NLP in Healthcare & Life Sciences Market by Offering, NLP Type (Statistical, Neural), NLP Technique (Sentiment Analysis, Topic Modeling), Application (Clinical Trial Matching, Clinical Decision Support), End User and Region - Global Forecast to 2028

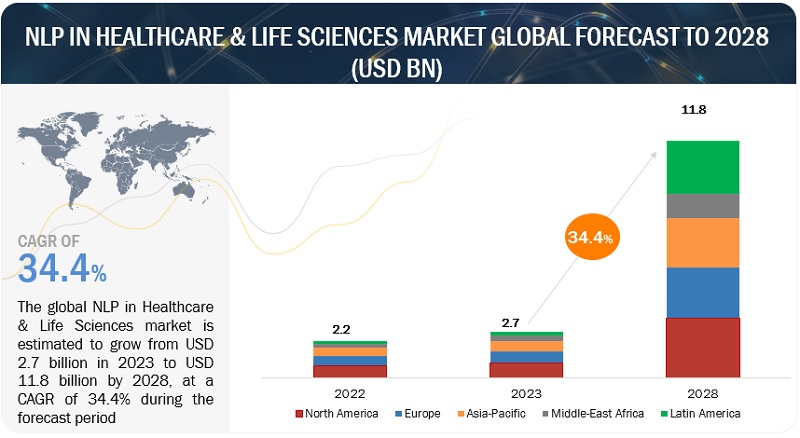

[360 Pages Report] The global NLP in Healthcare & Life sciences market is projected to grow from USD 2.7 billion in 2023 to USD 11.8 billion by 2028, at a CAGR of 34.4% during the forecast period. With the rapidly evolving technologies, the healthcare industry adopts new approaches regularly. Natural Language Processing, a subset of AI, facilitates human-computer communication through natural language. NLP in Healthcare & Life sciences is used to interpret vast amounts of medical text, enhancing clinical decision-making, documentation, and patient care. NLP structures unorganized data from records, aiding diagnoses and treatment suggestions. It identifies trends, supporting drug development and safety. Additionally, it powers patient engagement tools such as chatbots for personalized support, expedites research through rapid literature reviews and ensures regulatory compliance.

Technology Roadmap of NLP in Healthcare & Life sciences Market till 2030

The NLP in Healthcare & Life sciences Market market report covers technology roadmap till 2030, with insights around short-term, mid-term, and long-term developments.

Short-term roadmap (2023-2025)

- Enhanced NLP algorithms for more accurate and efficient clinical note extraction from patient records.

- NLP applied to radiology reports and diagnostic imaging for improved data extraction and analysis.

- Chatbots and virtual assistants providing basic health information and appointment scheduling.

- NLP used for text mining in scientific literature and clinical trial data for drug target identification.

Mid-term roadmap (2025-2028)

- Integration of voice-based NLP for real-time clinical documentation, reducing administrative burdens on healthcare professionals

- Integration with advanced imaging technologies to enable more accurate diagnostics.

- Advanced patient-centric NLP applications offering personalized health recommendations and treatment adherence support for context-aware responses.

- Increased automation in drug discovery workflows, with NLP aiding in target validation and compound screening.

Long-term roadmap (2028-2030)

- Advanced AI-powered clinical documentation tools to enhance documentation quality.

- AI-driven image analysis tools using NLP, and Generative AI for comprehensive diagnostics, with enhanced accuracy and contextual understanding.

- AI-driven conversational agents leveraging NLP, Generative AI, and LLMs for nuanced patient interactions.

- NLP-driven predictive models facilitated by Generative AI, accelerating drug development.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver: Focus on enhancing clinical decision support

The demand for advanced clinical decision support is increasing, which is driving the growth of NLP in Healthcare & Life sciences. Physicians have traditionally depended on Electronic Health Records (EHR) software for informed care decisions, but these systems mainly handle structured data through clinical decision support systems. However, clinical decision support systems have limitations in processing only structured data, which has created a need for more comprehensive insights.

NLP emerges as a crucial solution that unlocks untapped potential in this scenario. It enables the extraction of complex information from various sources beyond the scope of conventional clinical decision support systems data, significantly enhancing decision-making capacities. Healthcare systems are leveraging NLP to improve clinical decision support systems functionalities and bolster predictive analytics. This is achieved by comprehending unstructured data such as physician narratives and patient notes. The integration of NLP is motivated by the pursuit of improved clinical decision support, allowing for a more thorough and expansive comprehension of patient data. Ultimately, this facilitates better healthcare outcomes and well-informed medical actions.

Restraint: Issues related to domain-specific language and medical terminology in NLP model development

The use of medical terminology and language poses significant challenges to the progress of natural language processing (NLP) in healthcare and life sciences. To overcome these barriers, it becomes essential to develop industry-specific NLP models that are capable of dealing with the nuances of subsets of language, such as medical terminology and social media discourse. Medical terminology presents considerable hurdles to NLP, as clinical text varies significantly depending on the source of the data, such as PDF reports, clinical notes, and EHRs, leading to inconsistent data. Furthermore, terminology differs widely across various clinical specialties, creating additional complications. Traditional NLP methods are not capable of understanding the unique vocabulary, grammatical structures, and intended meanings embedded in medical text.

For instance, consider the phrase "Prescribe azithromycin 500 mg for SOB related to pneumonia". NLP struggles to comprehend details such as the medication, dosage, clinical abbreviation (SOB), and contextual nuances regarding the prescription's status and the patient's current condition.

These complexities hinder the development of NLP in healthcare and life sciences, requiring specialized models that can navigate the intricate language and nuances of medical terminology to enable accurate interpretation and insightful analysis.

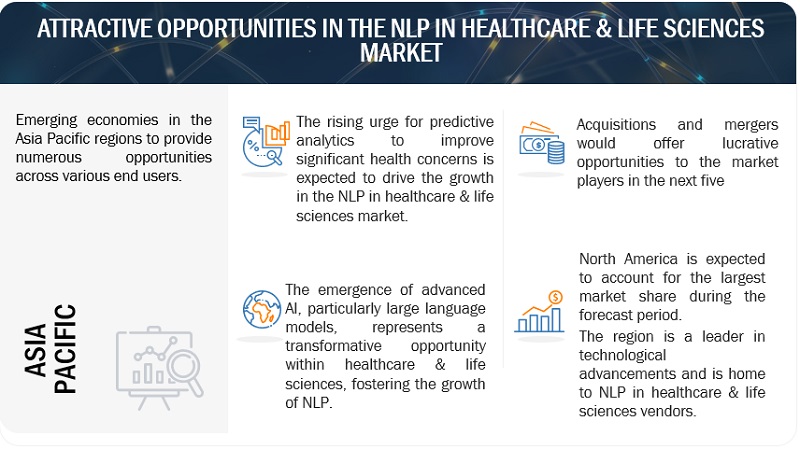

Opportunity: Emergence of advanced AI technology for generating valuable insights for healthcare

Advanced AI, specifically large language models offers a great opportunity for healthcare and life sciences. These cutting-edge technologies improve various aspects of healthcare and foster the growth of natural language processing. Large language models enhance efficiency and accuracy in handling Electronic Health Records (EHR) within clinical settings. It reviews and refine clinical documentation, identify any inconsistencies or missing information, and ensure alignment between treatment plans and diagnoses. Additionally, these AI-powered models delve into unstructured clinical texts through clinical text analysis, extracting valuable insights from diverse sources such as clinical notes, discharge summaries, and electronic health records. Their ability to decode and comprehend content accelerates the extraction of critical data from radiology reports, facilitating swift and precise diagnoses by efficiently indexing and retrieving pertinent findings. Furthermore, Large language models play a pivotal role in drug discovery and development by analyzing extensive biomedical literature and clinical data. They identify genetic markers, reveal disease mechanisms, and suggest potential drug targets, opening avenues for targeted treatments and confirming their potential efficacy. The rapid expansion of NLP in healthcare and life sciences is driven by the advent of advanced AI technologies, revolutionizing information processing, analysis, and utilization for improved patient care and scientific progress.

Challenge: Achievement of explainability and interpretability issues while deploying NLP algorithms

Achieving transparency and interpretability in NLP models is crucial for their successful integration into the healthcare and life sciences fields. However, this presents a significant challenge as these models often function as black boxes, with hidden decision-making processes. Although explainable AI and attention mechanisms have been developed to explain the reasoning behind NLP models, the underlying complexity remains. In the healthcare industry, transparency and interpretability are critical for building trust and acceptance with patients and healthcare professionals. Without clarity surrounding the process by which these models derive their conclusions, concerns about their accuracy, bias, and reliability persist, preventing their widespread application in clinical settings. Therefore, achieving interpretability and transparency in NLP models is essential for their increased recognition and successful integration into the Healthcare & Life sciences fields.

NLP in Healthcare & Life Sciences Market Ecosystem

By offering, services to hold the highest CAGR during the forecast period.

Services in NLP in Healthcare & Life sciences market offer a wide range of tools and solutions to improve data-driven insights and operational efficiency. These services involve the development, customization, and deployment of NLP models which are tailored to specific healthcare applications. Companies specialize in creating models for tasks such as analyzing clinical notes, extracting information from medical records, sentiment analysis of patient feedback, and facilitating drug discovery through text mining in scientific literature. These companies also offer consulting services to integrate NLP solutions with existing healthcare infrastructures, ensuring seamless interoperability and compliance with industry regulations.

Based on application, clinical trial matching to account for the largest market size during the forecast period.

The use of NLP in clinical trial matching automates and streamlines the process by leveraging AI. This technology reduces the burden on clinicians and enhances the efficiency of patient screening for trial eligibility. Techniques such as semantically enriched document representation and machine learning automate the laborious patient recruitment process. NLP extracts crucial information from narrative clinical documents to determine patient eligibility for specific clinical trials, significantly cutting down on manual efforts and time consumption.

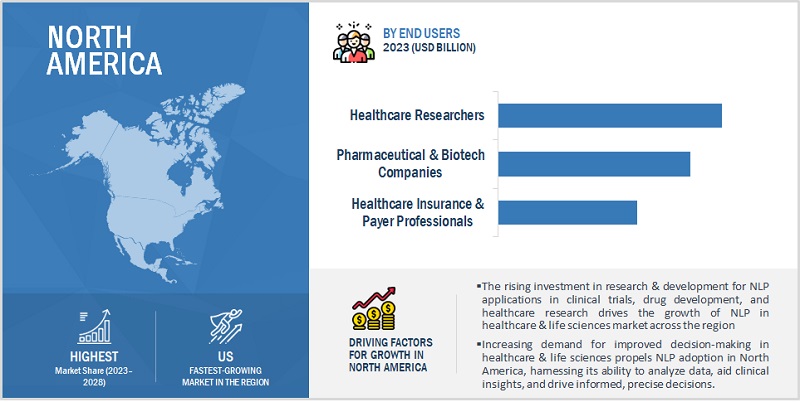

By end users, pharmaceutical & biotech companies to hold the highest CAGR during the forecast period.

Pharmaceutical & biotech companies are increasingly using NLP to revolutionize the healthcare and life sciences market. Leveraging NLP, pharmaceutical & biotech companies optimize research and development efforts, improve drug safety measures, and make strategic business decisions. This fosters innovation and advances the quality and accessibility of Healthcare & Life sciences products.

North America to account for the largest market size during the forecast period.

The adoption of NLP within the Healthcare & Life sciences market in North America is expected to grow significantly. This trend is primarily propelled by the widespread integration of advanced technology and the proactive strategies implemented by major industry players. North America is expected to dominate the NLP market in Healthcare & Life sciences, largely due to the escalating demand for NLP systems capable of contextual comprehension in medical records. Additionally, the emergence of cognitive computing is further stimulating the uptake of NLP solutions, especially in precision medicine applications.

Key Market Players

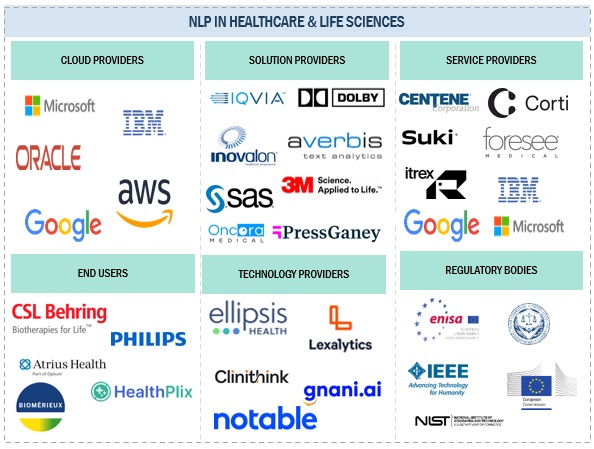

The NLP in Healthcare & Life sciences Market vendors have implemented various types of organic and inorganic growth strategies, such as partnerships and agreements, new product launches, product upgradations, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global market for NLP in Healthcare & Life sciences market include IBM (US), Microsoft (US), Google (US), AWS (US), IQVIA (US), Oracle Corporation (US), Inovalon(US), Dolbey and Company (US), Averbis (Germany), SAS Institute (US), 3M (US), Press Ganey (US), Ellipsis Health (US), Centene Corporation (US), Lexalytics (US), Caption Health (US), Clinithink (US), Hewlett Packard Enterprise (US), Oncora Medical (US), Flatiron Health (US), Apixio (US), Edifecs (US), John Snow Labs (US), ITRex Group (US), Forsee Medical (US), Gnani.ai (India), Notable (US), Biofourmis (US), Suki (US), Wave Health Technologies (US), Corti (Denmark), CloudMedx (US), MedlnReal (Netherlands), Emtelligent (Canada), Enlitic (US), and Deep 6 AI (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2018–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

USD Billion |

|

Segments Covered |

Offering, NLP Type, NLP Technique, Application, End Users, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America |

|

Companies covered |

IBM (US), Microsoft (US), Google (US), AWS (US), IQVIA (US), Oracle Corporation (US), Inovalon(US), Dolbey and Company (US), Averbis (Germany), SAS Institute (US), 3M (US), Press Ganey (US), Ellipsis Health (US), Centene Corporation (US), Lexalytics (US), Caption Health (US), Clinithink (US), Hewlett Packard Enterprise (US), Oncora Medical (US), Flatiron Health (US), Apixio (US), Edifecs (US), John Snow Labs (US), ITRex Group (US), Forsee Medical (US), Gnani.ai (India), Notable (US), Biofourmis (US), Suki (US), Wave Health Technologies (US), Corti (Denmark), CloudMedx (US), MedlnReal (Netherlands), Emtelligent (Canada), Enlitic (US), and Deep 6 AI (US) |

This research report categorizes the NLP in Healthcare & Life Sciences market based on Offering, NLP Type, NLP Technique, Application, End Users, and Region.

By Offering:

-

Solutions

-

By Type

- Software

- Platforms

-

By Deployment Mode

- On-premise

- Cloud

-

By Type

-

Services

-

Professional Services

- Training & Consulting

- 6system Integration & Implementation

- Managed Services

-

Professional Services

By NLP Type:

- Rule-Based

- Statistical

- Neural

- Hybrid

By NLP Technique:

- Optical Character Recognition

- Name Entity Recognition

- Sentiment Analysis

- Text Classification

- Topic Modeling

- Image & Pattern Recognition

- Other NLP Techniques (Predictive Risk Analytics, Auto Coding, Spelling Correction, Email Filtration, Question Answering, and Simulation & Modeling)

By Application:

- Clinical Decision & Diagnosis

- Drug Discovery & Development

- Clinical Trail Matching

- Electronic Health Record Search & Retrieval

- Healthcare Chatbots & Virtual Assistants

- Clinical Documentation Processing

- Medical Imaging

- Other Applications (Telemedicine & Telehealth Consultation, and Healthcare Knowledge Graphs)

By End Users:

- Clinical Practitioners

- Healthcare Researchers

- Healthcare Administrators

- Health Insurance & Payer Professionals

- Pharmaceutical & Biotech Companies

- Other End Users (Medical Educators & Researchers, Data Privacy & Ethics Consultants)

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

-

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Rest of the Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In October 2023, Inovalon collaborated with AWS to develop AI/ML solutions for the healthcare industry. The initial focus will be on risk adjustment, but the collaboration is expected to expand to other areas, such as disease management, population health, and clinical decision support. The goal of the collaboration is to improve patient outcomes and reduce costs.

- In September 2023, Apollo Hospitals announced an extended partnership with Google Cloud to make healthcare accessible to every Indian through its digital platform, Apollo 24|7. The partnership involved the development of a Clinical Intelligence Engine (CIE) using Google Cloud's Vertex AI and generative AI models. Apollo Hospitals is also considering the use of Med-PaLM 2, a Google-developed LLM capable of responding to medical queries and generating clinical text summaries, further enhancing healthcare services.

- In August 2023, Oracle partnered with TeleVox to provide cloud-based patient engagement solutions to healthcare organizations. This partnership would combine TeleVox's expertise in patient engagement with Oracle Cloud Infrastructure's (OCI) scalability, security, and reliability.

- In April 2023, Moderna signed an agreement with IBM to harness quantum computing and artificial intelligence for mRNA research, with the goal of accelerating scientific advancements in mRNA therapeutics and vaccines. This agreement aims to explore cutting-edge technologies to potentially revolutionize healthcare and biotechnology by leveraging data-driven insights and innovative solutions.

- In March 2023, Syneos Health announced a multi-year partnership with Microsoft to use its platform for deploying artificial intelligence (AI) in its clinical trials and commercial programs.

Frequently Asked Questions (FAQ):

What is NLP in Healthcare & Life Sciences?

According to ForeSee Medical, NLP is the ability of computers to understand the latest human speech terms and text. It is used in current technology to support spam email privacy, personal voice assistants, and language translation applications. The adoption of NLP in Healthcare & Life sciences is rising because of its recognized potential to search, analyze, and interpret a mammoth amount of patient datasets. Using advanced NLP-based algorithms, Healthcare & Life sciences firms harness the relevant insights and concepts from the clinical data previously considered buried in the text form.

Which countries are considered in the European region?

The report includes an analysis of the UK, Germany, France, Rest of Europe in the European region.

Which are key end users adopting NLP in Healthcare & Life sciences market solutions and services?

Key end users adopting NLP in Healthcare & Life sciences solutions and services include clinical practitioners, healthcare researchers, healthcare administrators, health insurance & payer professionals, pharmaceutical & biotech companies, and other end users (medical educators & researchers, data privacy & ethics consultants).

Which are the key drivers supporting the market growth for NLP in Healthcare & Life sciences Market?

The key drivers supporting the market growth for NLP in Healthcare & Life sciences market include focus on enhancing clinical decision support, need for predictive analytics to improve significant health concerns, rising demand to enhance care delivery and patient engagement.

Who are the key vendors in the market for NLP in Healthcare & Life Sciences?

The key vendors in the global NLP in Healthcare & Life sciences market include as IBM (US), Microsoft (US), Google (US), AWS (US), IQVIA (US), Oracle Corporation (US), Inovalon(US), Dolbey and Company (US), Averbis (Germany), SAS Institute (US), 3M (US), Press Ganey (US), Ellipsis Health (US), Centene Corporation (US), Lexalytics (US), Caption Health (US), Clinithink (US), Hewlett Packard Enterprise (US), Oncora Medical (US), Flatiron Health (US), Apixio (US), Edifecs (US), John Snow Labs (US), ITRex Group (US), Forsee Medical (US), Gnani.ai (India), Notable (US), Biofourmis (US), Suki (US), Wave Health Technologies (US), Corti (Denmark), CloudMedx (US), MedlnReal (Netherlands), Emtelligent (Canada), Enlitic (US), and Deep 6 AI (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

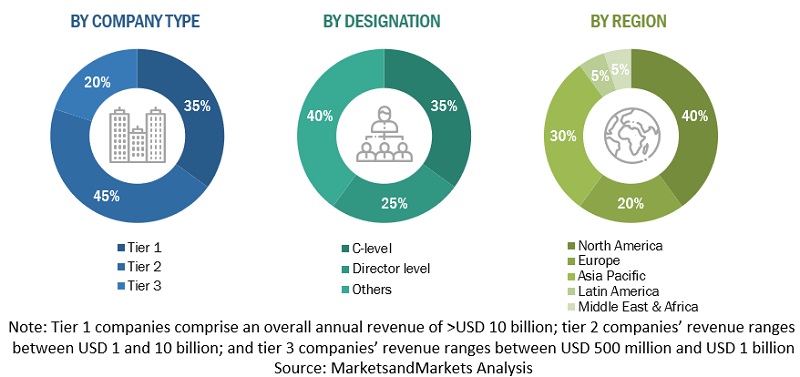

The research study for the NLP in Healthcare & Life sciences market involves the use of extensive secondary sources, directories, and several journals, including Journal of Biomedical Informatics, Journal for Healthcare Quality, Journal of Medical Internet Research, and Journal of Medical Internet Research to identify and collect information useful for this comprehensive market research study. Primary sources are mostly industry experts from the core and related industries, preferred NLP in Healthcare & Life sciences providers, third-party service providers, consulting service providers, end users, and other healthcare service providers. In-depth interviews have been conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information, and assess the market’s prospects.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as NLP in Healthcare & Life sciences Journal, Institute of Electrical and Electronics Engineers (IEEE) Journals and magazines, and Journal/forums for ML research, NLP in healthcare & life sciences magazines, and other magazines. The NLP in various countries' Healthcare & Life sciences spending was extracted from respective sources. Secondary research was mainly used to obtain key information about the industry’s value chain and supply chain to identify key players based on solutions; services; market classification and segmentation according to offerings of major players; industry trends related to solutions, services, NLP type, NLP Technique, applications, end users, and regions; and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side include various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from NLP in healthcare & life sciences vendors, SIs, professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using NLP in Healthcare & Life Sciences solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current need of NLP in Healthcare & Life Sciences which would impact the overall market.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

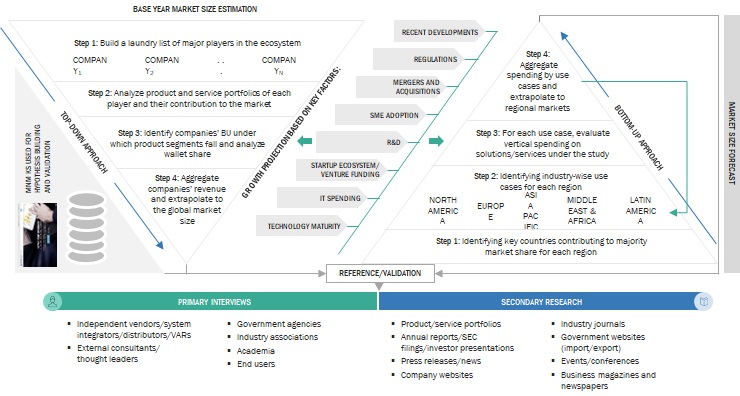

Market Size Estimation

For making market estimates and forecasting the NLP in Healthcare & Life Sciences market and the other dependent submarkets, top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global NLP in Healthcare & Life Sciences market, using the revenue from the key companies and their offerings in the market. With data triangulation and validation through primary interviews, this study determined and confirmed the exact value of the overall parent market size. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments.

In the top-down approach, an exhaustive list of all the vendors offering solutions and services in the NLP in the Healthcare & Life sciences market has been prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor's offerings have been evaluated based on breadth of solutions and services, deployment modes, applications, business functions, channel integration, and verticals. The aggregate of all the companies’ revenue was extrapolated to reach the overall market size. Each sub-segment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure includes extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers have been further triangulated with the existing MarketsandMarkets’ repository for validation.

In the bottom-up approach, the adoption rate of NLP in Healthcare & Life sciences among different end users in key countries with respect to their regions that contribute the most to the market share was identified. For cross-validation, the adoption of NLP in Healthcare & Life sciences solutions and services among major applications, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

All the possible parameters that affect the market covered in the research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

- The pricing trend is assumed to vary over time.

- All the forecasts are made with the standard assumption that the accepted currency is USD.

- For the conversion of various currencies to USD, average historical exchange rates are used according to the year specified. For all the historical and current exchange rates required for calculations and currency conversions, the US Internal Revenue Service's website is used.

- All the forecasts are made under the standard assumption that the globally accepted currency USD, remains constant during the next five years.

- Vendor-side analysis: The market size estimates of associated solutions and services are factored in from the vendor side by assuming an average of licensing and subscription-based models of leading and innovative vendors.

- Demand/end-user analysis: End users operating in verticals across regions are analyzed in terms of market spending on geospatial analytics based on some of the key use cases. These factors for the geospatial analytics per region are separately analyzed, and the average spending was extrapolated with an approximation based on assumed weightage. This factor is derived by averaging various market influencers, including recent developments, regulations, mergers and acquisitions, enterprise/SME adoption, start-up ecosystem, IT spending, technology propensity and maturity, use cases, and the estimated number of organizations per region.

Market Size Estimation: Top Down And Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

According to ForeSee Medical, NLP is the ability of computers to understand the latest human speech terms and text. It is used in current technology to support spam email privacy, personal voice assistants, and language translation applications. The adoption of NLP in Healthcare & Life sciences is rising because of its recognized potential to search, analyze, and interpret a mammoth amount of patient datasets. Using advanced NLP-based algorithms, Healthcare & Life sciences firms harness the relevant insights and concepts from the clinical data previously considered buried in the text form.

According to Lexalytics, NLP is a computing technique that analyzes text to determine its meaning, enabling computer applications to communicate effectively with humans. Healthcare providers, pharmaceutical companies, and biotechnology firms use text analytics and NLP technology to improve patient outcomes, streamline operations, and manage regulatory compliance.

Key Stakeholders

- NLP in Healthcare & Life sciences solution providers

- NLP in Healthcare & Life sciences service providers

- Independent Software Vendors (ISVs)

- NLP Service Providers

- Managed Service Providers

- Hospitals and Clinics

- Government Councils

- Health Information Exchanges

- Health Information Service Providers (HISPs)

- Pharmaceutical Companies

Report Objectives

- To define, describe, and predict the NLP in the Healthcare & Life sciences market by offering (solutions and services), NLP type, application, NLP technique, end users, and region

- To provide detailed information about major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments with respect to five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the NLP in the Healthcare & Life sciences market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American market for NLP in Healthcare & Life Sciences

- Further breakup of the European market for NLP in Healthcare & Life Sciences

- Further breakup of the Asia Pacific market for NLP in Healthcare & Life Sciences

- Further breakup of the Latin American market for NLP in Healthcare & Life Sciences

- Further breakup of the Middle East & Africa market for NLP in Healthcare & Life Sciences

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in NLP in Healthcare & Life Sciences Market

Understand the application of NLP in Healthcare.

Detailed understanding of the Artificial Intelligence (Data Scientist, Machine Learning, NLP, Sentiment Analysis, Recommender Systems).