Healthcare Analytics Market by Type (Descriptive, Predictive, Cognitive), Application (Financial, RCM, Fraud, Clinical, Operational), Component (Services, Software), Deployment (On-Premise, Cloud), End User (Hospitals, Payer) & Region - Global Forecast to 2027

The global healthcare analytics market in terms of revenue was estimated to be worth $21.1 billion in 2021 and is poised to reach $27.4 billion in 2022 and $85.9 billion by 2027, growing at a CAGR of 25.7% from 2022 to 2027. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The updated version of the report covers the historical market for healthcare analytics for the years 2020, 2021, and 2022, the forecast until 2027, and the CAGR from 2022 to 2027. Growth of the market is primarily driven by factors such as increased adoption of healthcare analytics solutions and services, the growing importance of analytics in healthcare, and increased use of technologically advanced tools. However, operational gaps between payers and providers, concerns regarding inaccurate and inconsistent data, and hesitancy to adopt healthcare analytics solutions in emerging countries are challenging the growth of this market.

To know about the assumptions considered for the study, Request for Free Sample Report

Healthcare Analytics Market Dynamics

Driver: EHR adoption is increasing in both developing and developed countries.

The increasing adoption of Electronic Health Records (EHR) is a major driver of the healthcare analytics industry. EHR adoption has been steadily increasing in both developing and developed countries, as healthcare providers and organizations seek to leverage the data contained within to improve patient care and reduce costs. The ability of EHRs to store and manage large volumes of data and provide access to a variety of stakeholders has made them invaluable tools for healthcare providers. With EHR adoption increasing, the amount of data available for analysis is growing exponentially, creating a need for analytics solutions to make sense of this data. This is driving the growth of the healthcare analytics industry, as providers and organizations seek to leverage healthcare analytics to gain insights into care quality, efficiency, and cost.

Opportunity: Use of analytics in precision and personalised medicines

The use of analytics in precision and personalised medicine is creating a huge market opportunity for healthcare analytics. Precision medicine is an emerging field of medicine which focuses on the individual patient, taking into account their personal characteristics such as genetics, lifestyle, environment, and history. By doing so, precision medicine is able to tailor treatments to individual patients and provide them with more effective and safer treatments. This leads to improved outcomes for patients, and cost savings for healthcare providers. Healthcare analytics is being used to understand the individual patient’s data in order to inform precision and personalised medicine. By leveraging the massive amounts of data collected from medical records, EMRs, and other sources, healthcare analytics can provide insights into patient populations, identify patterns and trends, and help inform precision and personalised medicine decisions. This not only provides more effective and safer treatments for patients, but can also reduce costs for healthcare providers. With the growing demand for precision and personalised medicine, the market opportunity for healthcare analytics is only expected to increase.

Restraint: high price of analytics solutions

Healthcare analytics solutions can be expensive, and the high cost of implementation and maintenance can be a significant barrier for many organizations. Moreover, the lack of technical expertise within healthcare organizations can also make it difficult to purchase and deploy these solutions, as they require specialized skills and knowledge to be used properly. This can limit the adoption of healthcare analytics solutions, and can be a major restraint on the growth of the market.

Challenge: Concerns regarding inaccurate and inconsistent data

The healthcare analytics market is faced with the challenge of inaccurate and inconsistent data. This is a major problem, as inaccurate or inconsistent data can lead to inaccurate or misleading insights and decisions. To address this challenge, healthcare organizations should ensure that their data is accurate, consistent, and up-to-date. This can be done by implementing data quality checks, regular data audits, and data cleansing processes. Additionally, healthcare organizations should also invest in data governance solutions, such as data mapping and data standardization, to ensure accurate and consistent data across the organization.

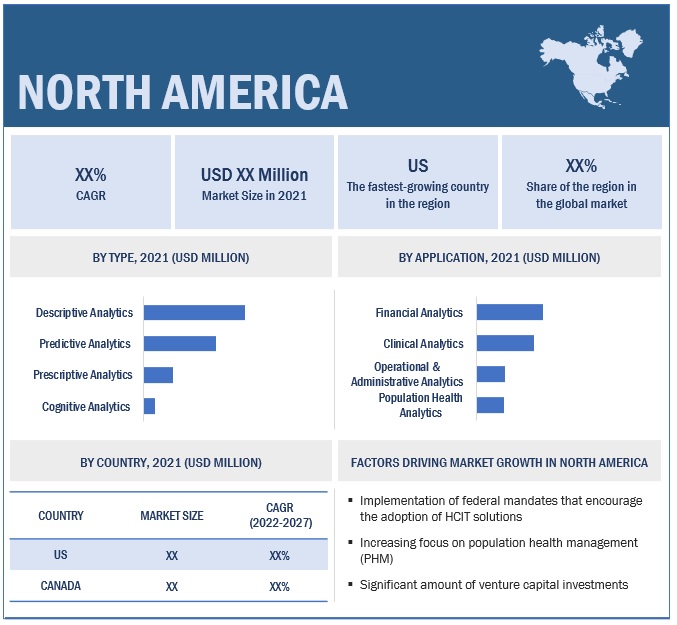

The descriptive analytics segment holds the largest share of the healthcare analytics industry, by type.

Based on type, the healthcare analytics market is segmented into cognitive analytics, descriptive analytics, predictive analytics, and prescriptive analytics. The descriptive analytics segment holds the largest share of the global market. The large share of this segment is primarily attributed to the fact that descriptive analytics support healthcare payers and providers in improving their business practices.

The financial analytics segment is expected to account for the largest share of the healthcare analytics industry by application.

Based on application, the healthcare analytics market is segmented into financial analytics, clinical analytics, operational and administrative analytics, and population health analytics. The financial analytics segment is expected to hold the largest share of the market. The high growth of this segment is attributed to the requirement to improve patient outcomes and reduce hospital readmission rates and the growing focus on personalised medicine-based analytics.

By component, the services segment will hold the largest share of the healthcare analytics industry.

Based on component, the healthcare analytics market is segmented into services, hardware, and software. The services sector held the largest market share. The high growth of this segment is attributed to the frequent need for services such as software upgrades and maintenance.

By deployment model, the on-premise segment is expected to hold the largest share of the healthcare analytics industry.

Based on the deployment model, the healthcare analytics market is segmented into on-premise and on-demand. The on-premises segment is estimated to account for the largest share of the global market. The large share of this segment is primarily attributable to the fact that on-premises deployment permits end users to make use of solutions from multiple vendors, which allows customizations as per end-user needs.

Payers' segment is expected to hold the largest share of the healthcare analytics industry by end user.

On the basis of end users, the healthcare analytics market is segmented into providers (hospitals, physician practices, IDNs, post-acute care organizations, and ambulatory settings), payers (private insurance companies, government agencies, employers, and private exchangers), and ASCOs, HIEs, and TPAs. The payer segment is expected to hold the largest share of the global market. Factors such as improving provider networks and reducing operational costs are the key factors driving the growth of this segment.

North America dominated the healthcare analytics industry.

North America dominated the healthcare analytics market, followed by Europe and the Asia Pacific. Factors such as the rising adoption of personalised medicine and value-based medicine and greater accessibility of analytics solutions and services are driving the growth of this market.

To know about the assumptions considered for the study, download the pdf brochure

Prominent players in the healthcare analytics market include IBM (US), SAS Institute Inc. (US), Optum, Inc. (US), Cerner Corporation (US), Allscripts Healthcare, LLC (US), Cotiviti, Inc. (US), CitiusTech Inc (US), Health Catalyst (US), CVS Health (US), Inovalon (US), McKesson Corporation (US), MedeAnalytics, Inc. (US), Oracle (US), ExlService Holdings, Inc. (US), Gainwell (US), Wipro (US), Flatiron (US), Apixio (US), Enlitic, Inc. (US), Komodo Health, Inc. (US), HealthEC, LLC, Sema4 OpCo, Inc. (US), Evidation Health, Inc. (US), Insilico Medicine (US), Exscientia (UK), Aetion, Inc.(US), and Premier (US).

Scope of the Healthcare Analytics Industry

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$27.4 billion |

|

Projected Revenue by 2027 |

$85.9 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 25.7% |

|

Market Driver |

EHR adoption is increasing in both developing and developed countries |

|

Market Opportunity |

Use of analytics in precision and personalised medicines |

This research report categorizes the healthcare analytics market to forecast revenue and analyze trends in each of the following submarkets:

By Type

- Descriptive Analytics

- Predictive Analytics

- Prescriptive Analytics

- Cognitive Analytics

By Application

- Clinical Analytics

- Financial Analytics

- Operational & Administrative Analytics

- Population Health Analytics

By Component

- Services

- Hardware

- Software

By Deployment Model

- On-premise

- On-demand

By End User

- Payers

- Providers

- ACOs, HIEs, MCOs and TPAs

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- RoE

-

Asia

- Japan

- China

- India

- RoAPAC

- Pacific Countries

- Latin America

- Middle East & Africa (MEA)

Healthcare Analytics Market Regional Forecast:

-

Japan and South Korea Healthcare Analytics Market is expected to grow at a CAGR of 25.7%

-

Europe Healthcare Analytics Market is expected to grow at a CAGR of 25.7%

-

USA Healthcare Analytics Market is expected to grow at a CAGR of 25.7%

Recent Developments of Healthcare Analytics Industry

- Accenture Acquires HealthTech Firm Intrigo Systems: In March 2021, Accenture announced that it had acquired Intrigo Systems, a healthcare technology firm based in New York City. Intrigo Systems offers a range of analytics solutions to healthcare organizations, including clinical data management, analytics and insights, population health, and decision support. This acquisition is expected to give Accenture a competitive edge in the healthcare analytics space.

- Microsoft Acquires Nuance Communications: In April 2021, Microsoft announced that it had acquired Nuance Communications, a leading provider of AI-powered healthcare solutions. The acquisition is expected to bolster Microsoft’s presence in the healthcare analytics space, enabling the company to offer an even wider range of solutions to healthcare providers and organizations.

- Cerner Acquires HealthTech Firm Explorys: In June 2021, Cerner Corporation announced that it had acquired Explorys, a healthtech firm that provides data-driven population health solutions. The acquisition is expected to give Cerner a strategic advantage in the healthcare analytics space, giving it the ability to offer a broader range of solutions to healthcare providers and organizations.

- IBM Acquires Truven Health Analytics: In July 2021, IBM announced that it had acquired Truven Health Analytics, a healthcare analytics company based in Chicago. The acquisition is expected to give IBM a strategic advantage in the healthcare analytics space, enabling the company to offer an even wider range of solutions to healthcare providers and organizations.

- Oracle Acquires HealthTech Firm MedeAnalytics: In August 2021, Oracle announced that it had acquired MedeAnalytics, a healthtech firm that provides cloud-based analytics solutions to healthcare organizations. This acquisition is expected to give Oracle a competitive edge in the healthcare analytics space, allowing the company to offer a wider range of solutions to healthcare providers and organizations.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global healthcare analytics market?

The global healthcare analytics market boasts a total revenue value of $85.9 billion by 2027.

What is the estimated growth rate (CAGR) of the global healthcare analytics market?

The global healthcare analytics market has an estimated compound annual growth rate (CAGR) of 25.7% and a revenue size in the region of $27.4 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

This study involved four major activities in estimating the size of the healthcare analytics market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

This research study involved the usage of widespread secondary sources, including directories, databases such as Bloomberg Business, Factiva, and the Wall Street Journal, white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. World Health Organization (WHO), Organization for Economic Cooperation and Development (OECD), World Analytics Association, Healthcare Data & Analytics Association (HDAA), Health Information and Management Systems Society (HIMSS), International Medical Informatics Association (IMIA), Centers for Medicare & Medicaid Services (CMS), National Association of Health Data Organizations (NAHDO), American Health Information Management Association (AHIMA), Association of Healthcare Data Analysts (AHDA), Association of Healthcare Data Analysts Fraud Annual reports, SEC filings, investor presentations, journals, publications from government sources and professional associations, expert interviews, and marketsandmarkets analysis are some of the resources available.

Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the healthcare analytics market. It was also used to obtain important information about key market players, market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives.

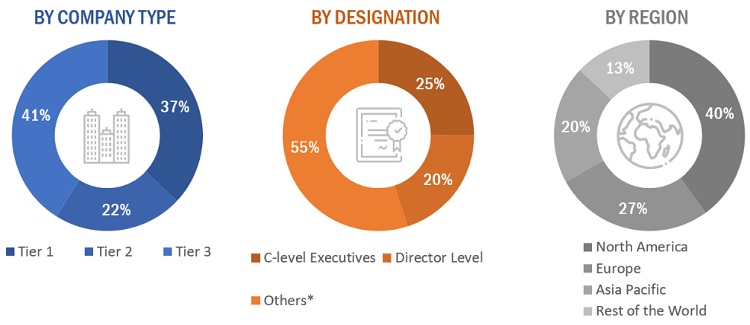

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report.

The primary sources from the supply side include CEOs, vice presidents, marketing and sales directors, business development managers, and technology and innovation directors of healthcare analytics companies. On the other hand, primary sources from the demand side include industry experts such as directors of hospitals, hospital purchase managers, insurance payers, physicians, and related key opinion leaders. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

Breakdown of Primary Interviews

Note 1: C-level executives include CEOs, COOs, CTOs, and VPs.

Note 2: Other primaries include sales managers, marketing managers, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. Tier 1 equals $1 billion in 2021, Tier 2 equals $500 million to $1 billion, and Tier 3 equals $500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the healthcare analytics market. These methods were also extensively used to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry's supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the market size, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The following figure shows the market validation, source structure, and data triangulation methodology implemented in this report's market engineering process.

Report Objectives

- To define, describe, and forecast the healthcare analytics market based on type, application, component, deployment model, end user, and region.

- To provide detailed information regarding the major factors influencing the growth of this market (such as drivers, restraints, opportunities, and challenges),

- to analyse the micromarkets with respect to individual growth trends, prospects, and contributions to the overall healthcare analytics market.

- to analyse the opportunities for stakeholders and provide details of the competitive landscape for market leaders.

- To forecast the size of the market segments with respect to the four main regions, namely, North America, Europe, Asia, Pacific countries, Latin America, and the Middle East and Africa

- To profile the key players and analyse their market shares and core competencies

- To track and analyse competitive developments such as product or service launches and approvals, partnerships, agreements, collaborations, joint ventures, expansions, and acquisitions in the overall healthcare analytics market

- to benchmark players within the market using the proprietary "Competitive Leadership Mapping" framework, which analyses market players on various parameters within the broad categories of business and product/service strategy.

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the healthcare analytics market

- Profiling of additional market players (up to 3)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Healthcare Analytics Market

Which major players have been included in the healthcare analytics market study?

Can you share the detailed information on technological advancements in the Healthcare Analytics Market?

In what way COVID19 is Impacting the global growth of the Healthcare Analytics Market?

Can you enlighten us about the key players operating in the global Healthcare Analytics Market?