Fire Protection System Market by Fire Suppression, Smoke Detector (Photoelectric, Ionization, Beam), Flame Detector (IR, UV), Heat Detector, Sprinkler (Wet, Dry, Deluge), Fire Response & Analysis, Service, Vertical and Region - Global Forecast to 2029

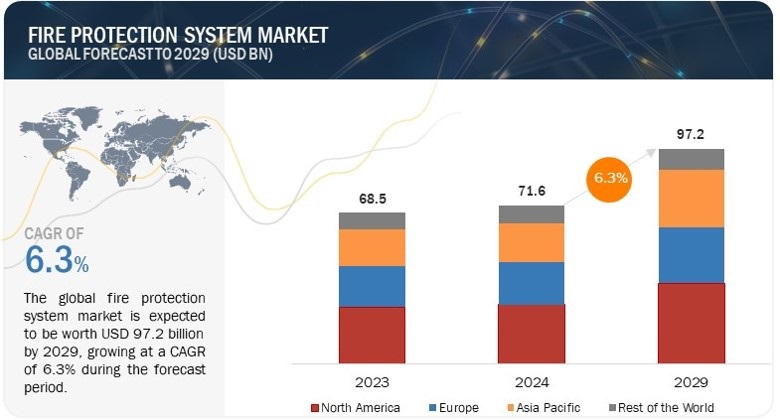

[284 Pages Report] The fire protection system market size is predicted to grow from USD 71.6 billion in 2024 to USD 97.2 billion by 2029, at a CAGR of 6.3%. An efficient fire protection management involves the combined efforts of federal custodians and tenants, private sector building owners, and fire protection programs (FPP) within the labor program and local fire service agencies. With the increased risk of fire accidents, government agencies are taking several measures to minimize losses. Policies and regulations imposed by the governments and concerned authorities for fire safety are specific to a respective region and are meant to safeguard human lives and property.

Attractive Opportunities in the Fire Protection System Market

Fire Protection System Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

DRIVERS: Surge in residential and commercial infrastructure development

The construction industry in developing countries has seen significant growth in new and retrofit infrastructure, leading to an increase in the use of construction equipment. Facility management in developing nations has made tremendous advancements in recent years, especially in building automation. Fire protection systems are commonly installed in buildings, as these systems are useful in detecting, containing, and extinguishing fires at an early stage. Advanced technologies have been developed for communicating during fires, which leads to quick deployment of response teams. Many players are investing in such technologies. For example, Honeywell International Inc. offers a 5104-fire control communicator and a six-zone fire alarm communicator, providing digital fire reporting over normal telephone lines. This fire control communicator can be used to monitor existing local fire alarm control panels or as a standalone unit for sprinkler supervisory.

RESTRAINTS: Issues of false alarms and detection failures High installation and maintenance costs

High costs associated with installing and maintaining fire protection systems are due to several factors. Firstly, the technology and materials used in modern fire protection systems are often advanced and specialized, leading to higher upfront expenses. This includes the cost of fire detection devices, sprinkler systems, fire extinguishers, and other components. Additionally, the installation process for these systems requires skilled professionals with fire safety engineering expertise, leading to higher labor costs. Moreover, high initial investments are required to implement fire protection systems, as the networks are complex, and sophisticated tools are needed to counter fire situations. Due to this, vendors need to upgrade their solutions and develop new technologies regularly.

OPPORTUNITIES: Increasing government initiatives to upgrade building codes

Authorities in many developed countries, such as the US, Canada, and Japan, have updated their building codes to include requirements related to fire suppression system installations. For example, the Sarbanes-Oxley Act has expanded the responsibilities of executive leadership beyond financial reporting to encompass all areas of risk management, including safety concerns. Consequently, firms are investing millions of dollars to assess and address weaknesses in their fire suppression systems, particularly in areas lacking firefighting infrastructure. In the UK, the Fire Safety Act was granted Royal Assent on April 29, 2021, and came into effect on May 16, 2022. The Act amends the Regulatory Reform Order 2005 and the Fire Safety Order. Under this Act, responsible persons (RPs) living in residential buildings must manage and reduce the fire risk for the structure and external walls of the building, including cladding, windows, balconies, and entrance doors to individual flats that open into common parts. Revised building codes now mandate the installation of fire alarm equipment in all offices, commercial and manufacturing sites, and educational and entertainment buildings. These revisions are due to the increasing demand for fire alarm equipment in the overall market. Buildings undergoing renovation are also included in the updated codes, further driving market growth.

CHALLENGES: Addressing ever-evolving regulatory requirements

Manufacturers and installers in the fire protection system market face substantial challenges while navigating the ever-changing regulatory landscape. Compliance can be complex and expensive due to varying standards across regions. Companies must keep themselves updated with changes and adapt quickly to ensure compliance. They also need to monitor regulatory updates and guidance documents from relevant authorities. Common challenges include uncertainties in regulatory language, resource constraints, and the need to interpret and implement new regulations efficiently. Adherence to regulatory compliance is crucial to safeguard organizations from legal and financial risks and foster continuous improvement. Embracing technology-driven solutions and staying ahead of regulatory challenges are essential for enduring success in this industry.

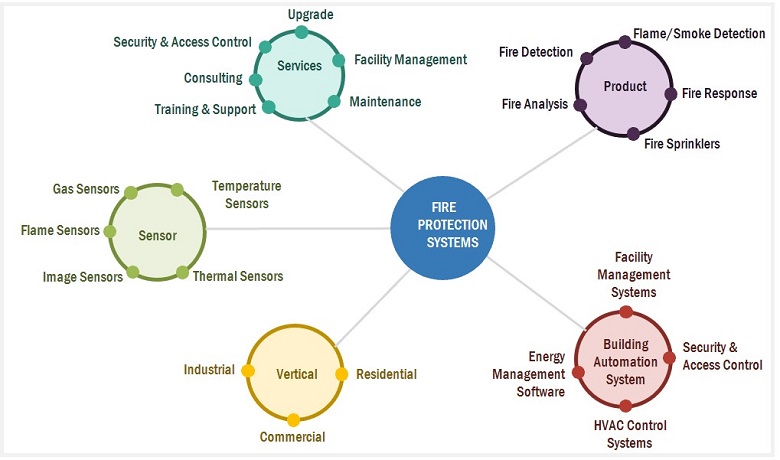

The Fire Protection System Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers such as Carrier (US), Honeywell International Inc. (US), Johnson Controls (Ireland), Robert Bosch GmbH (Germany), and Siemens (Germany). These companies have been operating in the market for several years and possess a diversified product portfolio and strong global sales and marketing networks.

The fire analysis segment to grow with the highest CAGR during the forecast period.

A fire protection system can work effectively if a proper analysis of events is done. Fire analysis is an important part of fire protection, facilitating informed decisions that maximize efficiency. It uses various software and technology solutions, such as fire mapping, analysis, and fire modeling and simulation software. Fire protection systems demand real-time information and analysis of the situation to allocate resources properly for minimal damage. Fire mapping and analysis software provides an interactive map display with a real-time system for decision-makers to make decisions efficiently and quickly during fire-related situations. Mapping helps provide a spatial representation of data, presenting groupings and associations unclear in a standard data view. Users can merge emergency equipment, boundaries, and topographic data into one display on the map for an immediate snapshot of all the resources in a specific region. Companies, such as Insight Numerics, LLC (US) and BakerRisk (US), provide fire mapping and analysis software.

The market for residential vertical is expected to gain substantial market share during forecast period.

Fire protection systems are highly effective and reliable elements in residential buildings, apartments, or individual units. Installing these systems in residential buildings has become common as they effectively detect, contain, and extinguish fires at an early stage. In the residential space, fire sprinkler systems that comprise a water supply, a water delivery system, and a water distribution system with water, pipes, and sprinkler heads are common. There is a growing need for retrofitting fire protection systems in residential buildings. Retrofitting involves adding new or updated fire protection systems to existing buildings, such as sprinklers, fire alarms and suppression systems. The retrofit process is tailored to meet the requirements of renovations and outdated systems. The increase in the world’s population has led to a rise in the demand for housing, driving the construction industry. These systems are installed to combat fire breakouts in critical environments. As residential construction activity increases worldwide, the demand for fire protection systems is expected to grow.

Fire Protection System Market by Region

To know about the assumptions considered for the study, download the pdf brochure

The fire protection system market in Asia Pacific has been studied for China, Japan, South Korea, and the Rest of Asia Pacific. The demand for fire protection systems is expected to increase due to technological and economic advancements. Moreover, growing urbanization has increased construction activities, contributing significantly to the growth of the market. Governments in this region have laid down fire safety norms, and the fire protection system market is expected to grow with the execution of these policies. China Fire Protection Association, Fire and Security Association of India (FSAI), and Japan Fire Retardant Association (JFRA) have developed fire safety norms. HOCHIKI Corporation, Johnson Controls, Carrier, and Eaton are a few companies in Asia Pacific that manufacture, design, install, and maintain fire protection systems.

Key Market Players

Carrier (US), Honeywell International Inc. (US), Johnson Controls (Ireland), Robert Bosch GmbH (Germany), and Siemens (Germany) are among a few top players in the fire protection system companies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size Available for Years |

2020–2029 |

|

Base Year |

2023 |

|

Forecast Period |

2024–2029 |

|

Units |

Value (USD Million/Billion) |

|

Segments Covered |

Type, Product, Service, and Vertical |

|

Geographic Regions Covered |

North America, Asia Pacific, Europe, and RoW |

|

Companies Covered |

Major Players: Carrier (US), Honeywell International Inc. (US), Johnson Controls (Ireland), Robert Bosch GmbH (Germany), Siemens (Germany), Halma plc (UK), HOCHIKI Corporation (Japan), Gentex Corporation (US), Eaton (Ireland), Teledyne Technologies Incorporated (US) and Others- (Total 30 players have been covered) |

Fire Protection System Market Highlights

This research report categorizes the fire protection system market by type, product, service, vertical and region.

|

Segment |

Subsegment |

|

By Type: |

|

|

By Product: |

|

|

By Service: |

|

|

By Vertical: |

|

|

By Region |

|

Recent Developments

- In June 2023, Kidde, the brand of Carrier expanded its HomeSafe line with three new devices, enhancing its integrated home health and safety product range. Utilizing Kidde HomeSafe technology and connected to the Kidde app, these smart detection products offer instant notifications for threats, such as smoke, carbon monoxide (CO), and indoor air quality (IAQ) issues.

- In December 2023, Siemens through its Smart Infrastructure segment enhanced its fire safety capabilities on Building X by introducing new applications and an API. This development aims to boost transparency, reduce incident response times, and improve maintenance processes for service providers within the digital building platform, contributing to an enhanced user experience, increased performance, and improved sustainability as part of Siemens Xcelerator.

- In December 2021, Honeywell International Inc. announced its acquisition of US Digital Designs, Inc., a leading alerting, and dispatch communications solutions provider. This acquisition will help grow the fire and connected life safety systems business.

Frequently Asked Questions(FAQs):

What is the total CAGR expected to be recorded for the fire protection system market during 2024-2029?

The global fire protection system market is expected to record a CAGR of 6.3% from 2024–2029.

What are the driving factors for the fire protection system market?

Expanding infrastructure and rising urbanization and strict government regulations pertaining to fire protection are the key driving factor for this fire protection system market.

Which vertical will grow at a fast rate in the future?

Industrial vertical is expected to grow at the highest CAGR during the forecast period.

Which are the significant players operating in the fire protection system market?

Carrier (US), Honeywell International Inc. (US), Johnson Controls (Ireland), Robert Bosch GmbH (Germany), and Siemens (Germany) are among a few top players in the fire protection system market.

Which region will grow at a fast rate in the future?

The fire protection system market in Asia Pacific is expected to grow at the highest CAGR during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

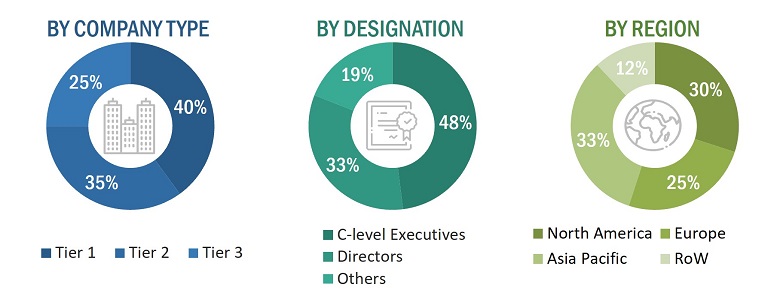

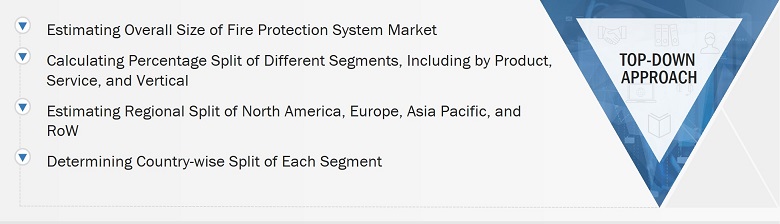

The study involved four major activities in estimating the current size of the fire protection system market. Exhaustive secondary research has been done to collect information on the market, peer, and parent markets. The next step has been to validate these findings and assumptions and size them with industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the total market size. After that, market breakdown and data triangulation methods were used to estimate the market size of segments and subsegments. Two sources of information—secondary and primary—have been used to identify and collect information for an extensive technical and commercial study of the fire protection system market.

Secondary Research

Secondary sources include company websites, magazines, industry news, associations, and databases (Factiva and Bloomberg). These secondary sources include annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

Primary sources mainly consist of several experts from the core and related industries, along with preferred fire protection system providers, distributors, alliances, standards, and certification organizations related to various segments of this industry’s value chain.

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts such as Chief Experience Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from fire protection system providers, such as Carrier (US), Honeywell International Inc. (US), Johnson Controls (Ireland), Robert Bosch GmbH (Germany), and Siemens (Germany); research organizations, distributors, industry associations, and key opinion leaders. Following is the breakdown of primary respondents.

The breakdown of primary respondents is provided below.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the fire protection system market. These methods have also been used extensively to estimate the size of various subsegments in the market. The following research methodology has been used to estimate the market size:

- Major players in the industry and markets have been identified through extensive secondary research.

- The industry’s value chain and market size (in terms of value) have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Top-Down Approach

In the top-down approach, the overall market size has been used to estimate the size of the individual market segments (mentioned in market segmentation) through percentage splits from secondary and primary research. For specific market segments, the size of the most appropriate immediate parent market has been used to implement the top-down approach. The bottom-up approach has also been implemented for data obtained from secondary research to validate the market size of various segments.

Fire Protection System Market: Top-Down Approach

Bottom-Up Approach

The bottom-up approach has been used to arrive at the overall size of the fire protection system market from the revenues of the key players and their market shares. Calculations based on revenues of key companies identified in the market led to the estimation of their overall market size.

Fire Protection System Market: Bottom-up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Market Definition

Fire protection systems are a set of connected devices or systems used to prevent fire accidents. These systems reduce the impact of uncontrolled fires, saving lives and property. They comprise fire detection, fire suppression, fire sprinkler, fire analysis, and fire response systems required during fire emergencies. The scope of this market includes products, software, and services, as mentioned in the table below. The services market covers various post-sales, installation, maintenance, and other services offered according to customer requirements and application areas.

Key Stakeholders

- Raw Material Suppliers

- Electronic Design Automation (EDA) and Design Tool Vendors

- Government Bodies, Venture Capitalists, and Private Equity Firms

- Integrated Device Manufacturers (IDMs)

- Fire Protection System Technology Platform Developers

- Fire Protection System Component Manufacturers

- Fire Protection System Original Equipment Manufacturers (OEMs)

- Assembly, Testing, and Packaging Vendors

- System Integrators

- Distributors and Traders

- Research Organizations

- Organizations, Forums, Alliances, and Associations

- End Users

Report Objectives

- To define and forecast the fire protection system market regarding type, product, and services.

- To describe and forecast the fire protection system market and its value segments for four regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW), along with their respective countries.

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the market growth

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall market size

- To study the complete value chain of the fire protection system market

- To analyze opportunities for stakeholders by identifying high-growth segments of the market

- To strategically profile the key players and comprehensively analyze their market positions in terms of their ranking and core competencies along with a detailed market competitive landscape

- To analyze competitive developments, such as product launches, acquisitions, collaborations, agreements, and partnerships, in the market

- To provide an analysis of the recession impact on the growth of the market and its segments

Available Customizations:

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Fire Protection System Market

New technological innovations such as cloud-based technology and 5G technology are creating huge opportunities for the fire protection device manufacturers. Do you have insights on how 5G technology has a positive impact on the growth of fire protection devices in the report?

With the increase in adoption of AR and VR technologies in various industrial applications, firefighters are also adopting VR training, which helps them to see outcomes and develop critical thinking skills. Could you provide more clarification on such type of training information in the report?

Nowadays, drones and UAVs are among of the fastest-growing markets and are used by fire departments as fire alarm resources. Is it possible to get few market trends and size of UAV-based fire protection systems from the report?

Does this analysis also include more specialized systems such as condensed aerosol fire suppression?

A fire in mines, forests, and other industries is a critical issue. Vehicle suppression systems are mostly used to inhibit the fire in heavy equipment used in such industries. I would like to have more information on vehicle suppression systems for APAC and Middle East regions, where these systems has penetrating with a high demand in the market.

Mobile ultrasound fire protection devices are more versatile than fixed monitors. These can be used for fast deployment in a wide range of scenarios and are creating huge opportunities for the growth of the fire protection system market. Could you provide more information on the vendors offering ultrasound fire protection monitors?