Gunshot Detection Systems Market by Installation (Fixed Installation, Vehicle Mounted, Soldier Mounted System), Solution (System, Subscription-based Gunshot Detection Services), Application, End User, and Region - Global Forecast to 2027

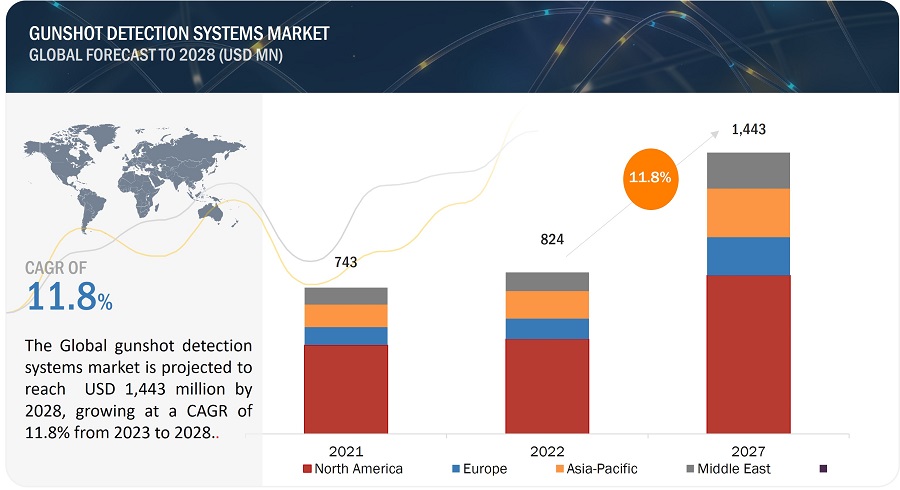

[186 Pages Report] The Gunshot Detection Systems Market is projected to grow from USD 824 million in 2022 to USD 1,443 million by 2027, at a CAGR of 11.8% from 2022 to 2027. A gunshot detection system is a combination of sensors that detect/locate gunshot firing in an area. Acoustic system-based gunshot detection systems use sensor networks deployed in the surveillance area. Sensors can differentiate other acoustic interferences in the environment by using acoustic pattern analysis. Another technology substituting gunshot detection are electro-optic detection, which uses thermal imaging to track the location of enemy snipers. Gunshot detection systems are being increasingly adopted by various countries. The US is the fastest-growing market for gunshot detection systems. Growth in gun ownership in the US and illegal arms sales have contributed to the threat of gunfire-related incidents. The rise in deaths or homicide incidents due to the use of guns is a major concern.

Gunshot Detection Systems Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Gunshot Detection Systems Market Dynamics

Driver: Need to track shooters and protect defense establishments effectively

Gunshot incidents are more frequent in contested environments wherein the defense forces need to track down the origin of a gunshot and apprehend the culprit or strategize an appropriate response. Gunshot detection systems are vital in determining the origin of gunfire and preparing soldiers for a counterattack. Several defense agencies worldwide have integrated such systems into their platoons to minimize the risk of casualty to the deployed troops. For instance, the US Army has purchased wearable sniper detector systems from QinetiQ Group plc (UK) for its troops stationed in Iraq and Afghanistan. These systems identify the distance and direction of shots fired within a tenth of a second. The US Army plans to integrate gunshot detection technology with its Land Warrior and Nett Warrior systems for future applications. These systems have network-situational-awareness capabilities, including a helmet-mounted display screen that uses the Global Positioning System (GPS) digital mapping display technology designed to provide enhanced tactical awareness to dismounted soldiers.

The increasing demand for such systems has also encouraged manufacturers to design several gunshot detection technologies whose capabilities and functioning parameters can be modified as per the engagement scenario. For instance, Raytheon Technologies Corporation’s (US) Boomerang uses a fixed array of microphones mounted on a High Mobility Multipurpose Wheeled Vehicle (HMMWV) to locate the position of the shooter. The Boomerang automatically provides an immediate indication of hostile fire or sniper attack and localizes the shooter’s position, allowing for a rapid, informed, and coordinated response. Another system prominently used in the European region is Pilar by the ACOEM Group (France). This system can be vehicle-mounted for sniper localization.

Restraint: High installation cost

Gunshot detection systems are widely used in homeland security applications. These systems require the installation of several spatially distributed sensors over a large area and are, thus, expensive. Maintaining these systems is an additional expense. The average installation cost varies between USD 0.2 million and USD 0.4 million for a 3-square mile area in a subscription period of 3 years (ShotSpotter Inc.). Maintenance and replacement of faulty sensors may increase the life-cycle cost of these systems, which leads to an increase in the tax rates for citizens. The high cost associated with the installation and maintenance of gunshot detection systems is one of the restraining factors for the market.

Opportunity: Focus of law enforcement agencies to suppress gun-related crimes

With digital technologies becoming more prevalent, law enforcement agencies are increasingly looking to external experts to help them with digital transformation. They are partnering with external managed service providers to upgrade existing systems and increase the coverage currently provided by gunshot detection technologies. According to a Forbes report published in 2018, the smart cities market has the potential to grow to USD 1.5 trillion by 2025. Futuristic smart cities are expected to employ high-end technologies to enhance security. Gunshot detection is one of the technologies playing an important role in improving civilian security services. It is being adopted by various cities across US, including Fresno, California, and Peoria, Illinois. In December 2020, ShotSpotter Inc. (US) announced new contracts with seven US cities, all with populations less than 50,000, to deploy its flagship gunshot detection solution called ShotSpotter Respond as part of an increasing trend of small cities adopting big city tools for preventing and reducing gun violence.

These systems provide law enforcement agencies and security firms with forensic evidence for investigations of gunshot events. Gunshot detectors use digital microphones installed on buildings and streets that record evidence of gunshots, provide near instantaneous notification, triangulate the location of shooters and the direction of a shot, detect the type of gun, and ultimately aid in catching fleeing suspects and solving crimes.

Challenge: High rate of false alarms

[187 Pages Report] Gunshot detection systems sense specific characteristics of ammunition leaving the gun chamber. The sensing modalities of such systems include both sound and visual elements. Thus, loud sounds, including fireworks, power tools, and helicopters, can all trigger the system, causing false alarms. Numerous false triggers have raised serious reliability concerns over the installed base of gunshot detection systems. In August 2021, a critical report issued by the City of Chicago’s Inspector General (IG) highlighted four major problems caused due to gunshot detection systems by ShotStopper. It stated that the false alarms result in 60 or more trips for law enforcement agencies into communities for no reason and on high alert, expecting to potentially confront a dangerous situation.

The methodology used by ShotSpotter to provide evidence against defendants in criminal cases is not transparent. It has not been peer-reviewed or otherwise independently evaluated. These sensors automatically send audio files to human analysts when those sensors detect gunshot-like sounds. These analysts then decide whether the sounds are gunshots or other loud noises such as firecrackers, car backfires, or construction noises. They also triangulate the timing of when sounds reach different microphones to establish a location for the noise. If it is believed to be the sound of a gunshot, they try to figure out how many shots were fired and what kind of gun is involved (such as a pistol versus a fully automatic weapon).

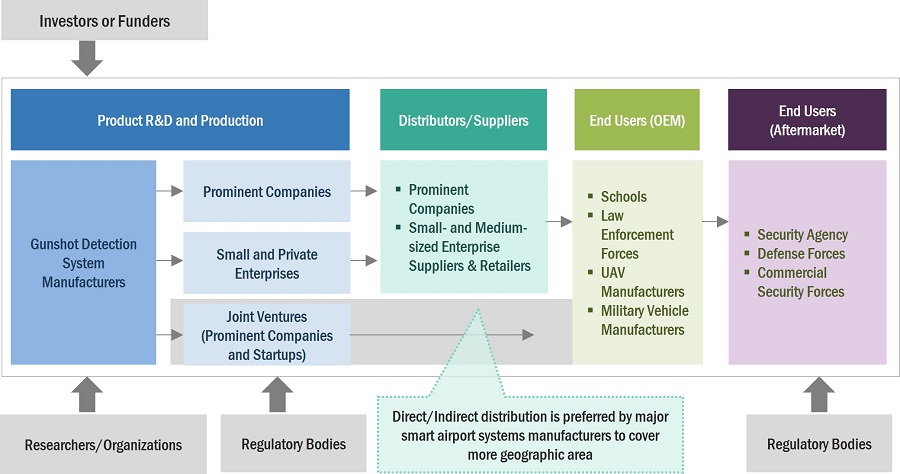

Gunshot Detection Systems Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of gunshot detection systems. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies include SoundThinking Inc. (Previously ShotStopper Inc.,) (US) and Shooter Detection Systems LLC (US), Raytheon Technologies Corporation (US), QinetiQ Group (US), ACOEM Group (France), Thales Group (France), and Elta Systems Ltd. (Israel), among others.

Fixed Installation segment to have second largest market share during the forecast period

Based on Installation, the Gunshot Detection Systems market has been segmented into fixed installation, vehicle installation and soldier mounted. The fixed installation segment is expected to increase significantly in the upcoming years. The increase in segment remuneration can be attributed to improvements in the safety systems of present school, university, and military infrastructures. Fixed gunshot detection systems track a gunshot occurrence using acoustic sensor node technology. These systems are put on walls, poles, or border crossings for military purposes.

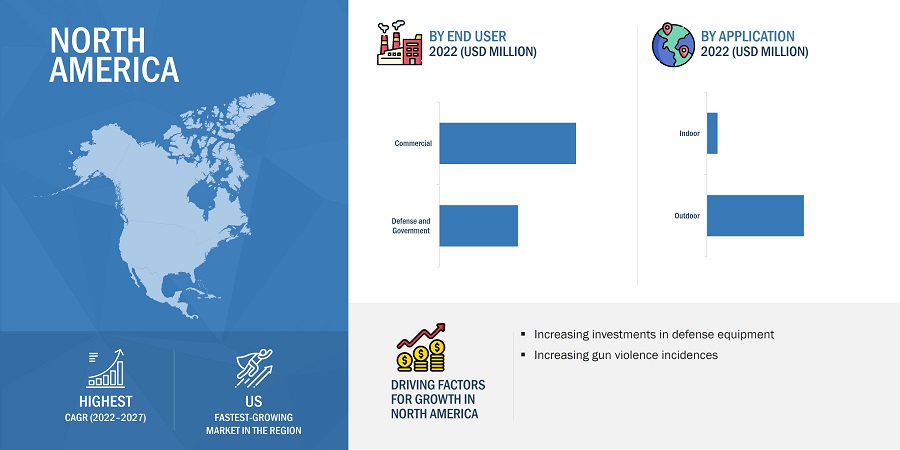

Defense and Government segment to lead the market for Gunshot Detection Systems during the forecast period

Based on End User, the Gunshot Detection Systems market has been segmented into Commercial, Defense and Government Segment. Gunshot detection systems in the defense and government sector are either platform-mounted or fixed installations deployed at defense and government establishments. An increase in open fire incidents and a rise in criminal activities have led to increased spending by government authorities of various countries to install gunshot detection systems. Additionally, the US government is installing gunshot detection systems in government offices and buildings to enhance safety.

System segment to witness higher demand during the forecast period

Based on Solution, the Gunshot Detection Systems market has been classified into System and Subscription based gunshot detection services. The system comprises all of the hardware needed to detect gunshots using sensors. Acoustic sensors and display systems, among others, are employed in gunshot detection systems. Increasing gunfire incidents across the globe are leading to the increased demand for the gunshot detection system.

Outdoor segment to acquire the largest market share during the forecast period

Based on Application, the Gunshot Detection Systems market has been classified into Indoor and outdoor segment. These systems are also used at international crossings, as well as on armoured vehicles and air platforms like UAVs and helicopter gunships. The outdoor category is expected to be the largest in 2022 and to maintain its dominance throughout the forecast period. The increased value is due to the greater coverage area and improved precision. The cross-border conflicts are the primary factor for the utilization of gunshot detection systems for outdoor applications.

Nort America is projected to witness the highest market share during the forecast period

North Ameica leads the Gunshot Detection Systems market. Because of the high rates of shooting or gunshots near schools, colleges, and universities, as educational facilities within the area, North America dominates the Gunshot Detection Systems market. The rising rate of gun violence, combined with the growing need for sophisticated gunshot detection systems, will drive market growth in the next years. The United States has seen a rise in gun crime in recent years, prompting law enforcement to deploy gunshot detection devices.

Gunshot Detection Systems Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Major players operating in the Gunshot Detection Systems market include Shot spotter, Inc., (US) and Shooter Detection Systems LLC (US), Raytheon Technologies Corporation (US), QinetiQ Group (US), ACOEM Group (France), THALES (France), and Elta Systems Ltd. (Israel), and among others.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2018-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

By Installation, By End User, By Solution, By Application, By Region |

|

Geographies Covered |

North America, Asia Pacific, Europe, Middle East, Rest of the World |

|

Companies Covered |

Shot spotter, Inc., (US) Shooter Detection Systems LLC (US), Raytheon Technologies Corporation (US), QinetiQ Group (US), Acoem Group (France), THALES (France), Databuoy Corporation (US), and Elta Systems Ltd. (Israel), among others. |

Gunshot Detection Systems Market Highlights

This research report categorizes the Gunshot detection system Market based on Component, Type, End User, Platform, Application and Region.

|

Aspect |

Details |

|

By Application |

|

|

By Solution |

|

|

By End User |

|

|

By Installation |

|

|

By Region |

|

Recent Developments

- In September 2022, 3xLOGIC, Inc., a supplier of integrated, intelligent security systems, introduced a new variety of deployment choices for users seeking to secure smaller areas in active shooter scenarios with the new Single Sensor Gunshot Detection solution. The 3xLOGIC 8-sensor device is intended for bigger places, such as a gymnasium, cafeteria, library, or pole installed outside to cover wider regions.

- In December 2021, Shooter Detection System, LLC signed the partnership agreement with Siemens Smart Infrastructure (US). The coupling of the Guardian Indoor Active Shooter Detection System and Surveillance Video system software will allow organizations to automatically alert building security by activating alarms, correlate live video feeds with real-time monitoring of recognized shots on building floor plans, and take other automated steps when gunfire is detected within a building.

- In September 2021, Shooter Detection System, LLC signed the partnership agreement with Genesys Inc. (US). The partnership will provide multi-channel active shooter warnings and enhanced critical event management.

- In June 2021, Shooter Detection System, LLC signed the partnership agreement with Singlewire Software, LLC (US). The companies have incorporated technology to improve public safety in the case of an active shooter. In response to a shooting in a building, companies employing both systems will be able to instantly disseminate emergency notifications to people in danger via several channels at the same time, including audio broadcast systems, digital signs, desktop alerts, mobile devices, and email.

- In April 2021, Shooter Detection System, LLC signed the partnership agreement with VS Energy, Inc. for the integration of the Guardian Indoor Active Shooter Detection System with the Lightway. The technological integration combines quick, precise gunshot detection with an overhead lighting system that illuminates the path to safety for building occupants and directs first responders to the danger area.

Frequently Asked Questions (FAQs) Addressed by the Report

What are your views on the growth prospect of the Gunshot Detection Systems market?

The Gunshot Detection Systems market is being driven by the installation on the advanced Gunshot Detection Systems in the schools, colleges, theater, public areas to enhance the public safety. The Systems helps in sharing real-time information that increases the possibility of saving lives in the event of a shooting incident. Other establishments, such as banks and financial organizations, also have a significant demand for these systems, as do high-security prisons and defence installations. Additionally the growth of the market has been pushed by the rising need for advancement in border surveillance systems and perimeter security.

What are the key sustainability strategies adopted by leading players operating in the Gunshot Detection Systems market?

Key players have adopted various organic and inorganic strategies to strengthen their position in the Gunshot Detection Systems market. The major players include Shot spotter, Inc., (US) and Shooter Detection Systems LLC (US), Raytheon Technologies Corporation (US), QinetiQ Group (US), ACOEM Group (France), THALES (France), and Elta Systems Ltd. (Israel), and among others. These players have adopted various strategies, such as acquisitions, contracts, expansions, new product launches, and partnerships & agreements, to expand their presence in the market.

What are the new emerging technologies and use cases disrupting the Gunshot Detection Systems market?

Some of the major emerging technologies and use cases disrupting the market include the Utilization of Optical Detection Systems, Infrared Cameras, Laser Range Finders, and GPS with Gunshot Detection Systems.

Who are the key players and innovators in the ecosystem of the Gunshot Detection Systems market?

The key players in the Gunshot Detection Systems market include Shot spotter, Inc. (US) and Shooter Detection Systems LLC (US), Raytheon Technologies Corporation (US), QinetiQ Group (US), ACOEM Group (France), THALES (France), and Elta Systems Ltd. (Israel).

Which region is expected to hold the highest market share in the Gunshot Detection Systems market?

The Gunshot Detection Systems market in North America is projected to hold the highest market share during the forecast period due open fire arm incidents occurring in the region and owing to the upgradation of security systems in existing infrastructure, such as universities, public banks, and corporate offices. More than 120 departments in US have installed gunfire detection systems on rooftops and light poles that use a web of wirelessly connected acoustic sensors to provide gunshot alerts.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

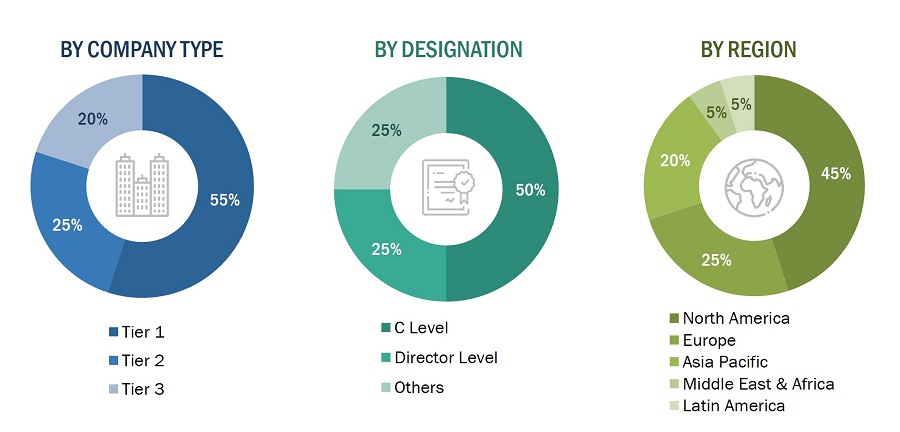

The study involved four major activities in estimating the current market size for the Gunshot detection system market. Exhaustive secondary research was conducted to collect information on the market, the peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research:

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg, BusinessWeek, and different magazines, were referred to identify and collect information for this study. Secondary sources also included annual reports, press releases & investor presentations of companies, certified publications, articles by recognized authors, and simulator databases.

Primary Research

The Gunshot detection system market comprises several stakeholders, such as raw material providers, Gunshot detection system manufacturers and suppliers, and regulatory organizations in the supply chain. While the demand side of this market is characterized by various end users, the supply side is characterized by technological advancements in actuator technologies. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Gunshot detection system market. These methods were also used extensively to estimate the size of various subsegments of the market. The research methodology used to estimate the market size includes the following:

- Key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Market size estimation methodology: Bottom-up approach

The bottom-up approach was employed to arrive at the overall size of the gunshot detection systems market from the demand for such systems and components by end users in each country, and the average cost of integration for both brownfield and greenfield. These calculations led to the estimation of the overall market size.

Market size estimation methodology: Top-down approach

In the top-down approach, the overall market size was used to estimate the size of the individual markets (mentioned in market segmentation) through percentage splits obtained from secondary and primary research.

The most appropriate and immediate parent market size was used to calculate the specific market segments to implement the top-down approach. The bottom-up approach was also implemented to validate the market segment revenues obtained.

A market share was then estimated for each company to verify the revenue share used earlier in the bottom-up approach. With data triangulation procedures and data validation through primaries, the overall parent market size and each market size were determined and confirmed in this study. The data triangulation procedure used for this study is explained in the market breakdown and triangulation section.

Data Triangulation

After arriving at the overall market size—using the market size estimation process explained above—the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides of the Gunshot detection system market.

Market Definition-

A gunshot detection system is defined as an acoustic sensing system capable of identifying, discriminating, and reporting gunshots to the police within seconds of a shot being fired. In the commercial sector, gunshot detection systems are used for public safety and law enforcement, interior gunfire detection, and wildlife poaching. In the defense segment, a gunshot detection system identifies, isolates, and provides the location the gunshot is fired from. In this segment, gunshot detection systems are typically platforms installed on armored vehicles and military drones. Individual systems are also provided to soldiers to identify and track a gunshot location. According to law enforcement authorities, acoustic gunshot detection devices are frequently installed in high- crime areas. Gunshot detection systems are being widely incorporated in the public & defense sector as well as in public safety and law enforcement, interior gunfire detection, and wildlife poaching.

Key Stakeholders:

- Gunshot detection system equipment manufacturer

- Original Equipment Manufacturer (OEM)

- Software Solution Provider

- Component Supplier

- Infrastructure Security Service Provider

- Military Vehicle Manufacturers and Retrofitters

Report Objectives

- To identify and analyze key drivers, restraints, challenges, and opportunities influencing the growth of the Gunshot detection system market

- To analyze the impact of macro and micro indicators on the market

- To forecast the market size of segments for five regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, along with major countries in each of these regions

- To strategically analyze micro markets with respect to individual technological trends, prospects, and their contribution to the overall market

- To strategically profile key market players and comprehensively analyze their market ranking and core competencies

- To provide a detailed competitive landscape of the market, along with an analysis of business and corporate strategies, such as contracts, agreements, partnerships, and expansions.

- To identify detailed financial positions, key products, unique selling points, and key developments of leading companies in the market

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 2)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Gunshot Detection Systems Market

We are considering to invest in a new company that developed a gunshot detection solution. I would like to review the brochure first.