Geospatial Analytics Market by Offering (Solutions (Type (Geocoding & Reverse Geocoding and Thematic Mapping & Spatial Analytics)) & Services), Technology (Remote Sensing, GPS, GIS), Vertical, and Region - Global Forecast to 2028

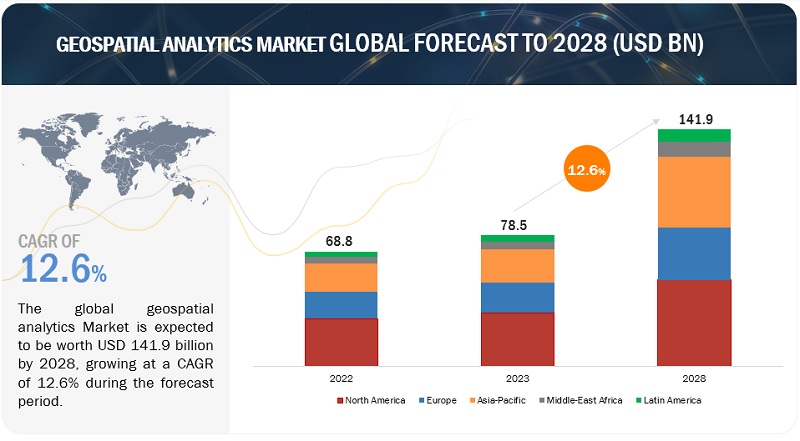

[325 Pages Report] The global market for Geospatial analytics is projected to grow from USD 78.5 billion in 2023 to USD 141.9 billion by 2028, at a CAGR of 12.6% during the forecast period. Geospatial analytics is a field that utilizes spatial data analysis, satellite imagery, artificial intelligence (AI), and machine learning (ML) techniques to extract valuable insights from geospatial data. It involves the processing, interpretation, and visualization of spatially referenced information to understand patterns, trends, and relationships within the data. Geospatial analytics integrates spatial data with satellite imagery to analyze and monitor changes in land cover, vegetation, and urban development. AI and ML algorithms are applied to automate analysis, classify features, detect anomalies, and make predictions. Geospatial analytics empowers industries such as urban planning, agriculture, environmental monitoring, and disaster management, enabling informed decision-making and sustainable development based on comprehensive spatial data analysis.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver: Growing demand for location intelligence

The increasing demand for location intelligence has become a major driver in advancing geospatial analytics. Organizations across diverse industries recognize the significant value that spatial insights bring to their operations and decision-making processes. Location intelligence integrates geospatial data with business data, offering a deeper understanding of spatial relationships, patterns, and trends. This demand is fueled by the understanding that location plays a critical role in various aspects of business, enabling insights into customer behavior, market trends, and resource optimization. Technological advancements, such as cloud computing, big data analytics, and artificial intelligence, have further accelerated the demand by enabling efficient processing and analysis of large-scale geospatial data.

Additionally, the increasing availability and accessibility of geospatial data from satellites, sensors, mobile devices, and social media platforms have opened new opportunities for organizations to harness the power of location intelligence. By integrating and analyzing diverse geospatial datasets, organizations can uncover valuable insights and make data-driven decisions based on spatial understanding. The combination of these factors has driven organizations to seek geospatial analytics solutions, aiming to gain a competitive edge and maximize the benefits of location intelligence.

Restraint: High costs and budget constraints for small and medium-sized enterprises

Geospatial data creation and analysis are widely used in scientific fields, governments, and corporations, but the inherent confidentiality features of location data pose challenges for geospatial research and its societal applications. The increased use of GIS and related geospatial technologies has led to public concern over privacy, and government rules and regulations restrict data gathering, location sharing, usage of location-based information, and data storage. Companies collecting users’ location data must comply with various data privacy rules such as Sensitive Personal Data or Information (SPDI) and General Data Protection Regulation (GDPR), which limits the availability of user location data with organizations and could limit the adoption of these geospatial analytics solutions.

Opportunity: Ability to analyze location data for wide range of critical insights

Geospatial analytics allows organizations to analyze location data for a wide range of critical insights, which can have major implications for decision-making across various aspects of business, such as talent, operations, marketing, and risk management. With the proliferation of location-enabled mobile devices, the amount of geospatial data is increasing tremendously, and organizations are moving to analyze this data to find useful patterns that can inform decision-making. Geospatial analytics can be an important source of innovation, helping solve problems and provide predictive insights. The geospatial analytics market is presently experiencing considerable and steady growth and is expected to grow by 2025. Organizations recognize the value of geospatial technology and leverage it across the enterprise to foster better decision-making and gain a competitive advantage.

Challenge: Cost and infrastructure requirements

Cost and infrastructure requirements pose significant challenges in implementing geospatial analytics solutions. The effective utilization of geospatial analytics demands substantial financial investment and infrastructure support. Organizations must allocate resources to acquire and maintain the necessary hardware, software, and licenses. High-performance computing capabilities, storage capacity, and networking infrastructure are essential for processing and analyzing large-scale geospatial data. The costs associated with procuring and maintaining such infrastructure can be substantial, particularly for organizations with limited budgets or those new to geospatial analytics.

Furthermore, organizations should consider the ongoing infrastructure maintenance costs, software updates, and licensing fees. Geospatial analytics technologies are evolving rapidly, and staying up to date with the latest advancements can be challenging and expensive. This includes investing in software licenses, renewing subscriptions, and acquiring specialized tools or applications tailored to geospatial analysis. Moreover, scaling infrastructure to handle the growing volume of geospatial data can present additional challenges. Accommodating this scalability strains financial resources and requires careful planning and budgeting.

By technology, remote sensing to account for the largest market size during the forecast period

Geospatial analytics plays a crucial role in remote sensing by utilizing advanced techniques to extract meaningful insights from remotely sensed data. Through the integration of geospatial data and remote sensing imagery, geospatial analytics enables the interpretation and analysis of Earth's surface characteristics and phenomena. It facilitates the extraction of valuable information such as land cover classification, vegetation health assessment, change detection, and spatial pattern analysis. Geospatial analytics enhances remote sensing by providing tools for image preprocessing, spatial analysis, and visualization, allowing for a deeper understanding of the Earth's features and processes.

By deployment, cloud to account for the largest market size during the forecast period

Geospatial analytics is being extensively used in the cloud segment to leverage the power of cloud computing and deliver advanced geospatial services. By combining geospatial data with cloud infrastructure, geospatial analytics enables scalable processing, storage, and analysis of spatial data. Cloud-based geospatial analytics platforms provide capabilities such as real-time spatial data processing, distributed computing, and on-demand scalability, allowing businesses and organizations to handle large volumes of geospatial data efficiently. Geospatial analytics in the cloud enables geospatial visualization, spatial modeling, and spatial data mining, empowering users to derive valuable insights, make data-driven decisions, and develop innovative geospatial applications across diverse domains, including urban planning, transportation, logistics, and environmental monitoring.

By offering, solutions to account for the largest market size during the forecast period

Geospatial analytics solutions offer advanced capabilities for analyzing and deriving insights from spatial data, enabling organizations to make informed decisions and optimize their operations. These solutions encompass a range of tools and techniques for spatial data processing, visualization, modeling, and predictive analytics. Geospatial analytics solutions find applications in various domains such as urban planning, transportation, environmental management, agriculture, public health, and natural resource management. They facilitate tasks such as spatial data integration, spatial pattern recognition, geospatial data mining, and spatial modeling, empowering users to extract valuable insights, identify trends, detect anomalies, and make data-driven decisions. Geospatial analytics solutions play a crucial role in unlocking the potential of location-based data, improving decision-making processes, and driving innovation in diverse industries.

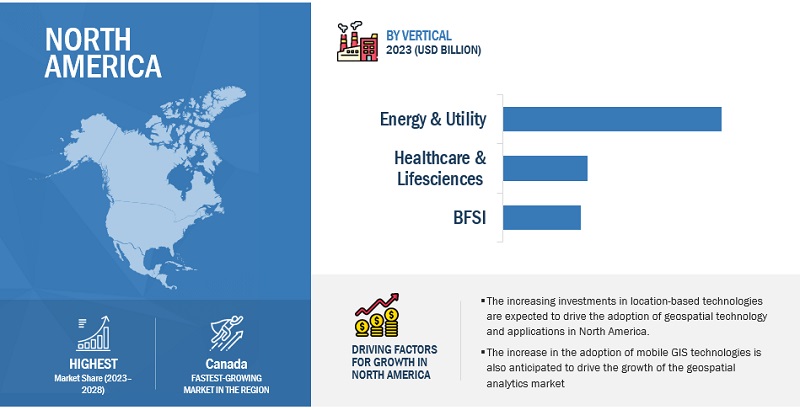

North America to account for the largest market size during the forecast period

North America is expected to have the largest market share in geospatial analytics market. Geospatial analytics is making a significant impact on North America, driving innovation and transforming industries across the region. By harnessing the power of location-based data, geospatial analytics enables organizations to make informed decisions, optimize operations, and drive economic growth. In North America, geospatial analytics is revolutionizing sectors such as urban planning, transportation, agriculture, environmental management, and public safety. It facilitates efficient infrastructure development, improved disaster preparedness and response, sustainable resource management, and enhanced decision-making for businesses and governments. Geospatial analytics empowers North America to leverage spatial insights, improve efficiency, and create smarter, more resilient communities through data-driven solutions and innovative applications.

Key Market Players

The Geospatial analytics vendors have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global market for Geospatial analytics Esri (US), Precisely (US), Caliper Corporation (US), Blue Marble Geographic (US), Google (US), Alteryx (US), Blue Sky Analytics (Netherlands), HexagonAB (Switzerland), TomTom (Netherlands), Trimble (US), Maxar Technologies (US), RMSI (India), Maplarge (US), General Electric (US), Bentley Systems (US), Fugro (Netherlands), Orbital Insights (US), Mapidea (Portugal), Geospin (Germany), Sparkgeo (Canada), Orbica (New Zealand), Descartes Lab (US), Skymap Global (Singapore), ReMOT Technologies (US), CARTO (US), Pasco Corporation (Japan), Geoviet Consulting (Vietnam), Mandalay Technology (Myanmar), GIS Co. Ltd. (Thailand), Suntac Technologies (Myanmar), Geomatic Consulting International (Vietnam), AAM, A Woolpert Company (Australia), Mappointasia (Thailand), Vegastar Technology (Vietnam), and HERE Technologies (Netherlands).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2017–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

USD Million/Billion |

|

Segments covered |

Offering, Technology, Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America |

|

Companies covered |

Esri (US), Precisely (US), Caliper Corporation (US), Blue Marble Geographic (US), Google (US), Alteryx (US), Blue Sky Analytics (Netherlands), HexagonAB (Switzerland), TomTom (Netherlands), Trimble (US), Maxar Technologies (US), RMSI (India), Maplarge (US), General Electric (US), Bentley Systems (US), Fugro (Netherlands), Orbital Insights (US), Mapidea (Portugal), Geospin (Germany), Sparkgeo (Canada), Orbica (New Zealand), Descartes Lab (US), Skymap Global (Singapore), ReMOT Technologies (US), CARTO (US), Pasco Corporation (Japan), Geoviet Consulting (Vietnam), Mandalay Technology (Myanmar), GIS Co. Ltd. (Thailand), Suntac Technologies (Myanmar), Geomatic Consulting International (Vietnam), AAM, A Woolpert Company (Australia), Mappointasia (Thailand), Vegastar Technology (Vietnam), and HERE Technologies (Netherlands). |

This research report categorizes the Geospatial analytics market based on Offering, Technology, Vertical, and Region.

By Offering:

-

Solutions

-

By Type:

- Geocoding and Reverse Geocoding

- Data Integration and Etl

- Reporting and Visualization

- Thematic Mapping and Spatial Analysis

- Others Solutions

-

By Deployment:

- Cloud

- On-premises

-

By Type:

-

Services

- Consulting Services

- Deployment & Integration

- Training, Support, and Maintenance

By Technology:

- Remote Sensing

- GIS

- GPS

- Other Technologies

By Vertical:

- Energy & Utility

- Government

- Defense & Intelligence

- Banking, Financial Services, and Insurance (Bfsi)

- Real estate & Construction

- Healthcare & Life Sciences

- Mining & Natural Resources

- Security

- Logistics & Supply Chain

- Automotive & Transportation

- Agriculture

- Other Verticals

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Thailand

- Australia & New Zealand

- Myanmar

- Vietnam

- Rest of Asia Pacific

-

Middle East & Africa

- UAE

- Kingdom of Saudi Arabia

- Israel

- Turkey

- Qatar

- South Africa

- Rest of the Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

Recent Developments:

- In May 2023, Google has launched Geospatial Creator, which empowers individuals to swiftly create, visualize, and share immersive and augmented reality (AR) content using Unity and Adobe Aero..

- In February 2023, Maxar Technologies has received an extension to its contract with the U.S. Army to continue delivering 3D geospatial data for the development of immersive digital environments.

- In July 2022, TomTom collaborated with the Dutch Ministry of Infrastructure and Water Management and five other partners to offer Dutch drivers better and more thorough safety alerts of traffic services.

- In June 2022, Hexagon AB announced the next generation Leica BLK360, providing speed and efficiency and substantially improving reality capturing. Users can travel rapidly and uninterrupted around any environment while viewing and sharing the data as it is being captured, giving them access to real-time updates.

- In February 2021, Trimble and Esri announced a collaboration by integrating the Esri Geospatial Cloud platform into Trimble’s Connected Forest solutions used by both forest owners and product companies. The integration added location intelligence technology designed to transform workflows and provide greater visibility, traceability, and efficiency for the forest industry.

- In June 2020, Maxar Technologies launched the Multi-Domain Analytics System for the US Department of Homeland Security.

Frequently Asked Questions (FAQ):

What is the market size of geospatial analytics?

How big is the geospatial analytics market?

What is growth rate of the geospatial analytics market?

Who are the players in geospatial analytics market?

Who will be the leading hub for geospatial analytics market?

What is geospatial analytics?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The research methodology for the global geospatial analytics market report involved the use of extensive secondary sources and directories, as well as various reputed open-source databases, to identify and collect information useful for this technical and market-oriented study. In-depth interviews were conducted with various primary respondents, including key opinion leaders, subject matter experts, high-level executives of multiple companies offering geospatial analytics offerings, and industry consultants to obtain and verify critical qualitative and quantitative information and assess the market prospects and industry trends.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports; press releases and investor presentations of companies; and white papers, certified publications, and articles from recognized associations and government publishing sources.

The secondary research was used to obtain key information about the industry’s value chain, the market’s monetary chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from the supply and demand sides of the geospatial analytics market ecosystem were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors providing Geospatial analytics offerings; associated service providers; and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

After the complete market engineering (including calculations for market statistics, market breakup, market size estimations, market forecast, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also undertaken to identify and validate the segmentation types; industry trends; key players; the market's competitive landscape, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecast for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to record the critical information/insights throughout the report.

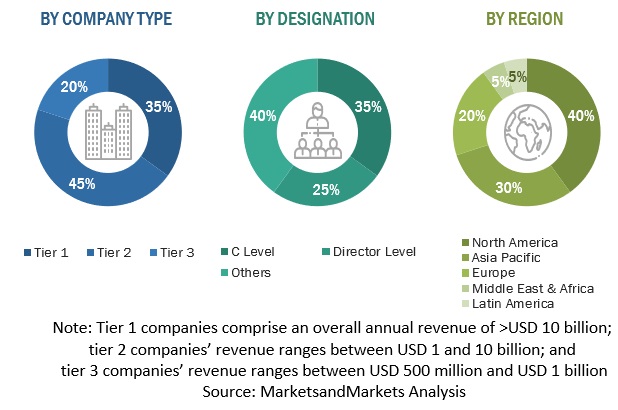

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For making market estimates and forecasting the geospatial analytics market and the other dependent submarkets, top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global geospatial analytics market, using the revenue from the key companies and their offerings in the market. With data triangulation and validation through primary interviews, this study determined and confirmed the exact value of the overall parent market size. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments.

The top-down approach prepared an exhaustive list of all the vendors offering geospatial analytics. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor’s offerings were evaluated based on the breadth of solution and service offerings, cloud types, organization sizes, and verticals. The aggregate of all the companies' revenues was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets repository for validation.

In the bottom-up approach, the adoption rate of geospatial analytics solutions and services among different end-users in key countries with respect to their regions contributing the most to the market share was identified. For cross-validation, the adoption of geospatial analytics solutions and services among industries, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

All the possible parameters that affect the market covered in the research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

- The pricing trend is assumed to vary over time.

- All the forecasts are made with the standard assumption that the accepted currency is USD.

- For the conversion of various currencies to USD, average historical exchange rates are used according to the year specified. For all the historical and current exchange rates required for calculations and currency conversions, the US Internal Revenue Service’s website is used.

- All the forecasts are made under the standard assumption that the globally accepted currency, USD, remains constant during the next five years.

- Vendor-side analysis: The market size estimates of associated solutions and services are factored in from the vendor side by assuming an average of licensing and subscription-based models of leading and innovative vendors.

- Demand/end-user analysis: End users operating in verticals across regions are analyzed in terms of market spending on Geospatial analytics solutions based on some of the key use cases. These factors for the Geospatial analytics tool industry per region are separately analyzed, and the average spending was extrapolated with an approximation based on assumed weightage. This factor is derived by averaging various market influencers, including recent developments, regulations, mergers and acquisitions, enterprise/SME adoption, startup ecosystem, IT spending, technology propensity and maturity, use cases, and the estimated number of organizations per region.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

According to IBM, geospatial analytics is used to add timing and location to traditional data types and build data visualizations. These visualizations can include maps, graphs, statistics, and cartograms that show historical changes and current shifts.

Key Stakeholders

- Investors and venture capitalists

- Geospatial analytics companies

- Technology services providers

- Government and research organizations

- Association and industry bodies

- Cloud services providers

- Technology consultants

- Value-added resellers

- Satellite service providers

- Market research and consulting firms

- Internet of Things (IoT) analytics vendors

- Analytics solution providers

- Independent software vendors (ISVs)

Report Objectives

- To determine and forecast the global geospatial analytics market by offering (solutions and services), technology, vertical, and region from 2023 to 2028, and analyze the various macroeconomic and microeconomic factors affecting the market growth

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and Latin America

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the geospatial analytics market

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To profile the key market players; provide a comparative analysis on the basis of business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the competitive landscape of the market

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and research & development (R&D) activities, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American market for Geospatial analytics

- Further breakup of the European market for Geospatial analytics

- Further breakup of the Asia Pacific market for Geospatial analytics

- Further breakup of the Latin American market for Geospatial analytics

- Further breakup of the Middle East & Africa market for Geospatial analytics

Company Information

-

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Geospatial Analytics Market

At MarketsandMarkets, the report helps to cater to specific requirements like any deep dive information, pricing models, country specific data, vendor specific analysis etc. Geospatial Analytics Report provides a breakdown of the market by technology and an explanation of the difference between the two Technology (in Geospatial Analytics) and collection medium (in Geospatial Imagery Analytics). Geospatial Analytics report also provides a qualitative overview of tools deployed in various collection mediums such as remote sensing using LIDAR, RADAR, GPS, GIS, and other mapping technologies.