Hot Melt Adhesive Tapes Market by Adhesive Resin (Rubber, Silicone), Backing Material (PP, Polyester), Product Type (Commodity, Specialty), Application (Packaging, Consumer & DIY, Masking, Healthcare & Hygiene) and Region - Global Forecast to 2024

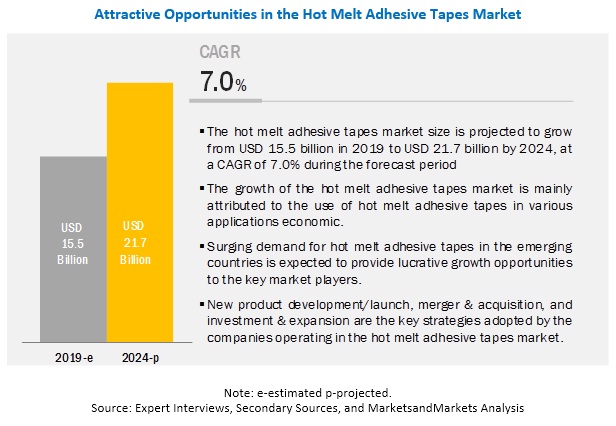

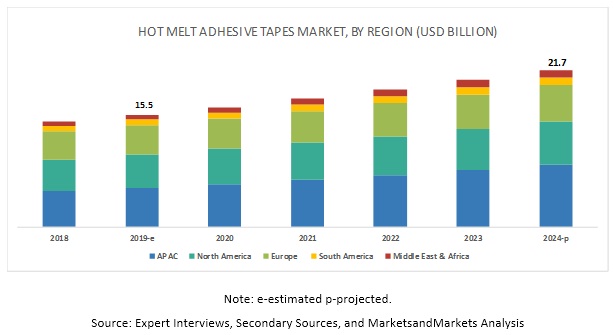

[149 Pages Report] The hot melt adhesive tapes market size is projected to grow from USD 15.5 billion in 2019 to USD 21.7 billion by 2024, at a CAGR of 7.0%, during the forecast period. The market is witnessing a high growth due to the growing use of hot melt adhesive tapes in diverse applications. The increasing adoption of hot melt adhesive technology is also leading to the growth of the market.

The rubber segment accounted for the largest share of the hot melt adhesive tapes market in 2018.

The rubber segment is projected to account for the largest share in 2024 because of its use in major hot melt adhesive tapes. Rubber possesses characteristics, such as high tack and peel strength, due to their ability to adhere well to several non-polar, low-energy surfaces, including polyethylene, and PP. These tapes possess high peel strength, versatility in a formulation, and good electrical and thermal insulation properties. The cost of rubber-based adhesive tapes is very low as compared to the silicone- and acrylic-based adhesive tapes.

APAC is projected to be the largest hot melt adhesive tapes market.

APAC is projected to be the largest and fastest-growing market, in terms of volume and value, during the forecast period. This growth is driven by rapidly rising household income and the fast-growing middle-class population, which has boosted the demand in packaging and DIY, among other applications, in the hot melt adhesive tapes market.

Key Market Players

The 3M Company (US), Nitto Denko Corporation (Japan), tesa SE (Germany), Avery Dennison Corporation (US), Intertape Polymer Group Inc. (Canada), Shurtape Technologies, LLC (US), Scapa Group plc (UK), LINTEC Corporation (Japan), ACHEM Technology Corporation (Taiwan), TE Connectivity Ltd (Switzerland) are some of the players operating in the global market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Years considered for the study |

20172024 |

|

Base year |

2018 |

|

Forecast period |

20192024 |

|

Units considered |

Value (USD Million) and Volume (Kiloton) |

|

Segments |

Adhesive Resin, Backing Material, Product Type, Application, and Region |

|

Regions |

APAC, North America, Europe, the Middle East & Africa, and South America |

|

Companies |

The 3M Company (US), Nitto Denko Corporation (Japan), tesa SE (Germany), Avery Dennison Corporation (US), and Intertape Polymer Group Inc. (Canada). |

This research report categorizes the hot melt adhesive tapes market based on adhesive resin, backing material, product type, application, and region.

On the basis of adhesive resin type, the hot melt adhesive tapes market has been segmented as follows:

- Rubber

- Silicone

- Others (Polyamide, Polyolefin, and Polyurethane)

On the basis of backing material, the hot melt adhesive tapes market has been segmented as follows:

- Polypropylene

- Polyesters

- Others (Polyethylene, PVC, Polyamide, Foam, Glass Fiber, Metal, Polyolefin, Synthetic Paper, Synthetic Cloth, and Polyimide)

On the basis of product type, the hot melt adhesive tapes market has been segmented as follows:

- Commodity tapes

- Specialty tapes

On the basis of application, the hot melt adhesive tapes market has been segmented as follows:

- Packaging

- Consumer & DIY

- Masking

- Healthcare & Hygiene

- Others (Electrical & Electronics, Building & Construction, and Automotive)

On the basis of region, the hot melt adhesive tapes market has been segmented as follows:

- APAC

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments

- In December 2016, LINTEC Corporation acquired MACtac Americas Holdings, LLC, manufacturer and distributor of adhesive papers and films for printing in the US to get a full-scale entry into the North American market.

- In July 2016, the company made a USD 20 million expansion by adding 24,000 square feet to its current Sparta facility. This facility is expected to add to the production of strapping tapes and acrylic adhesives, which will be used for healthcare applications of the hot melt-based adhesive tapes.

Key Questions Addressed by the Report

- What is the mid-to-long term impact of the developments undertaken in the industry?

- What are the upcoming applications of hot melt adhesive tapes?

- Which segment has the potential to register the highest market share?

- What is the current competitive landscape in the hot melt adhesive tapes market in terms of new technologies, production, and sales?

- What will be the growth prospects of the hot melt adhesive tapes market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Hot Melt Adhesive Tapes Market Segmentation

1.3.2 Regions Covered

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions for the Study

2.5 Limitations of the Study

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 34)

4.1 Attractive Opportunities in the Hot Melt Adhesive Tapes Market

4.2 Hot Melt Adhesive Tapes Market, By Adhesive Resin Type

4.3 APAC Hot Melt Adhesive Tapes Market, By Application and Country

4.4 Overview of Hot Melt Adhesive Tapes Market

4.5 Hot Melt Adhesive Tapes Market: Developed vs. Developing Countries

4.6 Hot Melt Adhesive Tapes Market: Growing Demand From APAC

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Adoption of Hot Melt Adhesive Technology

5.2.1.2 Growing Use of Hot Melt Adhesive Tapes in Diverse Applications

5.2.2 Restraints

5.2.2.1 Lower thermal Resistance Than Solvent-Based and Water-Based Adhesive Tapes

5.2.2.2 Volatility in Raw Material Prices Leading to Fluctuation in Demand for Hot Melt Adhesive Tapes

5.2.3 Opportunities

5.2.3.1 Growing Packaging Market in Emerging Economies

5.2.4 Challenges

5.2.4.1 Limited Use in High-Temperature Applications

5.3 Porters Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Suppliers

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

5.4 Macro Indicator Analysis

5.4.1 Introduction

5.4.2 Trends and Forecast of GDP

5.4.3 Trends in the Packaging Industry

5.4.4 Economic & Demographic Indicators

5.4.4.1 Economic & Demographic Indicators of US

5.4.4.2 Economic & Demographic Indicators of Germany

5.4.4.3 Economic & Demographic Indicators of China

5.4.4.4 Economic & Demographic Indicators of India

6 Hot Melt Adhesive Tapes Market, By Adhesive Resin Type (Page No. - 48)

6.1 Introduction

6.2 Rubber

6.2.1 SBC is the Major Rubber Resin Widely Used in Hot Melt Adhesive Tapes

6.3 Silicone

6.3.1 Excellent Performance of Silicone-Based Hot Melt Adhesive Tapes on Low Surface Energy Substrates is Expected to Drive their Demand

6.4 Others

7 Hot Melt Adhesive Tapes Market, By Backing Material (Page No. - 54)

7.1 Introduction

7.2 Polypropylene

7.2.1 Polypropylene as A Backing Material is Excellent for High Volume Sealing

7.3 Polyester

7.3.1 Low Absorption Properties of Polyester are Supporting Its Demand in Hot Melt Adhesive Tapes

7.4 Others

8 Hot Melt Adhesive Tapes Market, By Tape Type (Page No. - 59)

8.1 Introduction

8.2 Single-Sided Tape

8.3 Others

8.3.1 Double-Sided Tape

8.3.2 Transfer Tape

9 Hot Melt Adhesive Tapes Market, By Product Type (Page No. - 61)

9.1 Introduction

9.2 Commodity Tapes

9.2.1 Demand for Commodity Hot Melt Adhesive Tapes is Estimated to Grow in the Packaging and Retail Sectors

9.3 Specialty Tapes

9.3.1 The Growing Healthcare and Electrical & Electronic Industries are Generating Demand for Specialty Hot Melt Adhesive Tapes

10 Hot Melt Adhesive Tapes Market, By Application (Page No. - 65)

10.1 Introduction

10.2 Packaging

10.2.1 Hot Melt Adhesive Tapes Have an Array of Packaging Applications

10.3 Consumer & Diy

10.3.1 Gardening, Crafting, and Small Construction & Furniture Projects are the Major Consumer & Diy Applications of Hot Melt Adhesive Tapes

10.4 Masking

10.4.1 APAC is the Largest Consumer of Masking Adhesive Tapes

10.5 Healthcare & Hygiene

10.5.1 Ease of Use and Removal, Reduced Risk of Infection, and Easy Availability are Driving the Demand

10.6 Others

10.6.1 Automotive

10.6.2 Building & Construction

10.6.3 Electrical & Electronics

11 Hot Melt Adhesive Tapes Market, By Region (Page No. - 73)

11.1 Introduction

11.2 APAC

11.2.1 China

11.2.1.1 Growth in Various Sectors is Driving the Chinese Hot Melt Adhesive Tapes Market

11.2.2 India

11.2.2.1 A Boom in the Packaging Industry is Expected to Boost the Hot Melt Adhesive Tapes Market

11.2.3 Japan

11.2.3.1 Highest Per Capita Consumption in the Packaging Industry is Expected to Boost the Demand for Hot Melt Adhesive Tapes

11.2.4 South Korea

11.2.4.1 South Korea is the Fourth-Largest Market for Hot Melt Adhesive Tapes in APAC

11.2.5 Indonesia

11.2.5.1 Availability of Cheaper Raw Materials and Labor in Comparison to Other APAC Countries is A Driver for the Market

11.2.6 Taiwan

11.2.6.1 Adhesive Tapes Export Volume is Higher Than Domestic Sales in Taiwan

11.2.7 Vietnam

11.2.7.1 High Growth of the Economy is Supporting the Market for Hot Melt Adhesive Tapes Indirectly

11.2.8 Rest of APAC

11.3 North America

11.3.1 US

11.3.1.1 Changing Lifestyle, Increasing Purchasing Power, and Growing Demand for Packaging Goods are Boosting the Hot Melt Adhesive

Tapes Market

11.3.2 Canada

11.3.2.1 The Packaging Industry is the Major Contributor to the Hot Melt Adhesive Tapes Market Growth

11.3.3 Mexico

11.3.3.1 Proximity to the US, Rising Population, and Changing Lifestyle are Influencing the Hot Melt Adhesive Tapes Market

11.4 Europe

11.4.1 Germany

11.4.1.1 Growing Plastic Packaging Applications are Expected to Boost the Demand for Hot Melt Adhesive Tapes

11.4.2 Russia

11.4.2.1 Growth of the E-Commerce Industry is Likely to Drive the Packaging Industry and thereby the Hot Melt Adhesive Tapes Market

11.4.3 UK

11.4.3.1 The Growing Packaging and Construction Industries are Boosting the Demand for Hot Melt Adhesive Tapes

11.4.4 France

11.4.4.1 Reviving Economy, Coupled With the Demand From Key Industries, is Expected to Influence the Demand for Hot Melt Adhesive

Tapes Positively 93

11.4.5 Italy

11.4.5.1 Growth of the Consumer and Industrial Sectors is to Likely to Influence the Hot Melt Adhesive Tapes Market

11.4.6 Spain

11.4.6.1 Growth in the Packaging Industry is Expected to Drive the Market for Hot Melt Adhesive Tapes

11.4.7 Turkey

11.4.7.1 Growth of the Healthcare Industry Triggered By the Growing Aging Population is Supporting the Market Growth

11.4.8 Rest of Europe

11.5 Middle East & Africa

11.5.1 Saudi Arabia

11.5.1.1 Growth in Packaging and Construction Industries is Estimated to Increase the Hot Melt Adhesive Tapes Demand

11.5.2 South Africa

11.5.2.1 Low Production Costs and Access to New Markets Favor the Market Growth in This Country

11.5.3 Rest of Middle East & Africa

11.6 South America

11.6.1 Brazil

11.6.1.1 Packaging and Construction, Among Other Industries, are Likely to Be the Major Consumers of Hot Melt Adhesive Tapes

11.6.2 Argentina

11.6.2.1 Increase in Population and Improved Economic Conditions are Expected to Lead to High Demand for Hot Melt Adhesive Tapes

11.6.3 Rest of South America

12 Competitive Landscape (Page No. - 104)

12.1 Overview

12.2 Competitive Leadership Mapping, 2018

12.2.1 Visionary Leaders

12.2.2 Innovators

12.2.3 Dynamic Differentiators

12.2.4 Emerging Companies

12.3 Competitive Benchmarking

12.3.1 Strength of Product Portfolio

12.3.2 Business Strategy Excellence

12.4 Market Ranking of Key Players

12.5 Competitive Situation & Trends

12.5.1 Investment & Expansion

12.5.2 Merger & Acquisition

12.5.3 New Product Launch

13 Company Profiles (Page No. - 112)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

13.1 3M Company

13.2 Nitto Denko Corporation

13.3 Tesa SE

13.4 Avery Dennison Corporation

13.5 Intertape Polymer Group, Inc.

13.6 Scapa Group Plc

13.7 TE Connectivity Ltd.

13.8 Lintec Corporation

13.9 Shurtape Technologies, LLC

13.10 ACHEM

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13.11 Other Companies

13.11.1 Vibac Group

13.11.2 Advance Tapes International

13.11.3 American Biltrite Inc.

13.11.4 Industrias Tuk, S.A. De C.V. (Hystik Adhesive Tapes)

13.11.5 American Casting Mfg.

13.11.6 Atlas Tapes

13.11.7 Fabo S.P.A.

13.11.8 General Sealants Inc.

13.11.9 Irplast S.P.A.

13.11.10 Nar S.P.A.

13.11.11 Pitamas

13.11.12 PPM Industries

13.11.13 Pro Tapes & Specialties, Inc.

13.11.14 Tape Dynasty

14 Appendix (Page No. - 143)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets Subscription Portal

14.3 Available Customizations

14.4 Related Reports

14.5 Author Details

List of Tables (93 Tables)

Table 1 Hot Melt Adhesive Tapes Market Snapshot, 2019 vs. 2024

Table 2 Major Players Profiled in This Report

Table 3 GDP Percentage Change of Key Countries, 20192024

Table 4 Global Flexible Packaging Production (Volume), By Region

Table 5 Hot Melt Adhesive Tapes Market Size, By Adhesive Resin Type, 20172024 (USD Million)

Table 6 Hot Melt Adhesive Tape Market Size, By Adhesive Resin Type, 20172024 (Msm)

Table 7 Rubber: Hot Melt Adhesive Tapes Market Size, By Region, 20172024 (USD Million)

Table 8 Rubber: Hot Melt Adhesive Tape Market Size, By Region, 20172024 (Msm)

Table 9 Silicone: Hot Melt Adhesive Tapes Market Size, By Region, 20172024 (USD Million)

Table 10 Silicone: Hot Melt Adhesive Tape Market Size, By Region, 20172024 (Msm)

Table 11 Others: Hot Melt Adhesive Tapes Market Size, By Region, 20172024 (USD Million)

Table 12 Others: Hot Melt Adhesive Tape Market Size, By Region, 20172024 (Msm)

Table 13 Hot Melt Adhesive Tapes Market Size, By Backing Material, 20172024 (USD Million)

Table 14 Hot Melt Adhesive Tape Market Size, By Backing Material, 20172024 (Msm)

Table 15 PP: Hot Melt Adhesive Tapes Market Size, By Region, 20172024 (USD Million)

Table 16 PP: Hot Melt Adhesive Tape Market Size, By Region, 20172024 (Msm)

Table 17 Polyester: Hot Melt Adhesive Tapes Market Size, By Region, 20172024 (USD Million)

Table 18 Polyester: Hot Melt Adhesive Tape Market Size, By Region, 20172024 (Msm)

Table 19 Others: Hot Melt Adhesive Tapes Market Size, By Region, 20172024 (USD Million)

Table 20 Others: Hot Melt Adhesive Tape Market Size, By Region, 20172024 (Msm)

Table 21 Hot Melt Adhesive Tapes Market Size, By Product Type, 20172024 (USD Million)

Table 22 Hot Melt Adhesive Tape Market Size, By Product Type, 20172024 (Msm)

Table 23 Commodity Adhesive Tapes Market Size, By Region, 20172024 (USD Million)

Table 24 Commodity Adhesive Tapes Market Size, By Region, 20172024 (Msm)

Table 25 Specialty Adhesive Tapes Market Size, By Region, 20172024 (USD Million)

Table 26 Specialty Adhesive Tapes Market Size, By Region, 20172024 (Msm)

Table 27 Hot Melt Adhesive Tapes Market Size, By Application, 20172024 (USD Million)

Table 28 Hot Melt Adhesive Tape Market Size, By Application, 20172024 (Msm)

Table 29 Hot Melt Adhesive Tapes Market Size in Packaging Application, By Region, 20172024 (USD Million)

Table 30 Hot Melt Adhesive Tape Market Size in Packaging Application, By Region, 20172024 (Msm)

Table 31 Hot Melt Adhesive Tapes Market Size in Consumer & Diy Application, By Region, 20172024 (USD Million)

Table 32 Hot Melt Adhesive Tape Market Size in Consumer & Diy Application, By Region, 20172024 (Msm)

Table 33 Hot Melt Adhesive Tapes Market Size in Masking Application, By Region, 20172024 (USD Million)

Table 34 Hot Melt Adhesive Tape Market Size in Masking Application, By Region, 20172024 (Msm)

Table 35 Hot Melt Adhesive Tapes Market Size in Healthcare & Hygiene Application, By Region, 20172024 (USD Million)

Table 36 Hot Melt Adhesive Tape Market Size in Healthcare & Hygiene Application, By Region, 20172024 (Msm)

Table 37 Hot Melt Adhesive Tapes Market Size in Other Applications, By Region, 20172024 (USD Million)

Table 38 Hot Melt Adhesive Tape Market Size in Other Applications, By Region, 20172024 (Msm)

Table 39 Hot Melt Adhesive Tapes Market Size, By Region, 20172024 (USD Million)

Table 40 Hot Melt Adhesive Tapes Market Size, By Region, 20172024 (Msm)

Table 41 APAC: Hot Melt Adhesive Tapes Market Size, By Country, 20172024 (USD Million)

Table 42 APAC: Hot Melt Adhesive Tape Market Size, By Country, 20172024 (Msm)

Table 43 APAC: Market Size, By Product Type, 20172024 (USD Million)

Table 44 APAC: Market Size, By Product Type, 20172024 (Msm)

Table 45 APAC: Market Size, By Backing Material, 20172024 (USD Million)

Table 46 APAC: Market Size, By Backing Material, 20172024 (Msm)

Table 47 APAC: Market Size, By Adhesive Resin Type, 20172024 (USD Million)

Table 48 APAC: Market Size, By Adhesive Resin Type, 20172024 (Msm)

Table 49 APAC: Market Size, By Application, 20172024 (USD Million)

Table 50 APAC: Market Size, By Application, 20172024 (Msm)

Table 51 North America: Hot Melt Adhesive Tapes Market Size, By Country, 20172024 (USD Million)

Table 52 North America: Market Size, By Country, 20172024 (Msm)

Table 53 North America: Market Size, By Product Type, 20172024 (USD Million)

Table 54 North America: Market Size, By Product Type, 20172024 (Msm)

Table 55 North America: Market Size, By Backing Material, 20172024 (USD Million)

Table 56 North America: Market Size, By Backing Material, 20172024 (Msm)

Table 57 North America: Market Size, By Adhesive Resin Type, 20172024 (USD Million)

Table 58 North America: Market Size, By Adhesive Resin Type, 20172024 (Msm)

Table 59 North America: Market Size, By Application, 20172024 (USD Million)

Table 60 North America: Market Size, By Application, 20172024 (Msm)

Table 61 Europe: Hot Melt Adhesive Tapes Market Size, By Country, 20172024 (USD Million)

Table 62 Europe: Hot Melt Adhesive Tape Market Size, By Country, 20172024 (Msm)

Table 63 Europe: Market Size, By Product Type, 20172024 (USD Million)

Table 64 Europe: Market Size, By Product Type, 20172024 (Msm)

Table 65 Europe: Market Size, By Backing Material, 20172024 (USD Million)

Table 66 Europe: Market Size, By Backing Material, 20172024 (Msm)

Table 67 Europe: Market Size, By Adhesive Resin Type, 20172024 (USD Million)

Table 68 Europe: Market Size, By Adhesive Resin Type, 20172024 (Msm)

Table 69 Europe: Market Size, By Application, 20172024 (USD Million)

Table 70 Europe: Market Size, By Application, 20172024 (Msm)

Table 71 Middle East & Africa: Hot Melt Adhesive Tapes Market Size, By Country, 20172024 (USD Million)

Table 72 Middle East & Africa: Hot Melt Adhesive Tape Market Size, By Country, 20172024 (Msm)

Table 73 Middle East & Africa: Market Size, By Product Type, 20172024 (USD Million)

Table 74 Middle East & Africa: Market Size, By Product Type, 20172024 (Msm)

Table 75 Middle East & Africa: Market Size, By Backing Material, 20172024 (USD Million)

Table 76 Middle East & Africa: Market Size, By Backing Material, 20172024 (Msm)

Table 77 Middle East & Africa: Market Size, By Adhesive Resin Type, 20172024 (USD Million)

Table 78 Middle East & Africa: Market Size, By Adhesive Resin Type, 20172024 (Msm)

Table 79 Middle East & Africa: Market Size, By Application, 20172024 (USD Million)

Table 80 Middle East & Africa: Market Size, By Application, 20172024 (Msm)

Table 81 South America: Hot Melt Adhesive Tapes Market Size, By Country, 20172024 (USD Million)

Table 82 South America: Hot Melt Adhesive Tape Market Size, By Country,20172024 (Msm)

Table 83 South America: Market Size, By Product Type, 20172024 (USD Million)

Table 84 South America: Market Size, By Product Type, 20172024 (Msm)

Table 85 South America: Market Size, By Backing Material, 20172024 (USD Million)

Table 86 South America: Market Size, By Backing Material, 20172024 (Msm)

Table 87 South America: Market Size, By Adhesive Resin Type, 20172024 (USD Million)

Table 88 South America: Market Size, By Adhesive Resin Type, 20172024 (Msm)

Table 89 South America: Market Size, By Application, 20172024 (USD Million)

Table 90 South America: Market Size, By Application, 20172024 (Msm)

Table 91 Investment & Expansion (20152018)

Table 92 Merger & Acquisition (20152018)

Table 93 New Product Launch (20152018)

List of Figures (40 Figures)

Figure 1 Hot Melt Adhesive Tapes Market: Research Design

Figure 2 Hot Melt Adhesive Tape Market: Bottom-Up Approach

Figure 3 Hot Melt Adhesive Tapes Market: Top-Down Approach

Figure 4 Hot Melt Adhesive Tape Market: Data Triangulation

Figure 5 Rubber Was the Largest Resin Type for Hot Melt Adhesive Tapes in 2018

Figure 6 Specialty Tapes Accounted for the Largest Share of the Hot Melt Adhesive Tapes Market in 2018

Figure 7 Healthcare & Hygiene Was the Largest Application of Hot Melt Adhesive Tapes in 2018

Figure 8 APAC to Be the Fastest-Growing Hot Melt Adhesive Tapes Market

Figure 9 APAC Accounted for the Largest Market Share in 2018

Figure 10 Hot Melt Adhesive Tapes Market to Witness Moderate Growth Between 2019 and 2024

Figure 11 Rubber to Be the Fastest-Growing Segment of theHot Melt Adhesive Tapes Market

Figure 12 Packaging Application and China Accounted for the Largest Share in the APAC Hot Melt Adhesive Tapes Market

Figure 13 India to Emerge as A Lucrative Market for Hot Melt Adhesive Tapes

Figure 14 Developing Markets to Grow Faster Than Developed Markets

Figure 15 China to Account for the Largest Market Share

Figure 16 Drivers, Restraints, Opportunities, and Challenges in the Hot Melt Adhesive Tapes Market

Figure 17 Porters Five Forces Analysis for the Hot Melt Adhesive Tapes Market

Figure 18 Global Packaging Production Overview, By Type (2017)

Figure 19 Rubber Was the Largest Adhesive Resin Type for Hot Melt Adhesive Tapes in 2018

Figure 20 Polypropylene Segment Accounted for the Largest Market Share in 2018

Figure 21 India to Register the Highest Cagr

Figure 22 APAC: Hot Melt Adhesive Tapes Market Snapshot

Figure 23 North America: Hot Melt Adhesive Tapes Market Snapshot

Figure 24 Europe: Hot Melt Adhesive Tapes Market Snapshot

Figure 25 Companies Adopted Merger & Acquisition as the Key Strategy Between 2015 and 2018

Figure 26 Hot Melt Adhesive Tapes Market: Competitive Leadership Mapping, 2018

Figure 27 3M: Company Snapshot

Figure 28 3M: SWOT Analysis

Figure 29 Nitto Denko Corporation: Company Snapshot

Figure 30 Nitto Denko Corporation: SWOT Analysis

Figure 31 Tesa SE: Company Snapshot

Figure 32 Tesa SE: SWOT Analysis

Figure 33 Avery Dennison Corporation: Company Snapshot

Figure 34 Avery Dennison Corporation: SWOT Analysis

Figure 35 Intertape Polymer Group: Company Snapshot

Figure 36 Intertape Polymer Group: SWOT Analysis

Figure 37 Scapa Group: Company Snapshot

Figure 38 Scapa Group: SWOT Analysis

Figure 39 TE Connectivity: Company Snapshot

Figure 40 Lintec Corporation: Company Snapshot

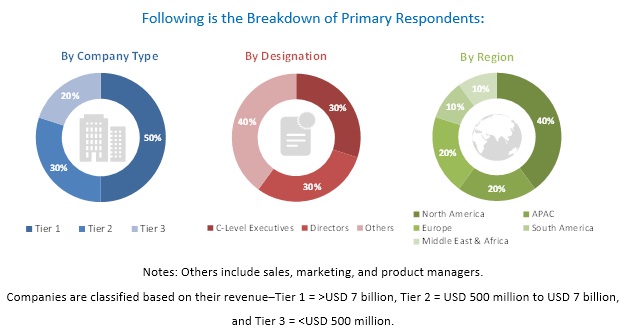

The study involved four major activities in estimating the current market size of hot melt adhesive tapes. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and subsegments of the overall market.

Secondary Research

This research report involves the use of extensive secondary sources, directories, and databases, such as Bloomberg, BusinessWeek, Factiva, ICIS, and OneSource to identify and collect information useful for the technical, market-oriented, and commercial study of the hot melt adhesive tapes market. The secondary sources included annual reports, press releases & investor presentations of companies, white papers, solvent journals, certified publications, and articles from recognized authors, authenticated directories, and databases.

Primary Research

The hot melt adhesive tapes market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations. The demand side of this market is characterized by the development of the end-use industries, such as packaging, masking, DIY, and healthcare. The supply side included industry experts, such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the hot melt adhesive tapes market. These methods were also used extensively to estimate the sizes of various subsegments in the market. The research methodology used to estimate the market size includes the following steps:

- The key players in the industry and markets were identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the estimation processes explained above-the market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To analyze and forecast the hot melt adhesive tapes market, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze and forecast the size of the market on the basis of adhesive resin, backing material, product type, application, and region

- To estimate and forecast the market size on the basis of five regions, namely, Asia Pacific (APAC), North America, Europe, the Middle East & Africa, and South America

- To estimate and forecast the hot melt adhesive tapes market at the country-level in each of the regions

- To analyze the market opportunities and competitive landscape of the market leaders and stakeholders

- To analyze the competitive developments, such as new product launch, investment & expansion, and merger & acquisition, in the hot melt adhesive tapes market

- To strategically identify and profile the key market players and analyze their core competencies

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- A further breakdown of the hot melt adhesive tapes market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Hot Melt Adhesive Tapes Market