IO-Link Market Size, Share & Industry Growth Analysis Report by Type (IO-Link Wired, IO-Link Wireless), Component (IO-Link Masters, IO-Link Devices), Industry (Process Industries, Hybrid Industries), Application (Machine Tools, Intralogistics Solutions) and Region - Global Forecast to 2028

Updated on : April 19, 2023

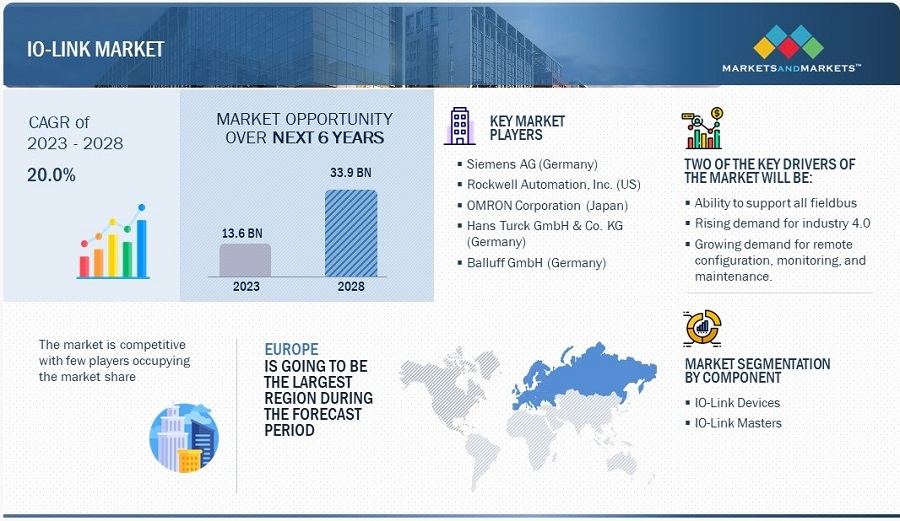

[231 Pages Report] The IO-Link Market Size is projected to reach USD 33.9 billion by 2028 from an estimated USD 13.6 billion in 2023, at a compound annual growth rate (CAGR) of 20.0% from 2023 to 2028. Ability to support all fieldbus protocols and growing demand for remote configuration, monitoring, and maintenance are among the factors driving the growth of the IO-Link industry.

IO-Link Market Analysis Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Rising demand for industry 4.0

Industry 4.0 aims at fully integrating the communication process used in manufacturing to improve the efficiency of factories and transform them into smart factories. This is achieved through the Industrial Internet of Things (IIoT), industrial automation, data exchange, and deployment of smart field devices. The benefits of Industry 4.0 and IIoT include the integration of IO-Link solutions with overall industrial automation systems, easy replacement of sensors, elimination of manual parameter settings, continuous data monitoring and status diagnostics, and increased uptime.

Restraint: Use of compact machines

IO-Link solutions help reduce cables and wiring for industrial machines. Manufacturing industries demand compact and reliable solutions for their operational processes. This leads to the requirement for compact machines on a factory floor. Apart from being small, such compact machines consume less power and offer better performance than other industrial solutions. Also, the wiring in compact machines is already short. In such cases, deploying IO-link solutions is costlier for IO-Link Industry players. In addition, these machines are efficient and require lesser space than traditional machines and other industrial solutions. Hence, the use of compact machines for industrial automation is a key hurdle for the growth of the IO-Link market.

Opportunity: Increasing adoption of IO-Link in automotive industry

A minor shutdown can result in huge losses in a manufacturing unit in the automotive industry. A fault can hamper the entire production process. IO-Link devices eliminate such downtimes, improve product and production processes, and ensure regular preventive maintenance. IO-Link masters are developed according to AIDA specifications for the automotive industry and provide improved performance. The Automation Initiative of German Domestic Automobile manufacturers (AIDA) has defined a standard for IO-Link masters in the automotive industry. The L-coded power connection with functional earth is to be used for all field modules. Vertical integration in automation for the automotive industry includes the support of EtherCAT and EtherNet/IP. Also, IO-Link products are used for seamless integration with controllers. Thus, the automotive industry is expected to create a huge opportunity for the IO-Link ecosystem players in the near future.

Challenge: Cyber risks associated with automation systems

IO-Link solutions are vulnerable to threats such as cross-site request forgery (CSRF), reflected cross-site scripting (XSS), blind command injection, and denial-of-service (DoS) issues. Other risks associated with IO-Link include spear phishing, watering holes, and database injection. In a phishing assault, a digital criminal can steal data from devices by deceiving them into sharing the security key for an application. Cyber risks threaten industrial automation and control systems (IACS). However, cybersecurity measures are taken to secure IACS against such risks. These assaults are used to threaten manufacturing industries and gain monetary benefits or critical business information. These dangers begin from the web, corporate systems, programming overhauls, and unapproved access.

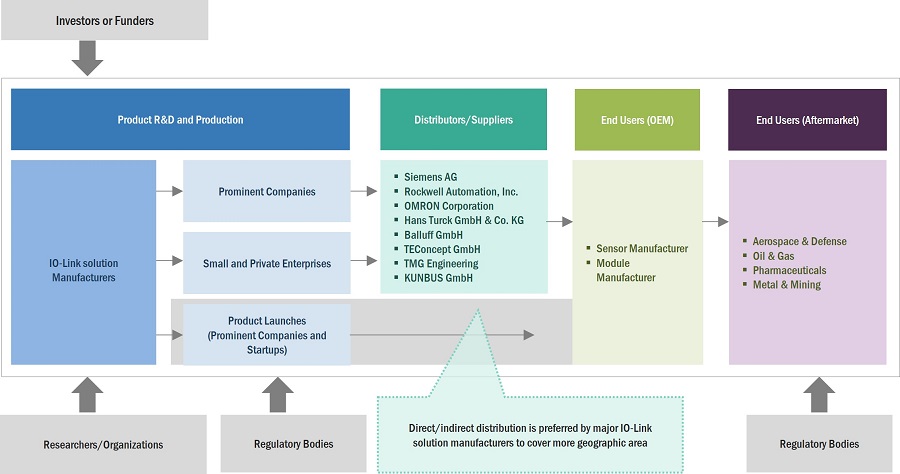

IO-Link Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of IO-Link solutions. These IO-Link Companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Siemens AG (Germany), Rockwell Automation, Inc. (US); OMRON Corporation (Japan); Hans Turck GmbH & Co. KG (Germany); Balluff GmbH (Germany); ifm electronic GmbH (Germany); Pepperl+Fuchs (Germany); Sick AG (Germany); Festo SE & Co. KG (Germany); SMC Corporation (Japan). The demand Product R&D and Production Distributors/Suppliers End Users (OEM) Prominent Companies Small- and Medium-sized Enterprise Suppliers & Retailers Prominent Companies Small and Private Enterprises Joint Ventures (Prominent Companies and Startups) Researchers/Organizations Regulatory Bodies IO-Link solution Manufacturers ? Private Contractors End Users (Aftermarket) Regulatory Bodies

By type, IO-Link wireless segment is expected to grow with the highest CAGR during 2022

The IO-Link wireless segment is expected to experience the second highest CAGR of 100.2% during 2022. IO-link wireless supports roaming capabilities and the possibility to include sensors with low energy consumption in real-time networks. IO-Link wireless is compatible with factory and process automation protocols. The rising demand for the IO-Link wireless protocol and increasing adoption of smart manufacturing across industries are expected to create lucrative opportunities for the growth of the IO-Link wireless segment in the near future.

By component, IO-Link masters segment is expected to grow with the second highest CAGR during the forecast period

The IO-Link masters of the IO-Link Market Size is expected to grow at the second highest CAGR of 18.6% during the forecast period. IO-Link masters are gateways for connecting up to 8 or 16 IO-Link devices, such as sensors, valves, and binary input or output modules. They reliably transmit machine data, process parameters, and diagnostic data to the controller using 20−30 V supply voltage. The masters simultaneously exchange data with controllers and automation systems. IO-Link masters are used for field applications and control cabinets. These masters have excellent electromagnetic stability, a wide temperature range, high protection rating, and robust housing. Due to these benefits, these are ideal for harsh industrial environment applications.

By IO-Link Industry, hybrid industries segment is expected to grow with the second highest CAGR during the forecast period

The hybrid industries segment is expected to experience the second highest CAGR of 18.9% during the forecast period. In hybrid industries, automation solution requirements are usually a mix of automation solutions for process and discrete industries. Hybrid industries include metals & mining, food & beverages, pharmaceuticals, cement, and glass. Food & beverages and pharmaceuticals industries are the leading hybrid industries in the IO-Link market.

By application, machine tools segment is expected to grow with the second highest CAGR during the forecast period

The machine tools segment is expected to witness the second highest CAGR of 20.3% during the forecast period. Machine tools contain multiple sensors for detecting pressure, level, and temperature. IO-Link-capable sensors are identifiable through their vendor and device ID. The program set by the user in a controller recognizes the connected sensor, checks it, and sets the sensor parameters using the parameter record. Sensors from different manufacturers can be used on a factory floor. IO-Link can also be used for the standard sensors installed on a machine. The signals from these sensors are collected and used in IO-Link sensor hubs and passed along to the controller.

IO-Link Market by Region

To know about the assumptions considered for the study, download the pdf brochure

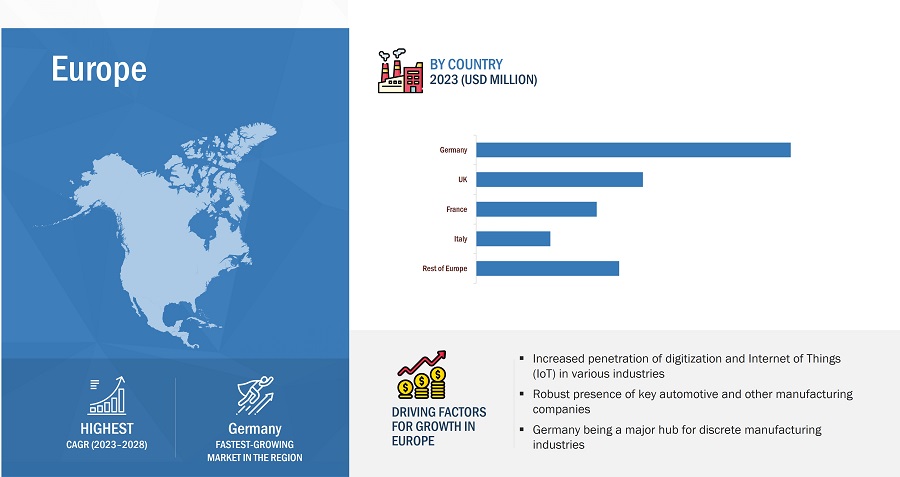

In 2028, Europe is projected to hold the largest share of the overall IO-Link market

Europe region is expected to grow at largest share of ~41% during the forecasted year. Europe comprises major growing economies, such as the UK, Germany, and France, which offer significant growth opportunities for the market. The region focuses on developing highly advanced connected cars and autonomous vehicles, thereby accelerating the demand for IO-Link solutions. The region produces a large number of motor vehicles, aerospace parts, and robots. Thus, the robots manufacturing IO-Link Industry and aerospace industry are an integral part of Europe’s economy.

Top IO-Link Companies - Key Market Players

Siemens AG (Germany), Rockwell Automation, Inc. (US); OMRON Corporation (Japan); Hans Turck GmbH & Co. KG (Germany); Balluff GmbH (Germany); ifm electronic GmbH (Germany); Pepperl+Fuchs (Germany); SICK AG (Germany); Festo SE & Co. KG (Germany); SMC Corporation (Japan) are some of the key players in the IO-Link companies.

IO-Link Market Report Scope :

|

Report Metric |

Details |

| Market size value in 2023 | USD 13.6 Billion |

| Market size value in 2028 | USD 33.9 Billion |

| CAGR (2023-2028) | 20.0% |

|

Years Considered |

2023–2028 |

|

On Demand Data Available |

2030 |

|

Forecast Period |

2019–2028 |

|

Forecast Units |

Value (USD Million/USD Billion) |

|

Segments Covered |

Type, Component, Industry, Application and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies Covered |

Are some of the key players in the IO-Link market. Total 10 Major Players are covered. |

IO-Link Market Highlights

This research report categorizes the IO-Link market based on by type, by industry, by component, by application, and by region.

|

Segment |

Subsegment |

|

Io-Link Market, By Type |

|

|

Io-Link Market, By Component |

|

|

Io-Link Market, By Industry |

|

|

Io-Link Market, By Application |

|

|

Geographic Analysis |

|

Recent Developments

- In August 2022, ifm electronic GmbH acquired a minority share in HiDensity AG, the sole holder of Biel-based HMT microelectronic AG. This acquisition is aimed at future growth potential.

- In June 2022. SICK partners with F1TENTH, which is focused on innovation in the field of autonomous systems for up-and-coming roboticists. This partnership aims at providing students resources in developing autonomous vehicles, including various races throughout the year.

- In June 2022, SICK AG launched Monitoring Box, it is a new Smart Service web application from SICK. It visualizes status data from SICK sensors, offering customers added value from previously unused sensor data. The monitoring box allows for the visualization of internal device parameters to diagnose and monitor fault conditions. It consists of a browser application, server-side data management, an IoT Gateway, and suitable predefined sensor apps for simple connection of SICK sensors.

- In July 2022, Pepperl+Fuchs launched CB10 series I/O hubs that offer the optimal solution for direct integration into the smallest installation spaces. The CB10 modules can be connected directly to an IO-Link master and make push button boxes IO-Link-capable this way.

- March 2022, Balluff GmbH launched BNI IO-Link master and I/O modules are compelling options wherever regular cleaning cycles, among other things, occur in challenging environments. With these new IO-Link devices, the user can better manage difficult conditions.

Frequently Asked Questions (FAQs):

What is the size of the IO-Link market projected growth rate over the next few years?

The market size of IO-Link is growing rapidly, with an estimated market size of $33.9 billion by 2028. The market is expected to grow 20.0% annually over the next 5 years.

What are the key drivers of growth in the IO-Link market, and what are the major trends shaping this industry?

The key drivers of growth in the IO-Link market include increasing demand for automation and industry 4.0 solutions, as well as the need for efficient and flexible communication between sensors, actuators, and controllers. Major trends shaping the industry include the growing adoption of IIoT (Industrial Internet of Things) and advancements in wireless technology.

Who are the leading players in the IO-Link market, and what are their market shares and competitive strategies?

Leading players in the IO-Link market includeSiemens AG (Germany), Rockwell Automation, Inc. (US); OMRON Corporation (Japan); Hans Turck GmbH & Co. KG (Germany); Balluff GmbH (Germany); ifm electronic GmbH (Germany); Pepperl+Fuchs (Germany); SICK AG (Germany); Festo SE & Co. KG (Germany); SMC Corporation (Japan). These players have significant market shares and are adopting competitive strategies such as partnerships, collaborations, and product innovations to maintain their market position.

What are the key regulatory and policy issues impacting the IO-Link market, and how are they likely to evolve in the coming years?

The key regulatory and policy issues impacting the IO-Link market include data privacy, cybersecurity, and intellectual property rights. These issues are likely to evolve in the coming years as new regulations and policies are introduced to address these concerns.

How is the IO-Link market likely to be affected by other technology trends, such as the Internet of Things (IoT), Industry 4.0, and digital transformation?

The IO-Link market is likely to be affected by other technology trends such as the Internet of Things (IoT), Industry 4.0, and digital transformation. These trends are expected to drive the adoption of IO-Link technology by enhancing its connectivity and interoperability with other systems.

What are the main customer requirements and preferences in the IO-Link market, and how are suppliers meeting these needs?

The main customer requirements and preferences in the IO-Link market include high reliability, cost-effectiveness, ease of installatio and maintenance, and compatibility with existing systems. Suppliers are meeting these needs by focusing on product innovations, customization, and customer support servicecapitalize on these opportunities.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

$$$##### #####

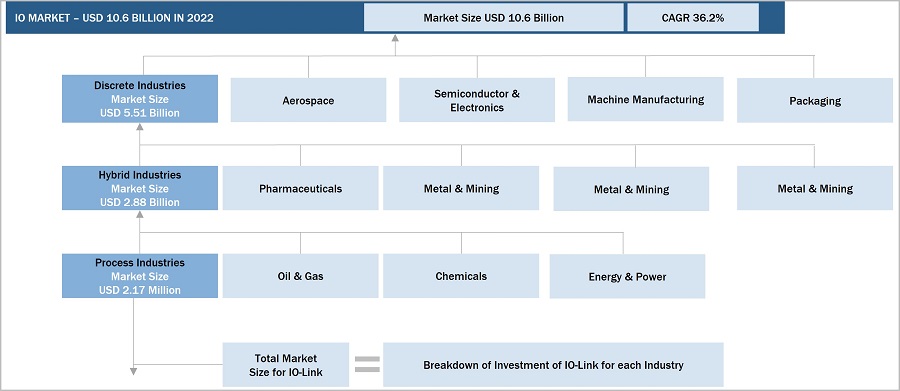

The study involved four major activities in estimating the size of the IO-Link market. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

Revenues of companies offering IO-Link solutions have been obtained from the secondary data available through paid and unpaid sources. The revenues have also been derived by analyzing the product portfolio of key companies, and these companies have been rated according to the performance and quality of their products.

In the secondary research process, various sources have been referred to for identifying and collecting information for this study on the IO-Link market. Secondary sources considered for this research study include government sources; corporate filings; and trade, business, and professional associations. Secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

Secondary research has been mainly used to obtain key information about the supply chain of IO-Link solutions to identify key players based on their products and prevailing industry trends in the IO-Link market by type, by industry, by component, application, and region. Secondary research also helped obtain market information- and technology-oriented key developments undertaken by market players to expand their presence and increase their market share.

Primary Research

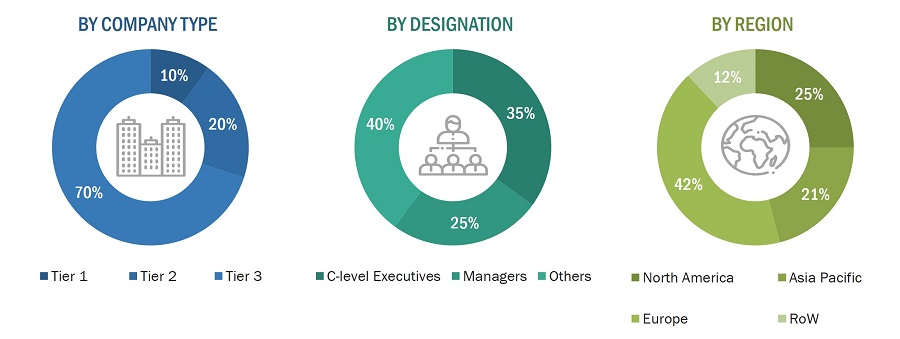

Extensive primary research has been conducted after understanding and analyzing the current scenario of the IO-Link market through secondary research. Several primary interviews have been conducted with the key opinion leaders from demand and supply sides across four main regions—the North America, Europe, Asia Pacific, and Rest of Europe. Approximately 25% of the primary interviews have been conducted with the demand-side respondents, while approximately 75% have been conducted with the supply-side respondents. The primary data has been collected through questionnaires, emails, and telephonic interviews.

After interacting with io-link industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up procedure has been employed to arrive at the overall size of the IO-Link market.

- Identifying various IO-Link products

- Analyzing the penetration of each product through secondary and primary research

- Analyzing the penetration of IO-Link in different industries and applications through secondary and primary research

- Conducting multiple discussions with key opinion leaders to understand the detailed working of IO-Link and their implementation in multiple industries and applications; this helped analyze the break-up of the scope of work carried out by each major company

- Verifying and cross-checking the estimates at every level with key opinion leaders, including CEOs, directors, operation managers, and finally with the domain experts at MarketsandMarkets

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

The top-down approach has been used to estimate and validate the total size of the IO-Link market.

- Focusing initially on the R&D investments and expenditures being made in the ecosystem of the IO-Link market, further splitting the market based on io-link industry, application, and region, and listing the key developments

- Identifying the leading players in the IO-Link market through secondary research and verifying them through brief discussions with industry experts

- Analyzing revenues, product mix, geographic presence, and key applications served by all identified players to estimate and arrive at percentage splits for all key segments

- Discussing splits with io-link industry experts to validate the information and identify key growth pockets across all key segments

- Breaking down the total market based on verified splits and key growth pockets across all segments

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides in the IO-Link market.

Market Definition

IO-Link is a point-to-point network communications standard for sensors and actuators. It is used to improve digital or analog sensor interfaces by providing more information, configurability, and control to simplify an automation system’s installation, operation, and maintenance. The advantages of IO-Link include simplified installation, automated parameter assignment, and expanded diagnostics. Due to low implementation and component costs, an IO-Link interface can be integrated even in price-sensitive field devices such as photoelectric sensors and position sensors.

Key Stakeholders

- Providers of components and materials for IO-Link

- Distributors, suppliers, and service providers for IO-Link

- Technology standards organizations, forums, alliances, and associations

- End users from discrete, process, and hybrid industries

- Research organizations

- Analysts and strategic business planners

- Venture capitalists, private equity firms, and startup companies

Report Objectives

- To describe and forecast the IO-Link market, by type, component, io-link industry, application, and region, in terms of value and volume

- To describe and forecast the market for four key regions — North America, Europe, Asia Pacific, and the Rest of the World (RoW) — in terms of value and volume

- To provide detailed information regarding the drivers, restraints, opportunities, and io-link industry-specific challenges influencing the growth of the market

- To provide a detailed overview of the supply chain of the IO-Link ecosystem, along with the average selling price of IO-Link components

- To strategically analyze the ecosystem, tariff and regulations, patent landscape, trade landscape, and case studies pertaining to the market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To strategically profile key players, comprehensively analyze their position in the market in terms of their ranking and core competencies2, and provide the competitive landscape of the market

- To analyze competitive developments, such as product launches, collaborations, acquisitions, expansions, and partnerships, in the market

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in IO-Link Market