Heat Pump Market by Technology (Air-to-Air, Air-to-Water, Water Source, Geothermal, Hybrid, PVT), Refrigerant (R410A, R407C, R744, R290, R717), Type (Reversible, Non-reversible), Rated Capacity, End User, Application and Region - Global Forecast to 2029

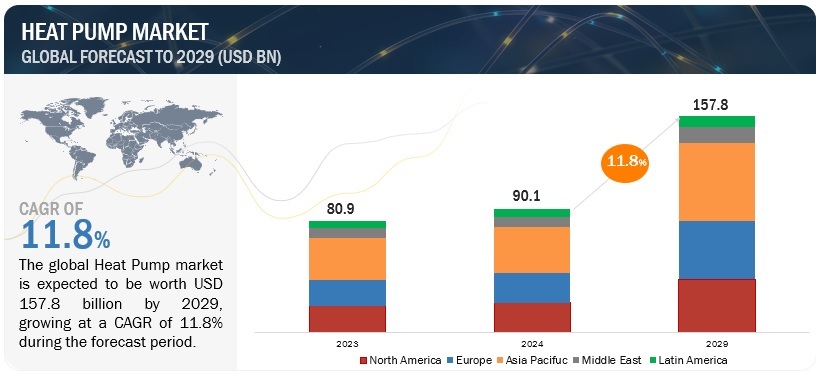

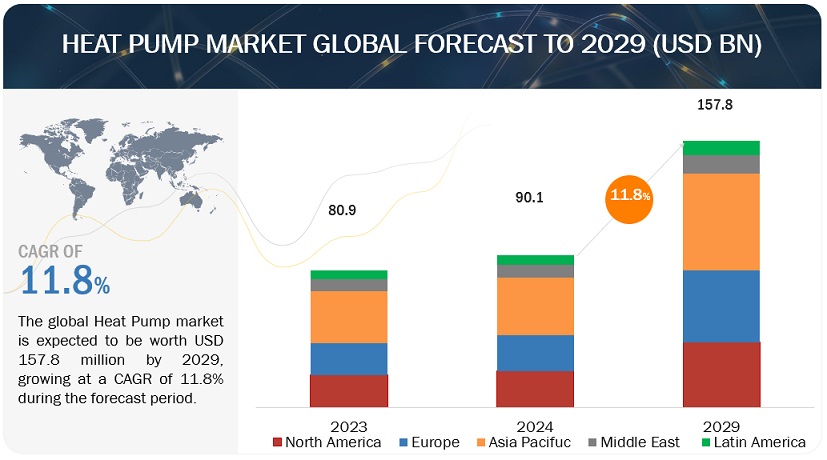

[310 Pages Report] The global heat pump market size in terms of revenue was estimated to be worth $90.1 billion in 2024 and is poised to reach $157.8 billion by 2029, growing at a CAGR of 11.8% from 2024 to 2029. Implementation of building codes and standards that mandate minimum energy performance requirements for HVAC systems, including heat pumps, drives demand for higher-efficiency equipment and encourages market growth. Smart home platforms provide detailed insights into energy usage patterns, allowing users to monitor and analyze the performance of their heat pump systems in real time. This visibility empowers users to identify opportunities for further energy savings and make informed decisions about their heating and cooling needs.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Heat Pump Market Dynamics

Driver: Broader Appeal and Efficiency

In addition to typical heating and cooling, heat pumps are being used for other purposes like drying clothing, heating pools, and supplying hot water. Their adaptability is increasing their market potential and increasing their attractiveness. When combined with solar thermal systems, heat pumps provide an energy-efficient replacement for conventional electric or gas water heaters. Heat pumps are an effective way to extend the seasons during which pools are heated while using less energy than electric or gas heaters since they draw heat from the surrounding air. Electricity is necessary for homes, schools, hospitals, and other establishments. However, both during production and consumption, a significant amount of greenhouse gases are generated. As a result, major economies throughout the world are gradually moving away from non-renewable energy sources and toward renewable energy sources to reduce greenhouse gas emissions.

Restraint: Limited Public Awareness

The heat pump is an intricately designed piece of machinery. Diverse end users have limited knowledge of the energy efficiency, financial effectiveness, and environmental advantages of heat pumps, in addition to their technical know-how. The International Organization for Standardization (ISO) heat pump norms are not well known among contractors, according to research released by the United Nations Environment Program. Regarding the safety and quality control of the goods and services that suppliers provide, the ISO standards are essential. Nonetheless, a major barrier to the market's expansion is the lack of knowledge about the benefits of adopting heat pumps and the relevant ISO standards.

Opportunities: Positive outlook

The Global Geothermal Alliance states that approximately 90 nations, including the US, Mexico, Indonesia, and Italy, have great potential for geothermal energy use. These countries stand to gain from improved exploration and drilling as well as improved oil and gas industry operations. The Climate Policy Initiative, an analysis and advisory organization, stated in September 2017 that in order to attract private investments and meet the 23 GW target by 2030, public financing for geothermal energy must increase from USD 7.4 billion to USD 73 billion. This is due to the fact that global spending on oil field exploration and development is on the rise.

Challenges: High Cost

Heat pumps are extensively utilized in the commercial, industrial, and residential sectors because they cut carbon emissions, lower energy costs, and improve energy efficiency. Due to its lower cost and greater efficiency in satisfying the temperature needs of users in both residential and commercial buildings, air-source heat pumps are in high demand. Although the installation of geothermal heat pumps is usually more expensive, they are more effective and may serve huge buildings' needs. Air-source heat pumps are 20–30% less expensive than ground-source heat pumps. Geothermal heat pumps require subterranean installation of high-density polyethylene pipes, which requires a team of experts to spend at least three days. Many factors affect the installation cost of heat pump equipment for commercial, industrial, and residential uses. For example, in a domestic setting, the installation cost of all heat pump types is contingent upon the size of the dwelling, the presence of extra ductwork, the kind of equipment, and the equipment's British Thermal Unit (BTU) value. It also relies on the heat pump's complexity, kind, name, and dimensions.

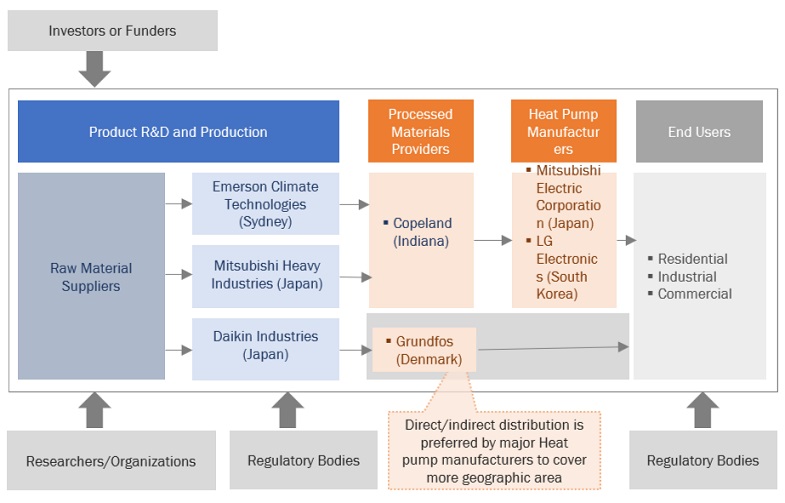

Heat Pump Market Ecosystem

In this market, prominent companies stand out as well-established and financially stable providers of Heat Pump products and services. With years of experience, these companies boast a diverse product portfolio, cutting-edge technologies, and robust global sales and marketing networks. Their proven track record in the industry positions them as reliable and trusted partners for customers seeking Heat pump solutions. These companies have demonstrated their ability to adapt to market dynamics and consistently deliver high-quality products and services, making them leaders in meeting the demands of the energy and power sector. Prominent companies in this market include SAMSUNG (South Korea), DENSO CORPORATION (Japan), Midea (China), Panasonic Holdings Corporation (Japan), and Mitsubishi Electric Corporation (Japan).

The Residential segment, by end user, is expected to be the largest market during the forecast period.

This report segments the heat pump market based on end user into three categories: residential, commercial, and industrial. The residential segment is expected to be the largest market during the forecast period. Heat pumps stand out as a preferred choice for compliance with these regulations due to their inherently high energy efficiency compared to traditional heating systems. They leverage renewable energy sources such as air, ground, or water heat, rather than relying solely on fossil fuels. As a result, heat pumps produce fewer greenhouse gas emissions and consume less energy to provide the same level of heating comfort.

By application, Heating application is expected to be the largest segment during the forecast period.

This report segments market based on application into two segments: Heating, Heating & Cooling. The Heating segment is expected to be the fastest-growing segment of the Heat Pump market during the forecast period. Heat Pump Standards and Certification play a crucial role in ensuring the quality, reliability, and interoperability of heat pump systems specifically designed for heating applications. These standards and certifications are essential components of the regulatory framework governing the heating industry, providing benchmarks for manufacturers, installers, and consumers alike.

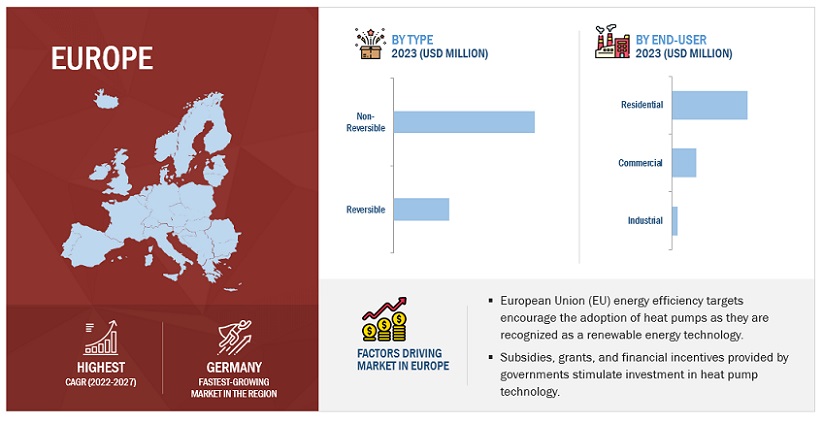

Europe: The fastest growing region in the Heat Pump Market.

Europe is expected to be the fastest growing region in the heat pump market between 2024–2029. In Europe, where ambitious renewable energy targets and decarbonization objectives are driving transformative shifts in energy systems, sector coupling initiatives play a pivotal role in maximizing the utilization of renewable energy resources and minimizing waste. One key aspect of sector coupling in Europe involves leveraging excess renewable energy generated from sources such as wind and solar power for heating purposes through the deployment of heat pump systems. This is especially pertinent in regions where renewable energy generation intermittency leads to periods of surplus electricity production. By integrating heat pumps with renewable energy sources, excess electricity can be efficiently converted into heat energy, which can then be utilized for space heating, water heating, and industrial processes.

Key Market Players

The market is dominated by a few major players that have a wide regional presence. The major players in the heat pump market include SAMSUNG (South Korea), DENSO CORPORATION (Japan), Midea (China), Panasonic Holdings Corporation (Japan), and Mitsubishi Electric Corporation (Japan). Between 2019 and 2023, Strategies such as new product launches, contracts, agreements, partnerships, collaborations, acquisitions, and expansions are followed by these companies to capture a larger share of the market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2019–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Value (USD Billion) |

|

Segments Covered |

Heat Pump Market by Technology, Type, Refrigerant, Rated Capacity, End User, Application, and Region. |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. |

|

Companies covered |

SAMSUNG (South Korea), DENSO CORPORATION (Japan), Midea (China), Panasonic Holdings Corporation (Japan), Mitsubishi Electric Corporation (Japan), LG Electronics (South Korea), Lennox International Inc (US), Fujitsu General (Japan), Daikin Industries, Ltd. (Japan) , Carrier (US), Johnson Controls (Europe), Thermax Limited (India), GEA Group Aktiengesellschaft (Germany), Trane Technologies plc, (Ireland), Bosch Thermotechnology Corp. (Germany), Guangzhou Sprsun New Energy Technology Development Co., Ltd (China), GLEN DIMPLEX GROUP (Ireland), NIBE Industry AB (Ireland), Rheem Manufacturing Company (US), Energen Hybrid Systems Limited (NewZealand), Evo Energy Technologies (Australia), Namma Swadeshi (India), EcoTech Solutions (India), DANDELION (US), Zealux Electric Limited (China). |

This research report categorizes the market based on Technology, Type, Refrigerant, Rated Capacity, End User, Application and region.

On the basis of Technology, the Heat Pump market has been segmented as follows:

- Air-to-Air Heat Pumps

- Air-to-Water Heat Pumps

- Water Source Heat Pumps

- Ground-source (Geothermal) Heat Pumps

- Hybrid Heat Pumps

- Photovoltaic-thermal (PVT) heat pumps

On the basis of Type, the Heat Pump market has been segmented as follows:

- Reversible Heat Pumps

- Non-Reversible Heat Pumps

On the basis of Refrigerant, the Heat Pump market has been segmented as follows:

- R410A

- R407C

- R744

- R290

- R717

- Other Refrigerants

On the basis of Rated Capacity, the Heat Pump market has been segmented as follows:

- Up to 10 kW

- 10-20 kW

- 20-30 kW

- ABOVE 30 kW

On the basis of End User, the Heat Pump market has been segmented as follows:

- Residential

- Commercial

- Industrial

On the basis of Application, the Heat Pump market has been segmented as follows:

- Heating

- Heating and Cooling

Based on region, the Heat Pump market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Recent Developments

- In November 2023, LG Electronics is setting up a research facility in Alaska, US, aimed at advancing its research and development in heating, ventilation, and air conditioning (HVAC). This initiative falls under the Consortium for Advanced Heat Pump Research (CAHR), a partnership between LG and local universities. The collaboration aims to bolster the competitiveness of LG's HVAC products by pioneering innovations in cold climate technology.

- In November 2023, Daikin Industries Ltd. launched new air-to-air heat pumps. The new products use difluoromethane (R32) as the refrigerant. The VRV 5 systems are available in two models – the Mini-VRV system with an output of up to 33.5 kW and the Top-Blow series reaching 56 kW. This new product launch will help the company to enhance its product portfolio in heat pump.

- In September 2023, Fujitsu General Australia and Fujitsu General New Zealand announced a new partnership with Sensibo to extend smart home air conditioning (AC) solutions to the Australian and New Zealand markets. Sensibo is a leading climate technology Internet of Things (IoT) company that develops smart AC and heat pump solutions.

- In March 2023, Mitsubishi Electric developed an air-source heat pump that uses propane (R290) as the refrigerant. It can produce between 5 kW and 8.5 kW of heat and domestic hot water to a temperature of up to 75 C.

Frequently Asked Questions (FAQ):

What is the current size of the Heat Pump market?

The current market size of the heat pump market is USD 90.1 billion in 2024.

What are the major drivers for the Heat Pump market?

Government subsidies, tax credits, and rebates for the installation of heat pumps are incentivizing consumers to adopt this technology are some of the major drivers for the heat pump market.

Which is the largest region during the forecasted period in the heat pump market?

Asia Pacific is expected to dominate the Heat Pump market between 2024–2029, followed by Europe and North America.

Which is the largest segment, by type, during the forecasted period in the heat pump market?

The Non-Reversible segment is expected to be the largest market during the forecast period owing to the relatively mature and cost-effective technology.

Which is the largest segment, by application, during the forecasted period in the heat pump market?

Heating is expected to be the largest market during the forecast period by application. The growth is attributed due to the penetration of renewables in the energy system. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

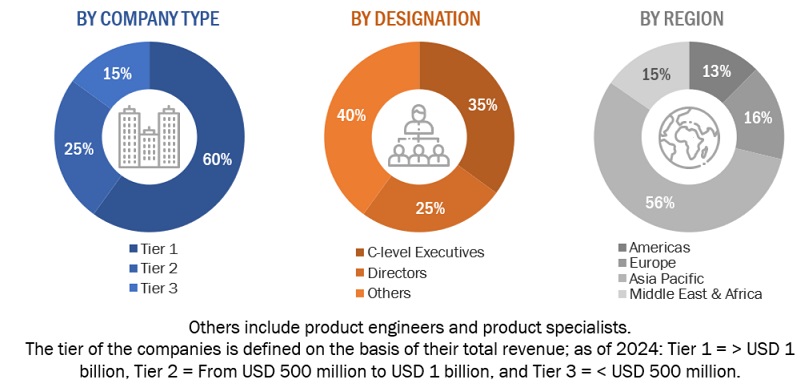

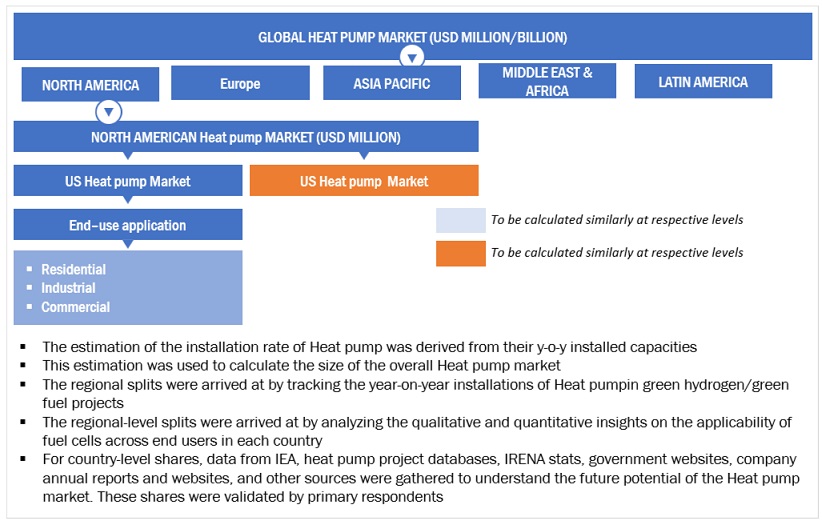

The study involved major activities in estimating the current size of the heat pump market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the market involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg, Factiva, IRENA, International Energy Agency, and Statista Industry Journal, to collect and identify information useful for a technical, market-oriented, and commercial study of the heat pumps market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The heat pump market comprises several stakeholders, such as heat pump manufacturers, technology providers, and technical support providers in the supply chain. The demand side of this market is characterized by the rising demand for heating and cooling solutions in various applications such as energy, mobility, industrial, and grid injection. The supply side is characterized by rising demand for contracts from the industrial sector and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

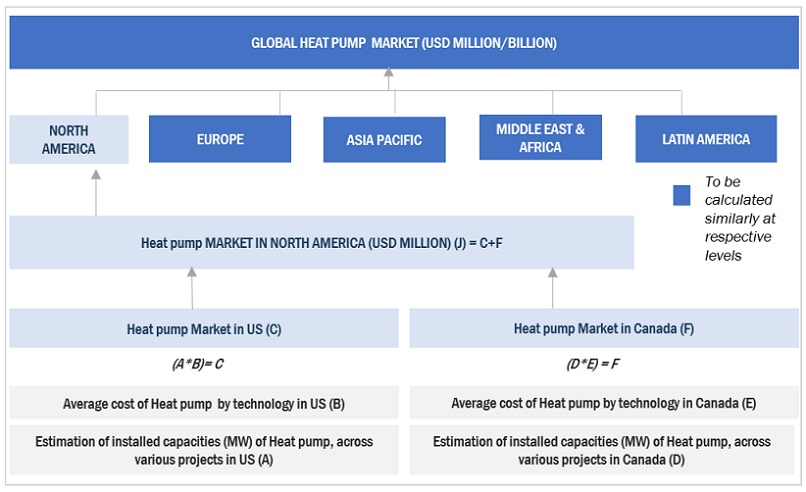

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the heat pumps market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share has been determined through primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through both primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Heat Pump Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Heat Pump Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the above estimation process, the total market has been split into several segments and subsegments. Data triangulation and market breakdown processes have been employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

A heat pump is an electrical device that uses electricity to transfer heat from one place to another. Refrigerants play a key role in the movement of heat from one set of coils in the heat pump to another. Thus, the heat exchange process allows the heat pump to warm the room/building/facility during the winter and cool during the summer. The heat pump has four main components—an evaporator, a condenser, a compressor, and an expansion device. Refrigerant is the working fluid that passes through all these components. The heat pump only transfers heat and does not generate it. It is considered an energy-efficient alternative to furnaces and air conditioners in all climates.

Key Stakeholders

- Maintenance and other major service providers

- Heat pump component manufacturers

- Government and research organizations

- Institutional investors

- National and local government organizations

- Heat pump equipment manufacturers

- Heat pump manufacturing companies

- Technology standard organizations, forums, alliances, and associations

State and national regulatory authorities Objectives of the Study

- To define, describe, segment, and forecast the Heat Pump market size, by type, refrigerant, rated capacity, end user and application, in terms of value.

- To forecast the Heat Pump market size, by technology, in terms of volume.

- To forecast the market size across five key regions: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, along with country-level analysis, in terms of value and volume.

- To describe key elements required to manufacture a Heat pump.

- To provide statistical data for installed Heat Pump capacity for each region and country.

- To provide detailed information regarding key drivers, restraints, opportunities, and challenges influencing the market growth.

- To provide the supply chain analysis, trends/disruptions impacting customer business, market mapping, pricing analysis, and regulatory landscape pertaining to the market.

- To strategically analyze the ecosystem, standards and regulations, patent analysis, trade analysis, Porter’s five forces, and case studies pertaining to the market under study.

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, contributions to the overall market size.

- To analyze opportunities for stakeholders in the market and draw a competitive landscape for market players.

- To benchmark players within the market using the company evaluation matrix, which analyzes market players based on several parameters within the broad categories of business and product strategies.

- To compare the key market players with respect to the market share, product specifications, and applications.

- To strategically profile the key players and comprehensively analyze their market ranking and core competencies.

- To analyze competitive developments in the market, such as contracts, agreements, investments, expansions, product launches, partnerships, joint ventures, and collaborations.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Heat Pump Market

We want to know the competitive scenario for the Heat Pump Market? and the Top vendors in the Heat Pump Industry for the Forecast period 2022 to 2026.