Human Microbiome Market by Product (Drugs, Probiotics, Prebiotics), Application (Therapeutic, Diagnostics), Disease (Cancer, Gastrointestinal, Infectious), Type (Peptide, Live Biotherapeutic Product, FMT) - Global Forecast to 2029

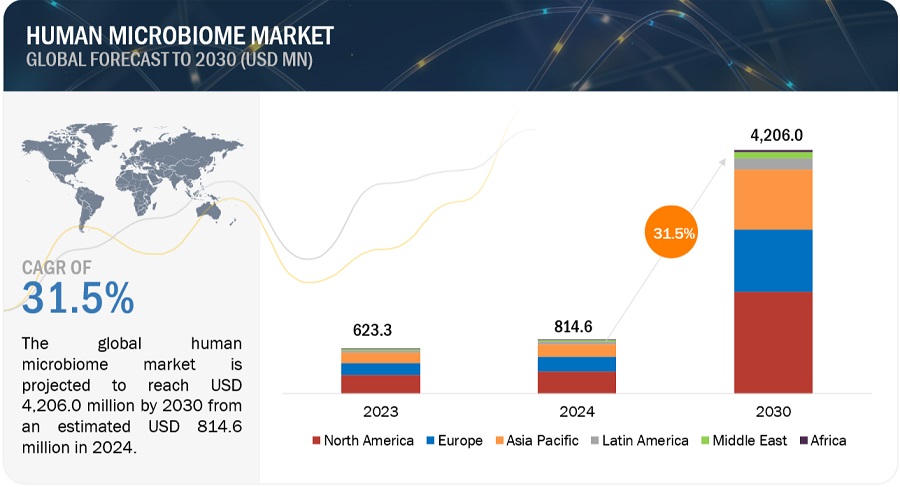

The global human microbiome market in terms of revenue was estimated to be worth $0.3 billion in 2023 and is poised to reach $1.7 billion by 2029, growing at a CAGR of 36.1% from 2023 to 2029. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The major factors driving the growth of the market are the surging demand for personalized medicine, and growing demand for natural and holistic approaches is expected to propel the growth of the market. However, limited understanding of microbial interactions are expected to restrain market growth to a certain extent.

Attractive Opportunities in the human microbiome market

To know about the assumptions considered for the study, Request for Free Sample Report

Human Microbiome Market Dynamics

DRIVER: Collaborative efforts between microbiome industry and academia for microbiome research

The microbiome industry and academia have forged collaborative efforts to advance microbiome research. This partnership leverages the expertise and resources of both sectors to unravel the complex interactions between microbes and their hosts. Industry provides valuable funding, technological innovations, and access to large-scale datasets, while academia contributes cutting-edge research, scientific rigor, and diverse academic perspectives. By working together, they accelerate the discovery of novel insights into the microbiome's role in health and disease, paving the way for innovative therapies, diagnostics, and personalized medicine approaches. This collaborative approach fosters a synergistic relationship that benefits both scientific progress and the translation of microbiome research into real-world applications.

RESTRAINT: Adverse impact of complex regulatory policies on commercialization of microbiomes

Complex regulatory policies can have adverse impacts on the commercialization of microbiomes. The dynamic and rapidly evolving nature of microbiome research presents unique challenges in navigating regulatory frameworks. Lengthy approval processes, high costs, and stringent requirements can hinder the timely development and launch of microbiome-based products and therapies. These obstacles disproportionately affect small and medium-sized enterprises (SMEs) and startups, limiting their ability to compete with larger established companies. Moreover, inconsistent regulations across different regions or countries can create barriers to global market access, further impeding commercialization efforts. Streamlining and harmonizing regulatory policies, promoting clear guidelines, and fostering collaboration between regulatory agencies and industry stakeholders are essential to facilitate innovation and ensure the responsible and efficient commercialization of microbiome-based technologies.

OPPORTUNIY: Increased collaboration of key players and small innovative companies to work on new microbiome technologies

The increased collaboration between key players and small innovative companies in the field of microbiome technologies is driving transformative advancements. Key players, such as established industry leaders and research institutions, recognize the potential of microbiome-based solutions and actively seek partnerships with smaller, agile companies at the forefront of innovation. These collaborations bring together complementary expertise, resources, and networks, fostering a synergistic environment for the development and commercialization of novel microbiome technologies. By pooling their collective strengths, these partnerships accelerate research, enhance product development, and enable faster market entry. This collaborative approach not only spurs innovation but also ensures a diverse range of perspectives, driving the discovery of groundbreaking solutions that can positively impact human health and various industries, such as agriculture, pharmaceuticals, and consumer goods.

CHALLENGE: Slow patient adoption of microbiome-based therapies

There is a lack of awareness and understanding among the general public about the microbiome and its role in health. Many patients may be unfamiliar with the concept of microbial communities within their bodies and may be hesitant to try treatments that involve manipulating these communities. Moreover, the novelty and complexity of microbiome-based therapies may lead to skepticism and caution among patients, who may prefer more established or conventional treatment options. Additionally, the high cost of microbiome-based therapies and limited insurance coverage can pose financial barriers for patients, limiting their access and willingness to adopt these treatments. Overcoming these challenges requires comprehensive patient education, robust clinical evidence, affordable pricing, and expanded insurance coverage to build trust and encourage broader adoption of microbiome-based therapies.

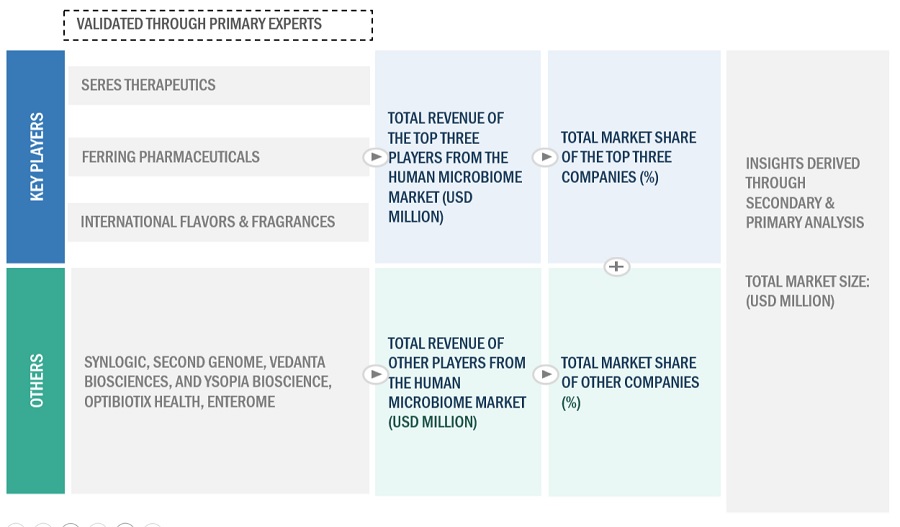

Human Microbiome Market Ecosystem

Prominent companies in the market include well established, financially stable manufacturers of human microbiomes products. These companies have been operating in the market for several years and posees diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Seres Therapeutics, Inc. (US), Enterome (France), 4D pharma plc (UK), International Flavors & Fragrances Inc. (US), OptiBiotix Health Plc (UK), Ferring Pharmaceuticals (Switzerland), Synlogic, Inc. (US), Second Genome, Inc. (US), Vedanta Biosciences, Inc. (US), YSOPIA Bioscience (France), FlightPath Biosciences, Inc. (US), Finch Therapeutics Group, Inc. (US), AOBiome Therapeutics (US), BioGaia (Sweden), Quantbiome, Inc. (dba Ombre) (US), Viome Life Sciences, Inc. (US), BIOHM Health (US), DayTwo (US), Atlas Biomed (UK), Bione Ventures Private Limited (India), Luxia Scientific (France), Metabiomics (US), Sun Genomics (US), Seed Health (US), and Gnubiotics Sciences (Switzerland).

The drugs segment accounted for the largest share of the product segment in human microbiome market in 2023.

Based on products, the market is categorized into drugs, diagnostic tests, probiotics, prebiotics, and other products. In 2023, the drugs segment accounted for the largest share of the market. This segment’s large share can primarily be attributed to factors such as an increasing number of microbiome-based drugs in the pipeline and growing funding for drug development.

The Infectious diseases segment dominated the disease segment in human microbiome market in 2023.

Based on the disease, the segment is categorized into infectious diseases, gastrointestinal diseases, endocrine & metabolic disorders, cancer, and other diseases. In 2023, the infectious diseases segment dominated the technology segment with the highest revenue share. The large share of this segment is due to the increasing research in microbiome-based products and their use in treating infectious diseases.

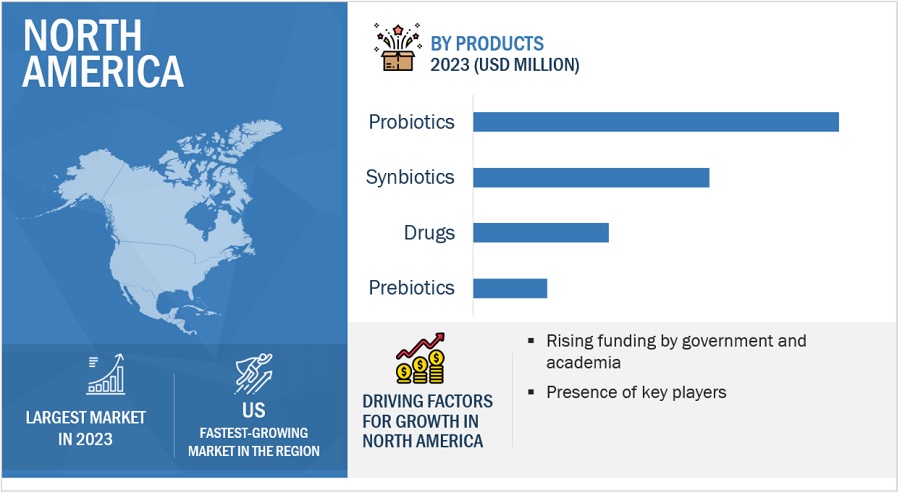

North America was the largest market for human microbiome market in 2023.

Geographically, the market is segmented into North America, Europe, Asia Pacific, and Rest of the World. The market is dominated by North America in 2023 and this dominance is anticipated to continue throughout the forecast period. The established research infrastructure, technological advancements, demand for precision medicine, supportive regulatory environment, robust biotechnology and healthcare industry, and availability of funding and investment drive the growth of the market in North America. However, the high cost associated with certain human microbiomes, which can limit the adoption of these products for some customers, especially smaller research institutions or clinics with limited budgets are negatively impacting the market growth.

To know about the assumptions considered for the study, download the pdf brochure

The prominent players in the human microbiome market are Seres Therapeutics, Inc. (US), Enterome (France), 4D pharma plc (UK), International Flavors & Fragrances Inc. (US), OptiBiotix Health Plc (UK), Ferring Pharmaceuticals (Switzerland), Synlogic, Inc. (US), Second Genome, Inc. (US), Vedanta Biosciences, Inc. (US), YSOPIA Bioscience (France), FlightPath Biosciences, Inc. (US), Finch Therapeutics Group, Inc. (US), AOBiome Therapeutics (US), BioGaia (Sweden), Quantbiome, Inc. (dba Ombre) (US), Viome Life Sciences, Inc. (US), BIOHM Health (US), DayTwo (US), Atlas Biomed (UK), Bione Ventures Private Limited (India), Luxia Scientific (France), Metabiomics (US), Sun Genomics (US), Seed Health (US), and Gnubiotics Sciences (Switzerland).

Human Microbiome Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$0.3 billion |

|

Projected Revenue by 2029 |

$1.7 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 36.1% |

|

Market Driver |

Collaborative efforts between microbiome industry and academia for microbiome research |

|

Market Opportunity |

Increased collaboration of key players and small innovative companies to work on new microbiome technologies |

This report categorizes the human microbiome market to forecast revenue and analyze trends in each of the following submarkets:

By product

- Drugs

- Diagnostic Tests

- Probiotics

- Prebiotics

- Other Products

By Disease

- Infectious Diseases

- Gastrointestinal Diseases

- Endocrine & Metabolic Disorders

- Cancer

- Other Diseases

By Application

- Therapeutics

- Diagnostics

By Type

- Bacterial Consortia Transplantation (BCT)/Fecal Microbiota Transplantation (FMT)

- Peptides

- Live Biotherapeutic Products

- Other Types

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Rest of Europe (RoE)

-

Asia Pacific (APAC)

- Japan

- India

- China

- Rest of Asia Pacific (RoAPAC)

- Rest of the World

Recent Developments

- In November 2021, Seres Therapeutics collaborated with Bacthera to manufacture SER-109. The company is a leading manufacturer for recurrent Clostridioides difficile infection (rCDI). As per the agreement, Bacthera is establishing a dedicated facility for commercial manufacturing in its new Microbiome Center of Excellence, a manufacturing site dedicated to the production of LBPs located on Lonza’s Ibex campus in Visp, Switzerland.

- In June 2020, Enterome announced a new financing totaling $52.6million to progress the clinical development of its therapeutic pipeline, including the first clinical trials of EO2401, a novel ‘OncoMimic’ cancer immunotherapy.

- In July 2020, OptiBiotix Health PLC launched WellBiome, a revolutionary ingredient to support digestive, cardiovascular, and metabolic health.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global human microbiome market?

The global human microbiome market boasts a total revenue value of $1.7 billion by 2029.

What is the estimated growth rate (CAGR) of the global human microbiome market?

The global human microbiome market has an estimated compound annual growth rate (CAGR) of 36.1% and a revenue size in the region of $0.3 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

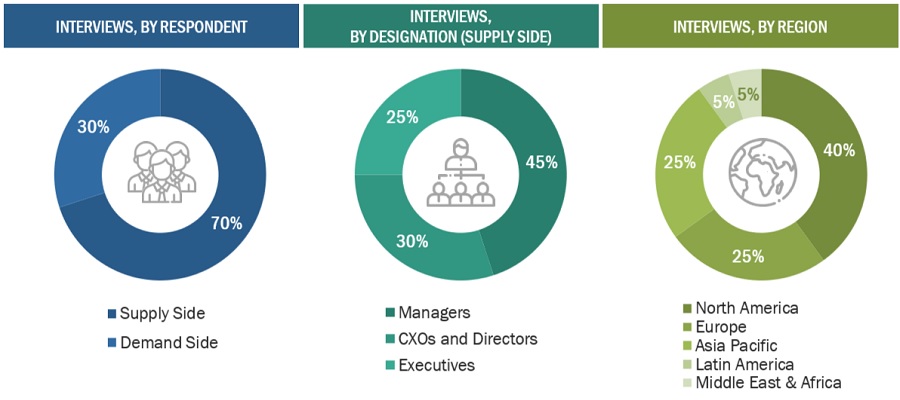

This study involved four major activities in estimating the current size of the human microbiome market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the human microbiome market. The secondary sources used for this study include some of the key secondary sources referred to for this study include publications from government sources such as World Health Organization (WHO), Human Microbiome Project (HMP), Organisation for Economic Co-operation and Development (OECD), National Institutes of Health (NIH), Food and Drug Administration (FDA), ClinicalTrials.gov, Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentations, Interviews with Experts, and MarketsandMarkets Analysis. These sources were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Alexander Puttick |

PhD Researcher |

|

Christophe C |

CMC&Process development Biotech |

|

Eugene Chang |

Director |

|

Mark Parker |

Global Business Development |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the human microbiome market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research

- The revenues generated from the human microbiome business of leading players have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Global Human microbiome Market: Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Human microbiome Market Size: Top Down Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

The human microbiome refers to a collection of microorganisms, including bacteria, viruses, fungi, and other microbes, that live within and on the human body. These microorganisms interact with each other and with the human host in a complex and dynamic manner, playing important roles in a range of physiological processes, including digestion, immune function, and metabolism. The human microbiome is highly diverse and varies between individuals and different regions of the body. The market encompasses various sectors, including research tools, diagnostics, therapeutics, and consumer products, aimed at leveraging the knowledge and potential of the microbiome to improve human health and well-being. This includes the development and commercialization of microbiome-based therapies, such as live biotherapeutic products (LBPs), probiotics, prebiotics, and other microbial interventions, as well as the development of diagnostic tools for assessing and monitoring the microbiome.

Key Stakeholders

- Manufacturers and distributors of human microbiome products

- Pharmaceutical and biotechnology companies

- Market research and consulting firms

- R&D centers

- Researchers and scientists

- Academic & research institutes

Report Objectives

- To define, describe, and forecast the human microbiome market based on products, type, application, and disease.

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, challenges, opportunities, and trends)

- To strategically analyse micro markets with respect to individual growth trends, future prospects, and contributions to the overall human microbiome market

- To analyse opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such as acquisitions, product launches, expansions, agreements, partnerships, and R&D activities in the human microbiome market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Company Information

- Twenty five company profiles

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Human Microbiome Market