Infrared Detector Market by Type (Mercury Cadmium Telluride, INGaas, Pyroelectric, Thermopile, Microbolometer), Technology (Cooled and Uncooled), Wavelength (NIR & SWIR, MWIR, LWIR), Application, Vertical and Region - Global Forecast to 2028

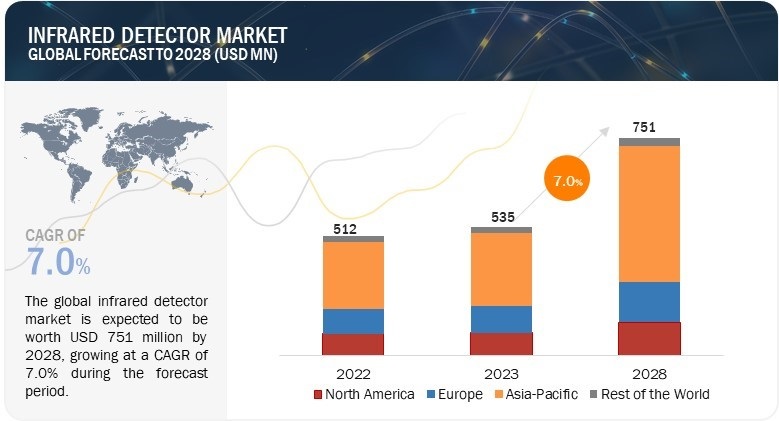

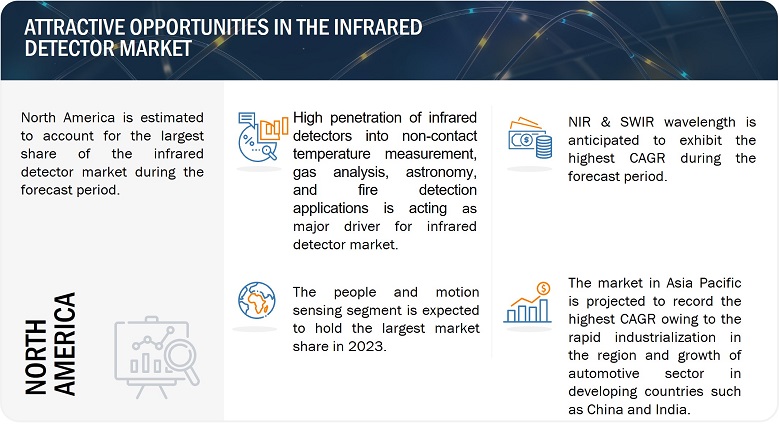

[226 Pages Report] The market size for the infrared detector market is predicted to grow from USD 535 million in 2023 to USD 751 million by 2028, at a CAGR of 7.0%. The growth of the infrared detector market is driven by increasing demand for security and surveillance systems, adoption of infrared detectors in industrial automation and manufacturing processes, and high penetration of infrared detectors into non-contact temperature measurement, gas analysis, astronomy, and fire detection applications. These factors are expected to continue to drive the growth of the infrared detector market in the coming years.

Infrared Detector Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Infrared detector market Dynamics

Driver: High penetration of infrared detectors into non-contact temperature measurement, gas analysis, astronomy, and fire detection applications.

The demand for infrared detectors is rapidly growing across various applications, including non-contact temperature measurement, gas analysis, astronomy, and fire detection. Industries such as manufacturing and energy benefit from the precise temperature measurements achieved without physical contact, ensuring effective process control, quality assurance, and enhanced safety. In gas analysis, infrared detectors offer real-time and highly accurate identification of gases, promoting environmental compliance and workplace safety measures. In astronomy, these detectors capture and analyze celestial objects beyond the visible spectrum, providing valuable insights into star formation and planetary systems. Additionally, infrared detectors are crucial in early fire detection systems, enabling swift response and effective risk mitigation. The increasing adoption of infrared detectors can be attributed to their exceptional accuracy, non-contact capabilities, significant safety benefits, and continuous technological advancements, resulting in improved performance and cost-effectiveness across applications.

Restraint: Stringent regulations about the import and export of cameras.

The International Traffic in Arms Regulations (ITAR) implemented by the US Department of State require commodity jurisdiction approval to sell restricted infrared cameras in the US. The stringent regulations surrounding the import and export of infrared cameras restrain their widespread use and availability. These regulations are often imposed due to national security, export control, intellectual property, and privacy concerns. The restrictions can include licensing requirements, export permits, compliance with technical standards, and limitations on transferring certain sensitive technologies. Stricter regulations make importing and exporting infrared cameras more complex and time-consuming. It may involve obtaining approvals from multiple government agencies, complying with specific documentation requirements, and undergoing rigorous screening processes. It can lead to shipment delays, increased administrative burden, and higher costs for businesses that import and export infrared cameras.

Opportunity: Rising demand for infrared detectors in emerging countries.

The surge in demand for infrared detectors in developing nations can be attributed to several key factors. Such as the swift pace of industrialization and infrastructure development in these countries necessitates advanced technologies, including infrared detectors, to support critical sectors such as manufacturing, energy, construction, and transportation. These detectors are vital in ensuring enhanced process efficiency, quality control, and safety across these industries. In addition, the economic growth experienced in developing nations translates to increased disposable income and greater purchasing power among individuals and businesses. It leads to a growing demand for consumer electronics, automotive products, and other goods that incorporate infrared detectors for applications such as thermal imaging, night vision, and sensing. The affordability and accessibility of infrared detectors further contribute to their escalating popularity in these regions. Furthermore, developing nations increasingly acknowledge the significance of environmental monitoring and resource management. Infrared detectors are indispensable tools for assessing air quality, identifying sources of pollution, and monitoring the environmental impact of industrial activities. Hence, these factors collectively drive the adoption of infrared detectors across various sectors, propelling their market growth in these regions.

Challenge: Availability of substitute technologies.

In most chemical and petrochemical plants, infrared detectors are used to detect or identify gas leakage from the plant to the outer atmosphere or within the plant. However, Catalytic detectors are considered substitutes for infrared detectors in chemical and petrochemical plants for several reasons. For instance, catalytic detectors are designed for detecting flammable gases and vapors, making them ideal for monitoring their presence. They are well-suited for applications in chemical and petrochemical plants with a high risk of gas leaks and hazardous vapors. Catalytic detectors offer reliable and sensitive detection capabilities in such environments.

Furthermore, catalytic detectors provide a cost-effective solution compared to infrared detectors. They are less expensive to purchase and maintain, making them appealing to budget-conscious industries. Moreover, catalytic detectors require less frequent calibration and have a longer lifespan, reducing overall costs for chemical and petrochemical plants. These factors are leading to a rise in the penetration of catalytic detectors in gas detection applications, thereby impacting the sale of infrared detectors.

The market for NIR & SWIR to grow at the highest CAGR Infrared detector market in 2028.

NIR and SWIR detectors offer a broader spectral range than other infrared detectors. They can detect wavelengths ranging from approximately 0.7 to 3 micrometers (NIR) and 1 to 3 micrometers (SWIR). This extended range enables them to capture more detailed and specific information about the objects or materials being observed. Furthermore, NIR and SWIR detectors have diverse applications across various industries such as agriculture, pharmaceuticals, food and beverage, and automotive, NIR and SWIR detectors are utilized for quality control, product inspection, sorting, and process monitoring. These detectors can identify and characterize materials based on their unique spectral signatures, allowing for accurate and efficient analysis in various industrial processes. Furthermore, the advancements in technology and the availability of cost-effective NIR and SWIR detectors have contributed to their growing adoption in the market. Developing smaller, more sensitive, and more affordable detectors has opened up new opportunities for their integration into various devices and systems, expanding their use across industries.

The market for cooled infrared detectors is to grow at the highest CAGR during the forecast period.

Cooled infrared detectors demonstrate superior performance in comparison to uncooled detectors. The thermal noise within the detector is significantly minimized by cooling the detectors to cryogenic temperatures. It leads to heightened sensitivity, improved spatial resolution, and an enhanced signal-to-noise ratio, resulting in superior image quality and detection capabilities. These exceptional performance characteristics make cooled infrared detectors highly sought-after in applications that demand exceptional accuracy and precision, including military and defense, surveillance, and scientific research. Additionally, advancements in materials and technologies, such as Mercury Cadmium Telluride (MCT) and Indium Antimonide (InSb), have contributed to expanding the spectral range and detection capabilities in cooled infrared detectors. These developments have allowed cooled detectors to encompass a broader range of wavelengths, including the Mid-Wave Infrared (MWIR) and Long-Wave Infrared (LWIR) regions. As a result, cooled detectors have become well-suited for a wider array of applications, providing businesses with increased versatility and opportunities for utilization.

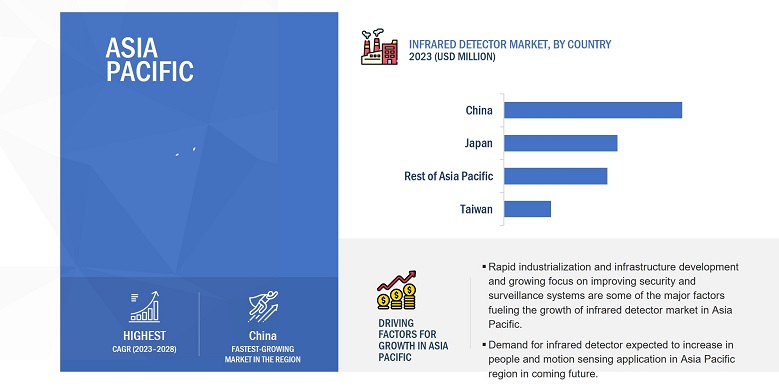

The market in Asia Pacific is projected to grow at the highest CAGR from 2023 to 2028.

The Asia Pacific region is experiencing rapid industrialization and infrastructure development, resulting in a heightened demand for advanced technologies and solutions in the manufacturing, energy, construction, and transportation industries. Infrared detectors, playing a vital role in these sectors, enable precise temperature measurements, ensuring process control, quality assurance, and safety. The increasing adoption of infrared detectors in these industries is a key driver of market growth within the region. Furthermore, a growing focus is on improving security and surveillance systems in the Asia Pacific region. Infrared detectors are extensively used in security cameras, intrusion detection systems, and access control systems to detect motion, monitor activity, and ensure safety. The need for enhanced security measures in public spaces, residential areas, and commercial establishments is driving the demand for infrared detectors.

Infrared Detector Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

A few key infrared detector companies players are Excelitas Technologies Corp. (US), Hamamatsu Photonics K.K. (Japan), Murata Manufacturing Co., Ltd. (Japan), Teledyne FLIR LLC (US), and Nippon Ceramic Co., Ltd. (Japan), Texas Instruments Incorporated (US), OMRON Corporation (Japan), InfraTec GmbH (Germany), Lynred (France), and TE Connectivity (Switzerland) are among a few key players in this market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size Available for Years |

2019–2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2028 |

|

Units |

Value (USD Million/Billion) |

|

Segments Covered |

By technology, wavelength, type, application, vertical |

|

Geographic Regions Covered |

North America, Asia Pacific, Europe, and RoW |

|

Companies Covered |

Major Players: Excelitas Technologies Corp. (US), Hamamatsu Photonics K.K. (Japan), Murata Manufacturing Co., Ltd. (Japan), Teledyne FLIR LLC (US), and Nippon Ceramic Co., Ltd. (Japan) Texas Instruments Incorporated (US), OMRON Corporation (Japan), InfraTec GmbH (Germany), Lynred (France), and TE Connectivity (Switzerland). and Others- (Total 25 players have been covered) |

Infrared Detector Market Highlights

This research report categorizes the infrared detector market by wavelength, type, application, vertical, and region.

|

Segment |

Subsegment |

|

By Technology |

|

|

By Wavelength: |

|

|

By Type: |

|

|

By Application: |

|

|

By Vertical: |

|

|

By Region |

|

Recent Developments

- In April 2023, Excelitas Technologies Corp. introduced the C30733BQC-01 InGaAs Avalanche Photodiode. The product offers an exceptional blend of high speed, high gain, and low noise for high-end and fiber-based telecom test and analysis equipment applications. The product is ideal for high-end telecommunication test equipment applications, optical communication, distributed fiber sensing systems, and eye-safe LiDAR and laser range-finding devices.

- In February 2023, Hamamatsu Photonics introduced a new InAsSb photovoltaic detector (P16702-011MN), which comes with a preamplifier offering high sensitivity to mid-infrared light, up to 11 micrometers (μm) in wavelength. These features make the detector a perfect option for portable gas analyzers, enabling prompt analysis of exhaust gas components directly at measurement sites near industrial facilities.

- In November 2022, Excelitas Technologies Corp. introduced the medical-grade TPiS 1T1386 L5.5H Thermopile Sensor. The product offers high-temperature accuracy, Configurable “Threshold” Functions, and the Lowest Power Consumption while used for remote skin-temperature measurement applications and temperature control of liquids and gases in medical applications.

Frequently Asked Questions (FAQ):

What is the current size of the global Infrared detector market?

The global Infrared detector market is estimated to be around USD 535 million in 2023 and projected to reach USD 751 million by 2028 at a CAGR of 7.0%.

Where will all these developments take the industry in the mid-to-long term?

Advancements in technology, expansion of applications, and integration with other technologies will enable the industry to address emerging challenges and create new opportunities. Key players operating in the Infrared detector marketplace are integrating emerging technologies within their existing ecosystem, which has helped to improve Infrared detector services.

Who are the winners of the global Infrared detector market?

Excelitas Technologies Corp. (US), Hamamatsu Photonics K.K. (Japan), Murata Manufacturing Co., Ltd. (Japan), Teledyne FLIR LLC (US), and Nippon Ceramic Co., Ltd. (Japan) are among a few key players in this market.

What are some features of an infrared detector?

An infrared detector is a specialized device that detects and measures infrared radiation, an invisible form of electromagnetic radiation. It is widely utilized in applications such as thermal imaging, spectroscopy, gas analysis, temperature measurement, and motion detection. By converting infrared radiation into electrical signals, these detectors play a vital role in capturing thermal data, identifying gases, monitoring temperature changes, and detecting movement in both industrial and consumer contexts. They are available in various types, including photodiodes, photovoltaic, thermal, and quantum detectors, each offering distinct advantages and operational principles.

What are the major strategies adopted by market players?

The key players have adopted product launches, acquisitions, and partnerships to strengthen their position in the infrared detector market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

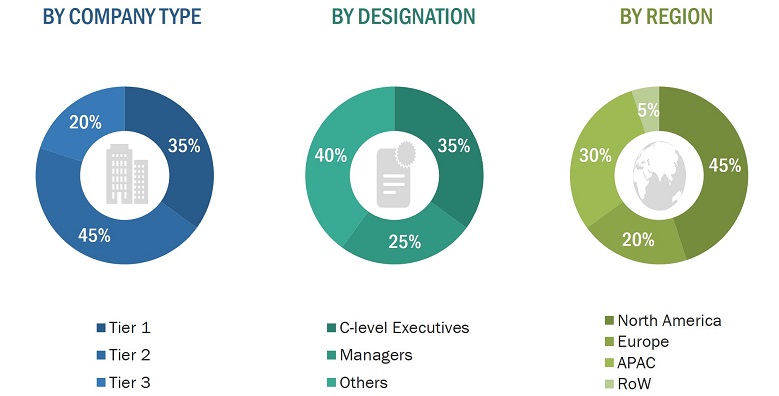

The study involved four major activities in estimating the current size of the infrared detector market. Exhaustive secondary research has been done to collect information on the market, peer, and parent markets. The next step has been to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods were applied to estimate the market size of segments and subsegments. Two sources of information—secondary and primary—have been used to identify and collect information for an extensive technical and commercial study of the infrared detector market.

Secondary Research

Secondary sources include company websites, magazines, industry news, associations, and databases (Factiva and Bloomberg). These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Secondary sources include corporate filings such as annual reports, investor presentations, financial statements, trade, business, and professional associations, white papers, manufacturing associations, and more.

Primary Research

Primary sources mainly consist of experts from the core and related industries, preferred infrared detector providers, distributors, alliances, standards, and certification organizations related to various segments of this industry’s value chain.

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts such as Chief Experience Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from infrared detector providers, such as research organizations, distributors, industry associations, and key opinion leaders. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches have been used to estimate and validate the size of the infrared detector market and other dependent submarkets. The leading players in the market have been identified through secondary research, and their market shares in the key regions have been determined through primary and secondary research. This entire procedure includes studying the annual and financial reports of top players and extensive interviews with industry experts such as chief executive officers, vice presidents, directors, and marketing executives.

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All possible parameters affecting the markets covered in this study have been accounted for, viewed in detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Data Triangulation

After arriving at the overall size of the infrared detector market from the market size estimation processes explained above, the total market has been split into several segments and sub-segments. The data triangulation procedure has been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments. The data has been triangulated by studying various factors and trends. Additionally, the market size has been validated using top-down and bottom-up approaches.

Market Definition

An infrared detector is an electronic device used to detect infrared radiation by sensing the surrounding environment. Infrared detectors can sense infrared spectrum ranging from wavelengths 0.7 μm to 1 μm. Various types of infrared detectors are available in the market, e.g., mercury cadmium telluride (MCT/HgCdTe), indium gallium arsenide (InGaAs), microbolometer, pyroelectric, and thermopile infrared detectors. They find applications in people & motion sensing, temperature measurement, security & surveillance, gas & fire detection, and spectroscopy & biomedical imaging in the industrial and nonindustrial verticals.

The infrared detector ecosystem includes various hardware providers. The market is diversified, with more than 30 companies competing across the value chain to sustain their market positions and increase their market shares. People & motion sensing, temperature measurement, and security & surveillance are expected to be the key application areas of infrared detectors.

Key Stakeholders

- Raw Material Suppliers

- Component Designers, Manufacturers, and Suppliers

- Original Equipment Manufacturers (OEMs)

- System Integrators

- Technology, Service, and Solution Providers

- Testing, Inspection, and Certification Companies

- Suppliers and Distributors

- Government and Other Regulatory Bodies

- Industry Forums, Alliances, and Associations

- Research Institutes and Organizations

- Market Research and Consulting Firms

- End Users

Report Objectives

- To define, describe, and forecast the infrared detector market segmented, in terms of value, based on type, wavelength, technology, application, vertical, and geography

- To forecast the pyroelectric and thermopile infrared detector markets in terms of volume

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the market growth

- To understand and analyze the impact of evolving technologies on the value chain of the infrared detector market and upcoming trends

- To highlight the impact of Porter’s five forces on the infrared detector ecosystem and analyze the underlying market opportunities

- To analyze the associated use cases in the infrared detector business and their impact on the business strategies adopted by key players

- To provide key industry trends and related regulations impacting the infrared detector market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To strategically profile key players and comprehensively analyze their market ranking and core competencies2, along with detailing the competitive landscape for market leaders

- To analyze the competitive developments such as joint ventures, mergers and acquisitions, product launches, and research and development (R&D) carried out by market players.

- To map the competitive intelligence based on company profiles, key strategies, and game-changing developments, such as product launches, collaborations, and acquisitions

- To benchmark the market players using the proprietary competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of business strategy excellence and strength of product portfolio.

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Infrared Detector Market

More details about the growth rate of the detector IR market for the next 8 years.