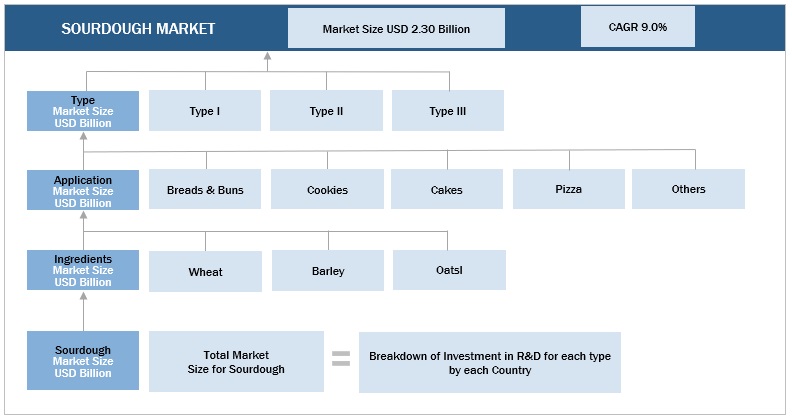

Sourdough Market by Type (Type I, Type II and Type III), Application (Bread & Buns, Cookies, Cakes, Pizza), Ingredients (Wheat, Barley, and Oats), and Region (North America, Europe, APAC, South America, RoW) - Global Forecast to 2028

Sourdough Market Size & Trends Overview

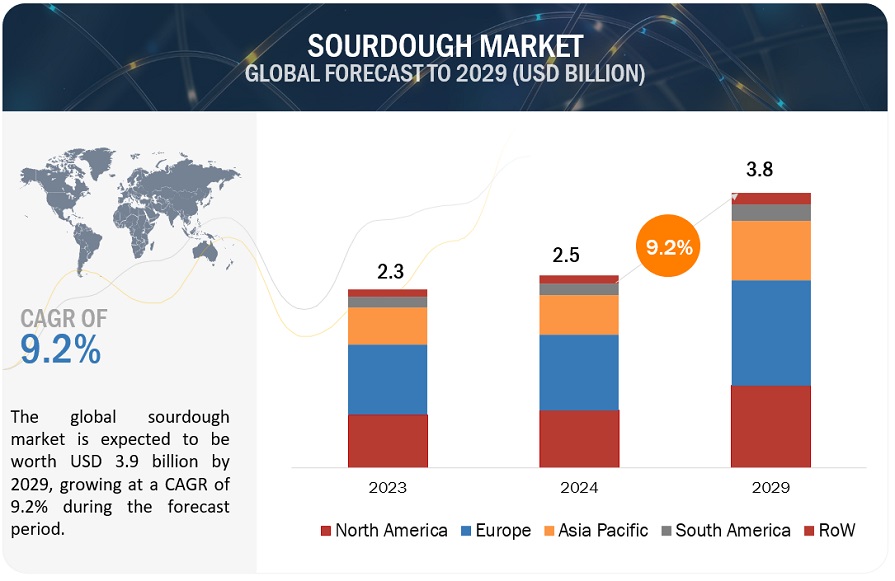

The sourdough market size is predicted to grow at a CAGR of 9.0% between 2023 and 2028, reaching a value of $3.5 billion by 2028 from a projection of $2.3 billion in 2023.

The significant shift in consumer preferences towards healthier and natural food options and sourdough bread aligns perfectly with this trend. The market is driven by the expanding product offerings by manufacturers who are introducing a wide range of sourdough-based products like baguettes, rolls, and even pastries. The increasing availability of artisanal and premium baked goods in supermarkets and specialty stores also contributes to market growth.

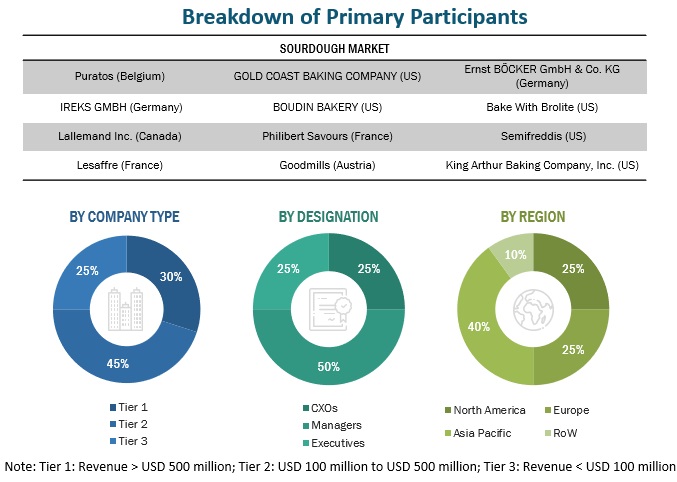

The expanding business has offered lucrative business opportunities to the players who are operating in the market segments. For instance, in January 2021, Puratos acquired Ruskhleb, a baking ingredient company based in Saint Petersburg (Russia), to expand its range of local sourdoughs in Russia and enable more Russian bakers to capitalize on the growing market demand for sourdough bread. Puratos planned to strengthen its local bakery leadership position with this acquisition and localize sourdough manufacturing utilizing regional ingredients. Other key players like Ernst Böcker GmbH & Co. KG. launched new products offering a versatile solution for global baking needs. The overall market is classified as a competitive market, with the top 5 key players, namely Puratos (Belgium), IREKS GMBH (Germany), Lallemand Inc. (Canada), Lesaffre (France), Goodmills (Austria), occupying 25-50% of the market share.

To know about the assumptions considered for the study, Request for Free Sample Report

Sourdough Market Growth Insights

Driver: Increasing Consumer Demand for Healthier and Natural Options

Sourdough bread aligns with this trend as it is perceived as a healthier alternative to traditional bread due to its natural fermentation process and potential digestive benefits. The rising consumer awareness about the advantages of sourdough, such as improved digestion and potentially lower glycemic index, further drives its popularity. Additionally, the growing availability of artisanal and premium sourdough products in supermarkets and specialty stores boosts market growth.

Restraint: Longer Production Time and Potential Higher Costs

The sourdough market is a longer production process compared to conventional bread. The fermentation process for sourdough can take several hours or even days, which may pose challenges for large-scale production and distribution. Moreover, sourdough requires specialized knowledge and skills, making it difficult for some manufacturers to maintain consistent quality. Another restraint is the potentially higher cost associated with sourdough due to its premium positioning and the use of quality ingredients.

Opportunity: Growing Trend of Artisanal and Premium Baked Goods

By introducing new flavors, variants, and formats of sourdough bread, as well as expanding into other sourdough-based products like pastries and snacks. Moreover, with increasing consumer interest in sustainability and locally sourced products, there is an opportunity to highlight the regional and cultural aspects of sourdough, promoting traditional baking techniques and local ingredients. Additionally, the online retail channel provides an avenue for reaching a wider consumer base and expanding sourdough market presence.

To know about the assumptions considered for the study, download the pdf brochure

Challenge: Competition from Alternative Bread Options and Cheaper Production Methods

As gluten-free diets gain popularity, consumers may opt for gluten-free bread options, which could affect the demand for sourdough. Additionally, the traditional bread market remains a strong competitor, as it still holds a significant market share. Regulatory challenges and food safety standards could pose threats to sourdough manufacturers, especially when it comes to maintaining consistency and quality in large-scale production.

Sourdough Market Ecosystem

Sourdough Market by Type Insights

Based on Type, Type II is anticipated to grow at a significant CAGR in the market.

Type II market is expected to witness significant growth in the market due to the increasing demand for sourdough with added ingredients, or variations drives the growth of Type II sourdough. It offers a wider range of flavors and taste experiences compared to basic Type I sourdough, satisfying consumers' desire for diversity and indulgence. Moreover, Type II sourdough allows for product differentiation and innovation, enabling bakers and manufacturers to create unique and specialized sourdough products tailored to specific consumer preferences. The trend towards premium and artisanal bakery products further supports the demand for Type II sourdough as consumers seek high-quality and unique offerings. Overall, the growth of Type II sourdough is fueled by its ability to cater to consumer preferences for variety, customization, and premium bakery experiences.

Sourdough Market by Ingredients Insights

The Oats segment is projected to grow at the highest rate during the forecast period.

Increasing consumer awareness of the health benefits of oats, such as high fiber content and gluten-free properties, is driving the demand for oat-based products. The shift towards healthier dietary preferences, including vegan and plant-based diets, is also contributing to the popularity of oats. Manufacturers are innovating and introducing a variety of oat-based products to cater to evolving consumer preferences. The sustainability aspect of oats, with lower water and land requirements, aligns with the growing focus on environmentally friendly food choices. These factors collectively propel the growth of the oats segment and make it a lucrative market opportunity.

Sourdough Market by Application Insights

Based on Application, the Cakes segment is projected to occupy a significant sourdough market share rate during the forecast period.

Sourdough cakes provide a healthier alternative to traditional cakes, appealing to health-conscious consumers. The unique tangy flavor and moist texture offered by sourdough enhance the taste experience, attracting consumers seeking new and distinct flavors. The association of sourdough cakes with artisanal and gourmet offerings adds to their appeal, as consumers increasingly value high-quality, handcrafted products. The growing variety of sourdough-based cakes from manufacturers provides consumers with more choices, driving market share. Increasing consumer awareness about the health benefits and unique characteristics of sourdough contributes to the demand for sourdough cakes.

Sourdough Market by Regional Insights

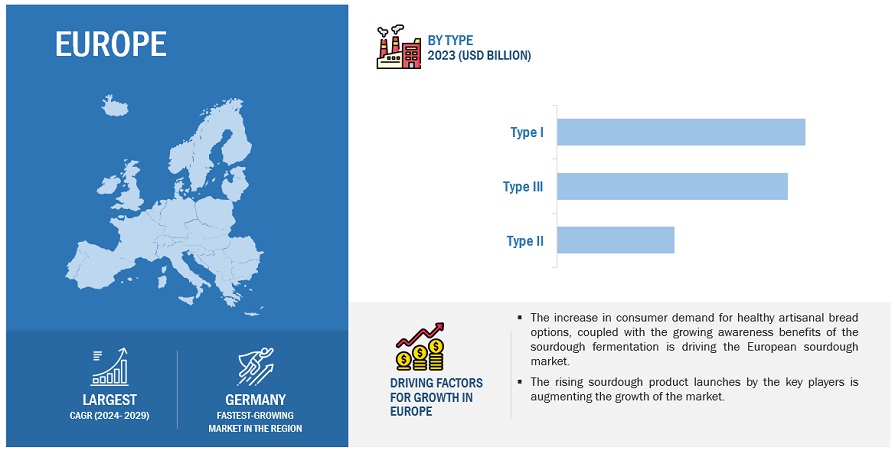

Europe holds the highest market share during the forecast period.

Europe accounted for the largest market share in the food & beverage metal cans market in 2022. Europe holds the highest market share during the forecast period in the sourdough market due to several key factors. Europe has a deep-rooted tradition and cultural connection to bread, making it an integral part of European diets. The region's familiarity and preference for bread contribute to the higher market share of sourdough in Europe. Europe values artisanal and traditional food products, aligning with the characteristics of sourdough. The demand for sourdough is driven by European consumers' appreciation for authenticity, high-quality ingredients, and unique flavors. Europe's advanced bakery industry, encompassing artisanal bakeries and commercial manufacturers, ensures the widespread availability and accessibility of sourdough products. The combination of cultural heritage, preference for artisanal foods, and a well-developed bakery industry establish Europe's dominant market share in the market.

Key Players in the Sourdough Industry

Key players in this market include Puratos (Belgium), IREKS GMBH (Germany), Lallemand Inc. (Canada), Lesaffre (France), BOUDIN BAKERY (US), Goodmills (Austria), and Bake With Brolite (US).

Sourdough Market Report Scope

|

Report Metric |

Details |

|

Market Valuation in 2023 |

US $2.3 Billion |

|

Revenue Forecast in 2028 |

US $3.5 Billion |

|

Progress Rate |

CAGR of 9.0% |

|

Companies studied |

|

|

Market Drivers |

|

|

Market Opportunities |

|

Sourdough Market Segmentation:

|

Segment |

Subsegment |

|

Market By Type |

|

|

Market By Application |

|

|

Market By Ingredients |

|

|

Sourdough Market By Region |

|

Recent Developments in Sourdough Market

- In January 2021, Puratos acquired Ruskhleb, a baking ingredient company based in Saint Petersburg (Russia), to expand its range of local sourdoughs in Russia and enable more Russian bakers to capitalize on the growing market demand for sourdough bread. Puratos planned to strengthen its local bakery leadership position with this acquisition and localize sourdough manufacturing utilizing regional ingredients.

- In November 2022, Ernst Böcker GmbH & Co. KG. (Germany) launched BÖCKER Mondial Vario sourdough starter, which offers a versatile solution for global baking needs. With a shelf life of three months and adaptable to various climates and raw materials, it guarantees consistent, high-quality results. Its mild flavor is perfect for wheat and mixed wheat pastries, including fine baked goods, and organic and gluten-free options.

- In November 2022, Ernst Böcker GmbH & Co. KG. (Germany), the sourdough specialist, introduced ActiVivo, a range of active, liquid sourdoughs, ensuring reliable processes and high-quality baked goods.

Frequently Asked Questions (FAQ):

Which are the major companies in the sourdough industry?

Some of the key companies operating in the sourdough industry are Puratos (Belgium), IREKS GMBH (Germany), Lallemand Inc. (Canada), Lesaffre (France), BOUDIN BAKERY (US), Goodmills (Austria), and Bake With Brolite (US).

What are the drivers and opportunities for the sourdough bread?

Increasing Consumer Demand for Healthier and Natural Food

Rising Popularity of Artisanal and Specialty Bakery Products

What is the total CAGR projected to be recorded for the sourdough industry from 2023 to 2028?

The CAGR is expected to be 9.0 % from 2023 – 2028 for the global sourdough market.

What kind of information is provided in the competitive landscape section?

For the list of players mentioned, company profiles provide insights such as a business overview covering information on the company’s business segments, financials, geographic presence, revenue mix, and business revenue mix and key developments associated with the company.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

This research involves the extensive use of secondary sources; directories; and databases (Bloomberg and Factiva) to identify and collect information useful for a technical, market-oriented, and commercial study of the Sourdough market. In-depth interviews were conducted with various primary respondents, such as key industry participants, Subject Matter Experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and to assess prospects.

Secondary Research

In the secondary research process, various sources, such as the Food and Agricultural Organization (FAO), United States Department of Agriculture (USDA), U.S. Food and Drug Administration (FDA) U.S. Food and Drug Administration (FDA), European Food Safety Authority (EFSA), World Health Organization (WHO), Consumer Healthcare Products Association (CHPA), European Federation of Associations of Health Product Manufacturers (EHPM), Canadian Health Food Association (CHFA), and Health Food Manufacturers' Association (HFMA), associations were referred to identify and collect information for this study. The secondary sources also include journals, press releases, investor presentations of companies, whitepapers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Primary Research

The Sourdough market encompasses various stakeholders involved in the supply chain, raw material manufacturers, raw material suppliers, regulatory organizations, and research institutions. To gather comprehensive information, primary sources from both the supply and demand sides were engaged. Primary interviewees from the supply side consisted of manufacturers, distributors, importers, and technology providers involved in the production and distribution of sourdough. On the demand side, key opinion leaders, executives, and CEOs of companies in the Sourdough industry were approached through questionnaires, emails, and telephonic interviews. This approach ensured a comprehensive and well-rounded understanding of the Sourdough market from various perspectives.

To know about the assumptions considered for the study, download the pdf brochure

Sourdough Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the market’s and various dependent submarkets’ size. The research methodology used to estimate the market size includes extensive secondary research of key players, reports, reviews, and newsletters of top market players, along with extensive interviews from leaders, such as CEOs, directors, and marketing executives.

Global Sourdough market size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Sourdough market size: Top-Down Approach

Data Triangulation

The data triangulation and market breakdown procedures explained above were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Sourdough Market Definition

A sourdough is a form of dough fermented by yeast and lactic acid bacteria (LAB) that is used as sponge dough in bread production. The creation, maintenance, and usage of a complex and varied starter culture are essential components of the ancient technique of creating sourdough bread. Around the world, sourdough starter cultures are used to make bread on both a small-scale (artisanal) and large-scale (commercial) basis. While there is a lot of scientific research on sourdough, neither the scientific community nor the bread industry has standardized methods for using sourdough starters, and there aren't many suggestions for where sourdough research should go in the future.

Stakeholders

- Raw material suppliers

- Traders, distributors, and manufacturers & suppliers of bakery fillings

- Bakery product manufacturers

- Government and research organizations

- Trade associations and industry bodies

-

Government authorities

- American Bakers Association (ABA)

- Specialty Food Association (SFA)

- Baking Association of Canada (BAC)

- International Dairy Deli Bakery Association (IDDBA)

- Brazilian Manufacturers Association of Biscuits, Pasta and Industrialized Breads & Cakes (ABIMAPI)

- Craft Bakers Association (CBA)

- European Commission

- European Food Safety Authority (EFSA)

Sourdough Market Report Objectives

- To define, segment, and project the global market for Sourdough on the basis of type, application, ingredients, and region

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micro markets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies

- To analyze competitive developments in the Sourdough market, including joint ventures, mergers & acquisitions, new product developments, and research & development activities

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of the European Sourdough market, by key country

- Further breakdown of the Rest of the Asia Pacific market, by key country

- Further breakdown of the Rest of South America market, by key country

Company Information

- Detailed analyses and profiling of additional market players

Growth opportunities and latent adjacency in Sourdough Market