IP Multimedia Subsystem (IMS) Market by Component (Product and Service (Professional and Managed Service)), Telecom Operator (Mobile and Fixed Operators), and Region (North America, Europe, APAC, MEA, and Latin America) - Global Forecast to 2023

[126 Pages Report] The global IP Multimedia Subsystem market was valued at USD 1.41 billion in 2017 and projected to reach USD 3.71 billion by 2023, at a Compound Annual Growth Rate (CAGR) of 15.7% during the forecast period. The base year considered for the study is 2017, and the forecast period is 2018–2023.

The report aims at estimating the market size and potential of the IP Multimedia Subsystem Market across different segments, such as by component (product and service), telecom operator, and region. The primary objectives of the report are to provide a detailed analysis of the major factors (drivers, restraints, opportunities, industry-specific challenges, and recent developments) influencing the market’s growth, analyze the market opportunities for stakeholders, and offer details of the competitive landscape to the market leaders.

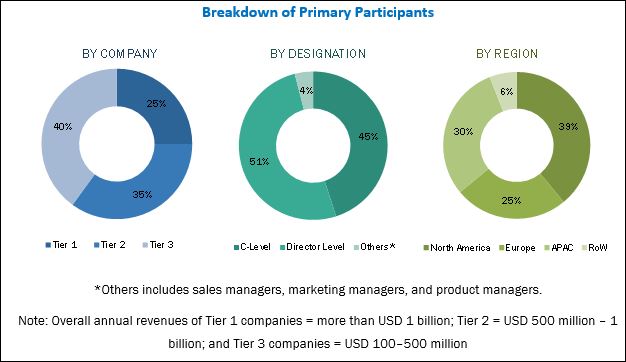

The research methodology used to estimate and forecast the IP Multimedia Subsystem market began with the capturing of data about revenues of the key vendors through secondary sources, such as annual reports, press releases, investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources. This research study involved the use of extensive secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva. Other than these sources, analyses, and releases from industry trade associations, such as government regulatory bodies were considered during the research process. Vendor offerings were also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global IP Multimedia Subsystem market from the revenues of the key market players. After arriving at the overall market size, the market was split into several segments and subsegments that were then verified through primary research by conducting extensive interviews with the key industry personnel, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of the profiles of primary participants is depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The IP Multimedia Subsystem market players include Ericsson (Sweden), Huawei (China), NEC (Japan), Nokia (Finland), ZTE (China), Athonet (Italy), Cirpack (France), Cisco (US), CommVerge Solutions (China), Dialogic (US), Interop Technologies (US), Italtel (Italy), Metaswitch (UK), Mavenir (US), Oracle (US), Radisys (US), Ribbon Communications (US), Samsung (South Korea), and WIT Software (Portugal).

Key Target Audience for IP Multimedia Subsystem Market

- IMS solution vendors

- Cloud services providers

- Telecom operators

- System integrators

- Third-party vendors

- Mobile Network Operators (MNOs)

- Mobile Virtual Network Operators (MVNOs)

- Government telecom regulatory authorities

- Cloud services providers

- Communication Service Providers (CSPs)

- Consulting companies

- Original Equipment Manufacturers (OEMs)

- Software-Defined Networking (SDN)/Virtualized Network Functions (VNFs) Providers

- Virtualization software and solution vendors

- Financial analysts and investors

Scope of the IP Multimedia Subsystem Market Report

|

Report Metric |

Details |

|

Market size available for years |

2016–2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast unit |

Value (USD) |

|

Segments covered |

Component, Mobile Operator, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific (APAC), Latin America, and Middle East and Africa (MEA) |

|

Companies covered |

Ericsson (Sweden), Huawei (China), NEC (Japan), Nokia (Finland), ZTE (China), Athonet (Italy), Cirpack (France), Cisco (US), CommVerge Solutions (China), Dialogic (US), Interop Technologies (US), Italtel (Italy), Metaswitch (UK), Mavenir (US), Oracle (US), Radisys (US), Ribbon Communications (US), Samsung (South Korea), and WIT Software (Portugal). |

The research report categorizes the IP Multimedia Subsystem Market to forecast revenues and analyze trends in each of the following subsegments:

IP Multimedia Subsystem Market By Component:

- Product

- Services

- Professional services

- Consulting

- Integration and deployment

- Training and support

- Managed services

- Professional services

IP Multimedia Subsystem Market By Mobile Operator:

- Mobile operators

- Fixed operators

IP Multimedia Subsystem (IMS) Market By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Middle East and Africa (MEA)

- Latin America

Drivers

Increasing network infrastructure all over the world

Network management is an important part of any business and plays a crucial role in business operations. Nowadays, managing the network infrastructure has become an important aspect in modern digital businesses. Organizations are unlocking new opportunities in business systems by investing in modern network infrastructure technologies, such as cloud services, data centers, SDN, NFV, IP networks, fixed wireless broadband network, enterprise mobility, and network orchestration, to streamline their business operations.

CAPEX and OPEX

The telecom sector is facing several issues in terms of low Return on Investment (RoI), massive legacy infrastructure, business transformation, stringent government regulations, and increased competition from peers and OTT players. In addition to this, the telcos are making huge investments in advanced technologies and spectrum allocations to cope with the next-generation technologies. Due to the high cost of network implementation, financial crisis, and increased competition, operators are more focused on cash flows and under the heavy burden of minimizing their CAPEX and OPEX. Therefore, telecom operators are looking for cost-effective solutions to improve their network infrastructures and launching new services more quickly. A reduction in the OPEX would help telecom operators address their customers’ needs for new business models, which would create an additional revenue stream.

Restraints

Reluctance in transiting from the legacy infrastructure to a virtualized infrastructure

Legacy telecom environments are considered to be a very severe restraint to new commercial telecom software spending. Many telecom operators continue to maintain and operate legacy systems, which are very complex and inefficient for business needs. Due to legacy systems, telecom operators often face various challenges, such as high maintenance costs, unsupported hardware and software, skill shortage, and lack of compatibility on different platforms, including COTS, servers, hypervisors, and cloud. This conversion carries a substantial upgradation cost with it. The new commercial software must be heavily customized to support old services. There is always a risk that the conversion will be incomplete and may cause a network outage affecting company’s business operation and incurring losses. Hence, when deploying systems to support new services, operators are reluctant to convert old services to new systems. Some operators continue to implement legacy systems that are incapable of supporting new services for the growing subscriber base, which could ultimately result in the fallout of services and hamper the customer experience. Big operators have already deployed traditional IMS solutions for LTE networks across the globe. These traditional IMS solutions, however, are very costly and involve a lot of maintenance activities. The installation life cycle of network components ranges from 2 to 5 years. Therefore, mobile operators are reluctant to add new solutions on their networks that are already deployed.

Opportunities

Huge opportunity for network operators in VoLTE and VoWiFi spaces

With the increasing momentum of LTE deployments, IMS is being looked on as a common platform for deploying communication services over the IP technology (VoLTE, RCS, and video calls). VoLTE is delivered using IMS architecture, which enables operators to add value to the data and the application delivery services. VoWiFi is an adjacent technology to VoLTE; it also works on the IMS architecture to offer voice services over the IP using Wi-Fi network.

Emergence of 5G

5G has emerged as a new next-generation technology in the ICT industry. It has a plethora of use cases in various industry verticals. Manufacturing, automotive, transportation, healthcare, media and entertainment, and government are the major industry verticals, wherein 5G plays a vital role. 5G offers seamless connectivity, lower latency, huge computing capabilities, and agility in the cloud. It would completely change the communication scenario experienced by people. Telecom operators have already started the 5G trial at various locations and are expected to launch 5G commercially by 2018–2019. Japan, South Korea, China, and the US are acting as frontrunners in the implementation of the 5G technology.

Challenges

Security concerns in virtualization

Security is an important concern for any business. With the evolution of advanced technologies, such as SDN and NFV, vulnerabilities and network threats on network components have also increased. Security attacks are the major concerns for mobile operators that adversely impact their business functions. Security hackers are improving their attack methods to increase vulnerabilities in the network environment and are working toward the betterment of network functions. In the traditional IMS, all network functions run on hardware modules that offer a very high level of security for various network components. It is relatively hard for an attacker to gain control over the mobile infrastructure and damage the network environment. However, in the recent years, operators have adopted virtualized solutions in the mobile core network to lower down their OPEX and improve their network efficiency. IMS solutions offer several benefits compared to the traditional IMS but lack security and performance.

Lack of skilled workforce

There is a lack of skilled and experienced network engineers for managing and using next-generation networking and virtualized solutions across the globe. Any error in the integration and implementation would negatively impact the mobile network infrastructure, thereby impacting customer experience and business revenues.

Competitive Landscape

New Product Launches/Product Enhancements

|

Date |

Company Name |

Description |

|

November 2017 |

Athonet (Italy) |

Athonet launched the S-GW local breakout function, which enables low latency videos, caching, and content management at the network edge, using standard 3GPP-compliant interfaces and open APIs. The feature also enables local breakout for other edge computing services that require low latency, security, and optimization of data flows. |

|

March 2016 |

ZTE (China) |

ZTE launched a commercial trail of VoLTE high-definition voice services for China Unicom in Henan Province. ZTE offered China Unicom with end-to-end VoLTE solutions, comprising VoLTE HD video and audio, VoWiFi, and RCS. |

Source: Press Releases

Partnerships, Agreements, and Collaborations

|

Date |

Company Name |

Description |

|

May 2018 |

Interop Technologies (US) and Inland Cellular (US) |

Inland Cellular, a US-based locally operating rural cellular communications company, partnered with Interop Technologies to implement private Cloud IMS Core Network with VoLTE and RCS. |

|

April 2018 |

Athonet (Italy) and Ambra (Canada) |

Athonet partnered with Ambra to implement Canada’s first LTE underground network in a gold mining company, Agnico Eagle, using Mobile Core and IMS. |

Source: Press Releases

Acquisitions

|

Date |

Company Name |

Description |

|

June 2018 |

Radisys (US) and RIL (India) |

Reliance Industries entered into an agreement to acquire Radisys for USD 75 million equity value. The transaction is expected to complete in the next 3–6 months. |

|

February 2018 |

Cisco (US) and BroadSoft (US) |

Cisco acquired BroadSoft for USD 1.9 billion. This acquisition helps in adding BroadSoft’s open interface and standards-based solutions to the existing portfolio of Cisco. |

Source: Press Releases

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific requirements. The following customization options are available for the report:

Product Analysis

- Product matrix provides detailed product information and comparisons

Geographic Analysis

- Further breakdown of the North American IP Multimedia Subsystem market

- Further breakdown of the European market

- Further breakdown of the APAC market

- Further breakdown of the MEA market

- Further breakdown of the Latin American IP Multimedia Subsystem Market

Company Information

- Detailed analysis and profiling of additional market players

MarketsandMarkets expects the IP Multimedia Subsystem Market size to grow from USD 1.79 billion in 2018 to USD 3.71 billion by 2023, at a Compound Annual Growth Rate (CAGR) of 15.7% during the forecast period. Low Capital Expenditure (CAPEX) and Operational Expenditure (OPEX), increasing number of Long-Term Evolution (LTE) mobile subscribers across the globe, and the growth of the network infrastructure are expected to drive the market growth.

The objective of the report is to define, describe, and forecast the IP Multimedia Subsystem market size by component (product and service), telecom operator, and region. Among components, the product segment is expected to account for the larger market share during the forecast period. This growth is because of large-scale implementation of IMS solution by telecom operators to deliver various use cases, such as Voice over LTE (VoLTE), Voice over Wireless Fidelity (VoWiFi), Rich Communication Services (RCS), and Unified Communications-as-a-Service (UCaaS).

Among telecom operators, the mobile operators segment is expected to hold the largest market share during the forecast period. Mobile operators have been facing several challenges, such as updating the legacy systems to meet the current demands for end-customers, intense competition, high CAPEX and OPEX, and low Return on Investment (RoI). Hence, they are in the process of seeking scalable and cost-effective solutions. All these factors are expected to be the key reason for the rapid adoption of IMS solutions and services by telecom operators.

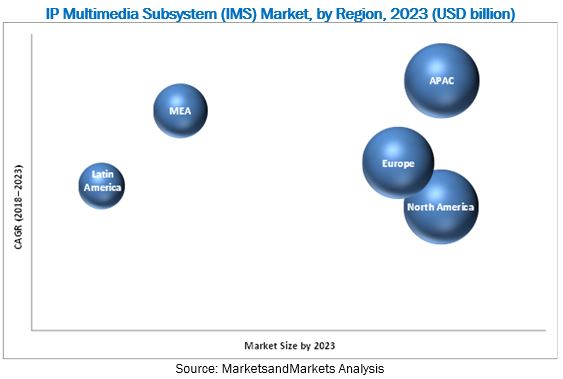

North America is expected to account for the largest size in the IP Multimedia Subsystem market during the forecast period, followed by Europe. North America is the house of big telecom giants. Mobile operators are rolling out new use cases, such as RCS, private LTE, and wireless broadband using their networks. The US government has planned to roll out the Citizens Broadband Radio Service (CBRS) band for private operators and enterprises, in 2018, which would act as a catalyst for the growth of the IMS market. Hence, North America is expected to account for the largest market share in the global IMS market during the forecast period.

The APAC region is expected to register strong growth in the coming years, as the majority of the mobile and fixed operators in the APAC region are still using traditional IMS solutions. However, this trend is expected to change while operators would eventually shift toward virtualized and cloud-based solutions. Moreover, APAC has been the largest contributor to the mobile subscriber base across the globe and is expected to add more subscribers to its network in the coming years.

Security concerns in virtualization and the unwillingness of telecom operators to transit from the legacy infrastructures to a virtual environment may hamper the growth of the market, but for a specific period.

Major and emerging vendors in the IP Multimedia Subsystem market includes Ericsson (Sweden), Huawei (China), NEC (Japan), Nokia (Finland), ZTE (China), Athonet (Italy), Cirpack (France), Cisco (US), CommVerge Solutions (China), Dialogic (US), Interop Technologies (US), Italtel (Italy), Metaswitch (UK), Mavenir (US), Oracle (US), Radisys (US), Ribbon Communications (US), Samsung (South Korea), and WIT Software (Portugal).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Attractive Market Opportunities in the IP Multimedia Subsystem Market

4.2 IP Multimedia Subsystem Market, By Service, 2018–2023

4.3 Market Investment Scenario

5 Market Overview (Page No. - 30)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Network Infrastructure All Over the World

5.2.1.2 Reduced Capex and Opex

5.2.2 Restraints

5.2.2.1 Reluctance in Transiting From the Legacy Infrastructure to A Virtualized Infrastructure

5.2.3 Opportunities

5.2.3.1 Huge Opportunity for Network Operators in Volte and Vowifi Spaces

5.2.3.2 Emergence of 5g

5.2.4 Challenges

5.2.4.1 Security Concerns in Virtualization

5.2.4.2 Lack of Skilled Workforce

5.3 IP Multimedia Subsystem (IMS) Architecture

6 IP Multimedia Subsystem Market, By Component (Page No. - 35)

6.1 Introduction

6.2 Product

6.3 Services

6.3.1 Professional Services

6.3.1.1 Consulting

6.3.1.2 Integration and Deployment

6.3.1.3 Training and Support

6.3.2 Managed Services

7 IP Multimedia Subsystem Market, By Telecom Operator (Page No. - 45)

7.1 Introduction

7.2 Mobile Operators

7.3 Fixed Operators

8 IP Multimedia Subsystem Market, By Region (Page No. - 49)

8.1 Introduction

8.2 North America

8.2.1 United States

8.2.2 Canada

8.3 Europe

8.3.1 EU5

8.3.2 Rest of Europe

8.4 Asia Pacific

8.4.1 Japan

8.4.2 China

8.4.3 India

8.4.4 Australia

8.4.5 Rest of Asia Pacific

8.5 Latin America

8.5.1 Brazil

8.5.2 Mexico

8.5.3 Rest of Latin America

8.6 Middle East and Africa

8.6.1 Middle East and North Africa

8.6.2 Sub-Saharan Africa

9 Competitive Landscape (Page No. - 71)

9.1 Overview

9.2 Vendor Market Share Analysis

9.3 Competitive Situations and Trends

9.3.1 New Product Launches/Product Enhancements

9.3.2 Partnerships, Agreements, and Collaborations

9.3.3 Acquisitions

10 Company Profiles (Page No. - 76)

10.1 Introduction

(Business Overview, Products, Solutions & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

10.2 Ericsson

10.3 Huawei

10.4 NEC

10.5 Nokia

10.6 ZTE

10.7 Athonet

10.8 Cirpack

10.9 Cisco

10.10 Commverge Solutions

10.11 Dialogic

10.12 Interop Technologies

10.13 Italtel

10.14 Metaswitch

10.15 Mavenir

10.16 Oracle

10.17 Radisys

10.18 Ribbon Communications

10.19 Samsung

10.20 WIT Software

*Details on Business Overview, Products Solutions, & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 121)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.3 Available Customizations

11.4 Related Reports

11.5 Author Details

List of Tables (42 Tables)

Table 1 IP Multimedia Subsystem Market Size, By Component, 2016–2023 (USD Million)

Table 2 Product: IP Multimedia Subsystem Market Size, By Region, 2016–2023 (USD Million)

Table 3 Services: Market Size, By Type, 2016–2023 (USD Million)

Table 4 Services: Market Size, By Region, 2016–2023 (USD Million)

Table 5 Professional Services: Market Size, By Type, 2016–2023 (USD Million)

Table 6 Professional Services: IP Multimedia Subsystem Market Size, By Region, 2016–2023 (USD Million)

Table 7 Consulting Market Size, By Region, 2016–2023 (USD Million)

Table 8 Integration and Deployment Market Size, By Region, 2016–2023 (USD Million)

Table 9 Training and Support Market Size, By Region, 2016–2023 (USD Million)

Table 10 Managed Services: IP Multimedia Subsystem Market Size, By Region, 2016–2023 (USD Million)

Table 11 IP Multimedia Subsystem Market Size, By Telecom Operator, 2016–2023 (USD Million)

Table 12 Mobile Operators:Market Size, By Region, 2016–2023 (USD Million)

Table 13 Fixed Operators: Market Size, By Region, 2016–2023 (USD Million)

Table 14 IP Multimedia Subsystem Market Size, By Region, 2016–2023 (USD Million)

Table 15 North America: Market Size, By Component, 2016–2023 (USD Million)

Table 16 North America: IP Multimedia Subsystem Market Size, By Service, 2016–2023 (USD Million)

Table 17 North America: Market Size, By Professional Service, 2016–2023 (USD Million)

Table 18 North America: Market Size, By Telecom Operator, 2016–2023 (USD Million)

Table 19 North America: IP Multimedia Subsystem Market Size, By Country, 2016–2023 (USD Million)

Table 20 Europe: IP Multimedia Subsystem Market Size, By Component, 2016–2023 (USD Million)

Table 21 Europe: Market Size, By Service, 2016–2023 (USD Million)

Table 22 Europe: Market Size, By Professional Service, 2016–2023 (USD Million)

Table 23 Europe: IP Multimedia Subsystem Market Size, By Telecom Operator, 2016–2023 (USD Million)

Table 24 Europe: Market Size, By Country, 2016–2023 (USD Million)

Table 25 Asia Pacific: IP Multimedia Subsystem Market Size, By Component, 2016–2023 (USD Million)

Table 26 Asia Pacific: Market Size, By Service, 2016–2023 (USD Million)

Table 27 Asia Pacific: IP Multimedia Subsystem Market Size, By Professional Service, 2016–2023 (USD Million)

Table 28 Asia Pacific: IP Multimedia Subsystem Market Size, By Telecom Operator, 2016–2023 (USD Million)

Table 29 Asia Pacific: Market Size, By Country, 2016–2023 (USD Million)

Table 30 Latin America: Market Size, By Component, 2016–2023 (USD Million)

Table 31 Latin America: IP Multimedia Subsystem Market Size, By Service, 2016–2023 (USD Million)

Table 32 Latin America: Market Size, By Professional Service, 2016–2023 (USD Million)

Table 33 Latin America: Market Size, By Telecom Operator, 2016–2023 (USD Million)

Table 34 Latin America: IP Multimedia Subsystem Market Size, By Country, 2016–2023 (USD Million)

Table 35 Middle East and Africa: Market Size, By Component, 2016–2023 (USD Million)

Table 36 Middle East and Africa: Market Size, By Service, 2016–2023 (USD Million)

Table 37 Middle East and Africa: IP Multimedia Subsystem Market Size, By Professional Service, 2016–2023 (USD Million)

Table 38 Middle East and Africa: Market Size, By Telecom Operator, 2016–2023 (USD Million)

Table 39 Middle East and Africa: Market Size, By Country, 2016–2023 (USD Million)

Table 40 New Product Launches/Product Enhancements, 2015–2017

Table 41 Partnerships, Agreements, and Collaborations, 2018

Table 42 Acquisitions, 2017–2018

List of Figures (40 Figures)

Figure 1 IP Multimedia Subsystem Market: Market Segmentation

Figure 2 IP Multimedia Subsystem Market: Research Design

Figure 3 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 4 Data Triangulation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 IP Multimedia Subsystem Market: Assumptions

Figure 8 Market Share in 2018, By Component

Figure 9 Market Share in 2018, By Telecom Operator

Figure 10 IP Multimedia Subsystem Market: Regional Snapshot

Figure 11 Reduced Capital Expenditure and Operational Expenditure is Expected to Drive the Growth of the Market

Figure 12 Managed Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 13 Asia Pacific is Expected to Emerge as the Best Market for Investments in the Next 5 Years

Figure 14 IP Multimedia Subsystem Market: Drivers, Restraints, Opportunities, and Challenges

Figure 15 Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 16 Managed Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 17 Training and Support Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 18 Mobile Operators Segment is Expected to Dominate the Market During the Forecast Period

Figure 19 Asia Pacific is Expected to Register the Highest CAGR During the Forecast Period

Figure 20 North America: IP Multimedia Subsystem Market Snapshot

Figure 21 Asia Pacific: Market Snapshot

Figure 22 Key Developments By Leading Players in the IP Multimedia Subsystem Market During 2015–2018

Figure 23 IP Multimedia Subsystem (IMS) Vendor Market Share, 2017

Figure 24 Geographic Revenue Mix of the Top Market Players

Figure 25 Ericsson: Company Snapshot

Figure 26 Ericsson: SWOT Analysis

Figure 27 Huawei: Company Snapshot

Figure 28 Huawei: SWOT Analysis

Figure 29 NEC: Company Snapshot

Figure 30 NEC: SWOT Analysis

Figure 31 Nokia: Company Snapshot

Figure 32 Nokia: SWOT Analysis

Figure 33 ZTE: Company Snapshot

Figure 34 ZTE: SWOT Analysis

Figure 35 Cisco: Company Snapshot

Figure 36 Italtel: Company Snapshot

Figure 37 Oracle: Company Snapshot

Figure 38 Radisys: Company Snapshot

Figure 39 Ribbon Communications: Company Snapshot

Figure 40 Samsung: Company Snapshot

Growth opportunities and latent adjacency in IP Multimedia Subsystem (IMS) Market