Hub Motor Market by Installation (Front & Rear), Vehicle (E-Bikes, E-Scooters/Mopeds, and E-Motorcycles), Motor (Geared and Gearless), Sales Channel (OE and Aftermarket), Power Output (Below 1000 W, 10003000 W, and Above 3000 W), and Region - Global Forecast to 2025

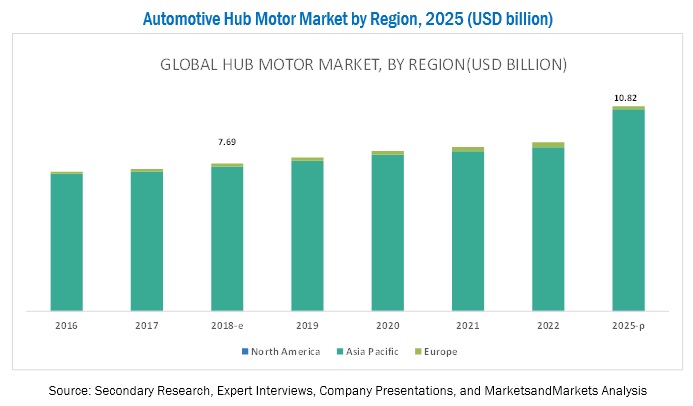

[105 Pages Report] The global hub motor market is projected to grow at a CAGR of 5.01% during the forecast period to reach USD 10.82 billion by 2025 from an estimated USD 7.69 billion in 2018. Hub motor improves the performance of electric vehicles. Hub motor helps supply torque to its associated tire and generates more power to improve the efficiency of a vehicle. The other benefits of hub motor technology is that it provides a pleasant and an effortless ride, e.g. in case of bicycles when a rider does not feel like pedaling.

Electric bikes account for largest market size during forecast period

The electric bikes segment is estimated to be the largest of the global hub motor market in 2018. The market growth of hub motors can be attributed to factors such as high torque, increased power, and provision of better vehicle handling to both new and existing vehicles. The increasing support from governments in France and Norway and the OEMs efforts to improve the existing electric two wheelers models are expected to drive the sales of electric bikes during the forecast period, which, in turn, would boost the demand for hub motors for electric bikes.

By Installation type, rear hub motor is expected to be the largest contributor in the hub motor market during the forecast period.

Rear hub motors are predominantly used in the global hub motor market. This type of installation provides powerful acceleration, better traction, and high flexibility. The powerful hub motors are appropriate for rear installation because higher power can be better handled in the rear wheel of the e-bikes. Major electric two wheeler manufacturers prefer installing hub motors in the rear wheel to take advantage of the traction control.

In motor type, geared hub motor is expected to grow at the fastest rate during the forecast period.

The geared hub motor is the largest and the fastest growing segment for motor type in the global hub motor market as it controls the speed of a vehicle. Geared hub motors provide high torque which helps in driving on mountains or hills. Asia Pacific is the largest market for geared hub motor. Geared hub motors are lighter in weight and smaller in size; hence, their major application is in e-bikes. The increasing sales of e-bikes in the Asia Pacific region will boost the demand for geared hub motor in this region.

Asia Pacific is expected to account for the largest market size during the forecast period

Asia Pacific is the largest hub motor market. China is the largest market in Asia Pacific because it is promoting the use of electric two wheelers to lower the rising pollution and vehicle emissions in the country. It is the worlds largest producer of e-bikes. Increase in sales of electric two wheelers will lead to the increase in sales of hub motors. For instance, NTN has developed the air-cooled in-wheel motor driving system and vehicle motion control system and concluded with FSAT, which is a Chinese company for designing and manufacturing automobile. NTN will provide technical support to FSAT for producing lightweight New Energy Vehicles (NEVs), which adopt in-wheel motor driving systems.

The global hub motor market is dominated by major players such as QS Motor (China), Schaeffler Technologies (Germany), Michelin (France), Jiashan Neopower International Trade (China), and Elaphe (Slovenia). These companies have strong distribution networks at the global level. In addition, these companies offer an extensive product range in the OEMs. The key strategies adopted by these companies to sustain their market position are new product developments, collaborations, and contracts & agreements.

Critical Questions:

- Where will the electric two wheelers sales take the industry in the long term?

- Will the industry cope with the challenge of high cost of the hub motor market?

- How do you see the impact of the additional weight of hub motors?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Hub Motor Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Hub Motor Market Size Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Market Breakdown and Data Triangulation

2.6 Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities in the Hub Motor Market

4.2 Asia Pacific to Lead the Global Market By 2025

4.3 Market, By Power Output Type, 2018

4.4 Market, By Installation Type, 2018 vs 2025

4.5 Market, By Motor Type

4.6 Market, By Vehicle Type

5 Hub Motor Market Overview (Page No. - 32)

5.1 Introduction

5.2 Hub Motor Market Dynamics

5.2.1 Drivers

5.2.1.1 Increased Performance Efficiency of A Vehicle

5.2.1.2 Increases Range of A Vehicle

5.2.2 Restraints

5.2.2.1 Mid-Drive Motors as an Alternative Option

5.2.3 Opportunities

5.2.3.1 Increasing Sales of Electric Two Wheelers Globally

5.2.4 Challenges

5.2.4.1 Increase in Unsprung Weight of the Wheel

5.2.4.2 High Cost

6 Industry Trends (Page No. - 36)

6.1 Mid-Drive Motor

6.1.1 Major Applications of Mid-Drive Motor

6.2 Neighborhood Electric Vehicle (NEV)

7 Hub Motor Market, By Vehicle Type (Page No. - 38)

7.1 Introduction

7.2 E-Bikes

7.2.1 Increasing Popularity of E-Bikes Will Boost the Demand for Hub Motors

7.3 E-Scooters/Mopeds

7.3.1 Growing Use of E-Scooters/Mopeds as Alternative Transport Mobility Will Boost the Demand

7.4 E-Motorcycles

7.4.1 Asia Pacific is the Largest Market for E-Motorcycles

8 Hub Motor Market, By Installation Type (Page No. - 44)

8.1 Introduction

8.2 Front Hub Motor

8.2.1 Factors Such as Equal Weight Distribution Will Boost the Demand for Front Hub Motor

8.3 Rear Hub Motor

8.3.1 Benefits Such as High Traction and Powerful Acceleration Will Boost the Demand for Rear Hub Motor

9 Hub Motor Market, By Motor Type (Page No. - 48)

9.1 Introduction

9.2 Gearless Hub Motor

9.2.1 Benefits Such as High Durabality and Power Will Boost the Demand for Gearless Hub Motor

9.3 Geared Hub Motor

9.3.1 Asia Pacific to Lead the Geared Hub Motor Market Between 2018 and 2025

10 Hub Motor Market, By Power Output Type (Page No. - 52)

10.1 Introduction

10.2 Below 1000 W

10.2.1 Increase in Sales of E-Bikes Will Boost the Demand for Below 1000 W Hub Motors

10.3 1000-3000 W

10.3.1 Increase in Sales of E-Scooters/Mopeds Will Boost the Demand for 10003000 W Hub Motors

10.4 Above 3000 W

10.4.1 Increase in Sales of E-Motorcycles Will Boost the Demand for Above 3000 W Hub Motors

11 Hub Motor Market, By Sales Channel (Page No. - 57)

11.1 Introduction

11.2 Aftermarket

11.3 Oe Market

12 Hub Motor Market, By Region (Page No. - 59)

12.1 Introduction

12.2 Asia Pacific

12.2.1 China

12.2.1.1 Government Regulations for Low Emission Vehicles in China Expected to Drive the Market

12.2.2 India

12.2.2.1 Increase in Sales of Electric Scooter/Mopeds in India Expected to Drive the Market

12.2.3 Japan

12.2.3.1 Presence of Major E-Bike Manufacturers in Japan Expected to Drive the Market

12.2.4 South Korea

12.2.4.1 Government Promoting Eco-Friendly Electric Scooters in South Korea is Expected to Drive the Market

12.2.5 Taiwan

12.2.5.1 Taiwan Expected to Witness the Highest Growth Rate in the Asia Pacific Geared Hub Motor Market

12.3 Europe

12.3.1 Austria

12.3.1.1 Increase in E-Bike Sales in Austria Expected to Drive the Market

12.3.2 France

12.3.2.1 Government E-Bikes Purchase Subsidy Expected to Drive the French Market

12.3.3 Germany

12.3.3.1 E-Bikes as A Prefered Mode of Mobility in Germany Expected to Drive the Market

12.3.4 Italy

12.3.4.1 Consumer Preference Toward E-Bikes in Italy Will Boost the Market

12.3.5 Netherlands

12.3.5.1 Rising E-Bike Popularity in the Netherlands Will Boost the Demand for Hub Motors

12.3.6 Spain

12.3.6.1 Increase in Sales of Electric-Scooters/Mopeds is Expected to Drive the Spanish Geared Hub Motor Market

12.3.7 United Kingdom

12.3.7.1 Growth in E-Bike Imports Expected to Drive the UK Market

12.4 North America

12.4.1 Canada

12.4.1.1 Canada Expected to Witness the Highest Growth Rate in the North American Geared Hub Motor Market

12.4.2 Us

12.4.2.1 The US Accounted for the Largest Market Size in the North American Geared Market

13 Competitive Landscape (Page No. - 76)

13.1 Overview

13.2 Hub Motor Market Ranking Analysis

13.3 Competitive Situation & Trends

13.3.1 New Product Developments

13.3.2 Collaborations/Joint Ventures/Supply Contracts/Partnerships/Agreements

14 Company Profiles (Page No. - 80)

(Overview, Product Offered, Recent Developments & SWOT Analysis)*

14.1 Key Players

14.1.1 QS Motor

14.1.2 Schaeffler

14.1.3 Michelin Group

14.1.4 Jiashan Neopower International Trade

14.1.5 Elaphe Ltd

14.1.6 NTN

14.1.7 Tajima EV

14.1.8 TDCM Corporation

14.1.9 Go Swissdrive

14.1.10 MAC Motor

14.1.11 Leaf Motor

14.1.12 Robert Bosch

14.2 Key Players From Other Regions

14.2.1 North America

14.2.1.1 Specialized Bicycle Components

14.2.1.2 Enertrac Corporation

14.2.1.3 Trek

14.2.1.4 Victory Motorcycles

14.2.1.5 Zero Motorcycles

14.2.1.6 Luna Cycle

14.2.2 Europe

14.2.2.1 Heinzmann

14.2.2.2 Accell Group

14.2.2.3 Pon Bike Group

14.2.3 Asia Pacific

14.2.3.1 Fuji-Ta

14.2.3.2 Geoby

14.2.3.3 Tainjin Golden Wheel

14.2.3.4 Giant

14.2.3.5 Merida

14.2.3.6 Uu Motor

*Details on Overview, Product Offered, Recent Developments & SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 99)

15.1 Key Insights of Industry Experts

15.2 Discussion Guide

15.3 Knowledge Store: Marketsandmarkets Subscription Portal

15.4 Available Customizations

15.5 Related Reports

15.6 Author Details

List of Tables (45 Tables)

Table 1 Currency Exchange Rates (Per 1 USD)

Table 2 Impact of Market Dynamics

Table 3 Electric Two Wheelers Definition, By Region

Table 4 Hub Motor Market Size, By Vehicle Type, 20162025 (Units)

Table 5 Market Size, By Vehicle Type, 20162025 (USD Million)

Table 6 E-Bikes: Market Size, By Region, 20162025 (Units)

Table 7 E-Bikes: Market Size, By Region, 20162025 (USD Million)

Table 8 E-Scooters/Mopeds: Market Size, By Region, 20162025 (Units)

Table 9 E-Scooters/Mopeds: Market Size, By Region, 20162025 (USD Million)

Table 10 E-Motorcycles: Market Size, By Region, 20162025 (Units)

Table 11 E-Motorcycles: Market Size, By Region, 20162025 (USD Million)

Table 12 Hub Motor Market, By Installation Type, 20162025 (Units)

Table 13 Front Hub Motor: Market, By Region, 20162025 (Units)

Table 14 Rear Hub Motor: Market, By Region, 20162025 (Units)

Table 15 Market, By Motor Type, 20162025 (Units)

Table 16 Gearless Hub Motor: Market, By Region, 20162025 (Units)

Table 17 Geared Hub Motor: Market, By Region, 20162025 (Units)

Table 18 Market, By Power Output Type, 20162025 (Units)

Table 19 Below 1000 W: Market, By Region, 20162025 (Units)

Table 20 10003000 W: Market, By Region, 20162025 (Units)

Table 21 Above 3000 W: Market, By Region, 20162025 (Units)

Table 22 Hub Motor Market, By Region, 20162025 (Units)

Table 23 Market, By Region, 20162025 (USD Million)

Table 24 Asia Pacific: Market, By Country, 20162025 (Units)

Table 25 Asia Pacific: Market, By Country, 20162025 (USD Million)

Table 26 China: Market, By Motor Type, 20162025 (Units)

Table 27 India: Market, By Motor Type, 20162025 (Units)

Table 28 Japan: Market, By Motor Type, 20162025 (Units)

Table 29 South Korea: Market, By Motor Type, 20162025 (Units)

Table 30 Taiwan: Hub Motor Market, By Motor Type, 20162025 (Units)

Table 31 Europe: Market, By Country, 20162025 (Units)

Table 32 Europe: Market, By Country, 20162025 (USD Million)

Table 33 Austria: Market, By Motor Type, 20162025 (Units)

Table 34 France: Hub Motor Market, By Motor Type, 20162025 (Units)

Table 35 Germany: Market, By Motor Type, 20162025 (Units)

Table 36 Italy: Market, By Motor Type, 20162025 (Units)

Table 37 Netherlands: Market, By Motor Type, 20162025 (Units)

Table 38 Spain: Market, By Motor Type, 20162025 (Units)

Table 39 United Kingdom: Market, By Motor Type, 20162025 (Units)

Table 40 North America: Hub Motor Market, By Country, 20162025 (Units)

Table 41 North America: Market, By Country, 20162025 (USD Million)

Table 42 Canada: Market, By Motor Type, 20162025 (Units)

Table 43 US: Market, By Motor Type, 20162025 (Units)

Table 44 New Product Developments, 20132018

Table 45 Collaborations/Joint Ventures/Supply Contracts/Partnerships/Agreements, 20172018

List of Figures (36 Figures)

Figure 1 Hub Motor Market Segmentation

Figure 2 Market: Research Design

Figure 3 Research Methodology Model

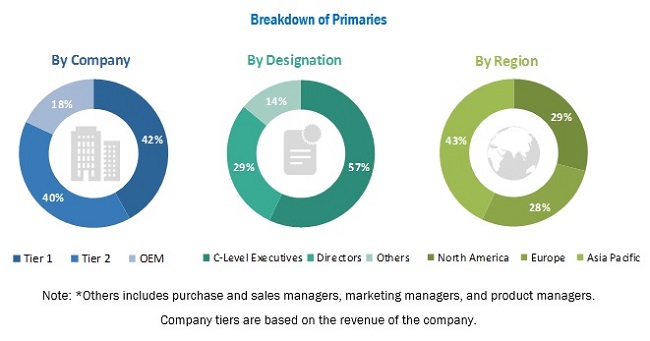

Figure 4 Breakdown of Primary Interviews

Figure 5 Market Size Estimation Methodology for the Market: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology for the Market: Top-Down Approach

Figure 7 Data Triangulation

Figure 8 Market: Market Dynamics

Figure 9 Hub Motor Market, By Region, 20182025 (USD Million)

Figure 10 Market, By Vehicle Type, 2018 vs 2025 (USD Million)

Figure 11 Increased Simplicity and Efficiency of Vehicle is Expected to Drive the Market, 20182025 (USD Million)

Figure 12 Market Share, By Region, 2025 (USD Million)

Figure 13 Below 1000 W Segment to Hold the Largest Market Share, 2018 vs 2025 (Units)

Figure 14 Rear Hub Motor Market to Hold the Largest Market Share, 2018 vs 2025 (Units)

Figure 15 Geared Hub Motor Market to Hold the Largest Market Share, 2018 vs 2025 (Units)

Figure 16 E-Bikes to Hold the Largest Market Share, 2018 vs 2025 (USD Million)

Figure 17 Market: Market Dynamics

Figure 18 E-Scooters/Mopeds Segment is Expected to Grow at the Highest CAGR During the Forecast Period (20182025)

Figure 19 Rear Hub Motor Segment is Expected to Grow at A Higher CAGR During the Forecast Period (20182025)

Figure 20 Geared Hub Motor Segment is Expected to Grow at A Higher CAGR During the Forecast Period (20182025)

Figure 21 10003000 W Segment is Expected to Grow at A Higher CAGR During the Forecast Period (20182025)

Figure 22 Asia Pacific to Dominate the Market During Forecast Period

Figure 23 Asia Pacific: Hub Motor Market Snapshot

Figure 24 Europe: Hub Motor Market Snapshot

Figure 25 North America: Market Snapshot (2018)

Figure 26 Key Developments By Leading Players in the Market From 20132018

Figure 27 Hub Motor Market Ranking: 2017

Figure 28 QS Motor: SWOT Analysis

Figure 29 Schaeffler: Company Snapshot

Figure 30 Schaeffler: SWOT Analysis

Figure 31 Michelin Group: Company Snapshot

Figure 32 Michelin Group: SWOT Analysis

Figure 33 Jiashan Neopower International Trade: SWOT Analysis

Figure 34 Elaphe Ltd: SWOT Analysis

Figure 35 NTN: Company Snapshot

Figure 36 Robert Bosch: Company Snapshot

The study involved four major activities to estimate the current market size for hub motors. Exhaustive secondary research was done to collect information on market, peer market and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. Both top-down and bottom-up approaches were employed to estimate the complete hub motor market size. Thereafter, market breakdown and data triangulation was used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [for example, European Alternative Fuels Observatory (EAFO), The European Association for Battery, Hybrid and Fuel Cell Electric Vehicles (AVERE), Alternative Fuels Data Center (AFDC), and China Association Of Automoblie Manufacturers (CAAM)], automotive magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases (for example, Marklines and Factiva) have been used to identify and collect information useful for an extensive commercial study of the global hub motor market.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the hub motor market scenario through secondary research. Several primary interviews have been conducted with the market experts from the demand- and supply-side OEMs (in terms of component supply, country-level government associations, and trade associations), and component manufacturers across three major regions, namely, North America, Europe, and Asia Pacific. Approximately 23% and 77% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject-matter experts opinions, has led us to the findings as described in the remainder of this report. Following is the

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the hub motor market. These methods were also used extensively to estimate the size of various sub segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides.

Report Objectives

- To segment and forecast the global hub motor market size, in terms of volume (units) and value (USD million)

- To define, describe, and forecast the global market based on motor type, vehicle type, power output, installation type, and region

- To segment and forecast the market size, by motor type (gearless hub motor and geared hub motor)

- To segment and forecast the market size, by vehicle type (E-bikes, E-scooters/mopeds. and E-motorcycles)

- To segment and forecast the market size, by capacity type (below 1000 W, 10003000 W, and above 3000 W)

- To segment and forecast the market size, by installation type (front hub motor and rear hub motor)

- To define and describe the global hub motor market based on sales channel (OEM and aftermarket)

- To forecast the market size with respect to key regions, namely, North America, Europe, and Asia Pacific

- To provide detailed information regarding the major factors influencing market growth (drivers, challenges, restraints, and opportunities)

- To strategically analyze markets with respect to individual growth trends, future prospects, and contribution to the total market.

- To analyze opportunities for stakeholders and details of a competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze recent developments, alliances, joint ventures, product innovations, and mergers & acquisitions in the hub motor market

Scope of The Report

|

Report Metric |

Details |

|

Years considered for the study |

|

|

Base year considered |

2017 |

|

Forecast period |

2018-2025 |

|

Forecast units |

Value(USD Million) and Volume(UNITS) |

|

Segments covered |

Motor Type, Installation Type, Vehicle Type, Power Output, and Region |

|

Geographies covered |

North America, Asia Pacific, and Europe |

|

Companies covered |

QS Motor (China), Schaeffler Technologies (Germany), Michelin (France), Jiashan Neopower International Trade (China), and Elaphe (Slovenia). |

This research report categorizes the hub motor market based on vehicle type, motor type, installation type, power output, and region.

On the basis of Vehicle type, the market has been segmented as follows:

- E-Bikes

- E-Scooters/Mopeds

- E-Motorcycles

On the basis of Motor type, the market has been segmented as follows:

- Geared Hub Motor

- Gearless Hub Motor

On the basis of Installation type, the market has been segmented as follows:

- Front Hub Motor

- Rear Hub Motor

On the basis of Power Output type, the market has been segmented as follows:

- Below 1000 W

- 10003000 W

- Above 3000 W

On the basis of Region, the market has been segmented as follows:

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- North America

- US

- Canada

- Europe

- Austria

- France

- Germany

- Italy

- Spain

- The Netherlands

- UK

Critical Questions:

- Which installation type will lead the hub motors market (front hub motor and rear hub motor)?

- Which are the industry trends of the hub motor market?

- What are the major technological developments in the hub motor market?

Available Customizations

- Hub motor market, by vehicle type at country level

- Company information

- Profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Hub Motor Market