Food & Beverage Processing Equipment Market by Type (Processing, Pre-Processing), Application (Bakery & Confectionery, Meat & Poultry, Dairy, Alcoholic & Non Alcoholic Beverages), Mode of Operation, End Product Form and Region - Global Forecast to 2028

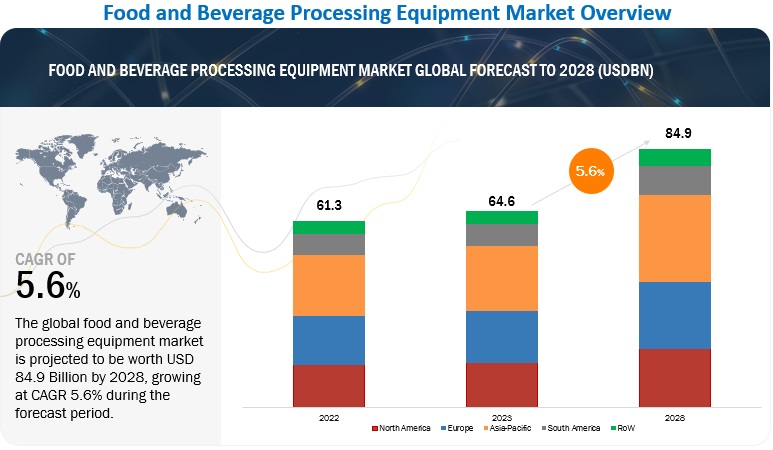

The global food and beverage processing equipment market size was valued at US$ 61.3 billion in 2022 and is poised to grow from US$ 64.6 billion in 2023 to US$ 84.9 billion by 2028, growing at a CAGR of 5.6% in the forecast period (2023-2028).

Food Processing and Preservation is an important aspect of food and beverage processing equipment. Equipment such as pasteurizers, sterilizers, vacuum heating, freezing and more operations helps to preserve the quality and shelf-life of food and beverage products. This allows manufacturers to produce products in bulk, store them for longer periods, and transport them over longer distances without compromising their quality. Processing also helps to reduce waste by extending the life of the product, making it more cost-effective for both manufacturers and consumers. The Food and beverage processing equipment are designed to comply with strict safety standards, ensuring that the products are safe for consumption, by the equipment manufacturers. Overall, these factors are expected to drive the growth of the food and beverage processing market in the future.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Drivers: Growth in demand for convenience foods

Over the upcoming years, the market is anticipated to be driven by advancements in food processing technology, an increase in consumer demand for processed foods, and more research and development into food processing equipment. Distribution, preservation, the convenience of preparation, and reduced susceptibility to deterioration compared to fresh food are all advantages of food processing. Additionally, it enhances food flavor while lowering the prevalence of foodborne illness. Food processing equipment is divided into depositors, extruding machines, mixers, refrigerators, slicers and dicers, and others based on type. Beverages, dairy, meat and poultry, bakery, convenience foods and snacks, fruits and vegetables, confectionery, and others are only a few food processing applications.

Reverse micellar, enzyme-assisted, and membrane ultrafiltration technologies are examples of innovations used in separating and functionalizing soy-based protein extraction and formulations that provide the finished products. Factors such as the expanding “health and wellness” movement, consumers’ increased interest in meat alternatives, and developments in ingredient technologies (such as microencapsulation) are supporting the growth of plant-based proteins. The US population’s 29% shift to flexitarians since 2017 presents the biggest growth opportunity for soy-based food and beverage products, according to PBFA. With this, introducing microencapsulation in industries allows food processing machine industries to curate machines to extract food from plant-based sources, which can later be processed and consumed by vegan consumers.

Due to the industry’s rapid growth, the outlook for growth of the food & beverage processing equipment market is anticipated to remain positive. Key players in the market offer a wide variety of premium food and beverage brands. Some examples of companies with premium brands include Danone, which sells Alpro and Activia; Cargill, which sells the Sterling Silver Premium Meats line; and Finsbury Food Group PLC, which sells Vogel’s Village Bakery, Cranks, and LivLife brands. Currently, consumers can choose from a wide variety of food products based on their preferences.

Restraints: Several rules and regulations implemented by governments globally

Due to the COVID-19 pandemic and the increased number of foodborne illnesses, numerous governments and food organizations worldwide have enacted rigorous laws and regulations on food processing and handling hygiene. To lessen the danger posed by convenience foods, governments are providing food processing and handling machinery operators with various safety training facilities. Due to the limited capital backing in some rising small and medium-sized businesses, implementing government regulations has become a complex process, which restrains the growth of the global market.

“All industry equipment and utensils shall be so designed, and of such material and workmanship as to be adequately cleanable, and shall be properly maintained,” according to the Current Good Manufacturing Practices (cGMPs) rule by US Public Health Service/US Food and Drug Administration (FDA) Food Code in 2021. Five fundamental principles are considered in the understanding of this statement:

- Under normal usage conditions, all equipment and utensils with food contact surfaces must be made of stainless steel or other non-toxic, smooth, impermeable, non-corrosive, non-absorbent materials.

- All surfaces that come into touch with food must be easily cleanable and free of breaks, open seams, cracks, and other problems.

- Surfaces that meet food must not provide any flavor, color, or other adulterants to the food.

- Except for food contact surfaces intended for clean-in-place (CIP) cleaning, all food contact surfaces must be easily accessible for manual cleaning.

- All joints and fittings must be made of hygienic materials.

The safety design specifications for equipment used in food processing are provided by the British Standards mentioned below. Since their initial release, most of these Standards have been revised (for instance, BSEN453:2000 was revised in 2009 to become BSEN453:2000 + A1:2009). The Standards are offered by the British Standards Institution and are founded on European CEN Standards.

Opportunities: Government initiatives toward meat & processed food industry

The growing demand for extruded snacks, dairy, meat, confections, and bakery products in developing markets such as China, India, Brazil, and the European region is driving up demand for automation in the food & beverage processing industry. Manufacturers are increasing production to reach these markets, driving up demand for food extruders in the area. Manufacturers of snack pellets are being inspired by this to upgrade and expand their facilities. Industry automation has steadily increased since 2017, says Invest India (National Investment Promotion and Facilitation Agency), and investments have increased. According to the Minister of State for Food Processing Industries, FDI in the food processing industry totaled USD 44.3 billion in 2018–2019.

In 2019, through training, food safety audits, certification of animal feed, and pressuring merchants to make health and safety improvements, the Food Safety and Standards Authority of India (FSSAI) undertook a hygiene and cleanliness crusade in the Indian meat business. Within the next three months, it intended to conduct a food safety audit of meat processing facilities, slaughterhouses, distribution centers, and retail establishments throughout 40 cities. Additionally, by December 2019, the FDA had held 50 training sessions for meat handlers throughout India. The FSSAI stated that it was considering updating formal animal feed requirements as well as financing initiatives offering small meat businesses government support to enhance their sanitary methods, collaborating with other government organizations, including the Bureau of Indian Requirements.

The cost of labor per hour increased by 4.2% in the Euro region and 4.1% in the European Union (EU) in the second quarter of 2020, the quarter that saw the widespread implementation of the COVID-19 containment measures in the European Union. Hourly labor costs climbed by 3.7% and 3.9%, respectively, in the first quarter of 2020. Automation now has more room to grow in all economies. To address the labor shortage, because of the increasing labor wages, European manufacturers are concentrating on robotic interventions because of the rising labor wages.

The working and living circumstances of the posted and temporary workers employed by the German meat processing sector had been the subject of heated discussion for years. The government attempted to address the issue by reaching agreements with the sector that would ensure moral behavior and better working conditions. However, the pandemic exposed occupational health and safety gaps, infection prevention, and health protection standards. The large number of infections that resulted from these gaps, as well as the new regulations on labor inspection in general and the working conditions in the meat sector, are the results. New rules went into effect on January 1, 2021. They must be vigorously enforced by the appropriate authorities.

Brazil is transforming into an economic powerhouse in promoting domestic industry development and foreign investment. For processed bakery and snack goods, there is a significant market in Europe. By bringing together various stakeholders in the snacks industry, the European Snacks Association (ESA) has supported the markets for snacks and snack pellets. To advance trade through knowledge sharing, the association organizes various trade shows, conferences, and publications of technical insights. The ESA accepts responsibility for informing members of the association’s current and future trends. The North American Association of Food Equipment Manufacturers also offers all the assistance needed to start, grow, or improve a business in terms of technical know-how and other guidance. Via all these government initiatives, the region-wise government is trying to increase employment opportunities and promote better quality meat for export purposes.

Challenges: Infrastructural challenges in emerging economies

The saturated markets of developed regions such as Europe and North America compel food processing equipment manufacturers to search for untapped markets and expand their consumer base. This requires substantial investments in many aspects of business expansion, especially in establishing new facilities in developing countries. Apart from internal investments in facilities, manufacturers also need to spend heavily on developing efficient supply chain management and storing raw materials and finished goods. Although low raw material prices and labor costs benefit processing companies entering developing countries, the investment costs for infrastructural development are a significant challenge. Many developing countries still lack proper infrastructure facilities, such as cold storage facilities, non-availability of refrigerated transport, and non-availability of electric supply and road and rail connectivity. These challenges need to be addressed by the respective governments and manufacturers to support the growth of the food & beverage processing equipment market in developing regions.

Based on mode of operations, automatic segment is estimated to account for the largest market share of the food and beverage processing equipment market.

Automatic machines offer several advantages over manual machines, which is why food manufacturers prefer them. Firstly, automatic machines can produce food products at a faster rate than manual machines, leading to increased efficiency and higher production capacity. This allows food manufacturers to meet demand while reducing production costs and increasing profits. Further, the use of automatic machines reduces labor costs, as they require fewer workers to operate. This is especially important in the food industry, where labor costs can be high. By reducing the number of workers required, food manufacturers can save money and increase their profits. The use of automatic machines offers several advantages to food manufacturers, including increased efficiency, consistency in production, reduced labor costs, and improved food safety. These advantages make them a preferred choice for food manufacturers, leading to increased adoption of automatic machines in the food industry.

Based on end product form, The solid segment are anticipated to dominate the market.

Solid foods tend to be more filling than semi-solid or liquid foods. They take longer to chew and digest, which helps to create a feeling of fullness and satisfaction. The process of chewing food helps to break it down into smaller pieces, which makes it easier for our bodies to digest and absorb the nutrients. Additionally, solid foods tend to take longer to digest in our stomachs, which can also contribute to feelings of fullness and satisfaction. Thus, consumers prefer more of solid food products over semi-solid and liquid food products.

Non-alcoholic segment of the food and beverage processing equipment market by application is projected to witness the highest CAGR during the forecast period.

Non-alcoholic beverages offer a wider variety of flavors and options than alcoholic beverages. There are many different types of non-alcoholic beverages available, including sparkling waters, iced teas, coffees, and mocktails, which can appeal to a broad range of tastes and preferences. Also, Non-alcoholic beverages are becoming more socially acceptable and are being offered in more settings, such as bars and cafes. Thus, the increase in consumer preference and consumption had led to the highest CAGR during the forecast period.

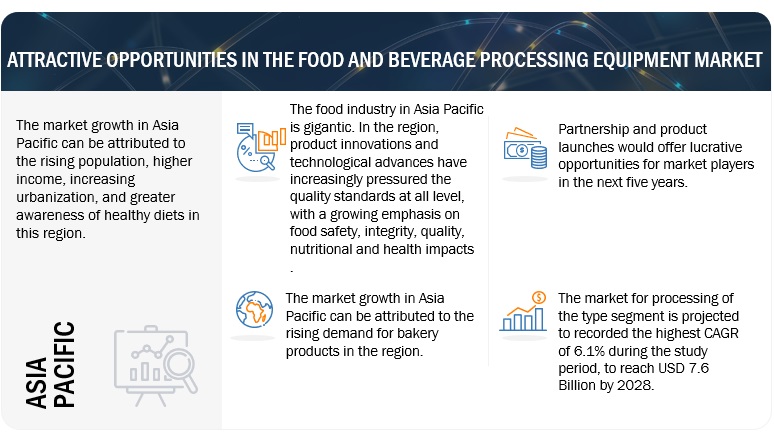

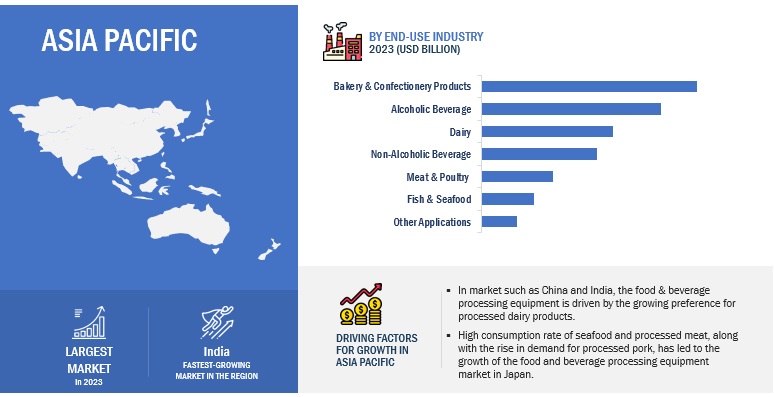

The Asia Pacific market is projected to contribute the largest share for the food and beverage processing equipment market.

The Asia Pacific region is the dominant market for food & beverages and is expected to be the largest for food & beverage processing equipment as well. The food industry in Asia Pacific is gigantic. In the region, product innovations and technological advances have increasingly pressured quality standards at all levels, with a growing emphasis on food safety, integrity, quality, and nutritional and health impacts. The growing consumer base and rising advanced technological developments in the processed food industry are expected to drive the growth of the food & beverage processing equipment market in emerging counties such as China, India, and Thailand, to name a few. Thus, creating a large market share in the food and beverage processing equipment market.

Key Market Players

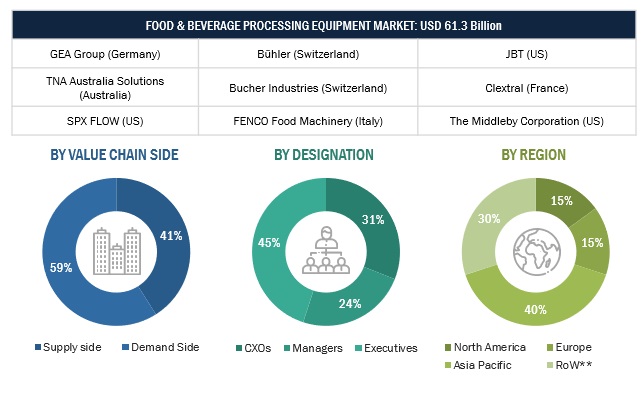

Marel (Iceland), GEA Group Aktiengesellschaft (Germany), Bühler (Switzerland), JBT (US), and Tetra Laval (Switzerland) are among the key players in the global food and beverage processing equipment market. Companies are focusing on expanding their production facilities by entering into partnerships and agreements as well as by launching new products to grow their businesses and their market shares. New product launches as a result of extensive research & development (R&D) initiatives, geographical expansion to tap the potential of emerging economies, and strategic acquisitions to gain a foothold over the large extent of the supply chain are the key strategies adopted by companies in the food & beverage processing equipment market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size estimation |

2023–2028 |

|

Base year considered |

2022 |

|

Forecast period considered |

2023–2028 |

|

Units considered |

Value (USD) |

|

Segments covered |

By Type, By Application, By End-product form, By Mode of Operation, By Region |

|

Regions covered |

North America, Europe, Asia Pacific, South America and RoW |

|

Companies studied |

|

Report Scope:

Food and Beverage Processing Equipment Market:

By Type

-

Pre-processing

- Sorting & grading

- Cutting, peeling, grinding, slicing, and washing

- Mixing & blending

-

Processing

- Forming

- Extruding

- Coating

- Drying, cooling, and freezing

- Thermal

- Homogenization

- Filtration

- Pressing

By Application

- Bakery & confectionery products

- Meat & poultry

- Dairy products

- Fish & seafood

- Alcoholic beverages

- Non-alcoholic beverages

- Other applications

By End Product form

- Solid

- Liquid

- Semi-solid

By Mode of Operation

- Semi-automatic

- Automatic

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)**

Recent Developments

- In February 2023, Marel launched the MS 2750 filleting machine, providing accurate and flexible salmon and trout filleting for secondary processors. The MS 2750 could process up to 25 fish per minute with minimal operator input, reducing labor dependency and improving yield. The MS 2750 would strengthen Marel's position in the food & beverage processing equipment market, particularly in the salmon and trout industry, by providing processors with durable and flexible equipment that maximizes yield and efficiency.

- In August 2021, new product launch of GEA Ariete Homogenizer 3160 was designed by GEA to be a high-pressure homogenizer to process a wide range of products, including those with high viscosity and solid content. The GEA TriplexPanda Lab Homogenizer, on the other hand, was a laboratory-scale homogenizer that could be used for product development and testing. By extending its range of homogenizers, GEA would be able to offer its customers a wider range of options to meet their specific processing needs. This would help strengthen the company’s position as a leading supplier of food & beverage processing equipment.

- In April 2021, SPX Flow acquired of Philadelphia Mixing Solutions, Ltd. from Thunder Basin Corporation. Philadelphia Mixing Solutions has more than six decades of industry experience in multi-industry mixing products and services, along with a reputation for world-class innovation, technical support, testing, analysis, and field service. This strategic acquisition would strengthen the company’s foothold in the food & beverage processing equipment market..

- In May 2022, Curio and Marel recently opened a demonstration and learning facility in Peterhead, Scotland, their first in the UK. The facility would offer live demonstrations of Curio’s heading and filleting machines, as well as other Marel solutions. The new demo and learning facility would help Marel strengthen its position in the food & beverage processing equipment market by showcasing its latest technology and expertise in fish processing.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share in the food and beverage processing equipment market?

The Asia Pacific region accounted for the largest share and fastest growing market, in terms of value, of USD 20.06 billion, of the global food & beverage processing equipment market in 2022 and is expected to grow at a CAGR of 6.2%. The growing consumer base and rising advanced technological developments in the processed food industry are expected to drive the growth of the food & beverage processing equipment market in emerging counties such as China, India, and Thailand, to name a few.

What is the current size of the global food and beverage processing equipment market?

The food and beverage processing equipment market is estimated at USD 64.6 billion in 2023 and is projected to reach USD 84.9 billion by 2028, at a CAGR of 5.6% from 2022 to 2028.

Which are the key players in the market?

Key players operating in this market include Tetra Laval (Switzerland), Marel (Iceland), GEA Group Aktiengesellschaft (Germany), JBT (US), Bühler (Switzerland), Alfa Laval (Sweden), Bucher Industries AG (Switzerland), SPX Flow Inc.( US), The Middleby Corporation (US), Krones AG (Germany), Bigtem Makine A.S (Turkey), Equipamientos Cárnicos, S.L (Spain), Tna Australia Pty Limited (Australia), Fenco Food Machinery S.R.L (Italy) And Khs Group (Germany).

What are the factors driving the food and beverage processing equipment market?

Growth in demand for convenience foods and Restaurants generate profits through automation in food & beverage industry.

Which segment by application accounted for the largest food and beverage processing equipment market share?

The bakery & confectionery segment dominated the market for food & beverage processing equipment and was valued the largest at USD 14.7 billion in 2022. This can be attributed to extended shelf life, improved flavor and texture and improved texture of the bakery & confectionery products that are processed using different processing equipment.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

This research study involved the extensive use of secondary sources directories and databases such as Bloomberg Businessweek and Factiva to identify and collect information useful for a technical, market-oriented, and commercial study of the food and beverage processing equipment market. In-depth interviews were conducted with various primary respondents such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants to obtain and verify critical qualitative and quantitative information as well as to assess prospects.

Secondary Research

The secondary sources referred for this research study include government sources, such as Association for Packaging and Processing Technologies (PMMI), Food Processing Suppliers Association (FPSA), the Center for Innovative Food Technology (CIFT), Bakery Equipment Manufacturers & Allied (BEMA), and Food and Drug Administration (FDA) have been referred to, to identify and collect information for this study. The secondary sources also included food & beverage equipment manufacturers’ annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and paid databases.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary research. It was also used to obtain information on the key developments from a market-oriented perspective.

Primary Research

The Food & Beverage processing equipment market comprises several stakeholders, including raw material suppliers, processed food suppliers, and regulatory organizations in the supply chain. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary interviewees from the supply side include research institutions involved in R&D to introduce technology, manufacturers, and importers & exporters of food and beverage processing equipment. Primary sources from the demand side include distributors, wholesalers, and key opinion leaders through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The following approaches represent the overall market size estimation process employed for the purpose of this study.

Both top-down and bottom-up approaches were used to estimate and validate the total size of the market. These approaches were also used extensively to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes the following:

Top-down approach:

- The key players in the industry and the market were identified through extensive secondary research.

- The revenues of major food & beverage processing equipment manufacturers were determined through primary and secondary research, such as paid databases, which were used as the basis for market estimation.

- Based on the market share analysis of key industry players from all regions, the final market size of the food & beverage processing equipment market has been arrived at.

Bottom-up approach:

- Based on the share of food & beverage processing equipment for each application at regional and country levels, the market sizes were analyzed. Thus, with a bottom-up approach to the application at the country level, the global market for food & beverage processing equipment was estimated.

- Based on the demand for applications, offerings of key players, and the region-wise market share of major players, the global market for applications was estimated.

- Other factors considered include the penetration rate of food & beverage processing equipment in the processed food & beverage industry, demand for health & wellness products, growth in immunity concerts, consumer awareness, functional trends, the adoption rate, patents registered, and organic & inorganic growth attempts.

- From this, market sizes for each region were derived.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the food & beverage processing equipment market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

The following sections (bottom-up & top-down) (supply-demand) depict the overall market size estimation process employed for this study.

Data Triangulation

After arriving at the global market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the food & beverage equipment market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Additionally, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

The food and beverage processing equipment market refers to the industry that produces machinery and equipment used in the processing, handling, and storing of food and beverages. This includes equipment used in food preparation, such as mixers & blenders, thermal processors, homogenizers, coolers, freezers, graders, sorters, size reduction machines and more. The food and beverage processing equipment market is an important industry that plays a vital role in ensuring the safety, quality, and efficiency of food and beverage production.

Stakeholders

- Government agricultural departments and regulatory bodies

- Manufacturers, dealers, and suppliers of food & beverage processing equipment

- Beverage product manufacturers

- Packaging equipment suppliers

- Intermediate suppliers, such as retailers, wholesalers, and distributors

- Raw material suppliers

- Technology providers

- Industry associations

-

Regulatory bodies and institutions:

- World Health Organization (WHO)

- Code of Federal Regulations (CFR)

- US Food and Drug Administration (FDA)

- Codex Alimentarius Commission (CAC)

- EUROPA

- United States Department of Agriculture (USDA)

- Food Processing Suppliers Association (FPSA)

- Logistics providers & transporters

- Research institutes and organizations

- Consulting companies/consultants in the agricultural technology sectors

Report Objectives

Market Intelligence

- Determining and projecting the size of the food & beverage processing equipment market, with respect to types, end-product forms, mode of operations, applications, and regions over a five-year period, ranging from 2023 to 2028

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Providing the regulatory framework for significant countries related to the food & beverage processing equipment market

- Analyzing the micromarkets, with respect to individual growth trends, prospects, and their contribution to the total market

- Impact of macro- and micro-economic factors on the market

- Shift in demand patterns across different subsegments and regions

Competitive Intelligence

- Identifying and profiling the key players in the global food & beverage processing equipment market

- Providing a comparative analysis of market leaders on the basis of the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions

- Analyzing the value chain and products across the key regions and their impact on the prominent market players

- Providing insights on key product innovations and investments in the global food & beverage processing equipment market.

**Rest of the World (RoW) includes the Middle East and Africa.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of Europe market for Food and beverage processing equipment into the Czech Republic, The Netherlands, Belgium, Hungary, Romania, and Ireland

- Further breakdown of the Rest of South America market for food and beverage processing equipment into Chile, Colombia, Paraguay, and Peru

- Further breakdown of other countries in the RoW market for food and beverage processing equipment into the Middle East & Africa

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Food & Beverage Processing Equipment Market