Forensic Equipment and Supplies Market by Product (Camera, Reagent, Consumable, LC, GC, Electrophoresis, PCR, NGS, MS, IR, UV-Vis Spectrometer), Application (Toxicology, DNA Analysis, Biometric), End user (Government & Forensic Lab) - Global Forecast to 2024

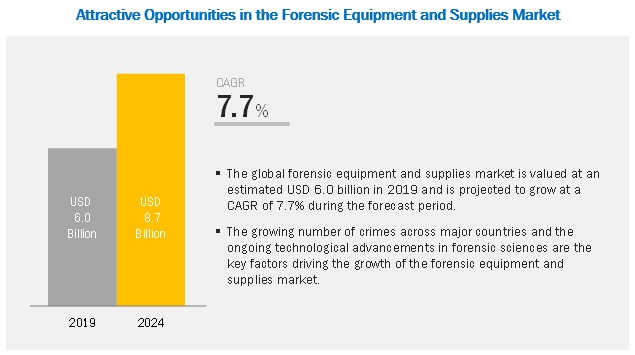

The forensic equipment market is projected to reach USD 8.7 billion by 2024, at a CAGR of 7.7%. Growth in the forensic equipment and supplies market is primarily driven by factors such as the growing number of crimes across major countries, ongoing technological advancements in forensic sciences, growing public-private investments in the field of forensics, and the rising awareness among investigators about the role of DNA profiling in criminology.

By product, the reagents and consumables segment is expected to grow at the highest CAGR during the forecast period

Forensic reagents include toxicology controls, supermixes, antibodies, enzymes, primers, probes, and specific-detection agents as well as consumables such as reaction tubes, needles, pipettes, clippers, vials, fingerprint powders, brushes, labels, and crime scene kits. These reagents are used in forensic applications for trace evidence detection. The growth of the reagents and consumables segment is attributed to factors such as the increasing number of criminal investigations, growing focus of governments on clearing the backlogs of crime cases, public-private investments in forensic sciences, and the rising awareness of DNA profiling in criminology across emerging and less-developed countries.

By application, the drug testing/toxicology segment is expected to dominate the forensic equipment and supplies market till 2024

Toxicology/toxicity testing includes the identification and quantification of pharmacological and chemical substances (such as heroin, cocaine, poisons, alcohols, metals, and gases) in a forensic sample. The growth of the drug testing/toxicology segment is attributed to factors such as the growing availability of innovative toxicity analysis platforms worldwide and the increasing number of drug testing laboratories across major countries.

By end user, government forensic laboratories are expected to be the largest contributor to the forensic equipment and supplies market

Government forensic laboratories utilize forensic equipment and supplies to perform key forensic analysis, such as DNA fingerprinting, facial identification, and histocompatibility analysis. Factors driving the growth of this segment include the growing funding and investments by governments to strengthen their analytical capabilities in the field of forensics and expand their coverage across sub-urban and rural areas to maintain law and order effectively.

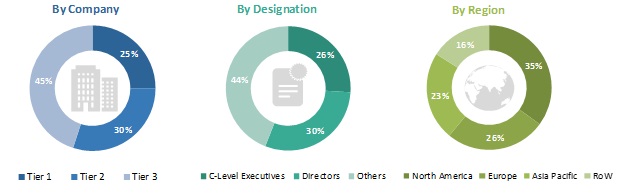

North America is estimated to be the largest regional market for forensic equipment and supplies during the forecast period

North America is one of the major revenue-generating regions in the forensic equipment and supplies industry. The increasing public-private investments in the forensics industry in the US and Canada, ongoing technological advancements in forensic equipment, increasing commercialization of forensic equipment, and the presence of major market players in the region are the major factors driving the growth of the forensic equipment and supplies market in North America.

Some of the key players of the global forensic equipment market are Thermo Fisher Scientific (US), SCIEX (Danaher Corporation, US), PerkinElmer (US), Agilent Technologies (US), and Waters Corporation (US) were the top five players operating in the global forensic equipment and supplies market. Other prominent players operating in this market include GE Healthcare (US), QIAGEN NV (Netherlands), Spectris (UK), Air Science (US), Lynn Peavey Company (US), Sirchie (US), BVDA International (Netherlands), Safariland, LLC (US), Horiba (Japan), and Illumina, Inc. (US).

Thermo Fisher Scientific (US) is one of the leading players operating in the forensic equipment and supplies market. The company has a strong presence in North America, Europe, the Asia Pacific, Africa, and the Middle East. The company operates its global operations through ~800 subsidiaries and focuses on strengthening its revenue growth and brand positioning by adopting growth strategies such as product commercialization and strategic acquisitions. For instance, Thermo Fisher Scientific acquired Advanced Scientifics, Inc. (US) and Finesse Solutions (US) in the last four years to expand and strengthen its automation systems and software product portfolio for bioproduction and forensic technologies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size Available for Years |

20172024 |

|

Base Year Considered |

2017 |

|

Forecast Period |

20182024 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

Product, Application, End User, and Region |

|

Geographies Covered |

North America (US & Canada), Europe (Germany, France, the UK, and RoE), APAC (Japan, China, India, and the RoAPAC), LATAM, and MEA |

|

Companies Covered |

Thermo Fisher Scientific (US), SCIEX (Danaher Corporation, US), PerkinElmer (US), Agilent Technologies (US), Waters Corporation (US), GE Healthcare (US), QIAGEN NV (Netherlands), Spectris (UK), Air Science (US), Lynn Peavey Company (US), Sirchie (US), BVDA International (Netherlands), Safariland, LLC (US), Horiba (Japan), and Illumina, Inc. (US). |

This research report categorizes the forensic equipment and supplies market based on product, application, end user, and region.

Forensic Equipment and Supplies Market, by Product

- Instruments

- Spectroscopy Equipment

- Fluorescence Spectrometers

- Atomic Absorption Spectrometers

- Infrared Spectrometers

- UV-visible Spectrometers

- Mass Spectrometers

- DNA Analyzers

- PCR Instruments

- NGS Instruments

- Electrophoresis Instruments

- Sanger Sequencers

- Liquid Chromatography Systems

- Gas Chromatography Systems

- Blood Chemistry Analyzers

- Fingerprint Analyzers

- Microscopes

- Forensic Cameras

- Laboratory Centrifuges

- Other Forensic Instruments (automated liquid handling systems, laboratory evaporators, powder dispensers, powder flow analyzers, cage changing hoods, and forensic workstations)

- Spectroscopy Equipment

- Reagents and Consumables

- Evidence Drying Cabinets

- Low-temperature Storage Devices

Forensic Equipment and Supplies Market, by Application

- Drug Testing/Toxicology

- DNA Analysis

- Blood Analysis

- Biometrics

- Other Applications

Forensic Equipment and Supplies Market, by End User

- Government Forensic Laboratories

- Independent Forensic Laboratories

- Research Laboratories & Academic Institutes

Forensic Equipment and Supplies Market, by Region

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- RoE

- Asia Pacific

- China

- Japan

- India

- RoAPAC

- Latin America

- Middle East and Africa

Recent Developments in Forensic Equipment Market

- In June 2016, Thermo Fisher launched the Thermo Scientific Q Exactive BioPharma MS/MS Hybrid Quadrupole-Orbitrap mass spectrometer. This helped the company to improve its position in the forensic equipment and supplies market.

Key questions addressed by the report:

- What are the growth opportunities related to the adoption of mass spectrometers across major regions in the coming years?

- Emerging countries will offer immense opportunities for the growth and adoption of forensic equipment and supplies. Will this scenario continue in the coming years?

- Where will all the advancements in products offered by various companies take the industry in the mid-to-long term?

- What are the various laboratories where forensic equipment find a high adoption rate?

- What are the new trends and advancements in the forensic equipment and supplies market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 20)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency Used for the Study

1.5 Major Market Stakeholders

2 Research Methodology (Page No. - 23)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.2 Market Estimation Methodology

2.2.1 End User-Based Market Estimation

2.2.2 Revenue Mapping-Based Market Estimation

2.2.3 Primary Research Validation

2.3 Data Triangulation

2.4 Research Assumptions

2.5 Research Limitations

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 36)

4.1 Forensic Equipment and Supplies Market Overview

4.2 Asia Pacific: Forensic Equipment and Supplies Market, By Product

4.3 Forensic Equipment and Supplies Market, By Application

4.4 Forensic Equipment and Supplies Market, By End User

4.5 Forensic Equipment and Supplies Market, By Country

5 Market Overview (Page No. - 41)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Number of Crimes Across Major Countries

5.2.1.2 Ongoing Technological Advancements

5.2.1.3 Growing Government Investments in the Field of Forensics

5.2.1.4 Rising Awareness Among Investigators About the Role of DNA Profiling in Criminology

5.2.2 Restraints

5.2.2.1 High Cost of Forensic Instruments

5.2.2.2 Dearth of Skilled Technicians

5.2.3 Opportunities

5.2.3.1 Emerging Markets

6 Forensic Equipment and Supplies Market, By Product (Page No. - 47)

6.1 Introduction

6.2 Instruments

6.2.1 Forensic DNA Analyzers

6.2.1.1 PCR Instruments

6.2.1.1.1 Incorporation of Microfluidics in Real-Time PCR has Greatly Reduced Reaction Cycle Times

6.2.1.2 NGS Instruments

6.2.1.2.1 Technological Advancements in NGS Platforms Have Allowed for Greater Efficiency and Turnaround Times

6.2.1.3 Electrophoresis Instruments

6.2.1.3.1 Rising Adoption of Electrophoresis is Due to Its Advantages and Benefits

6.2.1.4 Sanger Sequencers

6.2.1.4.1 Sanger Sequencers to Witness Modest Growth Owing to Greater Adoption of Allied Technologies

6.2.1.5 Other DNA Analyzers

6.2.2 Spectroscopy Equipment

6.2.2.1 Fluorescence Spectrometers

6.2.2.1.1 Decreased Instrument Cost and Complexity are Key Drivers of Market Growth

6.2.2.2 Atomic Absorption Spectrometers

6.2.2.2.1 Typical Applications Include Gunshot Powder Residue Analysis

6.2.2.3 Mass Spectrometers

6.2.2.3.1 Development of Novel Technologies Such as Hybrid MS and Miniaturization Contribute to the Adoption of Mass Spectrometry

6.2.2.4 UV-Visible Spectrometers

6.2.2.4.1 UV-Visible Spectrometry Finds Applications in Fingerprinting and Blood Analysis, Among Others

6.2.2.5 Infrared Spectrometers

6.2.2.5.1 High Instrument Costs to Hinder Market Growth

6.2.3 Gas Chromatography Systems

6.2.3.1 High Sensitivity and Non-Destructive Nature of Gas Chromatography Have Driven Its Use

6.2.4 Liquid Chromatography Systems

6.2.4.1 Rapidity and Accuracy and Wide Applications in Forensic Toxicology Have Contributed to Market Growth

6.2.5 Fingerprint Analyzers

6.2.5.1 Technological Advancement has Resulted in the Introduction of Precise and Powerful Instruments

6.2.6 Blood Chemistry Analyzers

6.2.6.1 Drug Use, Blood Cell Counts, and Antibody Detection are Some Applications of Blood Chemistry Analyzers

6.2.7 Microscopes

6.2.7.1 Favorable R&D Funding Scenario A Key Driver of Market Growth

6.2.8 Forensic Cameras

6.2.8.1 Array of Functionalities Offset By the High Cost of Forensic Digital Cameras

6.2.9 Laboratory Centrifuges

6.2.9.1 Long Centrifuge Lifespans Affect Sales Volumes

6.2.10 Other Forensic Instruments

6.3 Reagents and Consumables

6.3.1 Laboratory Automation has Reduced Reagent and Consumable Consumption

6.4 Evidence-Drying Cabinets

6.4.1 Rising Awareness and Growing Government Investments Will Contribute to the Adoption of Cabinets

6.5 Low-Temperature Storage Devices

6.5.1 Long Instrument Lifespans May Hinder Market Growth

7 Forensic Equipment and Supplies Market, By Application (Page No. - 94)

7.1 Introduction

7.2 Drug Testing/Toxicology

7.2.1 Drug Testing to Be the Dominant Application Segment in Forensic Products Industry Till 2024

7.3 DNA Analysis

7.3.1 Technological Advancements and Evolving Legal Framework to Replicate Into Higher Market Demand for DNA Fingerprinting Products

7.4 Biometrics

7.4.1 Ongoing Technological Advancements in the Field of Biometrics to Propel the Overall Market Growth

7.5 Blood Analysis

7.5.1 Growing Number of Trauma Cases and Paternity Disputes to Support Global Usage of Forensic Products for Blood Analysis

7.6 Other Applications

8 Forensic Equipment and Supplies Market, By End User (Page No. - 101)

8.1 Introduction

8.2 Government Forensic Laboratories

8.2.1 Government Labs to Be the Largest End User of Forensic Equipment and Supplies During the Forecast Period

8.3 Independent Forensic Laboratories

8.3.1 Demand for Forensic Equipment and Supplies in Independent Labs to Witness Modest Growth

8.4 Research Laboratories & Academic Institutes

8.4.1 Rising Government Support and Public-Private Investments in the Field of Forensic Research to Support the Growth

9 Forensic Equipment and Supplies Market, By Region (Page No. - 107)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 US Accounted for the Largest Share of the Global Forensic Equipment and Supplies Market in 2018; This Trend to Continue During the Forecast Period

9.2.2 Canada

9.2.2.1 Growth in the Forensic Equipment and Supplies Market in Canada is Driven By the Growing Availability of Novel Forensic Equipment and Supplies

9.3 Europe

9.3.1 Germany

9.3.1.1 Germany to Witness the Highest Growth in the European Forensic Equipment and Supplies Market During the Forecast Period

9.3.2 UK

9.3.2.1 Growth in This Market is Driven By the Rising Number of Research Activities for the Development of Novel Technologies in the Forensic Industry

9.3.3 France

9.3.3.1 Increasing Awareness Activities on Innovative Forensic Technologies are Driving the Forensic Equipment and Supplies Market in France

9.3.4 Rest of Europe

9.4 Asia Pacific

9.4.1 China

9.4.1.1 China to Register the Highest Growth in the Asia Pacific Forensic Equipment and Supplies Market

9.4.2 Japan

9.4.2.1 Increasing Number of Research and Growing Awareness About the Applications in Crime Investigation are the Key Factors Driving Market Growth

9.4.3 India

9.4.3.1 Increasing Focus of Oems on Strengthening Distribution Networks and the Growing Number of Crimes to Support Market Growth

9.4.4 Rest of Asia Pacific

9.5 Latin America

9.6 Middle East & Africa

10 Competitive Landscape (Page No. - 155)

10.1 Overview

10.2 Global Market Share Analysis (2017)

10.3 Competitive Scenario (2014-2018)

10.3.1 Key Product Launches

10.3.2 Key Expansions

10.3.3 Key Acquisitions

10.3.4 Key Partnerships, Agreements and Collaborations

10.4 Competitive Leadership Mapping: Overview

10.5 Vendor Inclusion Criteria

10.6 Competitive Leadership Mapping (Overall Market - 2017)

10.6.1 Visionary Leaders

10.6.2 Innovators

10.6.3 Dynamic Differentiators

10.6.4 Emerging Players

11 Company Profiles (Page No. - 162)

(Introduction, Products & Services, Strategy, & Analyst Insights, Developments, MnM View)*

11.1 Introduction

11.2 Agilent Technologies, Inc.

11.3 Air Science

11.4 BVDA International

11.5 Danaher Corporation

11.6 General Electric Company

11.7 Horiba

11.8 Illumina, Inc

11.9 Lynn Peavey Company

11.10 Perkinelmer, Inc.

11.11 Qiagen N.V.

11.12 Safariland, LLC

11.13 Sirchie

11.14 Spectris

11.15 Thermo Fisher Scientific

11.16 Waters Corporation

*Details on MarketsandMarkets view, Introduction, Product & Services, Strategy, & Analyst Insights, New Developments might not be captured in case of unlisted companies.

12 Appendix (Page No. - 211)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (156 Tables)

Table 1 Crime Index in Emerging Countries, 2017

Table 2 Forensic Equipment and Supplies Market, By Product, 20172024 (USD Million)

Table 3 Forensic Instruments Market, By Type, 20172024 (USD Million)

Table 4 Forensic Instruments Market, By Region, 20172024 (USD Million)

Table 5 Forensic Instruments Market, By Application, 20172024 (USD Million)

Table 6 Forensic Instruments Market, By End User, 20172024 (USD Million)

Table 7 Forensic DNA Analyzers Market, By Type, 20172024 (USD Million)

Table 8 Forensic DNA Analyzers Market, By Region, 20162023 (USD Million)

Table 9 Forensic DNA Analyzers Market, By Application, 20172024 (USD Million)

Table 10 Forensic DNA Analyzers Market, By End User, 20172024 (USD Million)

Table 11 Forensic Equipment Market for PCR Instruments, By Region, 20172024 (USD Million)

Table 12 Forensic Equipment Market for PCR Instruments, By End User, 20172024 (USD Million)

Table 13 Forensic Equipment Market for NGS Instruments, By Region, 20172024 (USD Million)

Table 14 Forensic Equipment Market for NGS Instruments, By End User, 20172024 (USD Million)

Table 15 Forensic Equipment Market for Electrophoresis Instruments, By Region, 20172024 (USD Million)

Table 16 Forensic Equipment Market for Electrophoresis Instruments, By Application, 20172024 (USD Million)

Table 17 Forensic Equipment Market for Electrophoresis Instruments, By End User, 20162023 (USD Million)

Table 18 Forensic Equipment Market for Sanger Sequencers, By Region, 20172024 (USD Million)

Table 19 Forensic Equipment Market for Sanger Sequencers, By End User, 20172024 (USD Million)

Table 20 Forensic Equipment Market for Other DNA Analyzers, By Region, 20172024 (USD Million)

Table 21 Forensic Equipment Market for Other DNA Analyzers, By End User, 20172024 (USD Million)

Table 22 Forensic Equipment Market for Spectroscopy Equipment, By Type, 20172024 (USD Million)

Table 23 Forensic Equipment Market for Spectroscopy Equipment, By Region, 20172024 (USD Million)

Table 24 Forensic Equipment Market for Spectroscopy Equipment, By Application, 20172024 (USD Million)

Table 25 Forensic Equipment Market for Spectroscopy Equipment, By End User, 20172024 (USD Million)

Table 26 Forensic Equipment Market for Fluorescence Spectrometers, By Region, 20172024 (USD Million)

Table 27 Forensic Equipment Market for Fluorescence Spectrometers, By Application, 20172024 (USD Million)

Table 28 Forensic Equipment Market for Fluorescence Spectrometers, By End User, 20172024 (USD Million)

Table 29 Forensic Equipment Market for Atomic Absorption Spectrometers, By Region, 20172024 (USD Million)

Table 30 Forensic Equipment Market for Atomic Absorption Spectrometers, By Application, 20172024 (USD Million)

Table 31 Forensic Equipment Market for Atomic Absorption Spectrometers, By End User, 20172024 (USD Million)

Table 32 Forensic Equipment Market for Mass Spectrometers, By Region, 20172024 (USD Million)

Table 33 Forensic Equipment Market for Mass Spectrometers, By Application, 20172024 (USD Million)

Table 34 Forensic Equipment Market for Mass Spectrometers, By End User, 20172024 (USD Million)

Table 35 Forensic Equipment Market for UV-Visible Spectrometers, By Region, 20172024 (USD Million)

Table 36 Forensic Equipment Market for UV-Visible Spectrometers, By Application, 20172024 (USD Million)

Table 37 Forensic Equipment Market for UV-Visible Spectrometers, By End User, 20172024 (USD Million)

Table 38 Forensic Equipment Market for Infrared Spectrometers, By Region, 20172024 (USD Million)

Table 39 Forensic Equipment Market for Infrared Spectrometers, By Application, 20172024 (USD Million)

Table 40 Forensic Equipment Market for Infrared Spectrometers, By End User, 20172024 (USD Million)

Table 41 Forensic Equipment Market for Gas Chromatography Systems, By Region, 20172024 (USD Million)

Table 42 Forensic Equipment Market for Gas Chromatography Systems, By Application, 20172024 (USD Million)

Table 43 Forensic Equipment Market for Gas Chromatography Systems, By End User, 20172024 (USD Million)

Table 44 Forensic Equipment Market for Liquid Chromatography Systems, By Region, 20172024 (USD Million)

Table 45 Forensic Equipment Market for Liquid Chromatography Systems, By Application, 20172024 (USD Million)

Table 46 Forensic Equipment Market for Liquid Chromatography Systems, By End User, 20172023 (USD Million)

Table 47 Forensic Equipment Market for Fingerprint Analyzers, By Region, 20172024 (USD Million)

Table 48 Forensic Equipment Market for Fingerprint Analyzers, By End User, 20172024 (USD Million)

Table 49 Forensic Equipment Market for Blood Chemistry Analyzers, By Region, 20172024 (USD Million)

Table 50 Forensic Equipment Market for Blood Chemistry Analyzers, By Application, 20172024 (USD Million)

Table 51 Forensic Equipment Market for Blood Chemistry Analyzers, By End User, 20172024 (USD Million)

Table 52 Forensic Equipment Market for Microscopes, By Region, 20172024 (USD Million)

Table 53 Forensic Equipment Market for Microscopes, By Application, 20172024 (USD Million)

Table 54 Forensic Equipment Market for Microscopes, By End User, 20172024 (USD Million)

Table 55 Forensic Cameras Market, By Region, 20172024 (USD Million)

Table 56 Forensic Cameras Market, By Application, 20172024 (USD Million)

Table 57 Forensic Cameras Market, By End User, 20172024 (USD Million)

Table 58 Forensic Equipment Market for Laboratory Centrifuges, By Region, 20172024 (USD Million)

Table 59 Forensic Equipment Market for Laboratory Centrifuges, By Application, 20172024 (USD Million)

Table 60 Forensic Equipment Market for Laboratory Centrifuges, By End User, 20162023 (USD Million)

Table 61 Other Forensic Instruments Market, By Region, 20172024 (USD Million)

Table 62 Other Forensic Instruments Market, By End User, 20172024 (USD Million)

Table 63 Forensic Reagents and Consumables Market, By Region, 20172024 (USD Million)

Table 64 Forensic Equipment and Supplies Market for Reagents and Consumables, By Application, 20172024 (USD Million)

Table 65 Forensic Reagents and Consumables Market, By End User, 20172024 (USD Million)

Table 66 Forensic Evidence-Drying Cabinets Market, By Region, 20172024 (USD Million)

Table 67 Forensic Evidence Drying Cabinet Market, By Application, 20172024 (USD Million)

Table 68 Forensic Evidence-Drying Cabinet Market, By End User, 20172024 (USD Million)

Table 69 Forensic Low-Temperature Storage Devices Market, By Region, 20172024 (USD Million)

Table 70 Forensic Low-Temperature Storage Devices Market, By Application, 20172024 (USD Million)

Table 71 Forensic Low-Temperature Storage Devices Market, By End User, 20172024 (USD Million)

Table 72 Forensic Equipment and Supplies Market, By Application, 20172024 (USD Million)

Table 73 Forensic Equipment and Supplies Market for Drug Testing/Toxicology, By Region, 20172024 (USD Million)

Table 74 Forensic Equipment and Supplies Market for DNA Analysis, By Region, 20172024 (USD Million)

Table 75 Forensic Equipment and Supplies Market for Biometrics, By Region, 20172024 (USD Million)

Table 76 Forensic Equipment and Supplies Market for Blood Analysis, By Region, 20172024 (USD Million)

Table 77 Forensic Equipment and Supplies Market for Other Applications, By Region, 20172024 (USD Million)

Table 78 Forensic Equipment and Supplies Market, By End User, 20172024 (USD Million)

Table 79 Forensic Equipment and Supplies Market for Government Forensic Laboratories, By Region, 20172024 (USD Million)

Table 80 Forensic Equipment and Supplies Market for Independent Forensic Laboratories, By Region, 20172024 (USD Million)

Table 81 Forensic Equipment and Supplies Market for Research Laboratories & Academic Institutes, By Region, 20172024 (USD Million)

Table 82 Forensic Equipment and Supplies Market, By Region, 20172024 (USD Million)

Table 83 Forensic Equipment and Supplies Market, By Country, 20172024 (USD Million)

Table 84 North America: Forensic Equipment and Supplies Market, By Country, 20172024 (USD Million)

Table 85 North America: Forensic Equipment and Supplies Market, By Product, 20172024 (USD Million)

Table 86 North America: Forensic Instruments Market, By Type, 20172024 (USD Million)

Table 87 North America: Forensic Spectroscopy Equipment Market, By Type, 20172024 (USD Million)

Table 88 North America: Forensic DNA Analyzers Market, By Type, 20172024 (USD Million)

Table 89 North America: Forensic Equipment and Supplies Market, By Application, 20172024 (USD Million)

Table 90 North America: Forensic Equipment and Supplies Market, By End User, 20172024 (USD Million)

Table 91 US: Forensic Equipment and Supplies Market, By Product, 20172024 (USD Million)

Table 92 US: Forensic Instruments Market, By Type, 20172024 (USD Million)

Table 93 US: Forensic Spectroscopy Equipment Market, By Type, 20172024 (USD Million)

Table 94 US: Forensic DNA Analyzers Market, By Type, 20172024 (USD Million)

Table 95 Canada: Forensic Equipment and Supplies Market, By Product, 20172024 (USD Million)

Table 96 Canada: Forensic Instruments Market, By Type, 20172024 (USD Million)

Table 97 Canada: Forensic Spectroscopy Equipment Market, By Type, 20172024 (USD Million)

Table 98 Canada: Forensic DNA Analyzers Market, By Type, 20172024 (USD Million)

Table 99 Europe: Forensic Equipment and Supplies Market, By Country, 20172024 (USD Million)

Table 100 Europe: Forensic Equipment and Supplies Market, By Product, 20172024 (USD Million)

Table 101 Europe: Forensic Instruments Market, By Type, 20172024 (USD Million)

Table 102 Europe: Forensic Spectroscopy Equipment Market, By Type, 20172024 (USD Million)

Table 103 Europe: Forensic DNA Analyzers Market, By Type, 20172024 (USD Million)

Table 104 Europe: Forensic Equipment and Supplies Market, By Application, 20172024 (USD Million)

Table 105 Europe: Forensic Equipment and Supplies Market, By End User, 20172024 (USD Million)

Table 106 Germany: Forensic Equipment and Supplies Market, By Product, 20172024 (USD Million)

Table 107 Germany: Forensic Instruments Market, By Type, 20172024 (USD Million)

Table 108 Germany: Forensic Spectroscopy Equipment Market, By Type, 20172024 (USD Million)

Table 109 Germany: Forensic DNA Analyzers Market, By Type, 20172024 (USD Million)

Table 110 UK: Forensic Equipment and Supplies Market, By Product, 20172024 (USD Million)

Table 111 UK: Forensic Instruments Market, By Type, 20172024 (USD Million)

Table 112 UK: Forensic Spectroscopy Equipment Market, By Type, 20172024 (USD Million)

Table 113 UK: Forensic DNA Analyzers Market, By Type, 20172024 (USD Million)

Table 114 France: Forensic Equipment and Supplies Market, By Product, 20172024 (USD Million)

Table 115 France: Forensic Instruments Market, By Type, 20172024 (USD Million)

Table 116 France: Forensic Spectroscopy Equipment Market, By Type, 20172024 (USD Million)

Table 117 France: Forensic DNA Analyzers Market, By Type, 20172024 (USD Million)

Table 118 RoE: Forensic Equipment and Supplies Market, By Product, 20172024 (USD Million)

Table 119 RoE: Forensic Instruments Market, By Type, 20172024 (USD Million)

Table 120 RoE: Forensic Spectroscopy Equipment Market, By Type, 20172024 (USD Million)

Table 121 RoE: Forensic DNA Analyzers Market, By Type, 20172024 (USD Million)

Table 122 Asia Pacific: Forensic Equipment and Supplies Market, By Country, 20172024 (USD Million)

Table 123 Asia Pacific: Forensic Equipment and Supplies Market, By Product, 20172024 (USD Million)

Table 124 Asia Pacific: Forensic Instruments Market, By Type, 20172024 (USD Million)

Table 125 Asia Pacific: Forensic Spectroscopy Equipment Market, By Type, 20172024 (USD Million)

Table 126 Asia Pacific: Forensic DNA Analyzers Market, By Type, 20172024 (USD Million)

Table 127 Asia Pacific: Forensic Equipment and Supplies Market, By Application, 20172024 (USD Million)

Table 128 Asia Pacific: Forensic Equipment and Supplies Market, By End User, 20172024 (USD Million)

Table 129 China: Forensic Equipment and Supplies Market, By Product, 20172024 (USD Million)

Table 130 China: Forensic Instruments Market, By Type, 20172024 (USD Million)

Table 131 China: Forensic Spectroscopy Equipment Market, By Type, 20172024 (USD Million)

Table 132 China: Forensic DNA Analyzers Market, By Type, 20172024 (USD Million)

Table 133 Japan: Forensic Equipment and Supplies Market, By Product, 20172024 (USD Million)

Table 134 Japan: Forensic Instruments Market, By Type, 20172024 (USD Million)

Table 135 Japan: Forensic Spectroscopy Equipment Market, By Type, 20172024 (USD Million)

Table 136 Japan: Forensic DNA Analyzers Market, By Type, 20172024 (USD Million)

Table 137 India: Forensic Equipment and Supplies Market, By Product, 20172024 (USD Million)

Table 138 India: Forensic Instruments Market, By Type, 20172024 (USD Million)

Table 139 India: Forensic Spectroscopy Equipment Market, By Type, 20172024 (USD Million)

Table 140 India: Forensic DNA Analyzers Market, By Type, 20172024 (USD Million)

Table 141 RoAPAC: Forensic Equipment and Supplies Market, By Product, 20172024 (USD Million)

Table 142 RoAPAC: Forensic Instruments Market, By Type, 20172024 (USD Million)

Table 143 RoAPAC: Forensic Spectroscopy Equipment Market, By Type, 20172024 (USD Million)

Table 144 RoAPAC: Forensic DNA Analyzers Market, By Type, 20172024 (USD Million)

Table 145 Latin America: Forensic Equipment and Supplies Market, By Product, 20172024 (USD Million)

Table 146 Latin America: Forensic Instruments Market, By Type, 20172024 (USD Million)

Table 147 Latin America: Forensic Spectroscopy Equipment Market, By Type, 20172024 (USD Million)

Table 148 Latin America: Forensic DNA Analyzers Market, By Type, 20172024 (USD Million)

Table 149 Latin America: Forensic Equipment and Supplies Market, By Application, 20172024 (USD Million)

Table 150 Latin America: Forensic Equipment and Supplies Market, By End User, 20172024 (USD Million)

Table 151 Middle East & Africa: Forensic Equipment and Supplies Market, By Product, 20172024 (USD Million)

Table 152 Middle East & Africa: Forensic Instruments Market, By Type, 20172024 (USD Million)

Table 153 Middle East & Africa: Forensic Spectroscopy Equipment Market, By Type, 20172024 (USD Million)

Table 154 Middle East & Africa: Forensic DNA Analyzers Market, By Type, 20172024 (USD Million)

Table 155 Middle East & Africa: Forensic Equipment and Supplies Market, By Application, 20172024 (USD Million)

Table 156 Middle East & Africa: Forensic Equipment and Supplies Market, By End User, 20172024 (USD Million)

List of Figures (40 Figures)

Figure 1 Research Design

Figure 2 Breakdown of Primaries: Forensic Equipment and Supplies Market

Figure 3 Research Methodology: Hypothesis Building

Figure 4 Market Size Estimation: Forensic Equipment and Supplies Market

Figure 5 Data Triangulation Methodology

Figure 6 Forensic Equipment and Supplies Market, By Product, 2018 vs 2024

Figure 7 Forensic Instruments Market, By Type, 2018 vs 2024 (USD Million)

Figure 8 Forensic Equipment and Supplies Market Share, By Application, 2019 vs 2024

Figure 9 Forensic Equipment and Supplies Market Share, By End User, 2019 vs 2024 (USD Million)

Figure 10 Geographic Snapshot: Forensic Equipment and Supplies Market

Figure 11 Growing Number of Crimes and Ongoing Technological Advancements to Drive the Demand for Forensic Equipment and Supplies Market During the Forecast Period

Figure 12 Instruments to Dominate the APAC Forensic Equipment and Supplies Market During the Forecast Period

Figure 13 Drug Testing/Toxicology Segment to Register the Highest CAGR During the Forecast Period

Figure 14 North America Will Dominate the Forensic Equipment and Supplies End-User Market in 2019

Figure 15 China is Estimated to Be the Fastest-Growing Country in Forensic Equipment and Supplies Market During the Forecast Period

Figure 16 Forensic Equipment and Supplies Market: Drivers, Restraints, and Opportunities

Figure 17 Crime Index, By Country (2017)

Figure 18 Forensic DNA Analyzers to Dominate the Forensic Instruments Market During the Forecast Period

Figure 19 PCR Instruments to Dominate the Forensic DNA Analyzers Market During the Forecast Period

Figure 20 Mass Spectrometers to Dominate the Forensic Spectroscopy Equipment Market During the Forecast Period

Figure 21 DNA Analysis Estimated to Be the Largest Application Segment in the Forensic Equipment and Supplies Market During the Forecast Period

Figure 22 Forensic Equipment and Supplies Market, By End User, 2019 vs 2024

Figure 23 North America: Forensic Equipment and Supplies Market Snapshot

Figure 24 Europe: Forensic Equipment and Supplies Market Snapshot

Figure 25 Asia Pacific: Forensic Equipment and Supplies Market Snapshot

Figure 26 Latin America: Forensic Equipment and Supplies Market Snapshot

Figure 27 Middle East and Africa: Forensic Equipment and Supplies Market Snapshot

Figure 28 Key Developments in the Forensic Equipment and Supplies Market From 2014 to 2018

Figure 29 Thermo Fisher Scientific Held the Leading Position in the Forensic Equipment and Supplies Market in 2017

Figure 30 Competitive Leadership Mapping: Key Global Players

Figure 31 Agilent Technologies: Company Snapshot

Figure 32 Danaher Corporation: Company Snapshot

Figure 33 General Electric Company: Company Snapshot

Figure 34 Horiba: Company Snapshot

Figure 35 Illumina, Inc.: Company Snapshot

Figure 36 Perkinelmer, Inc.: Company Snapshot

Figure 37 Qiagen N.V.: Company Snapshot

Figure 38 Spectris: Company Snapshot

Figure 39 Thermo Fisher Scientific: Company Snapshot

Figure 40 Waters Corporation: Company Snapshot

The study involved four major activities to estimate the current size of the forensic equipment and supplies market. Exhaustive secondary research was carried out to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to in order to identify and collect information for this study.

Primary Research

The forensic equipment and supplies market comprises several stakeholders such as manufacturers, suppliers, and distributors of forensic equipment and supplies; healthcare service providers; and research institutes. The demand side of this market is characterized by the growing number of crimes across major countries, while the supply side is characterized by advancements in technology. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Forensic Equipment Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the forensic equipment and supplies market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industrys supply chain and market size, in terms of value, have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market sizeusing the market size estimation processes as explained abovethe market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the forensic equipment and supplies industry.

Report Objectives

- To define, describe, and forecast the global forensic equipment and supplies market by product, application, end user, and region

- To provide detailed information about the major factors influencing market growth (key drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contributions to the global forensic equipment and supplies market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the value of various segments and subsegments with respect to five main regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players operating in the forensic equipment and supplies market and comprehensively analyze their global revenue shares and core competencies

- To track and analyze competitive market-specific developments such as product development & commercialization, agreements, collaborations, partnerships, and expansions in the forensic equipment and supplies market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolios of the top five global players

Product Analysis

- Further breakdown of the Rest of Europe forensic equipment and supplies market into Poland, Italy, Spain, and other European countries (aggregated)

Company Information

- Detailed analysis and profiling of additional market players (up to 5 OEMs)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Forensic Equipment and Supplies Market