Fixed Asset Management Software Market by Components (Software and Services), Organization Size (Large Enterprises, and Small- and Medium-Sized Enterprises), Deployment (On Premise and Cloud) Verticals, and Regions - Global Forecast to 2024

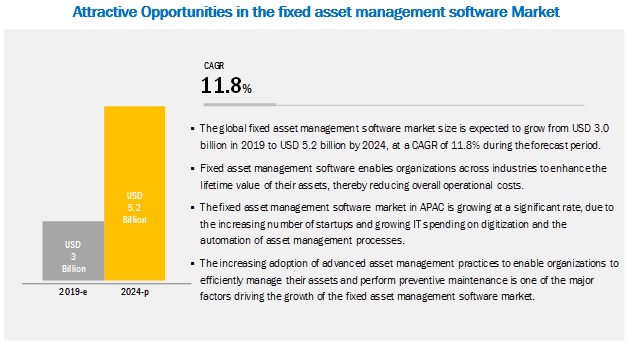

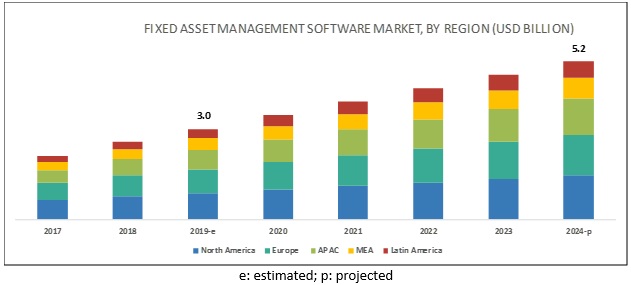

[123 Pages Report] The fixed asset management software market size is expected to grow from USD 3.0 billion in 2019 to USD 5.2 billion by 2024, at a Compound Annual Growth Rate (CAGR) of 11.8% during the forecast period. Preventive maintenance and IoT technology are anticipated to boost the adoption of fixed asset management software, and growing need to reduce operational cost and generate profits through efficient management of assets are the major factors driving the growth of the market.

By vertical, the manufacturing vertical to be a significant contributor in the fixed asset management software market during the forecast period

The fixed asset management software empowers organizations operating in the manufacturing industry to streamline maintenance processes, extend the longevity of assets, and improve productivity. The manufacturing industry has a massive demand for centralized software to manage its huge number of assets. The data collected through the asset performance software helps predict the exact failure point of a critical asset, thereby increasing uptime. Fixed asset management software also helps industrial manufacturers manage maintenance, equipment parts, and inventory. It enables manufacturers to maximize asset control, performance, and return from warranties by managing inspections and audits effectively. Furthermore, the fixed asset management software helps manufacturing organizations improve their plant and machinery maintenance processes.

On-premise type to hold the largest market share during the forecast period

Organizations, wherein assets and information about assets security are critical for business operations, prefer on-premises solutions as they control their systems. The on-premises deployment type is a traditional approach to implement solutions at the premises of an enterprise. Presently, the approach is followed in enterprises where security is the critical aspect of business operations, as it is considered safe when compared to the cloud deployment type. However, the rising cost associated with the maintenance of the on-premises infrastructure is the factor constraining the market over the years. Aerospace & defense, BFSI, and healthcare industries are expected to prefer the on-premises fixed asset management software deployment because they deal with critical and sensitive data related to national security, finance, and healthcare.

Asia Pacific to grow at the highest CAGR during the forecast period

APAC is among the fastest-growing economies and favorable markets for fixed asset management vendors, globally. The fixed asset management market in APAC is driven by the growing acceptance of cloud-based solutions, emerging technologies such as the IoT, as well as big data analytics and mobility. Many countries in the APAC region are likely to adopt fixed asset management solutions that have high demand, specifically in the government, oil & gas, transportation & logistics, healthcare, and energy & utilities industries. With the presence of growing economies, such as China, Japan, Australia, and India, APAC is expected to witness high growth in fixed asset management software implementation. APAC has a huge number of SMEs which are expected to boost the demand for cloud-based fixed asset management software as they are cost-effective. Furthermore, the enterprises in the APAC region are leveraging fixed asset management software to efficiently manage and maintain their assets to increase their return on assets.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

:

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

20172024 |

|

Base year considered |

2018 |

|

Forecast period |

20192024 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Components (software and services), organization size (large enterprises, and small- & medium-sized enterprises), deployment (on-premise and cloud) verticals, and regions |

|

Geographies covered |

North America, APAC, Europe, MEA, and Latin America |

|

Companies covered |

IBM (US), Infor, SAP (Germany), Microsoft (US), Oracle (US), Sage (UK), Infor (US). A total of 16 players were covered. |

This research report categorizes the fixed asset management software market based on components (software and services), organization size (large enterprises, and small- & medium-sized enterprises), deployment (on-premise and cloud) verticals, and regions

By Component

- Software

- Services

By Organization Size

- Large enterprises

- Small- & medium-sized enterprises

Fixed Asset Management Software Market By Vertical:

- Energy and utilities

- Manufacturing

- IT, Telecom and media

- Transportation and logistics

- Healthcare and life science

- Others (BFSI, retail, and government)

By Region:

- North America

- Europe

- APAC

- MEA

- Latin America

Key Fixed Asset Management Software Market Players

The major vendors in the market are IBM (US), Infor (US), SAP (Germany), Microsoft (US), Oracle (US), Sage (UK), Acumatica (US), Aptean (UK), Maintenance Connection (US), IFS (Sweden), eMaint (US), Aveva (UK), Ramco Systems (India), ABB (Switzerland), ,Trust (India), and Mainsaver (US).

Recent Developments:

- In April 2019, Infor entered into an agreement with First Bus. Infor agreed to enhance asset management for First Bus, which is a transport operator in the UK and North America.

Key questions addressed by the report:

- Where would all these developments take the industry in the mid to long term?

- What are the upcoming industry solutions for the fixed asset management software market?

- Which are the major factors expected to drive the market?

- Which region would offer high growth for vendors in the market?

- Which solution would gain the largest market share in the market?

Frequently Asked Questions (FAQ):

What is Fixed Asset Management?

Who are the major vendors in the Fixed Asset Management market?

What regions are expected to dominate the Fixed asset management market?

What is the market size of fixed asset management software market in 2024 ?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

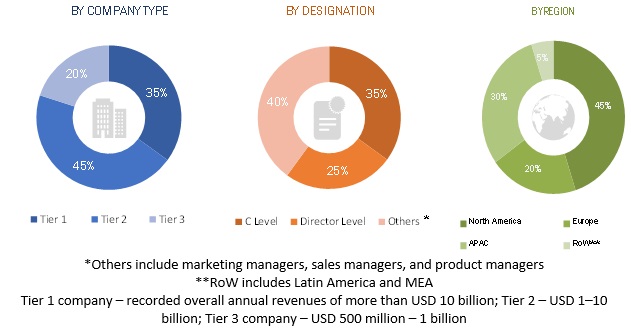

2.1.2.1 Breakup of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

2.3.1 Top-Down Approach

2.3.2 Bottom-Up Approach

2.4 Market Forecast

2.5 Assumptions for the Study

2.6 Limitations of the Study

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 29)

4.1 Attractive Market Opportunities in the Market

4.2 Market in North America, By Industry and Country, 2019

4.3 Fixed Asset Management Software Market: Major Countries

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Preventive Maintenance and IoT Technology to Boost the Adoption of Fixed Asset Management Software

5.2.1.2 Growing Need to Reduce Operational Cost and Proliferate Profits Through Efficient Management of Assets

5.2.2 Restraints

5.2.2.1 Lack of Awareness of Fixed Asset Management Software Benefits

5.2.3 Opportunities

5.2.3.1 Advent of Big Data and Analytics to Increase the Adoption of Fixed Asset Management Software

5.2.3.2 Surge in the Adoption of IoT-Based Solutions to Automate Asset Management

5.2.4 Challenges

5.2.4.1 Tracking of Assets

5.2.4.2 Lack of Skilled Fixed Asset Management Software Professionals

5.3 Use Cases

5.3.1 Oil Spill Response Limited

5.3.2 Ring Container Technologies

5.3.3 Medical Technologies Innovators (MTI)

5.3.4 Fsc Lighting

6 Fixed Asset Management Software Market By Component (Page No. - 37)

6.1 Introduction

6.2 Software

6.2.1 Growing Focus of Organizations on Automating and Enhancing Asset Management Processes to Drive the Demand for Fixed Asset Management Software

6.3 Services

6.3.1 Consulting and Implementation

6.3.1.1 Efficient Deployment of Fixed Asset Management Software as Per the Requirements of Clients to Drive the Growth of Consulting and Implementation Services

6.3.2 Training and Support

6.3.2.1 Growing Focus of Organizations on Improving the Performance of Their Assets to Drive the Growth of Support and Maintenance Services

7 Market By Organization Size (Page No. - 44)

7.1 Introduction

7.2 Large Enterprises

7.2.1 Growing Need Among Large Enterprises to Manage Their Large Number of Assets Driving the Demand for Fixed Asset Management Software

7.3 Small and Medium-Sized Enterprises

7.3.1 Need for A Cost-Effective and Comprehensive Solution to Drive the Adoption of Fixed Asset Management Software Across Small and Medium-Sized Enterprises

8 Fixed Asset Management Software Market By Deployment Type (Page No. - 48)

8.1 Introduction

8.2 On-Premises

8.2.1 Security Concerns Among Enterprises to Drive the Adoption of On-Premises Fixed Asset Management Software

8.3 Cloud

8.3.1 Scalability and Cost-Effectiveness to Be the Major Factors Driving the Adoption of Cloud-Based Fixed Asset Management Software

9 Market By Industry (Page No. - 52)

9.1 Introduction

9.2 Energy and Utilities

9.2.1 Growing Need to Offer Best-In-Class Customer Experience Driving the Growth of Fixed Asset Management Software in the Energy and Utilities Industry

9.3 Manufacturing

9.3.1 Growing Need to Maintain Huge Manufacturing Plants and Machinery Driving the Growth of Fixed Asset Management Software in the Manufacturing Industry

9.4 IT, Telecom, and Media

9.4.1 Growing Need for Utilizing Assets to Full Extent to Drive the Growth of Fixed Asset Management Software in the IT, Telecom, and Media Industry

9.5 Transportation and Logistics

9.5.1 Growing Need to Reduce Vehicle Operational Costs Driving the Growth of Fixed Asset Management Software in the Transportation and Logistics Industry

9.6 Healthcare and Life Sciences

9.6.1 Growing Need to Share Personalized and Updated Compliance-Approved Content With Prospects Driving the Growth of Fixed Asset Management Software in the Healthcare and Life Sciences Industry

9.7 Others

10 Fixed Asset Management Software Market By Region (Page No. - 60)

10.1 Introduction

10.2 North America

10.2.1 United States

10.2.1.1 Growing Adoption of Partnership Strategy and Advanced Technologies to Drive the Growth of Market in the Us

10.2.2 Canada

10.2.2.1 Efficient Management of Assets Throughout Its Life Cycle to Drive the Growth of Market in Canada

10.3 Europe

10.3.1 Germany

10.3.1.1 Advanced IT Infrastructure and Developed Manufacturing Industry to Boost the Growth of Market in Germany

10.3.2 United Kingdom

10.3.2.1 Increasing Adoption of Fixed Asset Management Software By SMEs to Boost the Growth of Market in the Uk

10.3.3 Rest of Europe

10.4 Asia Pacific

10.4.1 Japan

10.4.1.1 Automation of Asset Management Processes Across Industries Transforming Operational Processes to Boost the Adoption of Fixed Asset Management Software in Japan

10.4.2 Australia and New Zealand

10.4.2.1 Growing Need for Enhancing Return on Assets to Drive the Growth of Market in Anz

10.4.3 Rest of Asia Pacific

10.5 Middle East and Africa

10.5.1 Kingdom of Saudi Arabia

10.5.1.1 Growing Adoption of Asset Management Solutions By Large Enterprises to Drive the Growth of Market in Ksa

10.5.2 South Africa

10.5.2.1 Changing Landscape of Businesses to Promote the Growth of Market in South Africa

10.5.3 Rest of Middle East and Africa

10.6 Latin America

10.6.1 Brazil

10.6.1.1 Increasing Awareness About Benefits of Asset Management Solutions to Enhance the Business Operations Driving the Adoption of Fixed Asset Management Software in Brazil

10.6.2 Mexico

10.6.2.1 Enhanced Asset Monitoring Practices By Using Fixed Asset Management Software to Boost the Market in Mexico

10.6.3 Rest of Latin America

11 Competitive Landscape (Page No. - 82)

11.1 Introduction

11.2 Competitive Scenario

11.2.1 New Product/Solution Launches and Product Enhancements

11.2.2 Acquisitions

11.2.3 Partnerships, Agreements, and Collaborations

11.3 Competitive Leadership Mapping

11.3.1 Visionary Leaders

11.3.2 Dynamic Differentiators

11.3.3 Innovators

11.3.4 Emerging Companies

12 Company Profiles (Page No. - 88)

(Business Overview, Products, Services, Solutions & Platform, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

12.1 IBM

12.2 Infor

12.3 SAP

12.4 Microsoft

12.5 Oracle

12.6 Sage

12.7 Aptean

12.8 Maintenance Connection

12.9 IFS

12.10 Acumatica

12.11 Emaint

12.12 Aveva

12.13 Ramco Systems

12.14 ABB

12.15 Mainsaver

12.16 Tracet

*Details on Business Overview, Products, Services, Solutions & Platform, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 116)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets Subscription Portal

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

List of Tables (56 Tables)

Table 1 United States Dollar Exchange Rate, 20152017

Table 2 Factor Analysis

Table 3 Fixed Asset Management Software Market Size, By Component, 20172024 (USD Million)

Table 4 Software: Market Size By Region, 20172024 (USD Million)

Table 5 Services: Market Size By Type, 20172024 (USD Million)

Table 6 Services: Market Size By Region, 20172024 (USD Million)

Table 7 Consulting and Implementation Market Size, By Region, 20172024 (USD Million)

Table 8 Training and Support Market Size, By Region, 20172024 (USD Million)

Table 9 Market Size, By Organization Size, 20172024 (USD Million)

Table 10 Large Enterprises: Market Size By Region, 20172024 (USD Million)

Table 11 Small and Medium-Sized Enterprises: Market Size By Region, 20172024 (USD Million)

Table 12 Market Size By Deployment Type, 20172024 (USD Million)

Table 13 On-Premises: Market Size By Region, 20172024 (USD Million)

Table 14 Cloud: Market Size By Region, 20172024 (USD Million)

Table 15 Fixed Asset Management Software Market Size, By Industry, 20172024 (USD Million)

Table 16 Energy and Utilities: Market Size By Region, 20172024 (USD Million)

Table 17 Manufacturing: Market Size By Region, 20172024 (USD Million)

Table 18 IT, Telecom, and Media: Market Size By Region, 20172024 (USD Million)

Table 19 Transportation and Logistics: Market Size By Region, 20172024 (USD Million)

Table 20 Healthcare and Life Sciences: Market Size By Region, 20172024 (USD Million)

Table 21 Others: Market Size, By Region, 20172024 (USD Million)

Table 22 Market Size, By Region, 20172024 (USD Million)

Table 23 North America: Market Size By Component, 20172024 (USD Million)

Table 24 North America: Market Size By Service, 20172024 (USD Million)

Table 25 North America: Market Size By Organization Size, 20172024 (USD Million)

Table 26 North America: Market Size By Deployment Type, 20172024 (USD Million)

Table 27 North America: Market Size By Industry, 20172024 (USD Million)

Table 28 North America: Market Size By Country, 20172024 (USD Million)

Table 29 Europe: Fixed Asset Management Software Market Size, By Component, 20172024 (USD Million)

Table 30 Europe: Market Size By Service, 20172024 (USD Million)

Table 31 Europe: Market Size By Organization Size, 20172024 (USD Million)

Table 32 Europe: Market Size By Deployment Type, 20172024 (USD Million)

Table 33 Europe: Market Size By Industry, 20172024 (USD Million)

Table 34 Europe: Market Size By Country, 20172024 (USD Million)

Table 35 Asia Pacific: Market Size, By Component, 20172024 (USD Million)

Table 36 Asia Pacific: Market Size By Service, 20172024 (USD Million)

Table 37 Asia Pacific: Market Size By Organization Size, 20172024 (USD Million)

Table 38 Asia Pacific: Market Size By Deployment Type, 20172024 (USD Million)

Table 39 Asia Pacific: Market Size By Industry, 20162023 (USD Million)

Table 40 Asia Pacific: Market Size By Country, 20172024 (USD Million)

Table 41 Middle East and Africa: Fixed Asset Management Software Market Size, By Component, 20172024 (USD Million)

Table 42 Middle East and Africa: Market Size By Service, 20172024 (USD Million)

Table 43 Middle East and Africa: Market Size By Organization Size, 20172024 (USD Million)

Table 44 Middle East and Africa: Market Size By Deployment Type, 20172024 (USD Million)

Table 45 Middle East and Africa: Market Size By Industry, 20172024 (USD Million)

Table 46 Middle East and Africa: Market Size By Country, 20172024 (USD Million)

Table 47 Latin America: Market Size, By Component, 20172024 (USD Million)

Table 48 Latin America: Market Size By Service, 20172024 (USD Million)

Table 49 Latin America: Market Size By Organization Size, 20172024 (USD Million)

Table 50 Latin America: Market Size By Deployment Type, 20172024 (USD Million)

Table 51 Latin America: Market Size By Industry, 20172024 (USD Million)

Table 52 Latin America: Market Size By Country, 20172024 (USD Million)

Table 53 New Product/Solution Launches and Enhancements, 20182019

Table 54 Acquisitions, 20172019

Table 55 Partnerships, Agreements, and Collaborations, 20182019

Table 56 Evaluation Criteria

List of Figures (30 Figures)

Figure 1 Fixed Asset Management Software Market: Research Design

Figure 2 Market Top-Down and Bottom-Up Approaches

Figure 3 Segments With A Higher Market Share in the Market in 2019

Figure 4 North America to Account for the Highest Market Share in 2019

Figure 5 Growing Focus of Organizations on Optimizing Asset Utilization and Increasing Return on Assets to Drive the Growth of Market

Figure 6 Energy and Utilities Industry, and United States to Account for High Market Shares in the North American Market in 2019

Figure 7 Australia and New Zealand to Grow at the Highest CAGR During the Forecast Period

Figure 8 Drivers, Restraints, Opportunities, and Challenges: Fixed Asset Management Software Market

Figure 9 Services Segment to Grow at A Higher CAGR During the Forecast Period

Figure 10 Training and Support Segment to Grow at A Higher CAGR During the Forecast Period

Figure 11 Small and Medium-Sized Enterprises Segment to Grow at A Higher CAGR During the Forecast Period

Figure 12 Cloud Segment to Grow at A Higher CAGR During the Forecast Period

Figure 13 Healthcare and Life Sciences Industry to Grow at the Highest CAGR During the Forecast Period

Figure 14 Asia Pacific to Witness Significant Growth During the Forecast Period

Figure 15 North America: Market Snapshot

Figure 16 Asia Pacific: Market Snapshot

Figure 17 Key Developments By Leading Players in the Market, 20172019

Figure 18 Fixed Asset Management Software Market (Global) Competitive Leadership Mapping, 2018

Figure 19 IBM: Company Snapshot

Figure 20 IBM: SWOT Analysis

Figure 21 Infor: Company Snapshot

Figure 22 Infor: SWOT Analysis

Figure 23 SAP: Company Snapshot

Figure 24 SAP: SWOT Analysis

Figure 25 Microsoft: Company Snapshot

Figure 26 Microsoft: SWOT Analysis

Figure 27 Oracle: Company Snapshot

Figure 28 Oracle: SWOT Analysis

Figure 29 Sage: Company Snapshot

Figure 30 IFS: Company Snapshot

The study involved four major steps to estimate the current market size for the fixed asset management software market. The exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. Post that, market breakup and data triangulation were used to estimate the market size of the segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, have been referred for, to identify and collect information for this study. These secondary sources included annual reports, press releases, and investor presentations of companies; white papers, technology journals, and certified publications; and articles from recognized authors, directories, and databases.

Primary Research

The fixed asset management software market comprises several stakeholders, such as fixed asset management software providers, cloud service providers, system integrators, resellers and distributors, government agencies, enterprise users, technology providers, and venture capitalists, private equity firms, and startup companies. The extensive primary research was conducted to gather information and verify and validate the concluded numbers. Primary research was also undertaken to identify the segmentation types; industry trends; key players; the competitive landscape of different market players; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies. Following is the breakup of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Fixed Asset Management Software Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the overall size of the market. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and the market have been identified through extensive secondary research.

- The expenditures of the fixed asset management software market across the key regions, along with the geographic split in various segments, have been considered, to arrive at the overall market size.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above the market was split into several segments and sub-segments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and sub-segment, data triangulation, and market breakup procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the fixed asset management software industry.

Report Objectives:

- To define, describe, and forecast the fixed asset management software market by component, organization size, deployment type, vertical, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze the opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of the segments with respect to five main regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile the key players and comprehensively analyze their market rankings and core competencies2

- To analyze competitive developments, such as new partnerships, new contracts, and new product developments, in the market

2Core competencies of the companies have been captured in terms of their key developments and key strategies adopted by them to sustain their positions in the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the North American market into the US and Canada

- Further breakup of the European market into the UK, France, and Rest of Europe

- Further breakup of the APAC market into China, Japan, and Rest of APAC

- Further breakup of the MEA market into Africa and the Middle East

- Further breakup of the Latin American market into Brazil, Mexico, and Rest of Latin America

Company Information

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Fixed Asset Management Software Market