Industrial Nitrogen Generator Market by Technology Type (PSA, Membrane-based, Cryogenic based), Size and Design, End-use Industry (F&B, Medical & Pharmaceutical, Transportation, C&P, E&E, Manufacturing) and Region - Global Forecast till 2026

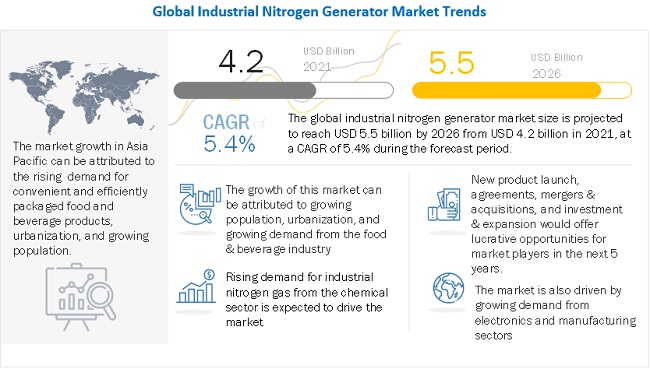

The global industrial nitrogen generator market was valued at USD 4.2 billion in 2021 and is projected to reach USD 5.5 billion by 2026, growing at a cagr 5.4% from 2021 to 2026. Growing demand for industrial nitrogen generator from the processed food sector is driving the market. Furthermore, increasing understanding around reduction in food wastage due to unhygienic and improper packaging are also driving the market. Growth in the demand for nitrogen gas from industrial processes used in various industries such as food & beverage, transportation, pharmaceutical, manufacturing, packaging, oil & gas, chemical, and pulp & paper and growth in urbanization in the emerging economies, such as APAC, Middle East & Africa, and South America, are also driving the global market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on Global Industrial nitrogen generator Market

Industrial nitrogen generators are used in the food & beverage, medical & pharmaceutical, transportation, electrical & electronics, chemical & petrochemical, and other industries. Due to the ongoing pandemic, food & beverage, transportation, and chemical, among other industries have been impacted globally. The COVID-19 pandemic also slowed the growth of the water sector in 2020 during the lockdown period. Industrial activities had to cope with supply chain disruptions, a shift in demand patterns, and other emergency measures. Revenue loss and decreased capital expenditures were observed during this crisis period. In the short term, measures such as long-term CAPEX planning to build resilience, maintaining proper hygiene at workplaces, government fiscal support, better supply chain planning, proper communication, and resuming industrial operations are expected to boost revenue and stabilize growth.

The food & beverage sector had to deal with various uncertainties in operations, safety procedures, supply chain disruptions, emergency responses, continual situational awareness, incident management, recreation of business models and strategies, financial pressures, and increased digitalization. In the transportation sector, production of automobile was hampered due to lockdowns and manpower shortage.

Industrial nitrogen generator: Market Dynamics

Driver: Increasing demand from the food & beverage industry

Industrial nitrogen generators are used in the food & beverage industry to produce nitrogen, which is then used in the packaging and processing of food and beverage products. The presence of moisture and oxygen has adverse effects on food products. Nitrogen creates an inert atmosphere, which helps preserve perishable food and beverage products for a longer time. Nitrogen gas is widely used in the production of fruit juices, beer, wine, and other beverages. In the food & beverage sector, an increase in the consumption of packaged food products can be observed due to their convenience. Convenience features such as easy opening, portability, and single-use packaging drive food packaging innovation for processed foods. Visual appeal and convenience are the two aspects that are driving the food packaging market.

Restrain: Stringent regulatory restrictions and measures

The regulations in the industrial gas market are very stringent. As these gases are flammable, corrosive, and explosive in nature, their use is governed by certain regulations. Nitrogen gas is stored at a certain temperature and pressure to avoid any leakage or accident. Regulations regarding the production, storage, and transportation of these gases affect the market directly. High concentrations of nitrogen gas are harmful to human health as they may cause physical and mental impairment. The end users are required to install early warning mechanisms, continuous monitoring systems, adequate ventilated spaces, and rescue protocols wherever workers come in contact with nitrogen gas. Proper storage and handling of nitrogen gas are required across end-use industries.

Opportunity: Growing demand from the chemical industry

The chemical industry is one of the largest industries globally. Industries, such as automotive, power, food & beverage, and packaging, depend on the chemical industry for various products and intermediates. The chemical industry experienced a slowdown during the pandemic. Supply chain disruptions, workforce unavailability, financial pressures, and other factors resulted in the slowdown. However, in future, increasing requirement for advanced chemical formulations and new technological advancements such as green chemistry, bioplastics, and others are expected to drive growth.

Challenge: High cost of production of nitrogen gas

The volatility in the cost of raw materials and the rise in the cost of production leads to large fluctuations in the profit margins of the vendors, thereby posing a significant challenge for them. The separation of noble gases from the atmosphere is largely energy-intensive, and a larger portion of the yield is nitrogen. Energy costs, storage costs, and distribution costs are the major cost attributes of the industrial nitrogen generator market. There are three major modes of distribution of nitrogen gas: tonnage, merchant-based, and packaged supply modes. Of the three, the tonnage supply mode is more profitable for the vendors, as it provides assured demand and low variable costs.

PSA industrial nitrogen generator accounted for the largest share amongst other types in the industrial nitrogen generator market

PSA-based industrial nitrogen generators produce a continuous stream of nitrogen gas through the principle of pressure swing adsorption from compressed and purified air. PSA nitrogen generators are also used in automotive electronics, consumer electronic product manufacturing, and metal processing, and so on. These are most commercially used industrial nitrogen generators owing to ease of use, efficient operations, and low cost. PSA technology can produce the highest purity level of nitrogen for use in food processing, providing inert atmosphere in electronics manufacturing, in transportation of perishable food products, and so on.

Stationary industrial nitrogen generators is estimated to be the largest market in the overall industrial nitrogen generator market

Stationary industrial nitrogen generators are widely used in food and beverage processing applications. The key growth driver of the high consumption of these industrial nitrogen generators is their use in various industries. Stationary industrial nitrogen generators are self-contained and fully integrated and do not require separate air. This also eliminates the requirement of handling high-pressure cylinders. These systems are highly durable and stable under normal operating conditions.

Plug & play based industrial nitrogen generators is estimated to be the largest market in the overall industrial nitrogen generator market

Plug & play industrial nitrogen generators are widely used in various industries. The major growth driver of the high consumption of these industrial nitrogen generators as they are compact in design and provide the operator with easy accessibility and autonomous function. These systems can be modular or stationary depending on the requirement, provide multistage filtration, are energy-efficient, and have optimum connectivity for real-time information gathering. Plug & play systems are also cost-effective, customizable, reliable, and safe to operate.

Food & beverage accounted for the largest market share amongst other end-use industry in the industrial nitrogen generator market

Food & beverage is the largest end-use industry for the industrial nitrogen generators market owing to the increased necessity for better quality packaged food items, growth in demand for convenient foods, increasing shelf life of food products, reducing wastage, and expanding urban population growth in the emerging economies. These equipments help in proper processing of food items and beverages and hence keep the processed foods fresh for a longer time and increase the shelf life of the products. Additionally, the rise in income levels and the growth of the middle-class population are also driving demand for industrial nitrogen generators in the food & beverage industry.

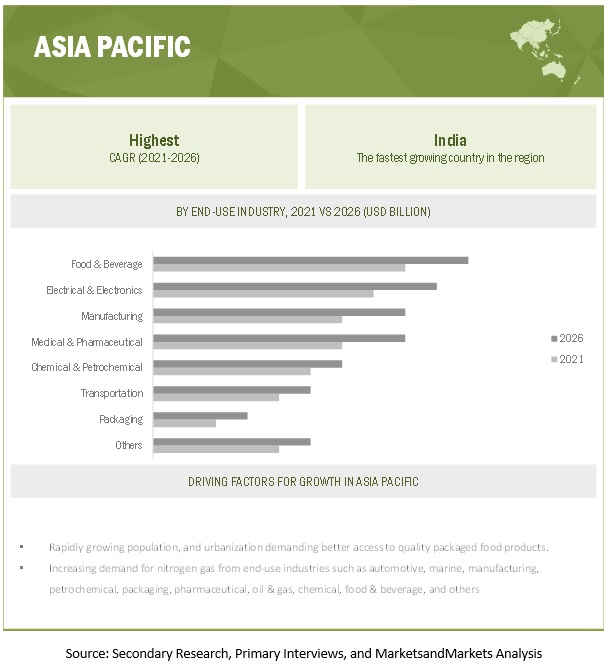

APAC is projected to grow the fastest in the industrial nitrogen generator market during the forecast period.

APAC is the fastest-growing market for industrial nitrogen generators. This growth is mainly owing to economic advancement of emerging economies, such as India, China, Indonesia, Malaysia, Singapore, Vietnam, and Thailand, in the region, where consumption for packed and accessible food products are growing annually. Furthermore, increase in population and growing urbanization rate are also driving the market for quality processed food products and boosting industrial nitrogen generator consumption. In addition, growth in industrialization, increasing demand due to changing demographics, such as improving living standards, rising disposable incomes, and government initiatives to attract business investments in industries such as automotive, marine, packaging, manufacturing, oil & gas, and chemical are also driving the market for industrial nitrogen generators in the region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key players in this market are Parker Hannifin Corporation (US), Ingersoll Rand (US), Air Products and Chemicals, Inc. (US), Atlas Copco (Sweden), Air Liquide (France), Hitachi Industrial Equipment System Company (Japan), Inmatec (Germany), Linde Plc (UK), Novair SAS (France), and Oxymat A/S (Denmark). These players have established a strong foothold in the market by adopting strategies, such as new product launches, investment & expansion, agreement & collaboration, and mergers & acquisitions between 2017 and 2021.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Years considered for the study |

2019–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Units considered |

Volume (Units) and Value (USD Thousand) |

|

Segments |

Technology Types, Size, Design, End-Use industry, and Region |

|

Regions |

North America, Asia Pacific, Europe, Middle East & Africa, and South America |

|

Companies |

Parker Hannifin Corporation (US), Ingersoll Rand (US), Air Products and Chemicals, Inc. (US), Atlas Copco (Sweden), Air Liquide (France), Hitachi Industrial Equipment System Company (Japan), Inmatec (Germany), Linde Plc (UK), Novair SAS (France), and Oxymat A/S (Denmark) |

This research report categorizes the industrial nitrogen generator market based on technology type, size, design, end-use industry, and region.

By Technology Type:

- PSA

- Membrane based

- Cryogenic based

By Size

- Stationary

- Portable

By Design:

- Cylinder based

- Plug & play

By End-use industry:

- Food & beverage

- Medical & Pharmaceutical

- Transportation

- Electrical & Electronics

- Chemical & Petrochemical

- Manufacturing

- Packaging

- Others

By Region:

- North America

- Asia Pacific

- Europe

- Middle East & Africa

- South America

The industrial nitrogen generator market has been further analyzed based on key countries in each of these regions.

Recent Developments

- In January 2021, Atlas Copco acquired the operating business of Purification Solutions LLC, a leading air treatment and nitrogen generator manufacturer. The acquisition aims to increase market share and accelerate business development in North America, Europe, and other strategic markets.

- In March 2020, Gardner Denver Holdings Inc. completed the merger with the Ingersoll Rand Industrial segment. The merger aims to provide a stronger, broader portfolio of mission-critical industrial, energy, medical and specialty vehicle products and services.

- In January 2019, Air Products and Chemicals, Inc. had been awarded additional onsite nitrogen supply contract by one of the world’s largest manufacturers of electronic components for its new production line in Binhai New Area, Tianjin, China. Air Products will add the sixth facility to further strengthen its supply position in the Beijing-Tianjin-Hebei region to serve the customer’s increasing need.

Frequently Asked Questions (FAQ):

What is the current size of the global industrial nitrogen generator market?

Global industrial nitrogen generators market size is projected to reach USD 5.5 billion by 2026 from USD 4.2 billion in 2021, at a CAGR of 5.4% during the forecast period.

Are there any regulations for industrial nitrogen generators?

Several countries in Europe and North America have introduced regulations for this market. For e.g., In the US, Occupational Safety and Health Administration (OSHA) mandates industrial manufacturers to provide a secure working atmosphere for employees. The OSHA 29 CFR 1910.146 sets standards and procedures for restricted spaces that could contain higher than normal concentrations of nitrogen gas.

Who are the winners in the global industrial nitrogen generator market?

Companies such as Parker Hannifin Corporation (US), Ingersoll Rand (US), Air Products and Chemicals, Inc. (US), Atlas Copco (Sweden), Air Liquide (France), Hitachi Industrial Equipment System Company (Japan), Inmatec (Germany), Linde Plc (UK), Novair SAS (France), and Oxymat A/S (Denmark) come under the winner’s category. They have the potential to broaden their product portfolio and compete with other key market players. Such advantages give these companies an edge over other companies.

What is the COVID-19 impact on industrial nitrogen generator manufacturers?

Due to the ongoing pandemic, sectors such as food & beverage, chemical, pharmaceutical, and automotive have been impacted globally. The COVID-19 pandemic slowed the growth of the equipment sector in 2020 during the lockdown period. The industry had to cope with supply chain disruptions, a shift in demand patterns, and other emergency measures. However, the situation is expected to improve as the economies stabilize and industrial activities normalize.

What are some of the drivers in the market?

The increasing requirement of industrial nitrogen generators in emerging economies for nitrogen gas to use in packaging of food and beverage products are the major driving factors for the market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 INDUSTRIAL NITROGEN GENERATOR MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 LIMITATIONS

1.8 INCLUSIONS & EXCLUSIONS

TABLE 1 INDUSTRIAL NITROGEN GENERATOR MARKET: INCLUSIONS & EXCLUSIONS

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 1 INDUSTRIAL NITROGEN GENERATOR MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.3 LIST OF PRIMARY SOURCES

2.1.3.1 Key data from primary sources

2.1.3.2 Key industry insights

2.1.3.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 2 INDUSTRIAL NITROGEN GENERATOR MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 3 INDUSTRIAL NITROGEN GENERATOR MARKET: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 4 INDUSTRIAL NITROGEN GENERATOR MARKET: DATA TRIANGULATION

2.3.1 INDUSTRIAL NITROGEN GENERATOR MARKET ANALYSIS THROUGH PRIMARY INTERVIEWS

FIGURE 5 INDUSTRIAL NITROGEN GENERATOR MARKET ANALYSIS THROUGH SECONDARY SOURCES

FIGURE 6 INDUSTRIAL NITROGEN GENERATOR MARKET ANALYSIS

2.4 LIMITATIONS

2.5 ASSUMPTIONS

2.6 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

2.6.1 SUPPLY SIDE

2.6.2 DEMAND SIDE

2.6.3 INSIGHTS FROM KEY RESPONDENTS

2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 7 PSA-BASED INDUSTRIAL NITROGEN GENERATOR TO BE THE LARGEST SEGMENT

FIGURE 8 STATIONARY INDUSTRIAL NITROGEN GENERATOR TO BE THE LARGER SEGMENT

FIGURE 9 PLUG & PLAY INDUSTRIAL NITROGEN GENERATORS TO BE THE LARGER SEGMENT

FIGURE 10 FOOD & BEVERAGE TO BE THE LARGEST END-USE INDUSTRY OF INDUSTRIAL NITROGEN GENERATORS

FIGURE 11 ASIA PACIFIC TO BE THE FASTEST-GROWING INDUSTRIAL NITROGEN GENERATOR MARKET

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 ATTRACTIVE OPPORTUNITIES IN THE INDUSTRIAL NITROGEN GENERATOR MARKET

FIGURE 12 GROWING DEMAND FOR INDUSTRIAL NITROGEN GENERATOR IN EMERGING ECONOMIES, TO DRIVE THE MARKET

4.2 INDUSTRIAL NITROGEN GENERATOR MARKET, BY TECHNOLOGY TYPE

FIGURE 13 PSA TECHNOLOGY TO BE THE LARGEST SEGMENT OF THE MARKET

4.3 INDUSTRIAL NITROGEN GENERATOR MARKET, BY SIZE

FIGURE 14 STATIONARY SIZE TO BE THE LARGER SEGMENT OF THE MARKET

4.4 INDUSTRIAL NITROGEN GENERATOR MARKET, BY DESIGN

FIGURE 15 PLUG & PLAY DESIGN TO BE THE LARGER SEGMENT OF THE MARKET

4.5 INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY

FIGURE 16 FOOD & BEVERAGE TO BE THE LARGEST END-USE INDUSTRY

4.6 ASIA PACIFIC INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY AND COUNTRY, 2020

FIGURE 17 FOOD & BEVERAGE SEGMENT AND CHINA ACCOUNTED FOR THE LARGEST SHARES

4.7 INDUSTRIAL NITROGEN GENERATOR MARKET, BY MAJOR COUNTRIES

FIGURE 18 INDIA TO RECORD THE HIGHEST CAGR DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE INDUSTRIAL NITROGEN GENERATOR MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing demand from the food & beverage industry

5.2.1.2 Growth of the healthcare industry in emerging economies

5.2.2 RESTRAINTS

5.2.2.1 Stringent regulatory restrictions and measures

5.2.3 OPPORTUNITIES

5.2.3.1 Growing demand from the chemical industry

5.2.4 CHALLENGES

5.2.4.1 High cost of production of nitrogen gas

5.3 ECOSYSTEM

FIGURE 20 INDUSTRIAL NITROGEN GENERATOR ECOSYSTEM

5.3.1 INDUSTRIAL NITROGEN GENERATOR MARKET: ECOSYSTEM

5.4 TECHNOLOGY ANALYSIS

5.4.1 TECHNOLOGIES – INDUSTRIAL NITROGEN GENERATORS

5.5 IMPACT OF COVID-19 ON INDUSTRIAL NITROGEN GENERATOR MARKET

5.5.1 COVID-19

5.5.2 CONFIRMED CASES AND DEATHS, BY GEOGRAPHY

FIGURE 21 THE PACE OF GLOBAL PROPAGATION OF COVID-19 IS UNPRECEDENTED

5.5.3 IMPACT ON INDUSTRIAL NITROGEN GENERATOR MARKET

5.6 RAW MATERIAL/COMPONENT ANALYSIS

5.6.1 CARBON MOLECULAR SIEVE (CMS)

5.6.2 HOLLOW FIBER MEMBRANE

5.7 AVERAGE SELLING PRICE TREND

FIGURE 22 AVERAGE PRICING IN THE INDUSTRIAL NITROGEN GENERATOR MARKET

5.8 PORTER'S FIVE FORCES ANALYSIS

FIGURE 23 PORTER'S FIVE FORCES ANALYSIS OF INDUSTRIAL NITROGEN GENERATOR MARKET

5.8.1 THREAT OF SUBSTITUTES

5.8.2 BARGAINING POWER OF SUPPLIERS

5.8.3 THREAT OF NEW ENTRANTS

5.8.4 BARGAINING POWER OF BUYERS

5.8.5 INTENSITY OF COMPETITIVE RIVALRY

5.9 VALUE CHAIN ANALYSIS

FIGURE 24 VALUE CHAIN ANALYSIS

5.9.1 RAW MATERIAL/COMPONENT SUPPLIERS

5.9.2 MANUFACTURERS

5.9.3 DISTRIBUTORS

5.9.4 END USERS

5.10 MACROECONOMIC INDICATORS

5.10.1 TRENDS AND FORECAST OF GDP

TABLE 2 GDP OF KEY COUNTRIES, USD BILLION, 2017-2020

5.10.2 AUTOMOTIVE INDUSTRY

TABLE 3 PRODUCTION VOLUMES OF AUTOMOBILES (NUMBER OF UNITS)

5.11 CASE STUDY ANALYSIS

5.11.1 ADVANCED ENGINEERING IMPROVES ITS LASER CUTTING OPERATION

5.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESS

FIGURE 25 ADVANCED GENERATORS, EFFICIENT PACKAGING, AND AUTOMATION TO DRIVE FUTURE MARKET GROWTH

5.13 TRADE ANALYSIS

TABLE 4 SELECTED IMPORT PARTNERS – MACHINERY AND APPARATUS FOR FILTERING OR PURIFYING GASES (USD THOUSAND)

TABLE 5 SELECTED EXPORT PARTNERS – MACHINERY AND APPARATUS FOR FILTERING OR PURIFYING GASES (USD THOUSAND)

5.14 OPERATIONAL DATA

TABLE 6 OPERATIONAL DATA – INDUSTRIAL NITROGEN GENERATORS

5.15 REGULATORY LANDSCAPE

5.16 PATENT ANALYSIS

5.16.1 INTRODUCTION

5.16.2 METHODOLOGY

5.16.3 DOCUMENT TYPE

TABLE 7 THE GRANTED PATENTS WERE 7 % OF THE TOTAL COUNT IN THE LAST 10 YEARS.

5.16.4 PUBLICATION TRENDS IN THE LAST 10 YEARS

5.16.5 INSIGHTS

5.16.6 LEGAL STATUS OF PATENTS

5.16.7 JURISDICTION ANALYSIS

5.16.8 TOP COMPANIES/APPLICANTS

5.16.9 TOP 10 PATENT OWNERS (US) IN THE LAST 10 YEARS

6 INDUSTRIAL NITROGEN GENERATOR MARKET, BY SIZE (Page No. - 73)

6.1 INTRODUCTION

TABLE 8 INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY SIZE, 2019–2026 (USD THOUSAND)

TABLE 9 INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY SIZE, 2019–2026 (UNIT)

6.2 STATIONARY INDUSTRIAL NITROGEN GENERATOR

6.2.1 ENSURES STABLE AND HIGHLY EFFICIENT OPERATIONS

6.3 PORTABLE INDUSTRIAL NITROGEN GENERATOR

6.3.1 AUTONOMOUS AND LOW OPERATING COSTS DRIVING THE DEMAND

7 INDUSTRIAL NITROGEN GENERATOR MARKET, BY DESIGN (Page No. - 75)

7.1 INTRODUCTION

TABLE 10 INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY DESIGN, 2019–2026 (USD THOUSAND)

TABLE 11 INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY DESIGN, 2019–2026 (UNIT)

7.2 CYLINDER BASED

7.2.1 COSTLY AND INEFFICIENT OPERATIONS LIMITING THEIR USE

7.3 PLUG & PLAY

7.3.1 HIGH RELIABILITY AND LOW OPERATING COSTS DRIVING THE MARKET

8 INDUSTRIAL NITROGEN GENERATOR MARKET, BY TECHNOLOGY TYPE (Page No. - 77)

8.1 INTRODUCTION

FIGURE 26 PSA TO BE THE LARGEST TECHNOLOGY TYPE DURING THE FORECAST PERIOD

TABLE 12 INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY TECHNOLOGY TYPE, 2019–2026 (USD THOUSAND)

TABLE 13 INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY TECHNOLOGY TYPE, 2019–2026 (UNIT)

8.2 PRESSURE SWING ADSORPTION (PSA)-BASED INDUSTRIAL NITROGEN GENERATOR

8.2.1 THE MOST COMMERCIALLY USED INDUSTRIAL NITROGEN GENERATOR

8.3 MEMBRANE-BASED INDUSTRIAL NITROGEN GENERATOR

8.3.1 LOW SYSTEM COMPLEXITY AND STABLE OPERATIONS DRIVING THE MARKET

8.4 CRYOGENIC-BASED INDUSTRIAL NITROGEN GENERATOR

8.4.1 HIGH PURITY OUTPUT DRIVING THE DEMAND FOR THESE SYSTEMS

9 INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY (Page No. - 81)

9.1 INTRODUCTION

FIGURE 27 FOOD & BEVERAGE TO BE THE LARGEST END-USE INDUSTRY DURING THE FORECAST PERIOD

TABLE 14 INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 15 INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 16 INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 17 INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (UNIT)

9.2 FOOD & BEVERAGE

TABLE 18 FOOD & BEVERAGE: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 19 FOOD & BEVERAGE: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY REGION, 2021–2026 (USD THOUSAND)

TABLE 20 FOOD & BEVERAGE: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY REGION, 2017–2020 (UNIT)

TABLE 21 FOOD & BEVERAGE: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY REGION, 2021–2026 (UNIT)

9.3 MEDICAL & PHARMACEUTICAL

TABLE 22 MEDICAL & PHARMACEUTICAL: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 23 MEDICAL & PHARMACEUTICAL: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY REGION, 2021–2026 (USD THOUSAND)

TABLE 24 MEDICAL & PHARMACEUTICAL: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY REGION, 2017–2020 (UNIT)

TABLE 25 MEDICAL & PHARMACEUTICAL: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY REGION, 2021–2026 (UNIT)

9.4 TRANSPORTATION

TABLE 26 TRANSPORTATION: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 27 TRANSPORTATION: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY REGION, 2021–2026 (USD THOUSAND)

TABLE 28 TRANSPORTATION: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY REGION, 2017–2020 (UNIT)

TABLE 29 TRANSPORTATION: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY REGION, 2021–2026 (UNIT)

9.5 ELECTRICAL & ELECTRONICS

TABLE 30 ELECTRICAL & ELECTRONICS: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 31 ELECTRICAL & ELECTRONICS: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY REGION, 2021–2026 (USD THOUSAND)

TABLE 32 ELECTRICAL & ELECTRONICS: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY REGION, 2017–2020 (UNIT)

TABLE 33 ELECTRICAL & ELECTRONICS: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY REGION, 2021–2026 (UNIT)

9.6 CHEMICAL & PETROCHEMICAL

TABLE 34 CHEMICAL & PETROCHEMICAL: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 35 CHEMICAL & PETROCHEMICAL: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY REGION, 2021–2026 (USD THOUSAND)

TABLE 36 CHEMICAL & PETROCHEMICAL: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY REGION, 2017–2020 (UNIT)

TABLE 37 CHEMICAL & PETROCHEMICAL: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY REGION, 2021–2026 (UNIT)

9.7 MANUFACTURING

TABLE 38 MANUFACTURING: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 39 MANUFACTURING: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY REGION, 2021–2026 (USD THOUSAND)

TABLE 40 MANUFACTURING: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY REGION, 2017–2020 (UNIT)

TABLE 41 MANUFACTURING: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY REGION, 2021–2026 (UNIT)

9.8 PACKAGING

TABLE 42 PACKAGING: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 43 PACKAGING: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY REGION, 2021–2026 (USD THOUSAND)

TABLE 44 PACKAGING: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY REGION, 2017–2020 (UNIT)

TABLE 45 PACKAGING: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY REGION, 2021–2026 (UNIT)

9.9 OTHERS

TABLE 46 OTHERS: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 47 OTHERS: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY REGION, 2021–2026 (USD THOUSAND)

TABLE 48 OTHERS: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY REGION, 2017–2020 (UNIT)

TABLE 49 OTHERS: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY REGION, 2021–2026 (UNIT)

10 INDUSTRIAL NITROGEN GENERATOR MARKET, BY REGION (Page No. - 98)

10.1 INTRODUCTION

FIGURE 28 INDIAN INDUSTRIAL NITROGEN GENERATOR MARKET TO RECORD THE HIGHEST GROWTH DURING THE FORECAST PERIOD

TABLE 50 INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 51 INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY REGION, 2021–2026 (USD THOUSAND)

TABLE 52 INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY REGION, 2017–2020 (UNIT)

TABLE 53 INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY REGION, 2021–2026 (UNIT)

10.2 NORTH AMERICA

FIGURE 29 NORTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET SNAPSHOT

TABLE 54 NORTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY COUNTRY, 2017–2020 (USD THOUSAND)

TABLE 55 NORTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY COUNTRY, 2021–2026 (USD THOUSAND)

TABLE 56 NORTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY COUNTRY, 2017–2020 (UNIT)

TABLE 57 NORTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY COUNTRY, 2021–2026 (UNIT)

TABLE 58 NORTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 59 NORTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 60 NORTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 61 NORTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (UNIT)

10.2.1 US

10.2.1.1 Recovering industrial activities to drive the demand

TABLE 62 US: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 63 US: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 64 US: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 65 US: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (UNIT)

10.2.2 CANADA

10.2.2.1 Growing export of manufactured goods to drive the market

TABLE 66 CANADA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 67 CANADA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 68 CANADA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 69 CANADA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (UNIT)

10.2.3 MEXICO

10.2.3.1 Growing electronics and beverage sectors to drive the demand

TABLE 70 MEXICO: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 71 MEXICO: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 72 MEXICO: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 73 MEXICO: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (UNIT)

10.3 EUROPE

TABLE 74 EUROPE: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY COUNTRY, 2017–2020 (USD THOUSAND)

TABLE 75 EUROPE: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY COUNTRY, 2021–2026 (USD THOUSAND)

TABLE 76 EUROPE: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY COUNTRY, 2017–2020 (UNIT)

TABLE 77 EUROPE: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY COUNTRY, 2021–2026 (UNIT)

TABLE 78 EUROPE: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 79 EUROPE: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 80 EUROPE: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 81 EUROPE: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (UNIT)

10.3.1 GERMANY

10.3.1.1 Increasing industrial activities to drive consumption

TABLE 82 GERMANY: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 83 GERMANY: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 84 GERMANY: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 85 GERMANY: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (UNIT)

10.3.2 UK

10.3.2.1 Growing food & beverage and pharmaceutical sectors to drive the market

TABLE 86 UK: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 87 UK: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 88 UK: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 89 UK: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (UNIT)

10.3.3 FRANCE

10.3.3.1 Growing food & beverage and manufacturing sectors to drive the demand for industrial nitrogen generators

TABLE 90 FRANCE: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 91 FRANCE: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 92 FRANCE: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 93 FRANCE: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (UNIT)

10.3.4 ITALY

10.3.4.1 Pharmaceutical and convenient food demand to drive the market

TABLE 94 ITALY: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 95 ITALY: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 96 ITALY: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 97 ITALY: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (UNIT)

10.3.5 SPAIN

10.3.5.1 Robust food export and growing pharmaceutical sector to drive the market

TABLE 98 SPAIN: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 99 SPAIN: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 100 SPAIN: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 101 SPAIN: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (UNIT)

10.3.6 REST OF EUROPE

TABLE 102 REST OF EUROPE: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 103 REST OF EUROPE: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 104 REST OF EUROPE: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 105 REST OF EUROPE: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (UNIT)

10.4 ASIA PACIFIC

FIGURE 30 ASIA PACIFIC: INDUSTRIAL NITROGEN GENERATOR MARKET SNAPSHOT

TABLE 106 ASIA PACIFIC: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY COUNTRY, 2017–2020 (USD THOUSAND)

TABLE 107 ASIA PACIFIC: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY COUNTRY, 2021–2026 (USD THOUSAND)

TABLE 108 ASIA PACIFIC: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY COUNTRY, 2017–2020 (UNIT)

TABLE 109 ASIA PACIFIC: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY COUNTRY, 2021–2026 (UNIT)

TABLE 110 ASIA PACIFIC: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 111 ASIA PACIFIC: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 112 ASIA PACIFIC: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 113 ASIA PACIFIC: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (UNIT)

10.4.1 CHINA

10.4.1.1 Changing consumer food preferences and growing manufacturing sector to drive the demand

TABLE 114 CHINA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 115 CHINA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 116 CHINA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 117 CHINA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (UNIT)

10.4.2 JAPAN

10.4.2.1 Sustainable packaging demand and growing pharmaceutical market to drive the market

TABLE 118 JAPAN: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 119 JAPAN: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 120 JAPAN: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 121 JAPAN: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (UNIT)

10.4.3 SOUTH KOREA

10.4.3.1 Increase in demand for packaged food to drive the market

TABLE 122 SOUTH KOREA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 123 SOUTH KOREA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 124 SOUTH KOREA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 125 SOUTH KOREA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (UNIT)

10.4.4 INDIA

10.4.4.1 The fastest-growing industrial nitrogen generator market in the region

TABLE 126 INDIA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 127 INDIA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 128 INDIA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 129 INDIA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (UNIT)

10.4.5 REST OF ASIA PACIFIC

TABLE 130 REST OF ASIA PACIFIC: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 131 REST OF ASIA PACIFIC: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 132 REST OF ASIA PACIFIC: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 133 REST OF ASIA PACIFIC: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (UNIT)

10.5 SOUTH AMERICA

TABLE 134 SOUTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY COUNTRY, 2017–2020 (USD THOUSAND)

TABLE 135 SOUTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY COUNTRY, 2021–2026 (USD THOUSAND)

TABLE 136 SOUTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY COUNTRY, 2017–2020 (UNIT)

TABLE 137 SOUTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY COUNTRY, 2021–2026 (UNIT)

TABLE 138 SOUTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 139 SOUTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 140 SOUTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 141 SOUTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (UNIT)

10.5.1 BRAZIL

10.5.1.1 Improved manufacturing sector and consumer awareness about healthy foods to drive the market

TABLE 142 BRAZIL: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 143 BRAZIL: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 144 BRAZIL: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 145 BRAZIL: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (UNIT)

10.5.2 ARGENTINA

10.5.2.1 Growing power and pharmaceutical sectors to fuel market growth

TABLE 146 ARGENTINA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 147 ARGENTINA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 148 ARGENTINA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 149 ARGENTINA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (UNIT)

10.5.3 REST OF SOUTH AMERICA

TABLE 150 REST OF SOUTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 151 REST OF SOUTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 152 REST OF SOUTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 153 REST OF SOUTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (UNIT)

10.6 MIDDLE EAST & AFRICA

TABLE 154 MIDDLE EAST & AFRICA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY COUNTRY, 2017–2020 (USD THOUSAND)

TABLE 155 MIDDLE EAST & AFRICA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY COUNTRY, 2021–2026 (USD THOUSAND)

TABLE 156 MIDDLE EAST & AFRICA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY COUNTRY, 2017–2020 (UNIT)

TABLE 157 MIDDLE EAST & AFRICA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY COUNTRY, 2021–2026 (UNIT)

TABLE 158 MIDDLE EAST & AFRICA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 159 MIDDLE EAST & AFRICA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 160 MIDDLE EAST & AFRICA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 161 MIDDLE EAST & AFRICA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (UNIT)

10.6.1 SAUDI ARABIA

10.6.1.1 Saudi Arabia leads the industrial nitrogen generator market in the region

TABLE 162 SAUDI ARABIA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 163 SAUDI ARABIA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 164 SAUDI ARABIA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 165 SAUDI ARABIA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (UNIT)

10.6.2 UAE

10.6.2.1 Government initiatives to drive industrial nitrogen generator demand

TABLE 166 UAE: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 167 UAE: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 168 UAE: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 169 UAE: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (UNIT)

10.6.3 REST OF MIDDLE EAST & AFRICA

TABLE 170 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 171 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 172 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 173 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL NITROGEN GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (UNIT)

11 COMPETITIVE LANDSCAPE (Page No. - 168)

11.1 OVERVIEW

11.1.1 INDUSTRIAL NITROGEN GENERATOR MARKET, KEY DEVELOPMENTS

TABLE 174 OVERVIEW OF STRATEGIES ADOPTED BY KEY INDUSTRIAL NITROGEN GENERATOR PLAYERS

11.2 REVENUE ANALYSIS

11.2.1 INDUSTRIAL NITROGEN GENERATOR MARKET

FIGURE 31 REVENUE ANALYSIS FOR KEY COMPANIES, 2016–2020.

11.3 MARKET SHARE ANALYSIS

FIGURE 32 INDUSTRIAL NITROGEN GENERATOR MARKET SHARE, BY COMPANY (2020)

TABLE 175 INDUSTRIAL NITROGEN GENERATOR MARKET: DEGREE OF COMPETITION

11.4 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2020

FIGURE 33 RANKING - INDUSTRIAL NITROGEN GENERATOR MARKET, 2020

11.4.1 PARKER HANNIFIN CORPORATION

11.4.2 INGERSOLL RAND

11.4.3 AIR PRODUCTS AND CHEMICALS, INC.

11.4.4 ATLAS COPCO

11.4.5 AIR LIQUIDE

11.5 COMPETITIVE EVALUATION QUADRANT (TIER 1)

11.5.1 STAR

11.5.2 PERVASIVE

11.5.3 EMERGING LEADER

FIGURE 34 INDUSTRIAL NITROGEN GENERATOR MARKET (GLOBAL): COMPANY EVALUATION MATRIX FOR TIER 1 COMPANIES, 2020

11.6 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 35 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN INDUSTRIAL NITROGEN GENERATOR MARKET

11.7 BUSINESS STRATEGY EXCELLENCE

FIGURE 36 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN INDUSTRIAL NITROGEN GENERATOR MARKET

11.8 COMPETITIVE EVALUATION QUADRANT (OTHER KEY PLAYERS)

11.8.1 PROGRESSIVE COMPANIES

11.8.2 RESPONSIVE COMPANIES

11.8.3 DYNAMIC COMPANIES

FIGURE 37 INDUSTRIAL NITROGEN GENERATOR MARKET (GLOBAL): COMPANY EVALUATION MATRIX FOR OTHER KEY PLAYERS, 2020

11.9 STRENGTH OF PRODUCT PORTFOLIO (OTHER KEY PLAYERS)

FIGURE 38 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN INDUSTRIAL NITROGEN GENERATOR MARKET (OTHER KEY PLAYERS)

11.10 BUSINESS STRATEGY EXCELLENCE (OTHER KEY PLAYERS)

FIGURE 39 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN INDUSTRIAL NITROGEN GENERATOR MARKET (OTHER KEY PLAYERS)

11.10.1 COMPANY FOOTPRINT

11.10.2 COMPANY TECHNOLOGY TYPE FOOTPRINT

FIGURE 40 COMPANY END-USE FOOTPRINT

11.10.3 COMPANY REGION FOOTPRINT

11.11 COMPETITIVE SCENARIO AND TRENDS

11.11.1 INDUSTRIAL NITROGEN GENERATOR MARKET

11.11.1.1 Product launches

TABLE 176 INDUSTRIAL NITROGEN GENERATOR MARKET: PRODUCT LAUNCHES, JANUARY 2017–NOVEMBER 2021

11.11.1.2 Deals

TABLE 177 INDUSTRIAL NITROGEN GENERATOR MARKET: DEALS, JANUARY 2017–NOVEMBER 2021

11.11.1.3 Others

TABLE 178 INDUSTRIAL NITROGEN GENERATOR MARKET: OTHER DEVELOPMENTS, JANUARY 2017-NOVEMBER 2021

12 COMPANY PROFILES (Page No. - 187)

12.1 MAJOR PLAYERS

(Business Overview, Products/solutions/services offered, Recent Developments, Product launch, MnM view, Key strategies/right to win, Strategic choices made, Weaknesses and competitive threats)*

12.1.1 PARKER HANNIFIN CORPORATION

TABLE 179 PARKER HANNIFIN CORPORATION: COMPANY OVERVIEW

FIGURE 41 PARKER HANNIFIN CORPORATION: COMPANY SNAPSHOT

TABLE 180 PARKER HANNIFIN CORPORATION: PRODUCT OFFERINGS

12.1.2 INGERSOLL RAND

TABLE 182 INGERSOLL RAND: COMPANY OVERVIEW

FIGURE 42 INGERSOLL RAND: COMPANY SNAPSHOT

TABLE 183 INGERSOLL RAND: PRODUCT OFFERINGS

TABLE 184 INGERSOLL RAND: DEALS

12.1.3 AIR PRODUCTS AND CHEMICALS, INC.

TABLE 185 AIR PRODUCTS AND CHEMICALS, INC.: COMPANY OVERVIEW

FIGURE 43 AIR PRODUCTS AND CHEMICALS, INC.: COMPANY SNAPSHOT

TABLE 186 AIR PRODUCTS AND CHEMICALS, INC.: PRODUCT OFFERINGS

TABLE 189 AIR PRODUCTS AND CHEMICALS, INC.: OTHER DEVELOPMENTS

12.1.4 ATLAS COPCO

TABLE 190 ATLAS COPCO: COMPANY OVERVIEW

FIGURE 44 ATLAS COPCO: COMPANY SNAPSHOT

TABLE 191 ATLAS COPCO: PRODUCT OFFERINGS

12.1.5 AIR LIQUIDE

TABLE 193 AIR LIQUIDE: COMPANY OVERVIEW

FIGURE 45 AIR LIQUIDE: COMPANY SNAPSHOT

TABLE 194 AIR LIQUIDE: PRODUCT OFFERINGS

TABLE 195 AIR LIQUIDE: DEALS

TABLE 196 AIR LIQUIDE: OTHER DEVELOPMENTS

12.1.6 HITACHI INDUSTRIAL EQUIPMENT SYSTEM COMPANY

TABLE 197 HITACHI INDUSTRIAL EQUIPMENT SYSTEM COMPANY: COMPANY OVERVIEW

TABLE 198 HITACHI INDUSTRIAL EQUIPMENT SYSTEM COMPANY: PRODUCT OFFERINGS

12.1.7 INMATEC

TABLE 199 INMATEC: COMPANY OVERVIEW

TABLE 200 INMATEC: PRODUCT OFFERINGS

12.1.8 LINDE PLC

TABLE 201 LINDE PLC: COMPANY OVERVIEW

FIGURE 46 LINDE PLC: COMPANY SNAPSHOT

TABLE 202 LINDE PLC: PRODUCT OFFERINGS

TABLE 204 LINDE PLC.: OTHER DEVELOPMENTS

12.1.9 NOVAIR SAS

TABLE 205 NOVAIR SAS: COMPANY OVERVIEW

TABLE 206 NOVAIR SAS: PRODUCT OFFERINGS

12.1.10 OXYMAT A/S

TABLE 208 OXYMAT A/S: COMPANY OVERVIEW

TABLE 209 OXYMAT A/S: PRODUCT OFFERINGS

12.2 OTHER KEY COMPANIES

12.2.1 AIRPACK

12.2.2 CLAIND

12.2.3 COMPRESSED GAS TECHNOLOGIES, INC.

12.2.4 ERREDUE S.P.A.

12.2.5 FOXOLUTION

12.2.6 GENERON

12.2.7 GAZTRON ENGINEERING PVT. LTD.

12.2.8 ISOLCELL S.P.A.

12.2.9 NOBLEGEN GAS GENERATORS

12.2.10 OXYWISE

12.2.11 OMEGA AIR

12.2.12 OXAIR

12.2.13 ON SITE GAS SYSTEMS, INC.

12.2.14 PEAK GAS GENERATION

12.2.15 WERTHER INTERNATIONAL

*Details on Business Overview, Products/solutions/services offered, Recent Developments, Product launch, MnM view, Key strategies/right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 215)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

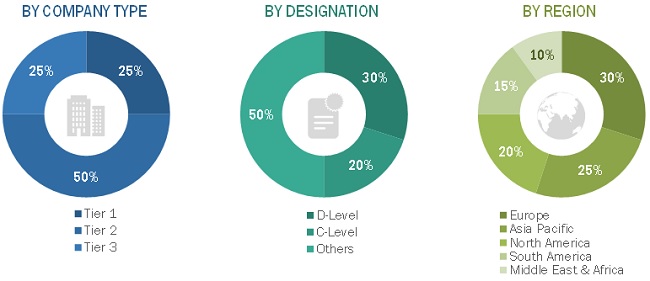

The study involved four major activities in estimating the current market size for industrial nitrogen generator The exhaustive secondary research was conducted to collect information on the market, peer market, and child market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methodologies were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources such as Bloomberg, World Bank, Statista, American Chemistry Council (ACC), BP Statistics, OICA, Trademap, Zauba, other government & private websites, associations related to the industrial nitrogen generator industry. The study also involves analyzing regulations such as the Occupational Safety and Health Standards (OSHA) and regional government websites to identify and collect information useful for this technical, market-oriented, and commercial market study for industrial nitrogen generators.

Primary Research

The industrial nitrogen generator market comprises several stakeholders such as raw material/component suppliers, distributors, manufacturers, end-users, and regulatory organizations in the supply chain. The demand side of this market consists of food & beverage processors, automobile manufacturers, refineries, healthcare institutions, chemical plants, textile processors, paper manufacturers, and so on. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the industrial nitrogen generator market. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players, technology types, size, design, and end-users in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation process explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply of industrial nitrogen generator and their applications.

Objectives of the Study:

- To define, describe, and forecast the industrial nitrogen generator market in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market

- To analyze and forecast the market by technology type, size, design, and end-use industry

- To forecast the size of the market with respect to five regions: Asia Pacific (APAC), Europe, North America, South America, and the Middle East & Africa, along with their key countries

- To strategically analyze micro markets1 with respect to individual trends, growth prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments such as merger & acquisition, agreement & collaboration, investment & expansion, and new product launch in the market

- To strategically profile key players and comprehensively analyze their market shares and core competencies2

- Notes: 1. Micro markets are defined as sub-segments of the industrial nitrogen generator market included in the report.

- 2. Core competencies of the companies are covered in terms of their key developments and strategies adopted to sustain their position in the market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the industrial nitrogen generator market

Company Information:

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Industrial Nitrogen Generator Market