Industrial Services Market by SCADA, Distributed Control System, Manufacturing Execution System, Safety Systems, Motors & Drives, Industrial Robotics, Industrial 3D Printing, Industrial PC, PLC, Service Type, End-user Industry - Global Forecast to 2028

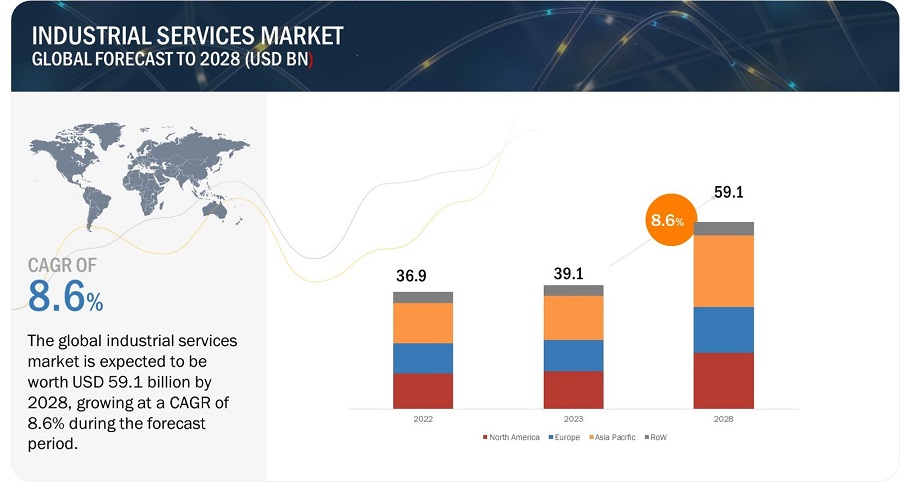

The global Industrial Services Market is expected to be valued at USD 39.1 billion in 2023 and is projected to reach USD 59.1 billion by 2028; it is expected to grow at a CAGR of 8.6% from 2023 to 2028. Industries are undergoing digital transformations to enhance efficiency and competitiveness. The recognition of the importance of comprehensive asset management, from installation to decommissioning, is driving demand for lifecycle services. Industrial services support lifecycle services digital initiatives, including implementing digital twins, predictive maintenance, and smart manufacturing.

Industrial Services Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Industrial services Market Dynamics

Driver: Increasing adoption of Industry 4.0 technologies

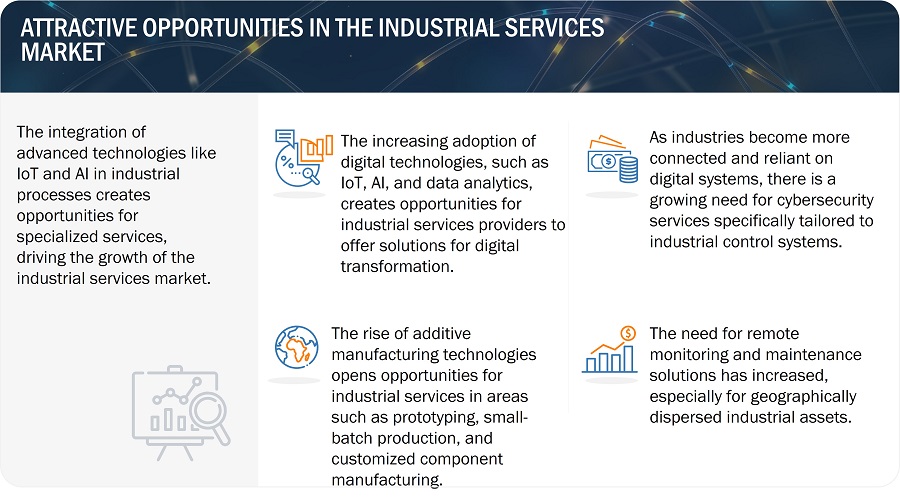

The increasing adoption of Industry 4.0 technologies, such as IoT (Internet of Things), AI (Artificial Intelligence), and automation, drives the industrial services market by creating a demand for specialized services that support these advanced technologies’ seamless integration, optimization, and maintenance. As industries undergo digital transformations, industrial services play a crucial role in ensuring the efficient implementation of Industry 4.0, leading to enhanced operational capabilities, predictive maintenance, and data-driven decision-making.

Restraint: Significant upfront investment

The significant upfront investment required for implementing advanced technologies, specialized equipment, and skilled workforce is a notable restraint for the industrial services market. This financial barrier can pose challenges for some industries, mainly smaller enterprises, limiting their ability to access and adopt certain industrial services.

Opportunity: Growing demand for robust cybersecurity

The growing demand for robust cybersecurity presents a significant opportunity for the industrial services market as industries increasingly rely on specialized services to enhance their cybersecurity measures, safeguard critical infrastructure, and mitigate the risks associated with cyber threats, ultimately ensuring the resilience and continuity of industrial operations.

Challenge: Highly competitive environment

In a highly competitive environment, the industrial services market faces challenges such as price pressures, continuous innovation, and the requirement to differentiate services. Providers must continually strive to offer unique value propositions, technological expertise, and efficient solutions to stand out amidst intense competition, impacting profit margins and necessitating strategic agility to adapt to market dynamics.

Industrial Services Market Ecosystem

The industrial services market is dominated by established and financially sound manufacturers with extensive experience in the industry. These companies have diversified product portfolios, cutting-edge technologies, and strong global sales and marketing networks. Leading players in the market include ABB from Switzerland, Honeywell International Inc. from the US, Rockwell Automation from the US, Schneider Electric from France, and Siemens from Germany.

Based on service type, the installation & commissioning service for the industrial services market to hold the second highest market share during the forecast period

The integration of advanced technologies such as automation, robotics, and IoT requires specialized knowledge during the installation phase. Industrial services providers are crucial in successfully integrating these technologies into existing industrial processes. Modern industrial systems and equipment often involve intricate configurations and technologies. Professional installation and commissioning services are essential to ensure these complex systems are set up correctly and function as intended.

Based on application, the industrial services market for DCS application to hold the second highest market share during the forecast period

The growing need for automation and precise control in industrial processes drives the demand for DCS applications. Industrial services support the implementation, optimization, and maintenance of DCS to enhance process efficiency. DCS applications contribute to improved safety and reliability in industrial processes through advanced control algorithms and real-time monitoring. Industrial services play a role in ensuring the proper implementation and ongoing maintenance of these safety-critical systems.

Based on end-user industry, the industrial services for oil & gas to hold the second highest market share during the forecast period

The Oil & Gas industry is increasingly adopting advanced technologies like IoT, AI, and automation. Industrial services support integrating and optimizing these technologies to enhance operational efficiency and decision-making. The industry relies heavily on maintaining complex equipment and infrastructure to ensure asset integrity and prevent unplanned downtime. Industrial services providers offer specialized maintenance solutions to support the reliability of critical assets.

Industrial services market in North America to hold the second highest market share during the forecast period

North America is witnessing a trend toward smart city initiatives, requiring industrial services for implementing intelligent infrastructure, including IoT-enabled systems for utilities, transportation, and public services. Additionally, water scarcity and environmental conservation concerns drive investments in water and wastewater management projects. Industrial services play a role in constructing, maintaining, and optimizing water-related infrastructure.

Industrial Services Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The industrial services companies is dominated by players such ABB (Switzerland), Honeywell International Inc. (US), Rockwell Automation (US), Schneider Electric (France), Siemens (Germany), and others

Industrial Services Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2019-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

By Service Type, By Application, and By End-User Industry |

|

Geographies covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

The major market players include ABB (Switzerland), Honeywell International Inc. (US), Rockwell Automation (US), Schneider Electric (France), Siemens (Germany), General Electric (US), Emerson Electric Co. (US), YokoGawa Electric Corporation (Japan), Eaton (Ireland), Mitsubishi Electric Corporation (Japan). (Total 25 players are profiled) |

Industrial Services Market Highlights

|

Segment |

Subsegment |

|

By Service Type |

|

|

By Application |

|

|

By End-user Industry |

|

|

By Region |

|

Recent Developments

- In August 2023, Schneider Electric launched a Managed Security Services (MSS) offering to help customers in operational technology (OT) environments address the increased cyber risk associated with the demand for remote access and connectivity technologies.

- In February 2023, Schneider Electric launched its new Industrial Digital Transformation Services. The specialized global service is designed to help industrial enterprises achieve future-ready, innovative, sustainable, and effective end-to-end digital transformation.

- In August 2022, Yokogawa Electric Corporation (TOKYO: 6841) announced the release on this date of the OpreXTM IT/OT Security Operations Center (IT/OT SOC) service. Targeted primarily at industrial enterprises, this service was developed by Yokogawa to improve the security of IT and OT networks by detecting, analyzing, and enabling a quick and effective response to cybersecurity incidents from anywhere in the world.

- In June 2022, Yokogawa Electric Corporation (TOKYO: 6841) announced the release of OpreX™ Asset Health Insights. The service offers a real-time connection with assets from anywhere in the world, giving organizations a 360-degree view of operational assets that eases the task of asset management and increases both operational and business efficiency.

Frequently Asked Questions (FAQs):

What are the major driving factors and opportunities in the industrial services market?

Some of the major driving factors for the growth of this market include Increasing adoption of industry 4.0 technologies, Growth in the manufacturing sector, Increasing aging infrastructure, Growing market expansion, and globalization. Moreover, Rising energy expenses in industrial facilities, Growing demand for robust cybersecurity, and Increasing complexity in supply chain management are some of the critical opportunities for the industrial services market.

Which region is expected to hold the highest market share?

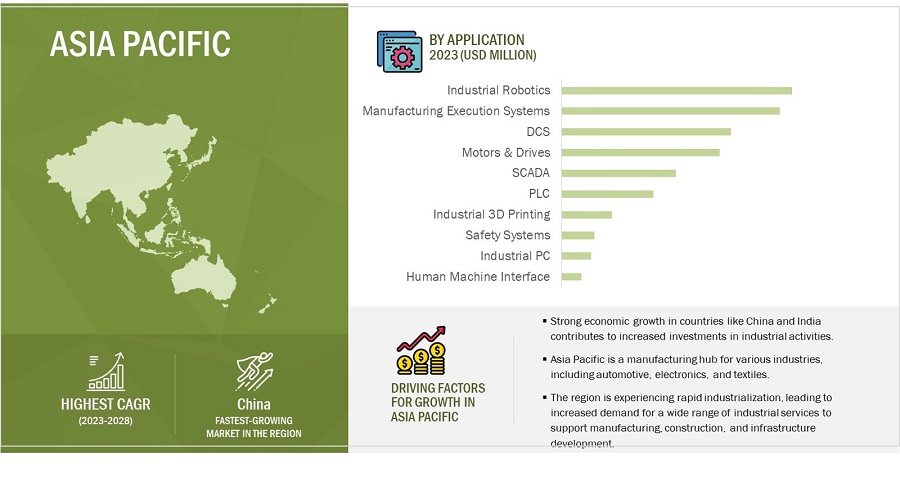

Asia Pacific, particularly China, is a hub for industrial innovation. Industries in Asia Pacific are increasingly focusing on achieving operational excellence. Industrial services play a critical role in optimizing processes and enhancing efficiency. Strong economic growth in countries like China and India contributes to increased investments in industrial activities, leading to a higher demand for related services.

Who are the leading players in the global industrial services market?

Companies such as ABB (Switzerland), Honeywell International Inc. (US), Rockwell Automation (US), Schneider Electric (France), and Siemens (Germany) are the leading players in the market. Moreover, these companies rely on strategies that include new product launches and developments, partnerships and collaborations, and acquisitions. Such advantages give these companies an edge over other companies in the market.

What are some of the technological advancements in the market?

Technological advancements in the industrial services market are revolutionizing traditional practices by integrating innovations like the Internet of Things (IoT), Artificial Intelligence (AI), and automation. IoT sensors enable real-time equipment health monitoring, predictive analytics enhance maintenance strategies, and AI-driven solutions optimize processes. Automation, including robotics and smart manufacturing, increases efficiency and reduces manual intervention. These technologies empower industrial services providers to offer more proactive, data-driven solutions, leading to improved operational performance, minimized downtime, and enhanced overall client productivity.

What is the impact of the global recession on the market?

This report includes an analysis of the impact of the global recession on the Industrial Services market. In this fast-changing environment, the exact effect of the recession on the worldwide economy may be partially known. Hence, scenario-based approaches, such as rising interest rates, the weakening of currencies, and mounting public debt, have been considered to assess the economic impact and recovery period at the global level. The impact and recovery period for each country/region is expected to be different.

The Industrial Services industry is expected to be adversely impacted by the recession and rising inflation in 2023. The growth primarily depends on the sales of a broad range of industrial solutions for which the industrial services are offered. With the increased inflation, interest rates, and unemployment, demand for Industrial Services among enterprises is bound to be less, which, in turn, will affect investments across the globe. Due to the recession, end-user industries, such as manufacturing, automotive, aerospace, and oil & gas, which use industrial services, would have low CAPEX spending.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

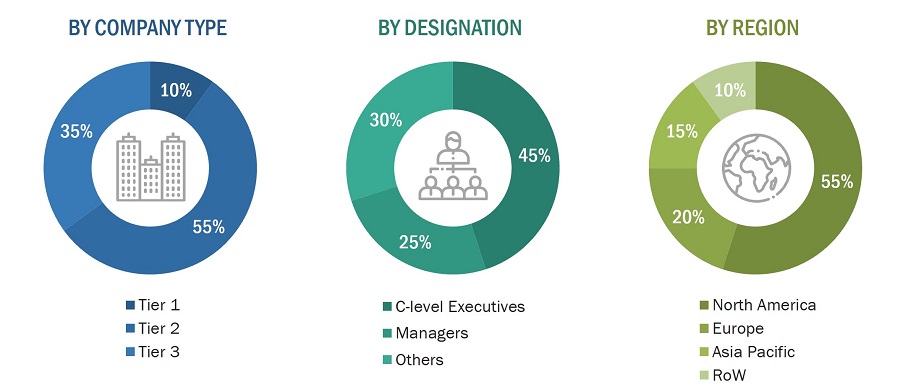

The study involved four major activities in estimating the current size of the industrial services market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources for this research study included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. The secondary data was collected and analyzed to determine the overall market size, further validated through primary research.

List of major secondary sources

|

SOURCE |

WEB LINK |

|

Occupational Safety and Health Administration (OSHA) |

|

|

Environmental Protection Agency (EPA) |

|

|

Federal Environment Agency (UBA) |

|

|

Directorate General of Factory Advice Service and Labour Institutes (DGFASLI) |

|

|

Ministry of Health, Labour and Welfare (MHLW) |

|

|

Health and Safety Executive (HSE) |

|

|

National Institute for Occupational Safety and Health (NIOSH) |

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the Industrial Services market through secondary research. Several primary interviews were conducted with experts from both demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the Industrial Services market and its various dependent submarkets. The key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire procedure involved the study of annual and financial reports of top players and extensive interviews with industry leaders such as chief executive officers (CEOs), vice presidents (VPs), directors, and marketing executives. All percentage shares and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Bottom-Up Approach

The bottom-up approach was used to arrive at the overall size of the Industrial Services market from the revenues of the key players and their shares in the market. The overall market size was calculated based on the revenues of the key players identified in the market.

- Identifying various applications using or expected to implement Industrial Services

- Analyzing each end-user industries, along with the major related companies and Industrial Services providers

- Estimating the Industrial Services market for end-user industries

- Understanding the demand generated by companies operating across different end-user industries

- Tracking the ongoing and upcoming implementation of projects based on Industrial Services technology by vertical and forecasting the market based on these developments and other critical parameters

- Carrying out multiple discussions with the key opinion leaders to understand the type of Industrial Services products designed and developed vertically. This information would help analyze the breakdown of the scope of work carried out by each major company in the Industrial Services market

- Arriving at the market estimates by analyzing Industrial Services companies as per their countries, and subsequently combining this information to arrive at the market estimates by region

- Verifying and cross-checking the estimates at every level through discussions with the key opinion leaders, including CXOs, directors, and operations managers, and finally with domain experts at MarketsandMarkets

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

Top-Down Approach

In the top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits from secondary and primary research.

To calculate the market size of specific segments, the most appropriate immediate parent market size has been used to implement the top-down approach. The top-down approach was implemented for the data extracted from the secondary research to validate the market size obtained.

The market share of each company was estimated to verify the revenue shares used earlier in the top-down approach. The overall parent market size and individual market sizes were determined and confirmed in this study by the data triangulation method and the validation of data through primaries. The data triangulation method used in this study is explained in the next section.

- Focusing on top-line investments and expenditures being made in the ecosystems of various verticals.

- Building and developing the information related to the market revenue generated by key Industrial Services providers

- Conducting multiple on-field discussions with the key opinion leaders involved in the development of Industrial Services products in various applications

- Estimating geographic splits using secondary sources based on various factors, such as the number of players in a specific country and region, the offering of Industrial Services, and the level of services offered in end-user industries

- Impact of the recession on the steps mentioned above has also been considered

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation procedure has been employed wherever applicable. The data has been triangulated by studying various factors and trends from both demand and supply sides. Along with this, the market size has been validated using top-down and bottom-up approaches.

Market Definition

Industrial services refer to a diverse set of specialized activities and support functions that facilitate the smooth functioning, maintenance, and enhancement of industrial processes and facilities. These services are integral to optimizing operational efficiency, ensuring compliance with regulatory standards, and addressing the complex needs of industrial sectors.

Key Stakeholders

- Manufacturers and Suppliers

- Service Providers

- End-User Industries

- Government Regulatory Bodies

- Investors and Financial Institutions

- Trade Associations and Industry Groups

- Research and Development Centers

- Technology Providers

- Logistics and Transportation Companies

- Environmental and Sustainability Organizations

- Workers and Labor Unions

- Insurance Companies

Report Objectives

- To define, describe, and forecast the Industrial Services market based on service type, application, end-user industry, and region.

- To forecast the size of the market segments for four major regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To study the complete value chain and allied industry segments and perform a value chain analysis of the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To analyze the opportunities in the market for stakeholders and describe the competitive landscape of the market

- To analyze competitive developments such as joint ventures, collaborations, agreements, partnerships, mergers & acquisitions, product developments, and research & development (R&D) in the market

- To analyze the impact of the recession on the Industrial Services market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the Industrial Services market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Industrial Services market.

Growth opportunities and latent adjacency in Industrial Services Market

How is this report segmented by service (engineering and consulting, installation and commissioning, and operational improvement and maintenance)? Are services further segmented into industries or vice versa?

There are two things we want to know; We want to know what "6.4 Operational Improvement & Maintenance" includes. And can we buy that segment by page (not whole report), and if we can, how much does it cost?

How detailed does this report get as far as service segmentation is concerned? What service markets are particularly sized?

I am a scientific journalist working and currently I am writing an article about the industrial services and maintenance industry, mainly in North America, but I am interested to have a worldwide perspective. To resume, my hypothesis is that this sector (about 80%) is still informal in North America and we are loosing a great opportunity to grow the market. My intention is to show that we can do better to grow this sector. I would consider this study as a very important tool to my research.