In-building Wireless Market by Component (Infrastructure [DAS and small cell] and Services), Business Model (Service Providers, Enterprises, and Neutral Host Operators), Venue, End User, and Region – Global Forecast to 2025

In-Building Wireless Industry Size & Forecast

The global In-Building Wireless Market size was crossed $10.3 billion in 2020 and is anticipated to exhibit a CAGR of 11.9% to reach $18.0 billion by the end of 2025. The in-building wireless industry growth is driven by the major factors such as, need for unique and defined network coverage, implementation of public safety measures, digital transformation and smart and intelligent building trends.

There are significant growth opportunities for in-building wireless vendors. The commercialization of 5G services and availability of unlicensed and shared spectrum in the globe are expected to shape the future of the in-building wireless market. The high initial cost of deployment may pose a challenge to market growth. Many countries are still facing challenges while investing in the infrastructure of in-building wireless solutions.

To know about the assumptions considered for the study, Request for Free Sample Report

The COVID-19 pandemic has affected every segment of society, including individuals and businesses. During the COVID-19 pandemic, the telecom sector is playing a vital role across the globe to support the digital infrastructure of countries. Every individual and government, irrespective of federal, state, central, local, and provinces, has been in constant touch with one other in the society to provide and get real-time information on COVID-19. Currently, healthcare, telecommunication, media and entertainment, utilities, and government institutes are functioning day and night to stabilize the condition and facilitate prerequisite services to every individual.

COVID-19 cases are growing day-by-day, as several infected cases have been on the rise. In line with individuals, COVID-19 has a massive impact on large enterprises and SMEs. Core industries, such as manufacturing, automotive, textile, transportation and logistics, travel and hospitality, and consumer goods, have been closed due to country-level lockdown across the globe. This would have a substantial impact on the global economy in terms of the decline in GDP. Since ages, SMEs are acting as the backbone of the economy. In the current situation, SMEs are the most affected due to the COVID-19 pandemic.

To know about the assumptions considered for the study, download the pdf brochure

In-Building Wireless Market Growth Dynamics

Driver: Increasing demand for network coverage and capacity

In-building wireless solutions are deployed to cope up with the instability faced by the cellular carrier networks with actuating data traffic in buildings such as offices, hospitals, hotels, and shopping malls. The reduced RF performance, facing power losses, and intermodulation challenges are covered by in-building wireless solutions utilizing DAS, in-building wireless equipment, and small cells. Moreover, providing Wi-Fi coverage in large buildings is critical, with the need to provide a seamless user experience that offers better indoor coverage. The lack of indoor wireless network coverage and capacity issues has actuated the MNOs/Mobile Virtual Network Operators (MVNOs) and neutral host providers to leverage the in-building wireless solutions.

Restraints: Proving economic backhaul connectivity across small and medium buildings

The microwave backhaul network faces the problem of Line of Sight (LoS). In contrast, the deployment of the fiber backhaul network for in-building wireless solutions is difficult due to its high cost and low availability in many cities. In the macro network, wireless operators handle backhauls through high-bandwidth, low-latency fiber-optic cables or directional, point-to-point microwave antennas. However, neither of the options are economical in a small-to-medium building, raising the challenge of getting all those cellular users connected to the world outside.

Opportunity: Emergence of industrial and commercial IoT

Organizations across various verticals are consistently trying to increase the use of IoT for automating their processes and increasing the throughput. Hence, the proliferation of IoT and associated technologies would create numerous opportunities for the in-building wireless market. The in-building wireless network allows users to integrate diverse sensors, machines, people, vehicles, and other devices across a wide range of applications and usage circumstances. Any in-building wireless network takes care of issues, such as reliability, service quality, security, and compliance. Companies such as Nokia, Samsung, and Cisco are some of the major players that are working toward the incorporation of in-building wireless networks in IoT.

Challenge: 5G for indoor coverage

5G is still evolving as its first deployments are still being made. There are several variables and unknowns about both the technical details, such as spectrum bands and antenna configurations. However, a 5G network for in-building infrastructure comes with recent parallel developments, such as Wi-Fi 6, optical Local Area Networks (LANs), digital remote powering, smart buildings, and edge-computing. In a 5G world of neutral hosts and localized spectrum, various new firms might turn into providers of indoor systems, rather than staying as end-users. They may also be able to get direct revenues from end-users (in a similar fashion to Wi-Fi today), or perhaps cut wholesale deals with national (or international) operators.

Neutral host operators segment sector to grow at the highest CAGR during the forecast period

In-building wireless networks can be served via the following business models: service providers, enterprises, and neutral host operators. As per the business requirements, businesses and property owners opt for either of the above-mentioned business models. These models operate depending on the bodies funding the implementation of these systems. Neutral host operators manage an in-building wireless network for businesses. Under the neutral host ownership model, DAS and small cells networks are owned by a neutral host operator that manages the end to end in-building wireless networks. These operators are also responsible for approvals from carriers and the selection of a suitable RF source-based on the blueprint of the facility where DAS and small cells need to be deployed. The neutral host operators primarily fund their business by developing multicarrier DAS and invoicing the carriers.

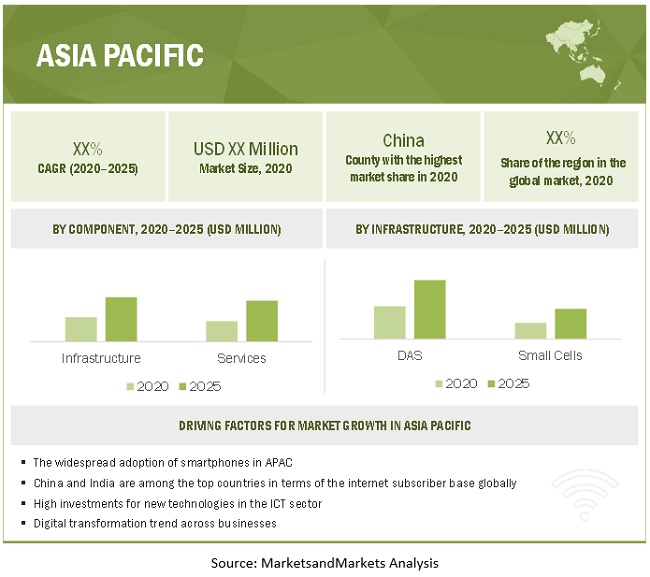

APAC to account for the highest CAGR during the forecast period

The large population in APAC has created an extensive pool of mobile subscribers for telecom companies. The region is the largest contributor to the total number of mobile subscribers across the globe and would add more subscribers to its network in the coming years. It is a diversified region that houses a wide range of countries moving toward digital transformation. It is set to dominate in-building wireless deployments due to its size, diversity, and the logical lead taken by countries, including South Korea, China, Australia, and Japan. Japan and China are the largest manufacturing economies that produce automobiles, IT products, and electronic products. The manufacturing paradigm has changed considerably with industry seeking advanced technologies, such as robotics and big data analytics becoming popular among them.

This research study outlines the market potential, market dynamics, and major vendors operating in the in-building wireless market. Key and innovative vendors in the in-building wireless market include Nokia (Finland), Ericsson (Sweden), Huawei (China), ZTE (China), NEC (Japan), CommScope (US), Corning (US), Axell Wireless (UK), Comba Telecom (Hong Kong), Samsung (South Korea), SOLiD (South Korea), Dali Wireless (US), Zinwave (US), ADRF (US), ip.access (UK), Airspan (US), Contela (South Korea), Fujitsu (Japan), BTI Wireless (US), Bird (US), Accelleran (Belgium), Baicells Technologies (US), Qucell (South Korea), Casa Systems (US), CommAgility (UK), Galtronics (Canada), G-Wave Solutions (US), HUBER+SUHNER (Switzerland), JMA Wireless (US), Microlab (US), Nextivity (US), Sarcomm (Taiwan), PCTEL (US), Whoop Wireless (US), and Westell Technologies (US). The study includes an in-depth competitive analysis of these key players in the in-building wireless market with their company profiles, recent developments, and key market strategies.

Scope of Report

|

Report Metric |

Details |

|

Market size available for years |

2015-2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020-2025 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

Component (infrastructure and services), business model, venues, and end users |

|

Regions covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

Nokia (Finland), Ericsson (Sweden), Huawei (China), ZTE(China), NEC(Japan), CommScope (US), Corning (US), Axell Wireless (UK), Comba Telecom (Hong Kong), Samsung (South Korea), SOLiD (South Korea), Dali Wireless (US), Zinwave (US), ADRF (US), ip.access (UK), Airspan (US), Contela (South Korea), Fujitsu (Japan), BTI Wireless (US), Bird (US), Accelleran (Belgium), Baicells Technologies (US), Qucell (South Korea), Casa Systems (US), CommAgility (UK), Galtronics (Canada), G-Wave Solutions (US), HUBER+SUHNER (Switzerland), JMA Wireless (US), Microlab (US), Nextivity (US), Sarcomm (Taiwan), PCTEL (US), Whoop Wireless (US), and Westell Technologies (US). |

This research report categorizes the in-building wireless market to forecast revenue and analyze trends in each of the following submarkets:

Based on Component

-

Infrastructure

- DAS

- Small Cell

- Services

Based on the business model:

- Service Providers

- Enterprises

- Neutral Host Operators

Based on Venue:

- Large Venues

- Medium Venues

- Small Venues

Based on End user:

- Government

- Manufacturing

- Transportation and Logistics

- Education

- Retail

- Hospitality

- Healthcare

- Others*

Based on regions:

- North America

- Europe

- APAC

- MEA

- Latin America

Recent Developments:

- In February 2020, CommScope enhanced its OneCell, a small cell solution, with the introduction of open interfaces, virtualized RAN functions, and new radio points. The enhanced OneCell solution leverages the latest Open RAN (O-RAN) and management frameworks that provide an innovative and open approach to operators deploying 5G networks and delivering in-building wireless services in enterprises and venues for all types of subscribers and use cases.

- In February 2019, Comba Telecom partnered with Parallel Wireless to deliver 4G and 5G Open VRAN solutions. The solutions integrate Parallel Wireless’ software with Comba’s Remote Radio Unit (RRU) and base station antennas and leverage its integration services.

- In March 2019, Corning opened an R&D center in Montreal, Canada. This center will focus on developing new technologies using AI, analytics, and virtualization to develop innovative solutions for the 5G and edge computing technologies.

- In April 2020, Ericsson partnered with GCI, a telecommunication corporation operating in Alaska, US, to deploy the first 5G cell sites in Anchorage, US. By the end of the year, GCI intends to upgrade several cell sites in Anchorage, Eagle River, and Girdwood to the 5-band 5G NR solution.

Frequently Asked Questions (FAQ):

What are the key factors that will drive the in-building market?

The in-building wireless market is driven by the following key factors, including increasing demand for indoor network coverage, complying with public safety regulations, growing digital transformations, and rising smart and intelligence building infrastructure trends.

What is the projected market value of the global in-building wireless market?

The global in-building wireless market size is expected to grow from USD 10.3 billion in 2020 to USD 18.0 billion by 2025, at a Compound Annual Growth Rate (CAGR) of 11.9% during the forecast period.

Which region has the highest market share in the in-building wireless market?

North America followed is expected to hold the largest market share in the in-building wireless market. North America has emerged as a prominent region in adopting and implementing DAS and small cell networks. The region presents a strong demand for implementing in-building wireless technologies across education, real estate, commercial campuses, healthcare, and retail sectors.

Which business model is expected to witness a higher adoption rate in the coming years?

The neutral host operators’ model is expected to grow at a higher CAGR during the forecast period, due to the scale of the implementation of in-building solutions.

Who are the major vendors in the in-building wireless market?

Nokia( Finland), Ericsson (Sweden), Huawei (China), ZTE(China), NEC(Japan), CommScope (US), Corning (US), Axell Wireless (UK), Comba Telecom (Hong Kong), Samsung (South Korea), SOLiD (South Korea), Dali Wireless (US), Zinwave (US), ADRF (US), ip.access (UK), Airspan (US), Contela (South Korea), Fujitsu (Japan), BTI Wireless (US), Bird (US), Accelleran (Belgium), Baicells Technologies (US), Qucell (South Korea), Casa Systems (US), CommAgility (UK), Galtronics (Canada), G-Wave Solutions (US), HUBER+SUHNER (Switzerland), JMA Wireless (US), Microlab (US), Nextivity (US), Sarcomm (Taiwan), PCTEL (US), Whoop Wireless (US), and Westell Technologies (US). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 36)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: THE GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 YEARS CONSIDERED FOR THE STUDY

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 45)

2.1 RESEARCH DATA

FIGURE 6 IN-BUILDING WIRELESS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

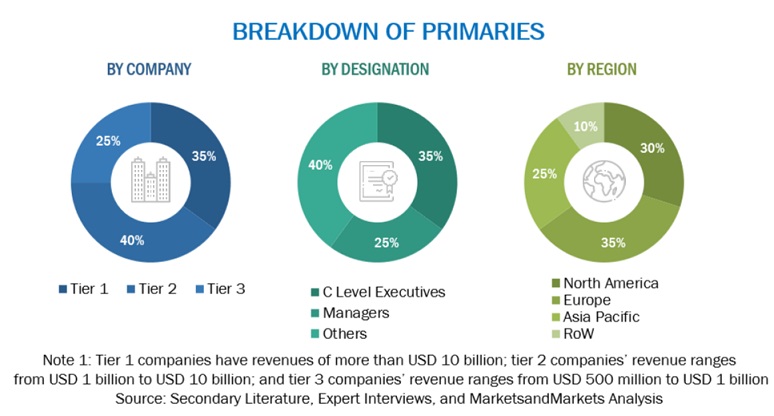

2.1.2.1 Breakup of primaries

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE OF INFRASTRUCTURE AND SERVICES OF THE MARKET

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1- BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF INFRASTRUCTURE AND SERVICES OF THE MARKET

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY- APPROACH 2 (DEMAND SIDE): IN-BUILDING WIRELESS MARKET

2.4 IMPLICATION OF COVID-19 ON THE MARKET

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY: COVID-19 IMPACT ON THE MARKET GROWTH

2.5 MARKET FORECAST

TABLE 1 FACTOR ANALYSIS

2.6 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 12 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.7 STARTUP/SME EVALUATION MATRIX METHODOLOGY

FIGURE 13 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.8 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.8.1 ASSUMPTIONS FOR THE STUDY

2.8.2 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 57)

FIGURE 14 IN-BUILDING WIRELESS MARKET: HOLISTIC VIEW

FIGURE 15 MARKET: GROWTH TREND

FIGURE 16 ASIA PACIFIC TO GROW AT THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 60)

4.1 ATTRACTIVE OPPORTUNITIES IN THE IN-BUILDING WIRELESS MARKET

FIGURE 17 INCREASING DEMAND FOR NETWORK COVERAGE AND CAPACITY TO DRIVE MARKET GROWTH DURING THE FORECAST PERIOD

4.2 IRELESS MARKET IN NORTH AMERICA, BY VENUE AND BUSINESS MODEL

FIGURE 18 LARGE VENUES AND SERVICE PROVIDERS SEGMENTS TO ACCOUNT FOR THE HIGHEST MARKET SHARES IN NORTH AMERICA IN 2020

4.3 MARKET IN EUROPE, BY VENUE AND BUSINESS MODEL

FIGURE 19 LARGE VENUES AND SERVICE PROVIDERS SEGMENTS TO ACCOUNT FOR THE HIGHEST MARKET SHARES IN EUROPE IN 2020

4.4 MARKET IN ASIA PACIFIC, BY VENUE AND BUSINESS MODEL

FIGURE 20 LARGE VENUES AND SERVICE PROVIDERS SEGMENTS TO ACCOUNT FOR THE HIGHEST MARKET SHARES IN ASIA PACIFIC IN 2020

5 MARKET OVERVIEW (Page No. - 63)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: IN-BUILDING WIRELESS MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing demand for network coverage and capacity

FIGURE 22 IN-BUILDING WIRELESS EMPLOYEE EXPERIENCES

5.2.1.2 Construction of buildings focused on modern and sustainable concepts

5.2.1.3 Trend shift toward smart and intelligent buildings

5.2.1.4 Business assurance for mission-critical applications

FIGURE 23 IN-BUILDING WIRELESS MARKET: INDUSTRY-WISE EXPERIENCES

5.2.1.5 Lack of investment from carriers in large venues

5.2.1.6 Public safety requirements in buildings

5.2.1.7 Rapid technological advancements

FIGURE 24 EMERGING TECHNOLOGICAL ADOPTION FOR DIGITAL TRANSFORMATION

5.2.2 RESTRAINTS

5.2.2.1 Privacy and security concerns

5.2.2.2 Proving economic backhaul connectivity across small and medium buildings

5.2.3 OPPORTUNITIES

5.2.3.1 Availability of unlicensed spectrum-CBRS and MulteFire bands

FIGURE 25 UNLICENSED BANDS: UNITED STATES, EUROPE, JAPAN, AND CHINA (MHZ)

5.2.3.2 5G for indoor coverage

5.2.4 CHALLENGES

5.2.4.1 Rising deployments of private networks

5.3 REGULATORY IMPLICATIONS

5.3.1 GENERAL DATA PROTECTION REGULATION

5.3.2 CALIFORNIA CONSUMER PRIVACY ACT

5.3.3 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD

5.3.4 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

5.3.5 DIGITAL IMAGING AND COMMUNICATIONS IN MEDICINE

5.3.6 HEALTH LEVEL SEVEN

5.3.7 GRAMM-LEACH-BLILEY ACT

5.3.8 SARBANES-OXLEY ACT

5.3.9 SOC2

5.3.10 COMMUNICATIONS DECENCY ACT

5.3.11 DIGITAL MILLENNIUM COPYRIGHT ACT

5.3.12 ANTI-CYBERSQUATTING CONSUMER PROTECTION ACT

5.3.13 LANHAM ACT

5.4 VALUE CHAIN ANALYSIS

FIGURE 26 IN-BUILDING WIRELESS MARKET: VALUE CHAIN ANALYSIS

5.5 ECOSYSTEM

FIGURE 27 MARKET: ECOSYSTEM

5.5.1 NETWORK INFRASTRUCTURE ENABLERS

5.5.2 GOVERNMENT REGULATORY AUTHORITIES

5.5.3 SYSTEM INTEGRATORS

5.5.4 INDUSTRIAL PARTNERS

5.5.5 STRATEGIC CONSULTANTS

5.5.6 ORIGINAL EQUIPMENT MANUFACTURERS

5.5.7 CUSTOMER PREMISES EQUIPEMENT

5.5.8 VIRTUALIZATION VENDORS

5.5.9 CLOUD SERVICE PROVIDERS

5.5.10 MOBILE NETWORK OPERATORS

5.5.11 NEUTRAL HOST PROVIDERS

5.6 USE CASES

5.6.1 HEALTHCARE

5.6.1.1 CommScope’s ION-E in-building wireless solution

5.6.2 HOSPITALITY

5.6.2.1 Zinwave’s UNItivity in-building wireless solution

5.6.3 TRANSPORTATION

5.6.3.1 Queen Alia International Airport’s cellular coverage

5.6.3.2 Dallas/Fort Worth International Airport cellular coverage

5.6.4 COMMERCIAL REAL ESTATE

5.6.4.1 Westfield Sydney’s indoor cellular coverage

5.6.4.2 NY Retail outlet indoor cellular coverage

5.6.5 PUBLIC SAFETY

5.6.5.1 9/11 Memorial and Museum indoor cellular coverage

5.6.6 PUBLIC VENUES

5.6.6.1 Bellevue City Hall indoor cellular coverage

5.6.6.2 Michigan Plaza indoor cellular coverage

5.6.6.3 Torre Diamante indoor cellular coverage

5.7 TECHNOLOGY ANALYSIS

5.7.1 WI-FI

5.7.2 WIMAX

5.7.3 SMALL CELL NETWORKS

5.7.4 LTE NETWORK

FIGURE 28 LTE NETWORK LAUNCHED WORLDWIDE (2019)

5.7.5 CITIZENS BROADBAND RADIO SERVICE

FIGURE 29 THREE-TIER MODEL FOR CBRS SPECTRUM ACCESS

5.7.6 MULTEFIRE

5.7.7 PRIVATE 5G

5.8 PATENT ANALYSIS

TABLE 2 EUROPE PATENT APPLICATION, BY COUNTRY

TABLE 3 EUROPE PATENT APPLICATION, BY TECHNOLOGY FIELD

FIGURE 30 EUROPE PATENT APPLICATION: DIGITAL TECHNOLOGY, BY APPLICANT

FIGURE 31 STANDARD ESSENTIAL PATENTS: 5G

FIGURE 32 4G AND 5G DECLARED PATENT PORTFOLIOS BY DECLARING THE COMPANY

5.9 AVERAGE SELLING PRICE

TABLE 4 PRICING ANALYSIS

5.1 COVID-19 OUTLOOK FOR THE IN-BUILDING WIRELESS MARKET

TABLE 5 MARKET: ANALYSIS OF DRIVERS AND OPPORTUNITIES IN THE COVID-19 ERA

TABLE 6 IN BUILDING WIRELESS: ANALYSIS OF CHALLENGES AND RESTRAINTS IN THE COVID-19 ERA

5.10.1 CUMULATIVE GROWTH ANALYSIS

TABLE 7 IN BUILDING WIRELESS: CUMULATIVE GROWTH ANALYSIS

6 IN-BUILDING WIRELESS MARKET, BY COMPONENT (Page No. - 92)

6.1 INTRODUCTION

FIGURE 33 SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 8 MARKET SIZE, BY COMPONENT, 2015–2019 (USD MILLION)

TABLE 9 MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

6.1.1 COMPONENT: MARKET DRIVERS

6.1.2 COMPONENT: COVID-19 IMPACT

6.2 INFRASTRUCTURE

TABLE 10 IN-BUILDING ARCHITECTURE

FIGURE 34 SMALL CELLS SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 11 INFRASTRUCTURE: MARKET SIZE, BY TYPE, 2015–2019 (USD MILLION)

TABLE 12 INFRASTRUCTURE: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 13 INFRASTRUCTURE: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 14 INFRASTRUCTURE: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.2.1 DISTRIBUTED ANTENNA SYSTEM

TABLE 15 DIFFERENCES BETWEEN ACTIVE DAS AND PASSIVE DAS

FIGURE 35 ANTENNAS SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 16 DISTRIBUTED ANTENNA SYSTEM: IN-BUILDING WIRELESS MARKET SIZE, BY TYPE, 2015–2019 (USD MILLION)

TABLE 17 DISTRIBUTED ANTENNA SYSTEM: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 18 DISTRIBUTED ANTENNA SYSTEM MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 19 DISTRIBUTED ANTENNA SYSTEM MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.2.1.1 Head End Units

TABLE 20 FREQUENCY BANDS: NORTH AMERICA

TABLE 21 FREQUENCY BANDS: EUROPE

TABLE 22 HEAD END UNITS MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 23 HEAD END UNITS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.2.1.2 Remote Units

TABLE 24 REMOTE UNITS MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 25 REMOTE UNITS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.2.1.3 Repeaters

TABLE 26 REPEATERS MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 27 REPEATERS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.2.1.4 Antennas

TABLE 28 ANTENNAS MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 29 ANTENNAS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.2.2 SMALL CELLS

FIGURE 36 MICROCELLS SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 30 SMALL CELLS SHIPMENT, 2015–2019 (UNIT MILLION)

TABLE 31 SMALL CELLS SHIPMENT, 2020–2025 (UNIT MILLION)

TABLE 32 SMALL CELLS: IN-BUILDING WIRELESS MARKET SIZE, BY TYPE, 2015–2019 (USD MILLION)

TABLE 33 SMALL CELLS: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 34 SMALL CELLS: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 35 SMALL CELLS: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 36 SMALL CELLS COMPARISON: PICOCELLS, FEMTOCELL, AND MICROCELLS

6.2.2.1 Femtocells

TABLE 37 FEMTOCELLS MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 38 FEMTOCELLS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.2.2.2 Picocells

TABLE 39 PICOCELLS MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 40 PICOCELLS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.2.2.3 Microcells

TABLE 41 MICROCELLS MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 42 MICROCELLS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.3 SERVICES

FIGURE 37 TRAINING, SUPPORT, AND MAINTENANCE SERVICES SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 43 SERVICES: IN-BUILDING WIRELESS MARKET SIZE, BY TYPE, 2015–2019 (USD MILLION)

TABLE 44 SERVICES: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 45 SERVICES: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 46 SERVICES: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.3.1 NETWORK DESIGN

TABLE 47 NETWORK DESIGN MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 48 NETWORK DESIGN MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.3.2 INTEGRATION AND DEPLOYMENT

TABLE 49 INTEGRATION AND DEPLOYMENT MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 50 INTEGRATION AND DEPLOYMENT MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.3.3 TRAINING, SUPPORT, AND MAINTENANCE

TABLE 51 TRAINING, SUPPORT, AND MAINTENANCE MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 52 TRAINING, SUPPORT, AND MAINTENANCE MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

7 IN-BUILDING WIRELESS MARKET, BY BUSINESS MODEL (Page No. - 120)

7.1 INTRODUCTION

FIGURE 38 NEUTRAL HOST OPERATORS SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 53 MARKET SIZE, BY BUSINESS MODEL, 2015–2019 (USD MILLION)

TABLE 54 MARKET SIZE, BY BUSINESS MODEL, 2020–2025 (USD MILLION)

7.1.1 BUSINESS MODEL: MARKET DRIVERS

TABLE 55 GLOBAL 4G LTE SPECTRUM LANDSCAPE

7.1.2 BUSINESS MODEL: COVID-19 IMPACT

7.2 SERVICE PROVIDERS

TABLE 56 SERVICE PROVIDERS: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 57 SERVICE PROVIDERS: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

7.3 ENTERPRISES

TABLE 58 ENTERPRISES: IN-BUILDING WIRELESS MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 59 ENTERPRISES: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

7.4 NEUTRAL HOST OPERATORS

TABLE 60 NEUTRAL HOST OPERATORS:MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 61 NEUTRAL HOST OPERATORS: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

8 IN-BUILDING WIRELESS MARKET, BY VENUE (Page No. - 129)

8.1 INTRODUCTION

FIGURE 39 MEDIUM VENUES SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 62 MARKET SIZE, BY VENUE, 2015–2019 (USD MILLION)

TABLE 63 MARKET SIZE, BY VENUE, 2020–2025 (USD MILLION)

8.1.1 VENUES: MARKET DRIVERS

8.1.2 VENUES: COVID-19 IMPACT

8.2 LARGE VENUES

TABLE 64 LARGE VENUES: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 65 LARGE VENUES: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

8.3 MEDIUM VENUES

TABLE 66 MEDIUM VENUES: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 67 MEDIUM VENUES: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

8.4 SMALL VENUES

TABLE 68 SMALL VENUES: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 69 SMALL VENUES: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

9 IN-BUILDING WIRELESS MARKET, BY END USER (Page No. - 135)

9.1 INTRODUCTION

FIGURE 40 HEALTHCARE SECTOR TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 70 MARKET SIZE, BY END USER, 2015–2019 (USD MILLION)

TABLE 71 MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

9.1.1 END USER: MARKET DRIVERS

TABLE 72 NUMBER OF INDUSTRIES, BY SECTOR

9.1.2 END USER: COVID-19 IMPACT

9.2 GOVERNMENT

TABLE 73 GOVERNMENT: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 74 GOVERNMENT: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

9.3 TRANSPORTATION AND LOGISTICS

TABLE 75 TRANSPORTATION AND LOGISTICS: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 76 TRANSPORTATION AND LOGISTICS: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

9.4 HOSPITALITY

TABLE 77 HOSPITALITY: IN-BUILDING WIRELESS MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 78 HOSPITALITY: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

9.5 MANUFACTURING

TABLE 79 MANUFACTURING: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 80 MANUFACTURING: LESS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

9.6 RETAIL

TABLE 81 RETAIL: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 82 RETAIL: RELESS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

9.7 EDUCATION

TABLE 83 EDUCATION: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 84 EDUCATION: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

9.8 HEALTHCARE

TABLE 85 HEALTHCARE: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 86 HEALTHCARE: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

9.9 OTHER END USERS

TABLE 87 OTHER END USERS: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 88 OTHER END USERS: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

10 IN-BUILDING WIRELESS MARKET, BY REGION (Page No. - 151)

10.1 INTRODUCTION

FIGURE 41 ASIA PACIFIC TO GROW AT THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

FIGURE 42 NORTH AMERICA TO LEAD THE MARKET DURING THE FORECAST PERIOD

TABLE 89 MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 90 MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: MARKET DRIVERS

10.2.2 NORTH AMERICA: PESTLE ANALYSIS OF THE MARKET

TABLE 91 NORTH AMERICA: PESTLE ANALYSIS

10.2.3 NORTH AMERICA: COVID-19 IMPACT

FIGURE 43 NORTH AMERICA: MARKET SNAPSHOT

TABLE 92 NORTH AMERICA: IN-BUILDING WIRELESS MARKET SIZE, BY COMPONENT, 2015–2019 (USD MILLION)

TABLE 93 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2020-2025 (USD MILLION)

TABLE 94 NORTH AMERICA: MARKET SIZE, BY INFRASTRUCTURE, 2015-2019 (USD MILLION)

TABLE 95 NORTH AMERICA: MARKET SIZE, BY INFRASTRUCTURE, 2020-2025 (USD MILLION)

TABLE 96 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2015-2019 (USD MILLION)

TABLE 97 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2020-2025 (USD MILLION)

TABLE 98 NORTH AMERICA: MARKET SIZE, BY DISTRIBUTED ANTENNA SYSTEM, 2015-2019 (USD MILLION)

TABLE 99 NORTH AMERICA: MARKET SIZE, BY DISTRIBUTED ANTENNA SYSTEM, 2020-2025 (USD MILLION)

TABLE 100 NORTH AMERICA: MARKET SIZE, BY SMALL CELL, 2015-2019 (USD MILLION)

TABLE 101 NORTH AMERICA: MARKET SIZE, BY SMALL CELL, 2020-2025 (USD MILLION)

TABLE 102 NORTH AMERICA: MARKET SIZE, BY VENUE, 2015-2019 (USD MILLION)

TABLE 103 NORTH AMERICA: MARKET SIZE, BY VENUE, 2020-2025 (USD MILLION)

TABLE 104 NORTH AMERICA: MARKET SIZE, BY BUSINESS MODEL, 2015-2019 (USD MILLION)

TABLE 105 NORTH AMERICA: MARKET SIZE, BY BUSINESS MODEL, 2020-2025 (USD MILLION)

TABLE 106 NORTH AMERICA: MARKET SIZE, BY END USER, 2015-2019 (USD MILLION)

TABLE 107 NORTH AMERICA: MARKET SIZE, BY END USER, 2020-2025 (USD MILLION)

TABLE 108 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2015-2019 (USD MILLION)

TABLE 109 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

10.2.4 UNITED STATES

10.2.4.1 United States: Regulatory norms

TABLE 110 UNITED STATES: IN-BUILDING WIRELESS MARKET SIZE, BY COMPONENT, 2015–2019 (USD MILLION)

TABLE 111 UNITED STATES: MARKET SIZE, BY COMPONENT, 2020-2025 (USD MILLION)

TABLE 112 UNITED STATES: MARKET SIZE, BY INFRASTRUCTURE, 2015-2019 (USD MILLION)

TABLE 113 UNITED STATES: MARKET SIZE, BY INFRASTRUCTURE, 2020-2025 (USD MILLION)

TABLE 114 UNITED STATES: MARKET SIZE, BY SERVICE, 2015-2019 (USD MILLION)

TABLE 115 UNITED STATES: MARKET SIZE, BY SERVICE, 2020-2025 (USD MILLION)

TABLE 116 UNITED STATES: MARKET SIZE, BY DISTRIBUTED ANTENNA SYSTEM, 2015-2019 (USD MILLION)

TABLE 117 UNITED STATES: IN-BUILDING WIRELESS MARKET SIZE, BY DISTRIBUTED ANTENNA SYSTEM, 2020-2025 (USD MILLION)

TABLE 118 UNITED STATES: MARKET SIZE, BY SMALL CELL, 2015-2019 (USD MILLION)

TABLE 119 UNITED STATES: MARKET SIZE, BY SMALL CELL, 2020-2025 (USD MILLION)

TABLE 120 UNITED STATES: MARKET SIZE, BY VENUE, 2015-2019 (USD MILLION)

TABLE 121 UNITED STATES: MARKET SIZE, BY VENUE, 2020-2025 (USD MILLION)

TABLE 122 UNITED STATES: MARKET SIZE, BY BUSINESS MODEL, 2015-2019 (USD MILLION)

TABLE 123 UNITED STATES: MARKET SIZE, BY BUSINESS MODEL, 2020-2025 (USD MILLION)

10.2.5 CANADA

10.2.5.1 Canada: Regulatory norms

TABLE 124 CANADA: IN-BUILDING WIRELESS MARKET SIZE, BY COMPONENT, 2015–2019 (USD MILLION)

TABLE 125 CANADA: MARKET SIZE, BY COMPONENT, 2020-2025 (USD MILLION)

TABLE 126 CANADA: MARKET SIZE, BY INFRASTRUCTURE, 2015-2019 (USD MILLION)

TABLE 127 CANADA: MARKET SIZE, BY INFRASTRUCTURE, 2020-2025 (USD MILLION)

TABLE 128 CANADA: MARKET SIZE, BY SERVICE, 2015-2019 (USD MILLION)

TABLE 129 CANADA: MARKET SIZE, BY SERVICE, 2020-2025 (USD MILLION)

TABLE 130 CANADA: MARKET SIZE, BY DISTRIBUTED ANTENNA SYSTEM, 2015-2019 (USD MILLION)

TABLE 131 CANADA: MARKET SIZE, BY DISTRIBUTED ANTENNA SYSTEM, 2020-2025 (USD MILLION)

TABLE 132 CANADA: MARKET SIZE, BY SMALL CELL, 2015-2019 (USD MILLION)

TABLE 133 CANADA: MARKET SIZE, BY SMALL CELL, 2020-2025 (USD MILLION)

TABLE 134 CANADA: MARKET SIZE, BY VENUE, 2015-2019 (USD MILLION)

TABLE 135 CANADA: MARKET SIZE, BY VENUE, 2020-2025 (USD MILLION)

TABLE 136 CANADA: MARKET SIZE, BY BUSINESS MODEL, 2015-2019 (USD MILLION)

TABLE 137 CANADA: MARKET SIZE, BY BUSINESS MODEL, 2020-2025 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: IN-BUILDING WIRELESS MARKET DRIVERS

10.3.2 EUROPE: PESTLE ANALYSIS OF MARKET

TABLE 138 EUROPE: PESTLE ANALYSIS

10.3.3 EUROPE: COVID-19 IMPACT

TABLE 139 EUROPE: MARKET SIZE, BY COMPONENT, 2015–2019 (USD MILLION)

TABLE 140 EUROPE: MARKET SIZE, BY COMPONENT, 2020-2025 (USD MILLION)

TABLE 141 EUROPE: MARKET SIZE, BY INFRASTRUCTURE, 2015-2019 (USD MILLION)

TABLE 142 EUROPE: MARKET SIZE, BY INFRASTRUCTURE, 2020-2025 (USD MILLION)

TABLE 143 EUROPE: MARKET SIZE, BY SERVICE, 2015-2019 (USD MILLION)

TABLE 144 EUROPE: MARKET SIZE, BY SERVICE, 2020-2025 (USD MILLION)

TABLE 145 EUROPE: MARKET SIZE, BY DISTRIBUTED ANTENNA SYSTEM, 2015-2019 (USD MILLION)

TABLE 146 EUROPE: MARKET SIZE, BY DISTRIBUTED ANTENNA SYSTEM, 2020-2025 (USD MILLION)

TABLE 147 EUROPE: MARKET SIZE, BY SMALL CELL, 2015-2019 (USD MILLION)

TABLE 148 EUROPE: MARKET SIZE, BY SMALL CELL, 2020-2025 (USD MILLION)

TABLE 149 EUROPE: IN-BUILDING WIRELESS MARKET SIZE, BY VENUE, 2015-2019 (USD MILLION)

TABLE 150 EUROPE: MARKET SIZE, BY VENUE, 2020-2025 (USD MILLION)

TABLE 151 EUROPE: MARKET SIZE, BY BUSINESS MODEL, 2015-2019 (USD MILLION)

TABLE 152 EUROPE: MARKET SIZE, BY BUSINESS MODEL, 2020-2025 (USD MILLION)

TABLE 153 EUROPE: MARKET SIZE, BY END USER, 2015-2019 (USD MILLION)

TABLE 154 EUROPE: MARKET SIZE, BY END USER, 2020-2025 (USD MILLION)

TABLE 155 EUROPE: MARKET SIZE, BY COUNTRY, 2015-2019 (USD MILLION)

TABLE 156 EUROPE: MARKET SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

10.3.4 UNITED KINGDOM

10.3.4.1 United Kingdom: Regulatory norms

TABLE 157 UNITED KINGDOM: IN-BUILDING WIRELESS MARKET SIZE, BY COMPONENT, 2015–2019 (USD MILLION)

TABLE 158 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2020-2025 (USD MILLION)

TABLE 159 UNITED KINGDOM: MARKET SIZE, BY INFRASTRUCTURE, 2015-2019 (USD MILLION)

TABLE 160 UNITED KINGDOM: MARKET SIZE, BY INFRASTRUCTURE, 2020-2025 (USD MILLION)

TABLE 161 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 2015-2019 (USD MILLION)

TABLE 162 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 2020-2025 (USD MILLION)

TABLE 163 UNITED KINGDOM: MARKET SIZE, BY DISTRIBUTED ANTENNA SYSTEM, 2015-2019 (USD MILLION)

TABLE 164 UNITED KINGDOM: MARKET SIZE, BY DISTRIBUTED ANTENNA SYSTEM, 2020-2025 (USD MILLION)

TABLE 165 UNITED KINGDOM: MARKET SIZE, BY SMALL CELL, 2015-2019 (USD MILLION)

TABLE 166 UNITED KINGDOM: MARKET SIZE, BY SMALL CELL, 2020-2025 (USD MILLION)

TABLE 167 UNITED KINGDOM: MARKET SIZE, BY VENUE, 2015-2019 (USD MILLION)

TABLE 168 UNITED KINGDOM: MARKET SIZE, BY VENUE, 2020-2025 (USD MILLION)

TABLE 169 UNITED KINGDOM: MARKET SIZE, BY BUSINESS MODEL, 2015-2019 (USD MILLION)

TABLE 170 UNITED KINGDOM: MARKET SIZE, BY BUSINESS MODEL, 2020-2025 (USD MILLION)

10.3.5 GERMANY

10.3.5.1 Germany: Regulatory norms

TABLE 171 GERMANY: IN-BUILDING WIRELESS MARKET SIZE, BY COMPONENT, 2015–2019 (USD MILLION)

TABLE 172 GERMANY: MARKET SIZE, BY COMPONENT, 2020-2025 (USD MILLION)

TABLE 173 GERMANY: MARKET SIZE, BY INFRASTRUCTURE, 2015-2019 (USD MILLION)

TABLE 174 GERMANY: MARKET SIZE, BY INFRASTRUCTURE, 2020-2025 (USD MILLION)

TABLE 175 GERMANY: MARKET SIZE, BY SERVICE, 2015-2019 (USD MILLION)

TABLE 176 GERMANY: MARKET SIZE, BY SERVICE, 2020-2025 (USD MILLION)

TABLE 177 GERMANY: MARKET SIZE, BY DISTRIBUTED ANTENNA SYSTEM, 2015-2019 (USD MILLION)

TABLE 178 GERMANY: MARKET SIZE, BY DISTRIBUTED ANTENNA SYSTEM, 2020-2025 (USD MILLION)

TABLE 179 GERMANY: MARKET SIZE, BY SMALL CELL, 2015-2019 (USD MILLION)

TABLE 180 GERMANY: MARKET SIZE, BY SMALL CELL, 2020-2025 (USD MILLION)

TABLE 181 GERMANY: MARKET SIZE, BY VENUE, 2015-2019 (USD MILLION)

TABLE 182 GERMANY: MARKET SIZE, BY VENUE, 2020-2025 (USD MILLION)

TABLE 183 GERMANY: MARKET SIZE, BY BUSINESS MODEL, 2015-2019 (USD MILLION)

TABLE 184 GERMANY: MARKET SIZE, BY BUSINESS MODEL, 2020-2025 (USD MILLION)

10.3.6 REST OF EUROPE

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: IN-BUILDING WIRELESS MARKET DRIVERS

10.4.2 ASIA PACIFIC: PESTLE ANALYSIS OF MARKET

TABLE 185 ASIA PACIFIC: PESTLE ANALYSIS

10.4.3 ASIA PACIFIC: COVID-19 IMPACT

FIGURE 44 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 186 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2015–2019 (USD MILLION)

TABLE 187 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2020-2025 (USD MILLION)

TABLE 188 ASIA PACIFIC: MARKET SIZE, BY INFRASTRUCTURE, 2015-2019 (USD MILLION)

TABLE 189 ASIA PACIFIC: MARKET SIZE, BY INFRASTRUCTURE, 2020-2025 (USD MILLION)

TABLE 190 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2015-2019 (USD MILLION)

TABLE 191 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2020-2025 (USD MILLION)

TABLE 192 ASIA PACIFIC: MARKET SIZE, BY DISTRIBUTED ANTENNA SYSTEM, 2015-2019 (USD MILLION)

TABLE 193 ASIA PACIFIC: MARKET SIZE, BY DISTRIBUTED ANTENNA SYSTEM, 2020-2025 (USD MILLION)

TABLE 194 ASIA PACIFIC: MARKET SIZE, BY SMALL CELL, 2015-2019 (USD MILLION)

TABLE 195 ASIA PACIFIC: IN-BUILDING WIRELESS MARKET SIZE, BY SMALL CELL, 2020-2025 (USD MILLION)

TABLE 196 ASIA PACIFIC: MARKET SIZE, BY VENUE, 2015-2019 (USD MILLION)

TABLE 197 ASIA PACIFIC: MARKET SIZE, BY VENUE, 2020-2025 (USD MILLION)

TABLE 198 ASIA PACIFIC: MARKET SIZE, BY BUSINESS MODEL, 2015-2019 (USD MILLION)

TABLE 199 ASIA PACIFIC: MARKET SIZE, BY BUSINESS MODEL, 2020-2025 (USD MILLION)

TABLE 200 ASIA PACIFIC: MARKET SIZE, BY END USER, 2015-2019 (USD MILLION)

TABLE 201 ASIA PACIFIC: MARKET SIZE, BY END USER, 2020-2025 (USD MILLION)

TABLE 202 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2015-2019 (USD MILLION)

TABLE 203 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

10.4.4 CHINA

10.4.4.1 China: Regulatory norms

TABLE 204 CHINA: IN-BUILDING WIRELESS MARKET SIZE, BY COMPONENT, 2015–2019 (USD MILLION)

TABLE 205 CHINA: MARKET SIZE, BY COMPONENT, 2020-2025 (USD MILLION)

TABLE 206 CHINA: MARKET SIZE, BY INFRASTRUCTURE, 2015-2019 (USD MILLION)

TABLE 207 CHINA: MARKET SIZE, BY INFRASTRUCTURE, 2020-2025 (USD MILLION)

TABLE 208 CHINA: MARKET SIZE, BY SERVICE, 2015-2019 (USD MILLION)

TABLE 209 CHINA: MARKET SIZE, BY SERVICE, 2020-2025 (USD MILLION)

TABLE 210 CHINA: MARKET SIZE, BY DISTRIBUTED ANTENNA SYSTEM, 2015-2019 (USD MILLION)

TABLE 211 CHINA: MARKET SIZE, BY DISTRIBUTED ANTENNA SYSTEM, 2020-2025 (USD MILLION)

TABLE 212 CHINA: MARKET SIZE, BY SMALL CELL, 2015-2019 (USD MILLION)

TABLE 213 CHINA: MARKET SIZE, BY SMALL CELL, 2020-2025 (USD MILLION)

TABLE 214 CHINA: MARKET SIZE, BY VENUE, 2015-2019 (USD MILLION)

TABLE 215 CHINA: MARKET SIZE, BY VENUE, 2020-2025 (USD MILLION)

TABLE 216 CHINA: MARKET SIZE, BY BUSINESS MODEL, 2015-2019 (USD MILLION)

TABLE 217 CHINA: MARKET SIZE, BY BUSINESS MODEL, 2020-2025 (USD MILLION)

10.4.5 JAPAN

10.4.5.1 Japan: Regulatory norms

TABLE 218 JAPAN: IN-BUILDING WIRELESS MARKET SIZE, BY COMPONENT, 2015–2019 (USD MILLION)

TABLE 219 JAPAN: MARKET SIZE, BY COMPONENT, 2020-2025 (USD MILLION)

TABLE 220 JAPAN: MARKET SIZE, BY INFRASTRUCTURE, 2015-2019 (USD MILLION)

TABLE 221 JAPAN: MARKET SIZE, BY INFRASTRUCTURE, 2020-2025 (USD MILLION)

TABLE 222 JAPAN: MARKET SIZE, BY SERVICE, 2015-2019 (USD MILLION)

TABLE 223 JAPAN: MARKET SIZE, BY SERVICE, 2020-2025 (USD MILLION)

TABLE 224 JAPAN: MARKET SIZE, BY DISTRIBUTED ANTENNA SYSTEM, 2015-2019 (USD MILLION)

TABLE 225 JAPAN: MARKET SIZE, BY DISTRIBUTED ANTENNA SYSTEM, 2020-2025 (USD MILLION)

TABLE 226 JAPAN: MARKET SIZE, BY SMALL CELL, 2015-2019 (USD MILLION)

TABLE 227 JAPAN: MARKET SIZE, BY SMALL CELL, 2020-2025 (USD MILLION)

TABLE 228 JAPAN: MARKET SIZE, BY VENUE, 2015-2019 (USD MILLION)

TABLE 229 JAPAN: MARKET SIZE, BY VENUE, 2020-2025 (USD MILLION)

TABLE 230 JAPAN: MARKET SIZE, BY BUSINESS MODEL, 2015-2019 (USD MILLION)

TABLE 231 JAPAN: MARKET SIZE, BY BUSINESS MODEL, 2020-2025 (USD MILLION)

10.4.6 REST OF ASIA PACIFIC

10.5 MIDDLE EAST AND AFRICA

10.5.1 MIDDLE EAST AND AFRICA: IN-BUILDING WIRELESS MARKET DRIVERS

10.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

TABLE 232 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2015–2019 (USD MILLION)

TABLE 233 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2020-2025 (USD MILLION)

TABLE 234 MIDDLE EAST AND AFRICA: MARKET SIZE, BY INFRASTRUCTURE, 2015-2019 (USD MILLION)

TABLE 235 MIDDLE EAST AND AFRICA: MARKET SIZE, BY INFRASTRUCTURE, 2020-2025 (USD MILLION)

TABLE 236 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2015-2019 (USD MILLION)

TABLE 237 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2020-2025 (USD MILLION)

TABLE 238 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DISTRIBUTED ANTENNA SYSTEM, 2015-2019 (USD MILLION)

TABLE 239 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DISTRIBUTED ANTENNA SYSTEM, 2020-2025 (USD MILLION)

TABLE 240 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SMALL CELL, 2015-2019 (USD MILLION)

TABLE 241 MIDDLE EAST AND AFRICA: IN-BUILDING WIRELESS MARKET SIZE, BY SMALL CELL, 2020-2025 (USD MILLION)

TABLE 242 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VENUE, 2015-2019 (USD MILLION)

TABLE 243 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VENUE, 2020-2025 (USD MILLION)

TABLE 244 MIDDLE EAST AND AFRICA: MARKET SIZE, BY BUSINESS MODEL, 2015-2019 (USD MILLION)

TABLE 245 MIDDLE EAST AND AFRICA: MARKET SIZE, BY BUSINESS MODEL, 2020-2025 (USD MILLION)

TABLE 246 MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 2015-2019 (USD MILLION)

TABLE 247 MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 2020-2025 (USD MILLION)

TABLE 248 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2015-2019 (USD MILLION)

TABLE 249 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

10.5.3 KINGDOM OF SAUDI ARABIA

10.5.3.1 Kingdom of Saudi Arabia: Regulatory norms

TABLE 250 KINGDOM OF SAUDI ARABIA: IN-BUILDING WIRELESS MARKET SIZE, BY COMPONENT, 2015–2019 (USD MILLION)

TABLE 251 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY COMPONENT, 2020-2025 (USD MILLION)

TABLE 252 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY INFRASTRUCTURE, 2015-2019 (USD MILLION)

TABLE 253 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY INFRASTRUCTURE, 2020-2025 (USD MILLION)

TABLE 254 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY SERVICE, 2015-2019 (USD MILLION)

TABLE 255 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY SERVICE, 2020-2025 (USD MILLION)

TABLE 256 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY DISTRIBUTED ANTENNA SYSTEM, 2015-2019 (USD MILLION)

TABLE 257 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY DISTRIBUTED ANTENNA SYSTEM, 2020-2025 (USD MILLION)

TABLE 258 KINGDOM OF SAUDI ARABIA: IN-BUILDING WIRELESS MARKET SIZE, BY SMALL CELL, 2015-2019 (USD MILLION)

TABLE 259 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY SMALL CELL, 2020-2025 (USD MILLION)

TABLE 260 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY VENUE, 2015-2019 (USD MILLION)

TABLE 261 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY VENUE, 2020-2025 (USD MILLION)

TABLE 262 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY BUSINESS MODEL, 2015-2019 (USD MILLION)

TABLE 263 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY BUSINESS MODEL, 2020-2025 (USD MILLION)

10.5.4 UNITED ARAB EMIRATES

10.5.4.1 United Arab Emirates: Regulatory norms

TABLE 264 UNITED ARAB EMIRATES: IN-BUILDING WIRELESS MARKET SIZE, BY COMPONENT, 2015–2019 (USD MILLION)

TABLE 265 UNITED ARAB EMIRATES: MARKET SIZE, BY COMPONENT, 2020-2025 (USD MILLION)

TABLE 266 UNITED ARAB EMIRATES: MARKET SIZE, BY INFRASTRUCTURE, 2015-2019 (USD MILLION)

TABLE 267 UNITED ARAB EMIRATES: MARKET SIZE, BY INFRASTRUCTURE, 2020-2025 (USD MILLION)

TABLE 268 UNITED ARAB EMIRATES: MARKET SIZE, BY SERVICE, 2015-2019 (USD MILLION)

TABLE 269 UNITED ARAB EMIRATES: MARKET SIZE, BY SERVICE, 2020-2025 (USD MILLION)

TABLE 270 UNITED ARAB EMIRATES: MARKET SIZE, BY DISTRIBUTED ANTENNA SYSTEM, 2015-2019 (USD MILLION)

TABLE 271 UNITED ARAB EMIRATES: MARKET SIZE, BY DISTRIBUTED ANTENNA SYSTEM, 2020-2025 (USD MILLION)

TABLE 272 UNITED ARAB EMIRATES: MARKET SIZE, BY SMALL CELL, 2015-2019 (USD MILLION)

TABLE 273 UNITED ARAB EMIRATES: MARKET SIZE, BY SMALL CELL, 2020-2025 (USD MILLION)

TABLE 274 UNITED ARAB EMIRATES: MARKET SIZE, BY VENUE, 2015-2019 (USD MILLION)

TABLE 275 UNITED ARAB EMIRATES: MARKET SIZE, BY VENUE, 2020-2025 (USD MILLION)

TABLE 276 UNITED ARAB EMIRATES: MARKET SIZE, BY BUSINESS MODEL, 2015-2019 (USD MILLION)

TABLE 277 UNITED ARAB EMIRATES: MARKET SIZE, BY BUSINESS MODEL, 2020-2025 (USD MILLION)

10.5.5 REST OF MIDDLE EAST AND AFRICA

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: IN-BUILDING WIRELESS MARKET DRIVERS

10.6.2 LATIN AMERICA: COVID-19 IMPACT

TABLE 278 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2015–2019 (USD MILLION)

TABLE 279 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2020-2025 (USD MILLION)

TABLE 280 LATIN AMERICA: MARKET SIZE, BY INFRASTRUCTURE, 2015-2019 (USD MILLION)

TABLE 281 LATIN AMERICA: MARKET SIZE, BY INFRASTRUCTURE, 2020-2025 (USD MILLION)

TABLE 282 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2015-2019 (USD MILLION)

TABLE 283 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2020-2025 (USD MILLION)

TABLE 284 LATIN AMERICA: MARKET SIZE, BY DISTRIBUTED ANTENNA SYSTEM, 2015-2019 (USD MILLION)

TABLE 285 LATIN AMERICA: MARKET SIZE, BY DISTRIBUTED ANTENNA SYSTEM, 2020-2025 (USD MILLION)

TABLE 286 LATIN AMERICA: MARKET SIZE, BY SMALL CELL, 2015-2019 (USD MILLION)

TABLE 287 LATIN AMERICA: MARKET SIZE, BY SMALL CELL, 2020-2025 (USD MILLION)

TABLE 288 LATIN AMERICA: MARKET SIZE, BY VENUE, 2015-2019 (USD MILLION)

TABLE 289 LATIN AMERICA: MARKET SIZE, BY VENUE, 2020-2025 (USD MILLION)

TABLE 290 LATIN AMERICA: MARKET SIZE, BY BUSINESS MODEL, 2015-2019 (USD MILLION)

TABLE 291 LATIN AMERICA: MARKET SIZE, BY BUSINESS MODEL, 2020-2025 (USD MILLION)

TABLE 292 LATIN AMERICA: MARKET SIZE, BY END USER, 2015-2019 (USD MILLION)

TABLE 293 LATIN AMERICA: MARKET SIZE, BY END USER, 2020-2025 (USD MILLION)

TABLE 294 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2015-2019 (USD MILLION)

TABLE 295 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

10.6.3 BRAZIL

10.6.3.1 Brazil: Regulatory norms

TABLE 296 BRAZIL: IN-BUILDING WIRELESS MARKET SIZE, BY COMPONENT, 2015–2019 (USD MILLION)

TABLE 297 BRAZIL: MARKET SIZE, BY COMPONENT, 2020-2025 (USD MILLION)

TABLE 298 BRAZIL: MARKET SIZE, BY INFRASTRUCTURE, 2015-2019 (USD MILLION)

TABLE 299 BRAZIL: MARKET SIZE, BY INFRASTRUCTURE, 2020-2025 (USD MILLION)

TABLE 300 BRAZIL: MARKET SIZE, BY SERVICE, 2015-2019 (USD MILLION)

TABLE 301 BRAZIL: MARKET SIZE, BY SERVICE, 2020-2025 (USD MILLION)

TABLE 302 BRAZIL: MARKET SIZE, BY DISTRIBUTED ANTENNA SYSTEM, 2015-2019 (USD MILLION)

TABLE 303 BRAZIL: MARKET SIZE, BY DISTRIBUTED ANTENNA SYSTEM, 2020-2025 (USD MILLION)

TABLE 304 BRAZIL: MARKET SIZE, BY SMALL CELL, 2015-2019 (USD MILLION)

TABLE 305 BRAZIL: MARKET SIZE, BY SMALL CELL, 2020-2025 (USD MILLION)

TABLE 306 BRAZIL: MARKET SIZE, BY VENUE, 2015-2019 (USD MILLION)

TABLE 307 BRAZIL: MARKET SIZE, BY VENUE, 2020-2025 (USD MILLION)

TABLE 308 BRAZIL: MARKET SIZE, BY BUSINESS MODEL, 2015-2019 (USD MILLION)

TABLE 309 BRAZIL: MARKET SIZE, BY BUSINESS MODEL, 2020-2025 (USD MILLION)

10.6.4 MEXICO

10.6.4.1 Mexico: Regulatory norms

TABLE 310 MEXICO: IN-BUILDING WIRELESS MARKET SIZE, BY COMPONENT, 2015–2019 (USD MILLION)

TABLE 311 MEXICO: MARKET SIZE, BY COMPONENT, 2020-2025 (USD MILLION)

TABLE 312 MEXICO: MARKET SIZE, BY INFRASTRUCTURE, 2015-2019 (USD MILLION)

TABLE 313 MEXICO: MARKET SIZE, BY INFRASTRUCTURE, 2020-2025 (USD MILLION)

TABLE 314 MEXICO: MARKET SIZE, BY SERVICE, 2015-2019 (USD MILLION)

TABLE 315 MEXICO: MARKET SIZE, BY SERVICE, 2020-2025 (USD MILLION)

TABLE 316 MEXICO: MARKET SIZE, BY DISTRIBUTED ANTENNA SYSTEM, 2015-2019 (USD MILLION)

TABLE 317 MEXICO: MARKET SIZE, BY DISTRIBUTED ANTENNA SYSTEM, 2020-2025 (USD MILLION)

TABLE 318 MEXICO: MARKET SIZE, BY SMALL CELL, 2015-2019 (USD MILLION)

TABLE 319 MEXICO: MARKET SIZE, BY SMALL CELL, 2020-2025 (USD MILLION)

TABLE 320 MEXICO: MARKET SIZE, BY VENUE, 2015-2019 (USD MILLION)

TABLE 321 MEXICO: MARKET SIZE, BY VENUE, 2020-2025 (USD MILLION)

TABLE 322 MEXICO: MARKET SIZE, BY BUSINESS MODEL, 2015-2019 (USD MILLION)

TABLE 323 MEXICO: MARKET SIZE, BY BUSINESS MODEL, 2020-2025 (USD MILLION)

10.6.5 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE (Page No. - 243)

11.1 INTRODUCTION

11.2 MARKET EVALUATION FRAMEWORK

FIGURE 45 MARKET EVALUATION FRAMEWORK, 2017-2020

11.3 REVENUE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 46 REVENUE ANALYSIS OF THE IN-BUILDING WIRELESS MARKET

11.4 HISTORICAL REVENUE ANALYSIS

11.4.1 INTRODUCTION

FIGURE 47 HISTORIC FIVE YEARS REVENUE ANALYSIS OF LEADING PLAYERS

11.5 RANKING OF KEY PLAYERS IN THE MARKET, 2020

FIGURE 48 RANKING OF KEY PLAYERS, 2020

11.6 COMPANY EVALUATION MATRIX

11.6.1 STAR

11.6.2 EMERGING LEADER

11.6.3 PERVASIVE

11.6.4 PARTICIPANT

FIGURE 49 IN-BUILDING WIRELESS MARKET (GLOBAL), COMPANY EVALUATION MATRIX, 2020

11.6.5 PRODUCT FOOTPRINT ANALYSIS OF KEY VENDORS

FIGURE 50 PRODUCT FOOTPRINT ANALYSIS OF IN-BUILDING WIRELESS VENDORS

11.7 STARTUP/SME EVALUATION MATRIX, 2020

11.7.1 PROGRESSIVE COMPANIES

11.7.2 RESPONSIVE COMPANIES

11.7.3 DYNAMIC COMPANIES

11.7.4 STARTING BLOCKS

FIGURE 51 IN-BUILDING WIRELESS MARKET (GLOBAL), STARTUP/SME EVALUATION MATRIX, 2020

12 COMPANY PROFILES (Page No. - 251)

12.1 INTRODUCTION

(Business Overview, Products & Services, Key Insights, Recent Developments, MnM View)*

12.2 AXELL WIRELESS

12.3 COMMSCOPE

FIGURE 52 COMMSCOPE: COMPANY SNAPSHOT

12.4 COMBA TELECOM

FIGURE 53 COMBA TELECOM: COMPANY SNAPSHOT

12.5 CORNING

FIGURE 54 CORNING: COMPANY SNAPSHOT

12.6 ERICSSON

FIGURE 55 ERICSSON: COMPANY SNAPSHOT

12.7 HUAWEI

FIGURE 56 HUAWEI: COMPANY SNAPSHOT

12.8 NOKIA

FIGURE 57 NOKIA: COMPANY SNAPSHOT

12.9 SAMSUNG

FIGURE 58 SAMSUNG: COMPANY SNAPSHOT

12.10 ZTE

FIGURE 59 ZTE: COMPANY SNAPSHOT

12.11 SOLID

12.12 DALI WIRELESS

12.13 ZINWAVE

12.14 ADRF

12.15 IP.ACCESS

12.16 AIRSPAN

12.17 CONTELA

12.18 FUJITSU

FIGURE 60 FUJITSU: COMPANY SNAPSHOT

12.19 NEC

FIGURE 61 NEC: COMPANY SNAPSHOT

12.20 BTI WIRELESS

12.21 BIRD

12.22 ACCELLERAN

12.23 BAICELLS TECHNOLOGIES

12.24 QUCELL

12.25 CASA SYSTEMS

12.26 COMMAGILITY

12.27 GALTRONICS

12.28 G-WAVE SOLUTIONS

12.29 HUBER+SUHNER

12.30 JMA WIRELESS

12.31 MICROLAB

12.32 NEXTIVITY

12.33 SARCOMM

12.34 PCTEL

12.35 WHOOP WIRELESS

12.36 WESTELL TECHNOLOGIES

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, MnM View might not be captured in case of unlisted companies.

12.37 KEY ECOSYSTEM VENDORS

12.37.1 AMERICAN TOWER

12.37.2 ANIXTER

12.37.3 AT&T

12.37.4 BETACOM

12.37.5 BOINGO WIRELESS

12.37.6 CONNECTIVITY WIRELESS

12.37.7 CROWN CASTLE

12.37.8 EXTENET SYSTEMS

12.37.9 T-MOBILE

12.37.10 VERIZON

12.38 LIST OF SYSTEM INTEGRATORS/DISTRIBUTORS/ VALUE ADDED DISTRIBUTORS

13 APPENDIX (Page No. - 338)

13.1 ADJACENT/RELATED MARKETS

13.1.1 5G INFRASTRUCTURE MARKET

13.1.1.1 Market definition

13.1.1.2 Limitations of the study

13.1.1.3 Market overview

13.1.1.4 5G infrastructure market, by communication infrastructure

TABLE 324 5G INFRASTRUCTURE MARKET, BY COMMUNICATION INFRASTRUCTURE, 2018–2027 (USD MILLION)

TABLE 325 5G COMMUNICATION INFRASTRUCTURE MARKET, BY REGION, 2018–2027 (USD MILLION)

TABLE 326 5G COMMUNICATION INFRASTRUCTURE MARKET IN ROW, BY REGION, 2018–2027 (USD MILLION)

TABLE 327 5G COMMUNICATION INFRASTRUCTURE MARKET, BY END USER, 2018–2027 (USD MILLION)

13.1.1.5 5G infrastructure market, by region

TABLE 328 5G INFRASTRUCTURE MARKET, BY REGION, 2018–2027 (USD MILLION)

TABLE 329 5G INFRASTRUCTURE MARKET IN NORTH AMERICA, BY OPERATIONAL FREQUENCY, 2018–2027 (USD MILLION)

TABLE 330 5G INFRASTRUCTURE MARKET IN NORTH AMERICA, BY CORE NETWORK TECHNOLOGY, 2018–2027 (USD MILLION)

TABLE 331 5G INFRASTRUCTURE MARKET IN CANADA, BY CORE NETWORK TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 332 5G INFRASTRUCTURE MARKET IN MEXICO, BY COMMUNICATION INFRASTRUCTURE, 2020–2027 (USD MILLION)

TABLE 333 5G INFRASTRUCTURE MARKET IN EUROPE, BY OPERATIONAL FREQUENCY, 2018–2027 (USD MILLION)

TABLE 334 5G INFRASTRUCTURE MARKET IN GERMANY, BY COMMUNICATION INFRASTRUCTURE, 2019–2027 (USD MILLION)

TABLE 335 5G INFRASTRUCTURE MARKET IN ITALY, BY CORE NETWORK TECHNOLOGY, 2019–2027 (USD MILLION)

TABLE 336 5G INFRASTRUCTURE MARKET IN REST OF EUROPE, BY COMMUNICATION INFRASTRUCTURE, 2018–2027 (USD MILLION)

TABLE 337 5G INFRASTRUCTURE MARKET IN REST OF EUROPE, BY CORE NETWORK TECHNOLOGY, 2018–2027 (USD MILLION)

TABLE 338 5G INFRASTRUCTURE MARKET IN APAC, BY COUNTRY, 2018–2027 (USD MILLION)

TABLE 339 5G INFRASTRUCTURE MARKET IN APAC, BY COMMUNICATION INFRASTRUCTURE, 2018–2027 (USD MILLION)

TABLE 340 5G INFRASTRUCTURE MARKET IN APAC, BY END USER, 2018–2027 (USD MILLION)

TABLE 341 5G INFRASTRUCTURE MARKET IN ASIA PACIFIC, BY CORE NETWORK TECHNOLOGY, 2018–2027 (USD MILLION)

TABLE 342 5G INFRASTRUCTURE MARKET IN JAPAN, BY COMMUNICATION INFRASTRUCTURE, 2019–2027 (USD MILLION)

TABLE 343 5G INFRASTRUCTURE MARKET IN JAPAN, BY CORE NETWORK TECHNOLOGY, 2019–2027 (USD MILLION)

TABLE 344 5G INFRASTRUCTURE MARKET IN REST OF ASIA PACIFIC , BY COMMUNICATION INFRASTRUCTURE, 2019–2027 (USD MILLION)

TABLE 345 5G INFRASTRUCTURE MARKET IN ROW, BY REGION, 2018–2027 (USD MILLION)

TABLE 346 5G INFRASTRUCTURE MARKET IN ROW, BY COMMUNICATION INFRASTRUCTURE, 2018–2027 (USD MILLION)

TABLE 347 5G INFRASTRUCTURE MARKET IN ROW, BY END USER, 2018–2027 (USD MILLION)

TABLE 348 5G INFRASTRUCTURE MARKET IN ROW, BY CORE NETWORK TECHNOLOGY, 2018–2027 (USD MILLION)

TABLE 349 5G INFRASTRUCTURE MARKET IN MIDDLE EAST AND AFRICA, BY COMMUNICATION INFRASTRUCTURE, 2018–2027 (USD MILLION)

TABLE 350 5G INFRASTRUCTURE MARKET IN SOUTH AMERICA, BY COMMUNICATION INFRASTRUCTURE, 2020–2027 (USD MILLION)

TABLE 351 5G INFRASTRUCTURE MARKET IN SOUTH AMERICA, BY CORE NETWORK TECHNOLOGY, 2020–2027 (USD MILLION)

13.1.2 5G SERVICES MARKET

13.1.2.1 Market definition

13.1.2.2 Limitations of the study

13.1.2.3 Market overview

13.1.2.4 5G services market, by application

TABLE 352 5G SERVICES MARKET SIZE, BY APPLICATION, 2020–2025 (USD BILLION)

13.1.2.5 5G service market, by region

TABLE 353 NORTH AMERICA: 5G SERVICES MARKET SIZE, BY APPLICATION, 2020–2025 (USD BILLION)

TABLE 354 NORTH AMERICA: 5G SERVICES MARKET SIZE, BY VERTICAL, 2020–2025 (USD BILLION)

TABLE 355 NORTH AMERICA: 5G SERVICES MARKET SIZE, BY SMART CITIES, 2020–2025 (USD BILLION)

TABLE 356 NORTH AMERICA: 5G SERVICES MARKET SIZE, BY SMART BUILDINGS, 2020–2025 (USD BILLION)

TABLE 357 NORTH AMERICA: 5G SERVICES MARKET SIZE, BY CONNECTED VEHICLES, 2020–2025 (USD BILLION)

TABLE 358 NORTH AMERICA: 5G SERVICES MARKET SIZE, BY CONNECTED HEALTHCARE, 2020–2025 (USD BILLION)

TABLE 359 NORTH AMERICA: 5G SERVICES MARKET SIZE, BY CONNECTED RETAIL, 2020–2025 (USD BILLION)

TABLE 360 NORTH AMERICA: 5G SERVICES MARKET SIZE, BY BROADBAND, 2020–2025 (USD BILLION)

TABLE 361 EUROPE: 5G SERVICES MARKET SIZE, BY APPLICATION, 2020–2025 (USD BILLION)

TABLE 362 EUROPE: 5G SERVICES MARKET SIZE, BY SMART CITIES, 2020–2025 (USD BILLION)

TABLE 363 EUROPE: 5G SERVICES MARKET SIZE, BY CONNECTED FACTORIES, 2020–2025 (USD BILLION)

TABLE 364 EUROPE: 5G SERVICES MARKET SIZE, BY SMART BUILDINGS, 2020–2025 (USD BILLION)

TABLE 365 EUROPE: 5G SERVICES MARKET SIZE, BY CONNECTED HEALTHCARE, 2020–2025 (USD BILLION)

TABLE 366 EUROPE: 5G SERVICES MARKET SIZE, BY CONNECTED RETAIL, 2020–2025 (USD BILLION)

TABLE 367 EUROPE: 5G SERVICES MARKET SIZE, BY BROADBAND, 2020–2025 (USD BILLION)

TABLE 368 ASIA PACIFIC: 5G SERVICES MARKET SIZE, BY APPLICATION, 2020–2025 (USD BILLION)

TABLE 369 ASIA PACIFIC: 5G SERVICES MARKET SIZE, BY SMART CITIES, 2020–2025 (USD BILLION)

TABLE 370 ASIA PACIFIC: 5G SERVICES MARKET SIZE, BY CONNECTED FACTORIES, 2020–2025 (USD BILLION)

TABLE 371 ASIA PACIFIC: 5G SERVICES MARKET SIZE, BY SMART BUILDINGS, 2020–2025 (USD BILLION)

TABLE 372 ASIA PACIFIC: 5G SERVICES MARKET SIZE, BY CONNECTED VEHICLES, 2020–2025 (USD BILLION)

TABLE 373 ASIA PACIFIC: 5G SERVICES MARKET SIZE, BY CONNECTED HEALTHCARE, 2020–2025 (USD BILLION)

TABLE 374 ASIA PACIFIC: 5G SERVICES MARKET SIZE, BY CONNECTED RETAIL, 2020–2025 (USD BILLION)

TABLE 375 ASIA PACIFIC: 5G SERVICES MARKET SIZE, BY BROADBAND, 2020–2025 (USD BILLION)

TABLE 376 LATIN AMERICA: 5G SERVICES MARKET SIZE, BY APPLICATION, 2020–2025 (USD BILLION)

TABLE 377 LATIN AMERICA: 5G SERVICES MARKET SIZE, BY VERTICAL, 2020–2025 (USD BILLION)

TABLE 378 LATIN AMERICA: 5G SERVICES MARKET SIZE, BY SMART CITIES, 2020–2025 (USD BILLION)

TABLE 379 LATIN AMERICA: 5G SERVICES MARKET SIZE, BY SMART BUILDINGS, 2020–2025 (USD BILLION)

TABLE 380 LATIN AMERICA: 5G SERVICES MARKET SIZE, BY CONNECTED VEHICLES, 2020–2025 (USD BILLION)

13.1.3 LTE AND 5G BROADCAST MARKET

13.1.3.1 Market definition

13.1.3.2 Limitations of the study

13.1.3.3 Market overview

13.1.3.4 LTE and 5G broadcast market, by technology

TABLE 381 LTE AND 5G BROADCAST MARKET, BY TECHNOLOGY, 2015–2024 (USD MILLION)

TABLE 382 5G BROADCAST MARKET, BY END USER, 2015–2024 (USD MILLION)

13.1.3.5 LTE and 5G broadcast market, by region

TABLE 383 NORTH AMERICAN LTE AND 5G BROADCAST MARKET, BY TECHNOLOGY, 2015–2024 (USD MILLION)

TABLE 384 NORTH AMERICAN LTE BROADCAST MARKET, BY COUNTRY, 2015–2024 (USD MILLION)

TABLE 385 NORTH AMERICAN 5G-BROADCAST MARKET, BY COUNTRY, 2015–2024 (USD MILLION)

TABLE 386 EUROPEAN LTE AND 5G BROADCAST MARKET, BY TECHNOLOGY, 2015–2024 (USD MILLION)

TABLE 387 EUROPE LTE BROADCAST MARKET, BY COUNTRY, 2015–2024 (USD MILLION)

TABLE 388 ASIA PACIFIC LTE BROADCAST MARKET, BY COUNTRY, 2015–2024 (USD MILLION)

TABLE 389 ROW LTE AND 5G BROADCAST MARKET, BY TECHNOLOGY, 2015–2024 (USD MILLION)

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

The study involved four major activities in estimating the current market size for the in-building wireless market. Exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub-segments of the In-building wireless market.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports; press releases and investor presentations of companies; and white papers, certified publications, and articles from recognized associations and government publishing sources. Journals such as the International Journal of Computer Science and Information Technology and Security (IJCSITS) and Scientific.Net; and various associations, including the European Association of Next Generation Telecommunications Innovators (EANGTI) and International Telecommunication Union (ITU) were referred to, for consolidating the report. Secondary research was mainly used to obtain key information about the industry insights, market’s monetary chain, overall pool of key players, and market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the In-building wireless market. The primary sources from the demand side included telecom operators, network administrators/consultants/ specialists, Chief Information Officers (CIOs), and subject matter experts from telecom and government associations.

Given below is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the market size of the In-building wireless market. The first approach involves the estimation of the market size by summing up companies’ revenue generated through the sale of solutions and services. The top-down and bottom-up approaches were used to estimate and validate the size of the market and various other dependent submarkets in the overall market. An exhaustive list of all the vendors who offer solutions and services in the In-building wireless market was prepared while using the top-down approach. The market revenue for all the vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor was evaluated based on its components (solution and services). The aggregate of all companies’ revenues was extrapolated to reach the overall market size. Further, each subsegment was studied and analyzed for its regional market size and country-level penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from the industry leaders, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and managers.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To determine and forecast the global in-building wireless market based on component (infrastructure and services), business model, venues, end-users, and regions from 2020 to 2025, and analyze various macro and microeconomic factors affecting the market growth

- To forecast the size of the market segments for five regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the In-building wireless market

- To analyze each submarket for individual growth trends, prospects, and contributions to the global market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the global in-building wireless market

- To profile the key market players, such as top vendors and startups; provide a comparative analysis based on their business overviews, regional presence, product offerings, and business strategies; and illustrate the market’s competitive landscape

- To track and analyze competitive developments, such as new product launches, product enhancements, partnerships, acquisitions, and agreements and collaborations, in the market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the In-building wireless market

- To profile key market players; provide a comparative analysis based on business overview, regional presence, product offerings, business strategies, and key financials; and illustrate the competitive landscape of the market

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities, in the market

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company information

- Detailed analysis and profiling of additional market players (Up to 5)

Growth opportunities and latent adjacency in In-building Wireless Market

Need information on in-building wireless millimeter wave Self-Organizing Network.

Wants to understand how big or small is IBC market in Australia

Information to help identify which new technologies to develop and what direction to steer companys outreach.