Indoor Location Market by Component (Hardware, Solutions, and Services), Technology (BLE, UWB, Wi-Fi, RFID), Application (Emergency Response Management, Remote Monitoring, Predictive Asset Maintenance), Vertical and Region - Global Forecast to 2028

Indoor Location Market - Size, Growth, Report & Analysis

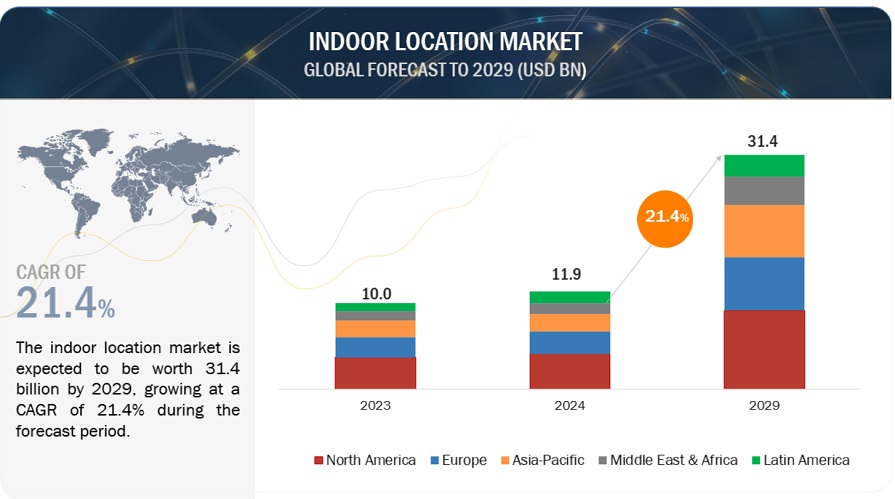

[289 Pages Report] The global Indoor Location Market size as per revenue was surpassed $10.9 billion in 2023 and is anticipated to hit a revenue around $29.8 billion by the end of 2028, projecting a CAGR of 22.3% during the forecast period (2023-2028). The base year for estimation is 2022 and the market size available for the years 2017 to 2028.

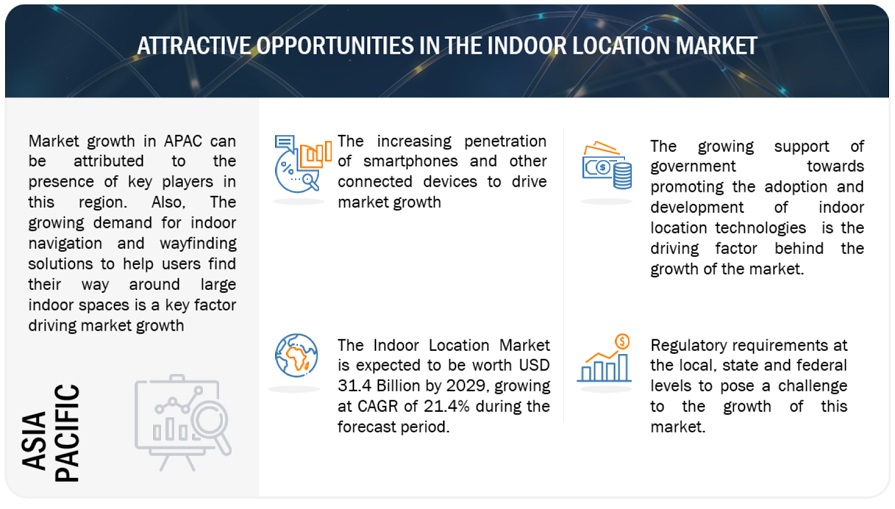

The growing penetration of smartphones and other connected devices which are equipped with GPS and other location-based technologies to track the location of users indoor, is expected to drive the growth of indoor location market.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Indoor Location Market Growth Dynamics

Driver: The power of simultaneous localization and mapping (SLAM)

The advancement and effectiveness of indoor positioning systems are significantly driven by Simultaneous Localization and Mapping (SLAM) techniques. SLAM combines computer vision, sensor fusion, and mapping algorithms to simultaneously map an unknown environment and estimate the position of the observer within it. By leveraging data from various sensors, SLAM algorithms accurately track the user's location in real-time, even in complex indoor settings. These techniques create and update a map of the environment, incorporating new sensor data and estimating landmark positions. SLAM's visual and geometric understanding of the environment allows for accurate positioning and mapping, adapting to dynamic changes within indoor space. Integration with other indoor positioning technologies enhances the accuracy and reliability of the system. Overall, SLAM techniques drive indoor positioning systems by improving accuracy, providing real-time mapping, adapting to dynamic environments, and facilitating robust and reliable indoor positioning.

Restraint: Concerns related to data security and privacy

Location-based data is sensitive information that must be protected at all costs. However, several concerns and fears are established by looking at the technical details of IPS more closely. Indoor location-based techniques are used in various fields, such as object tracking and locating people within a certain range. Because people spend a lot of time indoors, it is important for users and service providers to get accurate indoor location information. There are several technologies to gain indoor location information, such as Wi-Fi, BLE, and RFID, which require the characteristics of data, security, and privacy. Fingerprinting is one of the most recent technologies that is being deployed by several verticals. Mobile device users usually make use of an application provided by the service provider to access information from indoor positioning services. In such cases, these users send their unique identifier (Media Access Control [MAC] address) to the server, which enables the service provider to gain information related to the position of the user, posing a serious threat to the privacy of the user. These threats of data leaks can be a major disadvantage for the adoption of indoor location technologies.

Opportunity: Increasing demand for RFID tags across retail industry

For retailers, meeting the needs of their customers is the most important job. If one can order a particular product online and the company can have it shipped to the local store, it can be a win-win situation for everyone. If the customer orders the product and gets notice that it has been shipped, but the store misplaces it, it can be a huge disadvantage for the retailer. RFID technology mainly uses passive tags for location-related information, which is characterized by a small radius of detection with no need for an internal source. RFID tags are implemented due to their reduced cost. RFID is a technology that can help retailers, consumers, and brand owners with the ability to have clear, real-time insights into their inventory and its use in self-checkout, product information, and payment processes. This technology is projected to appear throughout the retail world. For example, Mammut Sports Group AG has embedded Smartrac Circus Flex NFC tags into some of its products. This, in turn, will allow consumers to receive digital content through Mammut Connect, Mammut’s smartphone app. RFID helps brands and retailers become more efficient as it provides them with several new opportunities, insights, additional services, and customized, defined, and instant information.

Challenge: Dearth of uniform standards and interoperability, and system incompatibility

End users have to choose from a wider range of available solutions; however, the lack of uniform standards makes it difficult to integrate the available solutions. The incompatibility between various infrastructures and the lack of interoperability creates problems for end users. Companies such as Zebra Technologies, HID Global, and Inpixon provide indoor location solutions that support more than one protocol; however, most of the players in the market primarily focus on a single protocol. Since different technologies operate on different protocols and frequency bands, there is no interoperability between various indoor location solutions, except for solutions provided by a few vendors, such as Zebra Technologies, which offer multiple indoor location technologies that are supported by the same middleware.

Currently, the major issue in the indoor location market is the availability of solutions with multiple interoperable technologies under the same roof. The installation of the indoor location solution integrated with multiple technologies, either in an enterprise or any institutional area, requires changes to be made in the existing infrastructure, such as additional servers, middleware, and other integrated systems. Putting a tag on assets, equipment, or personnel requires location readers to be set up in the doorways and hallways and an alteration in the protocol to locate assets.

Indoor Location Market Ecosystem

companies in this market include well-established, financially stable provider of indoor location hardware, solutions and services. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Zebra Technologies (US), Cisco (US), Google (US), Microsoft (US), HPE (US).

Based on services, the managed services segment is expected to register higher CAGR during forecast period

Managed services play a vital role in indoor location tracking by providing comprehensive support and expertise in implementing and managing the infrastructure and systems involved. These services encompass the design, deployment, configuration, and maintenance of the indoor location tracking solution. Managed service providers offer technical expertise, monitoring capabilities, and ongoing support to ensure the smooth operation and optimization of the tracking system. Managed services provide all required skillsets to maintain and upgrade solutions, which are of utmost importance in the indoor location or positioning environment.

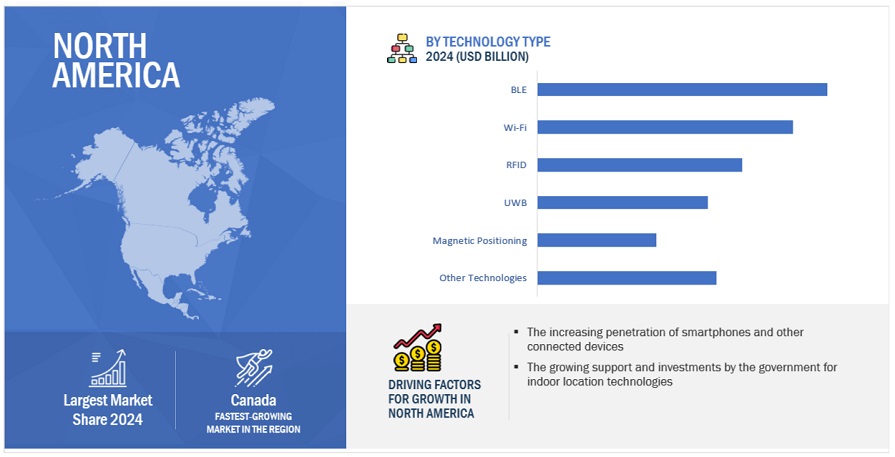

By technology, Bluetooth Low Energy (BLE) technology is expected to hold the largest market size during the forecast

The indoor location uses BLE signals from battery-operated beacons as its primary technology. One of the most recent technologies to develop and become a market standard is BLE, which is now present on the majority of devices. The bicycles were stolen from Michelin, a city in Belgium. Infsoft provided a Bluetooth beacon-based indoor tracking system based on infsoft Locator Nodes to resolve this issue. The solution allowed the local law enforcement to get the bikes back, convict the thieves, and lessen the quantity of thefts.

Based on vertical, the retail segment is expected to hold the largest market size during the forecast

Retailers need to manage their customer data to enhance customer experience. Retailers are now focusing on creating a 360-degree view of customers, which leads to customer satisfaction. Retailers use digital and offline marketing to increase sales. However, they often lack the means to connect with customers at the most important moment when they are passing by or in their stores. With the rising smartphone penetration and the changing consumer mobile buyer behavior, start-ups and established organizations are quickly looking for ways to provide location-based apps to engage their users indoors. Retailers may use indoor location software to boost sales, revenues, and customer pleasure. A decent mall navigation software enhances the shopping experience while also boosting sales. Location analytics provides accurate information on visitor flows within a property. The adoption of location-based marketing applications to drive product sales for higher revenues and profitability would increase customer experience.

Based on region, North America is expected to hold the largest market size during the forecast

Due to the widespread acceptance of technology by people and the presence of the major market players in the area, North America is anticipated to hold the highest share of the indoor location market during the forecast period. With substantial developments in the creation of smart cities, the US and Canada are the main markets in the area. In order to improve people and asset tracking throughout huge buildings, businesses, particularly in the US, have begun implementing indoor navigation and indoor tracking solutions. The rise of vendors in North America is being driven by the use of technologies like BLE, Wi-Fi, and UWB. Companies like Zebra Technologies, Inpixon, Apple, and Microsoft have launched indoor location solutions and services to meet the diverse needs of businesses and their clients as a result of rising consumer demand for indoor maps and the limited features of indoor GPS technology.

Market Players:

The major vendors in this Indoor location market include Zebra Technologies (US), Cisco (US), Google (US), Microsoft (US), HPE (US), Apple (US), Esri (US), Acuity Brands(US), Inpixon(US), HERE Technologies (US), HID Global (US), CenTrak (US), Sonitor (Norway), Ubisense (UK), infsoft (Germany), Polaris Wireless (US), Quuppa (Finland), Securitas Healthcare (US), Navigine (US), Blueiot (China), Kontakt.io (US), AiRISTA (US), InnerSpace (Canada), Syook (India), Oriient (Israel), Navenio (England), Situm (Spain), Pozyx (Belgium), Azitek (Portugal), and Mapxus (China). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and product enhancements, and acquisitions to expand their footprint in the location based entertainment market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2017-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) Million/Billion |

|

Segments covered |

By Offering, application, technology, vertical, and regions |

|

Region covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies covered |

Zebra Technologies Corporation (US), Cisco (US), Google (US), Microsoft (US), HPE (US), Apple (US), Esri (US), Acuity Brands(US), Inpixon(US), HERE Technologies (US), HID Global (US), CenTrak (US), Sonitor (Norway), Ubisense (UK), infsoft (Germany), Polaris Wireless (US), Quuppa (Finland), Securitas Healthcare (US), Navigine (US), Blueiot (China), Kontakt.io (US), AiRISTA (US), InnerSpace (Canada), Syook (India), Oriient (Israel), Navenio (England), Situm (Spain), Pozyx (Belgium), Azitek (Portugal), and Mapxus (China). |

This research report categorizes the indoor location market to forecast revenues and analyze trends in each of the following submarkets:

Based on Offering:

-

Hardware

- System on Chip

- Beacons

- Tags

- Sensors

- Gateways

- Fixed Readers

- Wi-Fi Access Points

-

Solutions

-

Indoor Tracking

- Asset and People Tracking

- Indoor Location Analytics

- Indoor Navigation

- Database Management System

-

Indoor Tracking

-

Services

-

Professional Services

- Training and Consulting

- Support and Maintenance

- System Integration and Implementation

- Managed Services

-

Professional Services

Based on Application:

- Emergency Response Management

- Sales and Marketing Optimization

- Remote Monitoring

- Predictive Asset Maintenance

- Supply Chain Management

- Inventory Management

- Other Applications

By Technology:

- BLE

- UWB

- Wi-Fi

- RFID

- Magnetic Positioning

- Other Technologies

By Vertical:

- Retail

- Travel and Hospitality

- Media and Entertainment

- Transportation and Logistics

- Government and Public Sector

- Manufacturing

- Healthcare and Pharmaceuticals

- Other Verticals

By Region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- France

- Italy

- Spain

- Nordics

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia and New Zealand

- Southeast Asia

- Rest of Asia Pacific

-

Middle East and Africa

- UAE

- KSA

- Israel

- South Africa

- Rest of Middle East and Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In January 2023, Apple launched Apple Business Connect. Apple Maps gained a new tool Apple Business Connect: It will now allow business owners to update and manage their own information on the platform, including key details like business hours and location, photos, logos, special offers and promotions, and more.

- In April 2022, Google partnered with Oriient, to create a joint offering for in-store navigation and proximity marketing.

- In January 2022, Cisco acquired Opsani. The acquisition will further enable Cisco AppDynamics to grow its product and engineering team and expand its platform's capabilities.

- In January 2022, HERE launched Indoor Map as a service: a one-stop shop for indoor mapping solutions that includes indoor map data, routing, and positioning, all available through the HERE SDK and seamlessly connected with its base map.

Frequently Asked Questions (FAQ):

What is indoor location technology?

The indoor location or indoor positioning technology facilitates the navigation and tracking of objects and people in a building using sensory information captured by mobile devices. It includes hardware, software, and service components to provide indoor location services to various organizations across verticals. Indoor location solutions may collect location data using Radio Frequency (RF), Visible Light Communication (VLC), Sound Navigation and Ranging (Sonar), Light Detection and Ranging (Lidar), or any technology or a combination of technologies.

What is the Indoor Location Market Size?

The indoor location market size is projected to grow from USD 10.9 billion in 2023 to USD 29.8 billion by 2028, at a CAGR of 22.3% during the forecast period.

What are the key drivers in the indoor location market?

The key drivers supporting the growth of the indoor location market include the proliferation of smartphones, connected devices, and location-based applications among customers, an increased number of applications powered by beacons and BLE tags, the power of simultaneous localization and mapping (SLAM), the growing integration of beacons in cameras, LED lightings, PoS devices, and digital signage, and the inefficiency of GPS in an indoor environment.

Who are the key players operating in the indoor location market?

The key vendors operating in the indoor location market include Zebra Technologies (US), Cisco (US), Google (US), Microsoft (US), HPE (US), Apple (US), Esri (US), Acuity Brands(US), Inpixon(US), HERE Technologies (US), HID Global (US), CenTrak (US), Sonitor (Norway), Ubisense (UK), infsoft (Germany), Polaris Wireless (US), Quuppa (Finland), Securitas Healthcare (US), Navigine (US), Blueiot (China), Kontakt.io (US), AiRISTA (US), InnerSpace (Canada), Syook (India), Oriient (Israel), Navenio (England), Situm (Spain), Pozyx (Belgium), Azitek (Portugal), and Mapxus (China).

What are the opportunities for new market entrants in the indoor location market?

The growing demand for indoor location technologies to support lean automation and robotic processes, growing use of 5G for location-based services, growing need for contact-tracing solutions due to COVID-19. Additionally, the increasing demand for RFID tags across retail industry are the various opportunities for new market entrants in the indoor location market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

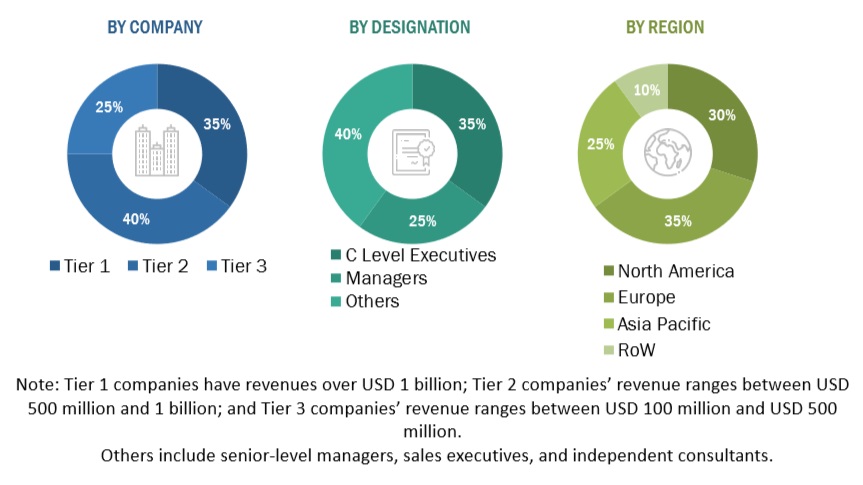

The research study for the indoor location market involves extensive secondary sources, directories, and several journals, including the International Journal of Geo-Information, Journal of Location-Based Services, and the International Journal of Interactive Multimedia and Artificial Intelligence. Primary sources have been mainly industry experts from the core and related industries, preferred indoor location providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews have been conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information, and assess growth prospects. These respondents included key industry participants, subject matter experts, C-level executives of key market players, and industry consultants.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources. The data has also been collected from other secondary sources, such as journals like the Journal of Location-Based Services and related magazines. Indoor location spending of various countries has been extracted from the respective sources. Secondary research was mainly used to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the Indoor location market. The primary sources from the demand side included Indoor location end users, network administrators/consultants/specialists, Chief Information Officers (CIOs), and subject-matter experts from enterprises and government associations.

The break-up of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the Indoor location market. The first approach involves estimating the market size by summating companies’ revenue generated through Indoor location solutions. In this approach for market estimation, we identified the key companies offering Indoor location by offerings: hardware, solutions, and services.

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Indoor location market. These methods were extensively used to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and break-ups have been determined using secondary sources and verified through primary sources.

Indoor location Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size, the indoor location market was divided into several segments and subsegments. The data triangulation procedures were used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

Indoor location or indoor positioning technology facilitates the navigation and tracking of objects and people in a building using sensory information captured by mobile devices. It includes hardware, software, and service components to provide indoor location services to various organizations across verticals. Indoor location solutions may collect location data using Radio Frequency (RF), Visible Light Communication (VLC), Sound Navigation and Ranging (Sonar), Light Detection and Ranging (Lidar), or any technology or a combination of technologies.

Key Stakeholders

- Indoor location solution providers

- Independent Software Vendors (ISVs)

- Investors and Venture Capitalists (VCs)

- Support and maintenance service providers

- Value-added Resellers (VARs) and distributors

Report Objectives

- To determine and forecast the global Indoor location market by offering (hardware, solutions, and services), application, technology, vertical and region from 2023 to 2028, and analyze the various macroeconomic and microeconomic factors that affect the market growth.

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East and Africa (MEA).

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the Indoor location market.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall Indoor location market.

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the Indoor location market.

- To profile the key market players; provide a comparative analysis on the basis of business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the competitive landscape of the market.

- In the market, track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the MEA market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Indoor Location Market