Fumed Silica Market by Type (Hydrophilic and Hydrophobic), Application (Silicone Elastomers, Paints, Coatings & Inks, Adhesives & Sealants, UPR & Composites), End-Use Industry, and Region - Global Forecast to 2026

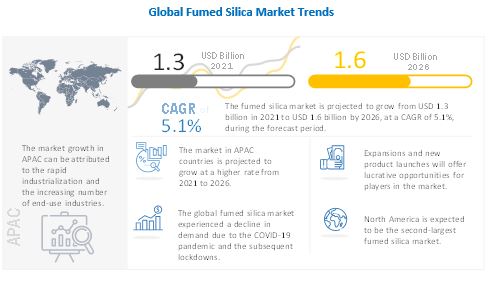

[195 Pages Report] The global fumed silica market size is projected to grow from USD 1.3 billion in 2021 to reach USD 1.6 billion by 2026, at a CAGR of 5.1% during the forecast period. The fumed silica market is expected to witness significant growth in the coming years due to its increased demand across the building & construction, electrical & electronics, automotive & transportation, personal care & beauty, food & beverage, and pharmaceutical industries.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on global fumed silica market

With the rise in cases of COVID-19, implementation of emergency protocols and shutdown of various operations and facilities have been observed during 2020. The outbreak of COVID-19 in Wuhan, China, has spread across the major APAC, European, and North American countries, affecting the market for fumed silica since most of the global companies have their headquarters in these countries. This impact of COVID-19 had caused disruption in the supply chain, which had slowed down the market growth due to lack of raw materials and unavailability of workforce.

In 2020, the fumed silica market was impacted to a very low extent by the COVID-19 pandemic with a nominal decline in CAGR. The market has been hampered owing to reduced raw material production, supply chain disruptions, and hampered trade movements during 2020. The end-use industries, such as building & construction, electrical & electronics, and automotive & transportation, were affected by the pandemic.

Fumed silica Market Dynamics

Driver: Increasing demand for fumed silica in the pharmaceutical industry

In the pharmaceutical industry, the production of tablets and capsules is a significant challenge but fumed silica aids to improve properties to make the procedure much easier. Fumed silica has many uses in tablet-making: as anticaking agents, adsorbents, disintegrates, or glidants to allow powder to flow freely when tablets are processed. These compounds appear to be biologically inert. It is generally recognized as safe by the FDA.

Fumed silica has been a well-known pharmaceutical excipient since 1957 as:

- Traditional glidant for solid dosage form

- Suitable for soft powder mixtures

- Thickener for pharmaceutical oils

The demand for fumed silica is expected to grow at an unprecedented rate in Europe, owing to its medical industry. In Europe, large investments are made in the pharmaceutical industry, and advancement in technology is strengthening the hold of the market. Due to the impact of COVID-19, the pharmaceutical industry has shown good growth.

Restraint: Stringent government regulations on the usage of fumed silica

Governments and associations globally have provided numerous regulations and mandates associated with the usage of fumed silica. For instance, the Food and Drug Administration (FDA) has restricted the use of fumed silica for manufacturing. Manufacturers can use fumed silica as a food additive but in a small amount that does not exceed more than 2% of the weight of the food. The Occupational Safety and Health Administration (OSHA) enforces a standard for fumed silica. This standard is expressed as a permissible exposure limit (PEL), the maximum amount of a substance that a worker can be exposed to as averaged over an 8-hour shift. The PEL for fumed silica is currently 20 mppcf, or 80 mg/m3 or %SiO2. The standard varies with the percent of fumed silica present. For pure fumed silica, the standard is 0.8 mg/m3.

Silica is classified as a hazardous substance and is therefore regulated under Chapter 4 of the Hazardous Substances of the 2017 Occupational Health and Safety Regulations. An employer has a legal duty to identify hazards and eliminate or control any risk, provide information and training, undertake atmospheric monitoring, and maintain records. The National Occupational Health and Safety Commission (NOHSC - now SafeWork Australia) has revised the exposure standards for the three forms of crystalline silica: quartz, cristobalite, and tridymite. These regulations and mandates have prompted manufacturers to employ new techniques to maintain a safe working environment. This, in turn, can lead to reduced profit margins and may hamper the growth of the fumed silica market to some extent.

Opportunity: Increased demand in paints, coatings and sealants industries

The increased demand in the paints, coating & sealants industry is expected to drive the demand for fumed silica across the globe during the forecast period. The World Painting and Coating Association outlined that the global painting and coating industry generated revenue of USD 150 billion in 2020, and the industry is increasing its demand for fumed silica, as it improves the property of paints and coatings to meet consumer demand. Fumed silica in sealants shows thixotropic behavior and gives sag-specific properties for successful practical application. It also provides reinforcement and mechanic properties to sealants. These properties cannot be achieved by any other source, and hence fumed silica has an advantage in the sealants market and enjoys supremacy. A growing construction industry across the globe is accelerating the demand for paints and coating, in turn offering significant growth opportunities for the fumed silica market. In the US, new construction activity worth USD 1,365 billion took place in 2019 and reached USD 1,430 billion in 2020. This simulated the consumption of sealants, and paints & coatings, adding to demand for fumed silica.

Challenge: Adverse effect of fumed silica on human health

Fumed silica can create various health hazards to the workers of various end use industries as well as to the people using the product in which fumed silica is used. It can cause health problems such as eye irritation in extreme contact and eye damage in repeated exposure. It can cause flu-like illnesses, such as headaches, fever, chills, aches, coughing, and chest tightness. Fibrosis is one long-term effect due to fumed silica which can cause lung damage. Biological pieces of research are underway to find the effects of fumed silica on living beings. The synthetic fumed silica is made without contamination of crystalline silica, but nowadays, contamination of crystalline silica takes place, which makes fumed silica more vulnerable to health hazards and risks for pulmonary diseases such as silicosis, tuberculosis, chronic bronchitis, chronic obstructive pulmonary disease (COPD), and lung cancer. Several regulations are made to use fumed silica in limited quantities.

Hydrophilic fumed silica is widely preferred.

Based on type, the hydrophilic segment is projected to be the largest segment in the fumed silica market. Hydrophilic fumed silica is produced by hydrolyzing volatile chlorosilanes in an oxyhydrogen flame. It can be completely soaked and dispersed in water. This silica has superior insulating properties at high temperatures. Hydrophilic fumed silica is suitable for usage in non-polar resin systems. It is used in silicone reinforcing & thickening as a glidant for food & industrial powders and in the thickening of non-polar solvents such as xylene, mineral spirits, & styrene. It is preferred in formulations where shelf stability is not a major consideration. Hydrophilic fumed silica is increasingly utilized for many applications owing to its low cost. It has high chemical purity and excellent insulating properties even at elevated temperatures.

Hydrophilic fumed silica is used to enhance the dispersion ability of adhesives, which can be used for building boats. It absorbs the surface water of the particle hence is best suited as an anti-caking agent.

Silicone elastomers application is the largest segment for fumed silica.

Based on application, silicone elastomers is projected to be the largest segment in the fumed silica market. Silicone elastomers are used in a wide variety of products, including voltage line insulators, cooking, baking, and food storage products; undergarments, sportswear, and footwear; electronics; medical devices and implants; and in household gaskets and O-rings. Some silicone elastomers are also used in the manufacturing of sealants. Their physiological inertness makes them suitable for use in the healthcare industry, especially for blood transfusions and in artificial heart valves and various prosthetic devices. Major countries producing silicone elastomers are the UK, France, Germany, the US, and Japan.

Significant increase in the demand for fumed silica in building & construction

By end-use industry, building & construction is projected to be the largest segment in the fumed silica market. Fumed silica has a wide range of applications in the building and construction industry, including pipes, ducts, electrical wiring within building walls and ceilings, architectural coatings, basements, glazing frames, ceiling joints, floors, roofs, external walls, cladding, retaining walls, bathroom components and fixtures, corrosion-resistant tanks, cultured marble, panels for floor and walls, sanitary-ware, and tanks. Building & construction is a major end-use industry for paints & coatings, adhesive & sealants, and UPR & composites.

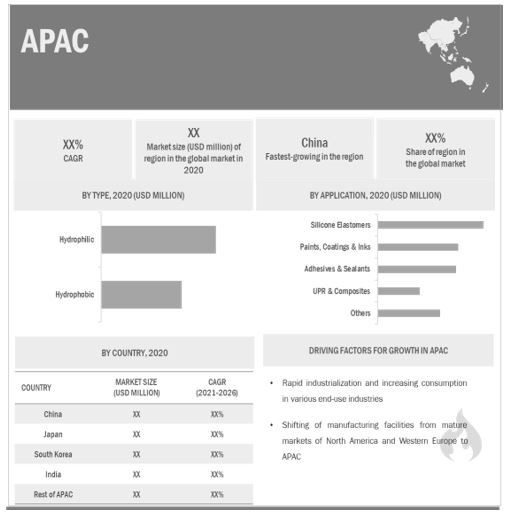

APAC region to lead the global fumed silica market by 2026.

APAC accounted for the largest market share of about 41.4%, in terms of value in 2020. The growing population and rapid urbanization are among the key factors propelling industry expansion in this region. High domestic demand, along with the easy availability of raw materials and low-cost labor, makes APAC a lucrative market for manufacturers that are focusing on this region to gain market share and increase profitability. Manufacturers of fumed silica are targeting this country due to the advantages of setting up production facilities, the low cost of production, and the ability to better serve local emerging markets.

Key Market Players

Key manufacturers in the fumed silica market are Evonik Industries (Germany), Cabot Corporation (US), Wacker Chemie AG (Germany), Tokuyama Corporation (Japan), and Applied Material Solutions Inc. (US), among others.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2019–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Value (USD Million) and Volume (Kiloton) |

|

Segments covered |

Type, Application, End-Use Industry, and Region |

|

Geographies covered |

North America, APAC, Europe, MEA, and South America |

|

Companies covered |

Evonik Industries (Germany), Cabot Corporation (US), Wacker Chemie AG (Germany), Tokuyama Corporation (Japan), and Applied Material Solutions Inc. (US), among others. |

This research report categorizes the fumed silica market based on type, application, end-use industry, and region.

Based on Type:

- Hydrophilic

- Hydrophobic

Based on Application

- Silicone Elastomers

- Paints, Coatings & Inks

- Adhesives & Sealants

- UPR & Composites

- Others (Food, Agri & Feed, CMP, Cosmetics, Toners & Developers, Paper Coating, Textile, Gel Batteries, Lighting (CFL)

Based on Application

- Building & Construction

- Electrical & Electronics

- Automotive & Transportation

- Personal Care & Beauty

- Food & Beverages

- Pharmaceuticals

- Others (Greases & Lubricants, Chemicals, and Fertilizers Industries)

Based on region:

- North America

- Europe

- APAC

- MEA

- South America

Recent Developments:

- In November 2020, Cabot Corporation announced the launch of PLASBLAK XP6801D black masterbatch, a unique Styrene Acrylonitrile (SAN)-based formulation that meets the needs of the styrenics market without the usual trade-off between color and mechanical properties. PLASBLAK XP6801D black masterbatch enables excellent color performance, mechanical properties, and UV resistance at a lower masterbatch concentration.

- In October 2019, Wacker Chemie AG expanded the production facility of fumed silica with the inauguration of new facility in Charleston. The facility has an annual capacity of 13,000 metric tons for its HDK brand.

- In June 2019, Evonik expanded its fumed silica production with its new plant complex in Antwerp. With this capacity expansion, the company is now able to cater to the rising fumed silica demand under its brand—AEROSIL.

- In February 2019, Wacker launched its new pyrogenic silica grade HDK H21 to be used as an additive for polar adhesive systems.

- In August 2018, Evonik industries entered a joint venture with Wynca Group based in China. This joint venture is focused on catering to the increasing fumed silica demand globally. With this joint venture, Evonik expanded its AEROSIL production capacity while Wynca Group expanded its silicone product offerings.

Frequently Asked Questions (FAQ):

What is the current size of the global fumed silica market?

The global fumed silica market size is projected to grow from USD 1.3 billion in 2021 to USD 1.6 billion by 2026, at a CAGR of 5.1% from 2021 to 2026.

How is the fumed silica market aligned?

The fumed silica market is consolidated, with a 75%-80% share held by the top three companies.. These players have strong and well-established procurement and distribution networks, which help in cost-efficient production.

Who are the key players in the global fumed silica market?

Key manufacturers in the fumed silica market are Evonik Industries (Germany), Cabot Corporation (US), Wacker Chemie AG (Germany), Tokuyama Corporation (Japan), and Applied Material Solutions Inc. (US), among others.

What are the factors driving the growth of the fumed silica market?

The growth of the fumed silica market is attributed to the increase in demand for fumed silica for numerous applications, particularly for silicone elastomers. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 INCLUSION AND EXCLUSION

TABLE 1 INCLUSION AND EXCLUSION

1.4 MARKET SCOPE

FIGURE 1 FUMED SILICA MARKET SEGMENTATION

1.4.1 REGIONAL SCOPE

FIGURE 2 FUMED SILICA MARKET, BY REGION

1.4.2 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

1.8 LIMITATIONS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 25)

2.1 RESEARCH DATA

FIGURE 3 FUMED SILICA MARKET: RESEARCH DESIGN

2.2 DATA TRIANGULATION

2.2.1 SECONDARY DATA

2.2.2 PRIMARY DATA

FIGURE 4 DATA TRIANGULATION

2.3 PRIMARIES

FIGURE 5 STAKEHOLDERS AND BREAKDOWN OF PRIMARY INTERVIEWS

2.4 MARKET SIZE ESTIMATION

2.4.1 SUPPLY-SIDE APPROACH – 1

FIGURE 6 FUMED SILICA MARKET: SUPPLY-SIDE APPROACH - 1

2.4.2 SUPPLY-SIDE APPROACH – 2

FIGURE 7 FUMED SILICA MARKET: SUPPLY-SIDE APPROACH – 2

2.5 RESEARCH ASSUMPTIONS & LIMITATIONS

2.5.1 ASSUMPTIONS

2.5.2 LIMITATIONS

2.5.3 RISK ASSESSMENT

TABLE 2 LIMITATIONS & ASSOCIATED RISKS

TABLE 3 RISKS

3 EXECUTIVE SUMMARY (Page No. - 32)

FIGURE 8 HYDROPHILIC FUMED SILICA TO BE LARGER MARKET DURING FORECAST PERIOD

FIGURE 9 UPR & COMPOSITES TO BE FASTEST-GROWING SEGMENT

FIGURE 10 BUILDING & CONSTRUCTION SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 11 APAC TO BE FASTEST-GROWING FUMED SILICA MARKET FROM 2021 TO 2026

4 PREMIUM INSIGHTS (Page No. - 36)

4.1 APAC TO SHOW HIGHER GROWTH RATE DUE TO RAPID INDUSTRIALIZATION AND INCREASING NUMBER OF END-USE INDUSTRIES

FIGURE 12 INCREASING DEMAND FROM BUILDING & CONSTRUCTION INDUSTRY WILL DRIVE FUMED SILICA MARKET

4.2 FUMED SILICA MARKET, BY REGION AND END-USE INDUSTRY

FIGURE 13 BUILDING & CONSTRUCTION AND APAC LED THEIR RESPECTIVE SEGMENTS IN FUMED SILICA MARKET IN 2020

4.3 FUMED SILICA MARKET, BY COUNTRY

FIGURE 14 FUMED SILICA MARKET IN CHINA TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 38)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 FUMED SILICA MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Unique properties and multiple applications of fumed silica

TABLE 4 APPLICATIONS OF FUMED SILICA

5.2.1.2 Increased demand in pharmaceutical industry

5.2.2 RESTRAINTS

5.2.2.1 Stringent government regulations restricting use of fumed silica

5.2.2.2 Volatility in raw material prices

5.2.3 OPPORTUNITIES

5.2.3.1 Increased demand in paints, coatings & sealants industry

5.2.3.2 Growth in cosmetic industry to drive demand

5.2.4 CHALLENGES

5.2.4.1 Adverse effects of fumed silica on human health

5.2.4.2 Harmful effects of fumed silica on manufacturing sites

6 INDUSTRY TRENDS (Page No. - 43)

6.1 INTRODUCTION

6.2 SUPPLY CHAIN ANALYSIS

FIGURE 16 FUMED SILICA MARKET: SUPPLY CHAIN

TABLE 5 FUMED SILICA MARKET: ECOSYSTEM

6.2.1 PROMINENT COMPANIES

6.2.2 SMALL & MEDIUM ENTERPRISES

6.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 17 PORTER’S FIVE FORCES ANALYSIS

TABLE 6 FUMED SILICA MARKET: PORTER’S FIVE FORCES ANALYSIS

6.3.1 THREAT OF NEW ENTRANTS

6.3.2 THREAT OF SUBSTITUTES

6.3.3 BARGAINING POWER OF SUPPLIERS

6.3.4 BARGAINING POWER OF BUYERS

6.3.5 INTENSITY OF COMPETITIVE RIVALRY

6.4 YC-YCC DRIVERS

FIGURE 18 YC-YCC DRIVERS

6.5 TARIFF AND REGULATORY ANALYSIS

6.6 MARKET MAPPING/ECOSYSTEM MAP

FIGURE 19 ECOSYSTEM MAP

6.7 PRICING ANALYSIS

6.7.1 FUMED SILICA– PRICE

6.8 TECHNOLOGY ANALYSIS

6.9 TRADE ANALYSIS

6.9.1 HS CODE USED FOR SILICON DIOXIDE – IMPORT

6.9.2 HS CODE USED FOR FUMED SILICA – IMPORT

6.9.3 TRADE OF SILICON DIOXIDE – EXPORT

6.9.4 HS CODE USED FOR FUMED SILICA - EXPORT

6.1 CASE STUDY

6.10.1 CASE STUDY TOPIC

6.10.2 INTRODUCTION

6.10.3 PROBLEM STATEMENT

6.10.4 SOLUTION PROVIDED

6.11 PATENT ANALYSIS

6.11.1 INTRODUCTION

6.11.2 METHODOLOGY

6.11.3 DOCUMENT TYPE

6.11.4 TOTAL NUMBER OF PATENTS FOR FUMED SILICA

FIGURE 20 FUMED SILICA MARKET: GRANTED PATENT, LIMITED PATENT, AND PATENT APPLICATION

FIGURE 21 PUBLICATION TRENDS - LAST 10 YEARS

6.11.5 INSIGHT

FIGURE 22 JURISDICTION ANALYSIS

6.11.6 TOP COMPANIES/APPLICANTS

FIGURE 23 TOP APPLICANTS OF FUMED SILICA

6.11.7 PATENTS BY SHIN-ETSU CHEMICAL CO., LTD.

6.11.8 PATENTS BY EVONIK INDUSTRIES AG

6.11.9 PATENTS BY COLGATE-PALMOLIVE COMPANY

6.11.10 PATENTS BY TOKUYAMA CORPORATION

6.11.11 PATENTS BY DOW GLOBAL TECHNOLOGIES LLC

6.11.12 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

7 IMPACT OF COVID-19 ON FUMED SILICA MARKET (Page No. - 63)

FIGURE 24 COVID-19 IMPACT ON GDP

FIGURE 25 GLOBAL VEHICLE PRODUCTION, 2019-2020

FIGURE 26 GLOBAL VEHICLE SALES, 2019-2020

8 FUMED SILICA MARKET, BY TYPE (Page No. - 65)

8.1 INTRODUCTION

8.1.1 HYDROPHILIC TO BE FASTER-GROWING SEGMENT

TABLE 7 FUMED SILICA MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 8 FUMED SILICA MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

8.2 HYDROPHILIC

8.2.1 COST-EFFECTIVENESS AND GOOD INSULATING PROPERTIES TO DRIVE THE SEGMENT

TABLE 9 FUMED SILICA MARKET SIZE IN HYDROPHILIC SEGMENT, BY REGION,2019–2026 (USD MILLION)

TABLE 10 FUMED SILICA MARKET SIZE IN HYDROPHILIC SEGMENT, BY REGION,2019–2026 (KILOTON)

8.3 HYDROPHOBIC

8.3.1 WIDE APPLICABILITY ACROSS VARIED END-USE INDUSTRIES

TABLE 11 FUMED SILICA MARKET SIZE IN HYDROPHOBIC SEGMENT, BY REGION, 2019–2026 (USD MILLION)

TABLE 12 FUMED SILICA MARKET SIZE IN HYDROPHOBIC SEGMENT, BY REGION, 2019–2026 (KILOTON)

9 FUMED SILICA MARKET, BY APPLICATION (Page No. - 69)

9.1 INTRODUCTION

9.1.1 UPR & COMPOSITES SEGMENT TO GROW AT HIGHEST CAGR

TABLE 13 FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 14 FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

9.2 SILICONE ELASTOMERS

9.2.1 INCREASING DEMAND IN MEDICAL & HEALTHCARE INDUSTRY

TABLE 15 FUMED SILICA MARKET SIZE IN SILICONE ELASTOMERS SEGMENT, BY REGION, 2019–2026 (USD MILLION)

TABLE 16 FUMED SILICA MARKET SIZE IN SILICONE ELASTOMERS SEGMENT, BY REGION, 2019–2026 (KILOTON)

9.3 PAINTS, COATINGS & INKS

9.3.1 THIXOTROPIC AND RHEOLOGICAL PROPERTIES OF FUMED SILICA

TABLE 17 FUMED SILICA MARKET SIZE IN PAINTS, COATINGS & INKS SEGMENT, BY REGION, 2019–2026 (USD MILLION)

TABLE 18 FUMED SILICA MARKET SIZE IN PAINTS, COATINGS & INKS SEGMENT, BY REGION, 2019–2026 (KILOTON)

9.4 ADHESIVE & SEALANTS

9.4.1 INCREASING DEMAND FROM END-USE INDUSTRIES TO BOOST DEMAND

TABLE 19 FUMED SILICA MARKET SIZE IN ADHESIVE & SEALANTS SEGMENT, BY REGION, 2019–2026 (USD MILLION)

TABLE 20 FUMED SILICA MARKET SIZE IN ADHESIVE & SEALANTS SEGMENT, BY REGION, 2019–2026 (KILOTON)

9.5 UPR & COMPOSITES

9.5.1 INCREASING RESIN APPLICATIONS IN VARIOUS INDUSTRY VERTICALS

TABLE 21 FUMED SILICA MARKET SIZE IN UPR & COMPOSITES SEGMENT, BY REGION, 2019–2026 (USD MILLION)

TABLE 22 FUMED SILICA MARKET SIZE IN UPR & COMPOSITES SEGMENT, BY REGION, 2019–2026 (KILOTON)

9.6 OTHERS

TABLE 23 FUMED SILICA MARKET SIZE IN OTHERS SEGMENT, BY REGION, 2019–2026 (USD MILLION)

TABLE 24 FUMED SILICA MARKET SIZE IN OTHERS SEGMENT, BY REGION, 2019–2026 (KILOTON)

10 FUMED SILICA MARKET, BY END-USE INDUSTRY (Page No. - 77)

10.1 INTRODUCTION

FIGURE 27 BUILDING & CONSTRUCTION SEGMENT TO LEAD FUMED SILICA MARKET

TABLE 25 FUMED SILICA MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 26 FUMED SILICA MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

10.2 BUILDING & CONSTRUCTION

10.2.1 INCREASING CONSTRUCTION ACTIVITIES TO DRIVE THE SEGMENT

TABLE 27 FUMED SILICA MARKET SIZE IN BUILDING & CONSTRUCTION SEGMENT, BY REGION, 2019–2026 (USD MILLION)

TABLE 28 FUMED SILICA MARKET SIZE IN BUILDING & CONSTRUCTION SEGMENT, BY REGION, 2019–2026 (KILOTON)

10.3 ELECTRICAL & ELECTRONICS

10.3.1 EMERGING TREND OF MINIATURIZATION IN ELECTRONICS INDUSTRY

TABLE 29 FUMED SILICA MARKET SIZE IN ELECTRICAL & ELECTRONICS SEGMENT, BY REGION, 2019–2026 (USD MILLION)

TABLE 30 FUMED SILICA MARKET SIZE IN ELECTRICAL & ELECTRONICS SEGMENT, BY REGION, 2019–2026 (KILOTON)

10.4 AUTOMOTIVE & TRANSPORTATION

10.4.1 MECHANICAL AND RHEOLOGICAL PROPERTIES TO DRIVE SEGMENT

TABLE 31 FUMED SILICA MARKET SIZE IN AUTOMOTIVE & TRANSPORTATION SEGMENT, BY REGION, 2019–2026 (USD MILLION)

TABLE 32 FUMED SILICA MARKET SIZE IN AUTOMOTIVE & TRANSPORTATION SEGMENT, BY REGION, 2019–2026 (KILOTON)

10.5 PERSONAL CARE & BEAUTY

10.5.1 VERSATILITY AND UNIQUE PROPERTIES OF FUMED SILICA

TABLE 33 FUMED SILICA MARKET SIZE IN PERSONAL CARE & BEAUTY SEGMENT, BY REGION, 2019–2026 (USD MILLION)

TABLE 34 FUMED SILICA MARKET SIZE IN PERSONAL CARE & BEAUTY SEGMENT, BY REGION, 2019–2026 (KILOTON)

10.6 FOOD & BEVERAGE

10.6.1 GROWING POPULATION AND NEED FOR HEALTHY & NUTRITIOUS FOOD TO DRIVE THE SEGMENT

TABLE 35 FUMED SILICA MARKET SIZE IN FOOD & BEVERAGE SEGMENT, BY REGION, 2019–2026 (USD MILLION)

TABLE 36 FUMED SILICA MARKET SIZE IN FOOD & BEVERAGE SEGMENT, BY REGION, 2019–2026 (KILOTON)

10.7 PHARMACEUTICALS

10.7.1 INCREASING R&D ON NEW DRUGS FOR CURING VARIOUS FATAL DISEASES

TABLE 37 FUMED SILICA MARKET SIZE IN PHARMACEUTICALS SEGMENT, BY REGION, 2019–2026 (USD MILLION)

TABLE 38 FUMED SILICA MARKET SIZE IN PHARMACEUTICALS SEGMENT, BY REGION, 2019–2026 (KILOTON)

10.8 OTHERS

TABLE 39 FUMED SILICA MARKET SIZE IN END-USE INDUSTRY SEGMENT, BY REGION, 2019–2026 (USD MILLION)

TABLE 40 FUMED SILICA MARKET SIZE IN OTHERS SEGMENT, BY REGION, 2019–2026 (KILOTON)

11 FUMED SILICA MARKET, BY REGION (Page No. - 87)

11.1 INTRODUCTION

TABLE 41 INTERIM ECONOMIC OUTLOOK FORECAST, 2019 TO 2021

FIGURE 28 APAC TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

TABLE 42 FUMED SILICA MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 43 FUMED SILICA MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

11.2 APAC

11.2.1 IMPACT OF COVID-19 IN APAC

FIGURE 29 APAC: FUMED SILICA MARKET SNAPSHOT

TABLE 44 APAC: FUMED SILICA MARKET SIZE, BY COUNTRY, 2014–2018 (USD MILLION)

TABLE 45 APAC: FUMED SILICA MARKET SIZE, BY COUNTRY, 2014–2018 (KILOTON)

TABLE 46 APAC: FUMED SILICA MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 47 APAC: FUMED SILICA MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 48 APAC: FUMED SILICA MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 49 APAC: FUMED SILICA MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 50 APAC: FUMED SILICA MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 51 APAC: FUMED SILICA MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 52 APAC: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 53 APAC: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

11.2.2 CHINA

11.2.2.1 Increasing industrial activities and high growth of electronics sector

TABLE 54 CHINA: FUMED SILICA MARKET SIZE, BY APPLICATION, 2014–2018 (USD MILLION)

TABLE 55 CHINA: FUMED SILICA MARKET SIZE, BY APPLICATION, 2014–2018 (KILOTON)

TABLE 56 CHINA: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 57 CHINA: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

11.2.3 INDIA

11.2.3.1 Growing construction industry and rapid industrialization are driving market

TABLE 58 INDIA: FUMED SILICA MARKET SIZE, BY APPLICATION, 2014–2018 (USD MILLION)

TABLE 59 INDIA: FUMED SILICA MARKET SIZE, BY APPLICATION, 2014–2018 (KILOTON)

TABLE 60 INDIA: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 61 INDIA: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

11.2.4 JAPAN

11.2.4.1 Increasing demand for lightweight passenger vehicles and growing electronics industry

TABLE 62 JAPAN: FUMED SILICA MARKET SIZE, BY APPLICATION, 2014–2018 (USD MILLION)

TABLE 63 JAPAN: FUMED SILICA MARKET SIZE, BY APPLICATION, 2014–2018 (KILOTON)

TABLE 64 JAPAN: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 65 JAPAN: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

11.2.5 SOUTH KOREA

11.2.5.1 Increasing government investments for research on the use of fumed silica across industries

TABLE 66 SOUTH KOREA: FUMED SILICA MARKET SIZE, BY APPLICATION, 2014–2018 (USD MILLION)

TABLE 67 SOUTH KOREA: FUMED SILICA MARKET SIZE, BY APPLICATION, 2014–2018 (KILOTON)

TABLE 68 SOUTH KOREA: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 69 SOUTH KOREA: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

11.2.6 REST OF APAC

TABLE 70 REST OF APAC: FUMED SILICA MARKET SIZE, BY APPLICATION, 2014–2018 (USD MILLION)

TABLE 71 REST OF APAC: FUMED SILICA MARKET SIZE, BY APPLICATION, 2014–2018 (KILOTON)

TABLE 72 REST OF APAC: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 73 REST OF APAC: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

11.3 NORTH AMERICA

11.3.1 IMPACT OF COVID-19 IN NORTH AMERICA

FIGURE 30 NORTH AMERICA: FUMED SILICA MARKET SNAPSHOT

TABLE 74 NORTH AMERICA: FUMED SILICA MARKET SIZE, BY COUNTRY, 2014–2018 (USD MILLION)

TABLE 75 NORTH AMERICA: FUMED SILICA MARKET SIZE, BY COUNTRY, 2014–2018 (KILOTON)

TABLE 76 NORTH AMERICA: FUMED SILICA MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 77 NORTH AMERICA: FUMED SILICA MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 78 NORTH AMERICA: FUMED SILICA MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 79 NORTH AMERICA: FUMED SILICA MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 80 NORTH AMERICA: FUMED SILICA MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 81 NORTH AMERICA: FUMED SILICA MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 82 NORTH AMERICA: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 83 NORTH AMERICA: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

11.3.2 US

11.3.2.1 US dominated fumed silica market in North America

TABLE 84 US: FUMED SILICA MARKET SIZE, BY APPLICATION, 2014–2018 (USD MILLION)

TABLE 85 US: FUMED SILICA MARKET SIZE, BY APPLICATION, 2014–2018 (KILOTON)

TABLE 86 US: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 87 US: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

11.3.3 CANADA

11.3.3.1 Government’s efforts to augment residential and public infrastructure

TABLE 88 CANADA: FUMED SILICA MARKET SIZE, BY APPLICATION, 2014–2018 (USD MILLION)

TABLE 89 CANADA: FUMED SILICA MARKET SIZE, BY APPLICATION, 2014–2018 (KILOTON)

TABLE 90 CANADA: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 91 CANADA: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

11.3.4 MEXICO

11.3.4.1 Growth of industrial sector and building & construction industry to drive demand for fumed silica

TABLE 92 MEXICO: FUMED SILICA MARKET SIZE, BY APPLICATION, 2014–2018 (USD MILLION)

TABLE 93 MEXICO: FUMED SILICA MARKET SIZE, BY APPLICATION, 2014–2018 (KILOTON)

TABLE 94 MEXICO: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 95 MEXICO: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

11.4 EUROPE

11.4.1 IMPACT OF COVID-19 IN EUROPE

FIGURE 31 EUROPE: FUMED SILICA MARKET SNAPSHOT

TABLE 96 EUROPE: FUMED SILICA MARKET SIZE, BY COUNTRY, 2014–2018 (USD MILLION)

TABLE 97 EUROPE: FUMED SILICA MARKET SIZE, BY COUNTRY, 2014–2018 (KILOTON)

TABLE 98 EUROPE: FUMED SILICA MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 99 EUROPE: FUMED SILICA MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 100 EUROPE: FUMED SILICA MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 101 EUROPE: FUMED SILICA MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 102 EUROPE: FUMED SILICA MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 103 EUROPE: FUMED SILICA MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 104 EUROPE: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 105 EUROPE: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

11.4.2 GERMANY

11.4.2.1 Demand for fumed silica to grow in automotive & transportation segment

TABLE 106 GERMANY: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 107 GERMANY: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

11.4.3 UK

11.4.3.1 Increased investments by government in construction and other industries

TABLE 108 UK: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 109 UK: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

11.4.4 ITALY

11.4.4.1 Growth of Italian automotive industry to drive demand for fumed silica

TABLE 110 ITALY: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 111 ITALY: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

11.4.5 FRANCE

11.4.5.1 Increasing use of fumed silica in personal care & cosmetic products

TABLE 112 FRANCE: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 113 FRANCE: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

11.4.6 BELGIUM

11.4.6.1 Paints & coatings industry is driving market

TABLE 114 BELGIUM: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 115 BELGIUM: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

11.4.7 SPAIN

11.4.7.1 Rising demand from food & beverage industry driving market growth

TABLE 116 SPAIN: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 117 SPAIN: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

11.4.8 RUSSIA

11.4.8.1 Immense growth potential of construction industry

TABLE 118 RUSSIA: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 119 RUSSIA: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

11.4.9 REST OF EUROPE

TABLE 120 REST OF EUROPE: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 121 REST OF EUROPE: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

11.5 MIDDLE EAST & AFRICA (MEA)

11.5.1 IMPACT OF COVID-19 IN MEA

FIGURE 32 MEA: FUMED SILICA MARKET SNAPSHOT

TABLE 122 MEA: FUMED SILICA MARKET SIZE, BY COUNTRY, 2014–2018 (USD MILLION)

TABLE 123 MEA: FUMED SILICA MARKET SIZE, BY COUNTRY, 2014–2018 (KILOTON)

TABLE 124 MEA: FUMED SILICA MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 125 MEA: FUMED SILICA MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 126 MEA: FUMED SILICA MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 127 MEA: FUMED SILICA MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 128 MEA: FUMED SILICA MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 129 MEA: FUMED SILICA MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 130 MEA: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 131 MEA: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

11.5.2 SAUDI ARABIA

11.5.2.1 Highest demand from building & construction industry

TABLE 132 SAUDI ARABIA: FUMED SILICA MARKET SIZE, BY APPLICATION, 2014–2018 (USD MILLION)

TABLE 133 SAUDI ARABIA: FUMED SILICA MARKET SIZE, BY APPLICATION, 2014–2018 (KILOTON)

TABLE 134 SAUDI ARABIA: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 135 SAUDI ARABIA: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

11.5.3 SOUTH AFRICA

11.5.3.1 Increase in consumption of plastics to fuel market growth

TABLE 136 SOUTH AFRICA: FUMED SILICA MARKET SIZE, BY APPLICATION, 2014–2018 (USD MILLION)

TABLE 137 SOUTH AFRICA: FUMED SILICA MARKET SIZE, BY APPLICATION, 2014–2018 (KILOTON)

TABLE 138 SOUTH AFRICA: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 139 SOUTH AFRICA: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

11.5.4 REST OF MEA

TABLE 140 REST OF MEA: FUMED SILICA MARKET SIZE, BY APPLICATION, 2014–2018 (USD MILLION)

TABLE 141 REST OF MEA: FUMED SILICA MARKET SIZE, BY APPLICATION, 2014–2018 (KILOTON)

TABLE 142 REST OF MEA: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 143 REST OF MEA: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

11.6 SOUTH AMERICA

11.6.1 IMPACT OF COVID-19 IN SOUTH AMERICA

FIGURE 33 SOUTH AMERICA: FUMED SILICA MARKET SNAPSHOT

TABLE 144 SOUTH AMERICA: FUMED SILICA MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 145 SOUTH AMERICA: FUMED SILICA MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 146 SOUTH AMERICA: FUMED SILICA MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 147 SOUTH AMERICA: FUMED SILICA MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 148 SOUTH AMERICA: FUMED SILICA MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 149 SOUTH AMERICA: FUMED SILICA MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 150 SOUTH AMERICA: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 151 SOUTH AMERICA: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

11.6.2 BRAZIL

11.6.2.1 Government’s efforts for fiscal sustainability

TABLE 152 BRAZIL: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 153 BRAZIL: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

11.6.3 ARGENTINA

11.6.3.1 Government investments in infrastructural development fueling market growth

TABLE 154 ARGENTINA: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 155 ARGENTINA: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

11.6.4 REST OF SOUTH AMERICA

TABLE 156 REST OF SOUTH AMERICA: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 157 REST OF SOUTH AMERICA: FUMED SILICA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

12 COMPETITIVE LANDSCAPE (Page No. - 148)

12.1 OVERVIEW

12.2 MARKET RANKING ANALYSIS

12.3 MARKET SHARE ANALYSIS

FIGURE 34 MARKET SHARE OF KEY PLAYERS IN FUMED SILICA MARKET, 2020

12.4 MARKET EVALUATION FRAMEWORK

TABLE 158 MARKET EVALUATION FRAMEWORK

12.5 REVENUE ANALYSIS OF TOP FOUR MARKET PLAYERS

FIGURE 35 TOP FOUR PLAYERS DOMINATED MARKET IN LAST THREE YEARS

12.6 COMPANY EVALUATION QUADRANT

12.6.1 STAR

12.6.2 EMERGING LEADERS

12.6.3 PERVASIVE

FIGURE 36 COMPETITIVE LEADERSHIP MAPPING: FUMED SILICA MARKET, 2020

12.6.4 PRODUCT FOOTPRINT

12.7 SME MATRIX, 2020

12.7.1 PROGRESSIVE COMPANIES

12.7.2 RESPONSIVE COMPANIES

12.7.3 STARTING BLOCKS

12.7.4 DYNAMIC COMPANIES

FIGURE 37 SME MATRIX: FUMED SILICA MARKET, 2020

12.8 COMPETITIVE SCENARIO

12.8.1 NEW PRODUCT LAUNCH

TABLE 159 FUMED SILICA MARKET: NEW PRODUCT LAUNCH, 2015-2021

12.8.2 OTHERS

TABLE 160 FUMED SILICA MARKET: OTHERS, 2015-2021

12.8.3 AGREEMENTS AND MERGER & ACQUISITION

TABLE 161 FUMED SILICA MARKET: AGREEMENTS AND MERGER & ACQUISITION, 2015-2021

13 COMPANY PROFILES (Page No. - 158)

(Business overview, Products/solutions/services Offered, Recent developments & MnM View)*

13.1 EVONIK INDUSTRIES

TABLE 162 EVONIK INDUSTRIES: BUSINESS OVERVIEW

FIGURE 38 EVONIK INDUSTRIES: COMPANY SNAPSHOT

13.2 WACKER CHEMIE AG

TABLE 163 WACKER CHEMIE AG: BUSINESS OVERVIEW

FIGURE 39 WACKER CHEMIE AG: COMPANY SNAPSHOT

13.3 CABOT CORPORATION

TABLE 164 CABOT CORPORATION: BUSINESS OVERVIEW

FIGURE 40 CABOT CORPORATION: COMPANY SNAPSHOT

13.4 TOKUYAMA CORPORATION

TABLE 165 TOKUYAMA CORPORATION: BUSINESS OVERVIEW

FIGURE 41 TOKUYAMA CORPORATION: COMPANY SNAPSHOT

13.5 CHINA NATIONAL BLUESTAR (GROUP) CORPORATION

TABLE 166 CHINA NATIONAL BLUESTAR (GROUP) CORPORATION: BUSINESS OVERVIEW

13.6 APPLIED MATERIAL SOLUTIONS INC.

TABLE 167 APPLIED MATERIAL SOLUTIONS INC.: BUSINESS OVERVIEW

13.7 CHIFENG SHENGSEN SILICON TECHNOLOGY DEVELOPMENT CO., LTD.

TABLE 168 CHIFENG SHENGSEN SILICON TECHNOLOGY DEVELOPMENT CO., LTD.: BUSINESS OVERVIEW

13.8 KEMITURA A/S

TABLE 169 KEMITURA A/S: BUSINESS OVERVIEW

13.9 ORISIL

TABLE 170 ORISIL: BUSINESS OVERVIEW

*Details on Business overview, Products/solutions/services Offered, Recent developments & MnM View might not be captured in case of unlisted companies.

13.10 ADDITIONAL PLAYERS

13.10.1 AGSCO CORPORATION

13.10.2 HERAEUS QUARGLAS GMBH & CO. KG

13.10.3 GUANGZHOU GBS HIGH-INDUSTRY CO, LTD.

13.10.4 CHINA-HENAN HUAMEICHEMICAL CO., LTD.

13.10.5 DONGYUE GROUP CO., LTD.

13.10.6 DALIAN FUCHANG CHEMICAL CO, LTD.

13.10.7 CHINA SILICON CORPORATION LIMITED

13.10.8 FUJI SILYSIA CHEMICAL LTD.

13.10.9 GELEST INC.

13.10.10 ZHEJIANG XINAN CHEMICAL INDUSTRIAL GROUP CO LTD

13.10.11 POWER CHEMICAL CORPORATION LTD.

13.10.12 YICHANG CSG POLYSILICON CO, LTD

14 APPENDIX (Page No. - 189)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

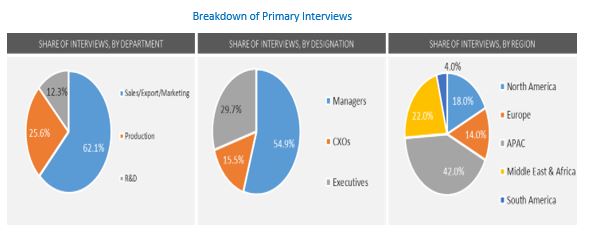

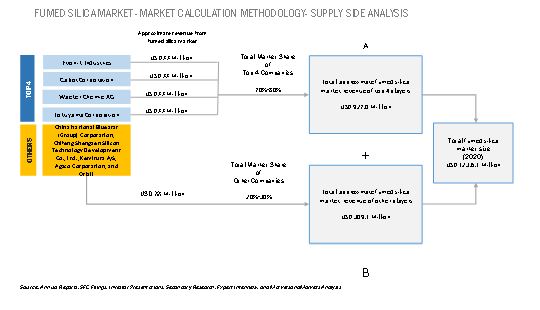

The study involved four major activities for estimating the current global size of the fumed silica market. The exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions and sizes with the industry experts across the value chain of fumed silica through primary research. The bottom-up approach was employed to estimate the overall size of the fumed silica market. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, so as to identify and collect information for this study on the fumed silica market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

Various primary sources from both the supply and demand sides of the fumed silica market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the fumed silica industry. The primary sources from the demand-side included key executives from banks, government organizations, and educational institutions. The breakdown of the profiles of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The above approach was used to estimate and validate the global size of the fumed silica market. These approaches were also used extensively to estimate the size of various dependent segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments of the fumed silica market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

Report Objectives

- To define, analyze, and project the size of the fumed silica market in terms of value and volume based on type, application, end-use industry and region

- To project the size of the market and its segments in terms of value and volume, with respect to the five main regions, namely, North America, Europe, APAC, MEA, and South America.

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the fumed silica report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis

- Further analysis of the fumed silica market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Fumed Silica Market