Geographic Information System Market by Offering (Hardware (GIS Collector, Total Station, LiDAR), Software, Services), Function (Mapping, Surveying, Telematics and Navigation, Location-Based Service), Industry, Region - Global Forecast, 2025

Geographic Information System (GIS) Market

Geographic Information System (GIS) Market and Top Companies

- Environmental Systems Research Institute, Inc. (Esri) (US) −The Company is one of the leading GIS software providers. Environmental Systems Research Institute, Inc. (Esri) designs and supplies GIS and mapping software, web GIS, and geodatabase management applications. The company offers ArcGIS, a suite of GIS software products. A few of the key products offered by Esri in the GIS market are ArcGIS Pro, ArcGIS Online, ArcGIS Enterprise ArcMap, ArcView, ArcInfo, ArcEditor, ArcIMS, and CityEngine.

- Autodesk (US) −The Company is a leading 3D design, engineering, and entertainment software developer and supplier in the world. The company has developed a broad portfolio of geospatial software solutions to help users visualize, simulate, and analyze real-world performance. The company also provides digital media creation and entertainment software. A few of its key GIS products are AutoCAD Map 3D, AutoCAD MapGuide Enterprise, AutoCAD Civil 3D, and InfraWorks. The company provides its products to customers in architecture, engineering, construction, civil infrastructure, natural resources, manufacturing, consumer, and media and entertainment industries.

- Trimble (US) − The Company provide location-based solutions including 3D scanners and software solutions. The company, through its Engineering & Construction segment, serves customers in engineering, architecture, construction, utilities, and government sectors. The Mobile Solutions segment provides hardware and software applications for managing mobile workers and mobile assets. The Advanced Devices segment includes offerings such as Applanix, Trimble Outdoors, military and advanced systems, and ThingMagic.

- Pitney Bowes (US) − The Company is a provider of customer information management, location intelligence, shipping and mailing, and e-commerce solutions. The company, through its Small and Medium Business Solutions segment, offers equipment, software, and services for digital mailing. The company, through its Digital Commerce Solutions segment, offers information management, location intelligence, customer engagement software, shipping management, and cross border e-commerce solutions for various businesses. It serves customers in financial services, insurance, public sector, telecommunications, retail, and healthcare industries.

- Hexagon AB (Sweden) – The Company is a leading global provider of geospatial technologies for industrial and enterprise applications. The company is focused on delivering precision measuring technologies. It operates through two segments, namely, Geospatial Enterprise Solutions (GES) and Industrial Enterprise Solutions (IES). The Geospatial Enterprise Solutions segment is further divided into geosystems, safety and infrastructure, and positioning intelligence. The company through its Geospatial Enterprise Solutions segment offers various software and hardware solutions related to GIS.

- Topcon Corporation (US) – The Company provides innovative positioning technologies with the use of mapping, scanning, and application software. The company offers cost-effective products with improved quality and productivity to its customers. The company’s operations are organized into 3 global divisions—Positioning Company, Eye Care Company, and Smart Infrastructure Company. Its Positioning Company division offers GNSS receivers, GIS, GPS+Reference station systems, machine control systems, precision agriculture equipment, and asset management systems.

- Caliper Corporation (Canada) – The Company is a technology leader in the development of GIS. The company offers GIS and transportation software solutions. It provides consulting and professional services in quantitative management consulting, transportation, and decision support systems development. In addition, the company offers Maptitude, a GIS software package. The company also provides custom software development, custom mapping, and mapping software training.

Geographic Information System (GIS) Market and Top Hardware Type

- Total Station − A total station is a surveying equipment integrated with an electronic distance measurement (EDM), microprocessor, electronic data collector, and storage system. Total stations are designed to measure slant distances, horizontal angles, vertical angles, and elevations for surveying applications. Most of the GIS mapping work is performed by total stations. In modern surveying, two types of total stations are used— manual total stations and robotic total stations. Of these total stations, robotic total stations are in greater demand as they allow the operator or the user to control the instrument remotely. Surveyors and construction professionals are adopting total stations for high-precision surveying; this factor is thereby, driving the demand for total stations.

- GIS Collectors − GIS collectors are used for collecting data related to shop floors or fields. Data collection is a real-time and event-oriented process carried out by construction professionals. GIS collectors derive data manually from a computer or directly from the place of their origin. GIS collectors allow construction professionals to carry out accurate measurements related to site reconnaissance, progress measurement, and site inspection. A few of these GIS collectors are integrated within cellular modems, GPS, cameras, and displays. Moreover, GIS collectors help in spatial analysis for manipulating, extracting, locating, and analyzing the geographic data. They are widely adopted for capturing, storing, recovering, analyzing, and displaying spatial data.

- LIDAR − LIDAR, an acronym for light detection and ranging, is an optical remote sensing technique used to sample the surface of the earth. It is used to collect accurate data regarding the elevation, contour, and vegetation on ground surfaces. LIDAR is a highly accurate and cost-effective solution compared with traditional photogrammetry techniques of mapping. The major components of LIDAR include laser scanners, collection vehicles (aircraft or UAV), GPS, and inertial measurement units (IMU). LIDAR is mainly used for airborne laser mapping applications. Various types of LIDAR techniques are used for GIS data collection such as airborne LIDAR, terrestrial LIDAR, UAV LIDAR, and mobile LIDAR.

- GNSS/GPS antenna - GNSS/GPS antenna is a critical component of the GNSS receiver module. GNSS/GPS antenna receives radio signals from satellites and converts them to electronic signals for use in a GNSS receiver module. GNSS receiver is used in numerous application sectors such as ground mapping, surveying, tracking, positioning, precision agriculture, and construction. GNSS/GPS high-precision antennas are used in challenging environments such as closed or covered areas to provide accurate location positioning. Trimble Inc. (US) and Leica Geosystems (Switzerland) are leading companies that provide GPS/GNSS antennas.

Geographic Information System (GIS) Market and Top End-user Industries

- Transportation − GIS is gaining traction in transportation applications such as transportation planning, highway maintenance, traffic modeling, accident analysis, and route planning. GIS helps transportation planners to store and analyze geospatial data, as well as the mapping of transportation features with a base map. GIS tools can be used in managing, planning and evaluating transportation management systems. Transportation has created an ever-increasing demand for GIS-based technologies. With the emergence of telematics and navigation applications, GIS is expected to play a vital role in the transportation sector. GIS is widely adopted in the transportation industry for applications such as highway and roadway management, real-time traffic data monitoring, railway route planning, and transportation modeling.

- Architecture, Engineering, and Construction − Architecture, engineering, and construction industry is a leading adopter industry of geospatial technologies. GIS plays an important role in the mapping and surveying of construction sites and serves as a complete platform for infrastructure development life cycle. The demand for civil infrastructure is expected to reach new levels with the increase in population, rapid urbanization, and economic expansion. The integration of GIS with computer-aided design (CAD) tools enables professionals to effectively aggregate geographic data for civil infrastructure development. GIS helps in the conversion of raster and vector data for BIM-specific applications. BIM uses the geospatial data to create an intelligent design model for civil infrastructure projects.

- Utilities − GIS-based utility mapping is used for the mapping and modeling of utility management systems. Utilities are using geospatial technologies to assist in the setup of smart grids, asset management, and identify the damage or connectivity issues in pipelines, as well as analyze underground electric wire damages. In the utility sector, GIS is widely used by electric, gas, and water and wastewater organizations for resource management. It is also used in environmental monitoring and disaster management applications. GIS is used for the mapping and monitoring of utility assets such as wastewater pipes, machinery, and others. Accurate location data is required for water and wastewater management. GIS technologies are gaining traction as these offer accurate data and are feasible to implement for utility asset management.

- Oil & Gas − Geographic information systems play an important role in the oil & gas industry. Crude oil and gas are now found in the deeper layers of the earth’s crust than before, and hence it is essential to use precise technologies such as GIS for oil and gas exploration, as well as for its appropriate utilization. In the oil & gas industry, GIS technologies such as satellite imagery and airborne remote sensing are widely used for oil and gas exploration, drilling oil wells, and pipeline management.

- Agriculture − Agricultural land mapping plays a vital role in the management of land resources. High-resolution geospatial images collected from remote sensing and land surveying technologies are used to map and analyze soil data to improve farming methods and procedures. The use of GIS helps farmers to manage their land resources efficiently. In addition, GIS technologies offer agricultural land cover mapping and the assessment of crop damage caused by natural disasters.

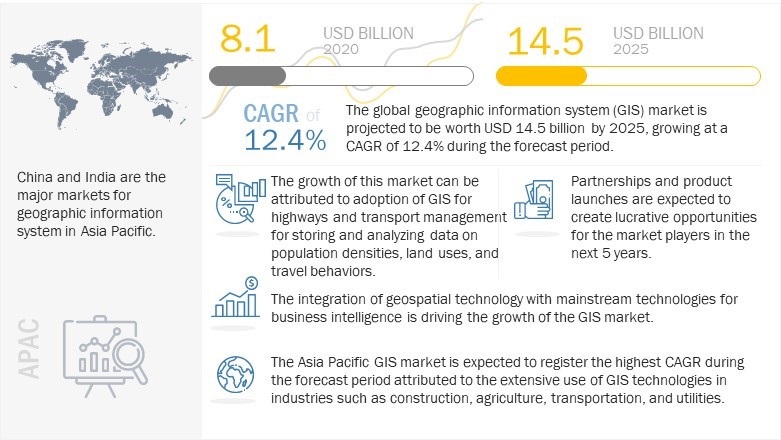

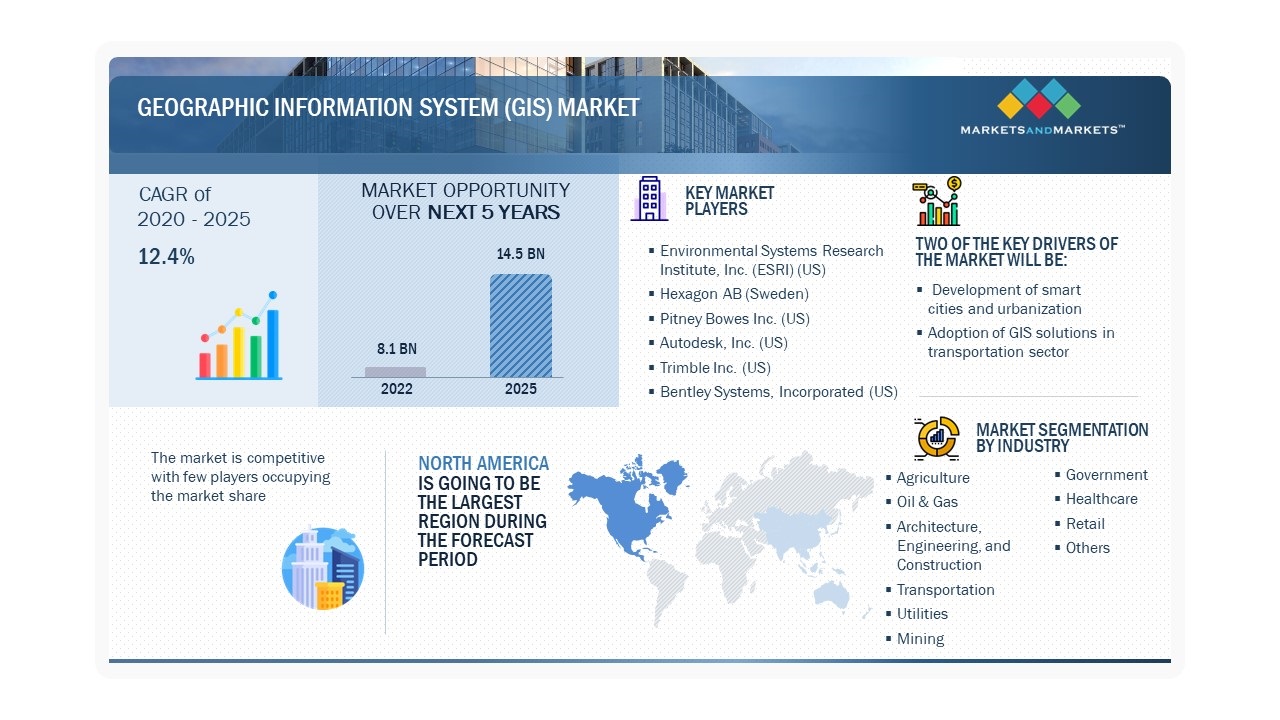

The Geographic Information System Market is projected to reach USD 14.5 Billion by 2025 from USD 11.4 Billion in 2022 at a CAGR of 12.4% during the forecast period. It was observed that the growth rate was 12% from 2021 to 2022. Transportation is expected to account high market share of 18%.

A geographic information system (GIS) is an electronic information system that analyzes, integrates, and displays information based on geographic locations. It provides a visual representation of geographic analysis on maps. Geospatial technology is used to acquire, manipulate, and store the geographic information. This market holds several opportunities for startups and new entrants to enable them to expand their businesses.

Geographic Information System (GIS) Market Forecast to 2025

To know about the assumptions considered for the study, Request for Free Sample Report

A geographic information system (GIS) captures, stores, manipulates, analyzes, manages, and displays spatial or geographic data on a map. The GIS market includes software and hardware products. The software solutions include desktop GIS, server GIS, developer GIS, and others. Hardware includes GNSS/GPS antennas, LiDAR, GIS collectors, total stations, and imaging sensors. Major industries in this study include agriculture, oil & gas, architecture, engineering, & construction, mining, transportation, utilities, retail, healthcare, government, and others.

Geographic Information System Market Dynamics:

Driver: Development of smart cities and urbanization

Smart city planning needs a large volume of geospatial data both at the time of planning and at the time of implementation of the plan to decide the status of the available market potential data. For a smart city, it would be essential to use GIS solutions for land use management to keep the track of zoning and related data of buildings and occupancy. GIS provides precise, orderly, and reliable information for planning and the management of a smart city. GIS is increasingly being used in the construction of smart infrastructure planning and green buildings as GIS easily interfaces with building information modeling (BIM). A few of the application areas of GIS in smart city development include smart urban planning, smart utilities, and smart public works. For the development of smart cities, GIS spatial analytical tools are used for effective decision-making for urban growth management.

Restraint: Geospatial data barriers and high cost

The geospatial industry has grown over the last decade and the number of application areas in which geospatial information is used has increased year-on-year. However, a few of the factors restraining the growth of the geospatial industry are the high cost of GIS solutions and geospatial data barriers. The development of GIS solutions for acquiring real-time data increases the complexity of the GIS software. High complexities involved in the development of GIS software and real-time data collection results in the high cost of the software. Companies with limited financial resources cannot invest in commercial geospatial solutions. The implementation of GIS requires a high initial investment, thereby resulting in a lower rate of adoption in small and medium-sized companies.

Geospatial data barriers are also hindering the market growth as geospatial data is offered in a variety of different incompatible formats. In response, GIS vendors are using geospatial data translators, but this solution results in poor interoperability. Data conversion and integration lead to a rise in the overall implementation cost of GIS.

Opportunity: Development of 4D GIS software and augmented reality platforms for GIS

GIS technologies have been increasingly used to incorporate not only spatial geographic data but also analyzing and visualizing space across time. 4D GIS data includes 2D data, 3D data, and time change data. An integrated database with real-time monitoring is required to generate 4D data. 4D GIS is used to integrate, manage, and analyze spatial information and nonspatial information collected from various data sources. 4D GIS is gaining popularity in areas where GIS is needed for predicting dimensions across time. For example, infrastructure monitoring needs to analyze where and when vulnerabilities may arise in infrastructure.

Challenge: Integration of GIS technology with other technologies

Organizations are facing a challenge for integrating geospatial data with enterprise solutions such as enterprise resource planning (ERP), customer relationship management (CRM), and business process management (BPM). The data collected from geospatial sources are heterogeneous/unstructured (images, videos, signals) and need to be processed to make them compatible with the existing database. Major challenges in GIS technology are to integrate and synchronize geospatial data with enterprise solutions and adopt workflows that are understandable to both systems. Moreover, understanding business processes and workflows for geospatial data with enterprise solutions are highly complex to synchronize. Thus, the integration of GIS technology with other technologies poses a challenge to the GIS market.

Geographic Information System Market Segment Insights:

Valve Positioner Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Based on Industry, the transportation segment to dominate the GIS market in the year 2020

GIS is gaining traction in transportation applications such as transportation planning, highway maintenance, traffic modeling, accident analysis, and route planning. GIS helps transportation planners to store and analyze geospatial data, as well as the mapping of transportation features with a base map. GIS plays a significant role in highway infrastructure management and the development of roads, bridges, and railway routes. With the growing adoption of GIS in transportation, companies are focusing on developing transportation-specific GIS applications. For instance, Caliper Corporation (US) offers TransCAD, GIS software, specially designed for transportation applications such as traffic modeling and transportation planning.

Regional Insights:

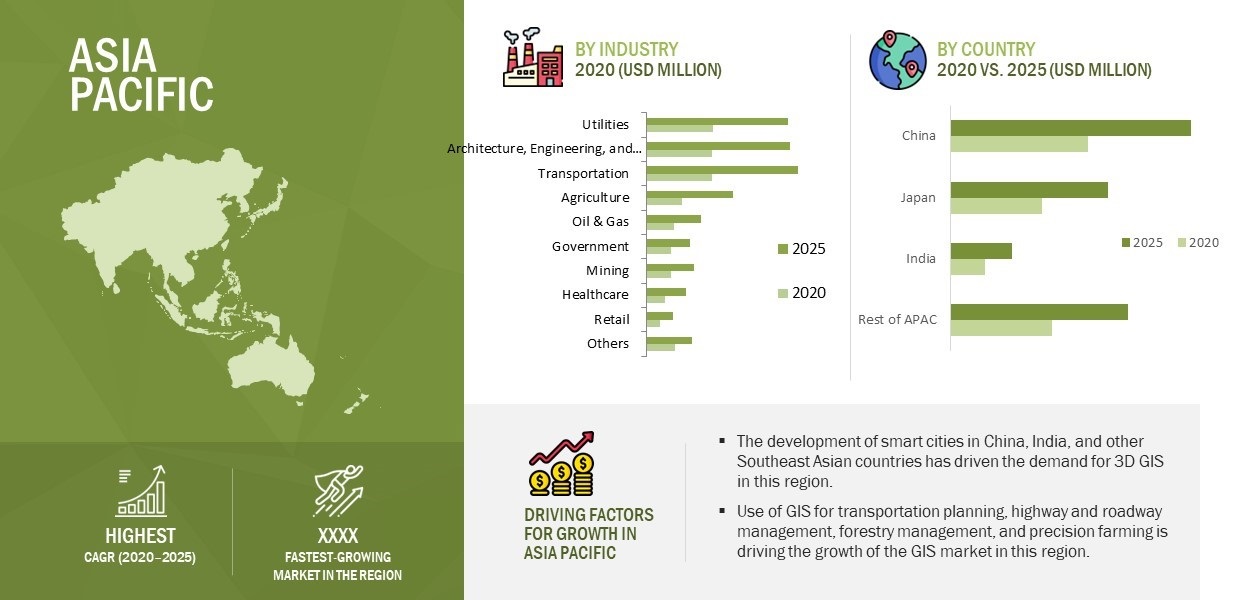

The Asia Pacific region is projected to grow at the highest CAGR during the forecast period

The GIS market in Asia Pacific is growing rapidly. Large-scale infrastructure developments in emerging economies such as India and China drive the market for industry-specific GIS solutions. China is expected to hold the largest size of the GIS market in Asia Pacific due to the widespread adoption of GIS technologies in agriculture, construction, transportation, and utilities. Government initiatives in India have promoted the use of GIS in urban planning, smart city development, and environmental monitoring. The use of GIS-integrated solutions such as BIM for construction planning is expected to drive the demand for GIS in this region during the forecast period.

Geographic Information System (GIS) Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players:

Some of the major players in the Geographic Information System (GIS) market are Environmental Systems Research Institute, Inc. (ESRI) (US), Hexagon AB (Sweden), Pitney Bowes Inc. (US), Autodesk, Inc. (US), Trimble Inc. (US), Bentley Systems, Incorporated (US), General Electric Co. (US), Blue Marble Geographics (US), Maxar Technologies Inc. (US), Caliper Corporation (US), Computer Aided Development Corporation Limited (Cadcorp) (UK), and ABACO Group (Italy). These players have adopted various growth strategies such as contracts, joint ventures, partnerships & agreements, acquisitions, and new product launches to expand their presence in the Geographic Information System (GIS) Market.

Environmental Systems Research Institute (ESRI) has a diversified portfolio of GIS software and geodatabase management applications. The core strengths of the company include comprehensive offerings, strong financial performance, global strategic alliances, and a huge customer base. The company primarily focuses on product launches and developments to offer technically advanced solutions to its customers. It has launched several new products, with a focus on product enhancement and on the development of advanced geospatial technologies.

Hexagon (Sweden) offers a diversified range of GIS software for surveying, construction, public safety, natural resources, transport and public service, and defense industries. Owing to its technologically innovative capability, the company can offer diversified and innovative products for major industries, thereby driving the competitiveness in the market. The company invested USD ~400 million in research and development (R&D) activities to develop and launch products based on innovative geospatial technology and strengthen its position in the geographical information system market.

Geographic Information System Market Size and Scope

|

Report Metric |

Details |

| Market Size Value in 2020 | USD 8.1 Billion |

| Revenue Forecast in 2025 | USD 14.5 Billion |

| Growth Rate | 12.4% |

|

Years considered to provide market size |

2018–2025 |

|

Forecast Period |

2020–2025 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

Offering, Function, Industry, and Geography |

|

Base Year |

2019 |

This research report categorizes the GIS market based on component, hardware type, function, end user and geography.

By Offering:

-

Hardware

- GIS collectors

- Imaging sensors

- LiDAR

- Total stations

- GNSS/GPS antennas

-

Software

- Desktop GIS

- Server GIS

- Developer GIS

- Mobile GIS

- Remote sensing software

- Services

By Function

- Mapping

- Surveying

- Telematics and navigation

- Location-based services

By the End-User

- Agriculture

- Oil & Gas

- Architecture, Engineering, and Construction

- Transportation

- Utilities

- Mining

- Government

- Healthcare

- Retail

- Others (Marine, Education, and Forestry)

By Region

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Geographic Information System (GIS) Market Highlights:

What is new?

- Major developments that can change the business landscape as well as market forecasts.

The geographic information system market has witnessed numerous technological advancements in software capabilities. Substantial investments have been made in the geographic information system's research & development and upgrades. The value chain of the GIS ecosystem starts with research and development (R&D), which comprises system requirements analysis, comparison of electronics specifications, and prototype development, followed by manufacturing and system integration phases.

-

Emerging Technology Trends

- Drones

- Robotics

- Artificial intelligence (AI)

- 5G Networking

- Refinement in segmentation–Increase the depth or width of market segmentation.

-

Geographic Information System Market, By Hardware

- Total Station

- LiDAR

- Imaging Sensor

- GPS Antennas

- Others

-

Geographic Information System Market, by Industry

- Automotive

- Space & Research

- Agriculture

- Medical and Healthcare

- Telecommunication

- Others.

- Inclusion of new players and change in the market share of existing players – Geographic Information System Market

Company profiles: Company profiles give a glimpse of the key players in the market with respect to their business overviews, financials, product offerings, recent developments undertaken by them, and MnM view. In the new edition of the report, we have a total of 25 players (15 major, 10 Startups/SME). Moreover, the share of companies operating in the Geographic Information System (GIS) Market and start-up matrix have also been provided in the report.

- Updated financial information and product portfolios of players operating in the Geographic Information System Market

Newer and improved representation of financial information: The latest edition of the report provides updated financial information in the Geographic Information System Market till 2022 for each listed company in the graphical representation in a single diagram (instead of multiple tables). This would help to easily analyze the present status of profiled companies in terms of their financial strength, profitability, key revenue-generating region/country, business segment focus in terms of the highest revenue-generating segment, and investment in research and development activities.

- Recent market developments of the profiled players

Recent Developments: Updated market developments such as contracts, joint ventures, partnerships & agreements, acquisitions, new product launches, investments, funding, and certification have been mapped for 2020 to 2022.

- New data points/analysis which was not present in the previous version of the report

- Competitive benchmarking of startups/SMEs covers employee details, financial status, the latest funding round, and total funding (if available).

- Inclusion of the impact of megatrends on the GIS Market that includes a shift in global climate change, rapid urbanization, greater customization, and disruptive technologies

- Technology analysis and case studies are added in this edition of the report to give the technological perspective and the significance of the advancements in the GIS Market

- We have included brief patent information for the overall market of GIS.

- The startup evaluation matrix is added in this edition of the report, covering startups.

- The new edition of the report consists of trends/disruptions in customer business, tariff & regulatory landscape, pricing analysis, and a market ecosystem map to better understand Linear Motion System's market dynamics.

Recent Developments

- In October 2022, Bentley Systems partnered with Nearabl Inc., which is the metaverse of accessibility company. This partnership aimed to expand the use of infrastructure engineering technology within the global infrastructure construction, and design industries. The Bentley company is now an iTwin Premier Partner, and its Nearabl app has achieved the “Powered by iTwin” designation.

- In September 2022, Trimble launched the Trimble Ri, which is an innovative robotic total station. This has high flexibility and upgradeability makes high-end total station technology more accessible and sets a new scalability standard for use across the construction industry.

Key Questions Addressed by the Report

What is the current size of the Linear Motion System Market?

The Linear Motion System Market is projected to grow to USD 8.1 billion in 2020 to USD 14.5 Billion by 2025, at a CAGR of 12.4% between 2020-2025.

Who are the winners in the Geographic Information System (GIS) Market?

Environmental Systems Research Institute (ESRI) (US), Hexagon (Sweden), Autodesk (US), Bentley Systems (US), Pitney Bowes (US), Caliper (US), and SuperMap Software (China).

What are some of the technological advancements in the market?

Aerial LIDAR system is preferred for collecting topographic data for corridor mapping purposes because it provides quick and accurate data for large areas.

Wearable technology can collect a very broad amount of healthcare information such as average heart rate, sleeping patterns, and exposure to the sun. Adding this data to a GIS could help determine if the average heart rate or sleeping patterns of individuals varies over geographic areas.

What are the factors driving the growth of the market?

Increasing need for GIS in development of smart cities and urbanization.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 SEGMENTATION OF GEOGRAPHIC INFORMATION SYSTEM MARKET

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 25)

2.1 RESEARCH DATA

FIGURE 2 GEOGRAPHIC INFORMATION SYSTEM MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 List of major secondary sources

2.1.1.2 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 Key data from primary sources

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.1.3.1 Key industry insights

2.1.3.2 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size by bottom-up analysis

FIGURE 3 GIS MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market share by top-down analysis

FIGURE 4 GIS MARKET: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 6 ASSUMPTIONS FOR RESEARCH STUDY

3 EXECUTIVE SUMMARY (Page No. - 34)

FIGURE 7 GEOGRAPHIC INFORMATION SYSTEM MARKET FOR SOFTWARE EXPECTED TO HOLD LARGEST MARKET SIZE IN 2025

FIGURE 8 GEOGRAPHIC INFORMATION SYSTEM MARKET FOR LOCATION-BASED SERVICES TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 9 TRANSPORTATION EXPECTED TO HOLD LARGEST SHARE OF GEOGRAPHIC INFORMATION SYSTEM MARKET IN 2025

FIGURE 10 NORTH AMERICA TO HOLD LARGEST SHARE OF GEOGRAPHIC INFORMATION SYSTEM MARKET IN 2025

4 PREMIUM INSIGHTS (Page No. - 37)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR GEOGRAPHICAL INFORMATION SYSTEM MARKET

FIGURE 11 INTEGRATION OF GEOSPATIAL TECHNOLOGY WITH EMERGING TECHNOLOGIES TO BOOST GROWTH OF GIS MARKET DURING FORECAST PERIOD

4.2 GEOGRAPHICAL INFORMATION SYSTEM MARKET, BY OFFERING

FIGURE 12 GEOGRAPHICAL INFORMATION SYSTEM MARKET FOR SOFTWARE TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.3 GEOGRAPHICAL INFORMATION SYSTEM MARKET, BY FUNCTION

FIGURE 13 MAPPING TO HOLD LARGEST SIZE OF GEOGRAPHICAL INFORMATION SYSTEM MARKET IN 2025

4.4 GEOGRAPHICAL INFORMATION SYSTEM MARKET IN NORTH AMERICA, BY INDUSTRY AND COUNTRY

FIGURE 14 TRANSPORTATION INDUSTRY TO HOLD LARGEST SHARE OF GEOGRAPHICAL INFORMATION SYSTEM MARKET IN NORTH AMERICA IN 2025

4.5 GEOGRAPHICAL INFORMATION SYSTEM MARKET, BY GEOGRAPHY

FIGURE 15 NORTH AMERICA EXPECTED TO HOLD MAJOR SHARE OF GEOGRAPHICAL INFORMATION SYSTEM MARKET IN 2025

5 MARKET OVERVIEW (Page No. - 40)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 GEOGRAPHIC INFORMATION SYSTEM MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Development of smart cities and urbanization

5.2.1.2 Integration of geospatial technology with mainstream technologies for business intelligence

5.2.1.3 Adoption of GIS solutions in transportation sector

FIGURE 17 GIS MARKET DRIVERS AND THEIR IMPACT

5.2.2 RESTRAINTS

5.2.2.1 Regulations and legal issues

5.2.2.2 Geospatial data barriers and high cost

5.2.3 OPPORTUNITIES

5.2.3.1 Benefits of drones integrated with GIS

5.2.3.2 Integration of cloud computing in GIS

5.2.3.3 Development of 4D GIS software and augmented reality platforms for GIS

FIGURE 18 GIS MARKET OPPORTUNITIES AND THEIR IMPACT

5.2.4 CHALLENGES

5.2.4.1 Integration of GIS technology with other technologies

FIGURE 19 GIS MARKET RESTRAINTS & CHALLENGES AND THEIR IMPACT

6 INDUSTRY TRENDS (Page No. - 46)

6.1 INTRODUCTION

6.2 VALUE CHAIN ANALYSIS

FIGURE 20 VALUE CHAIN ANALYSIS OF GEOGRAPHIC INFORMATION SYSTEM ECOSYSTEM

6.3 GIS DATA

6.3.1 TYPES OF GIS DATA MODELS

6.3.1.1 Vector data model

6.3.1.2 Raster data model

6.4 TRENDS IN GIS MARKET

6.4.1 AR AND VR TECHNOLOGIES

6.4.2 UNMANNED AERIAL VEHICLES

7 GEOGRAPHIC INFORMATION SYSTEM MARKET, BY OFFERING (Page No. - 49)

7.1 INTRODUCTION

FIGURE 21 GEOGRAPHIC INFORMATION SYSTEM MARKET, BY OFFERING

TABLE 1 GEOGRAPHIC INFORMATION SYSTEM MARKET, BY OFFERING, 2018–2025 (USD MILLION)

7.2 HARDWARE

FIGURE 22 GEOGRAPHIC INFORMATION SYSTEM MARKET, BY HARDWARE

TABLE 2 GEOGRAPHIC INFORMATION SYSTEM MARKET, BY HARDWARE, 2018–2025 (USD MILLION)

7.2.1 TOTAL STATIONS

7.2.1.1 High demand for robotic total stations boost growth of GIS market

7.2.2 GIS COLLECTORS

7.2.2.1 GIS collectors to hold largest market share in coming years

7.2.3 GNSS/GPS ANTENNAS

7.2.3.1 Mapping and surveying are major applications of GNSS/GPS antennas

7.2.4 LIDAR

7.2.4.1 LIDAR is likely to be fastest-growing segment in GIS hardware market

7.2.5 IMAGING SENSORS

7.2.5.1 Imaging sensors are key elements for remote sensing and imagery applications

7.3 SOFTWARE

TABLE 3 GEOGRAPHIC INFORMATION SYSTEM MARKET, BY SOFTWARE, 2018–2025 (USD MILLION)

7.3.1 DESKTOP GIS

7.3.1.1 Desktop GIS is commonly-used software for performing spatial analysis and managing tabular data

7.3.2 MOBILE GIS

7.3.2.1 Mobile GIS is used in handheld devices and provides location-based services

7.3.3 GIS SERVER AND WEB GIS

7.3.3.1 Majority of GIS servers are used by software and web developers

7.3.4 DEVELOPER GIS

7.3.4.1 Developer GIS used to create mapping and geoprocessing applications

7.3.5 REMOTE SENSING SOFTWARE

7.3.5.1 Remote sensing software is crucial for developing and analyzing geographic images

7.4 SERVICES

7.4.1 INSTALLATION

7.4.2 TRAINING & MAINTENANCE

7.4.3 SOFTWARE UPGRADATION

8 GEOGRAPHIC INFORMATION SYSTEM MARKET, BY FUNCTION (Page No. - 57)

8.1 INTRODUCTION

FIGURE 23 GEOGRAPHIC INFORMATION SYSTEM MARKET, BY FUNCTION

FIGURE 24 MAPPING FUNCTION TO HOLD LARGEST SIZE OF GIS MARKET IN 2025

TABLE 4 GEOGRAPHIC INFORMATION SYSTEM MARKET, BY FUNCTION, 2018–2025 (USD BILLION)

TABLE 5 GEOGRAPHIC INFORMATION SYSTEM MARKET FOR MAPPING FUNCTION, BY INDUSTRY, 2018–2025 (USD MILLION)

TABLE 6 GEOGRAPHIC INFORMATION SYSTEM MARKET, FOR SURVEYING FUNCTION, BY INDUSTRY, 2018–2025 (USD MILLION)

TABLE 7 GEOGRAPHIC INFORMATION SYSTEM MARKET, FOR TELEMATICS AND NAVIGATION FUNCTION, BY INDUSTRY, 2018–2025 (USD MILLION)

TABLE 8 GEOGRAPHIC INFORMATION SYSTEM MARKET, FOR LOCATION-BASED SERVICES, BY INDUSTRY, 2018–2025 (USD MILLION)

8.2 MAPPING

8.2.1 REMOTE SENSING AND LIDAR TECHNOLOGIES TO DRIVE GIS MARKET FOR MAPPING

8.3 SURVEYING

8.3.1 MARKET FOR SURVEYING FUNCTION TO WITNESS CONSIDERABLE GROWTH DURING FORECAST PERIOD

8.4 TELEMATICS AND NAVIGATION

8.4.1 ADOPTION OF ITS AND IVHS TO INCREASE DEMAND FOR GIS-BASED TELEMATICS AND NAVIGATION SERVICES

8.5 LOCATION-BASED SERVICES

8.5.1 RAPID EVOLUTION OF SMARTPHONES AND AVAILABILITY OF FAST WIRELESS INTERNET CONNECTIVITY TO FURTHER DRIVE GROWTH OF MARKET FOR LBS DURING FORECAST PERIOD

9 GEOGRAPHIC INFORMATION SYSTEM MARKET, BY INDUSTRY (Page No. - 64)

9.1 INTRODUCTION

FIGURE 25 GIS MARKET, BY INDUSTRY

TABLE 9 GEOGRAPHIC INFORMATION SYSTEM MARKET, BY INDUSTRY, 2018–2025 (USD MILLION)

FIGURE 26 GIS MARKET FOR TRANSPORTATION TO HOLD LARGEST MARKET SIZE IN 2025

9.2 AGRICULTURE

9.2.1 PRECISION FARMING CREATES SIGNIFICANT OPPORTUNITY FOR GROWTH OF GIS MARKET IN AGRICULTURE INDUSTRY

TABLE 10 GEOGRAPHIC INFORMATION SYSTEM MARKET FOR AGRICULTURE, BY FUNCTION, 2018–2025 (USD MILLION)

TABLE 11 GEOGRAPHIC INFORMATION SYSTEM MARKET FOR AGRICULTURE, BY REGION, 2018–2025 (USD MILLION)

9.3 OIL & GAS

9.3.1 SATELLITE IMAGERY AND AIRBORNE REMOTE SENSING TECHNOLOGY PLAY VITAL ROLE IN GROWTH OF GIS IN OIL & GAS INDUSTRY

TABLE 12 GEOGRAPHIC INFORMATION SYSTEM MARKET FOR OIL & GAS INDUSTRY, BY FUNCTION, 2018–2025 (USD MILLION)

TABLE 13 GEOGRAPHIC INFORMATION SYSTEM MARKET FOR OIL & GAS, BY REGION, 2018–2025 (USD MILLION)

9.4 ARCHITECTURE, ENGINEERING, AND CONSTRUCTION

9.4.1 GIS SOLUTIONS USED FOR URBAN AND REGIONAL PLANNING IN ARCHITECTURE, ENGINEERING, AND CONSTRUCTION INDUSTRIES

TABLE 14 GEOGRAPHIC INFORMATION SYSTEM MARKET FOR ARCHITECTURE, ENGINEERING, AND CONSTRUCTION, BY FUNCTION, 2018–2025 (USD MILLION)

TABLE 15 GEOGRAPHIC INFORMATION SYSTEM MARKET FOR ARCHITECTURE, ENGINEERING, AND CONSTRUCTION, BY REGION, 2018–2025 (USD MILLION)

9.5 TRANSPORTATION

9.5.1 TRANSPORTATION TO HOLD MAJOR SHARE OF GIS MARKET

TABLE 16 GEOGRAPHIC INFORMATION SYSTEM MARKET FOR TRANSPORTATION, BY FUNCTION, 2018–2025 (USD MILLION)

TABLE 17 GEOGRAPHIC INFORMATION SYSTEM MARKET FOR TRANSPORTATION, BY REGION, 2018–2025 (USD MILLION)

9.6 UTILITIES

9.6.1 GIS IS WIDELY USED FOR ENVIRONMENTAL MONITORING AND DISASTER MANAGEMENT APPLICATIONS IN UTILITY INDUSTRY

TABLE 18 GEOGRAPHIC INFORMATION SYSTEM MARKET FOR UTILITIES, BY FUNCTION, 2018–2025 (USD MILLION)

TABLE 19 GEOGRAPHIC INFORMATION SYSTEM MARKET FOR UTILITIES, BY REGION, 2018–2025 (USD MILLION)

9.7 MINING

9.7.1 MINING INDUSTRY UTILIZES GIS SOLUTIONS FOR MAPPING AND SURVEYING

TABLE 20 GEOGRAPHIC INFORMATION SYSTEM MARKET FOR MINING, BY FUNCTION, 2018–2025 (USD MILLION)

TABLE 21 GEOGRAPHIC INFORMATION SYSTEM MARKET FOR MINING, BY REGION, 2018–2025 (USD MILLION)

9.8 GOVERNMENT

9.8.1 GOVERNMENT INDUSTRY HAS HIGH GROWTH OF GIS MARKET DUE TO ADOPTION LIDAR TECHNOLOGY

TABLE 22 GEOGRAPHIC INFORMATION SYSTEM MARKET FOR GOVERNMENT, BY FUNCTION, 2018–2025 (USD MILLION)

TABLE 23 GEOGRAPHIC INFORMATION SYSTEM MARKET FOR GOVERNMENT, BY REGION, 2018–2025 (USD MILLION)

9.9 HEALTHCARE

9.9.1 GIS SOLUTION WOULD HELP HEALTHCARE INDUSTRY TO ANALYZE PATIENT HEALTHCARE DATA

TABLE 24 GEOGRAPHIC INFORMATION SYSTEM MARKET FOR HEALTHCARE, BY FUNCTION, 2018–2025 (USD MILLION)

TABLE 25 GEOGRAPHIC INFORMATION SYSTEM MARKET FOR HEALTHCARE, BY REGION, 2018–2025 (USD MILLION)

9.10 RETAIL

9.10.1 HIGH DEMAND OF AUTOMATED AND BUSINESS INTELLIGENCE SOLUTIONS TO DRIVE THE GIS MARKET

TABLE 26 GEOGRAPHIC INFORMATION SYSTEM MARKET FOR RETAIL, BY FUNCTION, 2018–2025 (USD MILLION)

TABLE 27 GEOGRAPHIC INFORMATION SYSTEM MARKET FOR RETAIL, BY REGION, 2018–2025 (USD MILLION)

9.11 OTHERS

TABLE 28 GEOGRAPHIC INFORMATION SYSTEM MARKET FOR OTHER INDUSTRIES, BY FUNCTION, 2018–2025 (USD MILLION)

TABLE 29 GEOGRAPHIC INFORMATION SYSTEM MARKET FOR OTHER INDUSTRIES, BY REGION, 2018–2025 (USD MILLION)

10 GEOGRAPHIC ANALYSIS (Page No. - 79)

10.1 INTRODUCTION

FIGURE 27 GEOGRAPHIC INFORMATION SYSTEM MARKET, BY REGION

FIGURE 28 GEOGRAPHIC INFORMATION SYSTEM MARKET IN APAC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 30 GIS MARKET, BY REGION, 2018–2025 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 29 SNAPSHOT OF GIS MARKET IN NORTH AMERICA

TABLE 31 GIS MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 32 GIS MARKET IN NORTH AMERICA, BY INDUSTRY, 2018–2025 (USD MILLION)

TABLE 33 GIS MARKET FOR AGRICULTURE IN NORTH AMERICA, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 34 GIS MARKET FOR OIL & GAS IN NORTH AMERICA, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 35 GIS MARKET FOR ARCHITECTURE, ENGINEERING, AND CONSTRUCTION IN NORTH AMERICA, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 36 GIS MARKET FOR TRANSPORTATION IN NORTH AMERICA, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 37 GIS MARKET FOR UTILITIES IN NORTH AMERICA, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 38 GIS MARKET FOR MINING IN NORTH AMERICA, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 39 GIS MARKET FOR GOVERNMENT IN NORTH AMERICA, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 40 GIS MARKET FOR HEALTHCARE IN NORTH AMERICA, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 41 GIS MARKET FOR RETAIL IN NORTH AMERICA, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 42 GIS MARKET FOR OTHER INDUSTRIES IN NORTH AMERICA, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 43 GIS MARKET IN US, BY INDUSTRY, 2018–2025 (USD MILLION)

TABLE 44 GIS MARKET IN CANADA, BY INDUSTRY, 2018–2025 (USD MILLION)

TABLE 45 GIS MARKET IN MEXICO, BY INDUSTRY, 2018–2025 (USD MILLION)

10.2.1 US

10.2.1.1 US to hold largest share of North American market in 2025

10.2.2 CANADA

10.2.2.1 High adoption of GIS for agriculture and transportation industries in Canada

10.2.3 MEXICO

10.2.3.1 Huge growth opportunity for cloud-based GIS and mobile GIS in Mexico

10.3 EUROPE

TABLE 46 GIS MARKET IN EUROPE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 47 GIS MARKET IN EUROPE, BY INDUSTRY, 2018–2025 (USD MILLION)

TABLE 48 GIS MARKET FOR AGRICULTURE IN EUROPE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 49 GIS MARKET FOR OIL & GAS IN EUROPE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 50 GIS MARKET FOR ARCHITECTURE, ENGINEERING, AND CONSTRUCTION IN EUROPE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 51 GIS MARKET FOR TRANSPORTATION IN EUROPE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 52 GIS MARKET FOR UTILITIES IN EUROPE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 53 GIS MARKET FOR MINING IN EUROPE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 54 GIS MARKET FOR GOVERNMENT IN EUROPE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 55 GIS MARKET FOR HEALTHCARE IN EUROPE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 56 GIS MARKET FOR RETAIL IN EUROPE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 57 GIS MARKET FOR OTHER INDUSTRIES IN EUROPE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 58 GIS MARKET IN GERMANY, BY INDUSTRY, 2018–2025 (USD MILLION)

TABLE 59 GIS MARKET IN UK, BY INDUSTRY, 2018–2025 (USD MILLION)

TABLE 60 GIS MARKET IN FRANCE, BY INDUSTRY, 2018–2025 (USD MILLION)

TABLE 61 GIS MARKET IN REST OF EUROPE, BY INDUSTRY, 2018–2025 (USD MILLION)

10.3.1 UK

10.3.1.1 Mandates related to implementation of BIM for construction in UK drive growth of GIS market in region

10.3.2 GERMANY

10.3.2.1 Adoption of GIS in German smart grid market to boost growth of GIS market

10.3.3 FRANCE

10.3.3.1 High adoption of GIS for construction and transportation industries in France

10.3.4 ITALY

10.3.4.1 Strong foothold of industrial base in Italy drives GIS market

10.3.5 REST OF EUROPE

10.4 APAC

FIGURE 30 SNAPSHOT OF GIS MARKET IN APAC

TABLE 62 GIS MARKET IN APAC, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 63 GIS MARKET IN APAC, BY INDUSTRY, 2018–2025 (USD MILLION)

TABLE 64 GIS MARKET FOR AGRICULTURE IN APAC, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 65 GIS MARKET FOR OIL & GAS IN APAC, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 66 GIS MARKET FOR ARCHITECTURE, ENGINEERING, AND CONSTRUCTION IN APAC, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 67 GIS MARKET FOR TRANSPORTATION IN APAC, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 68 GIS MARKET FOR UTILITIES IN APAC, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 69 GIS MARKET FOR MINING IN APAC, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 70 GIS MARKET FOR GOVERNMENT IN APAC, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 71 GIS MARKET FOR HEALTHCARE IN APAC, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 72 GIS MARKET FOR RETAIL IN APAC, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 73 GIS MARKET FOR OTHER INDUSTRIES IN APAC, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 74 GIS MARKET IN CHINA, BY INDUSTRY, 2018–2025 (USD MILLION)

TABLE 75 GIS MARKET IN JAPAN, BY INDUSTRY, 2018–2025 (USD MILLION)

TABLE 76 GIS MARKET IN INDIA, BY INDUSTRY, 2018–2025 (USD MILLION)

TABLE 77 GIS MARKET IN REST OF APAC, BY INDUSTRY, 2018–2025 (USD MILLION)

10.4.1 CHINA

10.4.1.1 China to hold major share of GIS market during forecast period

10.4.2 JAPAN

10.4.2.1 Growing investments in residential and infrastructure markets drive GIS market in Japan

10.4.3 INDIA

10.4.3.1 Increase in infrastructure development projects to drive GIS market in India

10.4.4 SOUTH KOREA

10.4.4.1 Growing concern for safety of power plants and other existing infrastructure from natural disasters to boost adoption of GIS in South Korea

10.4.5 REST OF APAC

10.5 ROW

TABLE 78 GIS MARKET IN ROW, BY REGION, 2018–2025 (USD MILLION)

TABLE 79 GIS MARKET IN ROW, BY INDUSTRY, 2018–2025 (USD MILLION)

TABLE 80 GIS MARKET FOR AGRICULTURE IN ROW, BY REGION, 2018–2025 (USD MILLION)

TABLE 81 GIS MARKET FOR OIL & GAS IN ROW, BY REGION, 2018–2025 (USD MILLION)

TABLE 82 GIS MARKET FOR ARCHITECTURE, ENGINEERING, AND CONSTRUCTION IN ROW, BY REGION, 2018–2025 (USD MILLION)

TABLE 83 GIS MARKET FOR TRANSPORTATION IN ROW, BY REGION, 2018–2025 (USD MILLION)

TABLE 84 GIS MARKET FOR UTILITIES IN ROW, BY REGION, 2018–2025 (USD MILLION)

TABLE 85 GIS MARKET FOR MINING IN ROW, BY REGION, 2018–2025 (USD MILLION)

TABLE 86 GIS MARKET FOR GOVERNMENT IN ROW, BY REGION, 2018–2025 (USD MILLION)

TABLE 87 GIS MARKET FOR HEALTHCARE IN ROW, BY REGION, 2018–2025 (USD MILLION)

TABLE 88 GIS MARKET FOR RETAIL IN ROW, BY REGION, 2018–2025 (USD MILLION)

TABLE 89 GIS MARKET FOR OTHER INDUSTRIES IN ROW, BY REGION, 2018–2025 (USD MILLION)

TABLE 90 GIS MARKET IN MIDDLE EAST, BY INDUSTRY, 2018–2025 (USD MILLION)

TABLE 91 GIS MARKET IN AFRICA, BY INDUSTRY, 2018–2025 (USD MILLION)

TABLE 92 GIS MARKET IN SOUTH AMERICA, BY INDUSTRY, 2018–2025 (USD MILLION)

10.5.1 SOUTH AMERICA

10.5.1.1 South America is expected to witness considerable growth of GIS market during forecast period

10.5.2 MIDDLE EAST

10.5.2.1 Middle Eastern countries have high demand for GIS solutions for architecture, engineering & construction industries

10.5.3 AFRICA

10.5.3.1 Infrastructure developments and usage of GIS by local governments of Africa drive GIS market growth in region

11 COMPETITIVE LANDSCAPE (Page No. - 112)

11.1 INTRODUCTION

FIGURE 31 KEY GROWTH STRATEGIES ADOPTED BY COMPANIES FROM 2018 TO 2020

11.2 MARKET RANKING ANALYSIS

FIGURE 32 RANKING OF KEY PLAYERS IN GIS SOFTWARE MARKET, 2019

11.3 COMPETITIVE LEADERSHIP MAPPING

11.3.1 VISIONARY LEADERS

11.3.2 INNOVATORS

11.3.3 DYNAMIC DIFFERENTIATORS

11.3.4 EMERGING COMPANIES

FIGURE 33 GIS MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

11.4 STRENGTH OF PRODUCT PORTFOLIO (FOR 26 PLAYERS)

11.5 BUSINESS STRATEGY EXCELLENCE (FOR 26 PLAYERS)

11.6 COMPETITIVE SCENARIO

11.6.1 PRODUCT LAUNCHES AND PRODUCT DEVELOPMENTS

TABLE 93 PRODUCT LAUNCHES & PRODUCT DEVELOPMENTS, 2018–2020

11.6.2 MERGERS, ACQUISITIONS, PARTNERSHIPS, AND COLLABORATIONS

TABLE 94 MERGERS, ACQUISITIONS, PARTNERSHIPS, AND COLLABORATIONS, 2018–2020

12 COMPANY PROFILES (Page No. - 120)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

12.2 KEY PLAYERS

12.2.1 AUTODESK

FIGURE 34 AUTODESK: COMPANY SNAPSHOT

12.2.2 ESRI

12.2.3 TRIMBLE

FIGURE 35 TRIMBLE: COMPANY SNAPSHOT

12.2.4 PITNEY BOWES

FIGURE 36 PITNEY: COMPANY SNAPSHOT

12.2.5 HEXAGON

FIGURE 37 HEXAGON: COMPANY SNAPSHOT

12.2.6 TOPCON

FIGURE 38 TOPCON: COMPANY SNAPSHOT

12.2.7 MAXAR TECHNOLOGIES

FIGURE 39 MAXAR TECHNOLOGIES: COMPANY SNAPSHOT

12.2.8 CALIPER CORPORATION

12.2.9 BENTLEY SYSTEMS

12.2.10 ABACO GROUP

12.3 RIGHT TO WIN

12.4 OTHER KEY PLAYERS

12.4.1 TOMTOM INTERNATIONAL

12.4.2 SUPERMAP SOFTWARE

12.4.3 GENERAL ELECTRIC

12.4.4 FARO TECHNOLOGIES

12.4.5 L3HARRIS TECHNOLOGIES

12.4.6 TAKOR GROUP

12.4.7 MAPTOSS TECHNOLOGIES

12.4.8 COMPUTER AIDED DEVELOPMENT CORPORATION LIMITED (CADCORP)

12.4.9 HI-TARGET SURVEYING INSTRUMENT

12.4.10 BLUE MARBLE GEOGRAPHICS

12.4.11 PASCO CORPORATION

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 151)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

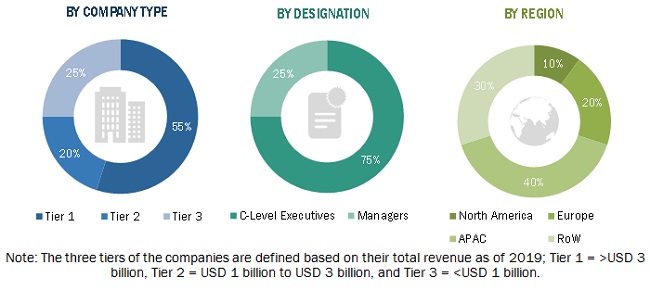

The study involved four major activities in estimating the size of the geographic information system (GIS) market. Exhaustive secondary research has been conducted to collect information on the geographic information system market. Validation of these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation have been used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research, various secondary sources have been referred to for identifying and collecting information important for the GIS market study. Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, manufacturing associations (such as American Association of Geographers, Cartography and Geographic Information Society (CaGIS), European Umbrella Organization for Geographic Information (EUROGI), Geospatial Information & Technology Association) International, and certified publications; articles from recognized authors; gold and silver standard websites; directories; and databases.

Primary Research

In the primary research, various primary sources from both the supply and demand sides have been interviewed to obtain the qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related key executives from major companies and organizations operating in the GIS market. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the overall GIS market and the market based on segments. The research methodology used to estimate the market size has been given below:

- Key players in the GIS market (Hardware manufacturers, GIS software developers, and service providers) have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall GIS market size—using the estimation processes explained above—the market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends in both the demand and supply sides of the GIS market.

Report Objectives:

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the GIS market report.

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Geographic Information System Market

Very Informative