IoT Technology Market by Node Component (Sensor, Memory Device, Connectivity IC), Solution (Remote Monitoring, Data Management), Platform, Service, End-use Application, Geography (2021-2027)

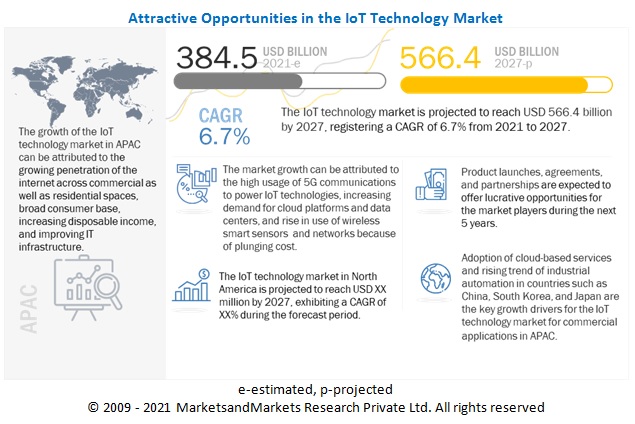

The IoT technology market size is expected to grow from USD 384.5 billion in 2021 to USD 566.4 billion by 2027, at a CAGR of 6.7%.

The market growth can be attributed to several factors, such as 5G communications technology, increasing necessity of data centers due to rising adoption of cloud platforms, growing use of wireless smart sensors and networks, and increased IP address space and better security solutions made available through IPv6.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global IoT technology market

The IoT technology industry includes major Tier I and Tier II suppliers such as Intel Corporation (US), Qualcomm Technologies (US), Texas Instruments Incorporated (US), STMicroelectronics (Switzerland), IBM (US), Hewlett Packard Enterprise (US), Cisco Systems (US), Microsoft Corporation (US), PTC (US), and Amazon Web Services (AWS) (US), and so on. These suppliers have their manufacturing facilities spread across various countries across North America, Europe, APAC, and RoW. COVID-19 has impacted their businesses as well.

Market Dynamics of IoT Technology Market

Driver: Increasing necessity of data centers due to rising adoption of cloud platforms

IoT involves transferring, storing, managing, and analyzing data generated from edge devices. Cloud platforms help to achieve this by providing analytics features. A cloud platform is a cost-efficient and easy-to-deploy solution, which eliminates the requirement for on-premises data centers. The data generated by IoT devices are stored on the cloud and cloud platforms. This helps businesses to draw sense from IoT-based devices and, hence, build processes based on the analysis. Furthermore, the emergence of IoT Platform-as-a-Service (PaaS) has also increased the deployment of IoT solutions across diverse industry verticals. Cloud platforms provide organizations with newer ways of connecting traditional information systems to IoT-enabled devices. Various companies in the IoT node and gateway market are tailoring their cloud offerings to meet the requirements of their customers. For example, in February 2021, NXP Semiconductors N.V. launched the EdgeLock 2GO IoT service cloud platform, which is designed for zero-touch, secure deployment, and security maintenance of IoT devices over the entire device lifecycle. Companies have realized the importance of cloud computing in providing comprehensive IoT solutions to their customers, which will further drive the IoT technology market share .

Tonnes of new data is being created and will need to be stored, which has increased the importance of data centers. For example, all the data from people creating new accounts, their personal and financial information, and usage data all need to be stored and encrypted. This will result in an increase in the usage of data centers. With such a huge rise in data consumption and traffic, the connections from devices to data centers will need to be improved drastically. By the end of 2021, there are estimated to be over ~10.0 billion IoT units active in the world, each one requiring a data connection to operate and connect with other devices. Thus, the use of IoT is likely to increase in the coming years.

Restraint: Unsettled concerns regarding security and privacy of user data

IoT has tremendous potential owing to the substantial rate of adoption in every end-use application, be it wearable, healthcare, or retail. However, privacy and security of data are major restraints for this market. As the number of connected devices is increasing with the growing adoption of IoT in end-use applications, a huge amount of data is being generated. Cybercriminals can hack into systems and use this data to automatically acquire a person’s car insurance, evaluate a person’s health status, track the behavior of a company’s strategies, and so on.

The IoT gateway, which serves as a connectivity layer between the edge devices and cloud services, has to handle a large number of IoT devices and the data transferred between them. While performing the protocol translation, the IoT gateway has to maintain data confidentiality. As the communication in IoT uses both private and public networks, a secure network is required. Protocol translation makes it difficult for the IoT gateway to maintain data privacy. Although encryption security keys can be used to secure the data, the management of those keys would still be a major concern.

Many companies are developing solutions for the security of user data during network communication. For instance, McAfee Inc. (US), a computer security software company, has already outlined its plan to secure IoT, while Cisco Systems, Inc. (US) provides a wide range of cybersecurity solutions—one of which is Cisco Advanced Malware Protection (AMP)—to tackle IoT security concerns. Intel Corporation (US) has also developed Wind River Intelligent Device Platform for security, connectivity, and deployment of gateways for IoT. Moreover, technologies such as Advanced Encryption Standard (AES) cipher suites and Transport Layer Security (TLS)/Secure Sockets Layer (SSL) encryption are being used to secure network communication to some extent. Many alliances and foundations find the security of a connected network to be a major concern in the IoT space. Many foundations, such as Internet of Things Security Foundation (IoTSF), are working toward collaborating to ensure data security.

Many systems and solutions are still prone to cyber threats despite the development of more secure hardware products and software solutions. Moreover, the data security concern is expected to continue and affect the demand for hardware for IoT applications, leading to the need for the development of more secure and highly encrypted hardware chipsets and connectivity solutions (such as gateways) in the future.

Opportunity: Government support for research and development of IoT technologies

Governments across the world are supporting and funding research and development of IoT to boost their productivity. Governments of multiple countries are looking for improvements and innovation in key areas such as smart traffic management systems, energy conservation through smart meters, and security system improvements through smart cameras. Moreover, various governments are funding new IoT research projects for the development of smart cities in the future. For instance, in 2012, the 12th 5-year development plan was launched in China with a focus on expanding the IoT market size to USD 163 billion by 2020. Furthermore, the government of China has launched a program “Made in China 2025,” which focuses on intelligent manufacturing capacity to enhance its manufacturing and production globally. Beijing has planned to invest USD 800 million in the IoT industry. Similarly, in September 2019, the Indian government decided to fund about USD 2 billion for indigenous technology development for 5G and IoT so that they can leverage a USD 660 billion opportunity. Thus, government support is likely to play a critical role in the development and growth of the IoT ecosystem.

Governments worldwide are becoming aware of the significant potential of IoT; therefore, they are supporting and funding IoT-related R&D activities. Government support in different countries, such as the US, Canada, Germany, and the UK, will play a crucial role in the growth and development of the IoT professional services market as these countries aim to become potential adopters of IoT in the coming years. The increasing use of IoT in various countries leads to the increased data traffic, which, in turn, drives the demand for IoT professional services. In addition, governments of various countries are striving for improvements and innovations in smart traffic management systems, energy conservation through the deployment of smart meters, and improvements in security systems through smart cameras. Such countries financially support the initiation of new IoT research projects to develop and run smart cities in the future. For instance, in July 2016, the European Commission launched the IoT European Platforms Initiative (IoT-EPI) funded under the Horizon 2020 program. In 2018, it launched a specific cluster of R&D projects to develop new solutions for the security and privacy of IoT-based applications. European Union (EU) is expected to invest USD ~555 million for IoT-based research and innovations, as well as for the deployment of IoT across core sectors from 2014 to 2021.

Challenge: High power consumption by wireless sensor terminals/connected devices

In IoT, sensors and other peripherals are significant power users. Although technologies such as ultra-low-power processors, tiny mobile sensors, and wireless networking are available, there is a need for efficient power management and optical power consumption in IoT devices. Connectivity load would be another critical challenge as numerous devices need to be connected at the same time. For instance, the average smart home may contain 50–100 connected appliances, lights, thermostats, and other devices, each with its own power requirements. Equipment such as smart meters would be used to make the line power efficient. As frequent manual replacements of batteries of thousands of sensors, actuators, and other connected devices within IoT systems are not feasible, the main hurdle is the power management of devices using wireless technologies such as Wi-Fi. Although semiconductor manufacturers are already working toward producing ultra-low-power chips and modules, there is still a challenge for innovation in battery technology and power management of portable and wearable electronics.

Data management segment to account for the largest share of IoT technology market in 2020

In 2020, the data management software solution segment accounted for the largest size of the market. Software solutions are designed to meet interoperability challenges that arise because of varied heterogeneous devices, and to manage a large volume of data and its security and privacy. Microsoft Corporation (US), IBM Corporation (US), SAP SE (Germany), Cisco Systems Inc. (US), and PTC, Inc. (US) are some of the top software solution providers. With the increase in the number of connected devices, the volume of data is also proliferating. Connected devices generate a huge volume of unstructured data on a daily basis. These data can be used to gain insights by analyzing the data generated. For the management of the massive volume of data, data management software solutions are required. Data management solutions are the most important software solutions in the realm of IoT technology as enormous amounts of data produced by IoT devices pose a challenge for the technology providers to deal with. By implementing the IoT data management software, businesses are aiming to get a competitive edge with predictive analytics, as well as optimize their operations.

The device management platform segment is expected to witness the highest growth rate of IoT technology market during the forecast period

The device management platform is expected to register the highest CAGR during the forecast period. A device management platform assists in managing, tracking, securing, and sustaining the devices that are used in organizations. With the increasing number of connected devices, the need for device management platform will increase. A device management platform helps in device provisioning, configuration, remote access, device monitoring, software management, and troubleshooting. Without device management software, businesses may end up investing a hefty amount (cost and labor-intensive effort) to manage devices. The market for device management platforms will grow owing to the increasing number of connected devices, traffic, and error rates. The benefits of using device management are fast device registration, simple IoT device organization, quick locating of connected devices, and easy remote device management

North America is leading the market for IoT technology in 2020

North America held the largest share in the IoT technology market share in 2020. North America is expected to continue to dominate the IoT technology market size during the forecast period due to the presence of various key players.

Increasing penetration of the internet in technologically advancing economies and growing adoption of wireless sensors and networks across major end-use applications such as healthcare, retail, consumer electronics, industrial, and automotive and transportation have resulted in the growth of the global IoT technology market share . Increased R&D in the field of IoT, in terms of new and improved technologies, and the increasing demand for improved lifestyle are the two crucial factors driving the growth of the market.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Major players in the IoT technology companies include Intel Corporation (US); Qualcomm Technologies (US); Texas Instruments Incorporated (US); STMicroelectronics (Switzerland); IBM (US), and so on.

IoT Technology Market Report Scope :

|

Report Metric |

Details |

| Market Size Value in 2021 | USD 384.5 Billion |

| Revenue Forecast in 2027 | USD 566.4 Billion |

| Growth Rate | 6.7%. |

|

Market size available for years |

2017–2027 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2027 |

|

Forecast units |

Value (USD Billion/Million/Thousand) |

|

Segments covered |

|

|

Region Covered |

|

|

Market Leaders |

|

| Key Market Driver | Increasing necessity of data centers due to rising adoption of cloud platforms |

| Key Market Opportunity | Government support for research and development of IoT technologies |

| Largest Growing Region | North America |

| Largest Market Share Segment | Data management segment |

| Highest CAGR Segment | Device management platform segment |

In this research report, the IoT technology market has been segmented on the basis of offering, type, end-use industry, and geography.

IoT Technology Market, by Node Component

- Processor

- Connectivity IC

- Memory Device

- Sensor

- Logic Device

IoT Technology Market, by Software Solution

- Data Management

- Real-Time Streaming Analytics

- Network Bandwidth Management

- Remote Monitoring

- Security Solution

IoT Technology Market, by Platform

- Device Management

- Application Management

- Network Management

IoT Technology Market, by Service

- Professional Services

- Managed Services

IoT Technology Market, by End-use Application

- Healthcare

- Automotive & Transportation

- Building Automation

- Manufacturing

- Retail

- BFSI

- Oil & Gas

- Agriculture

- Aerospace & Defense

- Wearable Devices

- Consumer Electronics

Geographic Analysis

- North America

- Latin America

- Europe

- APAC

- RoW

Recent Developments in IoT technology Industry :

- In April 2021, Intel launched new 3rd Generation Intel Xeon Scalable processors — combined with Intel’s portfolio of Intel Optane persistent memory and storage, Ethernet adapters, FPGAs, and optimized software solutions.

- In October 2020, Texas Instruments launched a new Ethernet physical layer (PHY) capable of transmitting 10-Mbps Ethernet signals up to 1.7 km through a single pair of twisted wires.

- In August 2019, Qualcomm entered into a new direct worldwide patent license 5-year agreement with LTE, which covered 3G, 4G, and 5G single and multimode devices.

Frequently Asked Questions (FAQ):

What is the current size of the global IoT technology market?

The IoT technology market is expected to grow from USD 384.5 billion in 2021 to USD 566.4 billion by 2027, at a CAGR of 6.7%.

Who are the winners in the global IoT technology market?

Some of the key companies operating in the IoT technology market are Intel Corporation (US), Qualcomm Technologies (US), Texas Instruments Incorporated (US), STMicroelectronics (Switzerland), IBM (US), Hewlett Packard Enterprise (US), Cisco Systems (US), Microsoft Corporation (US), PTC (US), and Amazon Web Services (AWS) (US), and so on. These players have adopted various growth strategies such as product launches/developments, partnerships/acquisitions/agreements/expansions to expand their global presence and increase their share in the global IoT technology market.

What are the major drivers for the IoT technology market?

The factors such as emergence of 5G communications technology, increasing necessity of data centers due to rising adoption of cloud platforms, growing use of wireless smart sensors and networks, and increased IP address space and better security solutions made available through IPv6 have proved to be the major driving forces for IoT technology market.

Which major countries are considered in the European region?

The report includes an analysis of the UK, Germany, France, and rest of European countries.

What are the impact of COVID-19 on the global IoT technology market?

The pandemic has affected various industries such as automotive, semiconductors, and energy. The functioning of manufacturing units is highly hampered owing to the global lockdowns and the limited availability of labor and raw materials. The pandemic has adversely impacted the supply chain of the industry. While there are several verticals that utilize IoT technologies, such as manufacturing, transportation, and travel and hospitality, where all the operations are put on hold, customers have changed their organization’s priorities. Moreover, in the wake of the current situation, the key players focus on maintaining and generating operating revenues. This has led to a reduction in the number of developments in the IoT node and gateway market. A number of scheduled product launches and related developments have been postponed due to the pandemic. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 53)

1.1 STUDY OBJECTIVES

1.2 DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKET COVERED

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 PACKAGE SIZE

1.6 LIMITATIONS

1.7 MARKET STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 59)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 Secondary sources

2.1.2.2 List of key secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary sources

2.1.3.2 Key industry insights

2.1.3.3 Primary interviews with experts

2.1.3.4 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH (DEMAND SIZE): BOTTOM-UP APPROACH FOR ESTIMATION OF SIZE OF IOT TECHNOLOGY MARKET

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Estimating market size using bottom-up analysis (demand side)

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Estimating market size using top-down approach (supply side)

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 RISK ASSESSMENT

TABLE 1 LIMITATIONS & ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 70)

FIGURE 6 IOT TECHNOLOGY MARKET: OPTIMISTIC, REALISTIC, AND PESSIMISTIC SCENARIO ANALYSIS, 2017–2027

3.1 IOT TECHNOLOGY MARKET: REALISTIC SCENARIO (POST-COVID-19)

3.2 MARKET: OPTIMISTIC SCENARIO (POST-COVID-19)

3.3 MARKET: PESSIMISTIC SCENARIO (POST-COVID-19)

FIGURE 7 CONNECTIVITY IC SEGMENT TO HOLD LARGEST SIZE OF MARKET FROM 2021 TO 2027

FIGURE 8 DATA MANAGEMENT SEGMENT TO HOLD LARGEST SIZE OF MARKET FROM 2021 TO 2027

FIGURE 9 CONSUMER APPLICATION SEGMENT TO HOLD LARGER SIZE OF MARKET FROM 2021 TO 2027

FIGURE 10 NORTH AMERICA HELD LARGEST SHARE OF IOT TECHNOLOGY MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 76)

4.1 KEY OPPORTUNITIES IN IOT TECHNOLOGY MARKET

FIGURE 11 MARKET TO REGISTER HIGHEST CAGR IN APAC FROM 2021 TO 2027

4.2 MARKET, BY NODE COMPONENT

FIGURE 12 LOGIC DEVICE SEGMENT TO REGISTER HIGHEST CAGR IN MARKET FROM 2021 TO 2027

4.3 MARKET, BY END-USE APPLICATION

FIGURE 13 CONSUMER SEGMENT TO HOLD LARGER SIZE OF MARKET FROM 2021 TO 2027

4.4 IOT TECHNOLOGY MARKET IN NORTH AMERICA, BY COUNTRY AND END-USE APPLICATION

FIGURE 14 BUILDING AUTOMATION SEGMENT AND US HELD LARGEST SHARES OF MARKET IN NORTH AMERICA IN 2020

4.5 IOT TECHNOLOGY MARKET, BY COUNTRY

FIGURE 15 MARKET TO REGISTER HIGHEST CAGR IN CHINA DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 79)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Emergence of 5G communications technology

FIGURE 17 INTERNET USERS TILL SEPTEMBER 30, 2020, BY REGION

FIGURE 18 INTERNET PENETRATION RATE TILL SEPTEMBER 30, 2020, BY REGION

5.2.1.2 Increasing necessity of data centers due to rising adoption of cloud platforms

5.2.1.3 Growing use of wireless smart sensors and networks

5.2.1.4 Increased IP address space and better security solutions made available through IPv6

FIGURE 19 CONNECTION OF DIFFERENT NODES TO CLOUD VIA IPV6

FIGURE 20 IMPACT ANALYSIS OF DRIVERS ON IOT TECHNOLOGY MARKET

5.2.2 RESTRAINTS

5.2.2.1 Unsettled concerns regarding security and privacy of user data

FIGURE 21 IMPACT ANALYSIS OF RESTRAINTS ON IOT TECHNOLOGY MARKET

5.2.3 OPPORTUNITIES

5.2.3.1 Cross-domain collaborations

FIGURE 22 CROSS-DOMAIN COLLABORATIONS BY USING IOT

5.2.3.2 Government support for research and development of IoT technologies

5.2.3.3 Accelerated IoT adoption in healthcare post COVID-19 outbreak

FIGURE 23 IMPORTANT SERVICES OFFERED BY IOT IN HEALTHCARE

FIGURE 24 IMPACT ANALYSIS OF OPPORTUNITIES ON MARKET

5.2.4 CHALLENGES

5.2.4.1 Interoperability and lack of common standards

5.2.4.2 High power consumption by wireless sensor terminals/connected devices

5.2.4.3 Delay in deployment of IoT projects due to lack of IoT-related skills and connectivity issues

FIGURE 25 IMPACT ANALYSIS OF CHALLENGES ON IOT TECHNOLOGY MARKET

5.3 VALUE CHAIN ANALYSIS

FIGURE 26 VALUE CHAIN: IOT TECHNOLOGY MARKET

5.4 TECHNOLOGY ANALYSIS

5.4.1 ARTIFICIAL INTELLIGENCE (AI)

5.4.2 MACHINE LEARNING

5.4.3 DIGITAL TWIN

5.4.4 EDGE COMPUTING

5.4.5 WI-FI

5.4.6 CLOUD COMPUTING

5.4.7 BIG DATA ANALYTICS

5.5 PATENT ANALYSIS

TABLE 2 PATENTS IN IOT TECHNOLOGY MARKET

5.6 PORTER’S FIVE FORCES ANALYSIS

FIGURE 27 PORTER’S FIVE FORCES ANALYSIS, 2020

TABLE 3 IOT TECHNOLOGY MARKET: PORTER’S FIVE FORCES ANALYSIS

5.6.1 INTENSITY OF COMPETITIVE RIVALRY

5.6.2 THREAT OF SUBSTITUTES

5.6.3 BARGAINING POWER OF BUYERS

5.6.4 BARGAINING POWER OF SUPPLIERS

5.6.5 THREAT OF NEW ENTRANTS

5.7 ECOSYSTEM ANALYSIS

5.8 TRENDS AND DISRUPTIONS IMPACTING BUSINESSES OF CUSTOMERS

5.9 CASE STUDY ANALYSIS

5.9.1 CASE STUDY 1: ATOS

TABLE 4 ATOS’ END-TO-END SOLUTION HELPED CCHBC IMPROVE CONSUMER RETAIL EXPERIENCE

5.9.2 CASE STUDY 2: HCL TECHNOLOGIES

TABLE 5 HCL TECHNOLOGIES HELPED PHARMA COMPANY ENHANCE PATIENT CARE WITH ITS IOT SOLUTION

5.9.3 CASE STUDY 3: AMAZON WEB SERVICES (AWS)

TABLE 6 AWS HELPED LG MAINTAIN CONTINUOUS CONNECTIVITY BETWEEN THINQ DEVICES AND ITS IOT PLATFORM

5.9.4 CASE STUDY 4: BOSCH

TABLE 7 WITH BOSCH’S IOT SOLUTION, HOLMER IMPROVED MACHINERY MANAGEMENT

5.10 AVERAGE SELLING PRICE TREND

FIGURE 28 AVERAGE SELLING PRICE OF IOT SENSORS, 2017–2019

5.11 TRADE ANALYSIS

5.11.1 TRADE ANALYSIS FOR HVAC

TABLE 8 WINDOW/WALL, SELF-CONTAINED, OR SPLIT-SYSTEM AIR-CONDITIONING MACHINE IMPORTS, BY COUNTRY, 2015–2019 (USD MILLION)

TABLE 9 WINDOW/WALL, SELF-CONTAINED, OR SPLIT-SYSTEM AIR-CONDITIONING MACHINE EXPORTS, BY COUNTRY, 2015–2019 (USD MILLION)

5.11.2 TRADE ANALYSIS FOR VIDEO SURVEILLANCE

TABLE 10 TELEVISION CAMERA, DIGITAL CAMERA, AND VIDEO CAMERA RECORDER EXPORTS, BY COUNTRY, 2015–2019 (USD MILLION)

TABLE 11 TELEVISION CAMERA, DIGITAL CAMERA, AND VIDEO CAMERA RECORDER IMPORTS, BY COUNTRY, 2015–2019 (USD MILLION)

5.11.3 TRADE ANALYSIS FOR FIRE PROTECTION SYSTEMS

TABLE 12 FIRE EXTINGUISHER EXPORTS, BY COUNTRY, 2015–2019 (USD MILLION)

TABLE 13 FIRE EXTINGUISHER IMPORTS, BY COUNTRY, 2015–2019 (USD MILLION)

5.12 REGULATORY LANDSCAPE

5.12.1 GENERAL DATA PROTECTION REGULATION

5.12.2 CALIFORNIA CONSUMER PRIVACY ACT

5.12.3 SERVICE ORGANIZATION CONTROL 2

5.12.4 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

5.12.5 COMMUNICATIONS DECENCY ACT

5.12.6 ANTI-CYBERSQUATTING CONSUMER PROTECTION ACT

5.12.7 CEN/ISO

5.12.8 ISO/IEC JTC 1

5.12.8.1 I SO/I EC J T C 1 /SWG 5

5.12.8.2 ISO/I EC J T C 1 /SC 3 1

5.12.8.3 ISO/I EC J T C 1 /SC 2 7

5.12.8.4 ISO/I EC J T C 1 /WG 7 S e n s o r s

5.12.9 ETSI

5.12.10 IEEE

6 INTERNET OF THINGS TECHNOLOGY MARKET, BY NODE COMPONENT (Page No. - 112)

6.1 INTRODUCTION

FIGURE 29 IOT TECHNOLOGY MARKET, BY NODE COMPONENT

FIGURE 30 CONNECTIVITY IC TO HOLD LARGEST SIZE OF IOT TECHNOLOGY MARKET IN 2021

TABLE 14 MARKET, BY NODE COMPONENT, 2017–2020 (MILLION UNITS)

TABLE 15 MARKET, BY NODE COMPONENT, 2021–2027 (MILLION UNITS)

6.2 PROCESSOR

6.2.1 PROCESSORS FACILITATE REAL-TIME DATA MONITORING AND ANALYTICS IN IOT DEVICES

TABLE 16 MARKET FOR PROCESSORS, BY TYPE, 2017–2020 (MILLION UNITS)

TABLE 17 MARKET FOR PROCESSORS, BY TYPE, 2021–2027 (MILLION UNITS)

6.2.2 MICROCONTROLLER (MCU)

6.2.3 MICROPROCESSOR (MPU)

6.2.4 DIGITAL SIGNAL PROCESSOR (DSP)

6.2.5 APPLICATION PROCESSOR (AP)

TABLE 18 MARKET FOR PROCESSORS, BY END-USE APPLICATION, 2017–2020 (MILLION UNITS)

TABLE 19 MARKET FOR PROCESSORS, BY END-USE APPLICATION, 2021–2027 (MILLION UNITS)

TABLE 20 MARKET FOR PROCESSORS, BY INDUSTRIAL APPLICATION, 2017–2020 (MILLION UNITS)

TABLE 21 MARKET FOR PROCESSOR, BY INDUSTRIAL APPLICATION, 2021–2027 (MILLION UNITS)

TABLE 22 MARKET FOR PROCESSORS, BY CONSUMER APPLICATION, 2017–2020 (MILLION UNITS)

TABLE 23 MARKET FOR PROCESSORS, BY CONSUMER APPLICATION, 2021–2027 (MILLION UNITS)

6.3 SENSOR

6.3.1 SENSORS CAN MEASURE VARIOUS PARAMETERS IN IOT DEVICES

TABLE 24 IOT TECHNOLOGY MARKET FOR SENSORS, BY TYPE, 2017–2020 (MILLION UNITS)

TABLE 25 IOT TECHNOLOGY MARKET FOR SENSORS, BY TYPE, 2021–2027 (MILLION UNITS)

6.3.2 ACCELEROMETER

6.3.3 INERTIAL MEASUREMENT UNIT (IMU)

6.3.4 HEART RATE SENSOR

6.3.5 PRESSURE SENSOR

6.3.6 TEMPERATURE SENSOR

6.3.7 BLOOD GLUCOSE SENSOR

6.3.8 BLOOD OXYGEN SENSOR

6.3.9 ELECTROCARDIOGRAM (ECG) SENSOR

6.3.10 HUMIDITY SENSOR

6.3.11 IMAGE SENSOR

6.3.12 AMBIENT LIGHT SENSOR

6.3.13 FLOW SENSOR

6.3.14 LEVEL SENSOR

6.3.15 CHEMICAL SENSOR

6.3.16 CARBON MONOXIDE SENSOR

6.3.17 MOTION AND POSITION SENSOR

6.3.18 CAMERA MODULE

TABLE 26 MARKET FOR SENSORS, BY END-USE APPLICATION, 2017–2020 (MILLION UNITS)

TABLE 27 MARKET FOR SENSORS, BY END-USE APPLICATION, 2021–2027 (MILLION UNITS)

TABLE 28 MARKET FOR SENSORS, BY INDUSTRIAL APPLICATION, 2017–2020 (MILLION UNITS)

TABLE 29 MARKET FOR SENSORS, BY INDUSTRIAL APPLICATION, 2021–2027 (MILLION UNITS)

TABLE 30 MARKET FOR SENSORS, BY CONSUMER APPLICATION, 2017–2020 (MILLION UNITS)

TABLE 31 MARKET FOR SENSORS, BY CONSUMER APPLICATION, 2021–2027 (MILLION UNITS)

6.4 CONNECTIVITY IC

TABLE 32 IOT TECHNOLOGY MARKET FOR CONNECTIVITY INTEGRATED CIRCUITS, BY CONNECTIVITY TECHNOLOGY, 2017–2020 (MILLION UNITS)

TABLE 33 MARKET FOR CONNECTIVITY INTEGRATED CIRCUITS, BY CONNECTIVITY TECHNOLOGY, 2021–2027(MILLION UNITS)

6.4.1 WIRED

6.4.1.1 Ethernet/IP

6.4.1.2 Modbus

6.4.1.3 Profinet

6.4.1.4 Foundation Fieldbus (FF)

TABLE 34 MARKET FOR CONNECTIVITY INTEGRATED CIRCUITS, BY WIRED CONNECTIVITY TECHNOLOGY, 2017–2020 (MILLION UNITS)

TABLE 35 MARKET FOR CONNECTIVITY INTEGRATED CIRCUITS, BY WIRED CONNECTIVITY TECHNOLOGY, 2021–2027 (MILLION UNITS)

6.4.2 WIRELESS

6.4.2.1 ANT+

6.4.2.2 Bluetooth

6.4.2.3 Bluetooth smart/Bluetooth low energy (BLE)

6.4.2.4 ZigBee

6.4.2.5 Wireless Fidelity (Wi-Fi)

FIGURE 31 SNAPSHOT OF KEY WI-FI-ENABLED IOT DEVICES

6.4.2.6 Near-field Communication (NFC)

6.4.2.7 Cellular Network

6.4.2.8 Wireless highway addressable remote transducer (WHART)

6.4.2.9 Global positioning system (GPS)/Global navigation satellite system (GNSS) module

6.4.2.10 ISA100

6.4.2.11 Bluetooth/WLAN

TABLE 36 IOT TECHNOLOGY MARKET FOR CONNECTIVITY INTEGRATED CIRCUITS, BY WIRELESS CONNECTIVITY TECHNOLOGY, 2017–2020 (MILLION UNITS)

TABLE 37 MARKET FOR CONNECTIVITY INTEGRATED CIRCUITS, BY WIRELESS CONNECTIVITY TECHNOLOGY, 2021–2027 (MILLION UNITS)

TABLE 38 MARKET FOR CONNECTIVITY INTEGRATED CIRCUITS, BY END-USE APPLICATION, 2017–2020 (MILLION UNITS)

TABLE 39 MARKET FOR CONNECTIVITY INTEGRATED CIRCUITS, BY END-USE APPLICATION, 2021–2027 (MILLION UNITS)

TABLE 40 MARKET FOR CONNECTIVITY INTEGRATED CIRCUITS, BY INDUSTRIAL APPLICATION, 2017–2020 (MILLION UNITS)

TABLE 41 MARKET FOR CONNECTIVITY INTEGRATED CIRCUITS, BY INDUSTRIAL APPLICATION, 2021–2027 (MILLION UNITS)

TABLE 42 MARKET FOR CONNECTIVITY INTEGRATED CIRCUITS, BY CONSUMER APPLICATION, 2017–2020 (MILLION UNITS)

TABLE 43 MARKET FOR CONNECTIVITY INTEGRATED CIRCUITS, BY CONSUMER APPLICATION, 2021–2027 (MILLION UNITS)

6.5 MEMORY DEVICE

6.5.1 ON-CHIP MEMORY

6.5.1.1 On-chip memory offers high-speed performance with reduced power consumption

TABLE 44 IOT TECHNOLOGY MARKET FOR MEMORY DEVICES, BY TYPE, 2017–2020 (MILLION UNITS)

TABLE 45 IOT TECHNOLOGY MARKET FOR MEMORY DEVICES, BY TYPE, 2021–2027 (MILLION UNITS)

6.5.2 OFF-CHIP MEMORY/EXTERNAL MEMORY

6.5.2.1 Off-chip memory devices are mostly used in servers, PCs, and mobile devices

FIGURE 32 SNAPSHOT OF FLOW OF DATA FROM EDGE DEVICES/NODES TO STORAGE CENTRES VIA GATEWAY

TABLE 46 MARKET FOR MEMORY DEVICES, BY END-USE APPLICATION, 2017–2020 (MILLION UNITS)

TABLE 47 MARKET FOR MEMORY DEVICES, BY END-USE APPLICATION, 2021–2027 (MILLION UNITS)

TABLE 48 MARKET FOR MEMORY DEVICES, BY INDUSTRIAL APPLICATION, 2017–2020 (MILLION UNITS)

TABLE 49 MARKET FOR MEMORY DEVICES, BY INDUSTRIAL APPLICATION, 2021–2027 (MILLION UNITS)

TABLE 50 MARKET FOR MEMORY DEVICES, BY CONSUMER APPLICATION, 2017–2020 (MILLION UNITS)

TABLE 51 MARKET FOR MEMORY DEVICES, BY CONSUMER APPLICATION, 2021–2027 (MILLION UNITS)

6.6 LOGIC DEVICE

6.6.1 LOGIC DEVICE OFFERS ADVANTAGES LIKE RAPID PROTOTYPING, SHORTER TIME TO MARKET, AND LONG PRODUCT CYCLE

6.6.2 FIELD-PROGRAMMABLE GATE ARRAY (FPGA)

TABLE 52 MARKET FOR LOGIC DEVICES, BY TYPE, 2017–2020 (MILLION UNITS)

TABLE 53 MARKET FOR LOGIC DEVICES, BY TYPE, 2021–2027 (MILLION UNITS)

TABLE 54 MARKET FOR LOGIC DEVICES, BY END-USE APPLICATION, 2017–2020 (MILLION UNITS)

TABLE 55 MARKET FOR LOGIC DEVICES, BY END-USE APPLICATION, 2021–2027 (MILLION UNITS)

7 INTERNET OF THINGS TECHNOLOGY MARKET, BY SOFTWARE SOLUTION (Page No. - 142)

7.1 INTRODUCTION

FIGURE 33 INTERNET OF THINGS TECHNOLOGY MARKET, BY SOFTWARE SOLUTION

FIGURE 34 REMOTE MONITORING SEGMENT IS EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 56 MARKET, BY SOFTWARE SOLUTION, 2017–2020 (USD BILLION)

TABLE 57 MARKET, BY SOFTWARE SOLUTION, 2021–2027 (USD BILLION)

7.2 REAL-TIME STREAMING ANALYTICS

7.2.1 IOT REAL-TIME STREAMING ANALYTICS SOLUTIONS LEVERAGE REAL-TIME REMOTE MANAGEMENT AND MONITORING AND GAIN INSIGHTS FROM REMOTE DEVICES

7.3 SECURITY SOLUTION

7.3.1 SECURITY SOLUTIONS ENABLE ORGANIZATIONS TO SECURE THEIR IOT ECOSYSTEM FROM SOPHISTICATED AND ADVANCED THREATS

7.4 DATA MANAGEMENT

7.4.1 DATA MANAGEMENT SOLUTIONS HELP TO MANAGE STRUCTURED AND UNSTRUCTURED DATA TO GENERATE INSIGHTS FROM DATA

7.5 REMOTE MONITORING

7.5.1 REMOTE MONITORING SYSTEMS HELP IN MINIMIZING COSTS AND PREVENTING UNPLANNED DOWNTIME

7.6 NETWORK BANDWIDTH MANAGEMENT

7.6.1 NETWORK BANDWIDTH MANAGEMENT INCREASES NETWORK EFFICIENCY BY TRACKING BANDWIDTH AND RESOURCE CONSUMPTION

8 INTERNET OF THINGS TECHNOLOGY MARKET, BY PLATFORM (Page No. - 148)

8.1 INTRODUCTION

FIGURE 35 IOT TECHNOLOGY MARKET, BY PLATFORM

FIGURE 36 NETWORK MANAGEMENT SEGMENT TO HOLD LARGEST MARKET SIZE IN 2021

TABLE 58 MARKET, BY PLATFORM, 2017–2020 (USD BILLION)

TABLE 59 MARKET, BY PLATFORM, 2021–2027 (USD BILLION)

8.2 DEVICE MANAGEMENT

8.2.1 DEVICE MANAGEMENT PLATFORMS HELP IN KEEPING SMART ASSETS CONNECTED, UP-TO-DATE, AND SECURE

8.3 APPLICATION MANAGEMENT

8.3.1 APPLICATION MANAGEMENT PLATFORMS MAINLY FOCUS ON MANAGING FIRMWARE AND SOFTWARE UPDATES IN DEVICES AND APPLICATIONS

8.4 NETWORK MANAGEMENT

8.4.1 NETWORK MANAGEMENT AIDS SEAMLESS AND FASTER DATA TRANSFER IN CRITICAL APPLICATIONS

9 INTERNET OF THINGS TECHNOLOGY MARKET, BY SERVICE (Page No. - 153)

9.1 INTRODUCTION

FIGURE 37 IOT TECHNOLOGY MARKET, BY SERVICE

FIGURE 38 MANAGED SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 60 MARKET, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 61 MARKET, BY SERVICE, 2021–2027 (USD MILLION)

9.2 PROFESSIONAL SERVICES

FIGURE 39 PROFESSIONAL SERVICES FOR IOT

9.2.1 DEPLOYMENT AND INTEGRATION SERVICE

9.2.1.1 Deployment and integration services allow organizations to integrate their operational and enterprise environment to ultimately provide transparent and secure IoT experience

9.2.2 SUPPORT AND MAINTENANCE

9.2.2.1 Support and maintenance services give organizations access to latest software features and functionalities

9.2.3 CONSULTING SERVICE

9.2.3.1 Consulting services help in identifying right platforms according to requirements, reducing complexity, and developing services in right time

9.3 MANAGED SERVICES

9.3.1 MANAGED SERVICES INCREASES PRODUCTIVITY AND HELP IN MITIGATING RISKS

FIGURE 40 MANAGED SERVICES FOR IOT

10 IOT TECHNOLOGY MARKET, BY END-USE APPLICATION (Page No. - 159)

10.1 INTRODUCTION

FIGURE 41 IOT TECHNOLOGY MARKET, BY END-USE APPLICATION

TABLE 62 MARKET, BY END-USE APPLICATION, 2017–2020 (USD MILLION)

TABLE 63 MARKET, BY END-USE APPLICATION, 2021–2027 (USD MILLION)

FIGURE 42 CONSUMER SEGMENT TO HOLD LARGE SIZE OF IOT TECHNOLOGY MARKET, 2021 TO 2027

TABLE 64 IOT TECHNOLOGY MARKET FOR INDUSTRIAL AND CONSUMER, BY SUB APPLICATION, 2017–2020 (USD MILLION)

TABLE 65 MARKET FOR INDUSTRIAL AND CONSUMER, BY SUB APPLICATION, 2021–2027 (USD MILLION)

FIGURE 43 CONSUMER ELECTRONICS SEGMENT EXPECTED TO HOLD LARGEST SIZE OF IOT TECHNOLOGY MARKET FROM 2021 TO 2027

TABLE 66 MARKET FOR INDUSTRIAL AND CONSUMER, BY SUB APPLICATION, 2017–2020 (MILLION UNITS)

TABLE 67 MARKET FOR INDUSTRIAL AND CONSUMER, BY SUB APPLICATION, 2021–2027 (MILLION UNITS)

TABLE 68 MARKET FOR GATEWAYS, BY END-USE APPLICATION, 2017–2020 (THOUSAND UNITS)

TABLE 69 MARKET FOR GATEWAYS, BY END-USE APPLICATION, 2021–2027 (THOUSAND UNITS)

10.2 INDUSTRIAL

10.2.1 HEALTHCARE

10.2.1.1 Remote monitoring of patients post COVID-19 has fueled demand for IoT in healthcare

TABLE 70 MARKET FOR HEALTHCARE, BY DEVICE TYPE, 2017–2020 (USD MILLION)

TABLE 71 MARKET FOR HEALTHCARE, BY DEVICE TYPE, 2021–2027 (USD MILLION)

TABLE 72 IOT TECHNOLOGY (ONLY NODE) MARKET FOR HEALTHCARE, BY DEVICE TYPE, 2017–2020 (THOUSAND UNITS)

TABLE 73 MARKET FOR HEALTHCARE, BY DEVICE TYPE, 2017–2020 (THOUSAND UNITS)

TABLE 74 IOT TECHNOLOGY (ONLY NODE) MARKET FOR HEALTHCARE, BY DEVICE TYPE, 2021–2027 (THOUSAND UNITS)

TABLE 75 MARKET FOR HEALTHCARE, BY DEVICE TYPE, 2021–2027 (THOUSAND UNITS)

TABLE 76 MARKET FOR HEALTHCARE, BY NODE COMPONENT, 2017–2020 (MILLION UNITS)

TABLE 77 MARKET FOR HEALTHCARE, BY NODE COMPONENT, 2021–2027 (MILLION UNITS)

TABLE 78 MARKET FOR HEALTHCARE, BY PROCESSOR TYPE, 2017–2020 (MILLION UNITS)

TABLE 79 MARKET FOR HEALTHCARE, BY PROCESSOR TYPE, 2021–2027 (MILLION UNITS)

TABLE 80 MARKET FOR HEALTHCARE IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 81 MARKET FOR HEALTHCARE IN NORTH AMERICA, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 82 MARKET FOR HEALTHCARE IN LATIN AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 83 MARKET FOR HEALTHCARE IN LATIN AMERICA, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 84 MARKET FOR HEALTHCARE IN EUROPE, COUNTRY, 2017–2020 (USD MILLION)

TABLE 85 MARKET FOR HEALTHCARE IN EUROPE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 86 MARKET FOR HEALTHCARE IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 87 MARKET FOR HEALTHCARE IN APAC, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 88 MARKET FOR HEALTHCARE IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 89 MARKET FOR HEALTHCARE IN ROW, BY REGION, 2021–2027 (USD MILLION)

10.2.1.2 Healthcare application: Products covered

10.2.1.2.1 Fitness & heart rate monitors

10.2.1.2.2 Blood pressure monitors

10.2.1.2.3 Blood glucose meters

10.2.1.2.4 Continuous Glucose Monitors

10.2.1.2.5 Pulse oximeters

10.2.1.2.6 Automated external defibrillators

10.2.1.2.7 Programmable syringe pumps

10.2.1.2.8 Wearable injectors

10.2.1.2.9 Multiparameter monitors

10.2.1.2.10 Fall detectors

10.2.1.2.11 Smart pill dispensers

10.2.1.2.12 Gateways

10.2.2 AUTOMOTIVE & TRANSPORTATION

10.2.2.1 Autonomous cars and intelligent transportation trends are fueling growth of market

TABLE 90 IOT TECHNOLOGY MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY TYPE, 2017–2020 (USD MILLION)

TABLE 91 MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY TYPE, 2021–2027 (USD MILLION)

TABLE 92 MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY TYPE, 2017–2020 (MILLION UNITS)

TABLE 93 MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY TYPE, 2021–2027 (MILLION UNITS)

TABLE 94 IMARKET FOR AUTOMOTIVE & TRANSPORTATION, BY NODE COMPONENT, 2017–2020 (MILLION UNITS)

TABLE 95 MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY NODE COMPONENT, 2021–2027 (MILLION UNITS)

TABLE 96 MARKET FOR AUTOMOTIVE & TRANSPORTATION IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 97 MARKET FOR AUTOMOTIVE & TRANSPORTATION IN NORTH AMERICA, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 98 MARKET FOR AUTOMOTIVE & TRANSPORTATION IN LATIN AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 99 MARKET FOR AUTOMOTIVE & TRANSPORTATION IN LATIN AMERICA, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 100 MARKET FOR AUTOMOTIVE & TRANSPORTATION IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 101 MARKET FOR AUTOMOTIVE & TRANSPORTATION IN EUROPE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 102 MARKET FOR AUTOMOTIVE & TRANSPORTATION IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 103 MARKET FOR AUTOMOTIVE & TRANSPORTATION IN APAC, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 104 MARKET FOR AUTOMOTIVE & TRANSPORTATION IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 105 MARKET FOR AUTOMOTIVE & TRANSPORTATION IN ROW, BY REGION, 2021–2027 (USD MILLION)

10.2.2.2 Automotive & transportation application: Products covered

10.2.2.2.1 Connected cars

10.2.2.2.1.1 Level 1 – driver assistance

10.2.2.2.1.2 Level 2 – partial automation

10.2.2.2.1.3 Level 3 – conditional automation

10.2.2.2.1.4 Level 4 – high automation

10.2.2.2.2 Ultrasonic sensors

10.2.2.2.3 Cameras/image sensors

10.2.2.2.4 Radar

10.2.2.2.5 Lidar

10.2.2.2.6 Infrared (IR) detector

10.2.2.3 In-car infotainment

10.2.2.4 Traffic management

10.2.2.4.1 Vehicle detection sensor

10.2.2.4.2 Pedestrian presence sensor

10.2.2.4.3 Speed sensor

10.2.2.4.4 Thermal camera

10.2.2.4.5 Automated incident detection (AID) camera

10.2.2.5 Public transport/mass transit

10.2.2.6 E-tolls/E-highways

10.2.2.7 Gateways

10.2.3 BUILDING AUTOMATION

10.2.3.1 Need for energy efficiency and enhanced security is boosting adoption of IoT in building automation

TABLE 106 IOT TECHNOLOGY MARKET FOR BUILDING AUTOMATION, BY TYPE, 2017–2020 (USD MILLION)

TABLE 107 MARKET FOR BUILDING AUTOMATION, BY TYPE, 2021–2027 (USD MILLION)

TABLE 108 IOT TECHNOLOGY (ONLY NODE) MARKET FOR BUILDING AUTOMATION, BY DEVICE TYPE, 2017–2020 (MILLION UNITS)

TABLE 109 MARKET FOR BUILDING AUTOMATION, BY DEVICE TYPE, 2017–2020 (MILLION UNITS)

TABLE 110 (ONLY NODE) MARKET FOR BUILDING AUTOMATION, BY DEVICE TYPE, 2021–2027 (MILLION UNITS)

TABLE 111 MARKET FOR BUILDING AUTOMATION, BY DEVICE TYPE, 2021–2027 (MILLION UNITS)

TABLE 112 MARKET FOR BUILDING AUTOMATION, BY NODE COMPONENT, 2017–2020 (MILLION UNITS)

TABLE 113 MARKET FOR BUILDING AUTOMATION, BY NODE COMPONENT, 2021–2027 (MILLION UNITS)

TABLE 114 MARKET FOR BUILDING AUTOMATION, BY PROCESSOR TYPE, 2017–2020 (MILLION UNITS)

TABLE 115 MARKET FOR BUILDING AUTOMATION, BY PROCESSOR TYPE, 2021–2027 (MILLION UNITS)

TABLE 116 MARKET FOR BUILDING AUTOMATION IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 117 MARKET FOR BUILDING AUTOMATION IN NORTH AMERICA, 2021–2027 (USD MILLION)

TABLE 118 MARKET FOR BUILDING AUTOMATION IN LATIN AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 119 MARKET FOR BUILDING AUTOMATION IN LATIN AMERICA, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 120 MARKET FOR BUILDING AUTOMATION IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 121 MARKET FOR BUILDING AUTOMATION IN EUROPE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 122 MARKET FOR BUILDING AUTOMATION IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 123 MARKET FOR BUILDING AUTOMATION IN APAC, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 124 MARKET FOR BUILDING AUTOMATION IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 125 MARKET FOR BUILDING AUTOMATION IN ROW, BY REGION, 2021–2027 (USD MILLION)

10.2.3.2 Building automation application: Products covered

10.2.3.2.1 Occupancy sensors

10.2.3.2.2 Daylight sensors

10.2.3.2.3 Smart Thermostats

10.2.3.2.4 IP cameras

10.2.3.2.5 Smart meters

10.2.3.2.6 Smart locks

10.2.3.2.7 Smoke detectors

10.2.3.2.8 Gateways

10.2.4 MANUFACTURING

10.2.4.1 Adoption of industry 4.0 principles has fueled IoT adoption in manufacturing

10.2.4.2 Manufacturing application: Products covered

10.2.4.2.1 Temperature sensors

10.2.4.2.2 Pressure sensors

10.2.4.2.3 Level sensors

10.2.4.2.4 Flow sensors

10.2.4.2.5 Chemical sensors

10.2.4.2.6 Humidity sensors

10.2.4.2.7 Motion and position sensors

10.2.4.2.8 Image sensors

10.2.4.2.9 Gateways

TABLE 126 IOT TECHNOLOGY MARKET FOR MANUFACTURING, BY TYPE, 2017–2020 (USD MILLION)

TABLE 127 MARKET FOR MANUFACTURING, BY TYPE, 2021–2027 (USD MILLION)

TABLE 128 (ONLY NODE) MARKET FOR MANUFACTURING, BY DEVICE TYPE, 2017–2020 (MILLION UNITS)

TABLE 129 MARKET FOR MANUFACTURING, BY DEVICE TYPE, 2017–2020 (MILLION UNITS)

TABLE 130 (ONLY NODE) MARKET FOR MANUFACTURING, BY DEVICE TYPE, 2021–2027 (MILLION UNITS)

TABLE 131 MARKET FOR MANUFACTURING, BY DEVICE TYPE, 2021–2027 (MILLION UNITS)

TABLE 132 MARKET FOR MANUFACTURING, BY NODE COMPONENT, 2017–2020 (MILLION UNITS)

TABLE 133 MARKET FOR MANUFACTURING, BY NODE COMPONENT, 2021–2027 (MILLION UNITS)

TABLE 134 MARKET FOR MANUFACTURING, BY CONNECTIVITY TECHNOLOGY, 2017–2020 (MILLION UNITS)

TABLE 135 MARKET FOR MANUFACTURING, BY CONNECTIVITY TECHNOLOGY, 2021–2027 (MILLION UNITS)

TABLE 136 MARKET FOR MANUFACTURING, BY WIRED CONNECTIVITY TECHNOLOGY, 2017–2020 (MILLION UNITS)

TABLE 137 MARKET FOR MANUFACTURING, BY WIRED CONNECTIVITY TECHNOLOGY, 2021–2027 (MILLION UNITS)

TABLE 138 MARKET FOR MANUFACTURING, BY WIRELESS CONNECTIVITY TECHNOLOGY, 2017–2020 (MILLION UNITS)

TABLE 139 MARKET FOR MANUFACTURING, BY WIRELESS CONNECTIVITY TECHNOLOGY, 2021–2027 (MILLION UNITS)

TABLE 140 MARKET FOR MANUFACTURING, BY DEVICE TYPE, 2017–2020 (THOUSAND UNITS)

TABLE 141 MARKET FOR MANUFACTURING, BY DEVICE TYPE, 2021–2027 (THOUSAND UNITS)

TABLE 142 MARKET FOR MANUFACTURING IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 143 MARKET FOR MANUFACTURING IN NORTH AMERICA, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 144 MARKET FOR MANUFACTURING IN LATIN AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 145 MARKET FOR MANUFACTURING IN LATIN AMERICA, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 146 MARKET FOR MANUFACTURING IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 147 MARKET FOR MANUFACTURING IN EUROPE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 148 MARKET FOR MANUFACTURING IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 149 IMARKET FOR MANUFACTURING IN APAC, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 150 MARKET FOR MANUFACTURING IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 151 MARKET FOR MANUFACTURING IN ROW, BY REGION, 2021–2027 (USD MILLION)

10.2.5 RETAIL

10.2.5.1 Growing popularity of digital signage and intelligent vending machines in retail is driving market growth

10.2.5.2 Retail application: Products covered

10.2.5.2.1 Intelligent vending machines

FIGURE 44 INTELLIGENT VENDING USING IOT GATEWAY

10.2.5.2.2 Contactless checkout/POS

10.2.5.2.3 Smart mirror

10.2.5.2.4 Smart shopping cart

10.2.5.2.5 Digital signage

10.2.5.2.6 Smart tags

10.2.5.2.7 Wireless beacon

10.2.5.2.8 Gateways

TABLE 152 MARKET FOR RETAIL, BY TYPE, 2017–2020 (USD THOUSAND)

TABLE 153 MARKET FOR RETAIL, BY TYPE, 2021–2027 (USD THOUSAND)

TABLE 154 (ONLY NODE) MARKET FOR RETAIL, BY DEVICE TYPE, 2017–2020 (THOUSAND UNITS)

TABLE 155 MARKET FOR RETAIL, BY DEVICE TYPE, 2017–2020 (THOUSAND UNITS)

TABLE 156 (ONLY NODE) MARKET FOR RETAIL, BY DEVICE TYPE, 2021–2027 (THOUSAND UNITS)

TABLE 157 MARKET FOR RETAIL, BY DEVICE TYPE, 2021–2027 (THOUSAND UNITS)

TABLE 158 MARKET FOR RETAIL, BY NODE COMPONENT, 2017–2020 (MILLION UNITS)

TABLE 159 MARKET FOR RETAIL, BY NODE COMPONENT, 2021–2027 (MILLION UNITS)

TABLE 160 MARKET FOR RETAIL IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 161 MARKET FOR RETAIL IN NORTH AMERICA, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 162 MARKET FOR RETAIL IN LATIN AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 163 MARKET FOR RETAIL IN LATIN AMERICA, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 164 MARKET FOR RETAIL IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 165 MARKET FOR RETAIL IN EUROPE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 166 MARKET FOR RETAIL IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 167 MARKET FOR RETAIL IN APAC, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 168 MARKET FOR RETAIL IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 169 MARKET FOR RETAIL IN ROW, BY REGION, 2021–2027 (USD MILLION)

10.2.6 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

10.2.6.1 Adoption of mPOS and kiosks is driving market growth

FIGURE 45 KEY APPLICATION AREAS OF IOT IN BFSI END-USE APPLICATION

10.2.6.2 BFSI application: Products covered

10.2.6.2.1 Mobile point of sale (mPOS)

10.2.6.2.2 Smart kiosk/Interactive kiosk

10.2.6.2.3 Gateways

TABLE 170 IOT TECHNOLOGY MARKET FOR BFSI, BY TYPE, 2017–2020 (USD MILLION)

TABLE 171 MARKET FOR BFSI, BY TYPE, 2021–2027 (USD MILLION)

TABLE 172 (ONLY NODE) MARKET FOR BFSI, BY TYPE, 2017–2020 (MILLION UNITS)

TABLE 173 MARKET FOR BFSI, BY TYPE, 2017–2020 (MILLION UNITS)

TABLE 174 (ONLY NODE) MARKET FOR BFSI, BY TYPE, 2021–2027 (MILLION UNITS)

&nnbsp; TABLE 175 IOT TECHNOLOGY MARKET FOR BFSI, BY TYPE, 2021–2027 (MILLION UNITS)

TABLE 176 MARKET FOR BFSI, BY NODE COMPONENT, 2017–2020 (THOUSAND UNITS)

TABLE 177 MARKET FOR BFSI, BY NODE COMPONENT, 2021–2027 (THOUSAND UNITS)

TABLE 178 MARKET FOR BFSI IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 179 MARKET FOR BFSI IN NORTH AMERICA, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 180 MARKET FOR BFSI IN LATIN AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 181 MARKET FOR BFSI IN LATIN AMERICA, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 182 MARKET FOR BFSI IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 183 MARKET FOR BFSI IN EUROPE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 184 MARKET FOR BFSI IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 185 MARKET FOR BFSI IN APAC, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 186 MARKET FOR BFSI IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 187 MARKET FOR BFSI IN ROW, BY REGION, 2021–2027 (USD MILLION)

10.2.7 OIL & GAS

10.2.7.1 Need for remote monitoring in operations of oil & gas industry is propelling market growth

10.2.7.2 Oil & gas application: Products covered

10.2.7.2.1 Temperature sensors

10.2.7.2.2 Pressure sensors

10.2.7.2.3 Level sensors

10.2.7.2.4 Flow sensors

10.2.7.2.5 Image sensors

10.2.7.2.6 Other sensors (humidity sensors, motion & position sensors, and chemical & gas sensors)

10.2.7.2.7 Gateways

TABLE 188 IOT TECHNOLOGY MARKET FOR OIL & GAS, BY TYPE, 2017–2020 (USD THOUSAND)

TABLE 189 MARKET FOR OIL & GAS, BY TYPE, 2021–2027 (USD THOUSAND)

TABLE 190 (ONLY NODE) MARKET FOR OIL & GAS, BY SENSOR TYPE, 2017–2020 (THOUSAND UNITS)

TABLE 191 MARKET FOR OIL & GAS, BY SENSOR TYPE, 2017–2020 (THOUSAND UNITS)

TABLE 192 (ONLY NODE) MARKET FOR OIL & GAS, BY SENSOR TYPE, 2021–2027 (THOUSAND UNITS)

TABLE 193 MARKET FOR OIL & GAS, BY SENSOR TYPE, 2021–2027 (THOUSAND UNITS)

TABLE 194 MARKET FOR OIL & GAS, BY NODE COMPONENT, 2017–2020 (MILLION UNITS)

TABLE 195 MARKET FOR OIL & GAS, BY NODE COMPONENT, 2021–2027 (MILLION UNITS)

TABLE 196 MARKET FOR OIL & GAS, BY CONNECTIVITY TECHNOLOGY, 2017–2020 (MILLION UNITS)

TABLE 197 MARKET FOR OIL & GAS, BY CONNECTIVITY TECHNOLOGY, 2021–2027 (MILLION UNITS)

TABLE 198 MARKET FOR OIL & GAS, BY WIRED CONNECTIVITY, 2017–2020 (THOUSAND UNITS)

TABLE 199 MARKET FOR OIL & GAS, BY WIRED CONNECTIVITY, 2021–2027 (THOUSAND UNITS)

TABLE 200 MARKET FOR OIL & GAS, BY WIRELESS CONNECTIVITY, 2017–2020 (THOUSAND UNITS)

TABLE 201 MARKET FOR OIL & GAS, BY WIRELESS CONNECTIVITY, 2021–2027 (THOUSAND UNITS)

TABLE 202 MARKET FOR OIL & GAS IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 203 MARKET FOR OIL & GAS IN NORTH AMERICA, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 204 MARKET FOR OIL & GAS IN LATIN AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 205 MARKET FOR OIL & GAS IN LATIN AMERICA, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 206 MARKET FOR OIL & GAS IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 207 MARKET FOR OIL & GAS IN EUROPE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 208 MARKET FOR OIL & GAS IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 209 MARKET FOR OIL & GAS IN APAC, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 210 MARKET FOR OIL & GAS IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 211 MARKET FOR OIL & GAS IN ROW, BY REGION, 2021–2027 (USD MILLION)

10.2.8 AGRICULTURE

10.2.8.1 Increasing global demand for food and adoption of smart farming practices is driving market growth

FIGURE 46 IOT IN AGRICULTURE

10.2.8.2 Agriculture application: Products covered

10.2.8.2.1 Climate sensors

10.2.8.2.2 Soil moisture sensors

10.2.8.2.3 Level sensors

10.2.8.2.4 Gateways

TABLE 212 MARKET FOR AGRICULTURE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 213 MARKET FOR AGRICULTURE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 214 (ONLY NODE) MARKET FOR AGRICULTURE, BY SENSOR TYPE, 2017–2020 (THOUSAND UNITS)

TABLE 215 MARKET FOR AGRICULTURE, BY DEVICE TYPE, 2017–2020 (THOUSAND UNITS)

TABLE 216 (ONLY NODE) MARKET FOR AGRICULTURE, BY SENSOR TYPE, 2021–2027 (THOUSAND UNITS)

TABLE 217 MARKET FOR AGRICULTURE, BY DEVICE TYPE, 2021–2027 (THOUSAND UNITS)

TABLE 218 MARKET FOR AGRICULTURE, BY NODE COMPONENT, 2017–2020 (THOUSAND UNITS)

TABLE 219 MARKET FOR AGRICULTURE, BY NODE COMPONENT, 2021–2027 (THOUSAND UNITS)

TABLE 220 MARKET FOR AGRICULTURE IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD THOUSAND)

TABLE 221 MARKET FOR AGRICULTURE IN NORTH AMERICA, BY COUNTRY, 2021–2027 (USD THOUSAND)

TABLE 222 MARKET FOR AGRICULTURE IN LATIN AMERICA, BY COUNTRY, 2017–2020 (USD THOUSAND)

TABLE 223 MARKET FOR AGRICULTURE IN LATIN AMERICA, BY COUNTRY, 2021–2027 (USD THOUSAND)

FALSE

TABLE 225 MARKET FOR AGRICULTURE IN EUROPE, BY COUNTRY, 2021–2027 (USD THOUSAND)

TABLE 226 MARKET FOR AGRICULTURE IN APAC, BY COUNTRY, 2017–2020 (USD THOUSAND)

TABLE 227 MARKET FOR AGRICULTURE IN APAC, BY COUNTRY, 2021–2027 (USD THOUSAND)

TABLE 228 MARKET FOR AGRICULTURE IN ROW, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 229 MARKET FOR AGRICULTURE IN ROW, BY REGION, 2021–2027 (USD THOUSAND)

10.2.9 AEROSPACE AND DEFENSE

10.2.9.1 Focus in improving efficiency, passenger safety, security, and experience is boosting IoT adoption in aerospace and defense

10.2.9.2 Aerospace and defense application: Products covered

10.2.9.2.1 Smart baggage tags

10.2.9.2.2 Smart beacons

10.2.9.2.3 ePassport gates

10.2.9.2.4 Drones/Unmanned aerial vehicle (UAV)

10.2.9.2.5 Gateways

TABLE 230 IOT TECHNOLOGY MARKET FOR AEROSPACE & DEFENSE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 231 MARKET FOR AEROSPACE & DEFENSE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 232 (ONLY NODE) MARKET FOR AEROSPACE & DEFENSE, BY TYPE, 2017–2020 (THOUSAND UNITS)

TABLE 233 MARKET FOR AEROSPACE & DEFENSE, BY TYPE, 2017–2020 (THOUSAND UNITS)

TABLE 234 (ONLY NODE) MARKET FOR AEROSPACE & DEFENSE, BY TYPE, 2021–2027 (THOUSAND UNITS)

TABLE 235 MARKET FOR AEROSPACE & DEFENSE, BY TYPE, 2021–2027 (THOUSAND UNITS)

TABLE 236 MARKET FOR AEROSPACE & DEFENSE, BY NODE COMPONENT, 2017–2020 (THOUSAND UNITS)

TABLE 237 MARKET FOR AEROSPACE & DEFENSE, BY NODE COMPONENT, 2021–2027 (THOUSAND UNITS)

TABLE 238 MARKET FOR AEROSPACE & DEFENSE IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 239 MARKET FOR AEROSPACE & DEFENSE IN NORTH AMERICA, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 240 MARKET FOR AEROSPACE & DEFENSE IN LATIN AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 241 MARKET FOR AEROSPACE & DEFENSE IN LATIN AMERICA, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 242 MARKET FOR AEROSPACE & DEFENSE IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 243 MARKET FOR AEROSPACE & DEFENSE IN EUROPE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 244 MARKET FOR AEROSPACE & DEFENSE IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 245 MARKET FOR AEROSPACE & DEFENSE IN APAC, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 246 IMARKET FOR AEROSPACE & DEFENSE IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 247 MARKET FOR AEROSPACE & DEFENSE IN ROW, BY REGION, 2021–2027 (USD MILLION)

10.3 CONSUMER

10.3.1 WEARABLE DEVICES

10.3.1.1 Escalating demand for smart watches to catalyze wearable devices market growth

FIGURE 47 WEARABLE TECHNOLOGY – KEY APPLICATIONS

10.3.1.2 Wearable devices application: Products covered

10.3.1.2.1 Activity monitors

10.3.1.2.2 Smart watches

10.3.1.2.3 Smart glasses

10.3.1.2.4 Body-worn cameras

10.3.1.2.5 Panic/SOS buttons

10.3.1.2.6 Smart locators

10.3.1.2.7 Smart water purifiers

10.3.1.2.8 Identity authenticators

10.3.1.2.9 Thermal bracelets

10.3.1.2.10 Safe driving ingestible pills

TABLE 248 IOT TECHNOLOGY MARKET FOR WEARABLE DEVICES, BY TYPE, 2017–2020 (USD MILLION)

TABLE 249 MARKET FOR WEARABLE DEVICES, BY TYPE, 2021–2027 (USD MILLION)

TABLE 250 MARKET FOR WEARABLE DEVICES, BY TYPE, 2017–2020 (MILLION UNITS)

TABLE 251 MARKET FOR WEARABLE DEVICES, BY TYPE, 2021–2027 (MILLION UNITS)

TABLE 252 MARKET FOR WEARABLE DEVICES, BY NODE COMPONENT, 2017–2020 (MILLION UNITS)

TABLE 253 MARKET FOR WEARABLE DEVICES, BY NODE COMPONENT, 2021–2027 (MILLION UNITS)

TABLE 254 MARKET FOR WEARABLE DEVICES IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 255 MARKET FOR WEARABLE DEVICES IN NORTH AMERICA, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 256 MARKET FOR WEARABLE DEVICES IN LATIN AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 257 MARKET FOR WEARABLE DEVICES IN LATIN AMERICA, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 258 MARKET FOR WEARABLE DEVICES IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 259 MARKET FOR WEARABLE DEVICES IN EUROPE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 260 MARKET FOR WEARABLE DEVICES IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 261 MARKET FOR WEARABLE DEVICES IN APAC, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 262 MARKET FOR WEARABLE DEVICES IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 263 MARKET FOR WEARABLE DEVICES IN ROW, BY REGION, 2021–2027 (USD MILLION)

10.3.2 CONSUMER ELECTRONICS

10.3.2.1 Growing demand for smart televisions and smart washing machines to support growth of consumer electronics segment

10.3.2.2 Consumer electronics application: Products covered

10.3.2.2.1 Smart lighting

10.3.2.2.2 Smart TV

10.3.2.2.3 Smart washing machine

10.3.2.2.4 Smart dryer

10.3.2.2.5 Smart refrigerator

10.3.2.2.6 Smart oven

10.3.2.2.7 Smart cooktop

10.3.2.2.8 Smart cooker

10.3.2.2.9 Smart deep freezer

10.3.2.2.10 Smart dishwasher

10.3.2.2.11 Smart coffee maker

10.3.2.2.12 Smart Kettle

10.3.2.2.13 Gateways

TABLE 264 MARKET FOR CONSUMER ELECTRONICS, BY TYPE, 2017–2020 (USD MILLION)

TABLE 265 MARKET FOR CONSUMER ELECTRONICS, BY TYPE, 2021–2027 (USD MILLION)

TABLE 266 (ONLY NODE) MARKET FOR CONSUMER ELECTRONICS, BY TYPE, 2017–2020 (THOUSAND UNITS)

TABLE 267 MARKET FOR CONSUMER ELECTRONICS, BY TYPE, 2017–2020 (THOUSAND UNITS)

TABLE 268 (ONLY NODE) MARKET FOR CONSUMER ELECTRONICS, BY TYPE, 2021–2027 (THOUSAND UNITS)

TABLE 269 MARKET FOR CONSUMER ELECTRONICS, BY TYPE, 2021–2027 (THOUSAND UNITS)

TABLE 270 MARKET FOR CONSUMER ELECTRONICS, BY NODE COMPONENT, 2017–2020 (MILLION UNITS)

TABLE 271 MARKET FOR CONSUMER ELECTRONICS, BY NODE COMPONENT, 2021–2027 (MILLION UNITS)

TABLE 272 MARKET FOR CONSUMER ELECTRONICS IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 273 MARKET FOR CONSUMER ELECTRONICS IN NORTH AMERICA, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 274 MARKET FOR CONSUMER ELECTRONICS IN LATIN AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 275 MARKET FOR CONSUMER ELECTRONICS IN LATIN AMERICA, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 276 MARKET FOR CONSUMER ELECTRONICS IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 277 MARKET FOR CONSUMER ELECTRONICS IN EUROPE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 278 MARKET FOR CONSUMER ELECTRONICS IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 279 MARKET FOR CONSUMER ELECTRONICS IN APAC, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 280 MARKET FOR CONSUMER ELECTRONICS IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 281 MARKET FOR CONSUMER ELECTRONICS IN ROW, BY REGION, 2021–2027 (USD MILLION)

11 GEOGRAPHIC ANALYSIS (Page No. - 273)

11.1 INTRODUCTION

TABLE 282 MARKET, BY GEOGRAPHY, 2017–2020 (USD BILLION)

TABLE 283 MARKET, BY GEOGRAPHY, 2021–2027 (USD BILLION)

TABLE 284 MARKET, BY GEOGRAPHY, 2017–2020 (MILLION UNITS)

TABLE 285 MARKET, BY GEOGRAPHY, 2021–2027 (MILLION UNITS)

11.2 NORTH AMERICA

FIGURE 48 SNAPSHOT: IOT TECHNOLOGY MARKET IN NORTH AMERICA

TABLE 286 MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 287 MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 288 MARKET IN NORTH AMERICA, BY END-USE APPLICATION, 2017–2020 (USD MILLION)

TABLE 289 MARKET IN NORTH AMERICA, BY END-USE APPLICATION, 2021–2027 (USD MILLION)

TABLE 290 MARKET IN NORTH AMERICA, BY END-USE APPLICATION, 2017–2020 (MILLION UNITS)

TABLE 291 MARKET IN NORTH AMERICA, BY END-USE APPLICATION, 2021–2027 (MILLION UNITS)

TABLE 292 MARKET IN NORTH AMERICA, BY INDUSTRIAL APPLICATION, 2017–2020 (USD MILLION)

TABLE 293 MARKET IN NORTH AMERICA, BY INDUSTRIAL APPLICATION, 2021–2027 (USD MILLION)

TABLE 294 MARKET IN NORTH AMERICA, BY INDUSTRIAL APPLICATION, 2017–2020 (MILLION UNITS)

TABLE 295 MARKET IN NORTH AMERICA, BY INDUSTRIAL APPLICATION, 2021–2027 (MILLION UNITS)

TABLE 296 MARKET IN NORTH AMERICA, BY CONSUMER APPLICATION, 2017–2020 (USD MILLION)

TABLE 297 MARKET IN NORTH AMERICA, BY CONSUMER APPLICATION, 2021–2027 (USD MILLION)

TABLE 298 MARKET IN NORTH AMERICA, BY CONSUMER APPLICATION, 2017–2020 (MILLION UNITS)

TABLE 299 MARKET IN NORTH AMERICA, BY CONSUMER APPLICATION, 2021–2027 (MILLION UNITS)

11.2.1 IMPACT OF COVID-19 ON IOT TECHNOLOGY MARKET IN NORTH AMERICA

FIGURE 49 IOT TECHNOLOGY MARKET IN NORTH AMERICA: ANALYSIS OF PRE- AND POST-COVID-19 SCENARIOS

11.2.2 US

11.2.2.1 Presence of leading IoT companies in US to continue to drive growth of IoT technology market

11.2.3 CANADA

11.2.3.1 IoT adoption by small and medium enterprises to market growth in Canada

11.3 LATIN AMERICA

FIGURE 50 SNAPSHOT: IOT TECHNOLOGY MARKET IN LATIN AMERICA

TABLE 300 MARKET IN LATIN AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 301 MARKET IN LATIN AMERICA, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 302 MARKET IN LATIN AMERICA, BY END-USE APPLICATION, 2017–2020 (USD MILLION)

TABLE 303 MARKET IN LATIN AMERICA, BY END-USE APPLICATION, 2021–2027 (USD MILLION)

TABLE 304 MARKET IN LATIN AMERICA, BY END-USE APPLICATION, 2017–2020 (MILLION UNITS)

TABLE 305 MARKET IN LATIN AMERICA, BY END-USE APPLICATION, 2021–2027 (MILLION UNITS)

TABLE 306 MARKET IN LATIN AMERICA, BY INDUSTRIAL APPLICATION, 2017–2020 (USD MILLION)

TABLE 307 MARKET IN LATIN AMERICA, BY INDUSTRIAL APPLICATION, 2021–2027 (USD MILLION)

TABLE 308 MARKET IN LATIN AMERICA, BY INDUSTRIAL APPLICATION, 2017–2020 (MILLION UNITS)

TABLE 309 MARKET IN LATIN AMERICA, BY INDUSTRIAL APPLICATION, 2021–2027 (MILLION UNITS)

TABLE 310 MARKET IN LATIN AMERICA, BY CONSUMER APPLICATION, 2017–2020 (USD MILLION)

TABLE 311 MARKET IN LATIN AMERICA, BY CONSUMER APPLICATION, 2021–2027 (USD MILLION)

TABLE 312 MARKET IN LATIN AMERICA, BY CONSUMER APPLICATION, 2017–2020 (MILLION UNITS)

TABLE 313 MARKET IN LATIN AMERICA, BY CONSUMER APPLICATION, 2021–2027 (MILLION UNITS)

11.3.1 IMPACT OF COVID-19 ON IOT TECHNOLOGY MARKET IN LATIN AMERICA

FIGURE 51 IOT TECHNOLOGY MARKET IN LATIN AMERICA: ANALYSIS OF PRE- AND POST-COVID-19 SCENARIOS

11.3.2 MEXICO

11.3.2.1 Growing penetration of IoT in telecommunications industry to propel market growth in Mexico

11.3.3 BRAZIL

11.3.3.1 Government funding for IoT implementation is driving market growth in Brazil

11.3.4 COLOMBIA

11.3.4.1 Reforms in manufacturing, construction, agriculture, and banking industries drives growth market in Colombia

11.3.5 REST OF LATIN AMERICA

11.4 EUROPE

FIGURE 52 SNAPSHOT: IOT TECHNOLOGY MARKET IN EUROPE

TABLE 314 MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 315 MARKET IN EUROPE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 316 MARKET IN EUROPE, BY END-USE APPLICATION, 2017–2020 (USD MILLION)

TABLE 317 MARKET IN EUROPE, BY END-USE APPLICATION, 2021–2027 (USD MILLION)

TABLE 318 MARKET IN EUROPE, BY END-USE APPLICATION, 2017–2020 (MILLION UNITS)

TABLE 319 MARKET IN EUROPE, BY END-USE APPLICATION, 2021–2027 (MILLION UNITS)

TABLE 320 MARKET IN EUROPE, BY INDUSTRIAL APPLICATION, 2017–2020 (USD MILLION)

TABLE 321 MARKET IN EUROPE, BY INDUSTRIAL APPLICATION, 2021–2027 (USD MILLION)

TABLE 322 MARKET IN EUROPE, BY INDUSTRIAL APPLICATION, 2017–2020 (MILLION UNITS)

TABLE 323 MARKET IN EUROPE, BY INDUSTRIAL APPLICATION, 2021–2027 (MILLION UNITS)

TABLE 324 MARKET IN EUROPE, BY CONSUMER APPLICATION, 2017–2020 (USD MILLION)

TABLE 325 MARKET IN EUROPE, BY CONSUMER APPLICATION, 2021–2027 (USD MILLION)

TABLE 326 MARKET IN EUROPE, BY CONSUMER APPLICATION, 2017–2020 (MILLION UNITS)

TABLE 327 MARKET IN EUROPE, BY CONSUMER APPLICATION, 2021–2027 (MILLION UNITS)

11.4.1 IMPACT OF COVID-19 ON IOT TECHNOLOGY MARKET IN EUROPE

FIGURE 53 IOT TECHNOLOGY MARKET IN EUROPE: ANALYSIS OF PRE- AND POST-COVID-19 SCENARIOS

11.4.2 UK

11.4.2.1 Industrial revolution in UK is driving market growth

11.4.3 GERMANY

11.4.3.1 Adoption of Industry 4.0 principles has created opportunity for market growth

11.4.4 FRANCE

11.4.4.1 Increased investment in R&D to modernize industrial sector is fueling market growth

11.4.5 REST OF EUROPE

11.5 APAC

FIGURE 54 SNAPSHOT: IOT TECHNOLOGY MARKET IN APAC

TABLE 328 MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 329 MARKET IN APAC, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 330 MARKET IN APAC, BY END-USE APPLICATION, 2017–2020 (USD MILLION)

TABLE 331 MARKET IN APAC, BY END-USE APPLICATION, 2021–2027 (USD MILLION)

TABLE 332 MARKET IN APAC, BY END-USE APPLICATION, 2017–2020 (MILLION UNITS)

TABLE 333 MARKET IN APAC, BY END-USE APPLICATION, 2021–2027 (MILLION UNITS)

TABLE 334 MARKET IN APAC, BY INDUSTRIAL APPLICATION, 2017–2020 (USD MILLION)

TABLE 335 MARKET IN APAC, BY INDUSTRIAL APPLICATION, 2021–2027 (USD MILLION)

TABLE 336 MARKET IN APAC, BY INDUSTRIAL APPLICATION, 2017–2020 (MILLION UNITS)

TABLE 337 MARKET IN APAC, BY INDUSTRIAL APPLICATION, 2021–2027 (MILLION UNITS)

TABLE 338 IOT TECHNOLOGY MARKET IN APAC, BY CONSUMER APPLICATION, 2017–2020 (USD MILLION)

TABLE 339 MARKET IN APAC, BY CONSUMER APPLICATION, 2021–2027 (USD MILLION)

TABLE 340 MARKET IN APAC, BY CONSUMER APPLICATION, 2017–2020 (MILLION UNITS)

TABLE 341 MARKET IN APAC, BY CONSUMER APPLICATION, 2021–2027 (MILLION UNITS)

11.5.1 IMPACT OF COVID-19 ON IOT TECHNOLOGY MARKET IN APAC

FIGURE 55 IOT TECHNOLOGY MARKET IN APAC: ANALYSIS OF PRE- AND POST-COVID-19 SCENARIOS

11.5.2 CHINA

11.5.2.1 Government support for R&D of IoT-based solutions to favor market growth

11.5.3 JAPAN

11.5.3.1 Large-scale adoption of IoT iny telecom industry to spur market growth in Japan

11.5.4 SOUTH KOREA

11.5.4.1 5G deployment to catalyze market growth in South Korea

11.5.5 REST OF APAC

11.6 ROW

FIGURE 56 SNAPSHOT: IOT TECHNOLOGY MARKET IN ROW

TABLE 342 MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 343 MARKET IN ROW, BY REGION, 2021–2027 (USD MILLION)

TABLE 344 MARKET IN ROW, BY END-USE APPLICATION, 2017–2020 (USD MILLION)

TABLE 345 MARKET IN ROW, BY END-USE APPLICATION, 2021–2027 (USD MILLION)

TABLE 346 MARKET IN ROW, BY END-USE APPLICATION, 2017–2020 (MILLION UNITS)

TABLE 347 MARKET IN ROW, BY END-USE APPLICATION, 2021–2027 (MILLION UNITS)

TABLE 348 MARKET IN ROW, BY INDUSTRIAL APPLICATION, 2017–2020 (USD MILLION)

TABLE 349 MARKET IN ROW, BY INDUSTRIAL APPLICATION, 2021–2027 (USD MILLION)

TABLE 350 MARKET IN ROW, BY INDUSTRIAL APPLICATION, 2017–2020 (MILLION UNITS)

TABLE 351 MARKET IN ROW, BY INDUSTRIAL APPLICATION, 2021–2027 (MILLION UNITS)

TABLE 352 MARKET IN ROW, BY CONSUMER APPLICATION, 2017–2020 (USD MILLION)

TABLE 353 MARKET IN ROW, BY CONSUMER APPLICATION, 2021–2027 (USD MILLION)

TABLE 354 MARKET IN ROW, BY CONSUMER APPLICATION, 2017–2020 (MILLION UNITS)

TABLE 355 MARKET IN ROW, BY CONSUMER APPLICATION, 2021–2027 (MILLION UNITS)

11.6.1 IMPACT OF COVID-19 ON IOT TECHNOLOGY MARKET IN ROW

FIGURE 57 IOT TECHNOLOGY MARKET IN ROW: ANALYSIS OF PRE- AND POST-COVID-19 SCENARIOS

11.6.2 MIDDLE EAST

11.6.2.1 The automotive and transportation and manufacturing industries are expected to see significant adoption of IoT-enabled devices as the businesses in this region

11.6.3 AFRICA

11.6.3.1 The significant growth in mobile communication and increasing internet penetration in Africa are factors driving the market

12 COMPETITIVE LANDSCAPE (Page No. - 314)

12.1 INTRODUCTION

12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

12.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN IOT TECHNOLOGY MARKET

12.3 REVENUE ANALYSIS OF TOP PLAYERS

FIGURE 58 5-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN IOT TECHNOLOGY MARKET, 2016–2020

12.4 MARKET SHARE ANALYSIS OF KEY PLAYERS IN 2020

FIGURE 59 MARKET SHARE ANALYSIS OF KEY PLAYERS IN IOT NODE HARDWARE MARKET IN 2020

TABLE 356 IOT NODE HARDWARE MARKET: DEGREE OF COMPETITION

TABLE 357 IOT NODE HARDWARE MARKET: RANKING ANALYSIS

12.5 COMPANY EVALUATION QUADRANT, 2020

12.5.1 STAR

12.5.2 EMERGING LEADER

12.5.3 PERVASIVE

12.5.4 PARTICIPANT

FIGURE 60 IOT TECHNOLOGY MARKET (GLOBAL) COMPANY EVALUATION QUADRANT, 2020

12.6 COMPETITIVE BENCHMARKING

12.6.1 COMPANY FOOTPRINT, BY END-USE APPLICATION

12.6.2 COMPANY FOOTPRINT, BY REGION

12.6.3 COMPANY FOOTPRINT

12.7 STARTUP/SME EVALUATION QUADRANT, 2020

12.7.1 PROGRESSIVE COMPANY

12.7.2 RESPONSIVE COMPANY

12.7.3 DYNAMIC COMPANY

12.7.4 STARTING BLOCK

FIGURE 61 IOT TECHNOLOGY MARKET (GLOBAL) STARTUP/SME EVALUATION QUADRANT, 2020

12.8 COMPETITIVE SITUATIONS AND TRENDS

12.8.1 PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 358 PRODUCT LAUNCHES/DEVELOPMENTS, 2019–2021

12.8.2 DEALS

TABLE 359 DEALS, 2019–2021

13 COMPANY PROFILES (Page No. - 332)

13.1 INTRODUCTION

13.2 IMPACT OF COVID-19 ON PLAYERS OF INTERNET OF THINGS TECHNOLOGY MARKET

(Business Overview, Products/solutions/services offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

13.3 KEY PLAYERS

13.3.1 INTEL CORPORATION

TABLE 360 INTEL CORPORATION: BUSINESS OVERVIEW

FIGURE 62 INTEL CORPORATION: COMPANY SNAPSHOT

TABLE 361 INTEL CORPORATION: PRODUCT LAUNCHES

TABLE 362 INTEL CORPORATION: DEALS

13.3.2 QUALCOMM TECHNOLOGIES

TABLE 363 QUALCOMM TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 63 QUALCOMM TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 364 QUALCOMM TECHNOLOGIES: PRODUCT LAUNCHES

TABLE 365 QUALCOMM TECHNOLOGIES: DEALS

13.3.3 TEXAS INSTRUMENTS INCORPORATED

TABLE 366 TEXAS INSTRUMENTS INCORPORATED: BUSINESS OVERVIEW

FIGURE 64 TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

TABLE 367 TEXAS INSTRUMENTS INCORPORATED: PRODUCT LAUNCHES

13.3.4 STMICROELECTRONICS

TABLE 368 STMICROELECTRONICS: BUSINESS OVERVIEW

FIGURE 65 STMICROELECTRONICS: COMPANY SNAPSHOT

TABLE 369 STMICROELECTRONICS: PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 370 STMICROELECTRONICS: DEALS

13.3.5 IBM

TABLE 371 IBM: BUSINESS OVERVIEW

FIGURE 66 IBM: COMPANY SNAPSHOT

TABLE 372 IBM: PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 373 IBM: DEALS

13.3.6 HEWLETT PACKARD ENTERPRISE (HPE)

TABLE 374 HEWLETT PACKARD ENTERPRISE: BUSINESS OVERVIEW

FIGURE 67 HEWLETT PACKARD ENTERPRISE: COMPANY SNAPSHOT

TABLE 375 HEWLETT PACKARD ENTERPRISE: DEALS

13.3.7 CISCO SYSTEMS

TABLE 376 CISCO SYSTEMS: BUSINESS OVERVIEW

FIGURE 68 CISCO SYSTEMS: COMPANY SNAPSHOT

TABLE 377 CISCO SYSTEMS: PRODUCT LAUNCHES

TABLE 378 CISCO SYSTEMS: DEALS

13.3.8 MICROSOFT CORPORATION

TABLE 379 MICROSOFT CORPORATION: BUSINESS OVERVIEW

FIGURE 69 MICROSOFT CORPORATION: COMPANY SNAPSHOT

TABLE 380 MICROSOFT CORPORATION: DEALS

13.3.9 PTC

TABLE 381 PTC: BUSINESS OVERVIEW

FIGURE 70 PTC: COMPANY SNAPSHOT

TABLE 382 PTC: PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 383 PTC: DEALS

13.3.10 AMAZON WEB SERVICES (AWS)

TABLE 384 AMAZON WEB SERVICES: BUSINESS OVERVIEW

TABLE 385 AMAZON WEB SERVICES: PRODUCT LAUNCHES & PRODUCT DEVELOPMENTS

TABLE 386 AMAZON WEB SERVICES: DEALS

13.4 OTHER PLAYERS

13.4.1 GENERAL ELECTRIC (GE)

13.4.2 SOFTEQ DEVELOPMENT CORPORATION

13.4.3 SCIENCESOFT

13.4.4 ORACLE CORPORATION

13.4.5 SIEMENS

13.4.6 SAP

13.4.7 BOSCH

13.4.8 HUAWEI TECHNOLOGIES CO., LTD.

13.4.9 SCHNEIDER ELECTRIC

13.4.10 ARM LIMITED

13.4.11 NXP SEMICONDUCTORS N.V.

13.4.12 TE CONNECTIVITY LTD.

13.4.13 SOFTWARE AG

13.4.14 MICROCHIP TECHNOLOGY INC.

13.4.15 VATES

*Details on Business Overview, Products/solutions/services offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 400)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

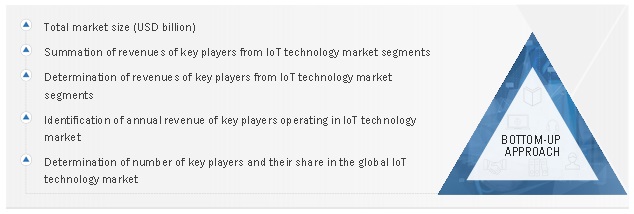

The study involved four major activities in estimating the size of the IoT technology market. Exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market’s size. After that, market breakdown and data triangulation were used to determine the market sizes of segments and sub-segments.

Secondary Research

The secondary sources referred to for this research study include organizations such as Internet of Things Consortium, Consumer Technology Association (CTA), Information Technology Industry Council (ITI), Alberta IoT, Illinois Technology Association (ITA), IoT World, and so on; corporate filings (such as annual reports, investor presentations, and financial statements); and trade, and business. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by primary research.

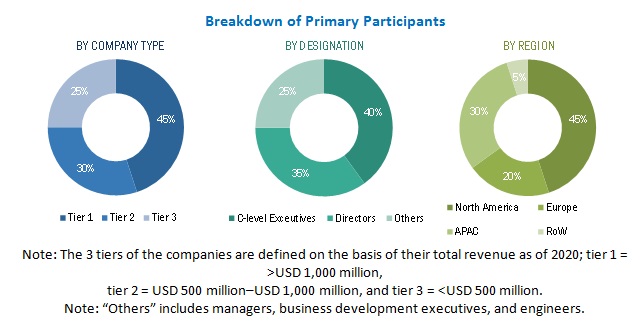

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the IoT technology market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand- (aerospace, healthcare. Manufacturing, oil & gas, construction, and others) and supply-side (OEM, system integrators, software providers, solution providers) players across four major regions, namely, North America, Europe, APAC, and Rest of the World (South America, Africa, Middle East). Approximately 75% and 25% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the IoT technology market. These methods were also extensively used to estimate the sizes of various market sub-segments. The research methodology used to estimate the market sizes includes the following:

- The key players in the market were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

Global IoT technology market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives:

- To define and forecast the IoT technology market size, by node component, software solution, platform, service, and end-use application, in terms of value

- To describe and forecast the Internet of Things technology market size in 4 key regions, namely North America, Latin America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW), along with their respective country-level market