Infrastructure as Code (IaC) Market by Tool (Configuration Orchestration, Configuration Management), Service, Type (Declarative & Imperative), Infrastructure Type (Mutable & Immutable), Deployment Mode, Vertical and Region - Global Forecast to 2027

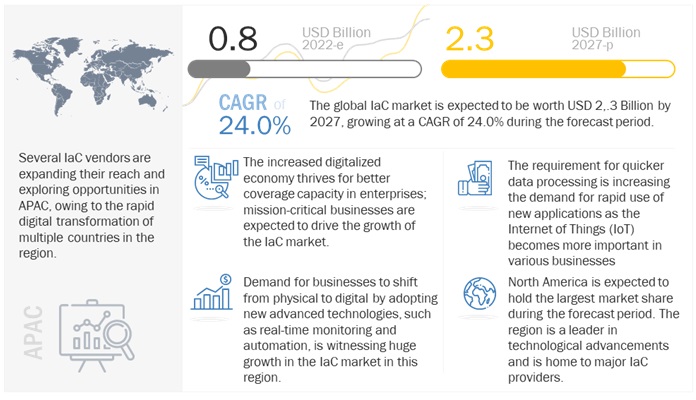

The global Infrastructure as Code Market size was valued at USD 0.8 billion in 2022 and it is projected to reach USD 2.3 billion by 2027, growing at a CAGR of 24.0% during the forecast period.

Increasing velocity entails automating, repeating, and scaling activities so they may be completed in moments rather than hours, such as racking machines, loading security updates, installing services and applications, establishing networks, and activating memory. Infrastructure as code decreases risk when properly implemented by tackling common IT issues such configuration drifting, operator mistakes, inefficiencies, and losing of information.

Attractive Opportunities in the Infrastructure as Code Market Overview

Source: Secondary Research, Expert Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Advent of modern cloud architecture

Consumer behavior and demands are currently witnessing tremendous evolution. Enterprises are prioritizing these demands to sustain themselves in the competitive market. Rising customer expectations and growing competitiveness among market leaders are increasing the demand for cost-effective measures to enhance the operational efficiencies of organizations. Enterprises that use manual processes for completing business-critical activities face issues, such as incorrect interpretation of given data, since manual processes are tedious, repetitive, and time-consuming. On the other hand, Infrastructure as code solutions help enterprises achieve new channels to engage their employees with customers and help improve workplace productivity. Other cloud benefits, such as faster deployment, cost savings, flexible licensing models, reduced maintenance costs, and continuous upgradation of software features, are a few significant factors driving the adoption of the Infrastructure as code market. Modern cloud architectures offer benefits, such as increased innovation, accelerated time to market, better dependability, and lower costs. However, this has made managing cloud infrastructure more difficult. Modern architectures comprise numerous loosely connected, interdependent services and APIs. As a result, the use of cloud resources that people must manage is rising. Infrastructure as code is the only method that can handle this complexity. Infrastructure as code platforms offer developers full power of programming languages, thus making it simpler to manage many dependencies of modern cloud applications.

Restraint: Limited number of skilled workforces

The complete lifecycle of servers and cloud infrastructure is now under the software's control with the help of infrastructure as code, as it provides a programmable resource model and uniform programming model. Since the infrastructure as code and DevOps models demand a high level of technical proficiency, some businesses might be hesitant to adopt them due to the necessary changes in culture and business procedures, the risks of migrating an existing application, or the possibility that their team lacks the necessary skills. The integration of AI solutions with the existing systems is a difficult task, which requires extensive data processing to replicate the behavior of a human brain. Additionally, many businesses choose to outsource their Infrastructure as code needs, particularly in the early phases of adoption.

Opportunity: Inception of composable infrastructure

Streamlined operations, resources scalability, reduced IT costs, and in-built data protection and data recovery are some of the factors expected to drive the adoption of Infrastructure as code solutions. In the current scenario, industries are not extensively aware of the benefits of composable solutions. However, this situation is expected to change in the coming years, as the leading companies of the Infrastructure as code ecosystem are making buyers aware of the benefits and advantages of composable solutions. Currently, large organizations are the leading adopters of Infrastructure as code solutions. However, SMEs are expected to rapidly adopt these solutions in the next few years.

The high availability of data protection, cost-savings, high return on investment, and simplicity in operations are the major benefits for the potential adopters of composable infrastructure solutions. Infrastructure as code vendors must align their products with the above-stated requirements to ensure high sales and greater profitability. If the upcoming composable infrastructure solutions can meet the stated requirements of adopters, then they would benefit both vendors and adopters.

Challenge: Potential duplication of error

Even though the Infrastructure as code implementation and machine construction processes mainly rely on automation, several steps of the overall process still need to be completed manually. One of those steps is writing the parent code. Wherever there is human involvement, an error is always possible, even in a setting where QA inspections are frequent and reliable. These errors might happen on numerous machines as a result of automation. Through stringent testing procedures with high levels of consistency and extensive auditing procedures, this error can be corrected. However, these extra efforts frequently result in higher overheads.

The Immutable segment is expected to grow at the highest CAGR during the forecast period

Based on infrastructure type, the infrastructure as code market is segmented into mutable and immutable. Immutable infrastructure takes Infrastructure as code to the next logical step, essentially hardening it to further ensure the benefits it offers. It eliminates configuration drift and makes it even easier to maintain consistency between the test and deployment environments. It also makes it easier to maintain and track infrastructure versions and confidently roll back to any version when necessary.

The large enterprises segment to account for the largest market size during the forecast period

The segmentation of the infrastructure as code market by the organization size includes large enterprises and SMEs. The trend of digitalization has been extensively increasing among large enterprises. The growing connectivity of bandwidth and mobility trends can be seen more among the large enterprises due to the presence of a huge workforce. Moreover, the rising demand for employees to access computing resources and applications from anywhere and at any time has made it complex for enterprises to store their data properly, maintain and manage their data centers, and focus on their core business operations. Large enterprises also generate huge amounts of critical business data regularly. Thus, it has become important for them to automate the application deployment infrastructure to increase work speed and minimize human errors. Large enterprises in the BFSI, telecommunication, retail, and manufacturing verticals cannot afford to lose customers due to delays in work. Therefore, they are opting to deploy Infrastructure as code.

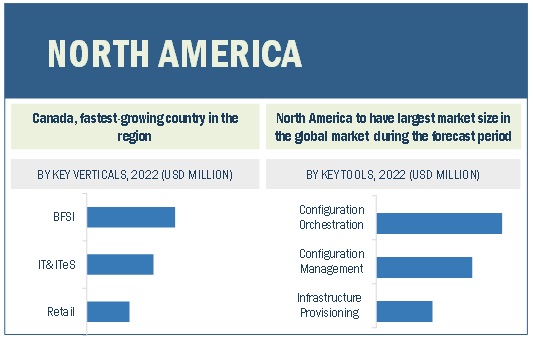

North America to account for the largest market size during the forecast period

North America has witnessed significant growth in the Infrastructure as code market. In North America, the focus is on expanding the North American critical infrastructure market, as end-users in the region are increasingly using critical infrastructure solutions. The US Infrastructure as code market represents a sizable market. It has a sizable supply base, which aids in the country’s market growth. Organizations are shifting toward the adoption of emerging technologies and digital business strategies, which is one of the major factors driving the adoption of Infrastructure as code solutions in North America. The increasing budget allocation for cloud services among enterprises is expected to drive the market in North America. The region is expected to be the most promising region for major verticals, such as telecom, IT and ITeS, BFSI, and the government and public sector. It has offered growth opportunities for many major players. For example, IBM offers IBM Cloud Schematics, a simplified solution for automating infrastructure management that has helped organizations increase application performance with consistent provisioning and orchestration.

Source: Secondary Research, Expert Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The bot service providers have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major players in the infrastructure as code market include IBM (US), Microsoft (US), AWS (US), Oracle (US), Hashicorp Terraform (US), Google (US), Alibaba Group (China), Dell (US), Rackspace Technology (US), HPE (US), ServiceNow (US), Broadcom (US), Pulumi (US), Puppet (US), Progress Software (US), NetApp (UK), Northern.tech (US), Canonical (UK), Alpacked (Ukraine), Jenkins (US), Gitlab (US), Github (US), Crossplane (US), and Docker (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size value in 2022 |

USD 0.8 Billion |

|

Revenue forecast in 2027 |

USD 2.3 Billion |

|

Growth rate |

CAGR of 24.0% |

|

Growth Drivers |

|

|

Challenges |

|

|

Segments covered |

Component, type, infrastructure type, Deployment Type, Organization Size, Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

IBM (US), Microsoft (US), AWS (US), Oracle (US), Hashicorp Terraform (US), Google (US), Alibaba Group (China), Dell (US), Rackspace Technology (US), HPE (US), ServiceNow (US) and many more. |

This research report categorizes the infrastructure as code market based on component, type, infrastructure type, deployment type, organization size, vertical, and region.

By Component:

- Tools

- Services

By Type:

- Declarative

- Imperative

By Infrastructure type:

- Mutable

- Immutable

By Organization Size:

- Large Enterprises

- SMEs

By Deployment Type:

- On-premises

- Cloud

By Verticals:

- BFSI

- IT & ITES

- Telecom

- Government

- Manufacturing

- Healthcare

- Retail

- Transportation & Logistics

- Others (travel and hospitality, energy and utilities, and education)

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- Australia & New Zealand

- Rest of Asia Pacific

-

Middle East and Africa

- Middle East

- Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In June 2022, AWS announced the general availability of Mainframe Modernization, which enables customers to upgrade mainframe-based workloads more quickly and easily by shifting them to cloud to take advantage of AWS's superior agility, elasticity, and cost benefits.

- In June 2022, HashiCorp launched Drift Detection to Terraform for Infrastructure Management. It would standardize operations, providing visibility and governance across teams for multi-cloud infrastructure.

- In April 2022, Using a software-as-a-service (SaaS) chip creation solution on the Microsoft Azure cloud computing platform, Microsoft aimed to change the landscape. Clients may immediately access cloud computing resources and any Synopsys cloud-enabled design and verification tool using the SaaS model.

- In March 2022, Google announced the launch of the Last Mile Fleet Solution and the Cloud Fleet Routing API, which would assist fleet operators in enhancing delivery success and maximizing fleet performance. Simple route planning requests may be answered almost instantly using the Cloud Fleet Routing API. Parallelized request batching allows it to handle even the most taxing workloads.

- In December 2021, Oracle announced the general availability of continuous integration features from the OCI DevOps service. It offers a full end-to-end CI/CD platform in OCI commercial regions. DevOps code repositories now allow developers to commit their source code, generate and test software artifacts, deliver artifacts to OCI repositories, and deploy those products to OCI platforms.

- In September 2021, IBM announced the new IBM Power E1080 server designed to assist clients in managing a safe, hassle-free hybrid cloud experience across their whole IT infrastructure.

Frequently Asked Questions (FAQ):

What is the projected market value of the global infrastructure as code market?

The global market for infrastructure as code is projected to reach USD 2.3 billion.

What is the estimated growth rate (CAGR) of the global infrastructure as code market for the next five years?

The global infrastructure as code market is projected to grow at a Compound Annual Growth Rate (CAGR) of 24.0% from 2022 to 2027.

What are the major revenue pockets in the infrastructure as code market currently?

North America has witnessed significant growth in the Infrastructure as code market. In North America, the focus is on expanding the North American critical infrastructure market, as end-users in the region are increasingly using critical infrastructure solutions. The US Infrastructure as code market represents a sizable market. It has a sizable supply base, which aids in the country’s market growth. Organizations are shifting toward the adoption of emerging technologies and digital business strategies, which is one of the major factors driving the adoption of Infrastructure as code solutions in North America. The increasing budget allocation for cloud services among enterprises is expected to drive the market in North America. The region is expected to be the most promising region for major verticals, such as telecom, IT and ITeS, BFSI, and the government and public sector. It has offered growth opportunities for many major players. For example, IBM offers IBM Cloud Schematics, a simplified solution for automating infrastructure management that has helped organizations increase application performance with consistent provisioning and orchestration.

Who are the key vendors in the infrastructure as code market?

The key players in the infrastructure as code market include IBM (US), Microsoft (US), AWS (US), Oracle (US), Hashicorp Terraform (US), Google (US), Alibaba Group (China), Dell (US), Rackspace Technology (US), HPE (US), ServiceNow (US), Broadcom (US), Pulumi (US), Puppet (US), Progress Software (US), NetApp (UK), Northern.tech (US), Canonical (UK), Alpacked (Ukraine), Jenkins (US), Gitlab (US), Github (US), Crossplane (US), and Docker (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 38)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 INFRASTRUCTURE AS CODE MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 INCLUSIONS AND EXCLUSIONS

1.4 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2019–2021

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 43)

2.1 RESEARCH DATA

FIGURE 2 INFRASTRUCTURE AS CODE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 List of key primary interview participants

2.1.2.3 Breakdown of primaries

2.1.2.4 Primary sources

2.1.2.5 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

2.3.1.1 Approach for capturing market share using bottom-up analysis (demand side)

FIGURE 4 INFRASTRUCTURE AS CODE MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF MARKET

2.3.2 TOP-DOWN APPROACH

2.3.2.1 Approach for capturing market share using top-down analysis (supply side)

2.3.3 MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

2.4 RESEARCH ASSUMPTIONS

2.4.1 RESEARCH ASSUMPTIONS

2.5 RISK ASSESSMENT

TABLE 2 RISK ASSESSMENT: INFRASTRUCTURE AS CODE MARKET

2.6 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 52)

TABLE 3 MARKET AND GROWTH RATE, 2016–2021 (USD MILLION, Y-O-Y%)

TABLE 4 MARKET AND GROWTH RATE, 2022–2027 (USD MILLION, Y-O-Y%)

FIGURE 7 TOOLS SEGMENT EXPECTED TO ACCOUNT FOR LARGER MARKET SIZE DURING FORECAST PERIOD

FIGURE 8 CONFIGURATION ORCHESTRATION SEGMENT EXPECTED TO ACCOUNT FOR LARGEST MARKET SIZE IN 2022

FIGURE 9 TRAINING, SUPPORT, AND MAINTENANCE SEGMENT EXPECTED TO ACCOUNT FOR LARGEST MARKET SIZE IN 2022

FIGURE 10 DECLARATIVE SEGMENT EXPECTED TO ACCOUNT FOR LARGER MARKET SHARE IN 2022

FIGURE 11 IMMUTABLE SEGMENT EXPECTED TO ACCOUNT FOR LARGER MARKET SIZE IN 2022

FIGURE 12 ON-PREMISES SEGMENT EXPECTED TO ACCOUNT FOR LARGER MARKET SIZE DURING FORECAST PERIOD

FIGURE 13 LARGE ENTERPRISES SEGMENT ESTIMATED TO DOMINATE MARKET IN 2022

FIGURE 14 BFSI VERTICAL EXPECTED TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

FIGURE 15 NORTH AMERICA ESTIMATED TO ACCOUNT FOR LARGEST SHARE IN 2022

4 PREMIUM INSIGHTS (Page No. - 58)

4.1 ATTRACTIVE OPPORTUNITIES IN INFRASTRUCTURE AS CODE MARKET

FIGURE 16 SURGING DEMAND FOR ADOPTION OF CLOUD, AI, AND ML SOLUTIONS DRIVING MARKET FOR INFRASTRUCTURE AS CODE

4.2 NORTH AMERICA: INFRASTRUCTURE AS CODE, BY COMPONENT AND VERTICAL, 2022

FIGURE 17 BFSI AND CONFIGURATION ORCHESTRATION SEGMENTS EXPECTED TO ACCOUNT FOR SIGNIFICANT MARKET SHARE

4.3 INFRASTRUCTURE AS CODE MARKET, BY REGION, 2022

FIGURE 18 NORTH AMERICA EXPECTED TO ACCOUNT FOR LARGEST MARKET SHARE

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 60)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: INFRASTRUCTURE AS CODE MARKET

5.2.1 DRIVERS

5.2.1.1 Advent of modern cloud architecture

5.2.1.2 Demand for better optimization of business operations

5.2.2 RESTRAINTS

5.2.2.1 Limited skilled workforce

5.2.3 OPPORTUNITIES

5.2.3.1 Inception of composable infrastructure

5.2.4 CHALLENGES

5.2.4.1 Data security and privacy concerns

5.2.4.2 Potential duplication of error

TABLE 5 CUMULATIVE GROWTH ANALYSIS

5.3 EVOLUTION

5.4 INFRASTRUCTURE AS CODE MARKET ECOSYSTEM

TABLE 6 MARKET ECOSYSTEM

5.5 CASE STUDY ANALYSIS

5.5.1 RETAIL

5.5.1.1 Use Case: Krost used infrastructure as code technology for simplified scalability in AWS

5.5.2 IT/ITES

5.5.2.1 Use Case: Rapyder built infrastructure as code technology using Terraform

5.5.3 HEALTHCARE

5.5.3.1 Use Case: Leveraging best practices for infrastructure as code and DevOps

5.5.4 BFSI

5.5.4.1 Use Case: Rapyder helped Oxigen successfully migrate to AWS cloud

5.5.5 MANUFACTURING

5.5.5.1 Use Case: Jabil powered manufacturing and customer success by delivering innovative IT projects efficiently and reliably with ServiceNow

5.5.6 TELECOM

5.5.6.1 Use Case: Orange Business Services powered customer experience with ServiceNow

5.5.7 GOVERNMENT

5.5.7.1 Use Case: Infrastructure as Code Agility and Kubernetes Governance using Nirmata and Crossplane

5.6 TECHNOLOGY ANALYSIS

5.6.1 INFRASTRUCTURE AS CODE AND ML

5.6.2 INFRASTRUCTURE AS CODE AND DATA SCIENCE

5.7 SUPPLY CHAIN/VALUE CHAIN ANALYSIS

FIGURE 20 INFRASTRUCTURE AS CODE: SUPPLY CHAIN ANALYSIS

5.8 PORTER’S FIVE FORCES ANALYSIS

FIGURE 21 INFRASTRUCTURE AS CODE: PORTER’S FIVE FORCES ANALYSIS

TABLE 7 INFRASTRUCTURE AS CODE MARKET: PORTER’S FIVE FORCES ANALYSIS

5.8.1 THREAT OF NEW ENTRANTS

5.8.2 THREAT OF SUBSTITUTES

5.8.3 BARGAINING POWER OF SUPPLIERS

5.8.4 BARGAINING POWER OF BUYERS

5.8.5 INTENSITY OF COMPETITIVE RIVALRY

5.9 PRICING MODEL ANALYSIS

5.10 PATENT ANALYSIS

5.10.1 METHODOLOGY

5.10.2 DOCUMENT TYPE

TABLE 8 PATENTS FILED, 2018-2021

5.10.3 INNOVATION AND PATENT APPLICATIONS

FIGURE 22 TOTAL NUMBER OF PATENTS GRANTED YEARLY, 2018–2021

5.10.3.1 Top applicants

FIGURE 23 TOP TEN COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2018–2021

TABLE 9 TOP TEN PATENT OWNERS (US) IN INFRASTRUCTURE AS CODE MARKET, 2018–2021

5.11 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 10 MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.12 TARIFF AND REGULATORY LANDSCAPE

5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 MIDDLE EAST AND AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.12.2 NORTH AMERICA: REGULATIONS

5.12.2.1 Personal Information Protection and Electronic Documents Act (PIPEDA)

5.12.2.2 Gramm-Leach-Bliley (GLB) Act

5.12.2.3 Health Insurance Portability and Accountability Act (HIPAA) of 1996

5.12.2.4 Federal Information Security Management Act (FISMA)

5.12.2.5 Federal Information Processing Standards (FIPS)

5.12.2.6 California Consumer Privacy Act (CCPA)

5.12.3 EUROPE: TARIFFS AND REGULATIONS

5.12.3.1 GDPR 2016/679

5.12.3.2 General Data Protection Regulation

5.12.3.3 European Committee for Standardization (CEN)

5.12.3.4 European Technical Standards Institute (ETSI)

5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

TABLE 16 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE VERTICALS (%)

5.13.2 BUYING CRITERIA

TABLE 17 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

6 INFRASTRUCTURE AS CODE MARKET, BY COMPONENT (Page No. - 83)

6.1 INTRODUCTION

FIGURE 24 SERVICES SEGMENT EXPECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

6.1.1 COMPONENTS: MARKET DRIVERS

TABLE 18 MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 19 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

6.2 TOOLS

TABLE 20 TOOLS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 21 TOOLS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.1 CONFIGURATION ORCHESTRATION

6.2.1.1 Increasing need for managing IT tasks and workflows in minimum time

TABLE 22 CONFIGURATION ORCHESTRATION: MARKET, BY REGION, 2016–2021(USD MILLION)

TABLE 23 CONFIGURATION ORCHESTRATION: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.2 CONFIGURATION MANAGEMENT

6.2.2.1 Growing need for automated configuration management environment

TABLE 24 CONFIGURATION MANAGEMENT: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 25 CONFIGURATION MANAGEMENT: MARKET, BY REGION, 2022–2027(USD MILLION)

6.2.3 INFRASTRUCTURE PROVISIONING

6.2.3.1 Demand for application development, deployment, and scalability

TABLE 26 INFRASTRUCTURE PROVISIONING: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 27 INFRASTRUCTURE PROVISIONING: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.4 APPLICATION DEVELOPMENT

6.2.4.1 Code-based approach providing speed and consistency in application development

TABLE 28 APPLICATION DEVELOPMENT: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 29 APPLICATION DEVELOPMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 SERVICES

TABLE 30 INFRASTRUCTURE AS CODE MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 31 MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 32 SERVICES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 33 SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.1 CONSULTING SERVICES

6.3.1.1 Technicalities involved in implementing Infrastructure as code tools and services

TABLE 34 CONSULTING SERVICES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 35 CONSULTING SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.2 INTEGRATION AND DEPLOYMENT

6.3.2.1 Growing need to overcome system-related issues

TABLE 36 INTEGRATION AND DEPLOYMENT: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 37 INTEGRATION AND DEPLOYMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.3 TRAINING, SUPPORT, AND MAINTENANCE

6.3.3.1 Growing deployment of Infrastructure as code solutions

TABLE 38 TRAINING, SUPPORT, AND MAINTENANCE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 39 TRAINING, SUPPORT, AND MAINTENANCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

7 INFRASTRUCTURE AS CODE, BY TYPE (Page No. - 95)

7.1 INTRODUCTION

FIGURE 25 IMPERATIVE SEGMENT EXPECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

7.1.1 TYPE: INFRASTRUCTURE AS CODE MARKET DRIVERS

TABLE 40 MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 41 MARKET, BY TYPE, 2022–2027 (USD MILLION)

7.2 DECLARATIVE

7.2.1 ELIMINATION OF CONFIGURATION DRIFT AND IMPROVED INFRASTRUCTURAL CONSISTENCY

TABLE 42 DECLARATIVE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 43 DECLARATIVE: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 IMPERATIVE

7.3.1 LOW-SPEED DEPLOYMENT AND REDUCED COST TO DRIVE GROWTH OF IMPERATIVE TYPE

TABLE 44 IMPERATIVE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 45 IMPERATIVE: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 INFRASTRUCTURE AS CODE, BY INFRASTRUCTURE TYPE (Page No. - 99)

8.1 INTRODUCTION

8.1.1 INFRASTRUCTURE TYPE: INFRASTRUCTURE AS CODE MARKET DRIVERS

FIGURE 26 IMMUTABLE SEGMENT EXPECTED TO ACCOUNT FOR LARGER MARKET SIZE DURING FORECAST PERIOD

TABLE 46 MARKET, BY INFRASTRUCTURE TYPE, 2016–2021 (USD MILLION)

TABLE 47 MARKET, BY INFRASTRUCTURE TYPE, 2022–2027 (USD MILLION)

8.2 MUTABLE

8.2.1 FLEXIBILITY OF MODIFICATIONS AFTER PROVISIONING

TABLE 48 MUTABLE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 49 MUTABLE: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 IMMUTABLE

8.3.1 LOW IT COMPLEXITY AND FAILURES, IMPROVED SECURITY, AND EASIER TROUBLESHOOTING BENEFITS DRIVING GROWTH

TABLE 50 IMMUTABLE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 51 IMMUTABLE: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 INFRASTRUCTURE AS CODE MARKET, BY ORGANIZATION SIZE (Page No. - 104)

9.1 INTRODUCTION

FIGURE 27 SMES SEGMENT EXPECTED TO GROW AT HIGHER GROWTH RATE DURING FORECAST PERIOD

9.1.1 ORGANIZATION SIZE: PLATFORM AS A SERVICE MARKET DRIVERS

TABLE 52 MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 53 MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

9.2 SMALL AND MEDIUM-SIZED ENTERPRISES

9.2.1 GROWING NEED FOR BUILDING AND MANAGING DYNAMIC INFRASTRUCTURE

TABLE 54 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 55 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 LARGE ENTERPRISES

9.3.1 ADVENT OF NEW APPLICATION AREAS AND CLOUD ADOPTION

TABLE 56 LARGE ENTERPRISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 57 LARGE ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 INFRASTRUCTURE AS CODE, BY DEPLOYMENT MODE (Page No. - 109)

10.1 INTRODUCTION

FIGURE 28 CLOUD SEGMENT EXPECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

10.1.1 DEPLOYMENT MODE: INFRASTRUCTURE AS CODE MARKET DRIVERS

TABLE 58 MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 59 MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

10.2 ON-PREMISES

10.2.1 ON-PREMISES DEPLOYMENT EXPECTED TO EXHIBIT SLOWER GROWTH

TABLE 60 ON-PREMISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 61 ON-PREMISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 CLOUD

10.3.1 LOW COST AND EASE OF IMPLEMENTATION EXPECTED TO MAKE CLOUD HIGHLY PREFERRED DELIVERY MODEL

TABLE 62 CLOUD: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 63 CLOUD: MARKET, BY REGION, 2022–2027 (USD MILLION)

11 INFRASTRUCTURE AS CODE MARKET, BY VERTICAL (Page No. - 114)

11.1 INTRODUCTION

FIGURE 29 BFSI VERTICAL EXPECTED TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 64 MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 65 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.1.1 VERTICAL: MARKET DRIVERS

11.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

11.2.1 BANKS INVESTING IN CLOUD MANAGEMENT SOLUTIONS TO INCREASE AGILITY AND IMPROVE COST-EFFICIENCY

TABLE 66 BFSI: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 67 BFSI: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.3 IT AND ITES

11.3.1 LARGE-SCALE ADOPTION OF DIGITAL TRANSFORMATION BOOSTING IT AND ITES INDUSTRY

TABLE 68 IT AND ITES: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 69 IT AND ITES: INFRASTRUCTURE AS CODE PLATFORM MARKET, BY REGION, 2022–2027 (USD MILLION)

11.4 GOVERNMENT

11.4.1 INFRASTRUCTURE AS CODE HELPING GOVERNMENTS IN MEETING COMPLIANCE

TABLE 70 GOVERNMENT: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 71 GOVERNMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.5 MANUFACTURING

11.5.1 NEED TO HAVE EFFICIENT OPERATIONS

TABLE 72 MANUFACTURING: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 73 MANUFACTURING: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.6 TELECOM

11.6.1 LARGE-SCALE GROWTH IN MOBILE SUBSCRIBERS AND DATA PENETRATION SERVICES

TABLE 74 TELECOM: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 75 TELECOM: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.7 RETAIL

11.7.1 GROWING ADOPTION OF CLOUD-BASED SOLUTIONS GENERATING DEMAND FOR INFRASTRUCTURE AS CODE

TABLE 76 RETAIL: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 77 RETAIL: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.8 HEALTHCARE

11.8.1 REAL-TIME SOLUTIONS HAVE BECOME INTEGRAL PART OF HEALTHCARE LANDSCAPE

TABLE 78 HEALTHCARE AND LIFE SCIENCES: INTEGRATED CLOUD MANAGEMENT PLATFORM MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 79 HEALTHCARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.9 TRANSPORTATION AND LOGISTICS

11.9.1 INFRASTRUCTURE AS CODE SOLUTIONS FACILITATING TRANSPORTATION AND LOGISTICS

TABLE 80 TRANSPORTATION AND LOGISTICS: INTEGRATED CLOUD MANAGEMENT PLATFORM MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 81 TRANSPORTATION AND LOGISTICS: INFRASTRUCTURE AS CODE PLATFORM MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

11.10 OTHER VERTICALS

11.10.1 ADOPTION OF ADVANCED TECHNOLOGIES FOR BETTER INTERACTIVE TEACHING AND TRAINING PRACTICES

TABLE 82 OTHER VERTICALS: INTEGRATED CLOUD MANAGEMENT PLATFORM MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 83 OTHER VERTICALS: INFRASTRUCTURE AS CODE PLATFORM MARKET, BY REGION, 2022–2027 (USD MILLION)

12 INFRASTRUCTURE AS CODE MARKET, BY REGION (Page No. - 126)

12.1 INTRODUCTION

12.1.1 REGION: NETWORK AS A SERVICE MARKET DRIVERS

FIGURE 30 ASIA PACIFIC EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 84 MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 85 MARKET, BY REGION, 2022–2027 (USD MILLION)

12.2 NORTH AMERICA

12.2.1 NORTH AMERICA: MARKET DRIVERS

FIGURE 31 NORTH AMERICA: MARKET SNAPSHOT

TABLE 86 NORTH AMERICA: INFRASTRUCTURE AS CODE MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET, BY TOOL, 2016–2021 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET, BY TOOL, 2022–2027 (USD MILLION)

TABLE 90 NORTH AMERICA: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 91 NORTH AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 93 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 94 NORTH AMERICA: MARKET, BY INFRASTRUCTURE TYPE, 2016–2021 (USD MILLION)

TABLE 95 NORTH AMERICA: MARKET, BY INFRASTRUCTURE TYPE, 2022–2027 (USD MILLION)

TABLE 96 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 97 NORTH AMERICA: INFRASTRUCTURE AS CODE MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 98 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 99 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 100 NORTH AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 101 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 102 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 103 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.2.2 US

12.2.2.1 Rapid adoption of advanced technologies and infrastructure

12.2.3 CANADA

12.2.3.1 Rapid adoption of emerging technologies and use of digital business strategies

12.3 EUROPE

12.3.1 EUROPE: INFRASTRUCTURE AS CODE MARKET DRIVERS

TABLE 104 EUROPE: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 105 EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 106 EUROPE: MARKET, BY TOOL, 2016–2021 (USD MILLION)

TABLE 107 EUROPE: MARKET, BY TOOL, 2022–2027 (USD MILLION)

TABLE 108 EUROPE: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 109 EUROPE: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 110 EUROPE: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 111 EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 112 EUROPE: MARKET, BY INFRASTRUCTURE TYPE, 2016–2021 (USD MILLION)

TABLE 113 EUROPE: INFRASTRUCTURE AS CODE MARKET, BY INFRASTRUCTURE TYPE, 2022–2027 (USD MILLION)

TABLE 114 EUROPE: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 115 EUROPE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 116 EUROPE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 117 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 118 EUROPE: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 119 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 120 EUROPE: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 121 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.3.2 UK

12.3.2.1 Need to deliver consistent customer service experience

12.3.3 GERMANY

12.3.3.1 Rapid growth of cloud and advanced technology

12.3.4 FRANCE

12.3.4.1 Increase in adoption of cloud technology

12.3.5 REST OF EUROPE

12.4 ASIA PACIFIC

12.4.1 ASIA PACIFIC: INFRASTRUCTURE AS CODE MARKET DRIVERS

FIGURE 32 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 122 ASIA PACIFIC: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 123 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 124 ASIA PACIFIC: MARKET, BY TOOL, 2016–2021 (USD MILLION)

TABLE 125 ASIA PACIFIC: MARKET, BY TOOL, 2022–2027 (USD MILLION)

TABLE 126 ASIA PACIFIC: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 127 ASIA PACIFIC: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 128 ASIA PACIFIC: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 129 ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 130 ASIA PACIFIC: INFRASTRUCTURE AS CODE MARKET, BY INFRASTRUCTURE TYPE, 2016–2021 (USD MILLION)

TABLE 131 ASIA PACIFIC: MARKET, BY INFRASTRUCTURE TYPE, 2022–2027 (USD MILLION)

TABLE 132 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 133 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 134 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 135 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 136 ASIA PACIFIC: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 137 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 138 ASIA PACIFIC: MARKET, BY COUNTRY/REGION, 2016–2021 (USD MILLION)

TABLE 139 ASIA PACIFIC: MARKET, BY COUNTRY/REGION, 2022–2027 (USD MILLION)

12.4.2 CHINA

12.4.2.1 Advance technologies, robust government support, and huge investments driving market growth

12.4.3 JAPAN

12.4.3.1 Development of new and modern law and privacy regulations driving growth

12.4.4 AUSTRALIA AND NEW ZEALAND

12.4.4.1 Use of cloud-based services for financial and operational benefits

12.4.5 REST OF ASIA PACIFIC

12.5 MIDDLE EAST AND AFRICA (MEA)

12.5.1 MIDDLE EAST AND AFRICA: INFRASTRUCTURE AS CODE MARKET DRIVERS

TABLE 140 MIDDLE EAST AND AFRICA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 141 MIDDLE EAST AND AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 142 MIDDLE EAST AND AFRICA: MARKET, BY TOOL, 2016–2021 (USD MILLION)

TABLE 143 MIDDLE EAST AND AFRICA: MARKET, BY TOOL, 2022–2027 (USD MILLION)

TABLE 144 MIDDLE EAST AND AFRICA: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 145 MIDDLE EAST AND AFRICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 146 MIDDLE EAST AND AFRICA: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 147 MIDDLE EAST AND AFRICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 148 MIDDLE EAST AND AFRICA: MARKET, BY INFRASTRUCTURE TYPE, 2016–2021 (USD MILLION)

TABLE 149 MIDDLE EAST AND AFRICA: MARKET, BY INFRASTRUCTURE TYPE, 2022–2027 (USD MILLION)

TABLE 150 MIDDLE EAST AND AFRICA: INFRASTRUCTURE AS CODE MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 151 MIDDLE EAST AND AFRICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 152 MIDDLE EAST AND AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 153 MIDDLE EAST AND AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 154 MIDDLE EAST AND AFRICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 155 MIDDLE EAST AND AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 156 MIDDLE EAST AND AFRICA: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 157 MIDDLE EAST AND AFRICA: MARKET, BY REGION, 2022–2027 (USD MILLION)

12.5.2 MIDDLE EAST

12.5.3 MIDDLE EAST

12.5.3.1 Supportive government initiatives boosting adoption of digital technologies

12.5.4 AFRICA

12.5.4.1 Adoption of cloud-based technology and growth of digital transformation

12.6 LATIN AMERICA

12.6.1 LATIN AMERICA: INFRASTRUCTURE AS CODE MARKET DRIVERS

TABLE 158 LATIN AMERICA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 159 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 160 LATIN AMERICA: MARKET, BY TOOL, 2016–2021 (USD MILLION)

TABLE 161 LATIN AMERICA: MARKET, BY TOOL, 2022–2027 (USD MILLION)

TABLE 162 LATIN AMERICA: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 163 LATIN AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 164 LATIN AMERICA: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 165 LATIN AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 166 LATIN AMERICA: MARKET, BY INFRASTRUCTURE TYPE, 2016–2021 (USD MILLION)

TABLE 167 LATIN AMERICA: MARKET, BY INFRASTRUCTURE TYPE, 2022–2027 (USD MILLION)

TABLE 168 LATIN AMERICA: INFRASTRUCTURE AS CODE MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 169 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 170 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 171 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 172 LATIN AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 173 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 174 LATIN AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 175 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.6.2 BRAZIL

12.6.2.1 Need for high operational efficiency

12.6.3 MEXICO

12.6.3.1 Rise in innovative, technological solutions and services

12.6.4 REST OF LATIN AMERICA

13 COMPETITIVE LANDSCAPE (Page No. - 164)

13.1 OVERVIEW

13.2 KEY PLAYER STRATEGIES

TABLE 176 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN INFRASTRUCTURE AS CODE MARKET

13.3 REVENUE ANALYSIS

FIGURE 33 REVENUE ANALYSIS OF KEY COMPANIES, 2017–2021

13.4 MARKET SHARE ANALYSIS

FIGURE 34 MARKET SHARE ANALYSIS, 2022

TABLE 177 MARKET: DEGREE OF COMPETITION

13.5 COMPANY EVALUATION QUADRANT

13.5.1 STARS

13.5.2 EMERGING LEADERS

13.5.3 PERVASIVE PLAYERS

13.5.4 PARTICIPANTS

FIGURE 35 KEY INFRASTRUCTURE AS CODE MARKET PLAYERS, COMPANY EVALUATION MATRIX, 2022

13.6 STARTUP/SME EVALUATION MATRIX

13.6.1 PROGRESSIVE COMPANIES

13.6.2 RESPONSIVE COMPANIES

13.6.3 DYNAMIC COMPANIES

13.6.4 STARTING BLOCKS

FIGURE 36 STARTUP/SME MARKET EVALUATION MATRIX, 2022

13.7 COMPETITIVE BENCHMARKING

TABLE 178 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 179 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

13.8 COMPETITIVE SCENARIO

13.8.1 PRODUCT LAUNCHES

TABLE 180 PRODUCT LAUNCHES, 2021–2022

13.8.2 DEALS

TABLE 181 DEALS, 2021–2022

14 COMPANY PROFILES (Page No. - 175)

(Business Overview, Solutions Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

14.1 INTRODUCTION

14.2 KEY PLAYERS

14.2.1 MICROSOFT

TABLE 182 MICROSOFT: BUSINESS OVERVIEW

FIGURE 37 MICROSOFT: COMPANY SNAPSHOT

TABLE 183 MICROSOFT: SOLUTIONS OFFERED

TABLE 184 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 185 MICROSOFT: DEALS

14.2.2 BROADCOM

TABLE 186 BROADCOM: BUSINESS OVERVIEW

FIGURE 38 BROADCOM: COMPANY SNAPSHOT

TABLE 187 BROADCOM: SOLUTIONS OFFERED

TABLE 188 BROADCOM: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 189 BROADCOM: DEALS

14.2.3 GOOGLE

TABLE 190 GOOGLE: BUSINESS OVERVIEW

FIGURE 39 GOOGLE: COMPANY SNAPSHOT

TABLE 191 GOOGLE: SOLUTIONS OFFERED

TABLE 192 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 193 GOOGLE: DEALS

14.2.4 AWS

TABLE 194 AWS: BUSINESS OVERVIEW

FIGURE 40 AWS: COMPANY SNAPSHOT

TABLE 195 AWS: SOLUTIONS OFFERED

TABLE 196 AWS: PRODUCT LAUNCHES

TABLE 197 AWS: DEALS

14.2.5 ORACLE

TABLE 198 ORACLE: BUSINESS OVERVIEW

FIGURE 41 ORACLE: COMPANY SNAPSHOT

TABLE 199 ORACLE: SOLUTIONS OFFERED

TABLE 200 ORACLE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 201 ORACLE: DEALS

14.2.6 IBM

TABLE 202 IBM: BUSINESS OVERVIEW

FIGURE 42 IBM: COMPANY SNAPSHOT

TABLE 203 IBM: SOLUTIONS OFFERED

TABLE 204 IBM: PRODUCT LAUNCHES

TABLE 205 IBM: DEALS

14.2.7 HPE

TABLE 206 HPE: BUSINESS OVERVIEW

FIGURE 43 HPE: COMPANY SNAPSHOT

TABLE 207 HPE: SOLUTIONS OFFERED

TABLE 208 HPE: PRODUCT LAUNCHES

TABLE 209 HPE: DEALS

14.2.8 SERVICENOW

TABLE 210 SERVICENOW: BUSINESS OVERVIEW

FIGURE 44 SERVICENOW: COMPANY SNAPSHOT

TABLE 211 SERVICENOW: SOLUTIONS OFFERED

TABLE 212 SERVICENOW: PRODUCT LAUNCHES

TABLE 213 SERVICENOW: DEALS

14.2.9 HASHICORP TERRAFORM

TABLE 214 HASHICORP TERRAFORM: BUSINESS OVERVIEW

FIGURE 45 HASHICORP TERRAFORM: COMPANY SNAPSHOT

TABLE 215 HASHICORP TERRAFORM: SOLUTIONS OFFERED

TABLE 216 HASHICORP TERRAFORM: PRODUCT LAUNCHES

TABLE 217 HASHICORP TERRAFORM: DEALS

14.2.10 PROGRESS SOFTWARE CORPORATION

14.2.11 PUPPET (PERFORCE)

14.2.12 PULUMI

14.2.13 DELL

14.2.14 ALIBABA

14.2.15 CROSSPLANE

14.2.16 DOCKER

14.2.17 JENKINS

14.2.18 NORTHERN.TECH

14.2.19 GITHUB

14.2.20 GITLAB

14.2.21 CANONICAL

14.2.22 NETAPP

14.2.23 ALPACKED

14.2.24 RACKSPACE TECHNOLOGY

*Details on Business Overview, Solutions Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

15 ADJACENT MARKETS (Page No. - 223)

15.1 INTRODUCTION

15.1.1 LIMITATIONS

15.1.2 CLOUD COMPUTING MARKET

15.1.2.1 Market definition

15.1.2.2 Cloud computing market, by component

TABLE 218 CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2015–2020 (USD BILLION)

TABLE 219 CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2021–2026 (USD BILLION)

15.1.2.3 Cloud computing market, by infrastructure as a service

TABLE 220 CLOUD COMPUTING MARKET, BY INFRASTRUCTURE AS A SERVICE, 2015–2020 (USD BILLION)

TABLE 221 CLOUD COMPUTING MARKET, BY INFRASTRUCTURE AS A SERVICE, 2021–2026 (USD BILLION)

15.1.2.4 Cloud computing market, by platform as a service

TABLE 222 CLOUD COMPUTING MARKET, BY PLATFORM AS A SERVICE, 2015–2020 (USD BILLION)

TABLE 223 CLOUD COMPUTING MARKET, BY PLATFORM AS A SERVICE, 2021–2026 (USD BILLION)

15.1.2.5 Cloud computing market, by software as a service

TABLE 224 CLOUD COMPUTING MARKET, BY SOFTWARE AS A SERVICE, 2015–2020 (USD BILLION)

TABLE 225 CLOUD COMPUTING MARKET, BY SOFTWARE AS A SERVICE, 2021–2026 (USD BILLION)

15.1.2.6 Cloud computing market, by deployment mode

TABLE 226 CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2015–2020 (USD BILLION)

TABLE 227 CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD BILLION)

15.1.2.7 Cloud computing market, by organization size

TABLE 228 CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD BILLION)

TABLE 229 CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD BILLION)

15.1.2.8 Cloud computing market, by vertical

TABLE 230 CLOUD COMPUTING MARKET, BY VERTICAL, 2015–2020 (USD BILLION)

TABLE 231 CLOUD COMPUTING MARKET, BY VERTICAL, 2021–2026 (USD BILLION)

15.1.3 HYPER-CONVERGED INFRASTRUCTURE MARKET

15.1.3.1 Market definition

15.1.3.2 Hyper-converged infrastructure market, by component

TABLE 232 HYPER-CONVERGED INFRASTRUCTURE MARKET, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 233 HYPER-CONVERGED INFRASTRUCTURE MARKET, BY COMPONENT, 2020–2025 (USD MILLION)

15.1.3.3 Hyper-converged infrastructure market, by application

TABLE 234 HYPER-CONVERGED INFRASTRUCTURE MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 235 HYPER-CONVERGED INFRASTRUCTURE MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

15.1.3.4 Hyper-converged infrastructure market, by organization size

TABLE 236 HYPER-CONVERGED INFRASTRUCTURE MARKET, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 237 HYPER-CONVERGED INFRASTRUCTURE MARKET, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

15.1.3.4.1 Small and medium-sized enterprises

TABLE 238 SMALL AND MEDIUM-SIZED ENTERPRISES: HYPER-CONVERGED INFRASTRUCTURE MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 239 SMALL AND MEDIUM-SIZED ENTERPRISES: HYPER-CONVERGED INFRASTRUCTURE MARKET, BY REGION, 2020–2025 (USD MILLION)

15.1.3.4.2 Large enterprises

TABLE 240 LARGE ENTERPRISES: HYPER-CONVERGED INFRASTRUCTURE MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 241 LARGE ENTERPRISES: HYPER-CONVERGED INFRASTRUCTURE MARKET, BY REGION, 2020–2025 (USD MILLION)

15.1.3.5 Hyper-converged infrastructure market, by end user

TABLE 242 HYPER-CONVERGED INFRASTRUCTURE MARKET, BY END-USER, 2016–2019 (USD MILLION)

TABLE 243 HYPER-CONVERGED INFRASTRUCTURE MARKET, BY END-USER, 2020–2025 (USD MILLION)

15.1.3.6 Hyper-converged infrastructure market, by enterprise

TABLE 244 HYPER-CONVERGED INFRASTRUCTURE MARKET, BY ENTERPRISE, 2016–2019 (USD MILLION)

TABLE 245 HYPER-CONVERGED INFRASTRUCTURE MARKET, BY ENTERPRISE, 2020–2025 (USD MILLION)

15.1.3.6.1 Banking, financial services, and insurance

TABLE 246 BANKING, FINANCIAL SERVICES, AND INSURANCE: HYPER-CONVERGED INFRASTRUCTURE MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 247 BANKING, FINANCIAL SERVICES, AND INSURANCE: HYPER-CONVERGED INFRASTRUCTURE MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

15.1.3.6.2 IT and telecom

TABLE 248 IT AND TELECOM: HYPER-CONVERGED INFRASTRUCTURE MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 249 IT AND TELECOM: HYPER-CONVERGED INFRASTRUCTURE MARKET, BY REGION, 2020–2025 (USD MILLION)

15.1.3.6.3 Healthcare

TABLE 250 HEALTHCARE: HYPER-CONVERGED INFRASTRUCTURE MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 251 HEALTHCARE: HYPER-CONVERGED INFRASTRUCTURE MARKET, BY REGION, 2020–2025 (USD MILLION)

15.1.3.6.4 Government

TABLE 252 GOVERNMENT: HYPER-CONVERGED INFRASTRUCTURE MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 253 GOVERNMENT: HYPER-CONVERGED INFRASTRUCTURE MARKET, BY REGION, 2020–2025 (USD MILLION)

15.1.3.6.5 Energy

TABLE 254 ENERGY: HYPER-CONVERGED INFRASTRUCTURE MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 255 ENERGY: HYPER-CONVERGED INFRASTRUCTURE MARKET, BY REGION, 2020–2025 (USD MILLION)

15.1.3.6.6 Education

TABLE 256 EDUCATION: HYPER-CONVERGED INFRASTRUCTURE MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 257 EDUCATION: HYPER-CONVERGED INFRASTRUCTURE MARKET, BY REGION, 2020–2025 (USD MILLION)

15.1.3.6.7 Manufacturing

TABLE 258 MANUFACTURING: HYPER-CONVERGED INFRASTRUCTURE MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 259 MANUFACTURING: HYPER-CONVERGED INFRASTRUCTURE MARKET, BY REGION, 2020–2025 (USD MILLION)

15.1.3.6.8 Others

TABLE 260 OTHERS: HYPER-CONVERGED INFRASTRUCTURE MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 261 OTHERS: HYPER-CONVERGED INFRASTRUCTURE MARKET, BY REGION, 2020–2025 (USD MILLION)

16 APPENDIX (Page No. - 245)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 CUSTOMIZATION OPTIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

The research study involved the use of extensive secondary sources, directories, and databases, such as D&B Hoovers and Bloomberg Businessweek, to identify and collect information useful for a technical, market-oriented, and commercial study of the global Infrastructure as code market. The primary sources were mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all the segments of the industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

Secondary Research

The market size of companies offering infrastructure as a code to various industries was arrived at based on the secondary data available through paid and unpaid sources and by analyzing the product portfolios of major companies in the ecosystem and rating the companies based on their performance and quality. In the secondary research process, various sources were referred to, for identifying and collecting information for the study. Secondary sources included annual reports and press releases of various companies, such as AWS, Google, Microsoft, and IBM. It also included white papers, journals, certified publications, and articles from recognized authors, directories, and databases, such as IEEE and OpenIaC.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from market- and technology-oriented perspectives, all of which were further validated by primary sources.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the Infrastructure as Code market.

Primary interviews were conducted to gather insights, such as market statistics, data of revenue collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Finance Officers (CFOs), Chief Strategy Officers (CSOs), and the installation team of end-users who use Infrastructure as Code, were interviewed to understand buyers’ perspectives on suppliers, products, service providers, and their current usage of Infrastructure as Code, which is expected to affect the overall Infrastructure as Code market growth.

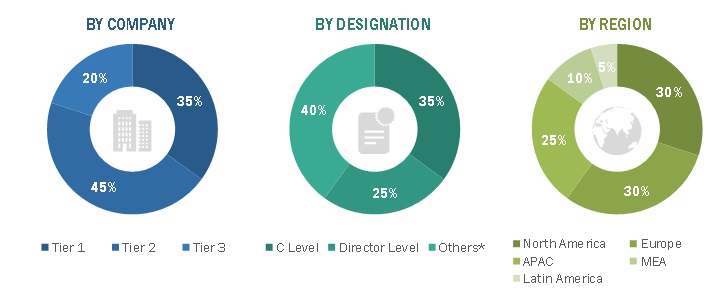

The following is the breakup of primary profiles:

Note: Tier 1 companies comprise the overall annual revenue of > USD 10 billion; tier 2 companies’ revenue ranges in between USD 1 and 10 billion; and tier 3 companies’ revenue ranges in between USD 500 million–USD 1 billion

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, the top-down and bottom-up approaches were used along with multiple data triangulation methods to estimate and validate the size of the Infrastructure as code market and other dependent submarkets. Key market players were identified through secondary research, and their market share in the targeted regions was determined with the help of primary and secondary research. This research methodology included the study of annual and financial presentations of the top market players and interviews with experts for key insights (quantitative and qualitative).

The percentage share, splits, and breakdowns were determined using secondary sources and verified through primary research. All the possible parameters that affect the Infrastructure as code market were verified in detail with the help of primary sources and analyzed to obtain quantitative and qualitative data. This data was supplemented with detailed inputs and analysis from MarketsandMarkets and presented in the report.

- The pricing trend is assumed to vary over time.

- All the forecasts are made with the standard assumption that the accepted currency is USD.

- For the conversion of various currencies to USD, average historical exchange rates are used according to the year specified. For all the historical and current exchange rates required for calculations and currency conversions, the US Internal Revenue Service's website is used.

- All the forecasts are made under the standard assumption that the globally accepted currency USD remains constant during the next five years.

- Vendor-side analysis: The market size estimates of associated solutions and services are factored in from the vendor side by assuming an average of licensing and subscription-based models of leading and innovative vendors in the market.

Demand/end-user analysis: End users operating in verticals across regions are analyzed in terms of market spending on infrastructure as code based on some of the key use cases. These factors for the infrastructure as code industry per region are separately analyzed, and the average spending was extrapolated with an approximation based on assumed weightage. This factor is derived by averaging various market influencers, including recent developments, regulations, mergers and acquisitions, enterprise/SME adoption, startup ecosystem, IT spending, technology propensity and maturity, use cases, and the estimated number of organizations per region.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To determine, segment, and forecast the global infrastructure as code market based on component, type, infrastructure type, deployment mode, organization size, vertical, and region in terms of value

- To forecast the size of market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Latin America, and Middle East and Africa (MEA)

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the market

- To study the complete value chain and related industry segments and perform a value chain analysis of the market landscape

- To strategically analyze macro and micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze industry trends, pricing data, and patents & innovations related to the infrastructure as code market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To profile key players in the market and comprehensively analyze their market share/ranking and core competencies2

- To track and analyze competitive developments, such as mergers and acquisitions, new product launches and product developments, partnerships, agreements, and collaborations, business expansions, and research and development (R&D) activities, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American infrastructure as code market

- Further breakup of the European market

- Further breakup of the Asia Pacific market

- Further breakup of the Latin American market

- Further breakup of the Middle East and Africa market

Company Information

- Detailed analysis and profiling of additional market players up to 5

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Infrastructure as Code (IaC) Market