IoT Market in Intelligent Transportation Systems by Components (Semiconductor, Wireless, and Others), Products, Software & Services, Verticals (Road, Rail, Air, and Maritime), Solutions, Applications, and Geography - Analysis & Forecast to 2014 - 2020

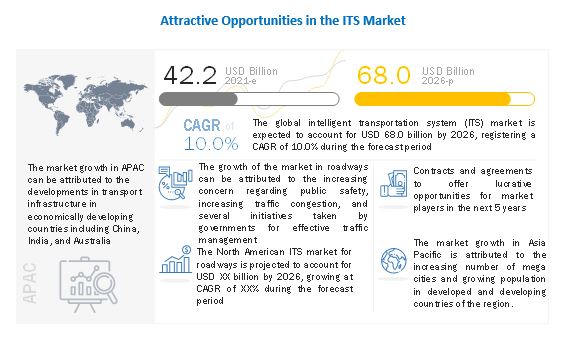

[188 Pages Report] The global ITS market is expected to grow from USD 42.2 billion in 2021 to USD 68.0 billion by 2026, at a CAGR of 10.0% from 2021 to 2026. The key factors driving the growth of the ITS market include government efforts to ensure road and public safety, increased need to reduce traffic congestion, and favourable government initiatives for effective traffic management.

Increasing focus of automobile companies on designing and developing smart vehicles compatible with ITS, increasing public-private partnerships and growing number of economically and technologically advanced countries are creating opportunities for the ITS market.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics of ITS Market

Driver: Favourable government initiatives for effective traffic management

Governments across the world are adopting ITS to improve road safety and operational performance of the transport system and reduce the impact of transportation on the environment. To implement ITS, substantial funds are required. Countries such as the US, Dubai, and Japan are heavily investing in different projects of ITS. For instance, in 2020, the UK government invested USD 1.9 million in three projects to trial innovative technologies and new ways to improve driving conditions, cut traffic congestion, and reduce time spent in traffic jams. Further, the government hopes that the deployment of next-generation AI-powered intelligent transport systems will provide drivers the confidence to plan their trips without the fear of being stuck in traffic. These systems reduce congestion, delays, and air pollution as well. Innovators in the UK are provided with funds of over USD 368 million to build a cleaner, greener, and sustainable transport network.

Restraint: Expensive ITS installation

For an intelligent transport setup, a sophisticated centralized traffic management center (TMC), which can deal with real-time traffic data and help reduce traffic congestion, is the basic requirement. This management center should be co-located with transportation managers, system operators, dispatchers, and response agencies, leading to the requirement for huge investments.

Further, the implementation of ITS includes CCTV cameras, microwave detectors, dynamic message signboards, advanced traveller information systems, highway advisory radios, mobile data terminals, fleet management systems, and several other systems and components. Mobile data terminals are multifunctional onboard devices that support two-way communication between a vehicle and a control center. Capital costs for mobile data terminals usually range from USD 1,000 to USD 4,000 per unit, with additional installation costs from USD 500 to USD 1,000, according to the US Department of Transportation.

Opportunity: Increasing public-private partnerships

ITS cannot be deployed by a single stakeholder; it requires collaboration among various domains, such as telecom operators, infrastructure providers, manufacturers, service providers, public sector companies, and user groups. Thus, public–private partnerships (PPPs) would be key to the success of ITS.

Many non-profit organizations such as ITS Canada, ITS America, ITS Thailand, ITS India, and ITS Germany sign strategic partnership agreements with different associations that work on roads and transport projects. In June 2020, Cubic Transportation Systems (CTS), a transportation business division of Cubic Corporation (US), was selected by the Yucatan state government to install advanced traffic management technologies in the city of Merida, Mexico. Cubic partnered with Vixionere SAPI de C.V. (Mexico) to deploy the Trafficware ATMS central transport management platform, controllers, and Transit Signal Priority software, which utilizes and is integrated with Cubic’s NextBus real-time platform, at all intersections included in the project. Cubic will also install the SynchroGreen Adaptive Signal Control module at over 50 intersections.

Challenge: Achieving interoperable and standard ITS architecture worldwide

The establishment of an ITS infrastructure involves the integration of various heterogeneous devices, which may create compatibility issues quite often. These heterogeneous devices must be synchronized according to the standards and specifications. However, a lack of universal standards in ITS infrastructure poses challenges; for instance, an electronic toll collection onboard unit does not have any display and performs only validation functions. Besides, it cannot receive or transmit any message; moreover, every country has different types of onboard unit (OBU) devices. The major problem in implementing ITS is to integrate it with information technology. The implementation and significant use of information technology is a process of interrelated steps. Any error in any of the stages during the implementation reduces the system efficiency.

In 2014, the European Commission introduced a new standard for ITS called EN 302 637 3. This standard defines the Decentralized Environmental Notification (DEN) basic service and supports road hazard warnings. DEN provides information related to a road hazard or an abnormal traffic condition, including its type and position. In the event of a mishap, an alert message is sent to nearby ITS stations via direct V2V or V2I communication to alert drivers regarding a potentially dangerous event. However, this standard is different from the US standard.

European countries, such as France, Spain, and Italy, use DSRC in the ITS, whereas countries in North America, such as the US, use GPS/GSM-based systems. DSRC cannot be included in an integrated technology platform as it would not work with other national transport systems.

These differences in the standards/protocols of different countries create a challenge in designing a centralized ITS infrastructure.

Hardware segment to account for the largest size of ITS market during the forecast period

On the basis of offering, the ITS market has been segmented into hardware, software, and services. The large share of the hardware segment is owing to the implementation of numerous heterogeneous devices, including cameras, sensors, intelligent traffic management systems, and advanced traveller information systems across the ITS infrastructure across the globe. In addition, these high-end systems are synchronized to respond in real-time; hence, these are likely to need frequent software updates, thereby increasing the operational cost.

Advanced traffic management systems application to account for the largest size of ITS market during the forecast period

On the basis of system, the ITS market is categorized into five different systems—Advanced Traffic Management Systems (ATMS), Advanced Traveller Information Systems (ATIS), ITS-enabled Transportation Pricing Systems, Advanced Public Transportation Systems (APTS), and Commercial Vehicle Operations (CVO) Systems. The advanced traffic management systems segment is projected to account for the largest size of the ITS market from 2021 to 2026. The largest market size of advanced traffic management systems is attributed to the increasing traffic congestion on roads across the world. In addition, the easy affordability of vehicles, due to favourable schemes and discounts offered by automobile manufacturers, is also resulting in traffic congestion. To address this concern, advanced traffic management systems will be adopted at a higher rate across the world.

The major aim of ATMS is to provide traffic management solutions that enable private concessionaires, highway operators, or government authorities to take actions that ultimately result in improving the safety of road users, along with improving the traffic flow, increase transportation system efficiency, increase economic productivity, and enhance mobility.

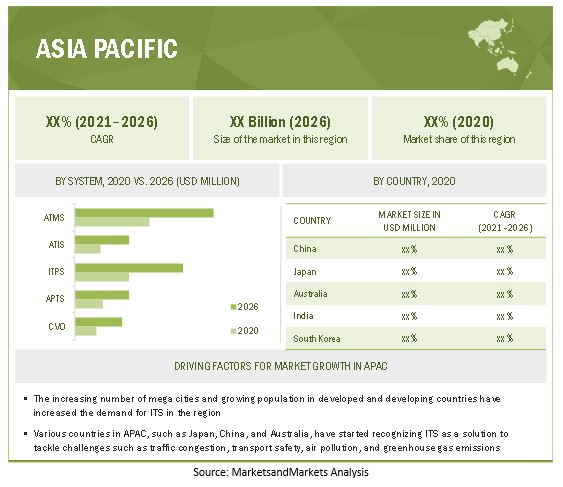

Asia Pacific to account for the highest growth of ITS market during the forecast period

Among all regions, Asia Pacific is expected to register the highest growth in the ITS market during the forecast period. The ITS market in APAC is growing rapidly because of the demand in countries such as China, Japan, Australia, and the Rest of APAC. Various countries in APAC have started recognizing intelligent transportation systems as a solution to tackle issues such as traffic congestion, air pollution, and greenhouse gas emissions. The market in APAC has high growth potential. The demand for ITS in APAC is significantly driven by strong economic growth, rise in population, and rapid urbanization. Formulating standards is a challenge as it requires a vast knowledge of technical aspects, coordination among stakeholders, and a vision to attain different objectives by such standards.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Major players in the ITS market include Thales Group (France), Siemens (Germany), Kapsch TrafficCom (Austria), Conduent, Inc. (US), Cubic Corporation (US), and so on.

Recent Developments

- In September 2021, Siemens has signed a contract with the National Authority for Tunnels (NAT) to deliver a comprehensive rail system that will feature the first-ever high-speed, electrified main, and freight rail line transforming Egypt’s transportation. Siemens Mobility will provide its comprehensive turnkey services to design, install, commission, and maintain the systems for 15 years. The total contract value is approximately USD 4.5 billion, of which Siemens Mobility’s share is around USD 3 billion.

- In June 2021, Kapsch TrafficCom announced that it had received a project from Plenary Infrastructure Group (Australia) to install a new toll collection system at the Louisiana Highway (LA-1) for the Louisiana Department of Transportation and Development (LADOTD). The project is an amendment to Kapsch’s existing contract with Plenary, where Kapsch is providing an end-to-end all-electronic tolling system and related maintenance services for a major bridge and tunnel replacement in Belle Chasse, Louisiana.

- In May 2021, Omaha Metro Transit (US) has awarded Cubic Transportation Systems (CTS) a multi-year contract to deliver its Umo Pass solution. Umo Pass will empower Omaha Metro Transit riders to seamlessly plan and pay for transit journeys through a single fare payment system.

Frequently Asked Questions (FAQs):

What is the current size of the global ITS market?

The global ITS market is expected to grow from USD 42.2 billion in 2021 to USD 68.0 billion by 2026, at a CAGR of 10.0% from 2021 to 2026.

Who are the winners in the global ITS market?

Some of the key companies operating in the ITS market are Thales Group (France), Siemens (Germany), Kapsch TrafficCom (Austria), Conduent, Inc. (US), Cubic Corporation (US), and so on. These players have adopted various growth strategies such as product launches/developments, partnerships/contracts/ collaborations/acquisitions to expand their global presence and increase their share in the global ITS market.

What are the major drivers for the ITS market?

The key factors driving the growth of the ITS market include government efforts to ensure road and public safety, increased need to reduce traffic congestion, favourable government initiatives for effective traffic management, high adoption of eco-friendly automobile technology, and rapid development of smart cities globally, and others.

What are the growing application verticals in the ITS market?

The ITS market is led by advanced traffic management systems segment. The largest market size of advanced traffic management systems is attributed to the increasing traffic congestion on roads across the world. In addition, the easy affordability of vehicles, due to favourable schemes and discounts offered by automobile manufacturers, is also resulting in traffic congestion. To address this concern, advanced traffic management systems will be adopted at a higher rate across the world.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.4 This Research Report Categorizes the IoT in Transportation Market Into the Following Segments

1.4.1 Years Considered for the Study

1.4.2 Currency and Pricing

1.5 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Market Size Estimation

2.2 Market Breakdown & Data Triangulation

2.3 Research Data

2.3.1 Secondary Data

2.3.2 Key Data Taken From Secondary Sources

2.3.3 Primary Data

2.3.4 Key Data From Primary Sources

2.4 Research Assumptions and Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Multiple Opportunities in the IoT in Trasnportation Market

4.2 IoT in Transportation Market, By Verticals

4.3 IoT in Transportaion Market

4.4 IoT in Transportation Market, By Solution

4.5 IoT in Transportation Market: Geographic Market Size

4.6 Life Cycle Analysis of IoT, 2014

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Component

5.2.2 By Vertical

5.2.3 By Solution

5.2.4 By Application

5.2.5 By Geography

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Dsrc for the V2V Communication Likely to Boost the IoT Market

5.3.1.2 Integration of Technologies Helps Develop Better Solutions in Transportation

5.3.1.3 Huge Investments in the R&D of IoT Related Software

5.3.1.4 Standardization of Ipv6 Would Increase the Ip Address Space

5.3.2 Restraints

5.3.2.1 Further Improvements are Required in Battery Related Technologies

5.3.2.2 Big Data Increases Complexity

5.3.3 Opportunities

5.3.3.1 Relaxation of Government Rules and Regulations is Creating More Opportunities

5.3.3.2 Predictive Maintenance (Pdm)

5.3.3.3 Data Centers Likely to Benefit From the Deployment of IoT in Transportation

5.3.4 Challenges

5.3.4.1 Development of Underlying Embedded Devices for IoT

5.3.4.2 Protection of Data Generated By IoT Devices

6 Industry Trends (Page No. - 49)

6.1 Introduction

6.2 Supply Chain Analysis

6.3 Value Chain Analysis

6.4 Porters Analysis

6.4.1 Bargaining Power of Suppliers

6.4.2 Bargaining Power of Buyers

6.4.3 Threat of New Entrants

6.4.4 Threat of Substitutes

6.4.5 Degree of Competition

6.5 History & Evolution

6.6 Technology Trends of IoT

6.6.1 Application Trends

6.6.1.1 Home Automation

6.6.1.2 Connected Cars

6.6.1.3 Wearable Technology

7 Market, By Component (Page No. - 62)

7.1 Introduction

7.2 Semiconductor Components

7.2.1 Sensors

7.3 Wireless/Cellular Components

8 Market By Product, Software, and Service (Page No. - 67)

8.1 Introduction

8.2 Products

8.2.1 Displays/Screens

8.2.2 Sensors

8.2.3 Connectivity Modules

8.2.4 Telematics

8.3 Software

8.4 Services

8.4.1 Oem Market

8.4.2 Aftermarket

9 Market, By Vertical (Page No. - 74)

9.1 Introduction

9.2 Roadways

9.3 Railways

9.4 Airways

9.5 Maritime

10 Transportation Solution Market (Page No. - 83)

10.1 Introduction

10.2 Traffic

10.2.1 Intelligent Signaling

10.2.2 Video Analytics

10.2.3 Route Scheduling and Guidance

10.2.4 Central Traffic Control

10.2.5 Traffic Analytics

10.2.6 Incident Detection

10.2.7 Communication Solutions

10.3 Asset

10.3.1 Monitoring Solutions

10.3.2 Performance Analytics

10.4 Ticketing

10.4.1 Open Payment System (OPS)

10.4.2 Passenger Analytics

10.5 Supervision Solutions

10.5.1 Silo Systems

10.5.2 Scada

10.6 Operation Solutions

10.6.1 Passenger Management

10.6.2 Revenue Management

10.6.3 Workforce Management

10.7 Passenger Information

10.7.1 Station/On-Board System

10.7.2 Gps Solution

10.7.3 Multimedia Solutions

10.7.4 Public Address Solutions

10.8 Maintenance

10.9 Maintenance Scheduling Solutions

10.10 Predective Analytics

10.11 Logistics and Fleet Solution

10.11.1 Freight Management

10.11.1.1 Freight Operation Management Solutions

10.11.1.2 Freight Tracking Solutions

10.11.2 Fleet Management

10.11.2.1 Fleet Planning

10.11.2.2 Damange Management

11 Market By Application (Page No. - 98)

11.1 Introduction

11.2 Telematics

11.2.1 In-Vehicle

11.2.1.1 Automatic Crash Notification

11.2.1.2 Vehicle Tracking

11.2.1.3 Fleet Management

11.2.1.3.1 Fuel Management

11.2.1.3.2 Power Management

11.2.1.4 Vehicle Relationship Management

11.2.2 Vehicle-To-Vehicle (V2V)

11.2.2.1 Safety and Security

11.2.2.2 Forward Hazard Warning

11.2.2.2.1 Curve Speed Warning

11.2.2.2.2 Overtake Vehicle Warning

11.2.3 Vehicle-To-Infrastructure

11.2.3.1 Road User Charging

11.2.3.2 Parking Management System

11.2.3.3 Dynamic Mobility

11.2.3.4 Traffic Control System

11.2.3.5 Remote Diagnostics

11.2.3.6 Usage-Based Insurance

11.3 Infotainment

11.4 Advanced Driver Assistance System (ADAS)

11.5 Market Trend Analysis of Different Applications

12 Geographic Analysis (Page No. - 106)

12.1 Introduction

12.2 the Americas

12.3 Europe

12.4 APAC

12.5 Middle East

12.6 Africa

13 Competitive Landscape (Page No. - 144)

13.1 Overview

13.2 Market Analysis

13.2.1 Elite Players of the Supply Chain

13.3 Competitive Scenario

13.3.1 New Product Launches

13.3.2 Partnerships, Agreements, and Collaborations

13.3.3 Mergers and Acquisitions

13.3.4 Expansions

13.3.5 Other Developments

14 Company Profiles (Page No. - 153)

(Overview, Products and Services, Financials, Strategy & Development)*

14.1 Introduction

14.2 Garmin International

14.3 Thales Group

14.4 Tomtom N.V.

14.5 Nuance Communication

14.6 Denso Corp.

14.7 Alcatel-Lucent

14.8 AT&T, Inc.

14.9 Verizon Communications

14.10 Sierra Wireless, Inc.

14.11 IBM Corporation

14.12 Cisco Systems, Inc.

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 182)

15.1 Insights of Industry Experts

15.2 Discussion Guide

15.3 Introducing RT: Real-Time Market Intelligence

15.4 Available Customizations

15.5 Related Reports

List of Tables (93 Tables)

Table 1 Increasing Demand for V2V Communication is the Major Driving Factor for the IoT Market in Transportation

Table 2 Lesser Battery Life and Managing Big Data are Restraining the Adoption of IoT in Transportation

Table 3 Increasing Usage of Portable Electronic Devices is Acting as A Catalyst for the Growth of the IoT Market in Transportation

Table 4 Porter’s Five Forces Analysis With Its Weightage Impact

Table 5 IoT in Trasnportation Market, By Component, 2014–2020 ($Billion)

Table 6 IoT in Trasnportation Market, By Semiconductor Component, 2014–2020 ($Billion)

Table 7 IoT in Trasnportation Market, By Sensor, 2014–2020 ($Billion)

Table 8 IoT in Trasnportation Market, By Wireless/Cellular Component, 2014–2020 ($Billion)

Table 9 IoT in Transportation Market, By Product, Software, and Service, 2014–2020 ($Billion)

Table 10 IoT in Transportation Market, By Vertical, 2014–2020 ($Billion)

Table 11 IoT in Transportation Market:R Oad Vertical, By Solution, 2014–2020 ($Billion)

Table 12 IoT in Transportation Market: Road Vertical, By Region, 2014–2020 ($Billion)

Table 13 IoT in Transportation Market: Railways Vertical, By Soution, 2014–2020 ($Billion)

Table 14 IoT in Transportation Market: Railways Vertical, By Region, 2014–2020 ($Billion)

Table 15 IoT in Transportation Market: Airways Vertical, By Solution, 2014–2020 ($Billion)

Table 16 IoT in Transportation Market: Airways Vertical, By Region, 2014–2020 ($Billion)

Table 17 IoT in Transportation Market: Maritime Vertical, By Solution, 2014–2020 ($Billion)

Table 18 IoT in Transportation Market: Maritime Vertical, By Region, 2014–2020 ($Billion)

Table 19 IoT in Transportation Market, By Solution, 2014–2020

Table 20 Product Mapping of Traffic Solution

Table 21 Product Mapping of Asset Solution

Table 22 Product Mapping of Ticketing Solution

Table 23 General Scada Components and Their Functions

Table 24 Product Mapping of Supervision Solutions

Table 25 Product Mapping of Operation Solution

Table 26 Product Mapping of Passenger Information Solution

Table 27 Product Mapping of Maintenance Solution

Table 28 Product Mapping of Logistics & Fleet Solutions

Table 29 Market Trend for IoT in Transportation Services

Table 30 IoT in Transportation Market, By Region, 2014–2020 ($Billion)

Table 31 The Americas IoT in Transportation Market, By Vertical, 2014–2020 ($Billion)

Table 32 The Americas IoT in Transportation Market, By Solution, 2014–2020 ($Billion)

Table 33 The Americas IoT in Transportation Market, By Product, Software, and Service, 2014–2020 ($Billion)

Table 34 The Americas Traffic Solution Market, By Vertical, 2014–2020 ($Billion)

Table 35 The Americas Asset Solution Market, By Vertical, 2014–2020 ($Billion)

Table 36 The Americas Ticketing Solution Market, By Vertical, 2014–2020 ($Billion)

Table 37 The Americas Supervision Solution Market, By Vertical, 2014–2020 ($Billion)

Table 38 The Americas Operation Solution Market, By Vertical, 2014–2020 ($Billion)

Table 39 The Americas Passenger Information Solution Market, By Vertical, 2014–2020 ($Billion)

Table 40 The Americas Maintenance Solution Market, By Vertical, 2014–2020 ($Billion)

Table 41 The Americas Logistics/Fleet Solution Market, By Vertical, 2014–2020 ($Billion)

Table 42 The European IoT in Transportation Market, By Vertical, 2014–2020 ($Billion)

Table 43 The European IoT in Transportation Market, By Solution, 2014–2020 ($Billion)

Table 44 European IoT in Transportation Market, By Product, Software, and Service, 2014–2020 ($Billion)

Table 45 European Traffic Solution Market, By Vertical, 2014–2020 ($Billion)

Table 46 European Asset Solution Market, By Vertical, 2014–2020 ($Billion)

Table 47 European Ticketing Solution Market, By Vertical, 2014–2020 ($Billion)

Table 48 European Supervision Solution Market, By Vertical, 2014–2020 ($Billion)

Table 49 European Operation Solution Market, By Vertical, 2014–2020 ($Billion)

Table 50 European Passenger Information Solution Market, By Vertical, 2014–2020 ($Billion)

Table 51 European Maintenance Solution Market, By Vertical, 2014–2020 ($Billion)

Table 52 European Logistics/Fleet Solution Market, By Vertical, 2014–2020 ($Billion)

Table 53 APAC IoT in Transportation Market, By Vertical, 2014–2020 ($Billion)

Table 54 APAC IoT in Transportation Market, By Solution, 2014–2020 ($Billion)

Table 55 APAC IoT in Transportation Market, By Product, Software, and Service, 2014–2020 ($Billion)

Table 56 APAC Traffic Solution Market, By Vertical, 2014–2020 ($Billion)

Table 57 APAC Asset Solution Market, By Vertical, 2014–2020 ($Billion)

Table 58 APAC Ticketing Solution Market, By Vertical, 2014–2020 ($Billion)

Table 59 APAC Supervision Solution Market, By Vertical, 2014–2020 ($Billion)

Table 60 APAC Operation Solution Market, By Vertical, 2014–2020 ($Billion)

Table 61 APAC Passenger Information Solution Market, By Vertical, 2014–2020 ($Billion)

Table 62 APAC Maintenance Solution Market, By Vertical, 2014–2020 ($Billion)

Table 63 APAC Logistics/Fleet Solution Market, By Vertical, 2014–2020 ($Billion)

Table 64 The Middle Eastern IoT in Transportation Market, By Vertical, 2014–2020 ($Billion)

Table 65 The Middle Eastern IoT in Transportation Market, By Solution, 2014–2020 ($Billion)

Table 66 The Middle Eastern IoT in Transportation Market, By Product, Software, and Service, 2014–2020 ($Billion)

Table 67 The Middle Eastern Traffic Solution Market, By Vertical, 2014–2020 ($Billion)

Table 68 The Middle Eastern Asset Solution Market, By Vertical, 2014–2020 ($Billion)

Table 69 Middle Eastern Ticketing Solution Market, By Vertical, 2014–2020 ($Billion)

Table 70 The Middle Eastern Supervision Solution Market, By Vertical, 2014–2020 ($Billion)

Table 71 The Middle Eastern Operations Solution Market, By Vertical, 2014–2020 ($Billion)

Table 72 The Middle Eastern Passenger Information Solution Market, By Vertical, 2014–2020 ($Billion)

Table 73 The Middle Eastern Maintenance Solution Market, By Vertical, 2014–2020 ($Billion)

Table 74 The Middle Eastern Logistics/Fleet Solution Market, By Vertical, 2014–2020 ($Billion)

Table 75 The African IoT in Transportation Market, By Vertical, 2014–2020 ($Billion)

Table 76 The African IoT in Transportation Market, By Solution, 2014–2020 ($Billion)

Table 77 The African IoT in Transportation Market, By Product, Software, and Service, 2014–2020 ($Billion)

Table 78 The African Traffic Solution Market, By Vertical, 2014–2020 ($Billion)

Table 79 African Asset Solution Market, By Vertical, 2014–2020 ($Billion)

Table 80 African Ticketing Solution Market, By Vertical, 2014–2020 ($Billion)

Table 81 African Supervision Solution Market, By Vertical, 2014–2020 ($Billion)

Table 82 The African Operation Solution Market, By Vertical, 2014–2020 ($Billion)

Table 83 African Passenger Information Solution Market, By Vertical, 2014–2020 ($Billion)

Table 84 African Maintenance Solution Market, By Vertical, 2014–2020 ($Billion)

Table 85 The African Logistics/Fleet Solution Market, By Vertical, 2014–2020 ($Billion)

Table 86 IoT in Trasnportation: Major Network Providers, 2014

Table 87 IoT in Trasnportation Platform Providers, 2014

Table 88 The Top Five Players in the IoT Ecosystem, 2014

Table 89 New Product Launches,

Table 90 Most Significant Partnerships, Agreements, and Collaborations in the IoT in Transportation Market,

Table 91 Recent Mergers and Acquisitions of the IoT in Transportation Market

Table 92 Recent Expansions of the IoT in Transportation Market

Table 93 Other Recent Developments in the IoT in Transportation Market

List of Figures (69 Figures)

Figure 1 IoT in Transportation Market, By Solution

Figure 2 IoT in Transportation: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 6 Market Breakdown and Data Triangulation

Figure 7 Assumptions of the Research Study

Figure 8 Limitations of the Research Study

Figure 9 The Implementation of IoT on Road Held the Largest Share in the IoT Market in Transportation Market in 2014

Figure 10 The Asset Tracking Solution is Expected to Be the Fastest-Growing Segment During the Forecast Period

Figure 11 APAC is Expected to Be One Ofthe Fastest-Growing Regions in the IoT in Transportation Market

Figure 12 The IoT in Trasnportation Market is Expected to Grow at A CAGR of 8.95% From 2014 to 2020

Figure 13 Roadways Would Account for the Maximum Share in the IoT in Transportation Market During the Forecast Period

Figure 14 The Americas Was the Leader Among All the Verticals in 2014

Figure 15 The Traffic Solution is Expected to Continue to Dominate the IoT in Transportation Market in 2014

Figure 16 APAC is Expected to Grow at A Higher Rate Than the Americas and Europe During the Forecast Period

Figure 17 Life Cycle Analysis of IoT With Respect to Applications

Figure 18 Segmentation of the IoT Market in Transportation

Figure 19 Market Segmentation: By Component

Figure 20 Market Segmentation: By Vertical

Figure 21 Market Segmentation: By Solution

Figure 22 Market Segmentation: By Application

Figure 23 Market Segmentation: By Geography

Figure 24 Major Parameters Impacting the IoT Market in Transportation

Figure 25 Functional Blocks of the IoT in Transportation Market

Figure 26 Supply Chain Analysis: Major Value is Added During the Raw Material Supply and Original Equipment Manufacturing Phase

Figure 27 Value Chain Analysis of IoT

Figure 28 Porter’s Five Forces Analysis

Figure 29 Due to the Large Number of Existing Players and New Entrants, the Degree of Competition is Expected to Remain High From 2015 to 2020

Figure 30 The Technology Factors Associated With the IoT Industry are Highly Impacting the Suppliers’ Power

Figure 31 The Availability of Customized Solutions is the Major Factor for the Buyers’ Bargaining Power

Figure 32 The Higher Market Growth Rate is Expected to Attract New Entrants

Figure 33 Legislative Regulations is the Key Factor Giving Strength to the Substitutes’ Market

Figure 34 New Product Launches and Innovations Have Led to A High Degree of Competition for the IoT in Transportation Market

Figure 35 History & Evolution of IoT

Figure 36 IoT in Trasnportation Market, By Component (2014-2020)

Figure 37 Intelligent Tracking and Monitoring Would Help to Boost the Growth of the Industry:

Figure 38 IoT in Traffic Management

Figure 39 The Supervision Solution System

Figure 40 Value Process of Supervision Management Using Scada

Figure 41 Operation Management Process

Figure 42 Value Chain of Operation Management

Figure 43 Passenger Management Process

Figure 44 Revenue Management Process

Figure 45 Workforce Management Process

Figure 46 Value Chain of Passenger Information

Figure 47 Maintenance Solution Classification

Figure 48 Geographic Snapshot (2014)

Figure 49 The Americas IoT in Transportation Market Snapshot

Figure 50 European IoT in Transportation Market Snapshot

Figure 51 APAC IoT in Transportation Market Snapshot

Figure 52 The Middle Eastern IoT in Transportation Market Snapshot

Figure 53 The African IoT in Transportation Market Snapshot

Figure 54 Companies Adopted Product Innovation as the Key Growth Strategy From 2012 to 2014

Figure 55 Intel Corp. Emerged as the Fastest-Growing Company From 2009 to 2013

Figure 56 Battle for Market Share: New Product Launches is the Key Strategy

Figure 57 Geographic Revenue Mix of the Top Market Players

Figure 58 Garmin International: Company Snapshot

Figure 59 Thales Group: Company Snapshot

Figure 60 Thales Group: SWOT Analysis

Figure 61 Tomtom N.V.: Company Snapshot

Figure 62 Nuance Communication: Company Snapshot

Figure 63 Denso Corp: Company Snapshot

Figure 64 Alcatel-Lucent: Company Snapshot

Figure 65 AT&T, Inc.: Company Snapshot

Figure 66 Verizon Communications: Company Snapshot

Figure 67 Sierra Wireless Inc.: Company Snapshot

Figure 68 IBM Corporation: Company Snapshot

Figure 69 Cisco Systems, Inc.: Company Snapshot

Growth opportunities and latent adjacency in IoT Market