel and oleochemicals. Oils of plant origin have been predominantly used for food-based applications. The fats & oils market, by form, is estimated to be dominated by the liquid segment in 2021.

To know about the assumptions considered for the study, Request for Free Sample Report

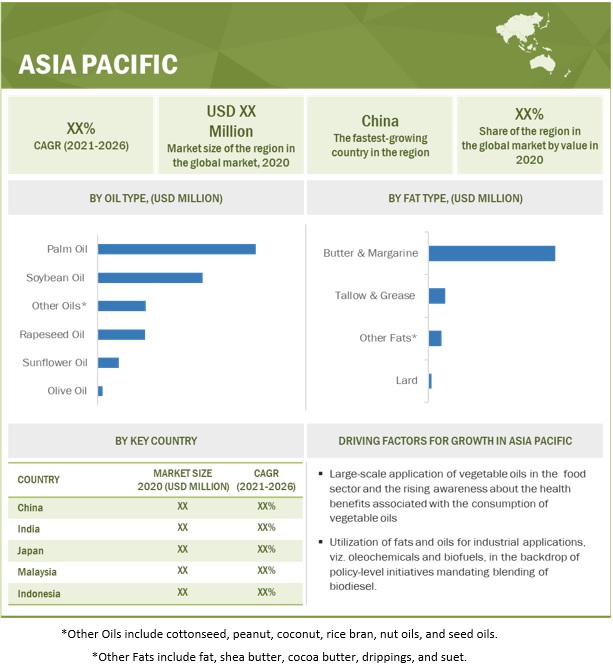

The growth of this market is attributed to the increased awareness about healthier substitutes to trans-fat, demand for a more nutritious and balanced diet among consumers, and sustainable food and energy systems. The large consumption base in Asia Pacific, i.e., robust processed foods and industrial applications for fats and oils, makes it the fastest-growing region during the forecast period. Asia pacific fats & oils market is majorly driven by China and India, owing to the shift in consumption patterns and the high imports of vegetable oils and fats.

Major consumers of fats and oils, which including households, hotels, restaurants, café, were greatly affected by COVID-19. During the lockdowns, the consumption pattern shifted from ordering to self-cooking. The lockdowns also impacted the households as the retail chains were disrupted and the supermarkets were closed. From the supply side, oilseed plantations, oilseed crushers, and other stakeholders were affected due to the trade barriers across the globe. Major oil-producing countries, such as Malaysia, Indonesia, the US, and Brazil, faced disruption in the supply chain as the exports declined drastically and domestic distribution was adversely affected.

Key insights & trends:

Biodiesel is an alternative to diesel fuel from fossil fuel energy sources. It has an advantage over diesel fuel as it does not run out and continues to grow in the fields. Rapeseeds, soybeans, the fruit of oil palms, and even old edible fats are ideal for biodiesel production. It is a non-toxic, biodegradable, and renewable fuel produced from a range of renewable raw materials, such as fresh or waste vegetable oils, animal fats, and oilseed plants. Environmental compatibility of land use, a verifiable saving of greenhouse emissions, and coexistence with food production are the main standards of sustainability maintained in biodiesel production. Hence, biodiesel and edible vegetable oils are produced with less harmful impact on the environment. Also, the rising costs of diesel fuel and continuous climatic changes due to the emission of greenhouse gases drive the market for the production and usage of biodiesel.

Owing to the increased health consciousness among consumers, trans-fats are gradually replaced by a much healthier substitute, namely unsaturated liquid vegetable oils, such as olive, canola, corn, or soy oils. The global market has been witnessing the trend of encapsulation. Several key manufacturers are now strategizing on encapsulating milk fat and vegetable oils in a matrix comprising whey proteins and mixtures of caseins and whey proteins. These fat-rich powders find applications in various food formulations as well as in nutritional supplements and pharmaceutical products. In the global fats and oils market, premium oil types, such as olive and sunflower, witness higher prices owing to their raw materials costing, superior-label claims, and value-added nutritional profiles. Western markets of Europe and North America remain the target for such premium categories of oils and fats, thereby witnessing comparatively higher prices than the global average. Thus, the factor is driving the market value for fats and oils in the global markets.

Fats and Oils Market Dynamics

Driver: Increasing demand for food boosting global consumption of vegetable oils

Edible oil products such as palm oil, sunflower oil, soybean oil, canola oil, among others, generally undergo purification through various methods, such as degumming, neutralizing, bleaching, and deodorizing, to produce uniformity in high-quality oil. In the purification process, minor components are either physically or chemically separated as they are considered impurities. The high-quality edible oils are mostly referred to as refined oils. Refined oils are high in monounsaturated fats.

High-quality oils are made using advanced technologies and are considered a rich source of nutrition. Hence, their consumption is increasing every year due to its increasing application and the growing population. However, the demand for high-quality oils is growing as consumers are opting for healthier alternatives to maintain the taste while enhancing the nutritional value. To meet this demand, manufacturers are improvising on processing technologies and also enhancing their product portfolios. ADM (U.S.), along with Novozymes (Denmark), developed a technology that revolutionized the fats & oils industry. This technology helped the company in manufacturing high-quality edible oils by utilizing enzymes in the developing process.

Restraint: Labelling of fat & oil products and the safety issues

Significant changes in the competitive position of important vegetable oils imply severe cost impacts and potential threats to some of the food products. Within this environment, the vegetable oil market in the world, especially the US, is under pressure because of various legislations. Also, there is a high degree of anonymity of the exact content in the food ingredients due to the use of ambiguous terms such as ‘vegetable fats’ or ‘vegetable oils.’ As a result, the exact composition of the ingredient and its role in the overall formulation is not identified.

New requirements to label trans-fatty acid levels in foods are creating pressure to shift to other formulations for producing hydrogenated oils, thereby increasing the demand for oils as an alternative to trans-fats. In the US, the standard for a product labelled as "vegetable oil margarine" specifies that only canola, safflower, sunflower, corn, soybean, or peanut oil may be used. Products not labelled as "vegetable oil margarine" do not have that sort of restraints. With the implementation of new legislation, consumers will be more informed about the inherent risks in foods containing trans-fats, and this would force them to look for suitable alternatives.

Opportunity: Emerging application of fats and oils as substitutes of trans-fats

Trans-fats are unsaturated fatty acids formed during the hydrogenation of vegetable oils or are found in animal products naturally produced in the gut of grazing animals. Consumption of trans-fat raises the level of low-density lipoprotein cholesterol in the blood. An elevated LDL blood cholesterol level can increase the risk of developing cardiovascular. Trans-fats are found in many food products, such as vegetable shortenings, stick margarine, refrigerated dough products (such as biscuits and cinnamon rolls), snack foods, coffee creamers, cookies, cakes, frozen pies, frozen pizza, and fast food.

Owing to the increased health consciousness among consumers, trans-fats are gradually replaced by a much healthier substitute, namely unsaturated liquid vegetable oils, such as olive, canola, corn, or soy oils.

Challenge: High dependence on imports, leading to high costs of end-products

There is a significant gap between the demand and supply of oilseed processed products, such as edible oil, owing to the limited availability of oilseeds in some domestic markets. For instance, India and European countries import palm oil on a large scale from Indonesia and Malaysia, which are the leading producers, owing to the favorable climatic conditions of these countries. Palm oil is widely used in the confectionery products sector, which experiences high demand in India and other European countries.

Similarly, the European personal care product manufacturers depend on high-cost imports of shea butter from South Africa, which accounts for a significant share of its production. Due to the high dependence of these countries on imports of palm oil and shea butter, respectively, their import cost as well as the cost of the end products increases, which serves as a challenge for the market.

To know about the assumptions considered for the study, download the pdf brochure

On the basis of type, the vegetable oil is projected to be the largest segment during the forecast period

The health benefits, easy availability, and cost-effectiveness are some of the factors that has driven the market for fats & oils. Within vegetable oils, the palm oil segment has dominated the market, as it is easily available and is relatively more stable than other oils.

On the basis of source, vegetable segment is expected to retain its dominance in the foreseeable period

Vegetable oils from sunflower, rapeseed, soybean, palm, cottonseed, and coconut are highly used in food applications which has driven the market for vegetable-sourced oils. The qualities associated with vegetable oils such as low-fat, low-cholesterol, and low-calories content are registering growth in the segment. Also, the variety of use of vegetable oils in food as well as other industries such as pleo-chemical industries, animal feed, and energy & biomass industry has also driven the market for vegetable oils.

On the basis of form, liquid oils are projected to witness the highest growth in the market

The liquid form of fats & oils is forecasted to dominate the market. However, the physical characteristics of fats and oils depends upon a lot of factors such as degree of unsaturation, the length of the parent carbon chain, the isomeric forms of the fatty acids, molecular configuration, and processing variables, but it is believed that the liquid oils are more unsaturated and are hence more preferred by the consumers.

Asia Pacific is projected to be the fastest-growing region in the fats and oils market.

The Asia Pacific region is projected to be the fastest-growing market for fats & oils. The region is home to two important palm and palm kernel oil-producing countries namely Malaysia, and Indonesia: and two major fats & oils consuming countries namely China, and India. This is one of the significant factor which ensures that Asia pacific region is the largest as well as the fastest-growing market in fats & oils.

Key Market Players

Key global market players offer wide range of fats & oils products in the retail chain. While prominent palm oil producing companies are present in Asia pacific region. The soybean oil producing companies capture the North American market. The key companies in the fats and oils market are Associated British Foods PLC (UK), Archer Daniels Midland Company (US), Bunge Limited (US), Wilmar International Limited (Singapore). Various strategies, such as expansions, mergers & acquisitions, and new product launches, were adopted by the key companies to remain competitive in the fats and oils market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size value in 2021 |

USD 236.7 billion |

|

Revenue forecast in 2026 |

USD 285.22 billion |

|

Growth Rate |

3.8 % |

|

Currency and Unit |

USD |

|

Research Duration Considered |

2017-2026 |

|

Historical Base Year |

2020 |

|

Segmentation |

|

|

Growing Market Geographies |

|

|

Dominant Geography |

Asia Pacific |

|

Key companies profiled |

|

This research report categorizes the fats and oils market based on type, application, form, source and region.

On the basis of type, the fats and oils market has been segmented as follows:

- Vegetable Oils

- Palm oil

- Soybean oil

- Sunflower oil

- Rapeseed oil

- Olive oil

- Other oils*

- Fats

- Butter & margarine

- Lard

- Tallow & grease

- Other fats**

On the basis of application, the fats and oils market has been segmented as follows:

- Food applications

- Bakery & confectionary

- Bakery

- Confectionery

- Processed food

- Snacks & savory

- R.T.E foods/Convenience foods

- Sauces, spreads, and dressings

- Other foods (incl. meat products)

- Industrial applications

- Biodiesel

- Other industrial applications

- Oleochemicals

- Animal feed

On the basis of form, the fats and oils market has been segmented as follows:

- Liquid

- Solid

On the basis of source, the fats and oils market has been segmented as follows:

- Vegetables

- Animals

On the basis of region, the fats and oils market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- South America

- Rest of World (RoW)***

* Other oils majorly include cottonseed, peanut, coconut, rice bran, nut oils, and seed oils.

**Other fats include fat, shea butter, cocoa butter, drippings, and suet.

***Rest of the World (RoW) includes Middle East and Africa.

Recent Developments

- In June 2021, Cargill laid out plans to build a new USD 200 million palm oil refinery in Indonesia to accelerate its efforts to develop a sustainable palm supply chain and provide verified deforestation-free products to customers.

- In May 2021, ADM planned to build its first-ever dedicated soybean crushing and refinery in the US to meet the fast-growing demand from food, feed, industrial and biofuel customers, including producers of renewable diesel.

- In December 2018, Richardson International acquired Wesson Oil brand of Conagra Food Inc. which is an iconic edible oil brand in the US. The product offering includes vegetable oils, canola oils, corn, and blended oils which would help Richardson establish a strong foothold in the North American market.

Frequently Asked Questions (FAQ):

What are fats and oils?

Fats and oils are essential components of our diet that provide energy and vital nutrients. They can be derived from animal or plant sources.

What is the current size of the global fats and oils market?

The global fats and oils market size is estimated to be valued at USD 229.4 billion in 2020. It is projected to reach USD 285.2 billion by 2026, recording a CAGR of 3.8% by 2026

Which are the key players in the fats and oils market?

The key market players include Associated British Foods PLC (UK), Archer Daniels Midland Company (US), Bunge Limited (US), Wilmar International Limited (Singapore), United Plantations Berhad (Malaysia), Unilever PLC (UK), Ajinomoto Co., Inc. (Japan), Mewah International Inc. (Singapore), Cargill, Incorporated (US), Richardson International Limited (Canada), International Foodstuff Company (UAE), Goodhope Asia Holdings Ltd. (Singapore), Vega Foods (Singapore), Welch, Holme & Clark Co., Inc. (US), Oleo Fats (Philippines), CSM Ingredients (US), AAK International (UK), Fuji Oil Co., Ltd. (Japan), Gemini Edible & Fats India Pvt Ltd. (India), and K S Oils (Singapore).

What are the trends in the fats and oils market?

The market is witnessing a growing demand for plant-based oils, low-fat and trans-fat-free products, and specialty fats and oils, such as omega-3 and medium-chain triglycerides.

What are the growth opportunities in the market?

The growing demand for organic and sustainable products presents opportunities for the market. The market for specialty fats and oils, such as omega-3 and medium-chain triglycerides, is also expected to grow.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SEGMENTATION

1.3.1 INCLUSIONS AND EXCLUSIONS

1.3.2 REGIONS COVERED

1.3.3 PERIODIZATION CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 US DOLLAR EXCHANGE RATES CONSIDERED, 2017–2020

1.5 VOLUME UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN: FATS & OILS MARKET

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

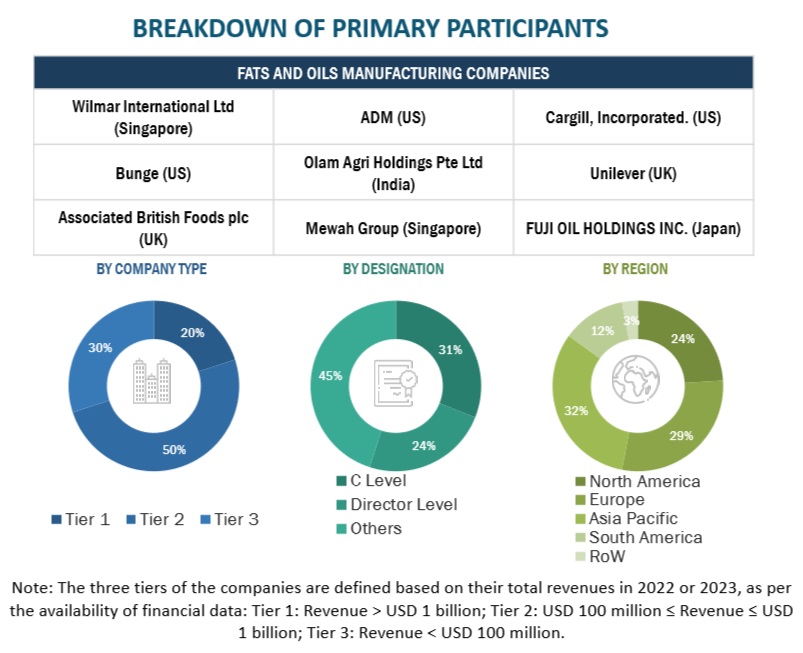

FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

2.2.1 SUPPLY-SIDE AND DEMAND-SIDE ASPECTS OF MARKET SIZING

2.2.2 BOTTOM-UP APPROACH

2.2.3 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH ASSUMPTIONS & LIMITATIONS

2.4.1 ASSUMPTIONS

TABLE 2 ASSUMPTIONS OF THE STUDY

2.5 RESEARCH LIMITATIONS & ASSOCIATED RISKS

2.6 MARKET SCENARIOS CONSIDERED FOR THE IMPACT OF COVID-19

2.6.1 SCENARIO-BASED MODELLING

2.7 COVID-19 HEALTH ASSESSMENT

FIGURE 4 COVID-19: GLOBAL PROPAGATION

FIGURE 5 COVID-19 PROPAGATION: SELECT COUNTRIES

2.8 COVID-19 ECONOMIC ASSESSMENT

FIGURE 6 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.8.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 7 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 8 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 52)

TABLE 3 FATS & OILS MARKET SNAPSHOT (VALUE), 2021 VS. 2026

FIGURE 9 IMPACT OF COVID-19 ON THE FATS & OILS MARKET SIZE, BY SCENARIO, 2020 VS. 2021 (USD MILLION)

FIGURE 10 VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 11 FATS & OILS MARKET, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

FIGURE 12 FATS & OILS MARKET, BY FORM, 2021 VS. 2026 (USD MILLION)

FIGURE 13 FATS & OILS MARKET, BY SOURCE, 2021 VS. 2026 (USD MILLION)

FIGURE 14 FATS & OILS MARKET SHARE (VALUE), BY REGION, 2020

4 PREMIUM INSIGHTS (Page No. - 59)

4.1 ATTRACTIVE OPPORTUNITIES IN THE FATS & OILS MARKET

FIGURE 15 INCREASED CONSUMPTION OF VEGETABLE FATS AND OILS

4.2 FAST & OILS MARKET: MAJOR REGIONAL SUBMARKETS

FIGURE 16 CHINA PROJECTED TO BE THE FASTEST-GROWING MARKET FOR FATS & OILS DURING THE FORECAST PERIOD

4.3 ASIA PACIFIC: FATS & OILS MARKET, BY KEY SOURCE & COUNTRY

FIGURE 18 CHINA ACCOUNTED FOR THE LARGEST SHARE IN THE ASIA PACIFIC MARKET IN 2020

4.4 FATS & OILS MARKET, BY APPLICATION

FIGURE 20 FOOD APPLICATIONS TO DOMINATE THE FATS & OILS MARKET DURING THE FORECAST PERIOD

4.5 FATS & OILS MARKET, BY FORM

FIGURE 21 LIQUID FORM SEGMENT PROJECTED TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.6 VEGETABLE OILS MARKET, BY OIL TYPE

FIGURE 22 PALM OIL MARKET PROJECTED TO DOMINATE THE FATS & OILS MARKET DURING THE FORECAST PERIOD

4.7 FATS MARKET, BY TYPE

FIGURE 23 BUTTER & MARGARINE MARKET PROJECTED TO DOMINATE DURING THE FORECAST PERIOD

FIGURE 24 COVID-19 IMPACT ON THE FATS & OILS MARKET: COMPARISON OF PRE-AND POST-COVID-19 SCENARIOS

5 MARKET OVERVIEW (Page No. - 65)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 25 FATS & OILS MARKET: MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing demand for food boosting global consumption of vegetable oils

FIGURE 26 VEGETABLE OIL CONSUMPTION ACROSS THE WORLD, FROM 2013-14 TO 2020-21

5.2.1.2 Increased consumption of bakery & confectionery and processed food products

5.2.1.3 Growing demand for biodiesel

FIGURE 27 US BIODIESEL CONSUMPTION, 2001-2019 (BILLION GALLONS)

5.2.2 RESTRAINTS

5.2.2.1 Labeling of fat & oil products and the safety issues

5.2.3 OPPORTUNITIES

5.2.3.1 Emerging application of fats and oils as substitutes of trans-fats

5.2.3.2 Growth in microencapsulation of fats and oils

5.2.4 CHALLENGES

5.2.4.1 High capital investments in extraction

5.2.4.2 High dependence on imports, leading to high costs of end-products

5.3 IMPACT OF COVID-19 ON MARKET DYNAMICS

5.3.1 COVID-19 NEGATIVELY IMPACTING THE SUPPLY CHAIN DYNAMICS OF THE FATS & OILS MARKET

6 INDUSTRY TRENDS (Page No. - 70)

6.1 INTRODUCTION

6.2 VALUE CHAIN ANALYSIS

FIGURE 28 FATS & OILS: VALUE CHAIN ANALYSIS

6.3 PRICING ANALYSIS: FATS & OILS MARKET, BY TYPE

FIGURE 29 FATS & OILS: PRICING ANALYSIS, BY REGION, 2017-2020 (USD/TON OF FATS/OILS)

6.4 ECOSYSTEM MAP

6.4.1 FATS & OILS MARKET: ECOSYSTEM VIEW

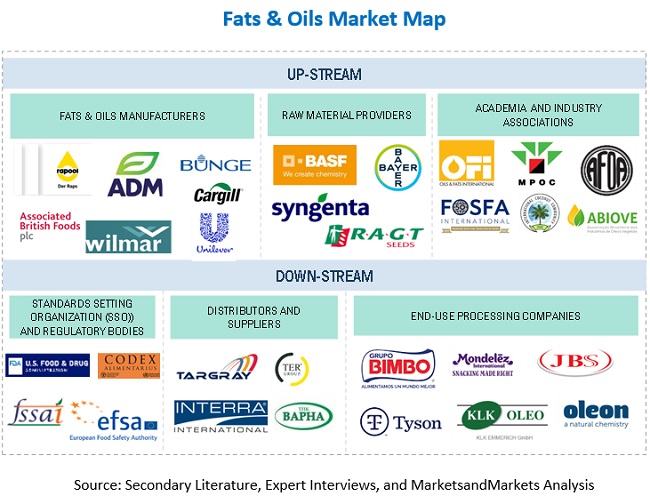

6.4.2 FATS & OILS MARKET: MARKET MAP

6.4.2.1 Upstream

6.4.2.1.1 Fat and oil manufacturers

6.4.2.1.2 Raw material providers

6.4.2.1.3 Academia and industry associations

6.4.2.1.4 Downstream companies

6.4.2.1.5 Regulatory bodies and standard-setting organizations

6.4.2.1.6 Distributors and suppliers

6.4.2.1.7 End-use processing companies

6.5 YC-YCC SHIFT

FIGURE 30 REVENUE SHIFT FOR THE FATS & OILS MARKET

6.6 PATENT ANALYSIS

FIGURE 31 NUMBER OF PATENTS GRANTED FOR FATS AND OILS IN A YEAR OVER THE LAST TEN YEARS (2010-2020)

TABLE 4 KEY PATENTS PERTAINING TO FATS AND OILS, 2020

FIGURE 32 NUMBER OF PATENTS GRANTED FOR FATS AND OILS, BY YEAR, ASSIGNEE, AND REGION (2018-2020)

6.7 TRADE ANALYSIS

TABLE 5 KEY COUNTRIES EXPORTING FATS AND OILS, 2020 (USD MILLION)

FIGURE 33 LEADING COUNTRIES IMPORTING (VOLUME ESTIMATES) FATS AND OILS, 2020 (%)

6.8 TECHNOLOGY ANALYSIS

6.9 PORTER’S FIVE FORCES ANALYSIS

TABLE 6 FATS & OILS MARKET: PORTER’S FIVE FORCES ANALYSIS

6.9.1 DEGREE OF COMPETITION

6.9.2 BARGAINING POWER OF SUPPLIERS

6.9.3 BARGAINING POWER OF BUYERS

6.9.4 THREAT OF SUBSTITUTES

6.9.5 THREAT OF NEW ENTRANTS

6.10 CASE STUDIES

6.10.1 VEGETABLE FATS ENHANCEMENT WITH ELIMINATION OF PARTIALLY HYDROGENATED OILS (PHOS)

6.10.1.1 Problem statement

6.10.1.2 Solution offered

6.10.1.3 Outcome

6.10.2 COVID-19 HAS INCREASED THE FOCUS ON PREVENTIVE NUTRITION

6.10.2.1 Problem statement

6.10.2.2 Solution offered

6.10.2.3 Outcome

7 REGULATORY ANALYSIS (Page No. - 85)

7.1 INTRODUCTION

7.1.1 UNITED STATES (US)

7.1.2 CANADA

7.1.3 EUROPEAN UNION (EU)

7.1.4 EMERGING ECONOMIES – REGULATIONS ON FATS & OILS

8 FATS & OILS MARKET, BY TYPE (Page No. - 89)

8.1 INTRODUCTION

8.2 VEGETABLE OILS

FIGURE 34 VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021 VS. 2026 (USD MILLION)

TABLE 7 VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (USD MILLION)

TABLE 8 VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021–2026 (USD MILLION)

TABLE 9 VEGETABLE OILS MARKET SIZE, BY OIL T YPE, 2017- 2020 (KILOTONS)

TABLE 10 VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021-2026 (KILOTONS)

8.3 COVID-19 IMPACT ON THE FATS & OILS MARKET, BY VEGETABLE OILS

8.3.1 OPTIMISTIC SCENARIO

TABLE 11 COVID-19 IMPACT ON THE VEGETABLE OILS MARKET, BY OIL TYPE, 2018–2021 (USD MILLION)

8.3.2 REALISTIC SCENARIO

TABLE 12 COVID-19 IMPACT ON THE VEGETABLE OILS MARKET, BY OIL TYPE, 2018–2021 (USD MILLION)

8.3.3 PESSIMISTIC SCENARIO

TABLE 13 COVID-19 IMPACT ON THE VEGETABLE OILS MARKET, BY OIL TYPE, 2018–2021 (USD MILLION)

8.4 PALM OIL

8.4.1 THE ABSENCE OF LINOLENIC ACID MAKES PALM OIL STABLE TO OXIDATIVE DETERIORATION

TABLE 14 PALM OIL MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 15 PALM OIL MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 16 PALM OIL MARKET SIZE, BY REGION, 2017- 2020 (KILOTONS)

TABLE 17 PALM OIL MARKET SIZE, BY REGION, 2021- 2026 (KILOTONS)

8.5 SOYBEAN OIL

8.5.1 HIGH AMOUNT OF ESSENTIAL FATTY ACIDS MAKE SOYBEAN OIL A HEALTHIER ALTERNATIVE

FIGURE 35 INPUTS FOR BIODIESEL PRODUCTION IN THE US, 2018-2020

TABLE 18 SOYBEAN OIL MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 19 SOYBEAN OIL MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 20 SOYBEAN OIL MARKET SIZE, BY REGION, 2017- 2020 (KILOTONS)

TABLE 21 SOYBEAN OIL MARKET SIZE, BY REGION, 2021- 2026 (KILOTONS)

8.6 SUNFLOWER OIL

8.6.1 HIGH PRICES OF SUNFLOWER OIL LIMITING ITS USE IN FOOD APPLICATIONS

TABLE 22 SUNFLOWER OIL MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 23 SUNFLOWER OIL MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 24 SUNFLOWER OIL MARKET SIZE, BY REGION, 2017- 2020 (KILOTONS)

TABLE 25 SUNFLOWER OIL MARKET SIZE, BY REGION, 2021- 2026 (KILOTONS)

8.7 RAPESEED OIL

8.7.1 HIGH LEVELS OF FATTY ACIDS LIMITING THE USE OF RAPESEED OIL IN THE FOOD INDUSTRY

TABLE 26 RAPESEED OIL MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 27 RAPESEED OIL MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 28 RAPESEED OIL MARKET SIZE, BY REGION, 2017- 2020 (KILOTONS)

TABLE 29 RAPESEED OIL MARKET SIZE, BY REGION, 2021- 2026 (KILOTONS)

8.8 OLIVE OIL

8.8.1 HIGHLY NUTRITIOUS QUALITY OF OLIVE OIL MAKES IT ONE OF THE MOST USED OILS IN HOUSEHOLDS

TABLE 30 OLIVE OIL MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 31 OLIVE OIL MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 32 OLIVE OIL MARKET SIZE, BY REGION, 2017-2020 (KILOTONS)

TABLE 33 OLIVE OIL MARKET SIZE, BY REGION, 2021-2026 (KILOTONS)

8.9 OTHER OILS

8.9.1 LOW CONCENTRATION OF UNSATURATED FATTY ACIDS IN COCONUT OIL MAKES THE OIL RESISTANT TO OXIDATION

TABLE 34 OTHER OILS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 35 OTHER OILS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 36 OTHER OILS MARKET SIZE, BY REGION, 2017-2020 (KILOTONS)

TABLE 37 OLIVE OILS MARKET SIZE, BY REGION, 2021-2026 (KILOTONS)

8.10 FATS

FIGURE 36 FATS MARKET SIZE, BY FAT TYPE, 2021 VS. 2026 (USD MILLION)

TABLE 38 FATS MARKET SIZE, BY FAT TYPE, 2017–2020 (USD MILLION)

TABLE 39 FATS MARKET SIZE, BY FAT TYPE, 2021–2026 (USD MILLION)

TABLE 40 FATS MARKET SIZE, BY FAT TYPE, 2017-2020 (KILOTONS)

TABLE 41 FATS MARKET SIZE, BY FAT TYPE, 2021-2026 (KILOTONS)

8.11 COVID-19 IMPACT ON THE FATS & OILS MARKET, BY FATS

8.11.1 OPTIMISTIC SCENARIO

TABLE 42 COVID-19 IMPACT ON THE FATS MARKET, BY FAT TYPE, 2018–2021 (USD MILLION)

8.11.2 REALISTIC SCENARIO

TABLE 43 COVID-19 IMPACT ON THE FATS MARKET, BY FAT TYPE, 2018–2021 (USD MILLION)

8.11.3 PESSIMISTIC SCENARIO

TABLE 44 COVID-19 IMPACT ON THE FATS MARKET, BY FAT TYPE, 2018–2021 (USD MILLION)

8.12 BUTTER & MARGARINE

8.12.1 ‘BREAD & BUTTER’ STAPLE BREAKFAST DRIVING THE MARKET FOR BUTTER

TABLE 45 BUTTER & MARGARINE MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 46 BUTTER & MARGARINE MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 47 BUTTER & MARGARINE MARKET SIZE, BY REGION, 2017-2020 (KILOTONS)

TABLE 48 BUTTER & MARGARINE MARKET SIZE, BY REGION, 2021-2026 (KILOTONS)

8.13 TALLOW & GREASE

8.13.1 TALLOW HELPS IN ABSORBING MORE NUTRIENTS AND IN REDUCING INFLAMMATION

TABLE 49 TALLOW & GREASE MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 50 TALLOW & GREASE MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 51 TALLOW & GREASE MARKET SIZE, BY REGION, 2017-2020 (KILOTONS)

TABLE 52 TALLOW & GREASE MARKET SIZE, BY REGION, 2021-2026 (KILOTONS)

8.14 LARD

8.14.1 THE RELATIVELY LESSER CONCENTRATION OF SATURATED FATS MAKES LARD A BETTER ALTERNATIVE TO BUTTER

TABLE 53 LARD MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 54 LARD MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 55 LARD MARKET SIZE, BY REGION, 2017- 2020 (KILOTONS)

TABLE 56 LARD MARKET SIZE, BY REGION, 2021- 2026 (KILOTONS)

8.15 OTHER FATS

8.15.1 POULTRY FATS AND MUTTON FATS ARE USED AS SOUPS AND PET FOODS

TABLE 57 OTHER FATS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 58 OTHER FATS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 59 OTHER FATS MARKET SIZE, BY REGION, 2017- 2020 (KILOTONS)

TABLE 60 OTHER FATS MARKET SIZE, BY REGION, 2021- 2026 (KILOTONS)

9 FATS & OILS MARKET, BY SOURCE (Page No. - 117)

9.1 INTRODUCTION

FIGURE 37 FATS & OILS MARKET SIZE, BY SOURCE, 2021 VS. 2026 (USD MILLION)

TABLE 61 FATS & OILS MARKET SIZE, BY SOURCE, 2017–2020 (USD MILLION)

TABLE 62 FATS & OILS MARKET SIZE, BY SOURCE, 2021–2026 (USD MILLION)

TABLE 63 FATS & OILS MARKET SIZE, BY SOURCE, 2017- 2020 (KILOTONS)

TABLE 64 FATS & OILS MARKET SIZE, BY SOURCE, 2021-2026 (KILOTONS)

9.2 COVID-19 IMPACT ON THE FATS & OILS MARKET, BY SOURCE

9.2.1 OPTIMISTIC SCENARIO

TABLE 65 COVID-19 IMPACT ON THE FATS & OILS MARKET, BY SOURCE, 2019–2021 (USD MILLION)

9.2.2 REALISTIC SCENARIO

TABLE 66 COVID-19 IMPACT ON THE FATS & OILS MARKET, BY SOURCE, 2019–2021 (USD MILLION)

9.2.3 PESSIMISTIC SCENARIO

TABLE 67 COVID-19 IMPACT ON THE FATS & OILS MARKET, BY SOURCE, 2019–2021 (USD MILLION)

9.3 VEGETABLES

9.3.1 INCREASING AWARENESS ABOUT HEALTHY DIETS AMONG PEOPLE DRIVING THE MARKET FOR VEGETABLE OIL

TABLE 68 FATS & OILS MARKET SIZE FOR VEGETABLE SOURCES, BY REGION, 2017–2020 (USD MILLION)

TABLE 69 FATS & OILS MARKET SIZE FOR VEGETABLE SOURCES, BY REGION, 2021–2026 (USD MILLION)

TABLE 70 FATS & OILS MARKET SIZE FOR VEGETABLE SOURCES, BY REGION, 2017- 2020 (KILOTONS)

TABLE 71 FATS & OILS MARKET SIZE FOR VEGETABLE SOURCES, BY REGION, 2021- 2026 (KILOTONS)

9.4 ANIMALS

9.4.1 ANIMAL-BASED OILS AND FATS ARE MORE STABLE AND MAKE THE FOOD CRISPIER, JUICIER, AND FLAVOURFUL

TABLE 72 FATS & OILS MARKET SIZE FOR ANIMAL SOURCES, BY REGION, 2017–2020 (USD MILLION)

TABLE 73 FATS AND OILS MARKET SIZE FOR ANIMAL SOURCES, BY REGION, 2021–2026 (USD MILLION)

TABLE 74 FATS & OILS MARKET SIZE FOR ANIMAL SOURCES, BY REGION, 2017- 2020 (KILOTONS)

TABLE 75 FATS AND OILS MARKET SIZE FOR ANIMAL SOURCES, BY REGION, 2021- 2026 (KILOTONS)

10 FATS & OILS MARKET, BY FORM (Page No. - 125)

10.1 INTRODUCTION a

10.1.1 FACTORS AFFECTING THE PHYSICAL CHARACTERISTICS OF FATS AND OILS

FIGURE 38 FAST & OILS MARKET SIZE, BY FORM, 2021 VS. 2026 (USD MILLION)

TABLE 76 FATS & OILS MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 77 FATS AND OILS MARKET SIZE, BY FORM, 2021–2026 (USD MILLION)

TABLE 78 FATS & OILS MARKET SIZE, BY FORM, 2017- 2020 (KILOTONS)

TABLE 79 FATS AND OILS MARKET SIZE, BY FORM, 2021-2026 (KILOTONS)

10.2 COVID-19 IMPACT ON THE FATS & OILS MARKET, BY FORM

10.2.1 OPTIMISTIC SCENARIO

TABLE 80 COVID-19 IMPACT ON THE FATS & OILS MARKET, BY FORM, 2019–2021 (USD MILLION) (OPTIMISTIC SCENARIO)

10.2.2 REALISTIC SCENARIO

TABLE 81 COVID-19 IMPACT ON THE FATS & OILS MARKET, BY FORM, 2019–2021 (USD MILLION) (REALISTIC SCENARIO)

10.2.3 PESSIMISTIC SCENARIO

TABLE 82 COVID-19 IMPACT ON THE FATS & OILS MARKET, BY FORM, 2019–2021 (USD MILLION) (PESSIMISTIC SCENARIO)

10.3 LIQUID

10.3.1 HIGH DEMAND FOR LIQUID OILS USED IN HOUSEHOLDS AND HOTELS

TABLE 83 LIQUID: FATS & OILS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 84 LIQUID: FATS AND OILS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 85 LIQUID: FATS AND OILS MARKET SIZE, BY REGION, 2017- 2020 (KILOTONS)

TABLE 86 LIQUID: FATS & OILS MARKET SIZE, BY REGION, 2021- 2026 (KILOTONS)

10.4 SOLID (CRYSTALLINE)

10.4.1 SOLID FORM CRYSTALLIZES THE ANIMAL- AND VEGETABLE-DERIVED FATS, MAKING THEM MORE CREAMY

TABLE 87 SOLID: FATS & OILS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 88 SOLID: FATS AND OILS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 89 SOLID: FATS AND OILS MARKET SIZE, BY REGION, 2017- 2020 (KILOTONS)

TABLE 90 SOLID: FATS & OILS MARKET SIZE, BY REGION, 2021- 2026 (KILOTONS)

11 FATS & OILS MARKET, BY APPLICATION (Page No. - 133)

11.1 INTRODUCTION

FIGURE 39 FATS & OILS MARKET SIZE, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

TABLE 91 FATS & OILS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 92 FATS AND OILS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 93 FATS & OILS MARKET SIZE, BY APPLICATION, 2017- 2020 (KILOTONS)

TABLE 94 FATS & OILS MARKET SIZE, BY APPLICATION, 2021-2026 (KILOTONS)

11.2 COVID-19 IMPACT ON THE FATS & OILS MARKET, BY APPLICATION

11.2.1 OPTIMISTIC SCENARIO

TABLE 95 COVID-19 IMPACT ON THE FATS & OILS MARKET, BY APPLICATION, 2018–2021 (USD MILLION) (OPTIMISTIC SCENARIO)

11.2.2 REALISTIC SCENARIO

TABLE 96 COVID-19 IMPACT ON THE FATS & OILS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

11.2.3 PESSIMISTIC SCENARIO

TABLE 97 COVID-19 IMPACT ON THE FATS & OILS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

11.3 FOOD APPLICATIONS

11.3.1 VEGETABLE OILS OFFER A HEALTHIER SUBSTITUTE FOR TRADITIONAL FATS USED IN FOOD PRODUCTS

TABLE 98 FOOD APPLICATIONS: FATS & OILS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 99 FOOD APPLICATIONS: FATS & OILS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 100 FOOD APPLICATIONS: FATS & OILS MARKET SIZE, BY REGION, 2017- 2020 (KILOTONS)

TABLE 101 FOOD APPLICATIONS: FATS & OILS MARKET SIZE, BY REGION, 2021- 2026 (KILOTONS)

11.3.2 BAKERY & CONFECTIONERY

11.3.2.1 Bakery

TABLE 102 COMPOSITION OF MAJOR FATS AND OILS USED IN BAKERIES

11.3.2.2 Confectionery

11.3.3 PROCESSED FOOD

11.3.3.1 Snacks & savory

11.3.3.2 R.T.E Foods/Convenience foods

11.3.3.3 Sauces, spreads, and dressings

TABLE 103 TYPES OF SPREADS AND THEIR DESCRIPTIONS

11.3.3.4 Others (incl. meat products)

11.4 INDUSTRIAL APPLICATIONS

11.4.1 DEMAND FOR VEGETABLE OIL HAS SIGNIFICANTLY INCREASED IN DEVELOPED COUNTRIES FOR USE IN BIODIESEL PRODUCTION

TABLE 104 INDUSTRIAL APPLICATIONS: FATS & OILS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 105 INDUSTRIAL APPLICATIONS: FATS & OILS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 106 INDUSTRIAL APPLICATIONS: FATS & OILS MARKET SIZE, BY REGION, 2017- 2020 (KILOTONS)

TABLE 107 INDUSTRIAL APPLICATIONS: FATS & OILS MARKET SIZE, BY REGION, 2021- 2026 (KILOTONS)

11.4.2 BIODIESEL

FIGURE 40 US MONTHLY BIODIESEL PRODUCTION, 2018-2020 (MILLION GALLONS)

11.4.3 OTHER INDUSTRIAL APPLICATIONS

11.4.3.1 Oleochemicals

11.4.3.2 Animal feed

12 FATS & OILS MARKET, BY REGION (Page No. - 144)

12.1 INTRODUCTION

FIGURE 41 GEOGRAPHIC SNAPSHOT OF THE FATS & OILS MARKET (2021–2026):

FIGURE 42 FATS & OILS MARKET, BY REGION, 2021 VS. 2026 (USD MILLION)

TABLE 108 FATS & OILS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 109 FATS & OILS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 110 FATS & OILS MARKET SIZE, BY REGION, 2017–2020 (KILOTONS)

TABLE 111 FATS & OILS MARKET SIZE, BY REGION, 2021-2026 (KILOTONS)

TABLE 112 VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (USD MILLION)

TABLE 113 VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021–2026 (USD MILLION)

TABLE 114 VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (KILOTONS)

TABLE 115 VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021-2026 (KILOTONS)

TABLE 116 FATS MARKET SIZE, BY FAT TYPE, 2017–2020 (USD MILLION)

TABLE 117 FATS MARKET SIZE, BY FAT TYPE, 2021–2026 (USD MILLION)

TABLE 118 FATS MARKET SIZE, BY FAT TYPE, 2017–2020 (KILOTONS)

TABLE 119 FATS MARKET SIZE, BY FATS TYPE, 2021-2026 (KILOTONS)

TABLE 120 FATS & OILS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 121 FATS AND OILS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 122 FATS & OILS MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTONS)

TABLE 123 FATS AND OILS MARKET SIZE, BY APPLICATION, 2021-2026 (KILOTONS)

TABLE 124 FATS & OILS MARKET SIZE, BY SOURCE, 2017–2020 (USD MILLION)

TABLE 125 FATS & OILS MARKET SIZE, BY SOURCE, 2021–2026 (USD MILLION)

TABLE 126 FATS AND OILS MARKET SIZE, BY SOURCE, 2017–2020 (KILOTONS)

TABLE 127 FATS AND OILS MARKET SIZE, BY SOURCE, 2021-2026 (KILOTONS)

TABLE 128 FATS & OILS MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 129 FATS & OILS MARKET SIZE, BY FORM, 2021–2026 (USD MILLION)

TABLE 130 FATS AND OILS MARKET SIZE, BY FORM, 2017–2020 (KILOTONS)

TABLE 131 FATS & OILS MARKET SIZE, BY FORM, 2021-2026 (KILOTONS)

12.2 COVID-19 IMPACT ON THE FATS & OILS MARKET, BY REGION

12.2.1 OPTIMISTIC SCENARIO

TABLE 132 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE FATS & OILS MARKET, BY REGION, 2019–2021 (USD MILLION)

12.2.2 REALISTIC SCENARIO

TABLE 133 COVID-19 IMPACT ON THE FATS & OILS MARKET, BY REGION, 2019–2021 (USD MILLION)

12.2.3 PESSIMISTIC SCENARIO

TABLE 134 COVID-19 IMPACT ON THE FATS & OILS MARKET, BY REGION, 2019–2021 (USD MILLION)

12.3 NORTH AMERICA

FIGURE 43 NORTH AMERICA: MARKET SNAPSHOT

TABLE 135 NORTH AMERICA: FATS & OILS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 136 NORTH AMERICA: FATS AND OILS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 137 NORTH AMERICA: FATS & OILS MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTONS)

TABLE 138 NORTH AMERICA: FATS AND OILS MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTONS)

TABLE 139 NORTH AMERICA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (USD MILLION)

TABLE 140 NORTH AMERICA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021–2026 (USD MILLION)

TABLE 141 NORTH AMERICA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (KILOTONS)

TABLE 142 NORTH AMERICA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021-2026 (KILOTONS)

TABLE 143 NORTH AMERICA: FATS MARKET SIZE, BY FAT TYPE, 2017–2020 (USD MILLION)

TABLE 144 NORTH AMERICA: FATS MARKET SIZE, BY FAT TYPE, 2021–2026 (USD MILLION)

TABLE 145 NORTH AMERICA: FATS MARKET SIZE, BY FAT TYPE, 2017–2020 (KILOTONS)

TABLE 146 NORTH AMERICA: SIZE, BY FAT TYPE, 2021-2026 (KILOTONS)

TABLE 147 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 148 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 149 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTONS)

TABLE 150 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2021-2026 (KILOTONS)

TABLE 151 NORTH AMERICA: MARKET SIZE, BY SOURCE, 2017–2020 (USD MILLION)

TABLE 152 NORTH AMERICA: MARKET SIZE, BY SOURCE, 2021–2026 (USD MILLION)

TABLE 153 NORTH AMERICA: MARKET SIZE, BY SOURCE, 2017–2020 (KILOTONS)

TABLE 154 NORTH AMERICA: MARKET SIZE, BY SOURCE, 2021-2026 (KILOTONS)

TABLE 155 NORTH AMERICA: MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 156 NORTH AMERICA: MARKET SIZE, BY FORM, 2021–2026 (USD MILLION)

TABLE 157 NORTH AMERICA: MARKET SIZE, BY FORM, 2017–2020 (KILOTONS)

TABLE 158 NORTH AMERICA: MARKET SIZE, BY FORM, 2021-2026 (KILOTONS)

12.3.1 US

12.3.1.1 Strong volume-based demand for soybean and rapeseed oils driving the sale of fats and oils

TABLE 159 US: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (USD MILLION)

TABLE 160 US: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021–2026 (USD MILLION)

TABLE 161 US: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (KILOTONS)

TABLE 162 US: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021-2026 (KILOTONS)

12.3.2 CANADA

12.3.2.1 High consumption rates for rapeseed, palm, and coconut oil in the processed food industry

TABLE 163 CANADA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (USD MILLION)

TABLE 164 CANADA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021–2026 (USD MILLION)

TABLE 165 CANADA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (KILOTONS)

TABLE 166 CANADA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021-2026 (KILOTONS)

12.3.3 MEXICO

12.3.3.1 Mexican bakery and confectionery sectors leading the demand dynamics for fats and oils

TABLE 167 MEXICO: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (USD MILLION)

TABLE 168 MEXICO: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021–2026 (USD MILLION)

TABLE 169 MEXICO: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (KILOTONS)

TABLE 170 MEXICO: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021-2026 (KILOTONS)

12.4 ASIA PACIFIC

FIGURE 44 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 171 ASIA PACIFIC: FATS & OILS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 172 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 173 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTONS)

TABLE 174 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTONS)

TABLE 175 ASIA PACIFIC: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (USD MILLION)

TABLE 176 ASIA PACIFIC: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021–2026 (USD MILLION)

TABLE 177 ASIA PACIFIC: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (KILOTONS)

TABLE 178 ASIA PACIFIC: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021-2026 (KILOTONS)

TABLE 179 ASIA PACIFIC: FATS MARKET SIZE, BY FAT TYPE, 2017–2020 (USD MILLION)

TABLE 180 ASIA PACIFIC: FATS MARKET SIZE, BY FAT TYPE, 2021–2026 (USD MILLION)

TABLE 181 ASIA PACIFIC: FATS MARKET SIZE, BY FAT TYPE, 2017–2020 (KILOTONS)

TABLE 182 ASIA PACIFIC: FATS MARKET SIZE, BY FAT TYPE, 2021-2026 (KILOTONS)

TABLE 183 ASIA PACIFIC: FATS & OILS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 184 ASIA PACIFIC: FATS & OILS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 185 ASIA PACIFIC: FATS & OILS MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTONS)

TABLE 186 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2021-2026 (KILOTONS)

TABLE 187 ASIA PACIFIC: MARKET SIZE, BY SOURCE, 2017–2020 (USD MILLION)

TABLE 188 ASIA PACIFIC: MARKET SIZE, BY SOURCE, 2021–2026 (USD MILLION)

TABLE 189 ASIA PACIFIC: MARKET SIZE, BY SOURCE, 2017–2020 (KILOTONS)

TABLE 190 ASIA PACIFIC: MARKET SIZE, BY SOURCE, 2021-2026 (KILOTONS)

TABLE 191 ASIA PACIFIC: MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 192 ASIA PACIFIC: MARKET SIZE, BY FORM, 2021–2026 (USD MILLION)

TABLE 193 ASIA PACIFIC: MARKET SIZE, BY FORM, 2017–2020 (KILOTONS)

TABLE 194 ASIA PACIFIC: MARKET SIZE, BY FORM, 2021-2026 (KILOTONS)

12.4.1 CHINA

12.4.1.1 Robust production, consumption, and import dynamics for palm and soybean oils to drive the fats & oils market

TABLE 195 CHINA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (USD MILLION)

TABLE 196 CHINA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021–2026 (USD MILLION)

TABLE 197 CHINA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (KILOTONS)

TABLE 198 CHINA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021-2026 (KILOTONS)

12.4.2 INDIA

12.4.2.1 Promising consumption patterns arising from processed food product growth driving the sales momentum of fats and oils

TABLE 199 INDIA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (USD MILLION)

TABLE 200 INDIA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021–2026 (USD MILLION)

TABLE 201 INDIA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (KILOTONS)

TABLE 202 INDIA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021-2026 (KILOTONS)

12.4.3 JAPAN

12.4.3.1 Health-conscious consumers driving the demand for clean-labeled fats and oils

TABLE 203 JAPAN: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (USD MILLION)

TABLE 204 JAPAN: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021–2026 (USD MILLION)

TABLE 205 JAPAN: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (KILOTONS)

TABLE 206 JAPAN: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021-2026 (KILOTONS)

12.4.4 INDONESIA

12.4.4.1 Robust per capita consumption of fats and oils

TABLE 207 INDONESIA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (USD MILLION)

TABLE 208 INDONESIA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021–2026 (USD MILLION)

TABLE 209 INDONESIA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (KILOTONS)

TABLE 210 INDONESIA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021-2026 (KILOTONS)

12.4.5 MALAYSIA

12.4.5.1 Favorable production patterns and promising consumption of palm oil fueling the fats & oils market

TABLE 211 MALAYSIA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (USD MILLION)

TABLE 212 MALAYSIA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021–2026 (USD MILLION)

TABLE 213 MALAYSIA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (KILOTONS)

TABLE 214 MALAYSIA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021-2026 (KILOTONS)

12.4.6 AUSTRALIA

12.4.6.1 Growing popularity of rapeseed, olive, and sunflower oils facilitating the fats and oils market

TABLE 215 AUSTRALIA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (USD MILLION)

TABLE 216 AUSTRALIA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021–2026 (USD MILLION)

TABLE 217 AUSTRALIA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (KILOTONS)

TABLE 218 AUSTRALIA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021-2026 (KILOTONS)

12.4.7 REST OF ASIA PACIFIC

12.4.7.1 Diversified consumption patterns for indulgent foods remain the key driver for fats and oils

TABLE 219 REST OF ASIA PACIFIC: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (USD MILLION)

TABLE 220 REST OF ASIA PACIFIC: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021–2026 (USD MILLION)

TABLE 221 REST OF ASIA PACIFIC: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (KILOTONS)

TABLE 222 REST OF ASIA PACIFIC: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021-2026 (KILOTONS)

12.5 EUROPE

FIGURE 45 EUROPE: MARKET SNAPSHOT

TABLE 223 EUROPE: FATS & OILS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 224 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 225 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTONS)

TABLE 226 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTONS)

TABLE 227 EUROPE: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (USD MILLION)

TABLE 228 EUROPE: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021–2026 (USD MILLION)

TABLE 229 EUROPE: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (KILOTONS)

TABLE 230 EUROPE: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021-2026 (KILOTONS)

TABLE 231 EUROPE: FATS MARKET SIZE, BY FAT TYPE, 2017–2020 (USD MILLION)

TABLE 232 EUROPE: FATS MARKET SIZE, BY FAT TYPE, 2021–2026 (USD MILLION)

TABLE 233 EUROPE: FATS MARKET SIZE, BY FAT TYPE, 2017–2020 (KILOTONS)

TABLE 234 EUROPE: FATS MARKET SIZE, BY FAT TYPE, 2021-2026 (KILOTONS)

TABLE 235 EUROPE: FATS & OILS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 236 EUROPE: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 237 EUROPE: MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTONS)

TABLE 238 EUROPE: MARKET SIZE, BY APPLICATION, 2021-2026 (KILOTONS)

TABLE 239 EUROPE: MARKET SIZE, BY SOURCE, 2017–2020 (USD MILLION)

TABLE 240 EUROPE: MARKET SIZE, BY SOURCE, 2021–2026 (USD MILLION)

TABLE 241 EUROPE: MARKET SIZE, BY SOURCE, 2017–2020 (KILOTONS)

TABLE 242 EUROPE: MARKET SIZE, BY SOURCE, 2021-2026 (KILOTONS)

TABLE 243 EUROPE: MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 244 EUROPE: MARKET SIZE, BY FORM, 2021–2026 (USD MILLION)

TABLE 245 EUROPE: MARKET SIZE, BY FORM, 2017–2020 (KILOTONS)

TABLE 246 EUROPE: MARKET SIZE, BY FORM, 2021-2026 (KILOTONS)

12.5.1 GERMANY

12.5.1.1 Policy and regulatory initiatives driving the consumption of healthier, clean-labeled fats and oils

TABLE 247 GERMANY: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (USD MILLION)

TABLE 248 GERMANY: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021–2026 (USD MILLION)

TABLE 249 GERMANY: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (KILOTONS)

TABLE 250 GERMANY: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021-2026 (KILOTONS)

12.5.2 UK

12.5.2.1 Significant reduction in saturated fats in the dietary habits expected to drive the sales of olive, sunflower, and other healthier variants of VEGETABLE oils

TABLE 251 UK: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (USD MILLION)

TABLE 252 UK: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021–2026 (USD MILLION)

TABLE 253 UK: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (KILOTONS)

TABLE 254 UK: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021-2026 (KILOTONS)

12.5.3 FRANCE

12.5.3.1 Culinary aspects of the French market favoring significant utilization of fats and oils

TABLE 255 FRANCE: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (USD MILLION)

TABLE 256 FRANCE: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021–2026 (USD MILLION)

TABLE 257 FRANCE: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (KILOTONS)

TABLE 258 FRANCE: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021-2026 (KILOTONS)

12.5.4 ITALY

12.5.4.1 Olive oil remains an indispensable ingredient in Italian food products

TABLE 259 ITALY: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (USD MILLION)

TABLE 260 ITALY: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021–2026 (USD MILLION)

TABLE 261 ITALY: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (KILOTONS)

TABLE 262 ITALY: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021-2026 (KILOTONS)

12.5.5 SPAIN

12.5.5.1 Greater share of animal-based food products in Spanish diets driving the sales of fats and oils

TABLE 263 SPAIN: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (USD MILLION)

TABLE 264 SPAIN: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021–2026 (USD MILLION)

TABLE 265 SPAIN: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (KILOTONS)

TABLE 266 SPAIN: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021-2026 (KILOTONS)

12.5.6 RUSSIA

12.5.6.1 Robust in-home consumption of fat-rich foods

TABLE 267 RUSSIA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (USD MILLION)

TABLE 268 RUSSIA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021–2026 (USD MILLION)

TABLE 269 RUSSIA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (KILOTONS)

TABLE 270 RUSSIA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021-2026 (KILOTONS)

12.5.7 NETHERLANDS

12.5.7.1 Dutch fats and oils market thriving on resilient production and trade dynamics

TABLE 271 NETHERLANDS: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (USD MILLION)

TABLE 272 NETHERLANDS: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021–2026 (USD MILLION)

TABLE 273 NETHERLANDS: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (KILOTONS)

TABLE 274 NETHERLANDS: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021-2026 (KILOTONS)

12.5.8 REST OF EUROPE

12.5.8.1 Promising demand patterns from Eastern European countries driving the market for fats and oils

TABLE 275 REST OF EUROPE: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (USD MILLION)

TABLE 276 REST OF EUROPE: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021–2026 (USD MILLION)

TABLE 277 REST OF EUROPE: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (KILOTONS)

TABLE 278 REST OF EUROPE: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021-2026 (KILOTONS)

12.6 SOUTH AMERICA

TABLE 279 SOUTH AMERICA: FATS & OILS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 280 SOUTH AMERICA: FATS AND OILS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 281 SOUTH AMERICA: FATS AND OILS MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTONS)

TABLE 282 SOUTH AMERICA: FATS & OILS MARKET SIZE, BY COUNTRY, 2021- 2026 (KILOTONS)

TABLE 283 SOUTH AMERICA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (USD MILLION)

TABLE 284 SOUTH AMERICA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021–2026 (USD MILLION)

TABLE 285 SOUTH AMERICA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (KILOTONS)

TABLE 286 SOUTH AMERICA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021-2026 (KILOTONS)

TABLE 287 SOUTH AMERICA: FATS MARKET SIZE, BY FAT TYPE, 2017–2020 (USD MILLION)

TABLE 288 SOUTH AMERICA: FATS MARKET SIZE, BY FAT TYPE, 2021–2026 (USD MILLION)

TABLE 289 SOUTH AMERICA: FATS MARKET SIZE, BY FAT TYPE, 2017–2020 (KILOTONS)

TABLE 290 SOUTH AMERICA: FATS MARKET SIZE, BY FAT TYPE, 2021-2026 (KILOTONS)

TABLE 291 SOUTH AMERICA: FATS & OILS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 292 SOUTH AMERICA: FATS & OILS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 293 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTONS)

TABLE 294 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2021-2026 (KILOTONS)

TABLE 295 SOUTH AMERICA: MARKET SIZE, BY SOURCE, 2017–2020 (USD MILLION)

TABLE 296 SOUTH AMERICA: MARKET SIZE, BY SOURCE, 2021–2026 (USD MILLION)

TABLE 297 SOUTH AMERICA: MARKET SIZE, BY SOURCE, 2017–2020 (KILOTONS)

TABLE 298 SOUTH AMERICA: MARKET SIZE, BY SOURCE, 2021-2026 (KILOTONS)

TABLE 299 SOUTH AMERICA: MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 300 SOUTH AMERICA: MARKET SIZE, BY FORM, 2021–2026 (USD MILLION)

TABLE 301 SOUTH AMERICA: MARKET SIZE, BY FORM, 2017–2020 (KILOTONS)

TABLE 302 SOUTH AMERICA: MARKET SIZE, BY FORM, 2021-2026 (KILOTONS)

12.6.1 BRAZIL

12.6.1.1 Increasing production of biofuel driving the market for vegetable oils

TABLE 303 BRAZIL: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (USD MILLION)

TABLE 304 BRAZIL: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021–2026 (USD MILLION)

TABLE 305 BRAZIL: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (KILOTONS)

TABLE 306 BRAZIL: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021-2026 (KILOTONS)

12.6.2 ARGENTINA

12.6.2.1 Significant export of soybean replenishing the country’s foreign currency reserves

FIGURE 46 VALUE OF ARGENTINE SOY EXPORTS, BY COMPONENT, 2010-2020

TABLE 307 ARGENTINA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (USD MILLION)

TABLE 308 ARGENTINA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021–2026 (USD MILLION)

TABLE 309 ARGENTINA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (KILOTONS)

TABLE 310 ARGENTINA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021-2026 (KILOTONS)

12.6.3 REST OF SOUTH AMERICA

TABLE 311 REST OF SOUTH AMERICA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (USD MILLION)

TABLE 312 REST OF SOUTH AMERICA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021–2026 (USD MILLION)

TABLE 313 REST OF SOUTH AMERICA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (KILOTONS)

TABLE 314 REST OF SOUTH AMERICA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021-2026 (KILOTONS)

12.7 ROW

TABLE 315 ROW: FATS & OILS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 316 ROW: FATS AND OILS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 317 ROW: FATS AND OILS MARKET SIZE, BY REGION, 2017–2020 (KILOTONS)

TABLE 318 ROW: FATS AND OILS MARKET SIZE, BY REGION, 2021- 2026 (KILOTONS)

TABLE 319 ROW: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (USD MILLION)

TABLE 320 ROW: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021–2026 (USD MILLION)

TABLE 321 ROW: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (KILOTONS)

TABLE 322 ROW: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021-2026 (KILOTONS)

TABLE 323 ROW: FATS MARKET SIZE, BY FAT TYPE, 2017–2020 (USD MILLION)

TABLE 324 ROW: FATS MARKET SIZE, BY FAT TYPE, 2021–2026 (USD MILLION)

TABLE 325 ROW: FATS MARKET SIZE, BY FAT TYPE, 2017–2020 (KILOTONS)

TABLE 326 ROW: FATS MARKET SIZE, BY FAT TYPE, 2021-2026 (KILOTONS)

TABLE 327 ROW: FATS AND OILS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 328 ROW: FATS AND OILS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 329 ROW: FATS & OILS MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTONS)

TABLE 330 ROW: FATS & OILS MARKET SIZE, BY APPLICATION, 2021-2026 (KILOTONS)

TABLE 331 ROW: FATS AND OILS MARKET SIZE, BY SOURCE, 2017–2020 (USD MILLION)

TABLE 332 ROW: MARKET SIZE, BY SOURCE, 2021–2026 (USD MILLION)

TABLE 333 ROW: MARKET SIZE, BY SOURCE, 2017–2020 (KILOTONS)

TABLE 334 ROW: MARKET SIZE, BY SOURCE, 2021-2026 (KILOTONS)

TABLE 335 ROW: MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 336 ROW: MARKET SIZE, BY FORM, 2021–2026 (USD MILLION)

TABLE 337 ROW: MARKET SIZE, BY FORM, 2017–2020 (KILOTONS)

TABLE 338 ROW: MARKET SIZE, BY FORM, 2021-2026 (KILOTONS)

12.7.1 MIDDLE EAST

12.7.1.1 Inclusion of fats and oils in the Middle Eastern culture driving the market

TABLE 339 MIDDLE EAST: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (USD MILLION)

TABLE 340 MIDDLE EAST: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021–2026 (USD MILLION)

TABLE 341 MIDDLE EAST: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (KILOTONS)

TABLE 342 MIDDLE EAST: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021-2026 (KILOTONS)

12.7.2 AFRICA

12.7.2.1 Africa offers a large potential market for vegetable fats and oils

TABLE 343 AFRICA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (USD MILLION)

TABLE 344 AFRICA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021–2026 (USD MILLION)

TABLE 345 AFRICA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2017–2020 (KILOTONS)

TABLE 346 AFRICA: VEGETABLE OILS MARKET SIZE, BY OIL TYPE, 2021-2026 (KILOTONS)

13 COMPETITIVE LANDSCAPE (Page No. - 248)

13.1 OVERVIEW

FIGURE 47 OVERVIEW OF THE STRATEGIES DEPLOYED BY KEY PLAYERS IN THE FATS AND OILS MARKET

13.2 REVENUE ANALYSIS OF KEY PLAYERS, 2018- 2020

FIGURE 48 REVENUE ANALYSIS (SEGMENTAL) OF KEY PLAYERS IN THE FATS & OILS MARKET BETWEEN 2018 AND 2020 (USD MILLION)

13.3 MARKET SHARE ANALYSIS, 2020

TABLE 347 FATS & OILS MARKET: DEGREE OF COMPETITION

13.4 COVID-19-SPECIFIC COMPANY RESPONSE

13.4.1 ASSOCIATED BRITISH FOODS PLC

13.4.2 ARCHER DANIELS MIDLAND COMPANY

13.5 BUNGE LIMITED

13.6 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

13.6.1 STARS

13.6.2 EMERGING LEADERS

13.6.3 PERVASIVE PLAYERS

13.6.4 PARTICIPANTS

FIGURE 49 FATS AND OILS MARKET: COMPANY EVALUATION QUADRANT, 2020 (KEY PLAYERS)

13.6.5 PRODUCT FOOTPRINT

TABLE 348 COMPANY FOOTPRINT, BY TYPE

TABLE 349 COMPANY FOOTPRINT, BY SOURCE

TABLE 350 COMPANY FOOTPRINT, BY APPLICATION

TABLE 351 COMPANY FOOTPRINT, BY REGION

13.7 COMPANY EVALUATION QUADRANT (START-UP/SME)

13.7.1 PROGRESSIVE COMPANIES

13.7.2 STARTING BLOCKS

13.7.3 RESPONSIVE COMPANIES

13.7.4 DYNAMIC COMPANIES

FIGURE 50 FATS & OILS MARKET: COMPANY EVALUATION QUADRANT, 2020 (START-UPS/SME)

13.8 COMPETITIVE SCENARIO

13.8.1 DEALS

TABLE 352 FATS & OILS MARKET: DEALS, 2018-2019

13.8.2 OTHER DEVELOPMENTS

TABLE 353 FATS & OILS MARKET: OTHER DEVELOPMENTS, 2021

14 COMPANY PROFILES (Page No. - 263)

14.1 KEY COMPANIES

(Business overview, Products offered, Recent Developments, MNM view)*

14.1.1 ASSOCIATED BRITISH FOODS PLC

TABLE 354 ASSOCIATED BRITISH FOODS PLC: BUSINESS OVERVIEW

FIGURE 51 ASSOCIATED BRITISH FOODS PLC: COMPANY SNAPSHOT

TABLE 355 ASSOCIATED BRITISH FOODS PLC: PRODUCT OFFERINGS

14.1.2 ARCHER DANIELS MIDLAND COMPANY

TABLE 356 ARCHER DANIELS MIDLAND COMPANY: BUSINESS OVERVIEW

FIGURE 52 ARCHER DANIELS MIDLAND COMPANY: COMPANY SNAPSHOT

TABLE 357 ARCHER DANIELS MIDLAND COMPANY: PRODUCT OFFERINGS

TABLE 358 ARCHER DANIELS MIDLAND COMPANY: PRODUCT LAUNCHES

TABLE 359 ARCHER DANIELS MIDLAND COMPANY: DEALS

TABLE 360 ARCHER DANIELS MIDLAND COMPANY: OTHERS

14.1.3 BUNGE LIMITED

TABLE 361 BUNGE LIMITED: BUSINESS OVERVIEW

FIGURE 53 BUNGE LIMITED: COMPANY SNAPSHOT

TABLE 362 BUNGE LIMITED: PRODUCT OFFERINGS

TABLE 363 BUNGE LIMITED: DEALS

14.1.4 WILMAR INTERNATIONAL LIMITED

TABLE 364 WILMAR INTERNATIONAL LIMITED: BUSINESS OVERVIEW

FIGURE 54 WILMAR INTERNATIONAL LIMITED: COMPANY SNAPSHOT

TABLE 365 WILMAR INTERNATIONAL LIMITED: PRODUCT OFFERINGS

14.1.5 UNITED PLANTATIONS BERHAD

TABLE 366 UNITED PLANTATIONS BERHAD: BUSINESS OVERVIEW

FIGURE 55 UNITED PLANTATIONS BERHAD.: COMPANY SNAPSHOT

TABLE 367 UNITED PLANTATIONS LIMITED: PRODUCT OFFERINGS

14.1.6 UNILEVER PLC

TABLE 368 UNILEVER PLC: BUSINESS OVERVIEW

FIGURE 56 UNILEVER PLC: COMPANY SNAPSHOT

TABLE 369 UNILEVER PLC: PRODUCT OFFERINGS

14.1.7 AJINOMOTO CO., INC.

TABLE 370 AJINOMOTO CO., INC.: BUSINESS OVERVIEW

FIGURE 57 AJINOMOTO CO., INC.: COMPANY SNAPSHOT

TABLE 371 AJINOMOTO CO., INC.: PRODUCT OFFERINGS

14.1.8 MEWAH INTERNATIONAL INC.

TABLE 372 MEWAH INTERNATIONAL INC.: BUSINESS OVERVIEW

FIGURE 58 MEWAH INTERNATIONAL INC.: COMPANY SNAPSHOT

TABLE 373 MEWAH INTERNATIONAL INC.: PRODUCT OFFERINGS

14.1.9 CARGILL, INCORPORATED

TABLE 374 CARGILL, INCORPORATED: BUSINESS OVERVIEW

TABLE 375 CARGILL, INCORPORATED: PRODUCT OFFERINGS

TABLE 376 CARGILL, INCORPORATED: DEALS

TABLE 377 CARGILL, INCORPORATED: OTHERS

14.1.10 RICHARDSON INTERNATIONAL LIMITED

TABLE 378 RICHARDSON INTERNATIONAL LIMITED: BUSINESS OVERVIEW

TABLE 379 RICHARDSON INTERNATIONAL LIMITED: PRODUCT OFFERINGS

TABLE 380 RICHARDSON INTERNATIONAL LIMITED: DEALS

14.1.11 INTERNATIONAL FOODSTUFF COMPANY HOLDINGS LIMITED (IFFCO)

TABLE 381 INTERNATIONAL FOODSTUFF COMPANY LIMITED: BUSINESS OVERVIEW

TABLE 382 INTERNATIONAL FOODSTUFF COMPANY LIMITED: PRODUCT OFFERINGS

14.2 OTHER PLAYERS

14.2.1 GOODHOPE ASIA HOLDINGS LTD.

TABLE 383 GOODHOPE ASIA HOLDINGS LTD.: BUSINESS OVERVIEW

TABLE 384 GOODHOPE ASIA HOLDINGS LTD.: PRODUCT OFFERINGS

14.2.2 VEGA FOODS

14.2.3 WELCH, HOLME & CLARK CO., INC.

14.2.4 OLEO FATS, INC.

14.2.5 CSM INGREDIENTS

14.2.6 AAK INTERNATIONAL

14.2.7 FUJI OIL CO., LTD.

14.2.8 GEMINI EDIBLES & FATS INDIA PVT. LTD.

14.2.9 K S OILS

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

15 ADJACENT MARKETS (Page No. - 315)

15.1 INTRODUCTION

15.2 LIMITATIONS

15.3 SPECIALTY FATS & OILS MARKET

15.3.1 MARKET DEFINITION

15.3.2 MARKET OVERVIEW

TABLE 385 SPECIALTY FATS AND OILS MARKET SIZE, BY FORM, 2016–2019 (USD MILLION)

TABLE 386 SPECIALTY FATS AND OILS MARKET SIZE, BY FORM, 2020–2026 (USD MILLION)

15.4 INDUSTRIAL OILS MARKET

15.4.1 MARKET DEFINITION

15.4.2 MARKET OVERVIEW

TABLE 387 INDUSTRIAL OILS MARKET SIZE, BY TYPE, 2017–2025 (USD BILLION)

16 APPENDIX (Page No. - 318)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 AVAILABLE CUSTOMIZATIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

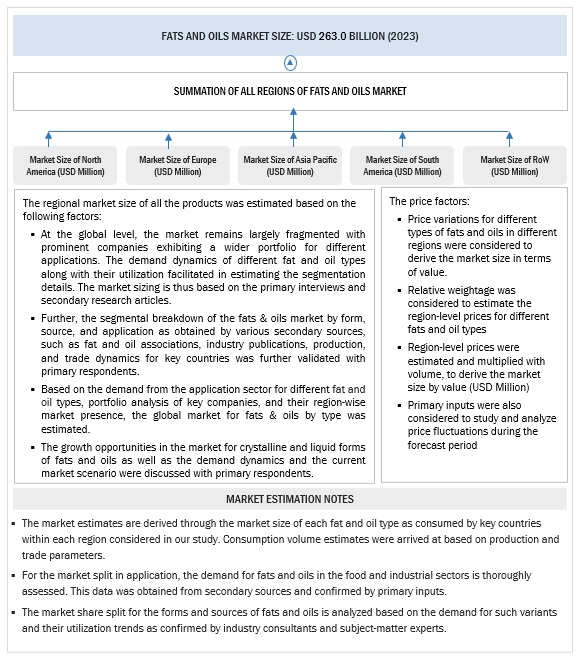

The study involved four major activities in estimating the fats and oils market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various sources, such as the United States Food and Drug Administration (US FDA), Organisation for Economic Co-operation and Development (OECD), Food and Agriculture Organization, United States Department of Agriculture, Natural Fats and oils Association (NATCOL), National Edible Oil Distributors Association (NEODA), Institute of Shortening and Edible Oils (ISEO), and American Oil Chemists’ Society 9AOCS) were referred to identify and collect information for this study. The secondary sources also include clinical studies and medical journals, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Secondary research was mainly conducted to obtain critical information about the industry’s supply chain, the total pool of key players, and market classification & segmentation according to the industry trends to the bottom-most level, and geographical markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The market comprises several stakeholders in the supply chain, which include supply-side (Fat and oil manufacturers, Fat and oil importers and exporters, Fat and oil traders, distributors, and suppliers); demand-side (large-scale food and beverage ingredient manufacturers, processed food manufacturers, and research organizations); regulatory-side (related government authorities, commercial research & development (R&D) institutions, FDA, EFSA, USDA, FSANZ, EUFIC government agencies & NGOs, and other regulatory bodies); food product consumers, regulatory bodies, including government agencies and NGOs, commercial research & development (R&D) institutions and financial institutions, and government and research organizations.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the market. These approaches have also been used extensively to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes the following details:

Top-Down

- Calculations for the market size have been based on the revenues of key companies identified in the market, which dominated the overall market size. This overall market size has been used in the top-down procedure to estimate the sizes of other individual markets (mentioned in the market segmentation) via percentage splits derived using secondary and primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the fats and oils market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- For the calculation of market shares of each market segment, the size of the most appropriate and immediate parent market has been considered for implementing the top-down procedure. The bottom-up procedure has also been implemented for data extracted from secondary research to validate the market sizes obtained for each segment.

Bottom-Up

- With the bottom-up approach, fats and oils for each type, form, and application were added up to arrive at the global and regional market size and CAGR.

- The pricing analysis was conducted based on types in regions. From this, we derived the market sizes, in terms of volume, for each region and type of fats and oils.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- The bottom-up procedure has been employed to arrive at the overall size of the fats and oils market from the revenues of key players (companies) and their product share in the market.

- The market share was then estimated for each company to verify the revenue share used earlier in the bottom-up procedure. With the data triangulation procedure and validation of data through primaries, the exact values of the overall parent and each individual market have been determined and confirmed in this study. The data triangulation procedure implemented for this study is explained in the next section.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into the product type segment and application segment. To estimate the overall fats and oils and arrive at the exact statistics for all subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- Determining and projecting the size of the fats & oils market, with respect to type, application, form, source, and regional markets, from 2021 to 2026.

- Analyzing and projecting the optimistic, pessimistic, and realistic impacts of COVID-19 on the market, with respect to type, application, form, source, and regional markets between 2019 and 2022

- Identifying attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Analyzing the micro-markets, with respect to individual growth trends, prospects, and their contribution to the total market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Application Analysis

- Application analysis, which gives a detailed analysis of the food and non-food applications in the fats & oils market

Regional Analysis

- Further breakdown of the Rest of Europe fats & oils market into Ireland., Norway, Austria, Denmark, and Poland

- Further breakdown of the Rest of Asia Pacific fats & oils market into Australia, Pakistan, Vietnam, Japan, Thailand, and Russia

- Further breakdown of the RoW fats & oils market into Latin America, Middle Eastern countries and Africa

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Fats and Oils Market

I would like to know the market size of Unsaturated fats and oils from vegetables, in Austria