Flame Detector Market Size, Share, Statistics and Industry Growth Analysis Report by Product (Single UV, single IR, Dual UV/IR, Triple IR, Multi IR), Connectivity, Industry (Oil & Gas, Energy & Power, Pharmaceuticals, Chemicals, Aerospace & Defense, Marine, Logistics, Automotive) & Region - Global Growth Driver and Industry Forecast to 2027

Updated on : April 04, 2024

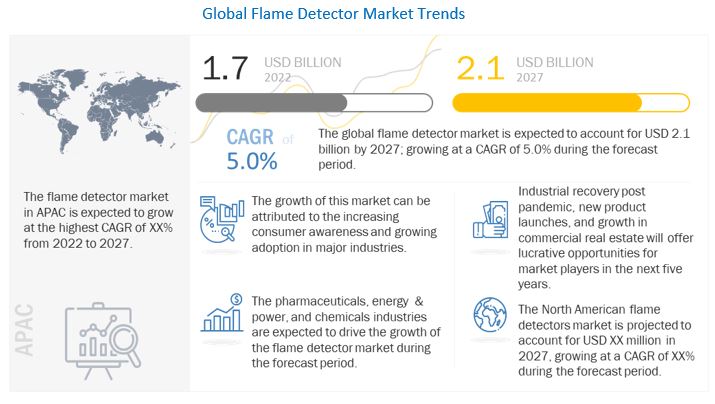

The global flame detector market size is expected to grow from USD 1.7 billion in 2022 to USD 2.1 billion by 2027, at a CAGR of 5.0% during the forecasted period. The growing technology implementation, rise in adoption from key industries, and the strict policies, and regulations for fire protection are the key drivers for the flame detectors.

To know about the assumptions considered for the study, Request for Free Sample Report

Flame Detector Market Dynamics

DRIVERS: Policies, regulations, and government initiatives

Flame detection is a risk avoidance and management practice which helps to reduce and avoid the risk of fire in public and private infrastructure. It involves the combined efforts of federal custodians and tenants, private building owners, and local fire service agencies. Fire safety and protection policies and regulations are generally country-specific and vary with respect to each country; however, they are meant to improve the safety of assets and humans. For example, the National Fire Protection Association’s Standard 86 states that no flame detectors are applicable up to 1400 degrees (Fahrenheit). This is because, as the air/fuel mixture is flammable, it will burn above that temperature, and the combustor temperature will be sufficient to detect the radiation of the flame. As a result of increased fire hazards, government agencies worldwide are keen to apply measures and reduce losses caused by fire. Thus, this contributes to the increased installations of flame safety systems, which in turn drives the growth of the flame detector market.

RESTRAINT: High initial investment in fire safety systems

The implementation of fire protection systems asks for high initial investment. This is primarily due to the complex nature of networks and the high quality of equipment required for emergency management. Additionally, the manufacturers also invest heavily for research and product development to offer innovative technology and most reliable fire protection systems. High investment trickles down to customers in the form of higher costs for fire protection systems. Flame detectors, in general, are complex and have a high cost. On average, the cost of flame detectors ranges from USD 300 to USD 3000. Additionally, regular service checks increase the operational cost of flame detectors. SMEs are growing rapidly across the globe and also require advanced sensing and detection equipment for operation. As SMEs generally look for affordable but effective solutions, the high investment cost of flame detectors poses a restraint.

OPPORTUNITIES: Growth in commercial real estate

Commercial real estate is one of the areas that has bounced back well since the initial impact of the pandemic. The pandemic has accelerated the shift from offline, in-store retail to online, e-commerce logistics, driving the demand for warehouse- and logistics-focused properties. It is observed that globally the development of logistics, industrial, and warehouse spaces has increased in the last three years and is estimated to continue for the next few years. Currently, some core markets such as warehouse/distribution, manufacturing, and technology are experiencing an industrial space crunch leading to increasing demand and growth in commercial real estate. As the industrial real estate grows, the opportunity for building and fire safety systems is expected to increase as this industry has a higher focus on building, asset, and personnel safety. Thus, the rising demand and growth in commercial real estate is a great opportunity for the flame detector industry.

CHALLENGES: Introduction of hydrogen blended gas streams

The introduction of new equipment and the transition to alternative fuels bring significant challenges for optical flame detection. Hydrogen is seen by industry leaders as a way to reduce society’s dependence on fossil fuels. Many natural gas distribution companies are exploring the possibility of introducing hydrogen into gas streams. Although the transition to a non-carbon-based gas network is distant, the shift toward the goal has started. This shift can affect fire safety products used within the distribution network. IR flame detectors are significantly used for natural gas fires. These detectors primarily monitor a small band of radiation that focuses on the emissions of hot carbon dioxide. The addition of hydrogen in a natural gas stream helps to reduce the carbon footprint and reduces the detection distance for the same size fire. This may lead to flame detection coverage gaps in a facility. In the instances where hydrogen completely replaces natural gas, the same IR flame detectors will not be able to detect fires. This is a challenge for the flame detector market

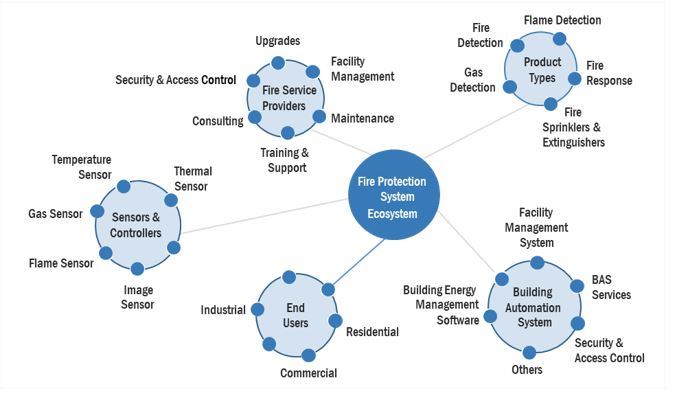

Flame Detector Market Ecosystem

Single UV flame detector to have the highest market share during the forecast period

The market for single UV flame detectors in expected to have the highest market share over the forecast period. This is due to the high demand from the oil and gas and energy and power industries or this detector. These are the preferred general purpose flame detectors as all fires emit UV radiations. The cost of UV flame detectors is also lower compared to the newer dual UV/IR or triple IR flame detectors. Additionally, the supply of single UV flame detectors is higher compared to the other new flame detectors and they are easily available to the consumers.

Pharmaceutical industry to observe the fastest growth rate during the forecast period

The pharmaceutical industry is expected to be the fastest growing market for flame detectors implementation during the forecast period. The increasing use of various chemicals and products that emit fumes along with the rigorous lab testing and research conducted in the pharmaceutical industry are driving the demand for flame detectors. The substantial investment in the pharmaceutical industry due to the pandemic has allowed the pharmaceutical industry to expand and this has also driven the demand for flame detectors.

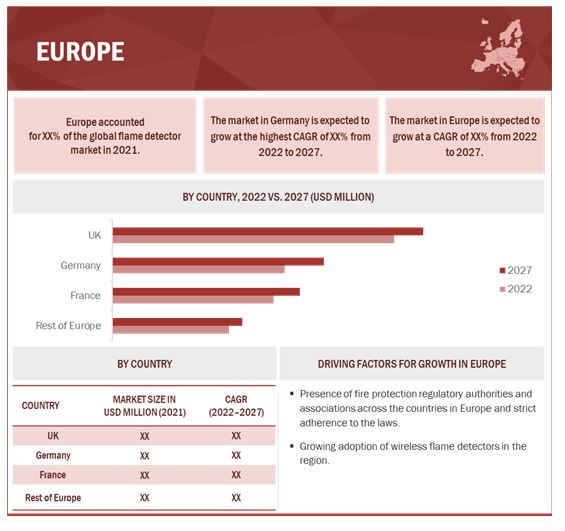

Europe to hold the second largest market during the forecast period

Europe is expected to hold the second largest market share during the forecast period. The technology adoption in the flame detector market is the highest in the European region. Europe is an organized market with the presence of all the stakeholders within the flame detector value chain. The strict policies, regulations and laws implemented in the European region also drive the high demand for flame detectors in the region. The small and medium sized companies are rapidly growing in the European region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The flame detector companies are dominated by a few globally established players such as Johnson Controls (Ireland), Siemens (Germany), MSA (US), Honeywell (US), and Halma (UK), Hochiki (Japan), Carrier Global (US), Emerson Electric (US), Robert Bosch (Germany), Draeger (Germany), Teledyne Technologies (US), and Nohmi Bosai (Japan) among others.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size availability for years |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

By product, by connectivity, by industry |

|

Geographies covered |

Asia Pacific, Europe, North America, and Rest of the World |

|

Companies covered |

The major market player includes Johnson Controls (Ireland), Siemens (Germany), MSA (US), Honeywell (US), and Halma (UK), Emerson Electric (US), Robert Bosch (Germany), Draeger (Germany), Teledyne Technologies (US), and Hochiki (Japan) among others. |

The study categorizes the flame detector market based on product, connectivity, industry, and region at the global level.

By Product

- Single UV

- Single IR

- Dual UV/IR

- Triple IR

- Multi IR

By Connectivity

- Wired

- Wireless

By Industry

- Oil & Gas

- Energy & Power

- Chemicals

- Aerospace & Defense

- Logistics

- Mining

- Automotive

- Pharmaceuticals

- Marine

- Other Industries

By Region

- North America

- Europe

- Asia Pacific

-

Rest of the World

- Middle East & Africa

- South America

Recent Developments

- In August 2021, Johnson Controls announced the release of the ZETTLER PROFILE Lite range of addressable fire alarm control panels in South Africa, the Czech Republic, and the Middle East. The two new addressable panel models, Pro215 Lite and Pro415 Lite, have color LCD screens with 32 zonal LEDs integrated into a simple interface that reduces operator errors.

- In June 2021, Spectrex launched the SharpEye 40/40D and C series flame detectors that provide optimum protection against hydrocarbon-based fuel and gas fires, hydroxyl, and hydrogen fires, as well as metal and inorganic fires. The detectors provide early warning of fires at long distances in record time and with high immunity to false alarms. The detectors feature new QuadSenseTM technology with enhanced performance. Furthermore, the SharpEye 40/40D offers the longest distance detection of hydrocarbon fires at up to 300 ft (90 m) in under 50 ms with high reliability.

- In February 2021, Apollo Fire Detectors launched a new range of flush-mounted, EN54-7-approved fire detectors for the international market. The fire detector range, Soteria Dimension, consists of two optical fire detectors which use chamber-less technology to protect challenging applications.

- In January 2020, MSA designed a General Monitors FL500-H2 Flame Detector for the protection of oil & gas refineries, chemical plants, fuel stations, and other sites managing large volumes of gas. The detector monitors optical radiation emitted by H2 flame in the UV and IR spectral ranges while rejecting false alarm sources common within industrial job sites.

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded for the flame detector market during forecasted?

The global flame detector market is forecasted to reach USD 2.1 billion in 2027, growing at a CAGR of 5.0% from 2022–2027. This growth attributed to the growing demand from key industries such as oil and gas, energy and power and pharmaceuticals.

What are some of the technology trends of flame detector market?

The recent trends of the flame detector market include Artificial Intelligence (AI), Industrial Internet of Things (IIoT), Visual flame detection.

What hardware components are covered in flame detector market?

The hardware of flame detectors include UV sensor, IR sensor, laser diodes, laser diode modules, LEDs, thermopile detector, pyroelectric detector, avalanche photodiode and other electrical, electronic, and mechanical components.

Who are the winners in the global flame detector market?

Johnson Controls (Ireland), Carrier Global (US), Honeywell (US), Siemens (Germany), and Halma (UK), fall under the winner category in the flame detector market.

Which region will lead the flame detector market in the future?

North America is expected to lead the flame detector market during the forecast period. Owing to increasing adoption of flamed detectors in various industries, strict government regulations and the rapid infrastructure development in the region are the key factors expected to drive the growth.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.3 INCLUSIONS AND EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 MARKETS COVERED

FIGURE 1 FLAME DETECTOR MARKET SEGMENTATION

1.4.2 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 2 FLAME DETECTOR MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 List of major secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primaries

2.1.2.2 Key data from primary sources

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.1.3.1 Key industry insights

2.2 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE OF PRODUCTS/SOLUTIONS/SERVICES IN FLAME DETECTOR MARKET

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size using bottom-up analysis

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for arriving at market size using top-down analysis

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 7 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 42)

FIGURE 8 SINGLE UV SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2022

FIGURE 9 PHARMACEUTICALS INDUSTRY TO REGISTER FASTEST GROWTH DURING FORECAST PERIOD

FIGURE 10 FLAME DETECTOR MARKET TO WITNESS FASTEST GROWTH IN APAC DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 BRIEF OVERVIEW OF FLAME DETECTOR MARKET

FIGURE 11 INCREASING HUMAN AND PROPERTY LOSS DUE TO FIRE BREAKOUTS TO BOOST MARKET

4.2 FLAME DETECTOR MARKET, BY PRODUCT

FIGURE 12 SINGLE UV TO DOMINATE FLAME DETECTOR MARKET FROM 2022

4.3 FLAME DETECTOR MARKET, BY INDUSTRY AND REGION

FIGURE 13 OIL & GAS AND NORTH AMERICA ACCOUNTED FOR LARGEST SHARES IN 2021

4.4 FLAME DETECTOR MARKET, BY REGION

FIGURE 14 US HELD LARGEST SHARE OF FLAME DETECTOR MARKET IN 2021

5 MARKET OVERVIEW (Page No. - 48)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 GROWING ADOPTION OF FLAME DETECTORS ACROSS VARIOUS MANUFACTURING INDUSTRIES

5.2.1 DRIVERS

FIGURE 16 IMPACT OF DRIVERS ON FLAME DETECTOR MARKET

5.2.1.1 Increasing adoption across key industries to drive demand

5.2.1.2 Technology improvement in flame detectors

5.2.1.3 Policies, regulations, and government initiatives

5.2.2 RESTRAINTS

FIGURE 17 IMPACT OF RESTRAINTS ON FLAME DETECTOR MARKET

5.2.2.1 High initial investment in fire safety systems

5.2.2.2 Concerns related to false alarm and detection failure

5.2.3 OPPORTUNITIES

FIGURE 18 IMPACT OF OPPORTUNITIES ON FLAME DETECTOR MARKET

5.2.3.1 Rising investments for the development of industrial sector post-pandemic

5.2.3.2 Integration of flame detectors with IoT and big data

5.2.3.3 Growth in commercial real estate

5.2.4 CHALLENGES

FIGURE 19 IMPACT OF CHALLENGES ON FLAME DETECTOR MARKET

5.2.4.1 Integration of user interfaces in fire detection solutions

5.2.4.2 Introduction of hydrogen blended gas streams

5.3 VALUE CHAIN ANALYSIS

FIGURE 20 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED BY MANUFACTURERS AND SYSTEM INTEGRATORS

5.4 ECOSYSTEM

FIGURE 21 FLAME DETECTOR ECOSYSTEM

TABLE 1 COMPANIES AND THEIR ROLES IN FLAME DETECTOR ECOSYSTEM

5.5 PRICING ANALYSIS

5.5.1 AVERAGE SELLING PRICE, BY PRODUCT

FIGURE 22 AVERAGE SELLING PRICE BY KEY PLAYERS FOR MAJOR PRODUCT TYPES (USD)

TABLE 2 AVERAGE SELLING PRICE BY KEY PLAYERS FOR MAJOR PRODUCT TYPES (USD)

5.5.2 BUYING CRITERIA

FIGURE 23 KEY BUYING CRITERIA FOR TOP 3 INDUSTRIES

TABLE 3 KEY BUYING CRITERIA FOR TOP 3 INDUSTRIES

5.6 TREND ANALYSIS

5.6.1 MULTI-SPECTRUM QUAD-SENSE FLAME DETECTOR

5.6.2 INTELLIGENT VIDEO FLAME DETECTORS

5.6.3 FLAME DETECTION USING GCI CAMERAS

5.6.4 SATELLITE FIRE DETECTION AND ALERTING SYSTEM

5.6.5 VISUAL IMAGE DETECTION

5.6.6 SMART DETECTORS

5.7 REVENUE SHIFT AND NEW REVENUE POCKETS FOR FLAME DETECTOR MARKET

FIGURE 24 REVENUE SHIFT IN FLAME DETECTOR MARKET

5.8 TECHNOLOGY ANALYSIS

5.8.1 ARTIFICIAL INTELLIGENCE (AI)

5.8.2 INTERNET OF THINGS (IOT)

5.8.3 MULTI-SPECTRUM IR (MSIR) FLAME DETECTION TECHNOLOGY

5.8.4 INTELLIGENT VISUAL FLAME DETECTION

5.9 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 PORTER’S FIVE FORCES IMPACT ON FLAME DETECTOR MARKET

FIGURE 25 PORTER’S FIVE FORCES ANALYSIS: FLAME DETECTOR MARKET

5.9.1 THREAT OF NEW ENTRANTS

5.9.2 THREAT OF SUBSTITUTES

5.9.3 BARGAINING POWER OF SUPPLIERS

5.9.4 BARGAINING POWER OF BUYERS

5.9.5 DEGREE OF COMPETITION

5.10 KEY STAKEHOLDERS

5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 26 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 END USES

TABLE 5 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 END USES (%)

5.11 CASE STUDY

5.11.1 USE CASE 1: WINGATE INSTITUTE

5.11.2 USE CASE 2: OIL AND GAS REFINERY

5.11.3 USE CASE 3: AAR MRO SERVICES

5.12 TRADE ANALYSIS

5.12.1 FIRE EXTINGUISHERS

FIGURE 27 EXPORT DATA FOR FIRE EXTINGUISHERS, 2017–2021 (USD MILLION)

FIGURE 28 IMPORT DATA FOR FIRE EXTINGUISHERS, 2017–2021 (USD MILLION)

5.13 PATENT ANALYSIS

FIGURE 29 TOP COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS

FIGURE 30 PATENT ANALYSIS RELATED TO FLAME DETECTORS

TABLE 6 LIST OF TOP PATENT OWNERS IN LAST 10 YEARS

5.13.1 LIST OF MAJOR PATENTS

5.14 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 7 FLAME DETECTOR MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.15 REGULATORY LANDSCAPE & STANDARDS

5.15.1 CODES AND STANDARDS RELATED TO FIRE PROTECTION SYSTEMS

TABLE 8 CODES AND STANDARDS RELATED TO FIRE DETECTION

TABLE 9 CODES AND STANDARDS RELATED TO FIRE SUPPRESSION

6 FLAME DETECTOR MARKET, BY PRODUCT (Page No. - 74)

6.1 INTRODUCTION

FIGURE 31 SINGLE UV TO HOLD LARGEST MARKET SIZE IN 2022

TABLE 10 FLAME DETECTOR MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 11 FLAME DETECTOR MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

6.2 OPTICAL FLAME DETECTION TECHNOLOGY

6.2.1 SINGLE UV

6.2.1.1 Single UV flame detector to hold largest share

6.2.1.2 UV Sensor

TABLE 12 SINGLE UV: FLAME DETECTOR MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 13 SINGLE UV: FLAME DETECTOR MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 14 SINGLE UV: FLAME DETECTOR MARKET, BY REGION, 2018–2021 (USD MILLION)

FIGURE 32 SINGLE UV NORTH AMERICA TO HOLD LARGEST MARKET SIZE IN 2027

TABLE 15 SINGLE UV: FLAME DETECTOR MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.2 SINGLE IR

6.2.2.1 Single IR to hold largest share among IR flame detectors

6.2.2.2 IR sensor

TABLE 16 SINGLE IR: FLAME DETECTOR MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

FIGURE 33 SINGLE IR FOR ENERGY & POWER TO HOLD LARGEST MARKET SIZE

TABLE 17 SINGLE IR: FLAME DETECTOR MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 18 SINGLE IR: FLAME DETECTOR MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 19 SINGLE IR: FLAME DETECTOR MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.3 DUAL UV/IR

6.2.3.1 Dual UV/IR flame detector to grow at highest rate

FIGURE 34 ADVANTAGES OF VARIOUS OPTICAL FLAME DETECTOR PRODUCTS

TABLE 20 DUAL UV/IR: FLAME DETECTOR MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 21 DUAL UV/IR: FLAME DETECTOR MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 22 DUAL UV/IR: FLAME DETECTOR MARKET, BY REGION, 2018–2021 (USD MILLION)

FIGURE 35 DUAL UV/IR MARKET IN APAC TO GROW AT HIGHEST RATE

TABLE 23 DUAL UV/IR: FLAME DETECTOR MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.4 TRIPLE IR FLAME DETECTOR

6.2.4.1 Triple IR flame detector to hold large share in oil and gas industry

TABLE 24 TRIPLE IR: FLAME DETECTOR MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 25 TRIPLE IR: FLAME DETECTOR MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 26 TRIPLE IR: FLAME DETECTOR MARKET, BY REGION, 2018–2021 (USD MILLION)

FIGURE 36 TRIPLE IR MARKET IN APAC TO GROW AT HIGHEST RATE

TABLE 27 TRIPLE IR: FLAME DETECTOR MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.5 MULTI IR FLAME DETECTOR

6.2.5.1 North America to hold largest share of multi IR flame detectors

TABLE 28 MULTI IR: FLAME DETECTOR MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 29 MULTI IR: FLAME DETECTOR MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 30 MULTI IR: FLAME DETECTOR MARKET, BY REGION, 2018–2021 (USD MILLION)

FIGURE 37 MULTI IR MARKET IN NORTH AMERICA TO HOLD LARGEST SHARE

TABLE 31 MULTI IR: FLAME DETECTOR MARKET, BY REGION, 2022–2027 (USD MILLION)

7 FLAME DETECTOR MARKET, BY CONNECTIVITY (Page No. - 91)

7.1 INTRODUCTION

FIGURE 38 WIRED SEGMENT TO HOLD LARGER MARKET SIZE

TABLE 32 FLAME DETECTOR MARKET, BY CONNECTIVITY, 2018–2021 (USD MILLION)

TABLE 33 FLAME DETECTOR MARKET, BY CONNECTIVITY, 2022–2027 (USD MILLION)

7.2 WIRED FLAME DETECTOR

7.2.1 WIRED FLAME DETECTORS HAVE LOWER TRANSMISSION FAILURE

7.3 WIRELESS FLAME DETECTOR

7.3.1 MINIMAL USE OF WIRES FOR IMPLEMENTATION OF FLAME DETECTORS

8 FLAME DETECTORS: IMPLEMENTATION SERVICES (Page No. - 94)

8.1 INTRODUCTION

8.2 ENGINEERING SERVICES

8.2.1 ENGINEERING SERVICES VARY ACCORDING TO CHANGING GOVERNMENT REGULATIONS

8.3 INSTALLATION AND DESIGN SERVICES

8.3.1 FOCUS SHIFTING TOWARD ASSET AND WORKER SAFETY

8.4 MAINTENANCE SERVICES

8.4.1 KEY INDUSTRIES HAVE HIGH DEMAND FOR MAINTENANCE SERVICES

8.5 INSPECTION AND MANAGED SERVICES

8.5.1 DECLINE IN IN-HOUSE SECURITY MANAGEMENT ALLOWS OUTSOURCED MANAGED SERVICES TO GROW

9 FLAME DETECTOR MARKET, BY INDUSTRY (Page No. - 96)

9.1 INTRODUCTION

TABLE 34 FLAME DETECTOR MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 35 FLAME DETECTOR MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

9.2 OIL & GAS

9.2.1 OIL & GAS INDUSTRY TO HOLD LARGEST MARKET SIZE IN 2022

TABLE 36 OIL & GAS: FLAME DETECTOR MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 37 OIL & GAS: FLAME DETECTOR MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 38 OIL & GAS: FLAME DETECTOR MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 39 OIL & GAS: FLAME DETECTOR MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 ENERGY & POWER

9.3.1 RISK OF FIRE OWING TO PRESENCE OF FUEL AND ELECTRICITY

TABLE 40 ENERGY & POWER: FLAME DETECTOR MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 41 ENERGY & POWER: FLAME DETECTOR MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

FIGURE 39 ENERGY & POWER INDUSTRY IN NORTH AMERICA TO HOLD LARGEST MARKET SIZE

TABLE 42 ENERGY & POWER: FLAME DETECTOR MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 43 ENERGY & POWER: FLAME DETECTOR MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 CHEMICALS

9.4.1 STRICT GOVERNMENT MANDATES RELATED TO OPERATION OF CHEMICAL PLANTS

TABLE 44 CHEMICALS: FLAME DETECTOR MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 45 CHEMICALS: FLAME DETECTOR MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 46 CHEMICALS: FLAME DETECTOR MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 47 CHEMICALS: FLAME DETECTOR MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 AEROSPACE & DEFENSE

9.5.1 NEED TO SAFEGUARD PROPERTIES TO FUEL DEMAND FOR FLAME DETECTORS

TABLE 48 AEROSPACE & DEFENSE: FLAME DETECTOR MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

FIGURE 40 DUAL UV/IR DETECTOR FOR AEROSPACE & DEFENSE TO GROW AT HIGHEST RATE

TABLE 49 AEROSPACE & DEFENSE: FLAME DETECTOR MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 50 AEROSPACE & DEFENSE: FLAME DETECTOR MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 51 AEROSPACE & DEFENSE: FLAME DETECTOR MARKET, BY REGION, 2022–2027 (USD MILLION)

9.6 LOGISTICS

9.6.1 GROWING E-COMMERCE INDUSTRY IN APAC TO FUEL MARKET FOR FLAME DETECTORS

TABLE 52 LOGISTICS: FLAME DETECTOR MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 53 LOGISTICS: FLAME DETECTOR MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 54 LOGISTICS: FLAME DETECTOR MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 55 LOGISTICS: FLAME DETECTOR MARKET, BY REGION, 2022–2027 (USD MILLION)

9.7 MINING

9.7.1 HYDROCARBON FUEL LEADS TO DEMAND FOR FLAME DETECTORS IN MINING INDUSTRY

TABLE 56 MINING: FLAME DETECTOR MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 57 MINING: FLAME DETECTOR MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 58 MINING: FLAME DETECTOR MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 59 MINING: FLAME DETECTOR MARKET, BY REGION, 2022–2027 (USD MILLION)

9.8 AUTOMOTIVE

9.8.1 APPLICATION OF FLAME DETECTORS IN PAINT SPRAY BOOTHS DRIVES DEMAND

TABLE 60 AUTOMOTIVE: FLAME DETECTOR MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 61 AUTOMOTIVE: FLAME DETECTOR MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 62 AUTOMOTIVE: FLAME DETECTOR MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 63 AUTOMOTIVE: FLAME DETECTOR MARKET, BY REGION, 2022–2027 (USD MILLION)

9.9 PHARMACEUTICALS

9.9.1 PHARMACEUTICALS INDUSTRY TO GROW AT HIGHEST RATE

TABLE 64 PHARMACEUTICALS: FLAME DETECTOR MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 65 PHARMACEUTICALS: FLAME DETECTOR MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 66 PHARMACEUTICALS: FLAME DETECTOR MARKET, BY REGION, 2018–2021 (USD MILLION)

FIGURE 41 PHARMACEUTICALS INDUSTRY IN NORTH AMERICA TO HOLD LARGEST SHARE

TABLE 67 PHARMACEUTICALS: FLAME DETECTOR MARKET, BY REGION, 2022–2027 (USD MILLION)

9.10 MARINE

9.10.1 DEMAND FOR FLAME DETECTORS DRIVEN BY INDOOR APPLICATIONS

TABLE 68 MARINE: FLAME DETECTOR MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 69 MARINE: FLAME DETECTOR MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 70 MARINE: FLAME DETECTOR MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 71 MARINE: FLAME DETECTOR MARKET, BY REGION, 2022–2027 (USD MILLION)

9.11 OTHER INDUSTRIES

TABLE 72 OTHER INDUSTRIES: FLAME DETECTOR MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 73 OTHER INDUSTRIES: FLAME DETECTOR MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 74 OTHER INDUSTRIES: FLAME DETECTOR MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 75 OTHER INDUSTRIES: FLAME DETECTOR MARKET, BY REGION, 2022–2027 (USD MILLION)

10 FLAME DETECTOR MARKET, BY REGION (Page No. - 119)

10.1 INTRODUCTION

FIGURE 42 CHINA PROJECTED TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

TABLE 76 FLAME DETECTOR MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 77 FLAME DETECTOR MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 43 NORTH AMERICA: PROMINENT COMPANIES IN FLAME DETECTOR MARKET

FIGURE 44 NORTH AMERICA: FLAME DETECTOR MARKET SNAPSHOT

10.2.1 US

10.2.1.1 US to hold largest share in North America

10.2.2 CANADA

10.2.2.1 Growth in construction, transportation, and logistics to fuel market

10.2.3 MEXICO

10.2.3.1 Adoption of fire protection equipment in its initial phase

TABLE 78 NORTH AMERICA: FLAME DETECTOR MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 79 NORTH AMERICA: FLAME DETECTOR MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 80 NORTH AMERICA: FLAME DETECTOR MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 81 NORTH AMERICA: FLAME DETECTOR MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 82 NORTH AMERICA: FLAME DETECTOR MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 83 NORTH AMERICA: FLAME DETECTOR MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

10.3 EUROPE

FIGURE 45 EUROPE: PROMINENT COMPANIES IN FLAME DETECTOR MARKET

FIGURE 46 EUROPE: FLAME DETECTOR MARKET SNAPSHOT

10.3.1 UK

10.3.1.1 UK to account for largest share in Europe

10.3.2 GERMANY

10.3.2.1 Flame detector market in Germany to grow at highest CAGR

TABLE 84 EUROPE: FLAME DETECTOR MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 85 EUROPE: FLAME DETECTOR MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 86 EUROPE: FLAME DETECTOR MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 87 EUROPE: FLAME DETECTOR MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 88 EUROPE: FLAME DETECTOR MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 89 EUROPE: FLAME DETECTOR MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 France contributes significantly to flame detector market

10.3.4 REST OF EUROPE

10.4 ASIA PACIFIC

FIGURE 47 ASIA PACIFIC: PROMINENT COMPANIES IN FLAME DETECTOR MARKET

FIGURE 48 ASIA PACIFIC: FLAME DETECTOR MARKET SNAPSHOT

10.4.1 CHINA

10.4.1.1 China to hold largest share

10.4.2 JAPAN

10.4.2.1 Japan contributes significantly to APAC market

10.4.3 SOUTH KOREA

10.4.3.1 Fire prevention and safety initiatives to boost market growth

10.4.4 REST OF ASIA PACIFIC

TABLE 90 ASIA PACIFIC: FLAME DETECTOR MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 91 ASIA PACIFIC: FLAME DETECTOR MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 92 ASIA PACIFIC: FLAME DETECTOR MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 93 ASIA PACIFIC: FLAME DETECTOR MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 94 ASIA PACIFIC: FLAME DETECTOR MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 95 ASIA PACIFIC: FLAME DETECTOR MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

10.5 ROW

FIGURE 49 ROW: PROMINENT COMPANIES IN FLAME DETECTOR MARKET

FIGURE 50 ROW: FLAME DETECTOR MARKET, BY REGION, 2022 VS. 2027

10.5.1 SOUTH AMERICA

10.5.1.1 South America to grow at faster pace than other regions in RoW

10.5.2 MIDDLE EAST & AFRICA

10.5.2.1 Oil and petroleum businesses drive demand for flame detectors

TABLE 96 ROW: FLAME DETECTOR MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 97 ROW: FLAME DETECTOR MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 98 ROW: FLAME DETECTOR MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 99 ROW: FLAME DETECTOR MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 100 ROW: FLAME DETECTOR MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 101 ROW: FLAME DETECTOR MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 141)

11.1 INTRODUCTION

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 102 STRATEGIES DEPLOYED BY KEY PLAYERS

11.3 TOP 5 COMPANIES: REVENUE ANALYSIS

FIGURE 51 TOP 5 PLAYERS IN FLAME DETECTOR MARKET, 2017–2021

11.4 MARKET SHARE ANALYSIS OF TOP PLAYERS, 2021

TABLE 103 GLOBAL FLAME DETECTOR MARKET: MARKET SHARE ANALYSIS

11.5 COMPETITIVE EVALUATION QUADRANT, 2021

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

FIGURE 52 FLAME DETECTOR MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

11.6 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES): EVALUATION QUADRANT, 2021

11.6.1 PROGRESSIVE COMPANIES

11.6.2 RESPONSIVE COMPANIES

11.6.3 DYNAMIC COMPANIES

11.6.4 STARTING BLOCKS

FIGURE 53 FLAME DETECTOR MARKET (GLOBAL): SMES EVALUATION QUADRANT, 2021

11.6.5 FLAME DETECTOR MARKET: COMPANY FOOTPRINT

TABLE 104 COMPANY TYPE FOOTPRINT

TABLE 105 COMPANY INDUSTRY FOOTPRINT

TABLE 106 COMPANY REGIONAL FOOTPRINT

TABLE 107 COMPANY FOOTPRINT

11.6.6 FLAME DETECTOR MARKET: SMES MATRIX

TABLE 108 FLAME DETECTOR MARKET: DETAILED LIST OF KEY SMES

TABLE 109 FLAME DETECTOR MARKET: COMPETITIVE BENCHMARKING OF KEY SMES

11.7 COMPETITIVE SITUATIONS AND TRENDS

11.7.1 PRODUCT LAUNCHES

TABLE 110 FLAME DETECTOR MARKET: PRODUCT LAUNCHES

11.7.2 DEALS

TABLE 111 FLAME DETECTOR MARKET: DEALS

12 COMPANY PROFILES (Page No. - 163)

12.1 INTRODUCTION

12.2 KEY PLAYERS

(Business overview, Products/Solutions/Services offered, Recent Developments, MNM view)*

12.2.1 JOHNSON CONTROLS

TABLE 112 JOHNSON CONTROLS: BUSINESS OVERVIEW

FIGURE 54 JOHNSON CONTROLS: COMPANY SNAPSHOT

12.2.2 MSA SAFETY

TABLE 113 MSA SAFETY: BUSINESS OVERVIEW

FIGURE 55 MSA SAFETY: COMPANY SNAPSHOT

12.2.3 ROBERT BOSCH

TABLE 114 ROBERT BOSCH: BUSINESS OVERVIEW

FIGURE 56 ROBERT BOSCH: COMPANY SNAPSHOT

12.2.4 HONEYWELL

TABLE 115 HONEYWELL: BUSINESS OVERVIEW

FIGURE 57 HONEYWELL: COMPANY SNAPSHOT

12.2.5 SIEMENS

TABLE 116 SIEMENS: BUSINESS OVERVIEW

FIGURE 58 SIEMENS: COMPANY SNAPSHOT

12.2.6 CARRIER GLOBAL CORPORATION

TABLE 117 CARRIER GLOBAL CORPORATION: BUSINESS OVERVIEW

FIGURE 59 CARRIER GLOBAL CORPORATION: COMPANY SNAPSHOT

12.2.7 EMERSON ELECTRIC

TABLE 118 EMERSON ELECTRIC: BUSINESS OVERVIEW

FIGURE 60 EMERSON ELECTRIC: COMPANY SNAPSHOT

12.2.8 MINIMAX VIKING GMBH

TABLE 119 MINIMAX VIKING GMBH: BUSINESS OVERVIEW

12.2.9 HALMA

TABLE 120 HALMA: BUSINESS OVERVIEW

FIGURE 61 HALMA: COMPANY SNAPSHOT

12.2.10 NOHMI BOSAI

TABLE 121 NOHMI BOSAI: BUSINESS OVERVIEW

12.2.11 HOCHIKI

TABLE 122 HOCHIKI: BUSINESS OVERVIEW

FIGURE 62 HOCHIKI: COMPANY SNAPSHOT

12.2.12 DRAEGER

TABLE 123 DRAEGER: BUSINESS OVERVIEW

FIGURE 63 DRAEGER: COMPANY SNAPSHOT

12.2.13 TELEDYNE TECHNOLOGIES

TABLE 124 TELEDYNE TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 64 TELEDYNE TECHNOLOGIES: COMPANY SNAPSHOT

*Details on Business overview, Products/Solutions/Services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

12.3 OTHER PLAYERS

12.3.1 MICROPACK ENGINEERING

12.3.2 CIQURIX

12.3.3 ELECTRO OPTICAL COMPONENTS

12.3.4 FIKE CORPORATION

12.3.5 FIRE & GAS DETECTION TECHNOLOGIES

12.3.6 REZONTECH

12.3.7 SENSE-WARE

12.3.8 TRACE AUTOMATION

12.3.9 ESP SAFETY

12.3.10 FORNEY CORPORATION

12.3.11 JSC “ELECTRONSTANDART-PRIBOR”

12.3.12 AMBETRONICS ENGINEERS

13 ADJACENT & RELATED MARKETS (Page No. - 232)

13.1 INTRODUCTION

13.2 LIMITATIONS

13.3 SMOKE DETECTOR MARKET, BY POWER SOURCE

13.3.1 INTRODUCTION

TABLE 125 SMOKE DETECTORS MARKET, BY POWER SOURCE, 2018–2021 (USD MILLION)

TABLE 126 SMOKE DETECTORS MARKET, BY POWER SOURCE, 2022–2027 (USD MILLION)

13.3.2 BATTERY-POWERED

13.3.2.1 Increasing demand for battery-powered smoke detectors

TABLE 127 BATTERY-POWERED SMOKE DETECTORS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 128 BATTERY-POWERED SMOKE DETECTORS MARKET, BY TYPE, 2022–2027 (USD MILLION)

13.3.3 HARDWIRED WITH BATTERY BACKUP

13.3.3.1 Hardwired interconnectable smoke detectors with battery backup

13.3.3.2 Hardwired wireless interconnectable smokes detectors with battery backup

TABLE 129 HARDWIRED SMOKE DETECTORS WITH BATTERY BACKUP MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 130 HARDWIRED SMOKE DETECTORS WITH BATTERY BACKUP MARKET, BY TYPE, 2022–2027 (USD MILLION)

13.3.4 HARDWIRED WITHOUT BATTERY BACKUP

13.3.4.1 Hardwired without battery backup connected to AC main power supply

TABLE 131 HARDWIRED SMOKE DETECTORS WITHOUT BATTERY BACKUP MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 132 HARDWIRED SMOKE DETECTORS WITHOUT BATTERY BACKUP MARKET, BY TYPE, 2022–2027 (USD MILLION)

13.4 SMOKE DETECTOR MARKET, BY END-USE INDUSTRY

13.4.1 INTRODUCTION

TABLE 133 SMOKE DETECTORS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 134 SMOKE DETECTORS MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

13.4.2 COMMERCIAL

13.4.2.1 Rising adoption of smoke detectors from commercial industry

13.4.2.2 Academia & Institutional

13.4.2.3 Retail

13.4.2.4 Healthcare

13.4.2.5 Hospitality

13.4.2.6 Banking, Financial Services, and Insurance (BFSI)

13.4.3 RESIDENTIAL

13.4.3.1 Government initiatives boosting the adoption of smoke detectors

13.4.4 OIL & GAS AND MINING

13.4.4.1 Growing adoption of smoke detectors ensures safety of industrial plants

13.4.5 TRANSPORTATION & LOGISTICS

13.4.5.1 Rising demand for beam smoke detectors to keep warehouses safe

13.4.6 TELECOMMUNICATION

13.4.6.1 Smoke detectors to safeguard service continuity

13.4.7 MANUFACTURING

13.4.7.1 Critical fire safety norms to increase demand for smoke detectors

13.4.8 OTHER END-USE INDUSTRIES

14 APPENDIX (Page No. - 243)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.1 AUTHOR DETAILS

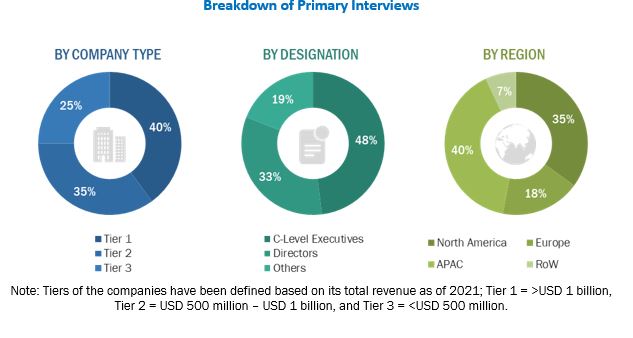

The study involved four major activities in estimating the current size of the flame detector market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments. Two sources of information-secondary and primary-have been used to identify and collect information for an extensive technical and commercial study of the flame detector market.

Secondary Research

Secondary sources referred for this study include company websites, magazines, industry news, associations (Fire Protection Association, Alarm Association of Florida, Fire Protection Systems, German Fire Protection Association, Canadian Association of Fire Chiefs, National Fire Protection Association, German Fire Protection Association, Confederation of Fire Protection Associations Europe, National Commercial Fire and Safety Association Beijing, and Occupational Safety and Health Administration among others), and databases (Factiva and Bloomberg). These secondary sources include annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, trade, and databases. The secondary data has been collected and analyzed to arrive at the overall flame detector market size, which is further validated by primary research.

Primary Research

Extensive primary research has been conducted after gaining knowledge about the present scenario of the flame detector market through secondary research. Several primary interviews have been conducted with market experts from both the demand (adopters and end users of flame detectors) and supply (flame detector manufacturers and distributors) sides across 4 key regions, namely, North America, Europe, Asia Pacific, and Rest of the World. Approximately 25% and 75% of the primary interviews have been conducted with parties from the demand and supply sides, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both the top-down and bottom-up approaches, along with several data triangulation methods, have been used to estimate and validate the size of the flame detector market and other dependent submarkets. The key players in the market have been determined through primary and secondary research. This entire research methodology involves the study of the annual and financial reports of the top market players and extensive interviews with industry experts, such as CEOs, vice presidents, directors, and marketing executives, for both qualitative and quantitative key insights related to the flame detector market.

- In the top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits obtained from secondary and primary research.

- For the calculation of sizes of segments of the flame detector market, the market size obtained by implementing the bottom-up approach has been used in the top-down approach. This has been later confirmed with primary respondents across different geographies.

- The bottom-up approach has also been implemented for the data extracted from secondary research to validate the size of various market segments.

- The market share of each company has been estimated to verify revenue shares used in the bottom-up approach earlier.

- The sizes of the overall parent markets (fire protection market) and each individual market have been determined and confirmed in this study with the help of a data triangulation procedure and validation of data through primary interviews.

Global Flame Detector Market Size: Top-down Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the flame detector market size, by product, connectivity, and industry, in terms of value

- To describe and forecast the flame detector market size, in terms of value and volume, with respect to four main regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the flame detector market

- To provide a detailed overview of the supply chain of the flame detector ecosystem

- To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the market

- To benchmark the market players using the proprietary, company evaluation matrix framework, which analyzes the market players on various parameters within the broad categories of business strategy excellence and strength of product portfolios

- To analyze competitive developments, such as acquisitions, product launches, partnerships, expansions, and collaborations, undertaken in the flame detector market

Available Customizations

MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

- Additional country level analysis of flame detector market

- Detailed analysis and profiling of additional market players (up to 3)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Flame Detector Market