Injection Pen Market Size, Growth by Product Type (Disposable, Reusable Pens), Therapy (Diabetes (Insulin, GLP-1), Growth Hormone, Osteoporosis, Fertility, Autoimmune disease, Cancer), End User (Hospitals, Clinics, Home Care), and Region - Global Forecasts to 2026

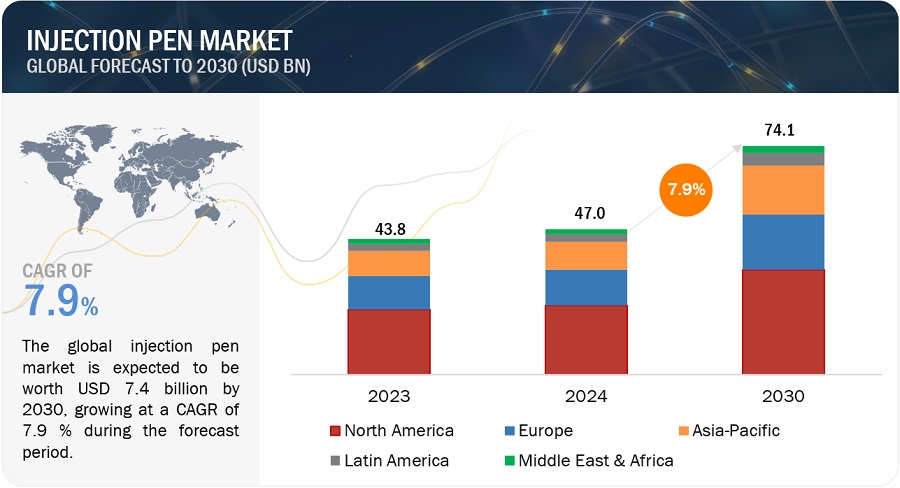

The global injection pen market size is projected to reach USD 53.3 billion by 2026, at a CAGR of 7.2%. Growing prevalence of chronic diseases, increasing number of regulatory approvals, favourable reimbursement and government support, and technological advancements in injection pen tend to drive the market growth. Though the market is growing, but factors like alternative drug delivery modes, poor reimbursement scenarios in developing regions, and needle anxiety tend to restrain the market growth. Whereas, needle-stick injuries & misuse of injection pens tend to pose a challenge for the market. But, the opportunities for the market lie in the patent expiry of biologics and emerging markets.

To know about the assumptions considered for the study, Request for Free Sample Report

Injection Pen Market Dynamics

Driver: Growing prevalence of chronic diseases

The prevalence of chronic diseases has increased significantly in the last few years. Diseases such as diabetes, osteoporosis, cardiovascular disease (CVD), and multiple sclerosis require daily or weekly injectable drug administration. Injector pens are an optimum option for chronic diseases as the frequency of drug administration is high. Injection pens have become the new standard for injectable drug delivery systems. Their popularity has soared due to their simplicity, reliability, and ability to be administered directly by the patient without the aid of a physician. Thus, the growing prevalence of chronic diseases has led to a greater focus on injection pen technologies to effectively handle the growing patient pool and increase patient compliance with therapies. Mentioned below are some key statistics pertaining to the prevalence of chronic diseases.

Restraints: Preference for alternative drug delivery modes

There are many alternatives to injection pen devices. The main restraining factors for injection pens are needle stick anxiety and injury. Hence, there are various needle-free devices that come with an added advantagethey do not induce needle anxiety, which is a significant deterrent to the greater adoption of injectable drug treatments. Non-complacence among children as well as adults is mostly attributed to the pain associated with daily injections and the requirements of long-term therapy. Additionally, insulin pen therapy is seen to cause hyperglycemia in some patients, as the dose cannot be regulated. Hence, in Europe, there has been a shift in diabetes treatment, from insulin pens to insulin pumps, due to their ability to perform automated insulin suspension and decrease the risk of hypoglycemia. In developing countries such as India, China, and Brazil, oral insulin delivery is preferred as it is easy to use, convenient, cost-effective, safe, and acceptable.

Opportunities: Patent expiry of biologics to drive the demand for biosimilars

Biosimilars were introduced in 2006 by many pharmaceutical companies such as Sandoz (Germany), Teva Pharmaceutical Industries Ltd. (Israel), and JCR Pharmaceuticals Co., Ltd. (Japan). Due to their lower costs (as compared to their patented counterparts), the demand for biosimilars has increased significantly. The impending patent expiry of many biologic molecules will also serve to drive the demand for biosimilars. Insurance companies and governments are favoring the use of biosimilars and generics. For instance, CVS Caremark, one of the major prescription insurers in the US, has replaced branded injectable drugs such as Lantus by Sanofi and EpiPen by Mylan with their biosimilars Basaglar (available in injection pen) by Eli Lilly and Adrenaclick (an autoinjector) by Amedra Pharmaceuticals. Since many injectables for the treatment of chronic diseases are biologics, the expiry of patents and growing support from governments and insurance providers provide an opportunity for the growth of the injection pens market.

Challenges: Needle-stick injuries and misuse of injection pens

The lack of proper training and education for the use of new delivery devices such as injection pens leads to improper use and may threaten the safety of the staff and patients. Such practices may affect the adoption of injection pens in a hospital setting. For example, the National Reporting and Learning System (NRLS, UK) reported about 56 incidents associated with withdrawing insulin from insulin pens or refill cartridges between January 2013 and June 2019. In addition, the strength of insulin in the injection pen varies; thus, this poses the risk of overdose if the dose strength is not taken into consideration. The reuse of insulin pens is another concern. According to the Institute for Safe Medication Practices (ISMP) (US), during 20132014, ~700 patients in New York may have been exposed to blood-borne pathogens due to the use of insulin pens on multiple patients. The ISMPs National Medication Errors Reporting Program (MERP) also reported cases where patients forgot to remove the inner cover of a standard insulin pen needle, which resulted in no insulin being delivered. Also, the FDA has reported patients using standard pen needles without removing the inner needle cover. This has resulted in hyperglycemia in patients because the inner needle cover stopped them from getting insulin.

To know about the assumptions considered for the study, download the pdf brochure

North America is expected to account for the largest share of the injection pens market

In 2020, North America dominated the global injection pens market. The large share of the North American injection pens market can primarily be attributed to the rising prevalence of diabetes, favorable reimbursement scenario, and the increasing number of awareness programs.

Prominent players in this market includes Novo Nordisk A/S (Denmark), Becton, Dickinson and Company (US), Ypsomed Holding AG (Switzerland), Sanofi (France), Eli Lilly and Company (US), Merck KGaA (Germany), AstraZeneca plc (UK), F. Hoffmann-La Roche Ltd. (Switzerland), Owen Mumford (UK), Sulzer Ltd. (Switzerland), Sun Pharmaceutical Industries Ltd. (India), Pfizer (US), Biocon Ltd. (India), Lupin Ltd. (India), Wockhardt Ltd. (India), AptarGroup, Inc. (US), Novartis AG (Switzerland), Gerresheimer AG (Germany), Bespak Europe Ltd. (UK), SHL Medical AG (Switzerland), Boehringer Ingelhem (Germany), Nemera France SA, Companion Medical (US), and Jiangsu Delfu Medical Devices Co., Ltd. (China).

Injection Pen Market Scope

|

Report Metrics |

Details |

|

Market Size value 2026 |

USD 53.3 billion |

|

Growth Rate |

7.2% CAGR |

|

Largest Market |

North America |

|

Market Dynamics |

Drivers, Opportunities, Restraints & Challenges |

|

Largest Share Segments |

Disposable injection pens & Diabetes |

|

Forecasts up to |

2026 |

|

Market Segmentation |

Product Type, Therapy, End Users and Region |

|

Injection Pen Market Growth Drivers |

|

|

Injection Pen Market Growth Opportunities |

|

|

Report Highlights |

|

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

The study categorizes the Injection Pen market based on product type, therapy, end user, and regional & global level.

By Product Type

- Disposable Injection Pens

- Reusable Injection Pens

By Therapy

- Diabetes

- Insulin therapy

- GLP-1 therapy

- Growth Hormone

- Osteoporosis

- Fertility

- Auto-immune Diseases

- Cancer

- Other Therapies

By End User

- Home-care Settings

- Hospitals & Diagnostic Clinics

By Region

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Benelux

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Southeast Asia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America (RoLA)

- Middle East & Africa

Recent Developments

- In April 2020, Sanofi (France) received FDA approval for a new Dupixent prefilled pen for use in asthma, atopic dermatitis, and chronic rhinosinusitis with nasal polyposis for at-home administration.

- In June 2019, Sanofi (France) received approval in Europe for Toujeo SoloStar Pens.

- Merck KGaG (Germany) launched Pergoveris a gonadotropin injection pen for fertility treatment in January 2019.

Frequently Asked Questions (FAQ):

Which are the top industry players in the injection pens market?

The prominent players in the injection pens market are Novo Nordisk A/S (Denmark), Becton, Dickinson and Company (US), Ypsomed Holding AG (Switzerland), Sanofi (France), Eli Lilly and Company (US), Merck KGaA (Germany), AstraZeneca plc (UK), F. Hoffmann-La Roche Ltd. (Switzerland), Owen Mumford (UK), Sulzer Ltd. (Switzerland), Sun Pharmaceutical Industries Ltd. (India), Pfizer (US), Biocon Ltd. (India), Lupin Ltd. (India), Wockhardt Ltd. (India), AptarGroup, Inc. (US), Novartis AG (Switzerland), Gerresheimer AG (Germany), Bespak Europe Ltd. (UK), SHL Medical AG (Switzerland), Boehringer Ingelhem (Germany), Nemera France SA, Companion Medical (US), and Jiangsu Delfu Medical Devices Co., Ltd. (China).

Which geographical region is growing at the largest share in the injection pens market?

In 2020, North America dominated the global injection pens market. The largest share of the North American injection pens market can primarily be attributed to the rising prevalence of diabetes, favorable reimbursement scenario, and the increasing number of awareness programs. The high awareness amongst the patients, increase in the disposable income of the patients and increased adoption of injection pens also contributes to the higher share of the North America in the injection pen market.

Which segment of product type is dominating the injection pens market?

Based on type, the injection pens market is segmented into reusable and disposable injection pens. In 2020, the disposable injection pens segment accounted for the largest share of the global injection pens market. The large share of the disposable injection pens segment can be attributed to their ease of use and the presence of a built-in cartridge which eliminates the need for manually loading the cartridge, making it more convenient for patients with reduced dexterity or visual impairments.

Which is the leading diabetes therapy segment with the largest share in injection pens market?

Based on type of diabetes therapy, the injection pens market for diabetes therapy is segmented into insulin and GLP-1. In 2020, the insulin segment accounted for the highest share of the injection pens market for diabetes therapy. The highest growth of this segment is attributed to factors such as the rising incidence of diabetes across the globe and the high dependence on insulin by diabetes patients.

Which is the highest growing end user segment in injection pens market?

Based on end users, the injection pens market is segmented into home care settings and hospitals & clinics. In 2020, the home care settings segment accounted for the highest growth of the injection pens market. The growing geriatric population, ease of drug administration, increasing prevalence of chronic diseases, technological advancements, and favorable reimbursement scenarios are some of the key factors driving the growth of the home care settings market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS OF THE STUDY

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.3.3 CURRENCY

TABLE 1 EXCHANGE RATES UTILIZED FOR THE CONVERSION TO USD

1.4 STAKEHOLDERS

1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 2 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

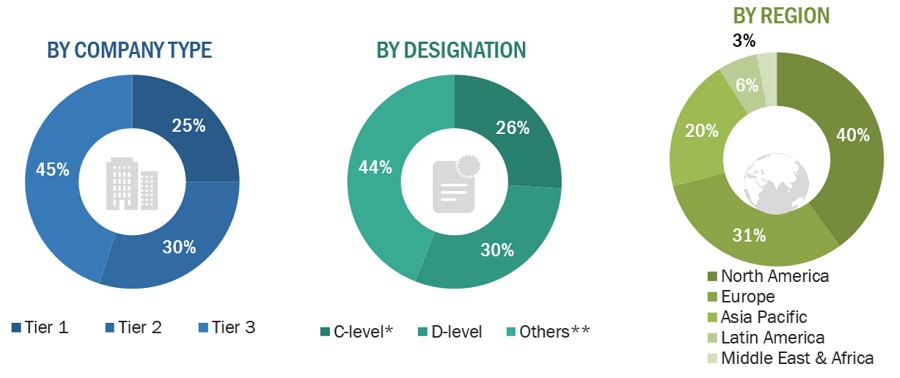

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

2.2 MARKET SIZE ESTIMATION

FIGURE 5 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 6 REVENUE SHARE ANALYSIS ILLUSTRATION: SANOFI

FIGURE 7 REVENUE ANALYSIS OF THE TOP FOUR COMPANIES: INJECTION PENS MARKET

FIGURE 8 CAGR PROJECTIONS FROM THE ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE INJECTION PENS MARKET (20212026)

FIGURE 9 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

FIGURE 10 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 11 MARKET DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 RISK ASSESSMENT

TABLE 2 RISK ASSESSMENT: INJECTION PENS MARKET

2.7 LIMITATIONS

2.7.1 METHODOLOGY-RELATED LIMITATIONS

2.7.2 SCOPE-RELATED LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 12 INJECTION PEN MARKET, BY TYPE, 2021 VS. 2026

FIGURE 13 INJECTION PEN MARKET, BY THERAPY, 2021 VS. 2026

FIGURE 14 INJECTION PEN MARKET FOR DIABETES THERAPY, BY TYPE, 2021 VS. 2026

FIGURE 15 INJECTION PEN MARKET, BY END USER, 2021 VS. 2026

FIGURE 16 GEOGRAPHICAL SNAPSHOT OF THE INJECTION PENS MARKET

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 INJECTION PEN MARKET OVERVIEW

FIGURE 17 GROWING PREVALENCE OF CHRONIC DISEASES TO DRIVE MARKET GROWTH

4.2 ASIA PACIFIC: INJECTION PEN MARKET, BY THERAPY AND COUNTRY

FIGURE 18 DIABETES SEGMENT ACCOUNTED FOR THE LARGEST SHARE OF THE ASIA PACIFIC INJECTION PEN MARKET IN 2020

4.3 INJECTION PEN MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 19 CHINA TO REGISTER THE HIGHEST GROWTH RATE IN THE INJECTION PEN MARKET DURING THE FORECAST PERIOD

4.4 INJECTION PEN MARKET, BY REGION, 20212026

FIGURE 20 NORTH AMERICA WILL CONTINUE TO DOMINATE THE GLOBAL INJECTION PEN MARKET IN 2026

4.5 INJECTION PEN MARKET: DEVELOPED VS. DEVELOPING MARKETS

FIGURE 21 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 53)

5.1 MARKET DYNAMICS

FIGURE 22 INJECTION PEN MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.1.1 MARKET DRIVERS

5.1.1.1 Growing prevalence of chronic diseases

FIGURE 23 NUMBER OF PEOPLE WITH CHRONIC DISEASES IN THE US, 19952030 (MILLION INDIVIDUALS)

FIGURE 24 ESTIMATED DIABETIC POPULATION, BY REGION, 2019 VS. 2030 VS. 2040

FIGURE 25 GLOBAL CANCER INCIDENCE, 20152040

5.1.1.2 Increasing number of regulatory approvals

5.1.1.3 Favorable reimbursement and government support

5.1.1.4 Technological advancements in injection pens

TABLE 3 MARKET DRIVERS: IMPACT ANALYSIS

5.1.2 MARKET RESTRAINTS

5.1.2.1 Preference for alternative drug delivery modes

5.1.2.2 Poor reimbursement scenario in developing countries

5.1.2.3 Needle anxiety

TABLE 4 MARKET RESTRAINTS: IMPACT ANALYSIS

5.1.3 MARKET OPPORTUNITIES

5.1.3.1 Patent expiry of biologics to drive the demand for biosimilars

5.1.3.2 Growth opportunities in emerging markets

FIGURE 26 DIABETES POPULATION IN DEVELOPING COUNTRIES, 2020 VS. 2040

TABLE 5 RISING INCOME LEVELS IN EMERGING COUNTRIES

TABLE 6 MARKET OPPORTUNITIES: IMPACT ANALYSIS

5.1.4 MARKET CHALLENGES

5.1.4.1 Needlestick injuries and misuse of injection pens

TABLE 7 MARKET CHALLENGES: IMPACT ANALYSIS

5.2 VALUE CHAIN ANALYSIS

FIGURE 27 INJECTION PEN MARKET: VALUE CHAIN ANALYSIS

5.3 SUPPLY CHAIN ANALYSIS

FIGURE 28 INJECTION PEN MARKET: SUPPLY CHAIN ANALYSIS

5.4 PRICING ANALYSIS

TABLE 8 PRICING OF INJECTION PENS AVAILABLE IN THE MARKET

5.5 ECOSYSTEM MARKET MAP

FIGURE 29 INJECTION PEN MARKET: ECOSYSTEM MARKET MAP

5.6 PORTERS FIVE FORCES ANALYSIS

TABLE 9 INJECTION PEN MARKET: PORTERS FIVE FORCES ANALYSIS

5.6.1 INTENSITY OF COMPETITIVE RIVALRY

5.6.2 BARGAINING POWER OF SUPPLIERS

5.6.3 BARGAINING POWER OF BUYERS

5.6.4 THREAT OF SUBSTITUTES

5.6.5 THREAT OF NEW ENTRANTS

5.7 REGULATORY ANALYSIS

5.7.1 NORTH AMERICA

5.7.1.1 US

TABLE 10 US FDA: MEDICAL DEVICE CLASSIFICATION

TABLE 11 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

5.7.1.2 Canada

TABLE 12 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

FIGURE 30 CANADA: CLASS II MEDICAL DEVICE APPROVAL PROCESS

5.7.2 EUROPE

FIGURE 31 EUROPE: CE APPROVAL PROCESS FOR CLASS IIA MEDICAL DEVICES

5.7.3 ASIA PACIFIC

5.7.3.1 Japan

TABLE 13 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PMDA

5.7.3.2 China

TABLE 14 CHINA: REGULATORY BODIES APPOINTED FOR MEDICAL DEVICE APPROVAL

TABLE 15 CHINA: CLASSIFICATION OF MEDICAL DEVICES

5.7.3.3 India

5.8 IMPACT OF COVID-19 ON THE INJECTION PEN MARKET

5.9 PATENT ANALYSIS

5.9.1 PATENT PUBLICATION TRENDS FOR INJECTION PENS

FIGURE 32 PATENT PUBLICATION TRENDS (JANUARY 2011SEPTEMBER 2021)

5.9.2 INSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

FIGURE 33 TOP APPLICANTS AND OWNERS (COMPANIES/INSTITUTES) FOR INJECTION PEN PATENTS (JANUARY 2011SEPTEMBER 2021)

FIGURE 34 TOP APPLICANT COUNTRIES/REGIONS FOR INJECTION PEN PATENTS (JANUARY 2011SEPTEMBER 2021)

5.10 TECHNOLOGY ANALYSIS

TABLE 16 PEN INJECTORS CLASSIFICATION

5.10.1 KEY TECHNOLOGIES

5.10.1.1 Dose setting and needle actuation

5.10.1.2 Pen injector material

5.10.2 COMPLEMENTARY TECHNOLOGIES

5.10.2.1 In-built dose and time log

5.10.2.2 Wireless connectivity

5.10.2.3 Smartpen injectors

5.10.2.4 Smart caps and attachments

5.10.2.5 Injector temperature monitoring

5.10.3 ADJACENT TECHNOLOGIES

5.10.3.1 Autoinjectors

5.10.3.2 Insulin pumps

6 INJECTION PENS MARKET, BY TYPE (Page No. - 79)

6.1 INTRODUCTION

TABLE 17 INJECTION PEN MARKET, BY TYPE, 20192026

6.2 DISPOSABLE INJECTION PENS

6.2.1 HIGH PATIENT COMPLIANCE AND EASE OF HANDLING TO DRIVE THE ADOPTION OF DISPOSABLE INJECTION PENS

TABLE 18 DISPOSABLE INJECTION PENS AVAILABLE IN THE MARKET

TABLE 19 DISPOSABLE INJECTION PEN MARKET, BY COUNTRY, 20192026

6.3 REUSABLE INJECTION PENS

6.3.1 REUSABLE INJECTION PENS TO REGISTER THE HIGHEST GROWTH DUE TO TECHNOLOGICAL ADVANCEMENTS

TABLE 20 REUSABLE INJECTION PENS AVAILABLE IN THE MARKET

TABLE 21 REUSABLE INJECTION PENS MARKET, BY COUNTRY, 20192026

7 INJECTION PENS MARKET, BY THERAPY (Page No. - 84)

7.1 INTRODUCTION

TABLE 22 INJECTION PEN MARKET, BY THERAPY, 20192026

7.2 DIABETES

TABLE 23 INJECTION PEN MARKET FOR DIABETES THERAPY, BY TYPE, 20192026

TABLE 24 INJECTION PEN MARKET FOR DIABETES THERAPY, BY COUNTRY, 20192026

7.2.1 INSULIN

7.2.1.1 Rising prevalence of diabetes is driving the growth of this market

TABLE 25 EXAMPLES OF INSULIN INJECTION PENS

TABLE 26 INJECTION PEN MARKET FOR INSULIN THERAPY, BY COUNTRY, 20192026

7.2.2 GLUCAGON-LIKE PEPTIDE-1 (GLP-1) THERAPY

7.2.2.1 Strong focus of major pharmaceutical companies to introduce GLP-1 drugs to drive market growth

TABLE 27 EXAMPLES OF GLP-1 INJECTION PENS

TABLE 28 INJECTION PEN MARKET FOR GLP-1 THERAPY, BY COUNTRY, 20192026

7.3 GROWTH HORMONE THERAPY

7.3.1 DEVELOPMENT OF SUSTAINED-RELEASE GROWTH HORMONE FORMULATIONS FOR REDUCING INJECTION FREQUENCY TO RESTRAIN THE MARKET GROWTH

TABLE 29 EXAMPLES OF INJECTION PENS FOR GROWTH HORMONE THERAPY

TABLE 30 INJECTION PEN MARKET FOR GROWTH HORMONE THERAPY, BY COUNTRY, 20192026

7.4 OSTEOPOROSIS

7.4.1 GROWING PREVALENCE OF OSTEOPOROSIS IN GERIATRIC PATIENTS AND WOMEN TO DRIVE MARKET GROWTH

TABLE 31 EXAMPLES OF INJECTION PENS FOR OSTEOPOROSIS THERAPY

TABLE 32 INJECTION PEN MARKET FOR OSTEOPOROSIS THERAPY, BY COUNTRY, 20192026

7.5 FERTILITY

7.5.1 DECREASE IN FERTILITY RATE HAS RESULTED IN THE INCREASED USE OF INJECTION PENS

TABLE 33 EXAMPLES OF INJECTION PENS FOR FERTILITY THERAPY

TABLE 34 INJECTION PEN MARKET FOR FERTILITY THERAPY, BY COUNTRY, 20192026

7.6 CANCER

7.6.1 RISING PREVALENCE OF CANCER TO DRIVE MARKET GROWTH

TABLE 35 EXAMPLES OF INJECTION PENS FOR CANCER THERAPY

TABLE 36 INJECTION PEN MARKET FOR CANCER THERAPY, BY COUNTRY, 20192026

7.7 AUTOIMMUNE DISEASES

7.7.1 DEVELOPMENTS IN THERAPIES AND DELIVERY DEVICES FOR THE TREATMENT OF MS TO BOOST THE MARKET GROWTH

TABLE 37 EXAMPLES OF INJECTION PENS FOR MULTIPLE SCLEROSIS AND PSORIASIS THERAPY

TABLE 38 INJECTION PEN MARKET FOR AUTOIMMUNE DISEASE THERAPY, BY COUNTRY, 20192026

7.8 OTHER THERAPIES

TABLE 39 INJECTION PEN MARKET FOR OTHER THERAPIES, BY COUNTRY, 20192026

8 INJECTION PENS MARKET, BY END USER (Page No. - 100)

8.1 INTRODUCTION

TABLE 40 INJECTION PEN MARKET, BY END USER, 20192026

8.2 HOME CARE SETTINGS

8.2.1 HOME CARE SETTINGS ARE THE LARGEST END USERS OF INJECTION PENS

TABLE 41 INJECTION PEN MARKET FOR HOME CARE SETTINGS, BY COUNTRY, 20192026

8.3 HOSPITALS & CLINICS

8.3.1 GROWING INCIDENCE OF NEEDLESTICK INJURIES AND UNSAFE INJECTION PRACTICES HAVE INCREASED THE DEMAND FOR INJECTION PENS

TABLE 42 INJECTION PEN MARKET FOR HOSPITALS & CLINICS, BY COUNTRY, 20192026

9 INJECTION PENS MARKET, BY REGION (Page No. - 105)

9.1 INTRODUCTION

TABLE 43 INJECTION PENS MARKET, BY REGION, 20192026

FIGURE 35 EMERGING COUNTRIES ARE EXPECTED TO WITNESS HIGHER GROWTH IN THE FORECAST PERIOD

9.2 NORTH AMERICA

FIGURE 36 NORTH AMERICA: INJECTION PENS MARKET SNAPSHOT

TABLE 44 INJECTION PENS MARKET, BY COUNTRY, 20192026

TABLE 45 NORTH AMERICA: INJECTION PENS MARKET, BY TYPE, 20192026

TABLE 46 NORTH AMERICA: INJECTION PENS MARKET, BY THERAPY, 20192026

TABLE 47 NORTH AMERICA: INJECTION PENS MARKET FOR DIABETES THERAPY, BY TYPE, 20192026

TABLE 48 NORTH AMERICA: INJECTION PENS MARKET, BY END USER, 20192026

9.2.1 US

9.2.1.1 The US dominates the North American injection pens market

FIGURE 37 TOTAL FERTILITY RATE IN THE US POPULATION (1990-2020)

TABLE 49 US: KEY MACROINDICATORS

TABLE 50 US: INJECTION PENS MARKET, BY TYPE, 20192026

TABLE 51 US: INJECTION PENS MARKET, BY THERAPY, 20192026

TABLE 52 US: INJECTION PENS MARKET FOR DIABETES THERAPY, BY TYPE, 20192026

TABLE 53 US: INJECTION PENS MARKET, BY END USER, 20192026

9.2.2 CANADA

9.2.2.1 Unfavorable regulatory processes in Canada to restrain the market growth

TABLE 54 CANADA: KEY MACROINDICATORS

TABLE 55 CANADA: INJECTION PENS MARKET, BY TYPE, 20192026

TABLE 56 CANADA: INJECTION PENS MARKET, BY THERAPY, 20192026

TABLE 57 CANADA: INJECTION PENS MARKET FOR DIABETES THERAPY, BY TYPE, 20192026

TABLE 58 CANADA: INJECTION PENS MARKET, BY END USER, 20192026

9.3 EUROPE

TABLE 59 EUROPE: INJECTION PENS MARKET, BY COUNTRY, 20192026

TABLE 60 EUROPE: INJECTION PENS MARKET, BY TYPE, 20192026

TABLE 61 EUROPE: INJECTION PENS MARKET, BY THERAPY, 20192026

TABLE 62 EUROPE: INJECTION PENS MARKET FOR DIABETES THERAPY, BY TYPE, 20192026

TABLE 63 EUROPE: INJECTION PENS MARKET, BY END USER, 20192026

9.3.1 GERMANY

9.3.1.1 High diabetes expenditure and reimbursement for injection pens to drive the market in Germany

TABLE 64 GERMANY: KEY MACROINDICATORS

TABLE 65 GERMANY: INJECTION PENS MARKET, BY TYPE, 20192026

TABLE 66 GERMANY: INJECTION PENS MARKET, BY THERAPY, 20192026

TABLE 67 GERMANY: INJECTION PENS MARKET FOR DIABETES THERAPY, BY TYPE, 20192026

TABLE 68 GERMANY: INJECTION PENS MARKET, BY END USER, 20192026

9.3.2 FRANCE

9.3.2.1 Misuse of injection pens pose a threat to the growth of this market

TABLE 69 FRANCE: KEY MACROINDICATORS

TABLE 70 FRANCE: INJECTION PENS MARKET, BY TYPE, 20192026

TABLE 71 FRANCE: INJECTION PENS MARKET, BY THERAPY, 20192026

TABLE 72 FRANCE: INJECTION PENS MARKET FOR DIABETES THERAPY, BY TYPE, 20192026

TABLE 73 FRANCE: INJECTION PENS MARKET, BY END USER, 20192026

9.3.3 UK

9.3.3.1 NHS support and access to cost-effective injection pens are likely to drive the market in the UK

TABLE 74 UK: KEY MACROINDICATORS

TABLE 75 UK: INJECTION PENS MARKET, BY TYPE, 20192026

TABLE 76 UK: INJECTION PENS MARKET, BY THERAPY, 20192026

TABLE 77 UK: INJECTION PENS MARKET FOR DIABETES THERAPY, BY TYPE, 20192026

TABLE 78 UK: INJECTION PENS MARKET, BY END USER, 20192026

9.3.4 ITALY

9.3.4.1 Regional variation in terms of coverage and benefits to hinder the market growth

TABLE 79 ITALY: KEY MACROINDICATORS

TABLE 80 ITALY: INJECTION PENS MARKET, BY TYPE, 20192026

TABLE 81 ITALY: INJECTION PENS MARKET, BY THERAPY, 20192026

TABLE 82 ITALY: INJECTION PENS MARKET FOR DIABETES THERAPY, BY TYPE, 20192026

TABLE 83 ITALY: INJECTION PENS MARKET, BY END USER, 20192026

9.3.5 SPAIN

9.3.5.1 Supportive regulations mandating the use of safety injection pens to boost the growth of the Spanish market

TABLE 84 SPAIN: KEY MACROINDICATORS

TABLE 85 SPAIN: INJECTION PENS MARKET, BY TYPE, 20192026

TABLE 86 SPAIN: INJECTION PENS MARKET, BY THERAPY, 20192026

TABLE 87 SPAIN: INJECTION PENS MARKET FOR DIABETES THERAPY, BY TYPE, 20192026

TABLE 88 SPAIN: INJECTION PENS MARKET, BY END USER, 20192026

9.3.6 BENELUX

9.3.6.1 Increasing awareness about injection pen devices to drive market growth

TABLE 89 BENELUX: INJECTION PENS MARKET, BY TYPE, 20192026

TABLE 90 BENELUX: INJECTION PENS MARKET, BY THERAPY, 20192026

TABLE 91 BENELUX: INJECTION PENS MARKET FOR DIABETES THERAPY, BY TYPE, 20192026

TABLE 92 BENELUX: INJECTION PENS MARKET, BY END USER, 20192026

9.3.7 REST OF EUROPE

TABLE 93 ROE: INJECTION PENS MARKET, BY TYPE, 20192026

TABLE 94 ROE: INJECTION PENS MARKET, BY THERAPY, 20192026

TABLE 95 ROE: INJECTION PENS MARKET FOR DIABETES THERAPY, BY TYPE, 20192026

TABLE 96 ROE: INJECTION PENS MARKET, BY END USER, 20192026

9.4 ASIA PACIFIC

FIGURE 38 ASIA PACIFIC: INJECTION PENS MARKET SNAPSHOT

TABLE 97 APAC: INJECTION PENS MARKET, BY COUNTRY, 20192026

TABLE 98 APAC: INJECTION PENS MARKET, BY TYPE, 20192026

TABLE 99 APAC: INJECTION PENS MARKET, BY THERAPY, 20192026

TABLE 100 APAC: INJECTION PENS MARKET FOR DIABETES THERAPY, BY TYPE, 20192026

TABLE 101 APAC: INJECTION PENS MARKET, BY END USER, 20192026

9.4.1 JAPAN

9.4.1.1 High diabetes incidence and supportive reimbursement policies to drive the market growth in Japan

TABLE 102 JAPAN: KEY MACROINDICATORS

TABLE 103 JAPAN: INJECTION PENS MARKET, BY TYPE, 20192026

TABLE 104 JAPAN: INJECTION PENS MARKET, BY THERAPY, 20192026

TABLE 105 JAPAN: INJECTION PENS MARKET FOR DIABETES THERAPY, BY TYPE, 20192026

TABLE 106 JAPAN: INJECTION PENS MARKET, BY END USER, 20192026

9.4.2 CHINA

9.4.2.1 Large patient population and healthcare infrastructure improvements to drive the market growth in China

TABLE 107 CHINA: KEY MACROINDICATORS

TABLE 108 CHINA: INJECTION PENS MARKET, BY TYPE, 20192026

TABLE 109 CHINA: INJECTION PENS MARKET, BY THERAPY, 20192026

TABLE 110 CHINA: INJECTION PENS MARKET FOR DIABETES THERAPY, BY TYPE, 20192026

TABLE 111 CHINA: INJECTION PENS MARKET, BY END USER, 20192026

9.4.3 INDIA

9.4.3.1 Rising prevalence of obesity to drive market growth

TABLE 112 INDIA: KEY MACROINDICATORS

TABLE 113 INDIA: INJECTION PENS MARKET, BY TYPE, 20192026

TABLE 114 INDIA: INJECTION PENS MARKET, BY THERAPY, 20192026

TABLE 115 INDIA: INJECTION PENS MARKET FOR DIABETES THERAPY, BY TYPE, 20192026

TABLE 116 INDIA: INJECTION PENS MARKET, BY END USER, 20192026

9.4.4 SOUTHEAST ASIA

9.4.4.1 Growing awareness about diabetes to drive the adoption of injection pens

FIGURE 39 DIABETES PREVALENCE IN SOUTHEAST ASIA (2019)

FIGURE 40 HEALTHCARE EXPENDITURE (% OF GDP) IN SOUTHEAST ASIA (2018)

FIGURE 41 GERIATRIC POPULATION (% OF THE TOTAL POPULATION), 2019

TABLE 117 SOUTHEAST ASIA: INJECTION PENS MARKET, BY TYPE, 20192026

TABLE 118 SOUTHEAST ASIA: INJECTION PENS MARKET, BY THERAPY, 20192026

TABLE 119 SOUTHEAST ASIA: INJECTION PENS MARKET FOR DIABETES THERAPY, BY TYPE, 20192026

TABLE 120 SOUTHEAST ASIA: INJECTION PENS MARKET, BY END USER, 20192026

9.4.5 REST OF APAC

TABLE 121 ROAPAC: INJECTION PENS MARKET, BY TYPE, 20192026

TABLE 122 ROAPAC: INJECTION PENS MARKET, BY THERAPY, 20192026

TABLE 123 ROAPAC: INJECTION PENS MARKET FOR DIABETES THERAPY, BY TYPE, 20192026

TABLE 124 ROAPAC: INJECTION PENS MARKET, BY END USER, 20192026

9.5 LATIN AMERICA

TABLE 125 LATAM: INJECTION PENS MARKET, BY COUNTRY, 20192026

TABLE 126 LATAM: INJECTION PENS MARKET, BY TYPE, 20192026

TABLE 127 LATAM: INJECTION PENS MARKET, BY THERAPY, 20192026

TABLE 128 LATAM: INJECTION PENS MARKET FOR DIABETES THERAPY, BY TYPE, 20192026

TABLE 129 LATAM: INJECTION PENS MARKET, BY END USER, 20192026

9.5.1 BRAZIL

9.5.1.1 Brazil dominates the injection pens market in Latin America

TABLE 130 BRAZIL: KEY MACROINDICATORS

TABLE 131 BRAZIL: INJECTION PENS MARKET, BY TYPE, 20192026

TABLE 132 BRAZIL: INJECTION PENS MARKET, BY THERAPY, 20192026

TABLE 133 BRAZIL: INJECTION PENS MARKET FOR DIABETES THERAPY, BY TYPE, 20192026

TABLE 134 BRAZIL: INJECTION PENS MARKET, BY END USER, 20192026

9.5.2 MEXICO

9.5.2.1 Increasing incidence of lifestyle-related disorders to drive market growth in Mexico

TABLE 135 MEXICO: KEY MACROINDICATORS

TABLE 136 MEXICO: INJECTION PENS MARKET, BY TYPE, 20192026

TABLE 137 MEXICO: INJECTION PENS MARKET, BY THERAPY, 20192026

TABLE 138 MEXICO: INJECTION PENS MARKET FOR DIABETES THERAPY, BY TYPE, 20192026

TABLE 139 MEXICO: INJECTION PENS MARKET, BY END USER, 20192026

9.5.3 REST OF LATIN AMERICA

FIGURE 42 HEALTH EXPENDITURE (% OF GDP) IN LATIN AMERICAN COUNTRIES, 2018

TABLE 140 ROLATAM: INJECTION PENS MARKET, BY TYPE, 20192026

TABLE 141 ROLATAM: INJECTION PENS MARKET, BY THERAPY, 20192026

TABLE 142 ROLATAM: INJECTION PENS MARKET FOR DIABETES THERAPY, BY TYPE, 20192026

TABLE 143 ROLATAM: INJECTION PENS MARKET, BY END USER, 20192026

9.6 MIDDLE EAST & AFRICA

9.6.1 INITIATIVES TO ENHANCE HEALTHCARE ACCESSIBILITY TO SUPPORT MARKET GROWTH

TABLE 144 MEA: INJECTION PENS MARKET, BY TYPE, 20192026

TABLE 145 MEA: INJECTION PENS MARKET, BY THERAPY, 20192026

TABLE 146 MEA: INJECTION PENS MARKET FOR DIABETES THERAPY, BY TYPE, 20192026

TABLE 147 MEA: INJECTION PENS MARKET, BY END USER, 20192026

10 COMPETITIVE LANDSCAPE (Page No. - 162)

10.1 OVERVIEW

10.2 KEY PLAYER STRATEGIES

10.3 REVENUE SHARE ANALYSIS OF THE TOP MARKET PLAYERS

FIGURE 43 REVENUE ANALYSIS OF THE TOP PLAYERS IN THE INJECTION PENS MARKET

10.4 MARKET SHARE ANALYSIS

FIGURE 44 INJECTION PENS MARKET SHARE ANALYSIS, BY KEY PLAYER, 2020

10.5 MARKET RANKING ANALYSIS OF OEM COMPANIES

FIGURE 45 INJECTION PENS MARKET RANKING, BY OEM COMPANY

10.6 COMPANY EVALUATION QUADRANT

10.6.1 STARS

10.6.2 EMERGING LEADERS

10.6.3 PERVASIVE PLAYERS

10.6.4 PARTICIPANTS

FIGURE 46 INJECTION PENS MARKET: COMPANY EVALUATION QUADRANT

10.7 COMPANY EVALUATION QUADRANT FOR START-UPS

10.7.1 PROGRESSIVE COMPANIES

10.7.2 DYNAMIC COMPANIES

10.7.3 STARTING BLOCKS

10.7.4 RESPONSIVE COMPANIES

FIGURE 47 INJECTION PENS MARKET: COMPANY EVALUATION QUADRANT FOR START-UPS

10.8 COMPANY PRODUCT FOOTPRINT

TABLE 148 PRODUCT PORTFOLIO ANALYSIS: INJECTION PENS MARKET, BY TYPE

TABLE 149 PRODUCT PORTFOLIO ANALYSIS: INJECTION PENS MARKET, BY THERAPY

10.9 GEOGRAPHIC FOOTPRINT OF MAJOR PLAYERS IN THE INJECTION PENS MARKET

TABLE 150 GEOGRAPHIC REVENUE MIX: INJECTION PENS MARKET

10.10 COMPETITIVE SCENARIO

10.10.1 PRODUCT LAUNCHES

TABLE 151 PRODUCT LAUNCHES (JANUARY 2018SEPTEMBER 2021)

10.10.2 OTHER DEVELOPMENTS

TABLE 152 OTHER DEVELOPMENTS (JANUARY 2018SEPTEMBER 2021)

11 COMPANY PROFILES (Page No. - 176)

11.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View)*

11.1.1 NOVO NORDISK A/S

TABLE 153 NOVO NORDISK A/S: BUSINESS OVERVIEW

FIGURE 48 NOVO NORDISK A/S: COMPANY SNAPSHOT

11.1.2 BECTON, DICKINSON AND COMPANY

TABLE 154 BECTON, DICKINSON AND COMPANY: BUSINESS OVERVIEW

FIGURE 49 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT

11.1.3 YPSOMED HOLDING AG

TABLE 155 YPSOMED HOLDING AG: BUSINESS OVERVIEW

FIGURE 50 YPSOMED HOLDING AG: COMPANY SNAPSHOT

11.1.4 SANOFI

TABLE 156 SANOFI: BUSINESS OVERVIEW

FIGURE 51 SANOFI: COMPANY SNAPSHOT

11.1.5 ELI LILLY AND COMPANY

TABLE 157 ELI LILLY AND COMPANY: BUSINESS OVERVIEW

FIGURE 52 ELI LILLY AND COMPANY: COMPANY SNAPSHOT

11.1.6 MERCK KGAA

TABLE 158 MERCK KGAA: BUSINESS OVERVIEW

FIGURE 53 MERCK KGAA: COMPANY SNAPSHOT

11.1.7 ASTRAZENECA

TABLE 159 ASTRAZENECA: BUSINESS OVERVIEW

FIGURE 54 ASTRAZENECA: COMPANY SNAPSHOT

11.1.8 F. HOFFMANN-LA ROCHE LTD.

TABLE 160 F. HOFFMANN-LA ROCHE LTD.: BUSINESS OVERVIEW

FIGURE 55 F. HOFFMANN-LA ROCHE LTD.: COMPANY SNAPSHOT

11.1.9 OWEN MUMFORD

TABLE 161 OWEN MUMFORD: BUSINESS OVERVIEW

11.1.10 SULZER LTD.

TABLE 162 SULZER LTD.: BUSINESS OVERVIEW

11.1.11 SUN PHARMACEUTICAL INDUSTRIES LTD.

TABLE 163 SUN PHARMACEUTICAL INDUSTRIES LTD: BUSINESS OVERVIEW

FIGURE 56 SUN PHARMACEUTICAL INDUSTRIES LTD.: COMPANY SNAPSHOT

11.1.12 PFIZER

TABLE 164 PFIZER: BUSINESS OVERVIEW

FIGURE 57 PFIZER: COMPANY SNAPSHOT

11.1.13 BIOCON LTD.

TABLE 165 BIOCON LTD.: BUSINESS OVERVIEW

FIGURE 58 BIOCON LTD.: COMPANY SNAPSHOT

11.1.14 LUPIN LTD.

TABLE 166 LUPIN LTD.: BUSINESS OVERVIEW

FIGURE 59 LUPIN LTD.: COMPANY SNAPSHOT

11.1.15 WOCKHARDT LTD.

TABLE 167 WOCKHARDT LTD.: BUSINESS OVERVIEW

FIGURE 60 WOCKHARDT LTD.: COMPANY SNAPSHOT

11.1.16 APTARGROUP, INC.

TABLE 168 APTARGROUP, INC.: BUSINESS OVERVIEW

FIGURE 61 APTARGROUP, INC.: COMPANY SNAPSHOT

11.1.17 NOVARTIS AG

TABLE 169 NOVARTIS AG: BUSINESS OVERVIEW

FIGURE 62 NOVARTIS AG: COMPANY SNAPSHOT

11.1.18 GERRESHEIMER AG

TABLE 170 GERRESHEIMER AG: BUSINESS OVERVIEW

FIGURE 63 GERRESHEIMER AG: COMPANY SNAPSHOT

11.2 OTHER PLAYERS

11.2.1 SHAILY ENGINEERING PLASTICS LTD.

TABLE 171 SHAILY ENGINEERING PLASTICS LTD.: BUSINESS OVERVIEW

11.2.2 BESPAK EUROPE LTD.

TABLE 172 BESPAK EUROPE LTD.: BUSINESS OVERVIEW

11.2.3 SHL MEDICAL AG

TABLE 173 SHL MEDICAL AG: BUSINESS OVERVIEW

11.2.4 EMPERRA GMBH

TABLE 174 EMPERRA GMBH: BUSINESS OVERVIEW

11.2.5 NEMERA FRANCE SAS

TABLE 175 NEMERA FRANCE SAS: BUSINESS OVERVIEW

11.2.6 COMPANION MEDICAL, INC.

TABLE 176 COMPANION MEDICAL, INC.: BUSINESS OVERVIEW

11.2.7 JIANGSU DELFU MEDICAL DEVICE CO., LTD.

TABLE 177 JIANGSU DELFU MEDICAL DEVICE CO., LTD.: BUSINESS OVERVIEW

* Business Overview, Products Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 223)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

This research study involved the usage of comprehensive secondary sources; directories; databases such as Bloomberg Business, Factiva, and Dun & Bradstreet; white papers; annual reports; company house documents; investor presentations; and SEC filings of companies. Secondary research was used to identify and collect information useful for an extensive, technical, market-oriented, and commercial study of the injection pen market. It was also used to obtain important information about the key players, market classification and segmentation according to industry trends to the bottommost level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side and demand side are detailed below.

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the injection pen market was arrived at after data triangulation from two different approaches, as mentioned below. After each approach, the weighted average of all approaches was taken based on the level of assumptions used in each approach.

Data Triangulation

After arriving at the market size, the total market was divided into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments, data triangulation and market breakdown procedures were employed, wherever applicable. The following figure shows the market validation, source structure, and data triangulation methodology implemented in this reports market engineering process.

Objectives of the Study

- To validate the segmentation defined through the assessment of the product portfolios of the leading players in the market

- To understand key industry trends and issues defining the growth objectives of market players

- To gather both demand- and supply-side validation of the key factors affecting market growth, including market drivers, restraints, opportunities, and challenges

- To validate assumptions for the market sizing and forecasting model used for this market study

- To understand the market positions of the leading players in the injection pen market and their shares/rankings

- To understand the ongoing pricing trends in the market and future expectations

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your companys specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the RoE injection pens market into Russia, Switzerland, Denmark, Austria, and others

- Further breakdown of the RoAPAC injection pens market into South Korea, Taiwan, and others

- Further breakdown of the RoLATAM injection pens market into Argentina, Colombia, Chile, Ecuador, and others

- Further breakdown of the Southeast Asia injection pens market into Malaysia, Singapore, Australia, New Zealand, and others

Competitive Landscape Assessment

- Market share analysis, by region (North America and Europe), which provides market shares of the top 3-5 key players in the injection pen market

- Competitive leadership mapping for established players for the US

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Injection Pen Market

who are the prominent players in diabetes injection pens market. pls share list

Need tailor made research report on injection pen market with informative data and various critical aspects such as market outlook, market share, growth, and trends.

advancements in injection pen market. how is it going to sustain. details pls