Healthcare Interoperability Solutions Market by Type (Software (EHR, Lab System, Imaging, Health Information Exchange, Enterprises), and Services), Interoperability Level (Foundational, Structural, Semantic), End User, and Region - Global Forecast to 2027

Updated on : April 03, 2023

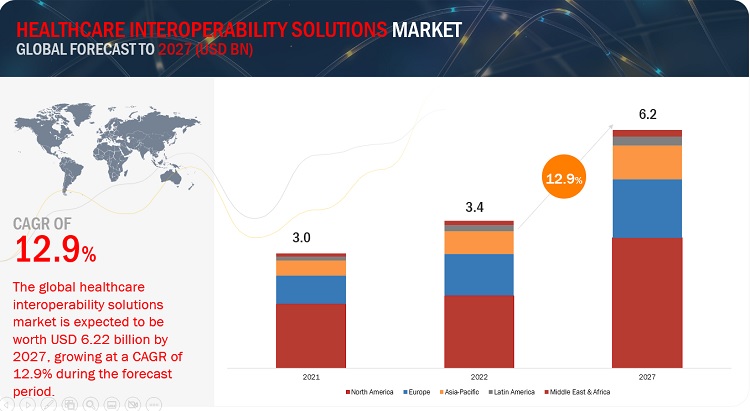

The global healthcare interoperability solutions market in terms of revenue was estimated to be worth $3.4 billion in 2022 and is poised to grow at a CAGR of 12.9% from 2022 to 2027.

The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. Growth in this market is driven by the government funding to increase adption of healthcare interoperability solutions, and the emergence of new technologies. However, increasing complexity due to lack of consistent data is challenging towards growth of the market to a certain extent during the forecast period.

Global Healthcare Interoperability Solutions Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Healthcare interoperability solutions Market Dynamics

Drivers: Emergence of new medical technologies

Technological advances over the last several decades have been on the rise. However, the cost of some of these technological advances is what is partially responsible for the overall increase in healthcare costs. In fact, new medical technologies are responsible for 40–50% of annual cost increases. Healthcare interoperability has several potential benefits. Well-communicating systems can improve operational efficiency, thereby reducing the time spent on administrative tasks such as manually entering data received from faxes. Interoperability can also reduce duplicate clinical interventions such as imaging studies or lab orders, thus decreasing waste and overall costs and also improving patient safety by reducing exposure to radiation or invasive procedures. Finally, interoperability may also improve clinical care by facilitating improved access to relevant and longitudinal clinical data at the point of care. FHIR, or Fast Healthcare Interoperability Resources, is an open-source standards framework for healthcare data that draws on HL7, a previous standards framework. FHIR was developed to facilitate the transfer of healthcare data from one system to another.

Restraints: Lack of accurate interoperability solutions across healthcare supply chain

The lack of accurate interoperability between healthcare providers, systems, technology, and information is a challenge across the healthcare supply chain. Diverse vendors, processes, and standards all obstruct the delivery of optimal patient results. Increasing healthcare expenditures, increased patient expectations, and a movement to value-based care requires providers to improve healthcare interoperability. The lack of true interoperability among electronic systems is a major concern. While many hospitals are able to use their current EHRs for some information exchange activities that promote interoperability (such as finding, sending, or receiving information), only 23% of hospitals can perform all four information exchange activities (find, send, receive, and use).

Opportunities: Advancements in software technology for real-time data exchange

The capacity of different solutions to freely and readily communicate with one another is referred to as software interoperability. Interoperable systems exchange data in real time without the need for specialized IT assistance or behind-the-scenes code. It might be as simple as a customer relationship management (CRM) system that integrates deeply with automation software to generate a data flow between sales and marketing. Alternatively, the team may set up a whole tech stack comprised of interconnected apps that communicate data to stramline procedures. The purpose of software interoperability is to eliminate data silos. This is getting increasingly crucial as the number of platforms and applications used. Some of the trends in market are HL-7 FHIR, Big data, Deep interoperability, EHR integration.

Challenges: Increasing complexity due to lack of consistent data

The healthcare IT landscape has grown increasingly vast and complex, with each department in a healthcare facility having its own IT system, from emergency services to imaging, laboratories, and patient wards. With the sheer volume of healthcare data that a hospital generates on a daily basis, healthcare facilities all around the world are under pressure to enhance efficiency and patient outcomes. The proliferation of technologically complex medical equipment, hidden pockets of unstructured data, and a lack of system compatibility limit their capacity to do more with the data they collect. Making disparate medical systems interoperable and wrangling patient record data from siloed hospital departments is important for several reasons—extracting data from hidden siloes takes valuable time away from the patient. There is also the chance that critical data could be missed. Devices and systems that can connect with each other and share data have the potential to enable a 360-degree view of the patient’s health, allowing clinicians to make faster and more responsive decisions, which is behind the drive to prioritize interoperability in hospital IT systems.

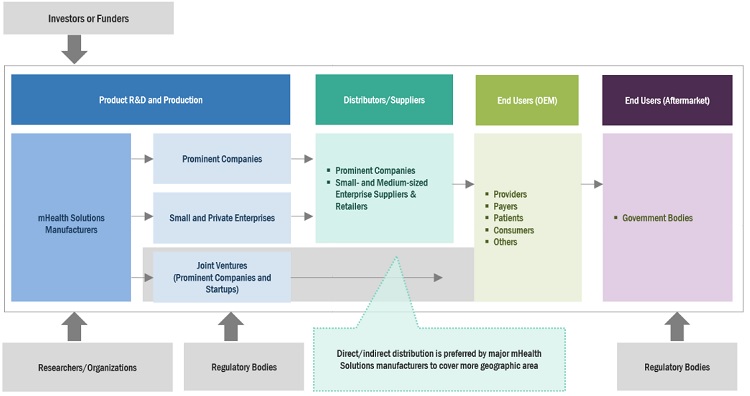

Healthcare Interoperability Solutions Market Ecosystem

Prominent companies in this market include well-established manufacturers and service providers of healthcare interoperability Solutions. These companies have been operating in the market for several years and possess a diversified product portfolio, organic & inorganic strategies, strong global sales and marketing networks. Prominent companies in this market include Oracle Health (US), Epic Systems Corporation (US), Infor, Inc. (US), InterSystems Corporation (US), Koninklijke Philips N.V. (Netherlands), Veradigm LLC (US), Cognizant (US), Change Healthcare (US), NextGen Healthcare, Inc. (US), Merative (US), Medical Information Technology, Inc. (US), and Lyniate (US).

Healthcare interoperability solutions Market Map

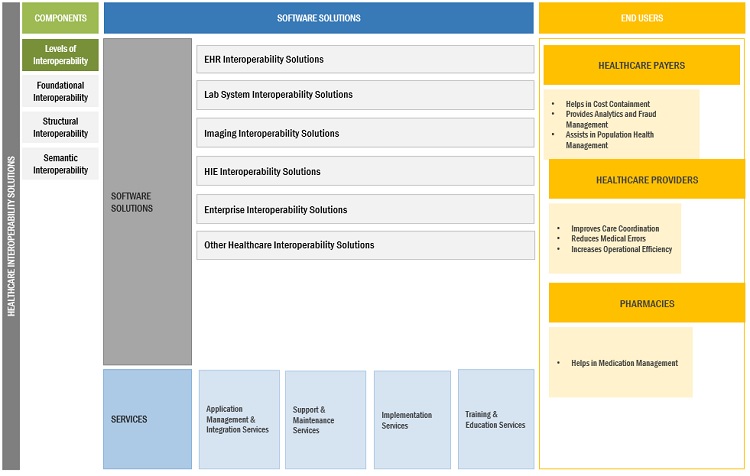

EHR interoperability solutions segment accounted for the largest share in the healthcare interoperability solutions market for software in 2021

On the basis of type, the EHR interoperability solutions segment accounted for the largest share in the market for software in 2021. The large share of the EHR interoperability solutions segment can be attributed to the large installed base of EHR solutions and the growing need to make these EHR systems interoperable to facilitate quick decision-making

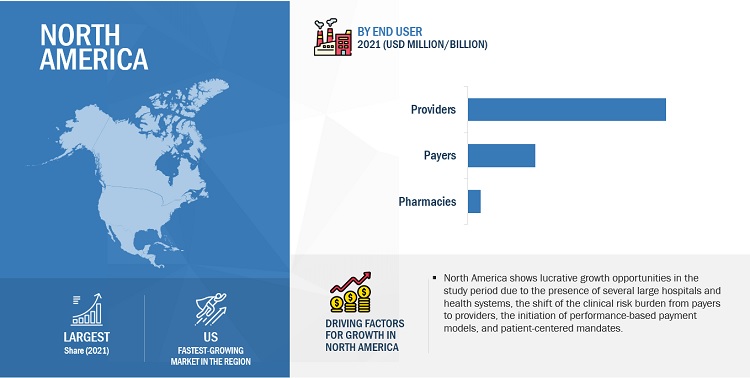

Healthcare providers is the largest end user segment in the healthcare interoperability solutions market in 2021

Based on end user, the healthcare providers segment is expected to register the highest CAGR during the forecast period. Factors responsible for the growth of this segment are increasing volume of patient data pertaining to increasing hospital enteries, shift towards quality-based care.

APAC region of healthcare interoperability solutions market to witness the highest growth rate during the forecast period.

The Asia Pacific market is projected to grow at the highest CAGR during the forecast period. Market growth in the APAC region is mainly driven by factors such as technological revolution in the region, growing penetration of smart gadgets, shift towards digitalization to ensure patient safety as well as streamline operationin healthcare enterprises, and various initiatives taken by developed countries in the region to unfold new policies and rework on the existing ones.

To know about the assumptions considered for the study, download the pdf brochure

The products and services market is dominated by a few globally established players such as Oracle Health (US), Epic Systems Corporation (US), Infor, Inc. (US), InterSystems Corporation (US), Koninklijke Philips N.V. (Netherlands), Veradigm LLC (US), Cognizant (US), Change Healthcare (US), NextGen Healthcare, Inc. (US), Merative (US), Medical Information Technology, Inc. (US), Lyniate (US), OSP Labs (US), Orion Health Group of Companies (New Zealand), Onyx Technology LLC (US). Some other players in the market include ViSolve (US), Jitterbit (US), iNTERFACEWARE Inc. (Canada), Virtusa Corp. (US), Consensus Cloud Solutions Inc. (US), MphRx (US), Wipro (India), eMids (US), Nalashaa (US), Deevita LLC (US).

- Oracle Health (US) https://www.cerner.com/

- Epic Systems Corporation (US) https://www.epic.com/

- Infor, Inc. (US) https://www.infor.com/

- InterSystems Corporation (US) https://www.intersystems.com/sa/

- Koninklijke Philips N.V. (Netherlands) https://www.philips.com/global

Healthcare Interoperability Solutions Market Report Scope:

|

Report Metric |

Details |

|

Market size available for years |

2020–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Million/Billion (USD) |

|

Segments covered |

Type, level of Interoperability, software solution, end user, healthcare providers and region. |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, and Middle East and Africa |

|

Companies covered |

Oracle Health (US), Epic Systems Corporation (US), Infor, Inc. (US), InterSystems Corporation (US), Koninklijke Philips N.V. (Netherlands), Veradigm LLC (US), Cognizant (US), Change Healthcare (US), NextGen Healthcare, Inc. (US), Merative (US), Medical Information Technology, Inc. (US), Lyniate (US), OSP Labs (US), Orion Health Group of Companies (New Zealand), Onyx Technology LLC (US). Some other players in the market include ViSolve (US), Jitterbit (US), iNTERFACEWARE Inc. (Canada), Virtusa Corp. (US), Consensus Cloud Solutions Inc. (US), MphRx (US), Wipro (India), eMids (US), Nalashaa (US), Deevita LLC (US). |

The study categorizes the healthcare interoperability solutions market based on product, type, technology, application, animal type, end user at regional and global level.

By Type

- Introduction

- Software Solutions

- Services

By Software Solutions

- Introduction

- EHR interoperability solutions

- Lab system interoperability solutions

- Imaging system interoperability solutions

- Healthcare information exchange interoperability solutions

- Enterprise interoperability solutions

- Other healthcare interoperability solutions.

By level of Interoperability

- Introduction

- Foundational Interoperability

- Structural Interoperability

- Semantic Interoperability

By End User

- Introduction

- Healthcare Providers

- Healthcare Payers

- Pharmacies

By Healthcare Providers

- Introduction

- Hospitals & Clinics

- Long-term Care centers

- Diagnostics & Imaging centers

- Other Healthcare Providers

By Region

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Netherlands

- Rest Of Europe

-

Asia Pacific

- Japan

- Australia

- Rest of APAC

- Latin America

- Middle East & Africa

Recent Developments

- In November 2022, Nextge Healthcare (US) acquired TSI Healthcare (US) to expand its presence in key specialties, including rheumatology, pulmonology, and cardiology.

- In October 2022, Lyniate (US) partnered with CyncHealth (US) to help healthcare providers and health networks, payers, and public health departments power more meaningful data exchange.

- In September 2022, Lyniate (US) partnered with BrightInsight (US) to improve Information Exchange for Regulated Digital Health Solutions Built on the BrightInsight Platform.

- In July 2022, Intersystem Corporation (US) partnered with Bedfordshire Hospitals NHS Foundation Trust to develop a new shared health and care record, which is being rolled out across Bedfordshire and Luton.

Frequently Asked Questions (FAQ):

What is the projected market value of the global healthcare interoperability solutions market?

The global market of healthcare interoperability solutions is projected to reach USD 6.2 billion.

What is the estimated growth rate (CAGR) of the global healthcare interoperability solutions market for the next five years?

The global healthcare interoperability solutions market in terms of revenue was estimated to be worth $3.4 billion in 2022 and is poised to grow at a CAGR of 12.9% from 2022 to 2027.

What are the major revenue pockets in the healthcare interoperability solutions market currently?

The Asia Pacific market is projected to grow at the highest CAGR during the forecast period. Market growth in the APAC region is mainly driven by factors such as technological revolution in the region, growing penetration of smart gadgets, shift towards digitalization to ensure patient safety as well as streamline operationin healthcare enterprises, and various initiatives taken by developed countries in the region to unfold new policies and rework on the existing ones.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

This research study involved the use of comprehensive secondary sources; directories and databases such as D&B, Bloomberg Business, and Factiva; and white papers, annual reports, and company house documents. Secondary research was used to identify and collect information for this extensive, technical, market-oriented, and commercial study of the global Healthcare interoperability solutions Market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, technology perspectives, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

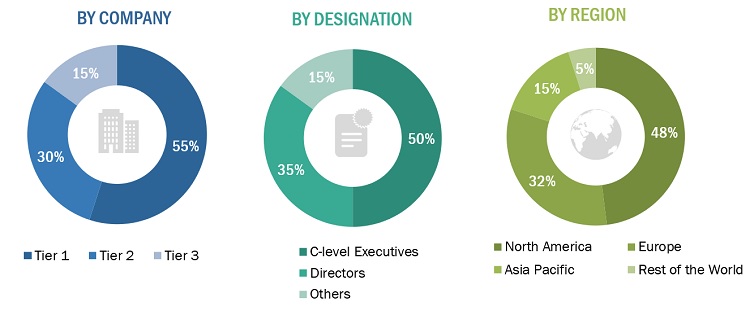

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the Healthcare interoperability solutions Market. The primary sources from the demand side include key personnel from hospitals, clinics, physicians’ offices, and healthcare providers and payers.

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, and product managers.

Note: Tiers are defined based on a company’s total revenue, as of 2020: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (segmental analysis of major segments) and top-down approach (assessment of utilization/adoption/penetration trends, by type, level of Interoperability, end user, and region).

Data Triangulation

After arriving at the market size, the total Healthcare interoperability solutions Market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments & subsegments, data triangulation, and market breakdown procedures were employed, wherever applicable.

Global HealthcareInteroperability Solutions Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Market Definition

Healthcare interoperability solutions allow the seamless exchange and interpretation of health-related data amongst healthcare companies and patients for clinical decision-making to offer proprietary control over health information. The market scope includes only interoperable solutions, whereas standalone solutions, such as EHR and HIE, are not included.

Key Stakeholders

- Healthcare IT Service Providers

- Healthcare Institutions/Providers (Hospitals, Medical Groups, Physician Practices, Diagnostic Centers, and Outpatient Clinics)

- Venture Capitalists

- Government Bodies

- Corporate Entities

- Accountable Care Organizations

- Academic Research Institutes

- Healthcare Payers

- Market Research and Consulting Firms

- Healthcare IT Vendors

Objectives of the Study

- To To define, describe, and forecast the healthcare interoperability solutions market by type, interoperability level, end user, and region

- To provide detailed information about the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments in North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile key players and comprehensively analyze their market shares and core competencies in the market

- To track and analyze competitive developments such as partnerships, agreements, and collaborations; mergers & acquisitions; product developments; and geographical expansions in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific Healthcare interoperability solutions Market into India, China, New Zealand and others

- Further breakdown of the Rest of Europe Healthcare interoperability solutions Market into the Spain, Belgium, Switzerland and others

- Further breakdown of the Latin America Healthcare interoperability solutions Market into Argentina, Colombia, Chile, and others

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Healthcare Interoperability Solutions Market