Innovation Management Market by Offering (Solution and Services), Function (Product Development, Business Processes), Application (Design Platforms, Marketing Platforms), Vertical (Telecom, BFSI, Retail & eCommerce) and Region - Global Forecast to 2028

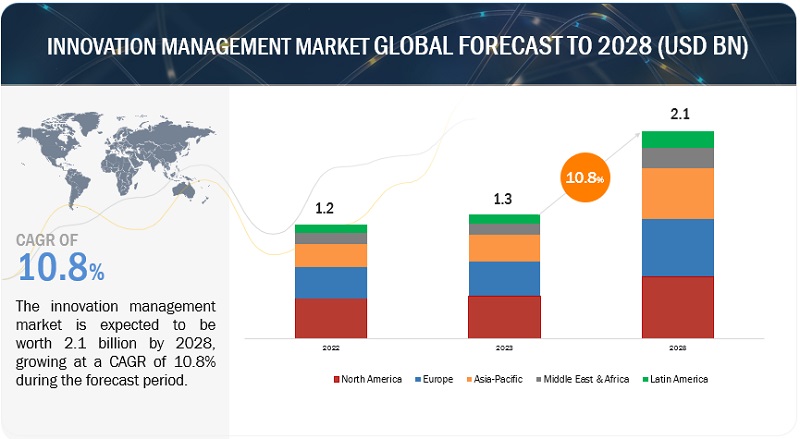

The global Innovation Management Market size is projected to grow from USD 1.3 billion in 2023 to USD 2.1 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 10.8%. Innovation management, with its emphasis on optimizing resource allocation and minimizing operational costs, serves as a strategic catalyst for driving the growth of innovation within organizations. By systematically identifying and prioritizing projects with the highest potential ROI, it ensures that limited resources are channeled toward initiatives that align closely with the organization's overarching goals and market demands. This methodical approach leads to enhanced efficiency, cost-effectiveness, and improved decision-making as it empowers leaders to make informed choices about where to allocate resources for innovation. The reduction in operational costs and efficient allocation of resources achieved through innovation management fosters a culture of sustainable innovation fueling growth of innovation management market.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Innovation Management Market Dynamics

Driver: Rapid technological progress helping explore new facets of innovation management

Technological advances act as a catalyst for innovation management, creating novel pathways that reshape industries. Emerging technologies drive new product development, offering innovative solutions beyond imagination. This dynamism enables organizations to respond agilely to market needs and changing expectations. Furthermore, technology optimizes processes, enhancing operational efficiency, reducing costs, and freeing resources for further innovation. This rapid progression empowers groundbreaking product development and operational excellence, propelling organizations to the forefront of their markets.

Restraint: Resource constraints

Resource limitations stand as a significant hurdle within the realm of innovation management, potentially impeding the realization of creative aspirations. The shortage of funding, skilled personnel, and dedicated time can cast a shadow on innovation initiatives, limiting their scope and potential impact. Insufficient financial backing may curtail the ability to invest in research, development, and experimentation, hindering the exploration of novel ideas. Moreover, the absence of skilled professionals capable of translating concepts into tangible innovations further compounds the challenge. The constraint of time compounds these obstacles, as innovation demands dedicated efforts and a willingness to explore uncharted territories. Organizations must adopt resource-efficient strategies, foster cross-functional collaboration, and seek partnerships to overcome these limitations, unlocking pathways for inventive solutions and sustaining their competitive edge in a rapidly evolving landscape.

Opportunity: Shift towards open innovation culture

Embracing the concept of open innovation, organizations unlock a gateway to a dynamic exchange of ideas and expertise. Collaborating with external partners, such as startups, research institutions, and suppliers, injects a breath of fresh perspectives into their innovation ecosystem. This influx of diverse viewpoints and insights enriches problem-solving processes, encouraging innovative solutions that might have remained undiscovered within the confines of internal thinking. Beyond knowledge exchange, open innovation creates a collaborative environment that amplifies collective strengths, fostering a co-creative atmosphere where opportunities for joint ventures, shared resources, and collaborative projects flourish. By blurring the lines between organizational boundaries, open innovation ushers in a new era of creativity and competitiveness, amplifying the potential for breakthrough discoveries and mutually beneficial partnerships.

Challenge: Uncertainty of post innovation outcomes

Market uncertainty presents a constant challenge in innovation management, as organizations strive to align their strategies with ever-evolving market trends and demands. Navigating this unpredictable terrain demands a delicate balance between proactive adaptation and agile responsiveness. Accurate prediction of future market shifts remains elusive, requiring companies to develop strategies that are flexible and adaptable to changing conditions. Advanced data analytics and trend monitoring become essential tools in gaining insights into consumer behavior and preferences. By cultivating a culture of market vigilance and continuous learning, organizations can better position themselves to anticipate shifts, pivot effectively, and capitalize on emerging opportunities, ultimately enhancing their ability to thrive in a landscape characterized by uncertainty.

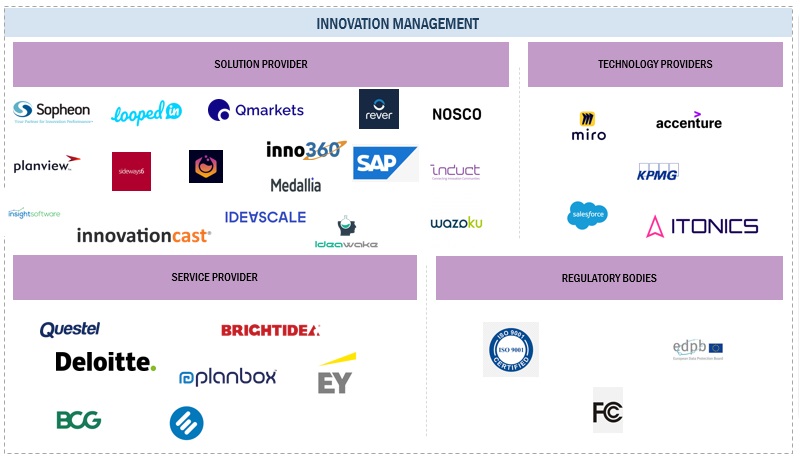

Innovation Management Market Ecosystem

Innovation Management Market: Key Trends

Prominent companies in this market include well-established, financially stable innovation management solutions, services providers, and regulatory bodies. These companies have been operating in the market for several years and possess a diversified product portfolio and state-of-the-art technologies. Prominent companies in this market include Accenture (Ireland), SAP (US), and Planview (US).

The project management platform to hold the largest market size during the forecast period

R&D projects are complex and the need for precise monitoring of phases and milestones underscores the pivotal role of innovation management tools in driving market growth. By offering organizations the capability to systematically track progress, identify bottlenecks, and enact timely adjustments, these tools not only enhance project efficiency but also significantly reduce the time-to-market for innovative products and solutions. Consequently, businesses increasingly recognize the tangible benefits of accelerated R&D project completion facilitated by innovation management solutions.

Training, support, & maintenance service segment is expected to register the fastest growth rate during the forecast period.

The inherent complexity of innovation management solutions, characterized by their diverse array of features and functionalities, underscores the critical role of training services in driving market growth. As organizations recognize the necessity of empowering their teams to harness these tools to their fullest capacity, the demand for comprehensive training solutions escalates. This growing need not only fuels the expansion of the innovation management market but also underscores the market's capacity to provide specialized training services tailored to the unique requirements of diverse industries and businesses, thereby fostering a robust ecosystem that promotes effective innovation practices and market growth.

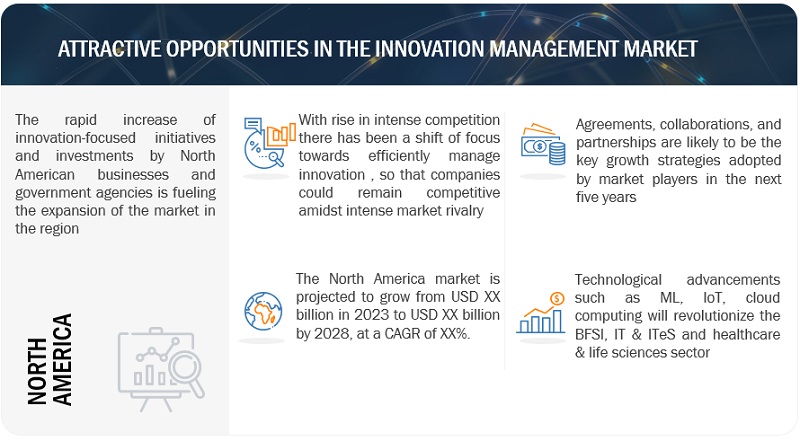

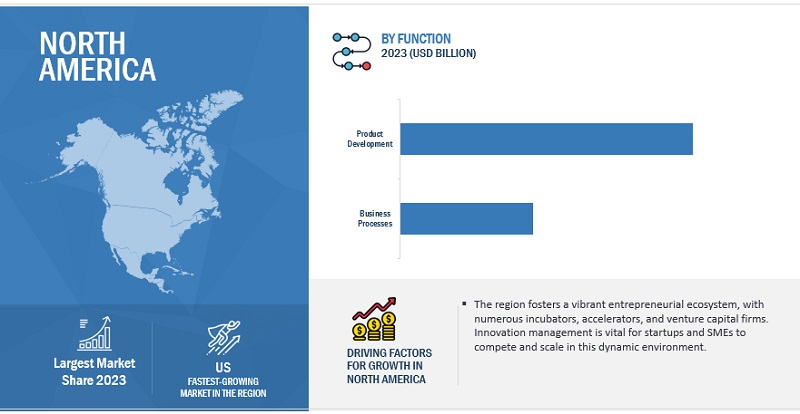

North America is expected to hold the largest market size during the forecast period

The presence of world-class universities, research institutions, and technology hubs fosters collaboration between academia and industry. This synergy results in cutting-edge research, technology transfer, and the development of skilled talent pools. Moreover, this seamless collaboration between academia and industry not only accelerates the development of groundbreaking technologies but also facilitates the commercialization of research findings. It empowers North American businesses with a continuous influx of fresh ideas and a well-trained workforce, strengthening their competitive edge and ultimately driving the growth of innovation management in the region.

Market Players:

The major players in the innovation management market are Accenture (Ireland), Planview (US), Questel (France), insightsoftware (US), SAP (Germany), KPMG (Netherlands), EY (UK), Salesforce (US), Medallia (US), Deloitte (UK), Boston Consulting Group (US), Miro (US), Sopheon (US), Qmarkets (Israel), Brightidea (US), HYPE Innovation(Germany), Planbox (Canada), IdeaScale (US), InnovationCast (Portugal), Nosco (Denmark), Wazoku (UK), inno360 (US), ITONICS (Germany), Rever (US), Induct (Norway), Sideways 6 (UK), Yambla (US), Ideawake (US), LoopedIn (UK). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and enhancements, and acquisitions to expand their footprint in the innovation management market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2017-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) Billion |

|

Segments covered |

Offering, Function, Innovation Management Tools, Vertical, and Region |

|

Region covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. |

|

Companies covered |

Accenture (Ireland), Planview (US), Questel (France), insightsoftware (US), SAP (Germany), KPMG (Netherlands), EY (UK), Salesforce (US), Medallia (US), Deloitte (UK), Boston Consulting Group (US), Miro (US), Sopheon (US), Qmarkets (Israel), Brightidea (US), HYPE Innovation (Germany), Planbox (Canada), IdeaScale (US), InnovationCast (Portugal), Nosco (Denmark), Wazoku (UK), inno360 (US), ITONICS (Germany), Rever (US), Induct (Norway), Sideways 6 (UK), Yambla (US), Ideawake (US), LoopedIn (UK). |

This research report categorizes the innovation management market to forecast revenues and analyze trends in each of the following submarkets:

Based on Offering:

- Solutions

-

Services

-

Professional Services

- Consulting

- System Integration

- Training, Support, & Maintenance

- Managed Services

-

Professional Services

Based on Function:

- Product Development

- Business Processes

Based on Innovation Management Tools:

- Project Management Platforms

- Marketing Platforms

- Design Platforms

- Idea Management Platforms

- Collective Intelligence & Prediction Platforms

- Human Resources Platforms

- Other Tools

Based on Vertical:

- IT & ITeS

- Telecom

- Banking, Financial Services, & Insurance (BFSI)

- Healthcare & Life Sciences

- Aerospace & Defense

- Retail & eCommerce

- Energy & Utilities

- Manufacturing

- Transportation & Logistics

- Other Verticals

By Region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- France

- Italy

- Spain

- Nordics

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- Southeast Asia

- Rest of Asia Pacific

-

Middle East & Africa

-

Middle East

- KSA

- UAE

- Israel

- Rest of Middle East

- Africa

-

Middle East

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In November 2023, Accenture acquired Founders Intelligence, an innovation strategy consulting firm that helps large corporations to create growth by using tools, techniques and insights from technology entrepreneurs and investors.

- In July 2023, KPMG and Microsoft partnered for multi-year cloud and AI alliance to supercharge the employee experience and accelerate innovation for clients across Audit, Tax and Advisory.

- In May 2023, Salesforce and Accenture collaborated to accelerate the deployment of generative AI for CRM

Frequently Asked Questions (FAQ):

What is the definition of the innovation management market?

Innovation management is the process of managing the innovation process, from idea generation to commercialization. It involves a set of activities and practices that organizations use to create, develop, and implement new ideas.

What is the market size of the innovation management market?

The innovation management market size is projected to grow from USD 1.3 billion in 2023 to USD 2.1 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 10.8% from 2023 to 2028.

What are the major drivers in the innovation management market?

The major drivers in innovation management market are Intense market competition, Open innovation opportunities, Globalization and rise of cross-cultural innovation, and rapid technological advances.

Who are the key players operating in the innovation management market?

The key market players profiled in the innovation management market are Accenture (Ireland), Planview (US), Questel (France), insightsoftware (US), SAP (Germany), KPMG (Netherlands), EY (UK), Salesforce (US), Medallia (US), Deloitte (UK), Boston Consulting Group (US), Miro (US), Sopheon (US), Qmarkets (Israel), Brightidea (US), HYPE Innovation (Germany), Planbox (Canada), IdeaScale (US), InnovationCast (Portugal), Nosco (Denmark), Wazoku (UK), inno360 (US), ITONICS (Germany), Rever (US), Induct (Norway), Sideways 6 (UK), Yambla (US), Ideawake (US), LoopedIn (UK).

What are the key technology trends prevailing in innovation management market?

The key technology trends in innovation management include AI, ML, blockchain, and cloud computing.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

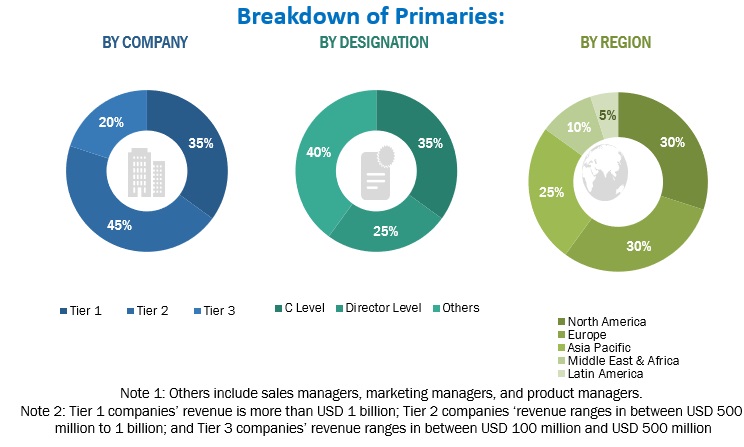

This research study involved the extensive use of secondary sources, directories, and databases, such as Dun & Bradstreet (D&B) Hoovers and Bloomberg BusinessWeek, to identify and collect information useful for a technical, market-oriented, and commercial study of the innovation management market. The primary sources have been mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews have been conducted with various primary respondents that included key industry participants, subject matter experts, C-level executives of key market players, and industry consultants to obtain and verify critical qualitative and quantitative information.

Secondary Research

The market for companies offering innovation management solutions and services to different verticals has been estimated and projected based on the secondary data made available through paid and unpaid sources, as well as by analyzing their product portfolios in the ecosystem of the market. It also involved rating company products based on their performance and quality. In the secondary research process, various sources such as the International Society for Professional Innovation Management (ISPIM), West African Research and Innovation Management Association (WARIM), the Caribbean Research Innovation Management Association (CabRIMA), South African Research and Innovation Management Association (SARIM) have been referred to for identifying and collecting information for this study on the innovation management market. The secondary sources included annual reports, press releases and investor presentations of companies, white papers, journals, and certified publications and articles by recognized authors, directories, and databases. Secondary research has been mainly used to obtain key information about the supply chain of the market, the total pool of key players, market classification, segmentation according to industry trends to the bottommost level, regional markets, and key developments from both market- and technology-oriented perspectives that have been further validated by primary sources.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from innovation management solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders. Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using innovation management solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of innovation management solutions and services, which would impact the overall innovation management market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the size of the innovation management market. The first approach involves estimating market size by summing up the revenue generated by companies through the sale of innovation management offerings, such as solutions, and services.

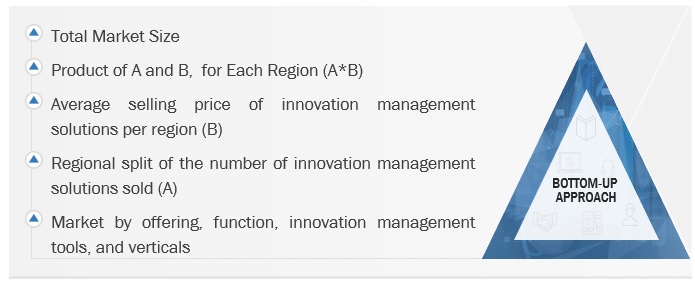

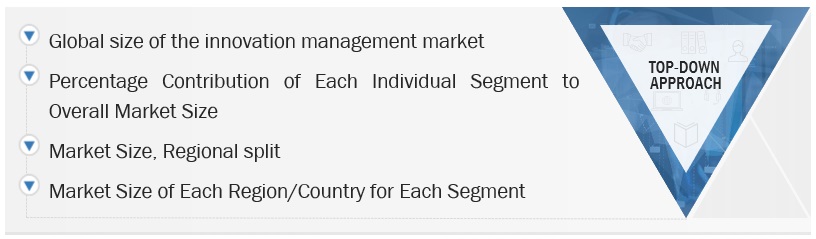

Both top-down and bottom-up approaches were used to estimate and validate the total size of the innovation management market. These methods were extensively used to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Innovation management Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Innovation management Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size, the innovation management market was divided into several segments and subsegments. A data triangulation procedure was used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

Innovation management is the process of managing the innovation process, from idea generation to commercialization. It involves a set of activities and practices that organizations use to create, develop, and implement new ideas.

Key Stakeholders

- Innovation management solution and service providers

- Government organizations, forums, alliances, and associations

- Consulting service providers

- Value-added resellers (VARs)

- End users

- System integrators

- Research organizations

- Consulting companies

- Software vendors

The main objectives of the study are as follows:

- To determine and forecast the global innovation management market by offering (solutions, and services), function, application, vertical, and region from 2023 to 2028, and analyze the various macroeconomic and microeconomic factors that affect the market growth.

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall market.

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the innovation management market.

- To profile the key market players; provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the market's competitive landscape.

- Track and analyze competitive developments in the market, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle East & Africa market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Innovation Management Market