Game-Based Learning Market by Component (Solution and Services), Game Type, Deployment Mode (On-premises and Cloud), End User (Education, Governments, Consumers, and Enterprises) and Region - Global Forecast to 2026

Game-based Learning Market - Size, Growth, Report & Analysis

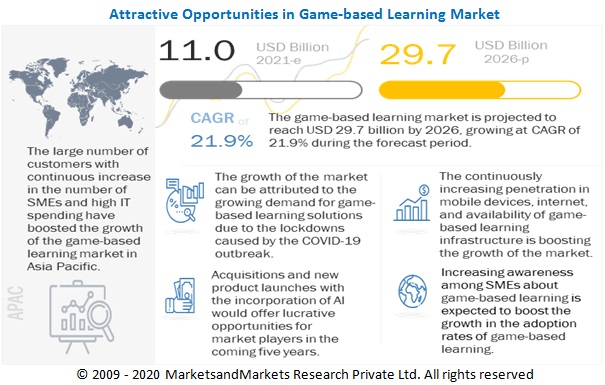

The global Game-based Learning Market size was valued at 11.0 billion in 2021 and is poised to hit revenue aroundof $29.7 billion by the end of 2026, projecting a CAGR of 21.9% during the anticipated period (2021-2026). The base year for estimation is 2020 and the data available for the years 2020 to 2026.

Game based learning is an innovative approach that uses computer games that offer educational value using different kinds of software applications to succeed teaching enhancement, assessment, and evaluation of learners.

To know about the assumptions considered for the study, Request for Free Sample Report

Game based Learning Market Growth Dynamics

Drivers: Increase demand for getting feedbacks

Conformational feedback is a type of feedback that is frequently used in games and game-based learning to aid in learning. Conformational feedback is intended to indicate the degree to which a response, action, or activity is "right" or "wrong." Feedback immediately tells the learner whether she did the right thing, the wrong thing, or something in between, but it does not tell the learner how to correct the action. Explanatory feedback is corrective, but it also includes relevant information about why an answer is correct in addition to providing the correct answer. Explanatory feedback explains why the correct answers were chosen. This type of feedback provides a rich explanation to the learner in the hope that the explanation provided at the precise time of incorrectly acting or attempting to recall information allows for effective knowledge encoding. Feedback always motivates student to improve themselves.

Restraints: Need high security for phishing attacks in game-based learning

Cybercrime is becoming a widespread issue that poses an increased risk as the number of Internet-connected devices, such as smartphones, grows. Smartphones are increasingly being used for a variety of purposes, including Internet browsing, gaming, social networking, online banking, and email. Over the last three years, smartphone email app usage has increased by 180%. (as per Heinze et al. 2016). Furthermore, over 2.3 billion banking users will use their mobile devices to manage their current accounts. A cyberattack simulation works on the same premise: the company can test its reaction times and defences without incurring any damage. Based on the results, it can then analyse and improve the areas where its policies and skills were lacking. Organizations are devoting significant resources to addressing this issue and ensuring that their networks and infrastructure are as secure as possible. Despite this, 90% of large organisations and 74% of small and medium-sized enterprises reported a security breach in 2015. When it comes to protecting network investments, phishing attacks remain one of the most serious threats. Worryingly, the rate of spearphishing campaigns targeting employees increased by 55% in 2015. As the attacks rates are very high enterprises need to make strong infrastructure to protech game-based learning apps.

Opportunities: Increased demand for student retention and comprehension

Game-based learning encourages students to learn by playing games that teach them about a concept or subject. These activities aid in the students' understanding and comprehension of the concept, as well as their retention of it. Learning games also lead to a deeper understanding of content, providing students with another opportunity to learn more about a subject and process the information more thoroughly. Playing educational games with friends can aid in the formation of strong bonds. A game that encourages collaborative learning allows students and teams to work together to achieve a common goal. This enables students to learn and practise important life skills such as teamwork and cooperation. The use of game-based learning tools and platforms can aid in the development of these skill sets. Thus, collaboration in game-based learning not only promotes social skills but also assists students in learning more effectively. Collaborative learning is commonplace in the workplace. When students play online games, they become members of a community in which they can apply and share their knowledge. They focus on how to achieve goals as a team rather than individually by cooperating.

Challenges: Complexity of elearning

Game-based learning is a tool, but using that term oversimplifies the concept. It's a tool with a purpose, but keep in mind that both the tool and the purpose are extremely complex. Misusing game-based learning in a training course not only wastes resources, but learners will lose patience with a game if they discover it has no real purpose or was haphazardly created. There are complexities in technology, vendor management, people management which creates problem for game-based learning. Games are multifaceted artefacts, and game development is a complex process that necessitates knowledge of design, psychology, and programming, to name a few. Game-based learning, like games, aims to create engaging experiences for users. According to Talon study on 2018, designing gamified elements is even more difficult than designing games because the game-based learning context is marked by operational requirements that limit games' unlimited design space. Not having a proper internet connection creates a technical problem for the students. So overall there are few complexities in game-based learning method.

Based on component, solution segment to be the larger contributor to the game-based learning market growth during the forecast period

Game-based learning solutions are a dynamic strategy that combines entertainment, engagement techniques, and loyalty boosting factors into a single package. It is more than just adding gaming elements to an app or a website; it is a dynamic marketing strategy with elements carefully designed to entice and engage a specific audience. Since then, various brands have adopted game-based learning marketing solutions that have resulted in massive traction and a strong brand following. It provides consumers with a value-added experience that engages, motivates, and rewards them appropriately. The user ends up spending more time with the brand than expected and begins to trust and rely on it. After completing a task or reaching a milestone, it engages emotions by providing an adrenaline rush and by releasing hormones that mimic natural happiness. Game-based learning solutions can help with not only customer acquisition but also retention, online traffic, and gradually encouraging brand loyalty among users. Most importantly, the game-based learning component must be extremely engaging and entertaining. When it comes to marketing game-based learning, competition is fierce. Users would rather invest their time and effort in something entertaining and worthwhile.

Based on game type, AR VR games segment is to be the 3rd largest dominator to the game-based learning market during the forecast period.

3D animation is an automated real-time deep learning technique. Companies such as Walmart, Agco, Bosch, and Boeing are currently using AR for corporate training. Only game-based learning or eLearning does not create engagement. AR is a feature that aids with the actual training. AR fits perfectly into scenario-based training, it talks to employees, interacts with clients, and understands the social surrounding. The Apple ARKit used by AR and VR developers has already yielded some amazing results. Apple’s ARKit 3 is an AR developer-friendly software to create amazing AR-based content with relative ease. KFC has designed an employee training program with VR simulator. Extended Reality enables the creation of a rich immersive environment that improves game play and game-based learning. It sparks engagement and interaction by superimposing a virtual setting within a real-life environment, resulting in a strong customer connection. Although these technologies have yet to make an impact on the e-learning industry, the continued growth of global AR and VR markets is a positive sign. Furthermore, increased investment in AR and VR indicate significant future growth potential in the e-learning industry. According to Goldman Sachs, USD 700 million will be invested in AR/VR applications in education by 2025.

Based on end user, the enterprises segment to grow at the highest growth rate during the forecast period

Enterprise game-based learning establishes performance goals for employees, which can be linked to corporate objectives. When someone sees their performance in the game, they know it is objective, which sends the message that it is thus "fair." This means that game-based learning increases organisational transparency and improves alignment with corporate goals. This alters the culture as well as the way performance is managed. Instead of a once-a-year review in which employees are presented with stale goals from the previous year, employees can see their goals in real time and know how they are performing, allowing them to self-correct. Game-based learning facilitates easy feedback. Employees in their twenties do not have the patience to wait for quarterly feedback. They want feedback right away, when it is relevant. Unlockable achievements, for example, provide employees with instant feedback whenever they do something positive. Badges, like assessments, can also be assigned to specific pieces of content. Receiving a shiny new badge right away keeps the employee motivated to learn.

To know about the assumptions considered for the study, download the pdf brochure

North America to hold the highest market share during the forecast period

North America has been an extremely open and competitive market in terms of the adoption of the game-based learning solution across end users. It is the topmost region in adopting based learning solution. It has been extremely responsive toward adopting the latest technological advancements, such as integration technologies with AI, cloud, and mobile technologies within traditional-based learning solution. The major growth driver for this region is the rigorous government standards and regulations framed for various industries. Due to the COVID-19 impact, the US companies have invested hugely in eLearning technologies, game-based learning, gamification as schools, colleges, and universities have shut down. According to the report ‘COVID-19 Effects on the US Higher Education Campuses from Emergency Response to Planning for Future Student Mobility’ by the Institute of International Education, 96% of on-campus events were canceled, 91% of campus buildings and offices were closed, and 82% international student travel was canceled during this pandemic situation. In North America there is a huge market for e-learning, gamification, game-based learning, education technology and many more. North America's market is expected to expand significantly during the forecast period. The region's high adoption of advanced technology, as well as the presence of large players, are likely to provide ample growth opportunities for the market.

The game-based learning market is dominated by companies such as Kahoot (Norway) Frontier Developments (UK), Minecraft (Sweden), Spin Master (Canada), Bublar Group (Sweden), BreakAway games (US), Gamelearn (Spain), Recurrence (US), Schell Games (US), Stratbeans (India), Tangible Play (US), Simulearn (US), Playgen (UK), Raptivity (US), Banzai Labs (US), Cognitive Toybox (US), Fundamentor (India), Idnusgeeks (India), Kuato Studios (UK), Monkimun (US), Smart Lumies (US), G-Cube (India), Hornbill FX (India), Infinite Dreams (Poland), Layup (Sri Lanka), MLevel (US), Quodeck (India), Threatgen (US), Gametize (Singapore), Sweetrush (US), Kidoz, (US) and VR Education Holdings (Ireland).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Revenue Forecast in 2026 |

$29.7 billion |

|

Market Value in 2021 |

$11.0 billion |

|

CAGR (2021-2026) |

21.9% |

|

Key Opportunities |

Increased demand for AR, VR, and AI for learning |

|

Key Market GDrivers |

Increase demand for getting feedbacks |

|

Market size available for years |

2020-2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021-2026 |

|

Market Segmentation |

Component, Game Type, Deployment Mode, End user and Region |

|

Regions covered |

North America, Europe, APAC, MEA and Latin America |

|

Companies covered |

Kahoot (Norway) Frontier Developments (UK), Minecraft (Sweden), Spin Master (Canada), Bublar Group (Sweden), BreakAway games (US), Gamelearn (Spain), Recurrence (US), Schell Games (US), Stratbeans (India), Tangible Play (US), Simulearn (US), Playgen (UK), Raptivity (US), Banzai Labs (US), Cognitive Toybox (US), Fundamentor (India), Idnusgeeks (India), Kuato Studios (UK), Monkimun (US), Smart Lumies (US), G-Cube (India), Hornbill FX (India), Infinite Dreams (Poland), Layup (Sri Lanka), MLevel (US), Quodeck (India), Threatgen (US), Gametize (Singapore), Sweetrush (US), Kidoz, (US) and VR Education Holdings (Ireland). |

This research report categorizes the global Game-Based Learning Market to forecast revenue and analyze trends in each of the following submarkets:

Based on the Component:

- Solution

- Services

Based on the Game type:

- AR VR games

- AI-based games

- Location-based games

- Assessment and evaluation games

- Training, knowledge and skill-based games

- Language learning games

- Others* (Role-based games and childhood learning games)

Based on Deployment mode:

- cloud

- on-premise

Based on End user:

- Consumer

- Education

- Government

-

Enterprises

- BFSI

- Manufacturing

- Healthcare and lifesciences

- Consumer goods and retail

- Others* (energy and utilities, media and entertainment, and transport and logistics)

Based on regions:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- ANZ

- Rest of APAC

-

MEA

- Kingdom of Saudi Arabia

- UAE

- South Africa

- Rest of MEA

-

Latin America

- Mexico

- Brazil

- Rest of Latin America

Recent Developments

- In May 2021, Kahoot! acquired Clever, one of the most widely used digital learning platforms in the US. K-12 schools to make learning awesome worldwide. The partnership between two of the most popular platforms in education, with distinct and highly complementary offerings, will provide improved learning solutions and offerings to the US schools while accelerating the global expansion of Clever’s solutions.

- In May 2021, Redstage becomes a value-added reseller for the Sayduck SaaS AR platform of Goodbye Kansas Group. The Sayduck Platform allows anyone to fully engage with products in 3D and AR, which offer a closer to real life shopping experience. With this partnership, the Sayduck Platform can be part of Redstage’s 3D/AR offering.

- In September 2020, Kahoot! acquired Actimo. Actimo is an employee engagement platform. Organizations can connect and engage their work teams with Actimo. Actimo can boost Kahoot!’s learning offerings for corporate learners and those learning at home, in addition to introducing new functionality that enables millions of users to learn more effectively.

Frequently Asked Questions (FAQ):

What is the market size of Game Based Learning Market?

What is the Game Based Learning Market CAGR?

What are the key opportunities in the Game Based Learning Market?

Who are the key players in Game Based Learning Market?

Who will be the leading hub for the Game Based Learning?

What is the Game Based Learning Market Segmentation?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2018–2020

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 6 GAME-BASED LEARNING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

FIGURE 7 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

TABLE 2 PRIMARY RESPONDENTS: ENTERPRISE PERFORMANCE MANAGEMENT MARKET

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 9 GAME-BASED LEARNING MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY-SIDE): REVENUE OF GAME-BASED LEARNING FROM VENDORS

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY-SIDE): COLLECTIVE REVENUE OF GAME-BASED LEARNING VENDORS

FIGURE 12 MARKET SIZE ESTIMATION METHODOLOGY – (SUPPLY-SIDE): ILLUSTRATION OF VENDOR REVENUE ESTIMATION

FIGURE 13 MARKET SIZE ESTIMATION METHODOLOGY – (SUPPLY SIDE): CAGR PROJECTIONS FROM THE SUPPLY SIDE

FIGURE 14 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 2 (DEMAND-SIDE): REVENUE GENERATED FROM GAME-BASED LEARNING SOLUTION AND SERVICES

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 42)

FIGURE 15 GAME-BASED LEARNING MARKET: GLOBAL SNAPSHOT, 2020–2026

FIGURE 16 TOP-GROWING SEGMENTS IN THE MARKET

FIGURE 17 CLOUD SEGMENT TO ACCOUNT FOR A LARGER MARKET SIZE BY 2026

FIGURE 18 ASSESSMENT AND EVALUATION GAMES SEGMENT TO ACCOUNT FOR THE LARGEST MARKET SIZE BY 2026

FIGURE 19 SOLUTION SEGMENT TO ACCOUNT FOR A LARGER MARKET SIZE BY 2026

FIGURE 20 END USERS IN THE MARKET, 2020–2026 (USD MILLION)

FIGURE 21 ENTERPRISES IN THE MARKET, 2020–2026 (USD MILLION)

FIGURE 22 NORTH AMERICA TO ACCOUNT FOR THE LARGEST MARKET SIZE BY 2026

4 PREMIUM INSIGHTS (Page No. - 52)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN THE GAME-BASED LEARNING MARKET

FIGURE 23 NEED FOR INCREASED LEARNER ENGAGEMENT DRIVING THE MARKET GROWTH

4.2 MARKET, BY COMPONENT (2021 VS. 2026)

FIGURE 24 SOLUTION SEGMENT TO ACCOUNT FOR A LARGER MARKET SHARE BY 2026

4.3 MARKET, BY GAME TYPE (2021 VS. 2026)

FIGURE 25 ASSESSMENT AND EVALUATION GAMES SEGMENT TO ACCOUNT FOR THE LARGEST MARKET SHARE BY 2026

4.4 MARKET, BY DEPLOYMENT MODE (2021 VS. 2026)

FIGURE 26 CLOUD SEGMENT TO ACCOUNT FOR A LARGER MARKET SHARE BY 2026

4.5 MARKET, BY END USER (2021 VS. 2026)

FIGURE 27 ENTERPRISES SEGMENT TO ACCOUNT FOR THE LARGEST MARKET SHARE BY 2026

4.6 MARKET, BY ENTERPRISE (2021 VS. 2026)

FIGURE 28 HEALTHCARE AND LIFESCIENCES SEGMENT TO ACCOUNT FOR THE LARGEST MARKET SHARE BY 2026

4.7 GAME-BASED LEARNING MARKET INVESTMENT SCENARIO

FIGURE 29 EUROPE TO EMERGE AS THE BEST MARKET FOR INVESTMENTS IN THE NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 56)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 30 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Ownership of young learners and user engagement in learning

5.2.1.2 Growing demand for training, presentation, and meetings among corporates and education institutes

5.2.1.3 Ease of learning, problem-solving, time-saving, and cost-effective

5.2.1.4 Demand for immediate feedback on performance

5.2.2 RESTRAINTS

5.2.2.1 Need for high security and cybersecurity from game-based learning

5.2.3 OPPORTUNITIES

5.2.3.1 Increased demand for AR, VR, and AI for learning

5.2.3.2 Building an emotional connection in learning and subject matter

5.2.4 CHALLENGES

5.2.4.1 Game-based learning modules with existing LMS

5.2.4.2 Game design with learning objectives

5.2.4.3 Cultural barriers with parents and faculties

5.2.4.4 Availability of IT infrastructure in schools and colleges, problems in access internet, and lack of financial support

5.3 CASE STUDY ANALYSIS

5.3.1 USE CASE 1: AUTOMOBILE

5.3.2 USE CASE 2: EDUCATION

5.3.3 USE CASE 3: HEALTHCARE

5.4 ECOSYSTEM

FIGURE 31 GAME-BASED LEARNING MARKET: ECOSYSTEM

5.5 SUPPLY CHAIN ANALYSIS

FIGURE 32 MARKET: VALUE CHAIN ANALYSIS

TABLE 4 MARKET: VALUE CHAIN

5.6 PRICING ANALYSIS

TABLE 5 PRICING ANALYSIS: MARKET

5.7 PATENT ANALYSIS

FIGURE 33 NUMBER OF PATENTS DOCUMENTS PUBLISHED

FIGURE 34 TOP FIVE PATENT OWNERS (GLOBAL)

TABLE 6 TOP TEN PATENT OWNERS

5.8 TECHNOLOGICAL ANALYSIS

5.8.1 CLOUD COMPUTING

5.8.2 ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

5.8.3 AUGMENTED REALITY AND VIRTUAL REALITY

5.9 PORTER’S FIVE FORCES ANALYSIS

FIGURE 35 MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 7 GAME-BASED LEARNING MARKET: PORTER’S FIVE FORCES ANALYSIS

5.9.1 THREAT OF NEW ENTRANTS

5.9.2 THREAT OF SUBSTITUTES

5.9.3 BARGAINING POWER OF SUPPLIERS

5.9.4 BARGAINING POWER OF BUYERS

5.9.5 INTENSITY OF COMPETITIVE RIVALRY

5.10 COVID-19 DRIVEN MARKET DYNAMICS

5.10.1 DRIVERS AND OPPORTUNITIES

5.10.2 RESTRAINTS AND CHALLENGES

5.11 REGULATIONS

5.11.1 NORTH AMERICA

5.11.2 EUROPE

5.11.3 ASIA PACIFIC

5.11.4 MIDDLE EAST AND SOUTH AFRICA

5.11.5 LATIN AMERICA

5.12 TRENDS/DISRUPTIONS IMPACTING BUYERS

FIGURE 36 MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

6 GAME-BASED LEARNING MARKET, BY COMPONENT (Page No. - 74)

6.1 INTRODUCTION

FIGURE 37 SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

6.1.1 COMPONENTS: MARKET DRIVERS

6.1.2 COMPONENTS: COVID-19 IMPACT

TABLE 8 MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 9 COMPONENTS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.2 SOLUTION

TABLE 10 SOLUTION: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3 SERVICES

TABLE 11 SERVICES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7 GAME-BASED LEARNING MARKET, BY GAME TYPE (Page No. - 79)

7.1 INTRODUCTION

FIGURE 38 AR VR GAMES SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

7.1.1 GAME TYPES: MARKET DRIVERS

7.1.2 GAME TYPES: COVID-19 IMPACT

TABLE 12 MARKET SIZE, BY GAME TYPE, 2020–2026 (USD MILLION)

7.2 AR VR GAMES

7.3 AI-BASED GAMES

7.4 LOCATION-BASED GAMES

7.5 ASSESSMENT AND EVALUATION GAMES

7.6 TRAINING, KNOWLEDGE, AND SKILL-BASED GAMES

7.7 LANGUAGE LEARNING GAMES

7.8 OTHER GAME TYPES

8 GAME-BASED LEARNING MARKET, BY DEPLOYMENT MODE (Page No. - 83)

8.1 INTRODUCTION

FIGURE 39 CLOUD SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

8.1.1 DEPLOYMENT MODES: MARKET DRIVERS

8.1.2 DEPLOYMENT MODES: COVID-19 IMPACT

TABLE 13 MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

8.2 ON-PREMISES

TABLE 14 ON-PREMISES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8.3 CLOUD

TABLE 15 CLOUD: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9 GAME-BASED LEARNING MARKET, BY END USER (Page No. - 87)

9.1 INTRODUCTION

FIGURE 40 EDUCATION SEGMENT TO HOLD THE LARGEST MARKET SHARE DURING THE FORECAST PERIOD

9.1.1 END USERS: MARKET DRIVERS

9.1.2 END USERS: COVID-19 IMPACT

TABLE 16 MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

9.2 CONSUMERS

TABLE 17 CONSUMERS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.3 EDUCATION

TABLE 18 EDUCATION: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.4 GOVERNMENTS

TABLE 19 GOVERNMENTS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.5 ENTERPRISES

FIGURE 41 HEALTHCARE AND LIFE SCIENCES SEGMENT TO HOLD THE LARGEST MARKET SHARE DURING THE FORECAST PERIOD

TABLE 20 ENTERPRISES: GAME-BASED LEARNING MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 21 MARKET SIZE, BY ENTERPRISE, 2020–2026 (USD MILLION)

9.6 BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 22 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.7 MANUFACTURING

TABLE 23 MANUFACTURING: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.8 HEALTHCARE AND LIFE SCIENCES

TABLE 24 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.9 IT AND TELECOMMUNICATIONS

TABLE 25 IT AND TELECOMMUNICATIONS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.10 CONSUMER GOODS AND RETAIL

TABLE 26 CONSUMER GOODS AND RETAIL: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.11 OTHER ENTERPRISES

TABLE 27 OTHER ENTERPRISES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

10 GAME-BASED LEARNING MARKET, BY REGION (Page No. - 98)

10.1 INTRODUCTION

FIGURE 42 NORTH AMERICA TO ACCOUNT FOR THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 28 MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: MARKET DRIVERS

10.2.2 NORTH AMERICA: COVID-19 IMPACT

FIGURE 43 NORTH AMERICA: MARKET SNAPSHOT

TABLE 29 NORTH AMERICA: GAME-BASED LEARNING MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 30 NORTH AMERICA: SOLUTION MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 31 NORTH AMERICA: SERVICES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 32 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 33 NORTH AMERICA: ON-PREMISES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 34 NORTH AMERICA: CLOUD MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 35 NORTH AMERICA: MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

TABLE 36 NORTH AMERICA: MARKET SIZE, BY ENTERPRISE, 2020–2026 (USD MILLION)

TABLE 37 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.2.3 UNITED STATES

TABLE 38 UNITED STATES: GAME-BASED LEARNING MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 39 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

10.2.4 CANADA

TABLE 40 CANADA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 41 CANADA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: MARKET DRIVERS

10.3.2 EUROPE: COVID-19 IMPACT

TABLE 42 EUROPE: GAME-BASED LEARNING MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 43 EUROPE: SOLUTION MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 44 EUROPE: SERVICES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 45 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 46 EUROPE: ON-PREMISES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 47 EUROPE: CLOUD MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 48 EUROPE: MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

TABLE 49 EUROPE: MARKET SIZE, BY ENTERPRISE, 2020–2026 (USD MILLION)

TABLE 50 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.3.3 UNITED KINGDOM

TABLE 51 UNITED KINGDOM: GAME-BASED LEARNING MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 52 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

10.3.4 GERMANY

TABLE 53 GERMANY: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 54 GERMANY: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

10.3.5 FRANCE

TABLE 55 FRANCE: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 56 FRANCE: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 57 REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 58 REST OF EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 44 ASIA PACIFIC: MARKET SNAPSHOT

10.4.1 ASIA PACIFIC: GAME-BASED LEARNING MARKET DRIVERS

10.4.2 ASIA PACIFIC: COVID-19 IMPACT

TABLE 59 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 60 ASIA PACIFIC: SOLUTION MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 61 ASIA PACIFIC: SERVICES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 62 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 63 ASIA PACIFIC: ON-PREMISES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 64 ASIA PACIFIC: CLOUD MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 65 ASIA PACIFIC: MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

TABLE 66 ASIA PACIFIC: MARKET SIZE, BY ENTERPRISE, 2020–2026 (USD MILLION)

TABLE 67 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.4.3 CHINA

TABLE 68 CHINA: GAME-BASED LEARNING MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 69 CHINA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

10.4.4 JAPAN

TABLE 70 JAPAN: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 71 JAPAN: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

10.4.5 AUSTRALIA AND NEW ZEALAND

TABLE 72 AUSTRALIA AND NEW ZEALAND: GAME-BASED LEARNING MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 73 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

10.4.6 REST OF ASIA PACIFIC

TABLE 74 REST OF ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 75 REST OF ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

10.5 MIDDLE EAST AND AFRICA

10.5.1 MIDDLE EAST AND AFRICA: GAME-BASED LEARNING MARKET DRIVERS

10.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

TABLE 76 MIDDLE EAST AND AFRICA MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 77 MIDDLE EAST AND AFRICA: SOLUTION MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 78 MIDDLE EAST AND AFRICA: SERVICES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 79 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 80 MIDDLE EAST AND AFRICA: ON-PREMISES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 81 MIDDLE EAST AND AFRICA: CLOUD MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 82 MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

TABLE 83 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ENTERPRISE, 2020–2026 (USD MILLION)

TABLE 84 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.5.3 KINGDOM OF SAUDI ARABIA

TABLE 85 KINGDOM OF SAUDI ARABIA: GAME-BASED LEARNING MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 86 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

10.5.4 UNITED ARAB EMIRATES

TABLE 87 UNITED ARAB EMIRATES: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 88 UNITED ARAB EMIRATES: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

10.5.5 SOUTH AFRICA

TABLE 89 SOUTH AFRICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 90 SOUTH AFRICA: GAME-BASED LEARNING MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

10.5.6 REST OF MIDDLE EAST AND AFRICA

TABLE 91 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 92 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: MARKET DRIVERS

10.6.2 LATIN AMERICA: COVID-19 IMPACT

TABLE 93 LATIN AMERICA: GAME-BASED LEARNING MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 94 LATIN AMERICA: SOLUTION MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 95 LATIN AMERICA: SERVICES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 96 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 97 LATIN AMERICA: ON-PREMISES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 98 LATIN AMERICA: CLOUD MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 99 LATIN AMERICA: MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

TABLE 100 LATIN AMERICA: MARKET SIZE, BY ENTERPRISE, 2020–2026 (USD MILLION)

TABLE 101 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.6.3 BRAZIL

TABLE 102 BRAZIL: GAME-BASED LEARNING MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 103 BRAZIL: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

10.6.4 MEXICO

TABLE 104 MEXICO: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 105 MEXICO: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

10.6.5 REST OF LATIN AMERICA

TABLE 106 REST OF LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 107 REST OF LATIN AMERICA: GAME-BASED LEARNING MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 134)

11.1 INTRODUCTION

FIGURE 45 MARKET EVALUATION FRAMEWORK

11.2 MARKET RANKING

FIGURE 46 MARKET RANKING IN 2021

11.3 HISTORICAL REVENUE ANALYSIS OF TOP VENDORS

FIGURE 47 HISTORICAL REVENUE ANALYSIS

11.4 COMPANY EVALUATION QUADRANT

FIGURE 48 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

11.4.1 STAR

11.4.2 EMERGING LEADER

11.4.3 PERVASIVE

11.4.4 PARTICIPANT

TABLE 108 GLOBAL COMPANY FOOTPRINT

TABLE 109 COMPANY END USER FOOTPRINT

TABLE 110 COMPANY REGION FOOTPRINT

FIGURE 49 GAME-BASED LEARNING MARKET: COMPANY EVALUATION QUADRANT

11.5 COMPETITIVE SCENARIO

11.5.1 MARKET NEW PRODUCT LAUNCHES

TABLE 111 MARKET: NEW PRODUCT LAUNCHES, 2019–2021

11.5.2 MARKET DEALS

TABLE 112 MARKET: DEALS, 2019–2021

12 COMPANY PROFILES (Page No. - 144)

12.1 MAJOR PLAYERS

(Business Overview, Products & Solutions, Key Insights, Recent Developments, MnM View)*

12.1.1 KAHOOT!

TABLE 113 KAHOOT!: BUSINESS OVERVIEW

FIGURE 50 KAHOOT!: COMPANY SNAPSHOT

TABLE 114 KAHOOT!: SOLUTIONS OFFERED

TABLE 115 KAHOOT!: GAME-BASED LEARNING MARKET: PRODUCT LAUNCH

TABLE 116 KAHOOT!: MARKET: DEALS

12.1.2 FRONTIER DEVELOPMENTS

TABLE 117 FRONTIER DEVELOPMENTS: BUSINESS OVERVIEW

FIGURE 51 FRONTIER DEVELOPMENTS: COMPANY SNAPSHOT

TABLE 118 FRONTIER DEVELOPMENTS: SOLUTIONS OFFERED

12.1.3 SPIN MASTER

TABLE 119 SPIN MASTER: BUSINESS OVERVIEW

FIGURE 52 SPIN MASTER: COMPANY SNAPSHOT

TABLE 120 SPIN MASTER: PRODUCTS OFFERED

TABLE 121 SPIN MASTER: MARKET: DEALS

12.1.4 BUBLAR GROUP

TABLE 122 BUBLAR GROUP: BUSINESS OVERVIEW

FIGURE 53 BUBLAR GROUP: COMPANY SNAPSHOT

TABLE 123 BUBLAR GROUP: SERVICES OFFERED

TABLE 124 BUBLAR GROUP: GAME-BASED LEARNING MARKET: DEALS

12.1.5 MINECRAFT

TABLE 125 MINECRAFT: BUSINESS OVERVIEW

TABLE 126 MINECRAFT: SERVICES OFFERED

12.1.6 BREAKAWAY GAMES

TABLE 127 BREAKAWAY GAMES: BUSINESS OVERVIEW

TABLE 128 BREAKAWAY: SOLUTIONS OFFERED

12.1.7 GAMELEARN

TABLE 129 GAMELEARN: BUSINESS OVERVIEW

TABLE 130 GAMELEARN: SOLUTIONS OFFERED

12.1.8 RECURRENCE

TABLE 131 RECURRENCE: BUSINESS OVERVIEW

TABLE 132 RECURRENCE: SOLUTIONS OFFERED

12.1.9 SCHELL GAMES

TABLE 133 SCHELL GAMES: BUSINESS OVERVIEW

TABLE 134 SCHELL GAMES: SERVICES OFFERED

12.1.10 STRATBEANS

TABLE 135 STRATBEANS: BUSINESS OVERVIEW

TABLE 136 STRATBEANS: SERVICES OFFERED

TABLE 137 STRATBEANS: GAME-BASED LEARNING MARKET: SERVICE LAUNCH

12.1.11 TANGIBLE PLAY

TABLE 138 TANGIBLE PLAY: BUSINESS OVERVIEW

TABLE 139 TANGIBLE PLAY: SERVICES OFFERED

12.1.12 SIMULEARN

TABLE 140 SIMULEARN: BUSINESS OVERVIEW

TABLE 141 SIMULEARN: SOLUTIONS OFFERED

12.1.13 PLAYGEN

TABLE 142 PLAYGEN: BUSINESS OVERVIEW

TABLE 143 PLAYGEN: SERVICES OFFERED

12.1.14 RAPTIVITY

TABLE 144 RAPTIVITY: BUSINESS OVERVIEW

12.1.14.2 Services offered

TABLE 145 RAPTIVITY: SERVICES OFFERED

12.1.14.3 Recent developments

TABLE 146 RAPTIVITY: GAME-BASED LEARNING MARKET: PRODUCT LAUNCH

12.1.15 KIDOZ

12.1.16 VR EDUCATION HOLDINGS

12.1.17 BANZAI LABS

12.1.18 COGNITIVE TOYBOX

12.1.19 FUNDAMENTOR

12.1.20 INDUSGEEKS

12.1.21 KUATO STUDIOS

12.1.22 MONKIMUN

12.1.23 SMART LUMIES

12.1.24 G-CUBE

12.1.25 HORNBILL FX

12.1.26 INFINITE DREAMS

12.1.27 LAYUP

12.1.28 MLEVEL

12.1.29 QUODECK

12.1.30 THREATGEN

12.1.31 GAMETIZE

12.1.32 SWEETRUSH

*Details on Business Overview, Solutions & Services, Key Insights, Recent Developments, MnM View might not be captured in case of unlisted companies.

13 ADJACENT/RELATED MARKET (Page No. - 184)

13.1 INTRODUCTION

13.1.1 RELATED MARKET

13.1.2 LIMITATIONS

13.2 EDTECH AND SMART CLASSROOM MARKET

TABLE 147 NORTH AMERICA: EDTECH AND SMART CLASSROOM MARKET SIZE, BY EDUCATION SYSTEM, 2014–2018 (USD MILLION)

TABLE 148 NORTH AMERICA: EDTECH AND SMART CLASSROOM MARKET SIZE, BY EDUCATION SYSTEM, 2019–2025 (USD MILLION)

TABLE 149 NORTH AMERICA: EDTECH AND SMART CLASSROOM MARKET SIZE, BY TECHNOLOGY, 2014–2018 (USD MILLION)

TABLE 150 NORTH AMERICA: EDTECH AND SMART CLASSROOM MARKET SIZE, BY TECHNOLOGY, 2019–2025 (USD MILLION)

TABLE 151 NORTH AMERICA: EDTECH AND SMART CLASSROOM MARKET SIZE, BY END USER, 2014–2018 (USD MILLION)

TABLE 152 NORTH AMERICA: EDTECH AND SMART CLASSROOM MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

TABLE 153 NORTH AMERICA: EDTECH AND SMART CLASSROOM MARKET SIZE, BY DEPLOYMENT TYPE, 2014–2018 (USD MILLION)

TABLE 154 NORTH AMERICA: EDTECH AND SMART CLASSROOM MARKET SIZE, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

TABLE 155 NORTH AMERICA: EDTECH AND SMART CLASSROOM MARKET SIZE, BY COUNTRY, 2014–2018 (USD MILLION)

TABLE 156 NORTH AMERICA: EDTECH AND SMART CLASSROOM MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

TABLE 157 UNITED STATES: EDTECH AND SMART CLASSROOM MARKET SIZE, BY END USER, 2014–2018 (USD MILLION)

TABLE 158 UNITED STATES: EDTECH AND SMART CLASSROOM MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

TABLE 159 UNITED STATES: EDTECH AND SMART CLASSROOM MARKET SIZE, BY DEPLOYMENT TYPE, 2014–2018 (USD MILLION)

TABLE 160 UNITED STATES: EDTECH AND SMART CLASSROOM MARKET SIZE, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

TABLE 161 CANADA: EDTECH AND SMART CLASSROOM MARKET SIZE, BY END USER, 2014–2018 (USD MILLION)

TABLE 162 CANADA: EDTECH AND SMART CLASSROOM MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

TABLE 163 CANADA: EDTECH AND SMART CLASSROOM MARKET SIZE, BY DEPLOYMENT TYPE, 2014–2018 (USD MILLION)

TABLE 164 CANADA: EDTECH AND SMART CLASSROOM MARKET SIZE, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

13.3 GAMIFICATION MARKET

TABLE 165 GAMIFICATION MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

TABLE 166 EDUCATION: GAMIFICATION MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 167 HEALTHCARE: GAMIFICATION MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 168 BANKING, FINANCIAL SERVICES, AND INSURANCE: GAMIFICATION MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 169 RETAIL: GAMIFICATION MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 170 MANUFACTURING: GAMIFICATION MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 171 MEDIA AND ENTERTAINMENT: GAMIFICATION MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 172 TELECOM: GAMIFICATION MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 173 IT AND ITES: GAMIFICATION MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 174 HOSPITALITY: GAMIFICATION MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 175 OTHERS: GAMIFICATION MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

14 APPENDIX (Page No. - 195)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

The study involved 4 major activities to estimate the current market size of game-based learning market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

The market size of companies offering game-based learning was derived on the basis of the secondary data available through paid and unpaid sources, and by analyzing the product portfolios of major companies in the ecosystem and rating the companies based on their solution capabilities and business strategies. In the secondary research process, various sources were referred to, for identifying and collecting information for the study. Secondary sources included annual reports, press releases, and investor presentations of companies and product data sheets; white papers; journals; certified publications; and articles from recognized authors, government websites, directories, and databases. Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology oriented perspectives; all of which were further validated by primary sources.

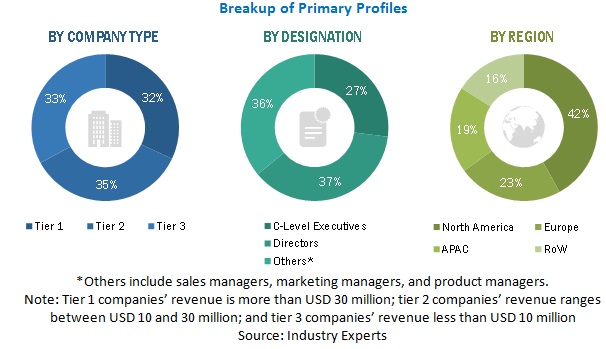

Primary Research

The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from game-based learning vendors, industry associations, and independent consultants; and key opinion leaders. Primary interviews were conducted to gather insights, such as market statistics, latest trends disrupting the market, new use cases implemented, data of revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technology and region. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), the installation teams of end-users using game-based learning, and digital initiatives project teams, were interviewed to understand the buyer’s perspective on suppliers, products, service providers and their current use of game-based learning solution, which would affect the overall game-based learning market.

The following figure depicts the breakup of the primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Game-Based Learning Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the game-based learning market and various other dependent subsegments. The research methodology used to estimate the market size included the following:

- Key players in the market were identified through secondary research, and their revenue contributions in respective countries were determined through primary and secondary research.

- This entire procedure included the study of the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as Chief Executive Officers (CEOs), VPs, directors, and marketing executives.

- All percentage splits and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from both, the demand and supply sides, in the game-based learning market.

Report Objectives

- To describe and forecast the global game-based learning market based on component, game type, deployment mode, end user and region

- To forecast the market size of regional segments: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To strategically analyze the market’s subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for major players

- To comprehensively analyze the core competencies of key players

- To track and analyze COVID-19 impact and competitive developments, such as mergers and acquisitions, new product developments, and partnerships and collaborations, in the market.

COVID-19 Impact

The COVID-19 has affected the global game-based learning market in different ways, such as directly impacting production and demand, disrupting supply chains and marketplaces, and having a financial impact on businesses and financial markets. Due to the COVID-19 pandemic, the adoption of AI, AR and VR technology has increased. Many companies have made new policies and regulations on remote working.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs and on best effort basis for profiling of additional market players.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Game-Based Learning Market

what are the market stats from 2022 to 2028?

Interested in understanding how the game-based learning market is expanding for education, consumers, and commercial customers in the coming years, as well as how companies are growing in this period. Along with this, what are present trends in the market? Which features seem to be driving adoption, retention/renewal of products, frequency of in-app content updates (how often do companies release new content within their apps), solo vs. multiplayer, and subjects covered within the app? Would like to know the revenue for game-based learning in 2024 - either globally or just in the United States.