Food Preservatives Market by Function (Antimicrobials, Antioxidants), Type (Synthetic Preservatives and Natural Preservatives), Application, and Region ( North America, Europe, Asia-Pacific, Middle-East Africa) - Global Forecast to 2028

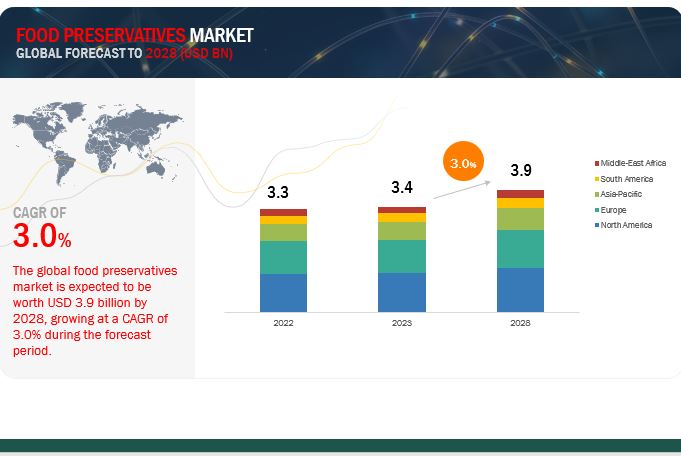

The global food preservatives market size was valued at US$ 3.3 billion in 2022 and is poised to grow from US$ 3.4 billion in 2023 to US$ 3.9 billion by 2028, growing at a CAGR of 3.0% in the forecast period (2023-2028).

Food preservatives are compounds that are added to food products to help them last longer and prevent deterioration. They aid in the inhibition of bacteria, fungus, yeasts, and other microorganisms that can cause foodborne sickness or degradation. Preservatives are widely utilised in processed and packaged foods, as well as some homemade and professionally produced goods. The food preservatives industry is bound to rise with high demand for processed food, the rise in meat consumption, and rising demand for products with an extended shelf life. New innovations are taking place in the natural preservatives segment owing to the rise in demand for clean-labeled ingredients in the European and North American market. This is also fueling the overall growth of the industry.

The latest version of the food preservatives market report provides valuable insights and data to help industry players and stakeholders make informed decisions and stay ahead of the competition. In addition, the report provides valuable insights into the market through detailed case studies, trade data, technology analyses, and updated regulations, among other key factors. The report also includes updated financials, recent developments, and product offerings of different players operating in the market, providing a clear picture of the competitive landscape.

Furthermore, the report includes an analysis of the impact of the COVID-19 pandemic on the market, taking into account the latest assumptions and data related to the pandemic. The report also provides recession impact analysis as part of regional chapters, offering a comprehensive view of the market in the current economic climate.

To know about the assumptions considered for the study, Request for Free Sample Report

Food Preservatives Market Dynamics

Market Drivers: Growing demand for food products with an extended shelf life

With the rise in urbanization and employment globally, consumer lifestyles and eating habits have changed drastically. Consumers are thus looking for food products that are easy to prepare, consume, and have a longer shelf life. Food preservatives play a huge role in extending the shelf-life of food apart from keeping it fresh. Thus, with the rise in demand for food with longer shelf-life, the demand for food preservatives has increased in the food and beverage industry. This is because preservatives offers food manufacturers advantages in terms of storage efficacy and competitive pricing. Moreover, post COVID-19 pandemic, health consciousness has rose, which is also positively stimulating the growth of natural preservatives such as citric acid and rosemary extracts, thereby driving the overall market.

Restraints: Growing demand for organic food

Organic sales have grown exponentially over the decade, especially in North American and European countries owing to the influx of knowledge regarding good diet. The USDA (United States Department of Agriculture) prohibits organic foods from containing artificial preservatives, colors, and flavors. Organic food products are also consumed fresh by the consumers which limits the necessity of storing the food over longer period, hence no use of preservatives. Though the overall demand for organic foods is smaller than for non-organic food, the significant rise in the demand for organic food is capable to restrain the growth of food preservatives market.

Opportunities: Clean-label trend across global food markets

Recent surveys and research show a growing inclination of consumers towards reading product labels, and preferring clean food ingredients. This is because consumers these days are constantly looking to incorporate natural, fresh, wholesome, and balanced nutrition. Manufacturers in the food preservatives industry are thus focused to find out clean-labelled solutions and breakthroughs in the market. As a result, innovation around natural preservatives is spiking across the industry. Growing trend toward clean-label products is expected to create lucrative growth opportunities for market players to focus on the development of new formulations and new developments in the food & beverage industry.

Challenges: High price and limited availability of natural preservatives

There is limited availability of natural sources; natural preservatives such as nisin and natamycin are at least ten times heavier priced than chemical preservatives. Many natural preservatives are yet to be manufactured on a larger scale. The commercialization of manufacturing processes of natural preservatives is in a nascent stage. Good and reliable sources of high-quality natural preservatives are still being studied, and tests are conducted to check for efficacy. Therefore, until these challenges related to natural preservatives are acknowledged and resolved, the full growth potential of the food preservatives market is expected to be challenging to a certain extent.

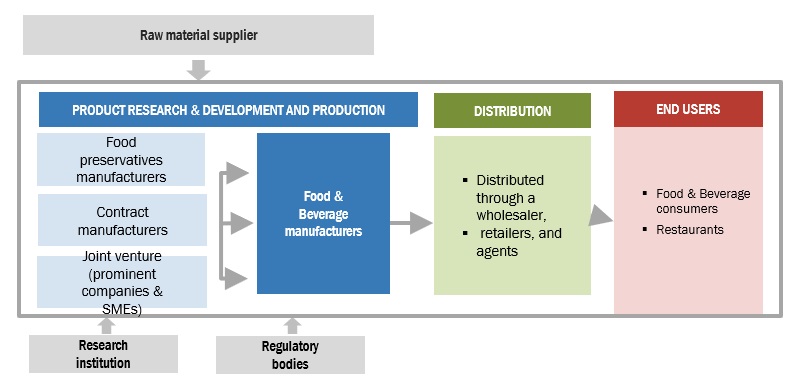

Food Preservatives Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of food preservatives. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market are Cargill, Incorporated (US), Kerry Group plc. (Ireland), DSM (Netherlands), Kemin Industries Inc. (US), and ADM (US).

To know about the assumptions considered for the study, download the pdf brochure

Synthetic preservatives by type are estimated to account for the largest market share of the food preservatives market

Based by type, synthetic preservatives are estimated to account for the largest market share. Factors responsible for the wide-scale popularity of synthetic preservatives in the food preservatives market include their large-scale commercialization, easy availability, proven efficacy and cost-effectiveness. Less R&D investment, and low regulatory norms in the emerging Asia-Pacific economies is also contributing significantly in the large market share of synthetic preservatives.

By function, antimicrobials are anticipated to dominate the market during the forecast period

Based on function, the market is segmented into antimicrobials, antioxidants, and other functions. Antimicrobials are anticipated to dominate the market during the forecast period. There is a rise in demand for frozen food products. Packaged foods when kept over a period of time are highly prone to microbial spoilage owing to temperature, moisture, and pH changes. Usage of antimicrobials such as nitrites, nitrates, and sulfur dioxide prevents degradation of food. This is facilitating the dominance of antimicrobials in the food preservatives market.

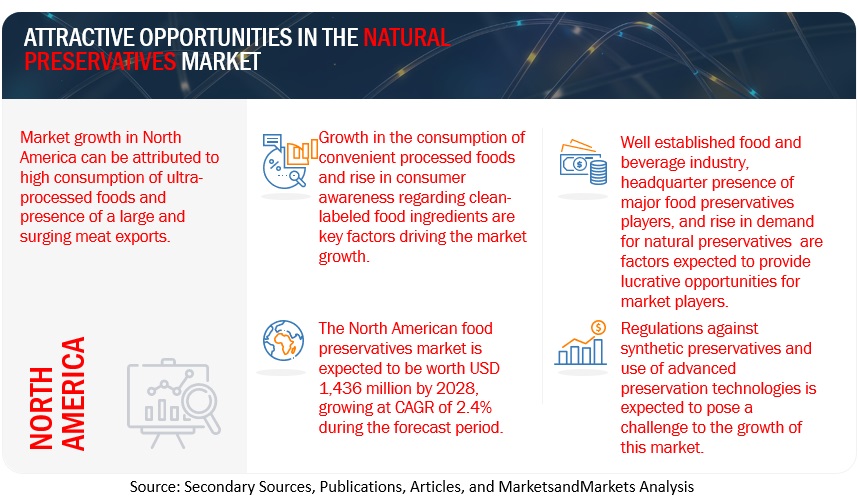

North America is projected to be the largest region in the food preservatives market, in 2022; it is anticipated to grow at a significant CAGR

North America has always been an attractive and huge market for processed food industries due to large consumption of packaged and ready-to-eat foods. It is also among the biggest exporters of meat and meat products. These food products need incorporation of food preservatives which are responsible for their longer shelf-life. As a result with high demand for meat exports and processed food, the demand for food preservatives in the region is high. Moreover, North America has a well established food & beverage industry with the presence of leading players such as PepsiCo (US), McCain Foods Limited(Canada), Tyson Foods (US), among others.

To cater these players, there is also a well-established market ecosystem for food preservatives. As a result, most of the leading players in the food preservatives industry such as Cargill, Incorporated (US), Kemin Industries Inc. (US), ADM (US), and International Flavors & Fragrances Inc. (US) are headquartered in the region, further enhancing the dominating position of North America in the food preservatives market.

Key Market Players

The key players in this market include Cargill, Incorporated (US), Kerry Group plc (Ireland), ADM (US), DSM (Netherlands), and, Kemin Industries Inc. (US).

Food Preservatives Market Report Scope

|

Report Metric |

Details |

|

Market valuation in 2023 |

USD 3.4 billion |

|

Revenue prediction in 2028 |

USD 3.9 billion |

|

Progress rate |

CAGR of 3.0% from 2023-2028 |

|

Market size available for years |

2019-2028 |

|

Base year for estimation |

2022 |

|

Forecast period |

2023-2028 |

|

Quantitative units |

Value (USD Million) and Volume (Thousand Units) |

|

Report Coverage & Deliverables |

Revenue forecast, company ranking, driving factors, Competitive benchmarking, and analysis |

|

Segments covered |

Application, Region, Type |

|

Regional Insight |

Europe, North America, South America, Asia Pacific |

|

Prominent firms featured |

Cargill, Incorporated (US), Kerry Group plc. (Ireland), DSM (Netherlands), Kemin Industries Inc. (US), and ADM (US) |

|

Essential drivers of market prosperity |

|

Food Preservatives Market Report Segmentation

|

By Function |

By Type |

By Application |

By Region |

|

|

|

|

Food Preservatives Market Recent Developments

- In March 2022, Kerry Group plc (Ireland) expanded its food manufacturing facilities with the newly upgraded facility in Rome, Georgia. A total of USD 141 million has been invested in creating the largest food manufacturing facility in the US. This facility aims to provide integrated taste and nutrition solutions to meet the growing consumer demand in the poultry, seafood, and alternative protein markets across the US and Canada.

- In April 2021, Jungbunzlauer Suisse AG (Switzerland) expanded its citric plant in Port Colborne, Canada, owing to the consistently strong and growing global demand for citric acid and citrates. These products are functional and bio-based ingredients in food, beverages, detergents, and industrial applications. This expansion will help the company improve its portfolio for customers looking for safe and biodegradable products from sustainable production plants.

- In January 2021, Corbion increased its capacity for producing lactic acid in North America by around 40% to meet the growing demand for natural ingredients in multiple industries. The investment will reinforce the company’s leadership position as a supplier of lactic acid and its derivatives worldwide.

Frequently Asked Questions (FAQ):

How big is the food preservatives market?

The global market for food preservatives is expected to increase at a compound annual growth rate of 3.0%, reaching $3.4 billion in 2023 and $3.9 billion by the end of 2028.

Which players are involved in the manufacturing of food preservatives market?

The key players in this market include Cargill, Incorporated (US), Kerry Group plc. (Ireland), DSM (Netherlands), Kemin Industries Inc. (US), and ADM (US).

Is there Oceania (New Zealand and Australia) specific information (market size, players, growth rate) for food preservatives market?

On request, We will provide details on market size, key players, and growth rate of this industry in the Oceania region. Also, you can let us know if there are any other countries of your interest.

What is the future growth potential of food preservatives market?

The future growth potential of the food preservatives market is promising, driven by various factors shaping consumer preferences and industry dynamics. As urbanization accelerates and lifestyles become busier, the demand for convenient and processed foods is on the rise, necessitating effective preservation methods to maintain product quality and safety. Concurrently, health-conscious consumers are driving the demand for clean-label products, spurring the development of natural preservatives and alternatives to synthetic additives. Technological innovations, including advancements in nanotechnology and edible coatings, offer new avenues for enhancing preservation techniques. Regulatory changes continue to play a significant role, influencing product formulations and consumer perceptions. Additionally, emerging markets present substantial growth opportunities, fueled by increasing urbanization and changing dietary habits.

What are the different types of food preservatives?

Food preservatives can be broadly classified into two categories: natural preservatives and synthetic preservatives. Natural preservatives include substances like salt, sugar, vinegar, and certain plant extracts, while synthetic preservatives include chemicals like sorbic acid, benzoic acid, and propionic acid.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

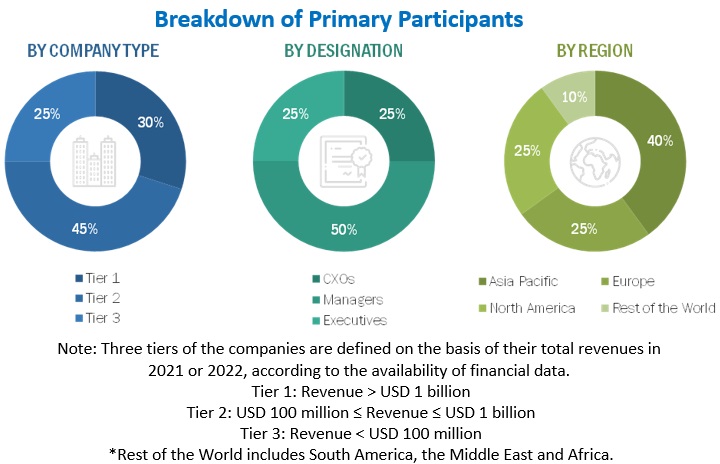

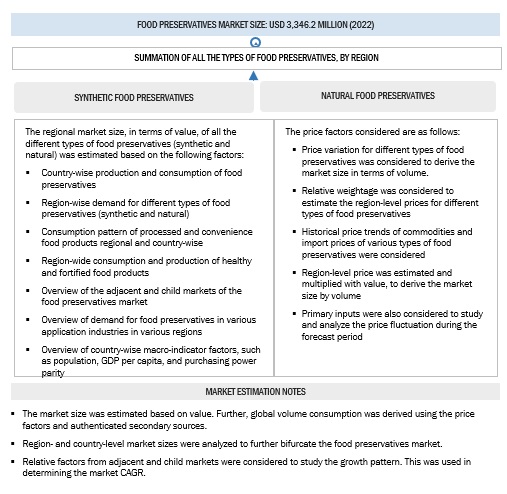

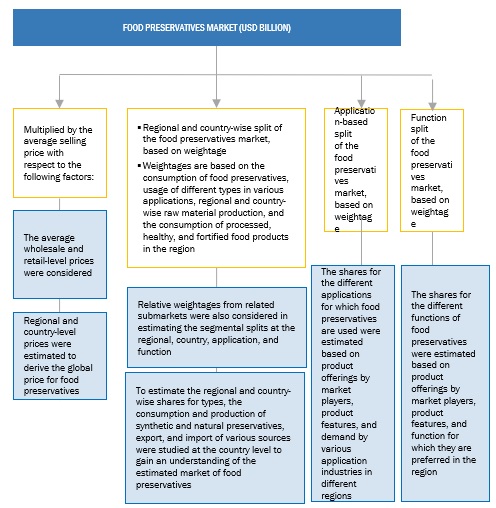

The study involved four major activities in estimating the current size of the food preservatives market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Food Preservatives Market Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering food preservatives and information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the food preservatives market, which was validated by the primary respondent.

Food Preservatives Market Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the food preservatives market.

To know about the assumptions considered for the study, download the pdf brochure

Food Preservatives Market Size Estimation

- Both the top-down and bottom-up approaches were used to estimate and validate the total size of the food preservatives market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research.

- The revenues of major food preservatives-based food manufacturers were determined through primary and secondary research, such as paid databases, which were used as the basis for market estimation.

- All macroeconomic and microeconomic factors affecting the growth of the food preservatives market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Food Preservatives Market Size Estimation Methodology: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Food Preservatives Market Size Estimation Methodology: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Food Preservatives Market Definition

Food preservatives are the ingredients that are used in food processing to slow down the spoilage of the food caused by mold, yeast, bacteria, fungi, and air. Food preservatives maintain the quality of the food and keep them fresh. Additionally, they also help in controlling contamination, which can lead to foodborne diseases, such as botulism and campylobacteriosis. Food preservatives used are of either natural or synthetic origin, which act as antimicrobial, antioxidant, chelating, or enzymatic agents.

Key Stakeholders

- Regulatory bodies

- Food Standards Australia New Zealand (Australia)

- US Food and Drug Administration (FDA) (US)

- European Food Safety Authority (EFSA) (Italy)

- Intermediary suppliers such as traders, distributors, and suppliers of food preservatives.

- Food preservatives manufacturers & suppliers

- Associations and industry bodies

- Food & beverage products manufacturers and suppliers

- Food preservatives traders and distributors

- Commercial research & development (R&D) institutions

- Government and research organizations

- Technology providers to food companies

Food Preservatives Market Report Objectives

- To define, segment, and project the global market for food preservatives on the basis of type, function, application, and region.

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders.

- To project the size of the market and its submarkets, in terms of value and volume, with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies.

- To analyze the competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & developments in the food preservatives market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of Europe region for food preservatives market into Ireland, Netherlands, Sweden, Turkey, Belgium, and other EU & non-EU countries.

- Further breakdown of the Asia Pacific region for food preservatives market into Vietnam, Malaysia, Thailand, Indonesia, the Philippines, and South Korea.

- Further breakdown of other countries in the South American region for food preservatives market into Columbia, Peru, and Venezuela.

- Further breakdown of other countries in the Rest of the World market for food preservatives market into Middle East and Africa.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Food Preservatives Market

I would like to know more about Who are the key players and how is the competitive landscape changing in the client ecosystem and impacting their revenue share?