Immersion Cooling Market by Type (Single-Phase, Two-Phase), Application (High Performance Computing, Edge Computing, Cryptocurrency Mining), Cooling Fluid (Synthetic Oil, Mineral Oil), Component (Solutions, Services), and Region - Global Forecast to 2031

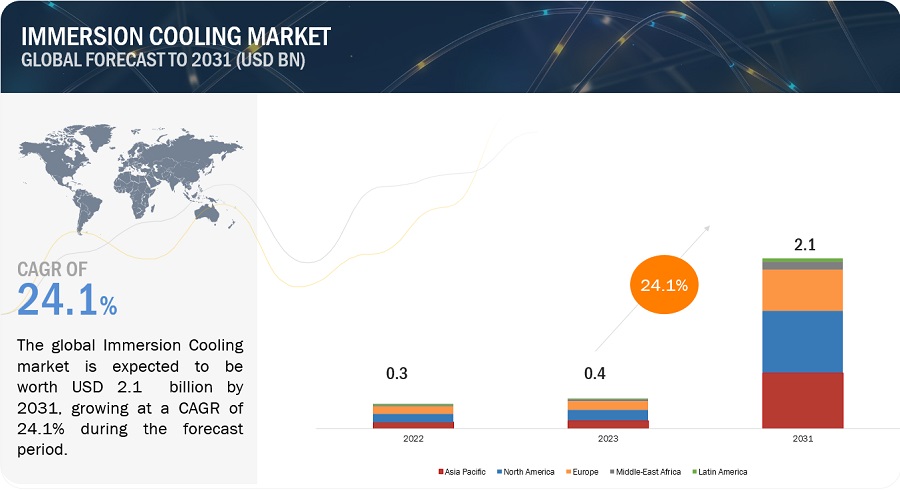

The immersion cooling market is projected to grow from USD 0.4 billion in 2023 to USD 2.1 billion by 2031, at a CAGR of 24.1% from 2023 to 2031. The major reason for the growth of the immersion cooling market is the demand for energy-efficient solutions. Immersion cooling solutions offer cost advantages, such as reduced operational expenditures and lower energy consumption, which make them an attractive option for data centers and other applications.

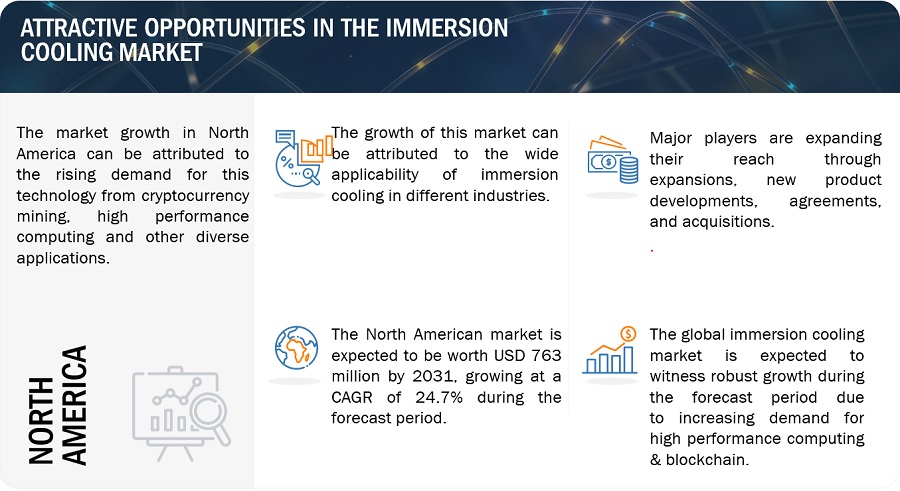

Attractive Opportunities in the Immersion Cooling Market

To know about the assumptions considered for the study, Request for Free Sample Report

Immersion Cooling Market Dynamics

Driver: Adoption of cryptocurrency mining & blockchain

The adoption of cryptocurrency mining and blockchain technologies is expected to drive the immersion cooling market's growth. Cryptocurrency mining, which involves solving complex algorithms and generating significant heat, can benefit from immersion cooling's ability to maintain optimal temperatures and reduce energy costs.. This has led to a renewed interest and investments in crypto mining, with immersion cooling offering advantages such as increased efficiency, hardware longevity, and improved mining power.

Restraint: Susceptible to leakage

Susceptibility to leakage is indeed a restraint of the immersion cooling market. While immersion cooling systems offer advantages such as reduced water usage and improved heat dissipation, they are not immune to leakage issues, which can affect their performance and reliability. This challenge is particularly notable in the case of fluorocarbon immersion coolants, which, despite being nonflammable and thermally stable, are still susceptible to leakage. The lack of knowledge on immersion cooling and fluid leakage issues is also estimated to hinder the market's growth.

Opportunity: Adoption of low-density data servers

The adoption of low-density data servers presents an opportunity for the immersion cooling market. As data center operators seek more compact and efficient cooling solutions, the use of low-density servers can complement the benefits of immersion cooling. By allowing for higher hardware density and reduced physical footprint in data centers, low-density servers align with the scalability and space-saving advantages offered by immersion cooling. This combination can lead to significant energy savings, reduced maintenance costs, and improved overall cost-effectiveness, making it an attractive proposition for data center operators looking to optimize their infrastructure. As the demand for data processing capabilities continues to rise, driven by technologies like IoT, AI, and blockchain, the synergy between low-density servers and immersion cooling is poised to play a key role in meeting the evolving needs of the data center industry.

Challenge: High investment in existing infrastructure

One of the challenges associated with immersion cooling technology is the high investment required for infrastructure and equipment. Immersion cooling systems require specialized equipment, such as tanks, pumps, and heat exchangers, which can be expensive to install and maintain. Additionally, installing immersion cooling systems may require significant modifications to existing data center infrastructure, which can further increase costs.

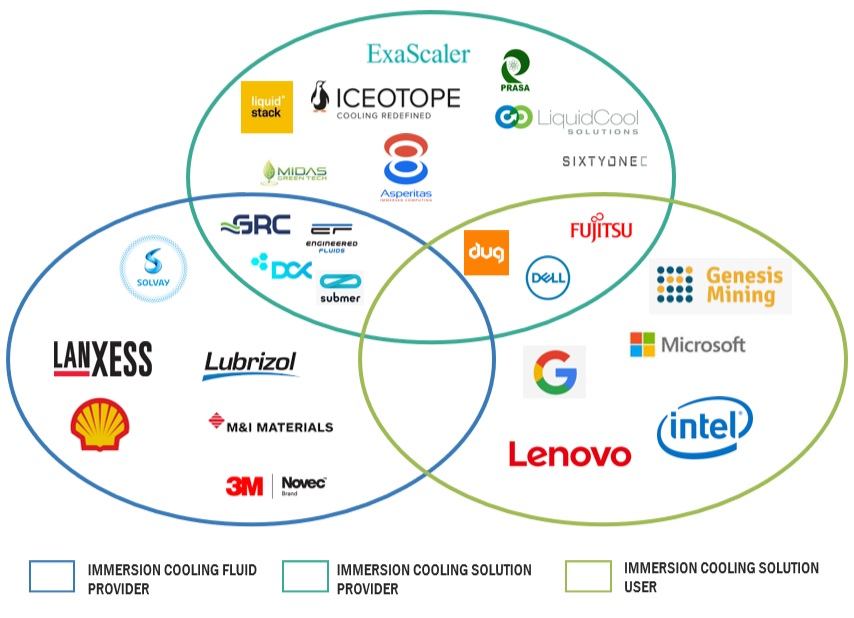

Immersion Cooling: Ecosystem

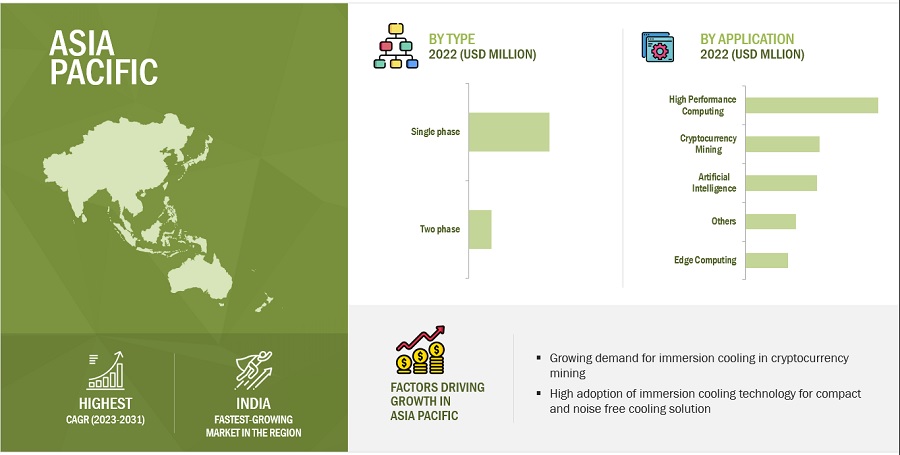

Based on the type, the Single phase is projected to grow at the highest CAGR during the forecast period.

Single-phase is anticipated to grow at the highest CAGR based on the type. The growth of the single-phase immersion cooling market can be attributed to its simplicity, efficiency in heat dissipation, energy-saving capabilities, and scalability. As the demand for high-performance computing continues to rise across various sectors, the advantages of single-phase immersion cooling make it a compelling choice for organizations seeking effective and sustainable cooling solutions for their increasingly powerful and densely packed computing systems.

Based on Application, the Artificial Intelligence segment is projected to grow at the highest CAGR during the forecast period.

The increasing demand for high-performance computing (HPC) in AI applications is a key driver. AI models, such as intense learning models, are becoming more complex and computationally intensive, leading to higher power densities and increased heat generation. Immersion cooling provides an efficient solution for managing the heat produced by powerful GPUs and TPUs used in AI model training, allowing optimal performance without the risk of thermal throttling.

Based on cooling fluids, the synthetic fuels segment is projected to grow at the highest CAGR during the forecast period.

The versatility of synthetic fluids in immersion cooling systems is another factor fueling market expansion. These fluids can be customized to suit different cooling requirements and hardware configurations, providing a flexible and adaptable solution for various industries. As technology advances, developing synthetic fluids with improved properties, such as higher thermal conductivity and excellent stability, further enhances their applicability in diverse immersion cooling settings.

Asia Pacific is projected to grow at the highest CAGR during the forecast period.

The rapid expansion of data center infrastructure in APAC is a significant driver for the growth of immersion cooling. As businesses and governments in the region invest heavily in digital transformation, cloud services, and AI-driven applications, the demand for efficient cooling solutions that can handle the heat generated by advanced computing systems is on the rise. Immersion cooling, with its ability to provide adequate heat dissipation and energy efficiency, is well-suited to meet the evolving needs of data centers in APAC.

Source: Expert Interviews, Secondary Research, Whitepapers, Journals, Magazines, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Some of the key players in the market include LiquidStack (Netherlands), Fujitsu (Japan), Green Revolution Cooling Inc (US), Submer (Spain), Asperitas (Netherlands), Midas Green Technologies (US), Iceotope Technologies Ltd (US), LiquidCool Solutions (US), and DUG Technology (Australia).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size Available for Years |

2017–2031 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2031 |

|

Forecast Units |

Value (USD Million and USD Billion) |

|

Segments Covered |

Type, Cooling Fluid, Application, and Region |

|

Geographies Covered |

Asia Pacific, North America, Europe, Middle East, South America, and Africa |

|

Companies Covered |

The major market players include LiquidStack (Netherlands), Fujitsu (Japan), Green Revolution Cooling Inc (US), Submer (Spain), Asperitas (Netherlands), Midas Green Technologies (US), Iceotope Technologies Ltd (US), LiquidCool Solutions (US), DUG Technology (Australia), DCX - The Liquid Cooling Company (Poland), Engineered Fluids (US), TIEMMERS (Netherlands), TMGcore, Inc. (US), GIGA-BYTE Technology Co., Ltd. and so on. |

This research report categorizes the immersion cooling market based on type, cooling fluid, application, and region.

Based on application, the immersion cooling market has been segmented into:

- High-performance Computing

- Artificial Intelligence

- Edge Computing

- Cryptocurrency Mining

- Others (Cloud Computing, Enterprise Computing)

Based on type, the immersion cooling market has been segmented into:

- Single-Phase Immersion Cooling

- Two-Phase Immersion Cooling

Based on the cooling fluid, the immersion cooling market has been segmented into:

- Mineral Oil

- Synthetic Fluids

- Fluorocarbon-based Fluids

- Other (Vegetable Oil, Bio-Oil, Silicone Oil, Deionized Water)

Based on the components, the immersion cooling market has been segmented into:

- Solutions

- Services

Based on the region, the immersion cooling market has been segmented into:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments

- In October 2023, GRC (Green Revolution Cooling) Inc., the leader in single-phase immersion cooling for data centers, announced the launch of a new data center solution, Next-Gen Immersion Cooled Data Centers in Middle East & Africa, with the collaboration of Dell Technologies, and DCV Industries.

- In October 2023, Submer and Intel collaborated to enhance single-phase immersion technology through a Forced Convection Heat Sink (FCHS) package. It reduces the quantity and cost of components required for comprehensive heat capture and the dissipation of chips with Thermal Design Power (TDP) exceeding 1000W.

- In May 2020, Asperitas partnered with European data center owner/operator, Maincubes. The two companies planned to offer immersion cooling solutions in dedicated immersion cooling colocation suites in the Maincubes Amsterdam AMS01 data center. AMS01 is also home to the European Open Compute Project (OCP) Experience Center, while Asperitas is a leading OCP standards contributor in immersion cooling.

Frequently Asked Questions (FAQ):

What is Immersion Cooling?

Immersion cooling technology, also known as direct liquid cooling, is used to cool electrical and electronic components, including complete servers and storage devices, by submerging them in a thermally conductive but electrically insulating liquid coolant.

What is the current size of the global immersion cooling market?

The global immersion cooling market is estimated to be USD 373 million in 2023 and projected to reach USD 2,098 million by 2031, at a CAGR of 24.1%.

Who are the winners in the global immersion cooling market?

Companies such as LiquidStack (Netherlands), Fujitsu (Japan), Green Revolution Cooling Inc (US), Submer (Spain), Asperitas (Netherlands), and Midas Green Technologies (US) are the leading players. These players have adopted the strategies of expansions, agreements, mergers & acquisitions, partnerships, new product launches, joint ventures, investments & contracts, collaborations, and new technology & new process developments to increase their presence in the global market.

What are the key regions in the global immersion cooling market?

In terms of region, the highest share was observed to be in North America. This is primarily due to growing demand for the application in cryptocurrency mining.

What is the major type of Immersion Cooling technology used in the global market?

The single-phase immersion cooling market has witnessed notable growth due to several factors that make it an attractive solution for cooling high-performance computing systems. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

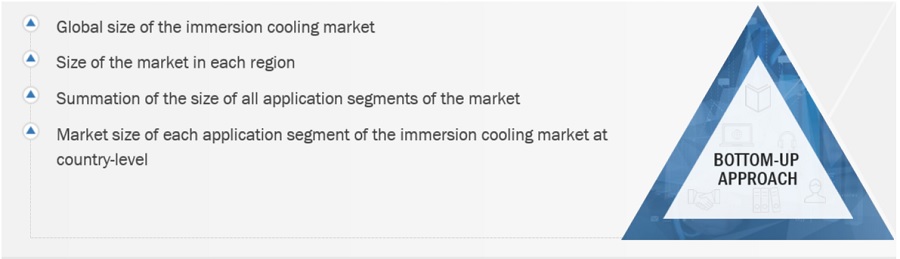

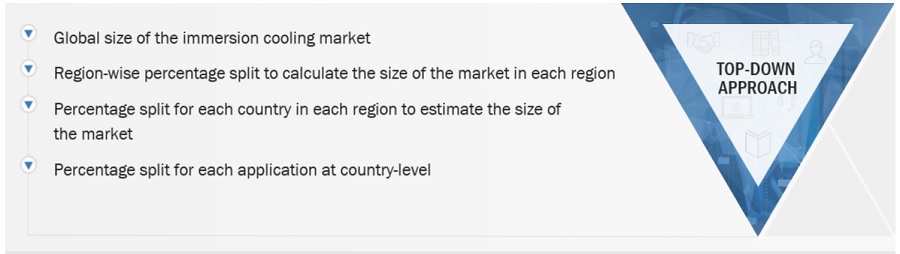

The study involved four major activities in estimating the current Immersion Cooling market size—exhaustive secondary research collected information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and measures with industry experts across the value chain of immersion cooling technology through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were used to estimate the size of the segments and sub-segments of the market.

Secondary Research

The research methodology used to estimate and forecast the access control market begins with capturing data on the revenues of key vendors in the market through secondary research. In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, Factiva, and Industry Journals, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, notifications by regulatory bodies, trade directories, and databases. Vendor offerings have also been taken into consideration to determine market segmentation.

Primary Research

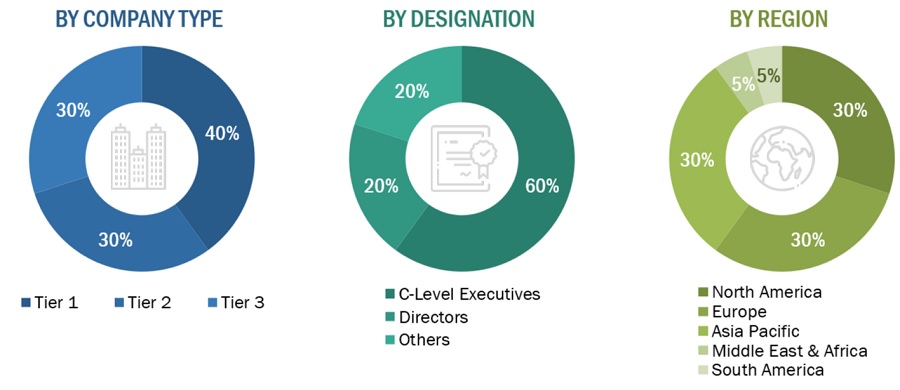

The immersion cooling market comprises several stakeholders in the supply chain, such as immersion cooling fluid providers, technology manufacturers, data centers manufacurures, traders, associations, and regulatory organizations. The demand side of this market is characterized by the development of high performance computing, edge computing, artificial intelligence, cryptocurrency mining, and other applications industries. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of the primary respondents:

Note: “Others” includes sales, marketing, and product managers

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the total size of the immersion cooling market. These methods were also used extensively to determine the market size of various segments. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the immersion cooling market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Global Immersion Cooling Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Immersion Cooling Market Size: Top-Down Approach

Data Triangulation

The market was split into several segments and sub-segments after arriving at the overall market size using the market size estimation processes as explained above. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The market size was calculated globally by summing up the country-level and regional-level data.

Market Definition

The global immersion cooling market refers to the industry involved in providing advanced cooling solutions for electronic components, particularly in data centers and high-performance computing environments. In immersion cooling, electronic hardware is submerged in dielectric fluids, which efficiently absorb and dissipate heat generated during operation. This innovative cooling method is gaining traction worldwide due to its ability to enhance energy efficiency, reduce operational costs, and optimize overall system performance. As the demand for high-density computing continues to rise, the global immersion cooling market plays a crucial role in addressing the challenges associated with heat dissipation and supporting the evolution of more sustainable and efficient data center infrastructure on a global scale.

Key Stakeholder

- Data center Manufacturers

- Crypto Miners.

- Manufacturers of immersion cooling fluids.

- Associations and Industrial Bodies such as The American National Standards Institute (ANSI), The American Society of Heating, Refrigerating, and Air-Conditioning Engineers (ASHRAE), The National Electrical Manufacturers Association (NEMA), The Telecommunication Industry Association (TIA), The Canadian Standards Association Group (CSA Group), and Others

- NGOs, Governments, Investment Banks, Venture Capitalists, and Private Equity Firms

Report Objectives:

- To define, describe, and forecast the size of the global immersion cooling market in terms of value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and industry-specific challenges, influencing the growth of the immersion cooling market

- To analyze and forecast the size of various segments (type, application and cooling fluid) of the immersion cooling market based on five major regions—North America, Europe, Asia Pacific, South America, Middle East, and Africa—along with key countries in each of these regions

- To analyze recent developments and competitive strategies, such as expansions, new product developments, collaborations, and acquisitions, to draw the competitive landscape of the market

- To strategically profile the key players in the market and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Further breakdown of the Middle East & African, and South American immersion cooling markets

- Product matrix, which gives a detailed comparison of the product portfolio of each company

- Detailed analysis and profiles of additional market players (up to 3)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Immersion Cooling Market