IoT Integration Market by Service (Device & Platform Management, System Design & Architecture, Network Management, Advisory Services), Application (Smart Building & Home Automation, Smart Healthcare) and Region - Global Forecast to 2028

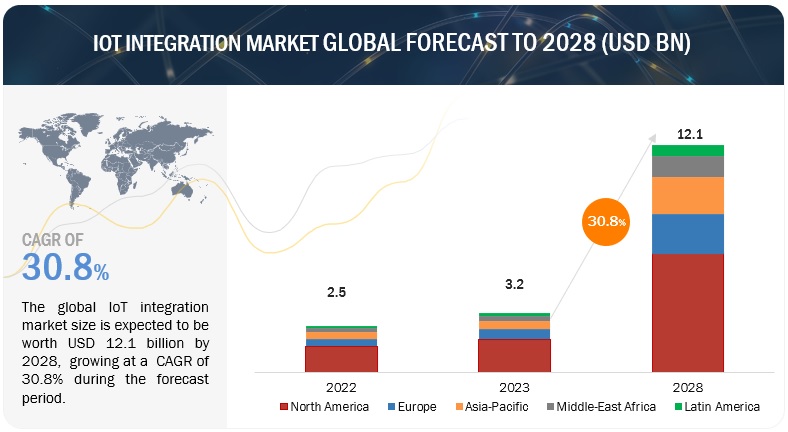

[246 Pages Report] The IoT integration market size is expected to grow from USD 3.2 billion in 2023 to USD 12.1 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 30.8% during the forecast period. A major driver of the IoT integration market is the proliferation of IoT devices across various industries as businesses sought to harness the data generated by these devices to optimize operations and make informed decisions. Also, the need to enhance operational efficiency, reduce downtime, predictive maintenance, and energy savings will drive the market.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

IoT Integration: Market Dynamics

Driver: Proliferation of connected devices to encourage BYOD and remote workplace management

The IoT is an ecosystem of connected physical devices accessible through the Internet. According to the latest IoT Analytics “State of IoT—Spring 2023” report there has been an 18% increase in global IoT connections in 2022, with 14.3 billion active IoT endpoints. Organizations are adopting advanced technologies like IoT, AI/ML, and cloud services to achieve successful digital transformation. However, collecting, managing, and analyzing the vast amount of data IoT devices generate efficiently is crucial. The increasing computational power of IoT devices enables them to perform multiple functions in real-time at a faster rate. The insights obtained after data analysis drive actionable steps to improve the business. As a result, the adoption rate of IoT devices is increasing globally, leading to a greater demand for integration services for these devices.

The IoT ecosystem includes a variety of technologies and systems, ranging from sensor-powered microcontrollers to devices powered by processors and interconnected to collect and analyze data in real-time. These devices can sense and transmit a large amount of information online. Connected devices can be accessed digitally and controlled anywhere using mobiles, desktop computers, tablets, and wearables. As the demand for these connected devices increases globally, there is a growing need for IoT integration services to ensure proper functioning. To manage the increasing number of connected devices, IoT architecture is required. IoT integration services help manage device vulnerability, ensure uninterrupted communication, handle the Internet, and tackle data security risks associated with the use of connected devices.

Restraint: Lack of standardization in IoT protocols

To increase the economies at scale, greater technical standardization is required to reduce the IoT integration market’s entry barriers; hence, there is a need for a global governing body. The standards are to be carefully designed to allow innovations in the IoT integration market. Service providers often help drive large parts of the market toward an acceptable IoT communications protocol. While some preliminary protocols are becoming visible to the market, formally available protocols remain. Different applications and stakeholders have evolved different standards for IoT. The International Telecommunication Union (ITU) has created an Internet of Things Global Standard Initiative (IoT-GSI) to develop a standard for IoT on a global scale. The European Commission has also created many European standard bodies for IoT-specific standards, such as European Telecommunications Standards Institute (ETSI), European Committee for Standardization (CEN), and European Committee for Electro-Technical Standardization (CENELEC). These bodies develop policies referring to European standard regulations and directives.

Opportunity: Increasing adoption of iPaaS

Integration Platform as a Service (iPaaS) is a hosted service offering wherein a third-party provider delivers infrastructure and middleware to manage, develop, and integrate data and applications. iPaaS is a suite of cloud services that enables the development, execution, and governance of integration flow, connecting any combination of on-premises and cloud-based processes, services, applications, and data within individual organizations or across multiple organizations. The adoption of iPaaS by IoT integration service providers would help them to scale up IoT projects and deliver more complex integrations. IoT projects are expected to grow in complexity and involve integration with multiple applications and databases as well as more complex Application Programming Interface (API) management, thus providing ample growth opportunities for IoT integration service providers

Challenge: Data security and privacy concerns

The IoT integration market has significant growth potential for enterprises across all verticals; however, maintaining data security and privacy is a key challenge players face. The installed smart devices and sensors continuously generate a huge amount of data; this is expected to help organizations handling data gain insights into the market position of their competitors. As the popularity of IoT integration services spreads, enterprises demand better security and privacy protections. With the increase in the number of IoT-integrated systems, several security and privacy issues will arise, and every endpoint, gateway, sensor, and smartphone will become a potential target for hackers. The most dangerous part of the IoT ecosystem is that enterprises surrender their privacy, bit by bit, without realizing it, because they are unaware of what data is being collected and how it is being used. There is a dire need for IoT security and privacy protection among enterprises, as some devices used in the IoT ecosystem have extremely limited memory, processing capacity, and battery power; consequently, classical IT security mechanisms are often inadequate to cope with the unique security situations that arise. Most IoT-enabled devices are connected to various connectivity networks, such as mobile connectivity, public Wireless-Fidelity (Wi-Fi), and office Wide Area Networks (WANs). Public networks may not be as protected as they are required to be at an enterprise level

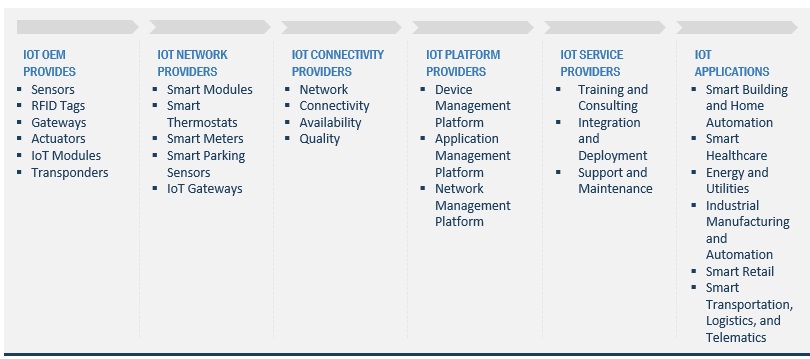

Market Ecosystem

Smart healthcare application segment is expected to account for a higher CAGR during the forecast period

Smart healthcare refers to integrating advanced technologies, data analytics, and interconnected devices within the healthcare industry to create more efficient, patient-centric, and data-driven healthcare systems. The driving force behind the adoption of IoT integration in smart healthcare is the pursuit of improved patient outcomes and experiences by providing healthcare professionals with real-time insights into patients' conditions, enabling remote monitoring and diagnostics, and enhancing data-driven decision-making. IoT integration empowers healthcare systems to deliver more personalized, proactive, and efficient care.

System Design and Architecture segment is expected to account for a higher CAGR during the forecast period.

System device and architecture services involve planning and designing the overall structure of an IoT system. This includes determining the arrangement of devices, data flows, communication protocols, and interaction patterns. As IoT networks expand, they must accommodate a growing number of devices and data sources. Scalable architectures and properly integrated devices are essential to support this growth.

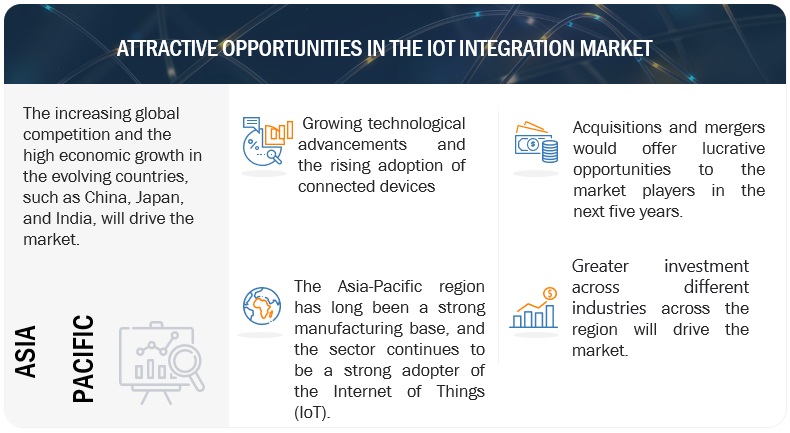

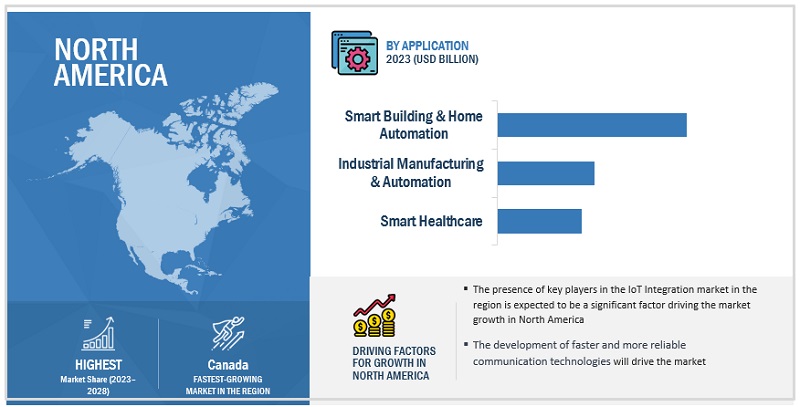

North America to account for the largest market share during the forecast period

North America is estimated to hold the largest share of the overall IoT integration market. Organizations in the region are early adopters of IoT integration solutions and services. The adoption of IoT integration in North America has been marked by a remarkable surge in various industries, driven by a convergence of technological innovation and strategic imperatives. Digitalization in the Industries spanning manufacturing, healthcare and smart cities have embraced IoT integration, unlocking unprecedented levels of efficacy, connectivity, and valuable insight boosting the IoT integration market in the region.

Key Market Players

The IoT integration market vendors have implemented various organic and inorganic growth strategies, such as new product launches, product upgrades, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global IoT integration market TCS Limited (India), Wipro Limited (India), Atos SE (France), Accenture (Ireland), Fujitsu Ltd. (Japan), Infosys Limited (India), Capgemini (France), HCL Technologies Limited (India), Tech Mahindra Limited (India), DXC Technology (US)

The study includes an in-depth competitive analysis of these key players in the IoT integration market with their company profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2018-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Million/ Billion) |

|

Segments covered |

By service, application, and region |

|

Regions covered |

North America, Europe, Asia Pacific, Latin America, and Middle East and Africa |

|

Companies covered |

TCS Limited (India), Wipro Limited (India), Atos SE (France), Accenture (Ireland), Fujitsu Ltd. (Japan), Infosys Limited (India), Capgemini (France), HCL Technologies Limited (India), Tech Mahindra Limited (India), DXC Technology (US), IBM Corporation (US), Cognizant (US), NTT Data Corporation (Japan), Dell EMC (US), Deloitte (US), Salesforce (US), Allerin Tech Pvt Ltd (India), Softdel (US), Phitomas (Malaysia), eInfochips (US), Timesys Corporation (US), Tibbo Systems (Taiwan), Aeris (US), Macrosoft Inc. (US), Damco (US) and Meshed (Australia). |

This research report categorizes the IoT integration market to forecast revenues and analyze trends in each of the following subsegments:

By Service:

- Device and Platform Management Services

- Application Management Services

- Advisory Services

- System Design and Architecture

- Testing Services

- Service Provisioning and Directory Management

- Third-party API Management Services

- Database and Block Storage Management Services

- Network Management Services

- Infrastructure and Workload Management Services

By Application:

- Smart building and home automation

- Smart healthcare

- Energy and utilities

- Industrial manufacturing and automation

- Smart retail

- Smart transportation, logistics and telematics

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- Rest of Europe

-

APAC

- China

- Japan

- India

- Rest of APAC

-

MEA

- Kingdom of Saudi Arabia

- United Arab Emirates

- Rest of Middle East and Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In August 2023, TCS and Lexmark, a global imaging and IoT solutions provider, entered into a partnership to transform its enterprise applications, accelerate its cloud journey, and scale up its innovation program

- In July 2023, Accenture acquired Strongbow Consulting, a data-driven strategic advisory firm with deep expertise in helping organizations plan and execute technology transformation strategies while minimizing risk and maximizing cost savings..

- In June 2023, DXC Technology partnered with Nokia to launch DXC Signal Private LTE and 5G Solution.

- In May 2023, Deloitte acquired substantially all of the assets of Optimal Design Co., a leading product engineering services (PES) company specializing in the innovation and development of smart connected products and IoT devices..

- In October 2022, Capgemini acquired Braincourt, a Germany-based firm specialized in business intelligence and data science services.

Frequently Asked Questions (FAQ):

What is IoT integration?

Software AG defines IoT integration as a critical IoT platform capability that enables enterprises to integrate data from connected things with other IT assets, such as SaaS. IoT can be defined as devices connected via the internet using sensors, actuators, and network communication technologies to interconnect people and machines. As per MnM, the IoT integration market refers to the market that incorporates integration services that are provided by the vendors for the efficient functioning of the IoT.

Which countries are considered in the European region?

The report includes an analysis of the UK, Germany in the European region.

Which are the key drivers supporting the growth of the IoT integration market?

The major driver of the IoT integration market is the proliferation of IoT devices across various industries as businesses sought to harness the data generated by these devices to optimize operations and make informed decisions. Also, the need to enhance operational efficiency, reduced downtime, predictive maintenance, and energy savings will drive the market.

Who are the key vendors in the IoT integration market?

The key vendors operating in the IoT integration market include. TCS Limited (India), Wipro Limited (India), Atos SE (France), Accenture (Ireland), Fujitsu Ltd. (Japan), Infosys Limited (India), Capgemini (France), HCL Technologies Limited (India), Tech Mahindra Limited (India), DXC Technology (US), IBM Corporation (US), Cognizant (US), NTT Data Corporation (Japan), Dell EMC (US), Deloitte (US), Salesforce (US), Allerin Tech Pvt Ltd (India), Softdel (US), Phitomas (Malaysia), eInfochips (US), Timesys Corporation (US), Tibbo Systems (Taiwan), Aeris (US), Macrosoft Inc. (US), Damco (US) and Meshed (Australia).

Which region is expected to hold the highest market share In the IoT integration market?

North America is expected to hold the highest market share in the IoT integration market. The presence of key players across the region will drive the growth of the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

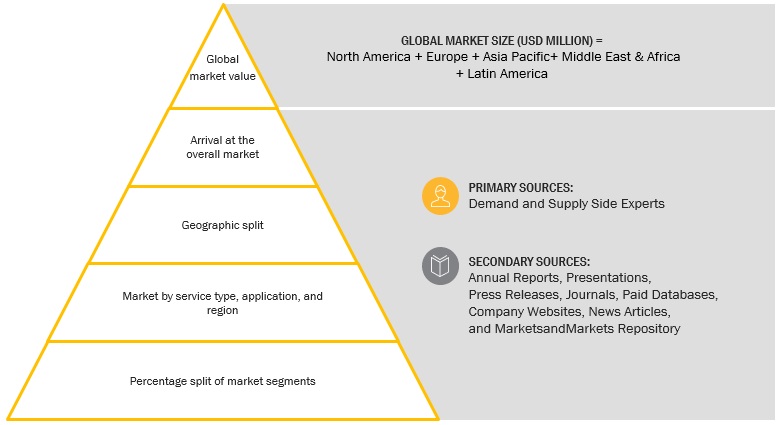

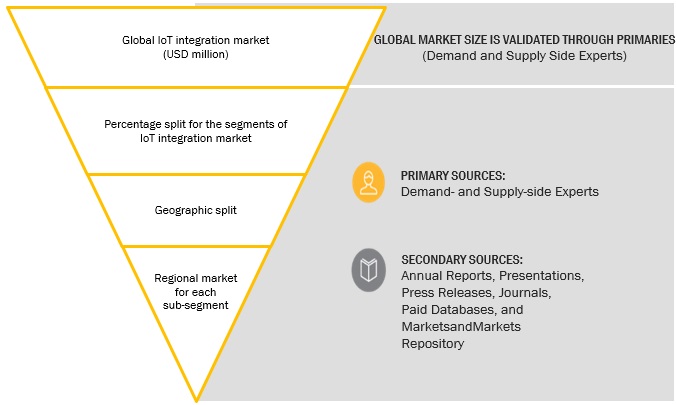

The study involved four major activities in estimating the current size of the IoT integration market. Exhaustive secondary research was done to collect information on the lending industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub-segments of the IoT integration market.

Secondary Research

In the secondary research process, various secondary sources were referred to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification and segmentation, and key developments in the market. The secondary sources included annual reports, press releases of various companies TCS Limited, Wipro Limited, Atos SE, and Accenture among others, white papers, journals, and certified publications and articles from recognized authors, directories, and databases.

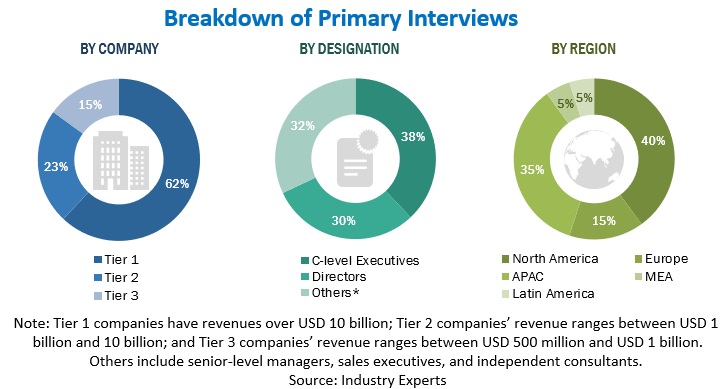

Primary Research

Extensive primary research has been conducted after understanding the IoT integration market scenario through secondary research. Several primary interviews have been conducted with market experts from demand and supply side players across five major regions: North America, Europe, Asia Pacific, Middle East and Africa, and Latin America. Approximately 70% and 30% of primary interviews have been conducted from the demand and supply sides. Primary data has been collected through questionnaires email, and telephonic interviews. In the canvassing of primaries, various organizations, such as sales. Operations and administration were covered to provide a holistic viewpoint in our report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the global IoT integration market and various other dependent submarkets in the overall market. An exhaustive list of all the vendors offering solutions and services in the IoT integration market was prepared while using the top-down approach. The market share for all the vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor was evaluated based on its offering (solutions and services). The aggregate of all companies’ revenues was extrapolated to reach the overall market size.

IoT integration market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

IoT integration market: Top-Down Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

As defined by Software AG, IoT integration is a critical IoT platform capability that enables enterprises to integrate data from connected things with other IT assets, such as SaaS. IoT integration services are transforming into core aspects of the IoT subsystem across multiple application areas to enable secure end-to-end communication between devices and data centers, remote troubleshooting of components, interoperability across subsystems, and advanced business analytics and metrics. IoT integration services offer a newer business proposition for an integrated Go-To-Market (GTM), thereby benefiting internal and external stakeholders, channel partners, and customers.

Key Stakeholders

- IoT platform providers

- IoT integration services providers

- Managed services providers (MSPs)

- Communication service providers

- Application providers

- Network-as-a-Service providers

- Third-party System Integrators (SIs)

- Hardware vendors

- Independent consultants

- IoT application providers

- Regulatory agencies

- Governments of various countries

Report Objectives

- To determine and forecast the global IoT integration market based on service, organization size, application, and regions from 2023 to 2028s, and analyze various macro and microeconomic factors that affect the market growth.

- To forecast the size of the market’s segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Latin America, and Middle East and Africa (MEA).

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the IoT integration market.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the total IoT integration market.

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the IoT integration market.

- To profile key market players (top vendors and startups); provide a comparative analysis based on their business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the market’s competitive landscape.

- To track and analyze competitive developments, such as mergers and acquisitions, a new product launched and product developments, partnerships, agreements, and collaborations, business expansions, and Research & Development (R&D) activities, in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in IoT Integration Market