Intent-based Networking (IBN) Market by Component (Solution, Services (Professional Services and Managed Services)), Deployment Type (Cloud and On-premises), Vertical (IT & Telecom, BFSI, Healthcare), Organization Size, & Region - Global Forecast to 2027

Intent-based Networking Market Forecast & Growth, Global Trends

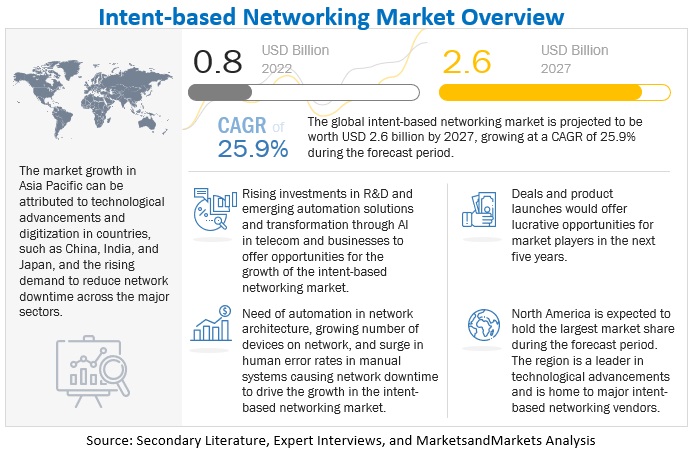

The global Intent-based Networking Market size was stood at $0.8 billion in 2022 and is projected to grow at a CAGR of 25.9% to rise over $2.6 billion by the end of 2027.

The need for automation in network architecture, rising implementation of cloud-based and software-defined networking, growing need for efficient connectivity network to handle increasing traffic, growing number of devices on network, and surge in human error rates in manual systems causing network downtime are all expected to drive the intent-based networking market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Growing number of devices on network

Due to the advances in Internet technology, there is a huge adoption of connected devices, smartphone penetration, and data sharing in the IoT-based connectivity arena. According to the Cisco Annual Internet Report, the number of devices connected to IP networks will be more than three times the global population by 2023 (there will be 29.3 billion networked devices by 2023, up from 18.4 billion in 2018). Also, 5G devices and connections will be over 10% of global mobile devices and connections by 2023. The increased adoption of connected devices is driving the demand for network automation solutions, which help in business process automation and increase productivity. Network automation solutions act on the network locally, automate the configuration of devices, ensure compliance, and leverage analytics for better business insights. These solutions have helped companies track the performance of devices, monitor data, and detect any unauthorized access. Also, automation ensures that the devices are connected and integrated properly into the network to ensure scalability and security.

Restraint: Lack of awareness among network administrators

Network automation solutions, with varied features and functionalities, are being offered by numerous vendors across the globe. Network admins need to understand their requirements to manage the network infrastructure and choose the appropriate solution. In the world of convergence, technology has been changing rapidly in the business system. Most of the network administrators are reluctant to modify the SOPs and are hesitant to automate their networks. Therefore, solution providers need to offer more training and education services to network admins so that they can gain more insights from unstructured network data. Many organizations, especially SMEs, do not have enough skilled workforce to manage the network infrastructure. Hence, the lack of awareness among network admins to distinguish between precise network automation solutions is a challenge for the growth of the intent-based networking market.

Opportunity: Growing adoption of Software-Defined Networking (SDN)

Due to the increased remote working facilities offered by most organizations worldwide, there is an increased need for high bandwidth networks. Thus, the adoption of virtual and software-defined networking has increased across various industry verticals. This growing adoption has direct consequences on intent-based network automation in terms of analyzing and managing the network traffic, network configuration, deployment of policies, and network bandwidth to streamline business continuity. This enhancement in network infrastructure helps in risk minimization and prevention over the network and data centers.

Challenge: Rising threats and vulnerabilities in networking

With the advancements in the communication industry, there is an increment in the adoption of variety and quantity of networking devices. Networking devices are widely used in smart wear, smart homes, smart cars, smart manufacturing, smart medical care, and many other life-related fields. Every internet-connected device, such as smartphones, laptops, and wearables, acts as a node within a global hazard-tracking system. Each networking device could act as a sensor that detects surrounding atmospheric conditions and transmits vital data to natural disaster researchers. With it, vulnerabilities of networking devices are continually emerging. The rise in vulnerabilities will bring severe risks if networking fails. According to the Cost of a Data Breach 2022 Report, Data breach costs surged 13% from 2020 to 2022. Organizations that had a fully deployed automation program such SDN, network automation, and IBN architecture, would face the risk of network vulnerability at minimal impact, compared to non-automated companies.

Based on component, the solution segment to hold a larger market size during the forecast period

Solution segment is expected to hold a larger market size during the forecast period. The intent-based networking market is a solution-driven market. The rising number of connected devices in various verticals is the major factor driving the growth of the solution segment of the intent-based networking market.

Based on service, the managed services segment to grow at a higher CAGR during the forecast period

Managed services are estimated to register a higher growth rate during the forecast period, compared to professional services. Managed services offer IT assistance to improve the client experience. Businesses outsource certain IT functions to third-party providers referred to as managed service providers. These outsourced tasks could be as simple as maintaining the functionality of IT infrastructure and other services by outsourcing the IT team. Businesses find it challenging to manage these services while focusing on their primary business operations. As a result, businesses rely heavily on third parties to provide managed services.

Based on deployment type, the cloud segment to hold a larger market size during the forecast period

The cloud segment is estimated to hold a larger market size during the forecast period. Cloud plays a significant role in the transformation of remote assets from manual to automated network processes. With cloud deployment, dedicated and high-availability setups are created to run instances of IBN solutions. Cloud-based IBN solution providers also take the responsibility of managing the service.

Based on vertical, the healthcare segment to grow at the highest CAGR during the forecast period

IBN has played a major part in the technological revamping of healthcare, whether it is integrating digital technology, advancing procedures, or introducing otherwise unthinkable competence and productivity. In the healthcare industry, cloud and AI offer the required security and are compliant with HIPAA and other government regulations, thus driving the intent-based networking market. In the healthcare industry, the IBN technology can benefit patients by reducing time in the identification of diseases, delivering superior patient care, quick fault detection, and reduction in risks without network connection failure.

To know about the assumptions considered for the study, download the pdf brochure

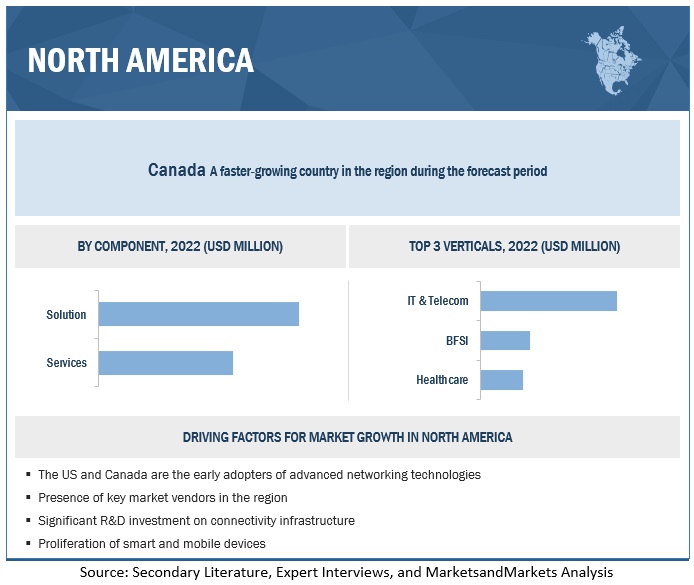

Based on region, North America to account for the largest market size during the forecast period

The intent-based networking market in North America is expected to provide maximum revenue opportunities to vendors, as it is likely to benefit from its technological advancements and its position as a developed region. North America has witnessed significant growth in the market as most IBN solution and service providers belong to North America. Government initiatives for the implementation of advanced networking technologies such as 5G, cloud, and IoT technology in intent-based networking are expected to drive the market in the region.

Key Market Players

Key and emerging intent-based networking market players include Cisco (US), Juniper Networks (US), IBM (US), Huawei (China), HPE (US), Nokia (Finland), Wipro (India), Gluware (US), Forward Networks (US), NetBrain Technologies (US), Frinx (Slovakia), and Indeni (US). These players have adopted various strategies to grow in the intent-based networking market. The companies are focused on inorganic and organic growth strategies to strengthen their market position.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2017–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Component (Solution and Services), Deployment type (Cloud and On-premises), Organization Size (Small and Medium-sized Enterprises [SMEs] and Large Enterprises), Vertical (IT & Telecom, BFSI, Healthcare, Manufacturing, Retail & Consumer Goods, and Other Verticals), and Region |

|

Geographies covered |

North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America |

|

Companies covered |

Cisco (US), Juniper Networks (US), IBM (US), Huawei (China), HPE (US), Nokia (Finland), Wipro (India), Gluware (US), Forward Networks (US), NetBrain Technologies (US), Frinx (Slovakia), and Indeni (US) |

The research report categorizes the intent-based networking market to forecast the revenues and analyze trends in each of the following subsegments:

By Offering

- Solution

-

Service

- Professional Services

- Managed Services

By Deployment Type

- Cloud

- On-premises

By Organization Size

- SMEs

- Large Enterprises

By Vertical

- IT & Telecom

- BFSI

- Healthcare

- Manufacturing

- Retail & Consumer Goods

- Other Verticals (Hospitality, Energy & Utilities, Education, Transportation & Logistics, and Government)

By Region

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific (APAC)

- China

- India

- Japan

- Rest of Asia Pacific

-

Middle East & Africa (MEA)

- United Arab Emirates

- Kingdom of Saudi Arabia

- South Africa

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In January 2023, Indeni launched Indeni 8.0, which comes with new Zscaler App Connector support and network security automation. It also has new auto-detect elements for checkpoint Maestro and Cisco ASA.

- In January 2023, HPE acquired Pachyderm and integrated Pachyderm’s software with its existing supercomputing and AI solutions to automate reproducible machine learning pipelines for large scale AI applications.

- In December 2022, Cisco released the latest version i.e., 2.3.5.0 of DNA Centre.

- In September 2022, Wipro partnered with Cisco to accelerate cloud transformation for customers and enabled to deploy Wipro FullStride Cloud Service to enable a fully automated hybrid-cloud stack, reducing the implementation time and enhancing the user experience.

- In July 2022, Forward Networks partnered with Arista CloudVision to automate network and security verification.

Frequently Asked Questions (FAQ):

How big is the Intent-based Networking Market?

The Intent-based Networking Market size was valued $0.8 billion in 2022 and is projected to reach USD 2.6 billion by 2027.

Which region has the largest market share in the intent-based networking market?

North America is estimated to hold the largest market share in intent-based networking in 2022.

Which industry vertical is expected to hold a larger market size during the forecast period?

Among verticals, IT & telecom segment is expected to hold a larger market size during 2022–2027.

Which deployment type is expected to hold the largest market size during the forecast period?

Between cloud and on-premises deployment type, the cloud segment is estimated to hold a larger market size during 2022–2027.

Which are the major compnies in the Intent-based Networking Market?

Major compnies in the intent-based networking market are Cisco (US), Juniper Networks (US), IBM (US), Huawei (China), HPE (US), Nokia (Finland), and Wipro (India).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

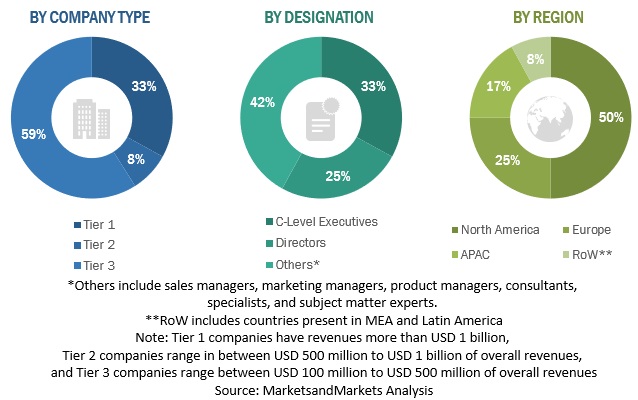

The study involved four major activities in estimating the current size of the Intent-based Networking (IBN) market. An extensive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of segments and subsegments of the intent-based networking market.

Secondary Research

In the secondary research process, various secondary sources, including D&B Hoovers, Bloomberg BusinessWeek, and Factiva, have been referred to, for identifying and collecting information for this study. These secondary sources included annual reports; press releases and investor presentations of companies; whitepapers, articles by recognized authors; gold standard and silver standard websites; Research and Development (R&D) organizations; and regulatory bodies. The data was also collected from secondary sources, such as such as Open Network Infrastructure Association (Switzerland), The Wireless Infrastructure Association (US), the Research & Educational Networking Association of Moldova, the Network Professional Association (NPA) (US), and the Open Networking Foundation (ONF) (US).

Primary Research

Various primary sources from both the supply and demand sides of the intent-based networking market ecosystem were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors providing intent-based networking in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The following is the breakup of the primary respondents’ profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

To make market estimations and forecast the intent-based networking market and other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall size of the global intent-based networking market using the revenues and offerings of the key companies in the market. The research methodology used to estimate the market size included the following:

- The key players in the market were identified through extensive secondary research.

- The market size, in terms of value, was determined through primary and secondary research processes.

- All percentage shares, splits, and breakups were determined using secondary sources and verified through primary sources.

ong>Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To determine, segment, and forecast the global intent-based networking market by component, deployment type, organization size, vertical, and region in terms of value

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the intent-based networking market

- To study the complete value chain and related industry segments and perform a value chain analysis of the intent-based networking market landscape

- To analyze the industry trends, pricing data, patents, and innovations related to the intent-based networking market

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To analyze the opportunities for stakeholders by identifying the high-growth segments of the intent-based networking market

- To track and analyze competitive developments, such as mergers & acquisitions, product launches & enhancements, partnerships, agreements, collaborations, business expansions, and Research & Development (R&D) activities

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific requirements. The following customization options are available for the report:

Product Analysis

- Product matrix provides detailed product information and comparisons

Geographic Analysis

- Further breakdown of India intent-based networking market

- Further breakdown of KSA intent-based networking market

- Further breakdown of Mexico intent-based networking market

- Further breakdown of Germany intent-based networking market

Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Intent-based Networking (IBN) Market