Heart Pump Device Market by Product (Ventricular Assist Devices (LVAD, RVAD, BiVAD, and pVAD), Intra-aortic Balloon Pumps, TAH), Type (Extracorporeal and Implantable Pumps), Therapy (Bridge-to-transplant, Destination Therapy) & Region - Global Forecasts to 2026

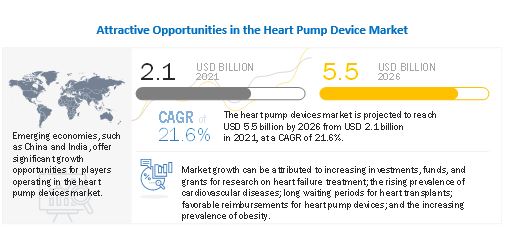

The global heart pump device market in terms of revenue was estimated to be worth $2.1 billion in 2021 and is poised to reach $5.5 billion in 2026, growing at a CAGR of 21.6% from 2021 to 2026. Promising product pipeline, increasing number of product approvals and emerging markets are expected to offer growth opportunities in the market during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Heart Pump Device Market Dynamics

Driver: Long waiting periods for heart transplant procedures

In the last few years, the demand for heart transplantation has increased significantly due to the rising incidence of CVDs and heart failure. However, the unavailability of adequate hearts for transplantation to meet the existing demand has globally resulted in a shortage crisis. According to the national database maintained by the Health Resources and Services Administration (US), as of March 2018, there are about 3,980 candidates on the heart transplant waiting list.

Even at a country level, significant differences in the number of donors and patients on waiting lists have been observed. For instance, in Australia, during 2020, around 1,650 individuals were on the waiting list for a heart transplant, whereas only 463 donors were available (Source: Transplant Australia Ltd). As per the Transplant Activity Report 2018/19, the number of patients active on heart transplant lists by year-end 2018/19 increased by 134% since 2010.

In this scenario, there has not only been an increase in the number of patients on the transplant waiting list but also in the number of patients dying while on the waiting list. LVADs have become important tools for managing advanced HF as bridge-to-transplantation (BTT) or destination therapy (DT). Organ shortages, together with the rising number of end-stage HF patients and technological advances in mechanical circulatory support (MCS), have increased demand for MCS devices used in these patients. Between 2009 and 2016, 43% of recipients were bridged with some type of MCS, LVAD, RVAD, TAH, and ECMO. Between 2007 and 2017, 50% of all adult heart transplant recipients were implanted with VAD in the US.

These devices provide the necessary support to patients while they wait for a heart transplant or also act as a permanent solution for patients who are not candidates for heart transplants. Thus, the significant gap between the demand and supply of donor hearts is expected to support the growth of the heart pump device market in the coming years.

Restraint: Complications associated with LVAD implantations

Ventricular assist devices specifically left ventricular assist devices (LVADs), are used widely for bridge-to-heart transplantation. Although LVADs are considered life-saving devices, they come along with various associated complications.

LVAD-related complications usually occur in up to 60% of patients by six months post-implantation. By two years, nearly 80% of patients experience at least one adverse event. Unplanned hospital readmissions are common. It has been witnessed that patients are readmitted, on average, 2.2 times during their 11-month median follow-up time.

Major non-surgical, adverse events and complications associated with LVAD include device thrombosis, bleeding complications, renal impairment, ischemic and hemorrhagic strokes, multi-organ failure, and infections. Certain complications also prove to be fatal to the patients if left untreated. According to sources from the University of Michigan Frankel Cardiovascular Center, about 60% of VAD patients develop an infection within 90 days. Some of the common complications of LVAD include bleeding complications, thromboembolic events, and infections, among others.

Opportunity: Promising Product Pipeline

The heart pump device market consists of various companies with products in the developmental phase. Companies with products in the pipeline focus on developing innovative solutions, which can accelerate the growth of the market.

For instance, the TAH industry is a dynamic area of device innovation and is anticipated to witness a surge in the number of launches and approvals in the coming years. The below table lists the TAHs in the pipeline and their respective stages.

These TAHs come along with advanced features compared to the SynCardia Total Heart (sole player until December 2020), making them a preferred option in the future. For instance, CARMAT’s total artificial heart received the CE Mark in December 2020. The TAH developed by CARMAT is self-regulated—it changes the blood flow based on the patient’s physical activity.

A similar trend is witnessed in the VAD industry, with players developing innovative products in the market. Various manufacturers in the field aim to commercialize their VADs in the market in the coming years. For instance, UK-based Calon Cardio-Technology Ltd. aims to receive the CE Mark for its MiniVAD around early 2024, by which time a US FDA Early Feasibility Study is due to have been completed. The company seeks to raise investments of nearly USD 47 million (£34 million) to USD 60 million (£43 million) to fund its clinical studies of the MiniVAD in the US and Europe from 2020 to 2023. Similarly, the PERKAT RV right heart pump, manufactured by Germany-based NovaPump GmbH, is the only cardiac support that works percutaneously, pulsatile and self-expanding. With a successful round A funding, the company aims to participate in clinical trials and advance in R&D collaborations to accelerate the launch of its product.

With the existing strong product pipeline, the chances of innovative products being commercialized are anticipated to rise, which serves as a growth opportunity for the market.

Ventricular assist devices are expected to hold the largest share of the heart pump device industry, by product in 2021.

Based on products, the heart pump device market is segmented into ventricular assist devices, intra- aortic balloon pumps, and total artificial hearts. Ventricular assist devices are the largest and fastest-growing segment in this market. Growth in this segment can primarily be attributed to the technological advancements made by the manufacturers, the scarcity of organ donors, and the significant rise in the prevalence of heart failure across the globe.

Implantable heart pump devices are expected to hold the largest share of the heart pump device industry, by type in 2021.

Based on type, the heart pump device market is segmented into implantable heart pump devices and extracorporeal heart pump devices. In 2020, implantable heart pump devices accounted for the largest share of this market, due to the launch of technologically advanced products by leading players and the need for an efficient solution to manage heart failure.

Bridge-to-transplant is expected to hold the largest share of the heart pump device industry, by therapy in 2021.

Based on therapy, the heart pump device market is segmented into bridge-to-transplant (BTT), bridge-to-candidacy (BTC), destination therapy (DT), and other therapies. In 2020, the BTT segment accounted for the largest share of this market. Factors such as rising awareness regarding transplantation and the availability of VADs for BTT have accelerated growth of this segment.

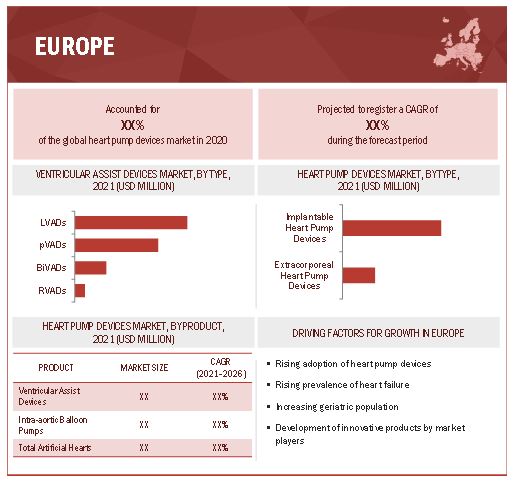

Europe commanded the largest share of the heart pump device industry in 2021.

On the basis of region, the heart pump device market is segmented into North America, Europe, Asia Pacific, and the Rest of the World. In 2020, Europe commanded the largest share of the market. The large share of this region can be attributed to the increasing use of heart pump devices, rising prevalence of CVDs, and the rise in the number of research activities to improve current technologies.

The major players operating in heart pump device market are Abbott Laboratories (US), Abiomed (US), Medtronic (Ireland), Teleflex Incorporated (US), SynCardia Systems (US), Fresenius Medical Care AG & Co. KGaA (Germany), Getinge (Sweden), CardiacAssist, Inc. (US), Berlin Heart (Germany), Jarvik Heart, Inc. (US), CARMAT (France), SENKO MEDICAL INSTRUMENT Mfg. CO., LTD. (Japan), Angiodroid (Italy), CardioDyme (US), and World Heart Corporation (US).

Heart Pump Device Market Report Scope:

|

Report Metric |

Details |

|

Market Size Available for Years |

2019–2026 |

|

Base Year Considered |

2020 |

|

Forecast Period |

2021–2026 |

|

Forecast Units |

Value (USD Billion) |

|

Segments Covered |

Product, type, therapy, and region |

|

Geographies Covered |

North America (US and Canada), Europe (Germany, France, UK, Italy, Spain, and the RoE), APAC (Japan, China, India, Australia, and the RoAPAC), and Rest of the World (RoW) (Middle East & Africa and Latin America) |

|

Companies Covered |

Abbott Laboratories (US), Abiomed (US), Medtronic (Ireland), Teleflex Incorporated (US), SynCardia Systems (US), Fresenius Medical Care AG & Co. KGaA (Germany), Getinge (Sweden), CardiacAssist, Inc. (US), Berlin Heart (Germany), Jarvik Heart, Inc. (US), CARMAT (France), SENKO MEDICAL INSTRUMENT Mfg. CO., LTD. (Japan), Angiodroid (Italy), CardioDyme (US), and World Heart Corporation (US). |

This research report categorizes the heart pump device market to forecast revenue and analyze trends in each of the following submarkets:

By Product

-

Ventricular Assist Devices

- Left Ventricular Assist Devices

- Percutaneous Ventricular Assist Devices

- Biventricular Ventricular Assist Devices

- Right Ventricular Assist Devices

- Intra aortic Balloon Pumps

- Total Artificial Hearts

By Type

- Implanted Heart Pump Device

- Extracorporeal Heart Pump Device

By Therapy

- Bridge-to-Transplant (BTT)

- Bridge-to-Candidacy (BTC)

- Destination Therapy (DT)

- Other Therapies

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia

- Rest of Asia Pacific

-

Rest of the World

- Latin America

- Middle East & Africa

Recent Developments of Heart Pump Device Industry:

- In 2021, CARMAT Received FDA approval to conduct an Early Feasibility Study (EFS) of its TAH in the US

- In 2020, Abbott received FDA approval for the updated labeling for the HeartMate 3 Heart Pump to be used in pediatric patients with advanced refractory left ventricular heart failure

- In 2020, Abiomed received approval from the Ministry of Health, Labour and Welfare (MHLW) for the Impella CP Heart Pumps in Japan

- In 2020, SynCardia Systems received FDA approval for the 50cc temporary Total Artificial Heart (TAH-t)

- In 2020, CARMAT received the CE Mark for its total artificial heart.

- In 2019, Medtronic received FDA’s “Breakthrough Device Designation” for its fully implantable left ventricular assist device (LVAD)

- In 2018, Angiodroid Received the CE Mark for ANGIOPULSE, the company’s IABP device.

Frequently Asked Questions (FAQs):

What is the projected market value of the global heart pump device market?

The global market of heart pump device is projected to reach USD 5.5 billion.

What is the estimated growth rate (CAGR) of the global heart pump device market for the next five years?

The global heart pump device market is projected to grow at a Compound Annual Growth Rate (CAGR) of 21.6% from 2021 to 2026.

What are the major revenue pockets in the heart pump device market currently?

In 2020, Europe commanded the largest share of the heart pump device market. The large share of this region can be attributed to the increasing use of heart pump devices, rising prevalence of CVDs, and the rise in the number of research activities to improve current technologies.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS OF THE STUDY

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 HEART PUMP DEVICES: MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 3 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 APPROACH 3: PARENT MARKET ANALYSIS [ACTIVE IMPLANTABLE MEDICAL DEVICES MARKET]

FIGURE 7 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

FIGURE 8 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 COVID-19 ECONOMIC ASSESSMENT

2.7 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE ECONOMIC SCENARIO

FIGURE 10 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 11 RECOVERY SCENARIO OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 44)

FIGURE 12 HEART PUMP DEVICE MARKET, BY PRODUCT, 2021 VS. 2026 (USD BILLION)

FIGURE 13 HEART PUMP DEVICES MARKET, BY TYPE, 2021 VS. 2026 (USD BILLION)

FIGURE 14 GLOBAL MARKET, BY THERAPY, 2021 VS. 2026 (USD BILLION)

FIGURE 15 GLOBAL MARKET, BY REGION, 2021 VS. 2026 (USD BILLION)

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 GLOBAL MARKET OVERVIEW

FIGURE 16 THE RISING INCIDENCE OF HEART FAILURE IS A MAJOR FACTOR DRIVING THE GROWTH OF THE GLOBAL MARKET

4.2 EUROPE: MARKET SHARE, BY THERAPY (2020)

FIGURE 17 BTT THERAPY SEGMENT DOMINATED THE EUROPEAN MARKET IN 2020

4.3 GEOGRAPHICAL SNAPSHOT OF THE GLOBAL MARKET

FIGURE 18 CHINA TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 50)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 HEART PUMP DEVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing investments, funds, and grants for research on heart failure treatment

5.2.1.2 Rising prevalence of cardiovascular diseases

FIGURE 20 SHARE OF GLOBAL POPULATION AGED 65 AND ABOVE (2015–2019)

5.2.1.3 Long waiting periods for heart transplant procedures

5.2.1.4 Favorable reimbursements for heart pump devices

TABLE 1 CPT CODES FOR PROCEDURES RELATED TO VENTRICULAR ASSIST DEVICES AND TAH

TABLE 2 CPT CODES FOR PROCEDURES RELATED TO IABP

5.2.1.5 Increasing prevalence of obesity

5.2.2 RESTRAINTS

5.2.2.1 Complications associated with LVAD implantations

5.2.2.2 Lack of funding for destination therapy

5.2.3 OPPORTUNITIES

5.2.3.1 Promising product pipeline

TABLE 3 TOTAL ARTIFICIAL HEARTS IN PIPELINE

5.2.3.2 Increasing number of product approvals

TABLE 4 RECENT APPROVALS IN THE GLOBAL MARKET, 2018–2020

5.2.3.3 Emerging markets

5.2.4 CHALLENGES

5.2.4.1 Frequent product recalls

TABLE 5 KEY PRODUCT RECALLS IN THE GLOBAL MARKET

5.2.4.2 Stringent regulatory requirements delaying the approval of cardiac devices

5.3 SUPPLY CHAIN ANALYSIS

FIGURE 21 DIRECT DISTRIBUTION—THE PREFERRED STRATEGY OF PROMINENT COMPANIES

5.4 VALUE CHAIN ANALYSIS

FIGURE 22 VALUE CHAIN ANALYSIS: MAJOR VALUE IS ADDED DURING THE MANUFACTURING AND ASSEMBLY PHASES

5.5 ECOSYSTEM ANALYSIS

FIGURE 23 ECOSYSTEM ANALYSIS OF THE HEART PUMP DEVICES INDUSTRY

5.5.1 ROLE IN THE ECOSYSTEM

5.6 REGULATORY LANDSCAPE

TABLE 6 LIST OF REGULATORY AUTHORITIES

5.6.1 EU REGULATIONS

5.6.2 US REGULATIONS

5.7 PORTER’S FIVE FORCES ANALYSIS

5.7.1 THREAT FROM NEW ENTRANTS

5.7.2 BARGAINING POWER OF SUPPLIERS

5.7.3 BARGAINING POWER OF BUYERS

5.7.4 INTENSITY OF COMPETITIVE RIVALRY

5.7.5 THREAT FROM SUBSTITUTES

5.8 COVID-19 IMPACT ANALYSIS FOR THE GLOBAL MARKET

FIGURE 24 PERCENTAGE OF MEDTRONIC’S CARDIAC AND VASCULAR GROUP NET SALES, BY DIVISION, FY 2019 VS. FY 2020

5.9 PATENT ANALYSIS

5.9.1 VENTRICULAR ASSIST DEVICES

5.9.2 TOTAL ARTIFICIAL HEARTS

5.9.3 INTRA-AORTIC BALLOON PUMPS

5.10 TRADE ANALYSIS

5.10.1 IMPORT DATA, BY COUNTRY, 2017–2019 (USD MILLION)

5.10.2 EXPORT DATA, BY COUNTRY, 2017–2019 (USD MILLION)

5.10.3 EXPORT DATA, BY COUNTRY, 2017–2019 (KILOGRAMS)

5.10.4 IMPORT DATA, BY COUNTRY, 2017–2019 (KILOGRAMS)

5.11 TECHNOLOGY ANALYSIS

5.12 AVERAGE SELLING PRICE TREND

TABLE 7 AVERAGE SELLING PRICES OF HEART PUMP DEVICE PRODUCTS

5.13 YCC SHIFT

6 HEART PUMP DEVICE MARKET, BY PRODUCT (Page No. - 73)

6.1 INTRODUCTION

TABLE 8 HEART PUMP DEVICES MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

6.2 VENTRICULAR ASSIST DEVICES

TABLE 9 VENTRICULAR ASSIST DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 10 VENTRICULAR ASSIST DEVICES MARKET, BY REGION, 2019–2026 (USD MILLION)

6.2.1 LEFT VENTRICULAR ASSIST DEVICES

6.2.1.1 LVADs are the most common types of VAD used—a key factor driving market growth

TABLE 11 LEFT VENTRICULAR ASSIST DEVICES MARKET, BY REGION, 2019–2026 (USD MILLION)

6.2.2 PERCUTANEOUS VENTRICULAR ASSIST DEVICES

6.2.2.1 Ability to provide efficient cardiac support to drive the growth of this market segment

TABLE 12 PERCUTANEOUS VENTRICULAR ASSIST DEVICES MARKET, BY REGION, 2019–2026 (USD MILLION)

6.2.3 BIVENTRICULAR ASSIST DEVICES

6.2.3.1 Lack of reimbursement for BiVAD to restrict market growth to a certain extent

TABLE 13 BIVENTRICULAR ASSIST DEVICES MARKET, BY REGION, 2019–2026 (USD MILLION)

6.2.4 RIGHT VENTRICULAR ASSIST DEVICES

6.2.4.1 RVADs are used as temporary cardiac assist devices

TABLE 14 RIGHT VENTRICULAR ASSIST DEVICES MARKET, BY REGION, 2019–2026 (USD MILLION)

6.3 INTRA-AORTIC BALLOON PUMPS

6.3.1 INCREASING RECALLS OF IABPS TO HINDER THE MARKET GROWTH

TABLE 15 RECENT IABP RECALLS IN THE GLOBAL MARKET

TABLE 16 INTRA-AORTIC BALLOON PUMPS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.4 TOTAL ARTIFICIAL HEARTS

6.4.1 LAUNCH OF INNOVATIVE PRODUCTS TO ACCELERATE GROWTH IN THIS PRODUCT SEGMENT

TABLE 17 TOTAL ARTIFICIAL HEARTS MARKET, BY REGION, 2019–2026 (USD MILLION)

7 HEART PUMP DEVICE MARKET, BY TYPE (Page No. - 82)

7.1 INTRODUCTION

TABLE 18 HEART PUMP DEVICE MARKET, BY TYPE, 2019–2026 (USD MILLION)

7.2 IMPLANTABLE HEART PUMP DEVICES

7.2.1 TECHNOLOGICAL ADVANCEMENTS TO DRIVE GROWTH IN THIS MARKET SEGMENT

TABLE 19 IMPLANTABLE GLOBAL MARKET, BY REGION, 2019–2026 (USD MILLION)

7.3 EXTRACORPOREAL HEART PUMP DEVICES

7.3.1 EXTRACORPOREAL HEART PUMP DEVICE CAN BE USED IN PEDIATRIC PATIENTS—A KEY FACTOR DRIVING MARKET GROWTH

TABLE 20 EXTRACORPOREAL GLOBAL MARKET, BY REGION, 2019–2026 (USD MILLION)

8 HEART PUMP DEVICE MARKET, BY THERAPY (Page No. - 86)

8.1 INTRODUCTION

TABLE 21 HEART PUMP DEVICE MARKET, BY THERAPY, 2019–2026 (USD MILLION)

8.2 BRIDGE-TO-TRANSPLANT (BTT)

8.2.1 GROWING NUMBER OF PATIENTS ON THE WAITING LIST TO SUPPORT MARKET GROWTH

TABLE 22 HEART PUMP DEVICES MARKET FOR BRIDGE-TO-TRANSPLANT THERAPY, BY REGION, 2019–2026 (USD MILLION)

8.3 BRIDGE-TO-CANDIDACY (BTC)

8.3.1 EFFICIENT OUTCOMES PROVIDED BY BTC TO PROPEL MARKET GROWTH

TABLE 23 GLOBAL MARKET FOR BRIDGE-TO-CANDIDACY THERAPY, BY REGION, 2019–2026 (USD MILLION)

8.4 DESTINATION THERAPY (DT)

8.4.1 INTRODUCTION OF INNOVATIVE TECHNOLOGIES TO ACCELERATE SEGMENTAL GROWTH

TABLE 24 GLOBAL MARKET FOR DESTINATION THERAPY, BY REGION, 2019–2026 (USD MILLION)

8.5 OTHER THERAPIES

TABLE 25 GLOBAL MARKET FOR OTHER THERAPIES, BY REGION, 2019–2026 (USD MILLION)

9 HEART PUMP DEVICE MARKET, BY REGION (Page No. - 91)

9.1 INTRODUCTION

TABLE 26 GLOBAL MARKET, BY REGION, 2019–2026 (USD MILLION)

9.2 NORTH AMERICA

TABLE 27 NORTH AMERICA: HEART PUMP DEVICES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 28 NORTH AMERICA: HEART PUMP DEVICE MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 29 NORTH AMERICA: VENTRICULAR ASSIST DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 30 NORTH AMERICA: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 31 NORTH AMERICA: MARKET, BY THERAPY, 2019–2026 (USD MILLION)

9.2.1 US

9.2.1.1 Availability of reimbursements to support market growth

TABLE 32 CPT CODES FOR PROCEDURES RELATED TO VAD AND TAH

TABLE 33 US: HEART PUMP DEVICES MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 34 US: VENTRICULAR ASSIST DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 35 US: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 36 US: MARKET, BY THERAPY, 2019–2026 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Rising incidence and prevalence of heart failure to propel market growth

TABLE 37 CANADA: HEART PUMP DEVICES MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 38 CANADA: VENTRICULAR ASSIST DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 39 CANADA: HEART PUMP DEVICE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 40 CANADA: MARKET, BY THERAPY, 2019–2026 (USD MILLION)

9.3 EUROPE

FIGURE 25 EUROPE: HEART PUMP DEVICES MARKET SNAPSHOT

TABLE 41 EUROPE: HEART PUMP DEVICE MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 42 EUROPE: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 43 EUROPE: VENTRICULAR ASSIST DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 44 EUROPE: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 45 EUROPE: MARKET, BY THERAPY, 2019–2026 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 High adoption of VADs as destination therapy in Germany to drive market growth

TABLE 46 GERMANY: HEART PUMP DEVICES MARKET, BY PRODUCT, 2019-2026 (USD MILLION)

TABLE 47 GERMANY: VENTRICULAR ASSIST DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 48 GERMANY: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 49 GERMANY: MARKET, BY THERAPY, 2019–2026 (USD MILLION)

9.3.2 UK

9.3.2.1 Long waiting list for heart transplants in the UK

TABLE 50 UK: HEART PUMP DEVICES MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 51 UK: VENTRICULAR ASSIST DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 52 UK: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 53 UK: MARKET, BY THERAPY, 2019–2026 (USD MILLION)

9.3.3 FRANCE

9.3.3.1 Developments undertaken by local players to accelerate market growth in France

TABLE 54 FRANCE: HEART PUMP DEVICES MARKET, BY PRODUCT, 2019-2026 (USD MILLION)

TABLE 55 FRANCE: VENTRICULAR ASSIST DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 56 FRANCE: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 57 FRANCE: MARKET, BY THERAPY, 2019–2026 (USD MILLION)

9.3.4 ITALY

9.3.4.1 Initiatives undertaken by local players to drive market growth in Italy

TABLE 58 ITALY: HEART PUMP DEVICES MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 59 ITALY: VENTRICULAR ASSIST DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 60 ITALY: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 61 ITALY: MARKET, BY THERAPY, 2019–2026 (USD MILLION)

9.3.5 SPAIN

9.3.5.1 Rising geriatric population to propel market growth in Spain

TABLE 62 SPAIN: HEART PUMP DEVICES MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 63 SPAIN: VENTRICULAR ASSIST DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 64 SPAIN: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 65 SPAIN: MARKET, BY THERAPY, 2019–2026 (USD MILLION)

9.3.6 REST OF EUROPE

TABLE 66 PERCENTAGE OF POPULATION AGED 60 YEARS OR OVER, 2017 VS. 2050

TABLE 67 ROE: HEALTH EXPENDITURE (% OF GDP), 2010 VS. 2017

TABLE 68 ROE: HEART PUMP DEVICES MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 69 ROE: VENTRICULAR ASSIST DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 70 ROE: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 71 ROE: MARKET, BY THERAPY, 2019–2026 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 26 ASIA PACIFIC: HEART PUMP DEVICES MARKET SNAPSHOT

TABLE 72 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 73 ASIA PACIFIC: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 74 ASIA PACIFIC: VENTRICULAR ASSIST DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 75 ASIA PACIFIC: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 76 ASIA PACIFIC: MARKET, BY THERAPY, 2019–2026 (USD MILLION)

9.4.1 JAPAN

9.4.1.1 Low rate of transplantations in the country to drive market growth

TABLE 77 JAPAN: HEART PUMP DEVICES MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 78 JAPAN: VENTRICULAR ASSIST DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 79 JAPAN: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 80 JAPAN: MARKET, BY THERAPY, 2019–2026 (USD MILLION)

9.4.2 CHINA

9.4.2.1 High prevalence of CVDs in China to drive market growth

TABLE 81 CHINA: HEART PUMP DEVICES MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 82 CHINA: VENTRICULAR ASSIST DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 83 CHINA: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 84 CHINA: MARKET, BY THERAPY, 2019–2026 (USD MILLION)

9.4.3 INDIA

9.4.3.1 Huge target population in India to drive market growth

TABLE 85 INDIA: HEART PUMP DEVICES MARKET, BY PRODUCT, 2019–2026 (US MILLION)

TABLE 86 INDIA: VENTRICULAR ASSIST DEVICES MARKET, BY TYPE,2019–2026 (USD MILLION)

TABLE 87 INDIA: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 88 INDIA: MARKET, BY THERAPY, 2019–2026 (USD MILLION)

9.4.4 AUSTRALIA

9.4.4.1 Increasing prevalence of heart disease to accelerate market growth in Australia

TABLE 89 AUSTRALIA: HEART PUMP DEVICES MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 90 AUSTRALIA: VENTRICULAR ASSIST DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 91 AUSTRALIA: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 92 AUSTRALIA: MARKET, BY THERAPY, 2019–2026 (USD MILLION)

9.4.5 REST OF ASIA PACIFIC

TABLE 93 ROAPAC: HEART PUMP DEVICES MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 94 ROAPAC: VENTRICULAR ASSIST DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 95 ROAPAC: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 96 ROAPAC: MARKET, BY THERAPY, 2019–2026 (USD MILLION)

9.5 REST OF THE WORLD

TABLE 97 REST OF THE WORLD: HEART PUMP DEVICES MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 98 REST OF THE WORLD: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 99 REST OF THE WORLD: VENTRICULAR ASSIST DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 100 REST OF THE WORLD: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 101 REST OF THE WORLD: MARKET, BY THERAPY, 2019–2026 (USD MILLION)

9.5.1 MIDDLE EAST & AFRICA

9.5.1.1 Increasing adoption of heart pump devices in the region to drive market growth

TABLE 102 MIDDLE EAST & AFRICA: HEART PUMP DEVICES MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 103 MIDDLE EAST & AFRICA: VENTRICULAR ASSIST DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 104 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 105 MIDDLE EAST & AFRICA: MARKET, BY THERAPY, 2019–2026 (USD MILLION)

9.5.2 LATIN AMERICA

9.5.2.1 Rising geriatric population to increase the demand for heart pump devices in the region

TABLE 106 LATIN AMERICA: HEART PUMP DEVICES MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 107 LATIN AMERICA: VENTRICULAR ASSIST DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 108 LATIN AMERICA: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 109 LATIN AMERICA: MARKET, BY THERAPY, 2019–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 132)

10.1 OVERVIEW

FIGURE 27 KEY DEVELOPMENTS IN THE HEART PUMP DEVICES MARKET, JANUARY 2018–APRIL 2021

FIGURE 28 MARKET EVOLUTION MATRIX: JANUARY 2018 TO APRIL 2021

10.2 REVENUE ANALYSIS

10.2.1 GLOBAL MARKET: REVENUE ANALYSIS OF THE TOP 5 MARKET PLAYERS

FIGURE 29 TOP 5 PLAYERS HAVE DOMINATED THE MARKET IN THE LAST 3 YEARS

10.3 MARKET SHARE ANALYSIS

TABLE 110 GLOBAL MARKET: DEGREE OF COMPETITION

10.4 COMPANY EVALUATION MATRIX

10.4.1 STARS

10.4.2 EMERGING LEADERS

10.4.3 PERVASIVE PLAYERS

10.4.4 PARTICIPANTS

FIGURE 30 VENDOR DIVE: GLOBAL MARKET

10.5 COMPETITIVE LEADERSHIP MAPPING (START-UPS AND SMES)

10.5.1 PROGRESSIVE COMPANIES

10.5.2 STARTING BLOCKS

10.5.3 RESPONSIVE COMPANIES

10.5.4 DYNAMIC COMPANIES

FIGURE 31 GLOBAL MARKET: VENDOR DIVE MATRIX FOR SMES AND START-UPS, 2020

10.6 COMPETITIVE SCENARIO

10.6.1 PRODUCT APPROVALS

TABLE 111 KEY PRODUCT APPROVALS, JANUARY 2018–APRIL 2021

10.6.2 DEALS

TABLE 112 KEY DEALS, JANUARY 2018–APRIL 2021

10.6.3 OTHER DEVELOPMENTS

TABLE 113 OTHER KEY DEVELOPMENTS, JANUARY 2018–APRIL 2021

10.7 COMPANY FOOTPRINT

TABLE 114 COMPANY FOOTPRINT

TABLE 115 COMPANY PRODUCT FOOTPRINT

TABLE 116 COMPANY TYPE FOOTPRINT

TABLE 117 COMPANY GEOGRAPHICAL FOOTPRINT

11 COMPANY PROFILES (Page No. - 144)

11.1 KEY PLAYERS

(Business Overview, Products/Solutions Offered, Recent Developments, SWOT Analysis, Winning Imperatives, Current Focus and Strategies, Threat From Competition, Right to Win)*

11.1.1 ABBOTT LABORATORIES

TABLE 118 ABBOTT LABORATORIES: BUSINESS OVERVIEW

FIGURE 32 ABBOTT LABORATORIES: COMPANY SNAPSHOT (2020)

11.1.2 ABIOMED

TABLE 119 ABIOMED: BUSINESS OVERVIEW

FIGURE 33 ABIOMED: COMPANY SNAPSHOT (2020)

11.1.3 MEDTRONIC

TABLE 120 MEDTRONIC: BUSINESS OVERVIEW

FIGURE 34 MEDTRONIC: COMPANY SNAPSHOT (2020)

11.1.4 TELEFLEX INCORPORATED

TABLE 121 TELEFLEX INCORPORATED: BUSINESS OVERVIEW

FIGURE 35 TELEFLEX INCORPORATED: COMPANY SNAPSHOT (2020)

11.1.5 SYNCARDIA SYSTEMS

TABLE 122 SYNCARDIA SYSTEMS: BUSINESS OVERVIEW

11.1.6 FRESENIUS MEDICAL CARE AG & CO. KGAA

TABLE 123 FRESENIUS MEDICAL CARE AG & CO. KGAA: BUSINESS OVERVIEW

FIGURE 36 FRESENIUS MEDICAL CARE AG & CO. KGAA: COMPANY SNAPSHOT (2020)

11.1.7 CARDIACASSIST, INC.

TABLE 124 CARDIACASSIST, INC.: BUSINESS OVERVIEW

FIGURE 37 LIVANOVA PLC: COMPANY SNAPSHOT (2020)

11.1.8 GETINGE

TABLE 125 GETINGE: BUSINESS OVERVIEW

FIGURE 38 GETINGE: COMPANY SNAPSHOT (2020)

11.2 OTHER PLAYERS

11.2.1 BERLIN HEART

TABLE 126 BERLIN HEART: BUSINESS OVERVIEW

11.2.2 JARVIK HEART, INC.

TABLE 127 JARVIK HEART, INC.: BUSINESS OVERVIEW

11.2.3 CARMAT

TABLE 128 CARMAT: BUSINESS OVERVIEW

11.2.4 SENKO MEDICAL INSTRUMENT MFG. CO., LTD.

TABLE 129 MERA: BUSINESS OVERVIEW

11.2.5 ANGIODROID

TABLE 130 ANGIODROID: BUSINESS OVERVIEW

11.2.6 CARDIODYME

TABLE 131 CARDIODYME: BUSINESS OVERVIEW

11.2.7 WORLD HEART CORPORATION

TABLE 132 WORLD HEART CORPORATION: BUSINESS OVERVIEW

*Business Overview, Products/Solutions Offered, Recent Developments, SWOT Analysis, Winning Imperatives, Current Focus and Strategies, Threat From Competition, Right to Win might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 171)

12.1 INSIGHTS FROM INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

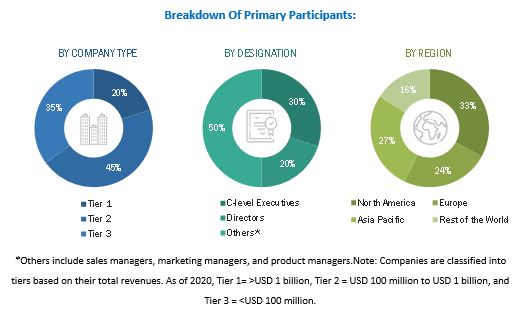

The study involved four major activities to estimate the current size of the heart pump device market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to in order to identify and collect information for this study.

Primary Research

Several stakeholders such as heart pump device manufacturers, vendors, distributors, perfusionists, and physicians from hospitals and clinics were consulted for this report. The demand side of this market is characterized by increasing investments, funds, and grants for research on heart failure treatment; rising prevalence of cardiovascular diseases; long waiting periods for heart transplants; favorable reimbursements for heart pump devices; and increasing obesity. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the heart pump device market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size-using the market size estimation processes-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the heart pump device industry.

Report Objectives

- To define, describe, and forecast the heart pump device market on the basis of product, type, therapy, and region.

- To provide detailed information regarding the major factors influencing market growth (such as drivers, restraints, and opportunities, COVID-19 Impact Analysis)

- To strategically analyse micromarkets with respect to individual growth trends, prospects, and contributions to the overall heart pump device market

- To analyse market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments in four geographical regions, namely, North America, Europe, the Asia Pacific, and Rest of the World.

- To profile the key players and comprehensively analyse their product portfolios, market positions, and core competencies.

- To track and analyse competitive developments such as product launches and approvals, deals and other developments in the heart pump device market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis:

- Further breakdown of the heart pump device market into specific countries/regions in the Rest of Europe, Rest of Asia Pacific, and Latin American countries

Company Information:

- Detailed analysis and profiling of additional market players (up to 5) inclusive of:

- Business Overview

- Financial Information

- Product Portfolio

- Developments (last three years)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Heart Pump Device Market

Which factors are influencing the global growth for Heart Pump Device Market?

What are the advantages of advanced Heart Pump Device over the traditional heart transplant procedures?

How the global Heart Pump Device Market is being impacted by COVID19?