Laboratory Informatics Market by Type of Solutions (LIMS, ELN, CDS, EDC, CDMS, LES, ECM, SDMS), Component (Software, Service), Delivery (On premise, Cloud), Industry (CRO, CMO, Pharma, Biotech, Chemical, Agriculture, Oil, Gas) & Region - Global Forecast to 2026

The global laboratory informatics market in terms of revenue was estimated to be worth $3.4 billion in 2021 and is poised to reach $5.6 billion by 2026, growing at a CAGR of 10.8% from 2021 to 2026. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

Growth in this market is mainly driven by the increasing need for laboratory automation and the growing demand for biobanks and biorepositories. and growing R&D expenditure in the pharmaceutical and biotechnology industries. On the other hand, the lack of integration standards and interoperability challenges are expected to restrain the growth of this market to a certain extent.

To know about the assumptions considered for the study, Request for Free Sample Report

Laboratory Informatics Market Dynamics

Driver: Increasing need for laboratory automation

Laboratory automation is emerging as an effective solution for tackling the challenges of shortage of laboratory professionals and methods to reduce manual intervention in lab processes. Automation of routine lab procedures, with the help of devoted workstations and software to program instruments, improves lab productivity and enables individual researchers to focus on important tasks. Automation provides high-quality data and facilitates better documentation. The presence of supervisory standards, coupled with stringent regulatory requirements for error-free results, helps in the development of standardised systems with reproducible results. The exponential rise in the data being produced by lab systems has created the need for efficient data storage, analysis, and sharing methods. Laboratory informatics solutions offer an effective solution to this demand, as these solutions significantly facilitate, advance, and improve the productivity and efficiency of laboratory processes.

Opportunity: Significant growth potential in emerging countries

China, Japan, India, Singapore, Brazil, and Middle Eastern countries are major upcoming markets for LIMS. These markets lack proper standards and government regulations, thus offering huge potential for vendors unable to meet the standards implemented in developed markets such as the US. Several biopharmaceutical players are also shifting their manufacturing plants to Asia for low-cost production. This is creating a significant demand for informatics solutions in Asian countries. However, the COVID-19 pandemic has compelled stakeholders from developed markets such as the US and Europe to reduce their heavy dependence on Asian countries and shift back to in-house operations.

Restraint: High maintenance and service cost

The high maintenance and service costs associated with laboratory informatics solutions are one of the major factors restraining the growth of this market. According to industry experts, the maintenance cost of IT solutions is higher than the actual price of the software. Service and maintenance (which includes modification of the software as per changing user requirements) represent a recurring expenditure, amounting to almost 20–30% of the total cost of ownership. Moreover, training and implementation costs together represent around 15% of the actual price. Due to these factors, many small and medium-sized laboratories find it difficult to invest in these systems, thereby limiting their adoption. However, with the emergence of cloud-based offerings, the effect of this restraint is expected to decrease in the coming years.

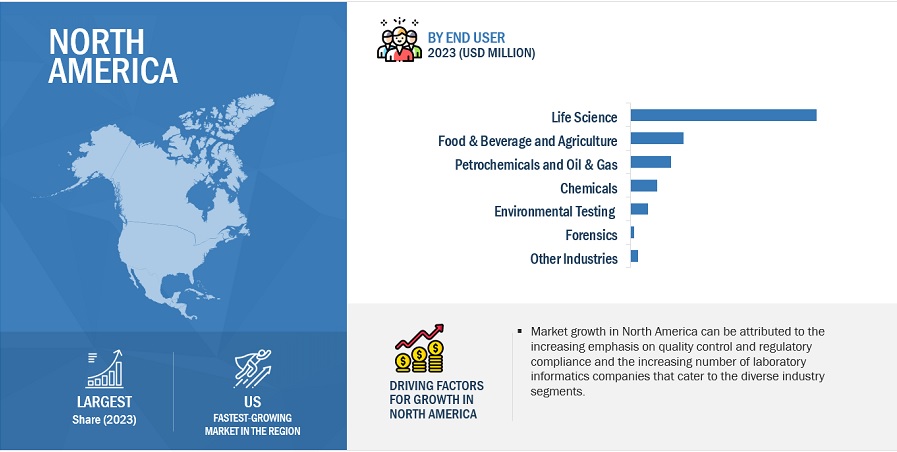

North America to Witness Significant Growth in the Laboratory Informatics Industry from 2021 to 2026

North America commanded the largest share of the laboratory informatics market, followed by Europe. North America’s dominance in the market can be attributed to the strong economies of the US and Canada, which have allowed for significant investments in new technologies, growth in biobanks, easy availability of lab informatics products and services, and stringent regulatory requirements across industries.

To know about the assumptions considered for the study, download the pdf brochure

LabVantage Solutions, Inc. (US), LabWare (US), Thermo Fisher Scientific Inc. (US), Abbott Informatics (US), PerkinElmer Inc. (US), Agilent Technologies, Inc. (US), LabLynx, Inc. (US), Waters (US), Autoscribe Informatics (US), Dassault Systèmes (Paris, France), LABWORKS LLC (US), and are some of the prominent players operating in the laboratory informatics market.

Scope of the Laboratory Informatics Industry

|

Report Metric |

Details |

|

Market Revenue in 2021 |

$3.4 billion |

|

Projected Revenue by 2026 |

$5.6 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 10.8% |

|

Market Driver |

Increasing need for laboratory automation |

|

Market Opportunity |

Significant growth potential in emerging countries |

This research report categorizes the laboratory informatics market to forecast revenue and analyze trends in each of the following submarkets:

By Type of Solution

- Laboratory Information Management Systems (LIMS)

- Electronic Lab Notebooks (ELN)

- Chromatography Data Systems (CDS)

- Electronic Data Capture (EDC) & Clinical Data Management Systems (CDMS)

- Laboratory Execution Systems (LES)

- Enterprise Content Management (ECM)

- Scientific Data Management Systems (SDMS)

By Component

- Services

- Software

By Deployment Model

- On-premise

- Cloud-based

- Remotely Hosted

By Industry

-

Life Sciences Industry

- Pharmaceutical & Biotechnology Companies

- Biobanks & Biorepositories

- Molecular Diagnostics & Clinical Research Laboratories

- Contract Service Organizations

- Academic Research Institutes

- Chemicals Industry

- Food & Beverage and Agriculture Industry

- Petrochemical Refineries and Oil & Gas Industry

- Environmental Testing Laboratories

- Other Industries

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Spain

- Italy

- Rest of Europe (RoE)

-

Asia

- Japan

- China

- India

- Rest of Asia (RoA)

-

Rest of the World (RoW)

Recent Developments of Laboratory Informatics Industry

- In June 2020, LabWare introduced the latest version of its LIMS—LabWare 8. The LabWare 8 solution is the company’s enterprises laboratory platform (ELP) that delivers the capabilities of both LIMS and ELN in a single integrated system.

- In July 2020, LabVantage launched 8.5, an upgraded version of its LabVantage platform that offers a fully integrated SDMS.

- In August 2018, Waters (US) signed an agreement with Restek Corporation (US). Under this agreement, Waters and Restek Corporation agreed to provide training and application support of GC-MS methods and workflows for pesticide monitoring and screening to food safety laboratories.

- In May 2018, Agilent Technologies (US) acquired Genohm (Switzerland). This acquisition enhanced Agilent’s current software portfolio by adding LIMS and workflow management, thus expanding the company’s ELN capabilities.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global laboratory informatics market?

The global laboratory informatics market boasts a total revenue value of $5.6 billion by 2026.

What is the estimated growth rate (CAGR) of the global laboratory informatics market?

The global laboratory informatics market has an estimated compound annual growth rate (CAGR) of 10.8% and a revenue size in the region of $3.4 billion in 2021.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 34)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 LABORATORY INFORMATICS MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES MADE

2 RESEARCH METHODOLOGY (Page No. - 38)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 3 PRIMARY SOURCES

2.1.2.1 Key industry insights

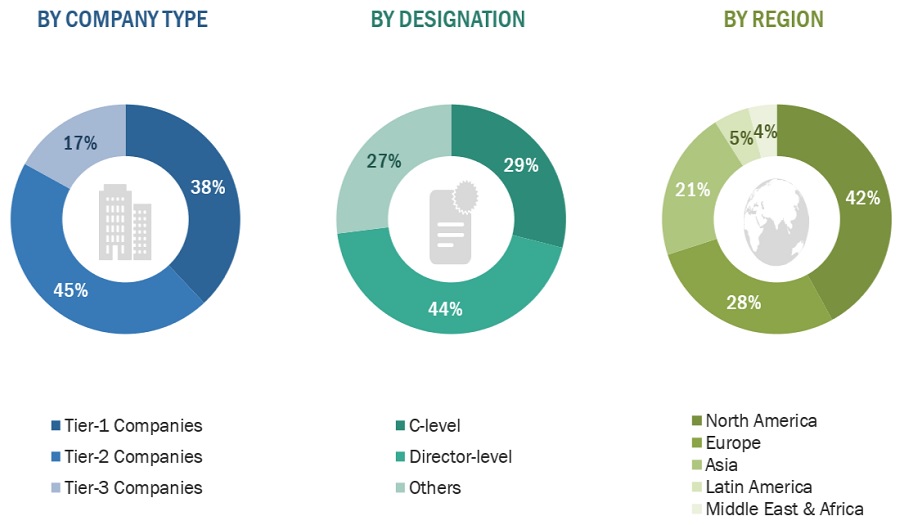

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY TYPE OF INDUSTRY AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 7 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 8 REVENUE SHARE ANALYSIS ILLUSTRATION FOR LIMS

FIGURE 9 BOTTOM-UP APPROACH: END-USER SPENDING ON LABORATORY INFORMATICS

2.2.1 GROWTH FORECAST

FIGURE 10 CAGR PROJECTIONS FROM THE ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE LABORATORY INFORMATICS INDUSTRY (2021–2026)

FIGURE 11 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

FIGURE 12 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 13 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ESTIMATION

2.5 MARKET SIZING ASSUMPTIONS

2.6 OVERALL STUDY ASSUMPTIONS

2.7 LIMITATIONS

2.8 RISK ASSESSMENT

TABLE 1 RISK ASSESSMENT: MARKET

3 EXECUTIVE SUMMARY (Page No. - 55)

FIGURE 14 LABORATORY INFORMATICS INDUSTRY, BY TYPE OF SOLUTION, 2021 VS. 2026 (USD MILLION)

FIGURE 15 MARKET, BY COMPONENT, 2021 VS. 2026 (USD MILLION)

FIGURE 16 MARKET, BY DEPLOYMENT MODEL, 2021 VS. 2026 (USD MILLION)

FIGURE 17 LABORATORY INFORMATICS INDUSTRY, BY INDUSTRY, 2021 VS. 2026 (USD MILLION)

FIGURE 18 GEOGRAPHICAL SNAPSHOT OF THE LABORATORY INFORMATICS MARKET

4 PREMIUM INSIGHTS (Page No. - 59)

4.1 LABORATORY INFORMATICS INDUSTRY OVERVIEW

FIGURE 19 THE GROWING USE OF LAB INFORMATICS SOLUTIONS TO COMPLY WITH STRINGENT REGULATORY REQUIREMENTS WILL DRIVE THE MARKET GROWTH

4.2 MARKET, BY LIMS TYPE, 2021–2026

FIGURE 20 BROAD-BASED LIMS SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

4.3 LABORATORY INFORMATICS INDUSTRY SHARE, BY INDUSTRY & REGION (2020)

FIGURE 21 LIFE SCIENCES INDUSTRY SEGMENT ACCOUNTED FOR THE LARGEST SHARE OF THE MARKET IN 2020

4.4 GEOGRAPHICAL SNAPSHOT OF THE MARKET

FIGURE 22 ASIA TO WITNESS THE HIGHEST GROWTH DURING THE FORECAST PERIOD (2021–2026)

5 MARKET OVERVIEW (Page No. - 63)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 23 LABORATORY INFORMATICS INDUSTRY: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing need for laboratory automation

5.2.1.2 Development of integrated lab informatics solutions

5.2.1.3 Stringent regulatory requirements

5.2.1.4 Growing demand for lab informatics in biobanks/biorepositories, academic research institutes, and CROs

5.2.1.5 Growing R&D expenditure in pharmaceutical and biotechnology industries

5.2.2 RESTRAINTS

5.2.2.1 High maintenance and service costs

5.2.2.2 Lack of integration standards for LIMS

5.2.2.3 Interoperability challenges

5.2.3 OPPORTUNITIES

5.2.3.1 Growing popularity of cloud-based laboratory informatics

5.2.3.2 Significant growth potential in emerging countries

5.2.3.3 Use of lab informatics solutions in the cannabis industry

TABLE 2 INDICATIVE LIST OF CANNABIS LIMS OFFERED BY MARKET PLAYERS

5.2.4 CHALLENGES

5.2.4.1 Dearth of trained professionals

5.2.4.2 Interfacing with diverse laboratory instruments

5.3 IMPACT OF COVID-19 ON THE LABORATORY INFORMATICS INDUSTRY

TABLE 3 COVID-19 VACCINE R&D INVESTMENTS AS OF JULY 2021

5.4 VALUE CHAIN ANALYSIS

FIGURE 24 VALUE CHAIN: MARKET

5.5 ECOSYSTEM

FIGURE 25 LABORATORY INFORMATICS INDUSTRY ECOSYSTEM

TABLE 4 ECOSYSTEM: LABORATORY INFORMATICS MARKET

5.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 LABORATORY INFORMATICS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.7 PRICING ANALYSIS

TABLE 6 LABORATORY INFORMATION MANAGEMENT SYSTEMS MARKET: PRICING ANALYSIS, BY TYPE OF LICENSE

5.8 TECHNOLOGY ANALYSIS

5.8.1 ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

5.8.2 INTERNET OF THINGS

5.8.3 DATA ANALYTICS

5.8.4 BLOCKCHAIN

5.8.5 CLOUD COMPUTING

5.9 REGULATORY ANALYSIS

5.9.1 NORTH AMERICA

5.9.2 EUROPE

5.9.3 ASIA PACIFIC

5.9.4 MIDDLE EAST AND AFRICA

5.9.5 LATIN AMERICA

5.1 CASE STUDY ANALYSIS

5.10.1 CASE STUDY 1

5.10.2 CASE STUDY 2

5.10.3 CASE STUDY 3

5.10.4 CASE STUDY 4

6 LABORATORY INFORMATICS MARKET, BY TYPE OF SOLUTION (Page No. - 82)

6.1 INTRODUCTION

TABLE 7 LABORATORY INFORMATICS INDUSTRY, BY TYPE OF SOLUTION, 2019–2026 (USD MILLION)

6.2 LABORATORY INFORMATION MANAGEMENT SYSTEMS

TABLE 8 LABORATORY INFORMATION MANAGEMENT SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 9 LABORATORY INFORMATION MANAGEMENT SYSTEMS MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 10 NORTH AMERICA: LABORATORY INFORMATION MANAGEMENT SYSTEMS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 11 EUROPE: LABORATORY INFORMATION MANAGEMENT SYSTEMS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 12 ASIA: LABORATORY INFORMATION MANAGEMENT SYSTEMS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

6.2.1 BROAD-BASED LIMS

6.2.1.1 Broad-based LIMS offers advantages such as faster ROI and reduced total cost of ownership

TABLE 13 BROAD-BASED LABORATORY INFORMATION MANAGEMENT SYSTEMS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.2.2 INDUSTRY-SPECIFIC LIMS

6.2.2.1 Need for laboratories to implement in-house customized LIMS solutions to cater to specific industry requirements to support market growth

TABLE 14 INDUSTRY-SPECIFIC LABORATORY INFORMATION MANAGEMENT SYSTEMS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.3 ELECTRONIC LAB NOTEBOOKS

6.3.1 INCREASING NEED FOR COMPLIANCE WITH REGULATIONS, IP PROTECTION, AND INSTRUMENT MANAGEMENT TO SUPPORT MARKET GROWTH

TABLE 15 ELN SOLUTIONS OFFERED BY KEY PLAYERS

TABLE 16 ELECTRONIC LAB NOTEBOOKS MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 17 NORTH AMERICA: ELECTRONIC LAB NOTEBOOKS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 18 EUROPE: ELECTRONIC LAB NOTEBOOKS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 19 ASIA: ELECTRONIC LAB NOTEBOOKS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

6.4 CHROMATOGRAPHY DATA SYSTEMS

6.4.1 CHROMATOGRAPHY DATA SYSTEMS ARE USED TO INTERPRET DATA FROM CHROMATOGRAPHY INSTRUMENTS AND CONVERT IT INTO A HUMAN-READABLE FORMAT

TABLE 20 CDS SOLUTIONS OFFERED BY KEY PLAYERS

TABLE 21 CHROMATOGRAPHY DATA SYSTEMS MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 22 NORTH AMERICA: CHROMATOGRAPHY DATA SYSTEMS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 23 EUROPE: CHROMATOGRAPHY DATA SYSTEMS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 24 ASIA: CHROMATOGRAPHY DATA SYSTEMS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

6.5 ELECTRONIC DATA CAPTURE & CLINICAL DATA MANAGEMENT SYSTEMS

6.5.1 INCREASING R&D EXPENDITURE OF PHARMACEUTICAL COMPANIES TO DRIVE THE ADOPTION OF EDC & CDMS

TABLE 25 EDC & CDMS SOLUTIONS OFFERED BY KEY MARKET PLAYERS

TABLE 26 ELECTRONIC DATA CAPTURE & CLINICAL DATA MANAGEMENT SYSTEMS MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 27 NORTH AMERICA: ELECTRONIC DATA CAPTURE & CLINICAL DATA MANAGEMENT SYSTEMS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 28 EUROPE: ELECTRONIC DATA CAPTURE & CLINICAL DATA MANAGEMENT SYSTEMS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 29 ASIA: ELECTRONIC DATA CAPTURE & CLINICAL DATA MANAGEMENT SYSTEMS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

6.6 LABORATORY EXECUTION SYSTEMS

6.6.1 LABORATORY EXECUTION SYSTEMS PROVIDE AN ELECTRONIC ENVIRONMENT THAT REMOVES PAPER PROCESSES

TABLE 30 LES SOLUTIONS OFFERED BY KEY PLAYERS

TABLE 31 LABORATORY EXECUTION SYSTEMS MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 32 NORTH AMERICA: LABORATORY EXECUTION SYSTEMS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 33 EUROPE: LABORATORY EXECUTION SYSTEMS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 34 ASIA: LABORATORY EXECUTION SYSTEMS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

6.7 ENTERPRISE CONTENT MANAGEMENT SYSTEMS

6.7.1 ENTERPRISE CONTENT MANAGEMENT SYSTEMS INCREASE PRODUCTIVITY FOR ORGANIZATIONS BY SAVING TIME SPENT ON MANUAL TASKS

TABLE 35 ENTERPRISE CONTENT MANAGEMENT SYSTEMS MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 36 NORTH AMERICA: ENTERPRISE CONTENT MANAGEMENT SYSTEMS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 37 EUROPE: ENTERPRISE CONTENT MANAGEMENT SYSTEMS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 38 ASIA: ENTERPRISE CONTENT MANAGEMENT SYSTEMS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

6.8 SCIENTIFIC DATA MANAGEMENT SYSTEMS

6.8.1 SDMS IS DESIGNED PRIMARILY FOR DATA CONSOLIDATION, KNOWLEDGE MANAGEMENT, AND KNOWLEDGE ASSET REALIZATION

TABLE 39 SCIENTIFIC DATA MANAGEMENT SYSTEMS MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 40 NORTH AMERICA: SCIENTIFIC DATA MANAGEMENT SYSTEMS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 41 EUROPE: SCIENTIFIC DATA MANAGEMENT SYSTEMS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 42 ASIA: SCIENTIFIC DATA MANAGEMENT SYSTEMS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7 LABORATORY INFORMATICS MARKET, BY COMPONENT (Page No. - 102)

7.1 INTRODUCTION

TABLE 43 LABORATORY INFORMATICS INDUSTRY, BY COMPONENT, 2019–2026 (USD MILLION)

7.2 SERVICES

7.2.1 INCREASING ADOPTION OF CLOUD-BASED SOLUTIONS TO DRIVE THE DEMAND FOR LAB INFORMATICS SERVICES

TABLE 44 LABORATORY INFORMATICS SERVICES MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 45 NORTH AMERICA: LABORATORY INFORMATICS SERVICES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 46 EUROPE: LABORATORY INFORMATICS SERVICES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 47 ASIA: LABORATORY INFORMATICS SERVICES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.3 SOFTWARE

7.3.1 SHIFTING TREND TOWARD LABORATORY AUTOMATION IS THE KEY FACTOR DRIVING MARKET GROWTH

TABLE 48 LABORATORY INFORMATICS SOFTWARE MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 49 NORTH AMERICA: LABORATORY INFORMATICS SOFTWARE MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 50 EUROPE: LABORATORY INFORMATICS SOFTWARE MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 51 ASIA: LABORATORY INFORMATICS SOFTWARE MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

8 LABORATORY INFORMATICS MARKET, BY DEPLOYMENT MODEL (Page No. - 108)

8.1 INTRODUCTION

TABLE 52 LABORATORY INFORMATICS INDUSTRY, BY DEPLOYMENT MODEL, 2019–2026 (USD MILLION)

8.2 ON-PREMISE MODEL

8.2.1 GROWTH OF THIS SEGMENT IS DECLINING AS ON-PREMISE SOLUTIONS HAVE A HIGH COST OF OWNERSHIP

TABLE 53 MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 55 EUROPE: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 56 ASIA: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

8.3 CLOUD-BASED MODEL

8.3.1 THIS SEGMENT IS EXPECTED TO GROW AT THE HIGHEST RATE DURING THE FORECAST PERIOD

TABLE 57 MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 59 EUROPE: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 60 ASIA: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

8.4 REMOTELY HOSTED MODEL

8.4.1 FACTORS SUCH AS THE LOW TOTAL COST OF OWNERSHIP AND A GOOD RETURN ON INVESTMENT ARE EXPECTED TO DRIVE THE GROWTH OF THIS MARKET SEGMENT

TABLE 61 MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 62 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 63 EUROPE: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 64 ASIA: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

9 LABORATORY INFORMATICS MARKET, BY INDUSTRY (Page No. - 116)

9.1 INTRODUCTION

TABLE 65 LABORATORY INFORMATICS INDUSTRY, BY INDUSTRY, 2019–2026 (USD MILLION)

9.2 LIFE SCIENCES INDUSTRY

TABLE 66 LABORATORY INFORMATICS INDUSTRY FOR THE LIFE SCIENCES INDUSTRY, BY TYPE, 2019–2026 (USD MILLION)

TABLE 67 LABORATORY INFORMATICS INDUSTRY FOR THE LIFE SCIENCES INDUSTRY, BY REGION, 2019–2026 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET FOR THE LIFE SCIENCES INDUSTRY, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 69 EUROPE: MARKET FOR THE LIFE SCIENCES INDUSTRY, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 70 ASIA: MARKET FOR THE LIFE SCIENCES INDUSTRY, BY COUNTRY, 2019–2026 (USD MILLION)

9.2.1 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

9.2.1.1 Pharmaceutical & biotechnology companies are increasingly adopting informatics solutions to improve their efficiency

TABLE 71 LABORATORY INFORMATICS INDUSTRY FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2019–2026 (USD MILLION)

TABLE 72 NORTH AMERICA: MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 73 EUROPE: MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 74 ASIA: MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2019–2026 (USD MILLION)

9.2.2 BIOBANKS & BIOREPOSITORIES

9.2.2.1 Demand for high-quality specimens has boosted the use of automated systems

TABLE 75 LABORATORY INFORMATICS INDUSTRY FOR BIOBANKS & BIOREPOSITORIES, BY REGION, 2019–2026 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET FOR BIOBANKS & BIOREPOSITORIES, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 77 EUROPE: MARKET FOR BIOBANKS & BIOREPOSITORIES, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 78 ASIA: MARKET FOR BIOBANKS & BIOREPOSITORIES, BY COUNTRY, 2019–2026 (USD MILLION)

9.2.3 ACADEMIC RESEARCH INSTITUTES

9.2.3.1 Advances in cancer, genomics, and proteomics research to support market growth

TABLE 79 MARKET FOR ACADEMIC RESEARCH INSTITUTES, BY REGION, 2019–2026 (USD MILLION)

TABLE 80 NORTH AMERICA: LABORATORY INFORMATICS MARKET FOR ACADEMIC RESEARCH INSTITUTES, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 81 EUROPE: LABORATORY INFORMATICS MARKET FOR ACADEMIC RESEARCH INSTITUTES, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 82 ASIA: LABORATORY INFORMATICS MARKET FOR ACADEMIC RESEARCH INSTITUTES, BY COUNTRY, 2019–2026 (USD MILLION)

9.2.4 MOLECULAR DIAGNOSTICS & CLINICAL RESEARCH LABORATORIES

9.2.4.1 Clinical labs offer significant opportunities for the growth of the market

TABLE 83 LABORATORY INFORMATICS MARKET FOR MOLECULAR DIAGNOSTICS & CLINICAL RESEARCH LABORATORIES, BY REGION, 2019–2026 (USD MILLION)

TABLE 84 NORTH AMERICA: LABORATORY INFORMATICS MARKET FOR MOLECULAR DIAGNOSTICS & CLINICAL RESEARCH LABORATORIES, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 85 EUROPE: MARKET FOR MOLECULAR DIAGNOSTICS & CLINICAL RESEARCH LABORATORIES, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 86 ASIA: LABORATORY INFORMATICS MARKET FOR MOLECULAR DIAGNOSTICS & CLINICAL RESEARCH LABORATORIES, BY COUNTRY, 2019–2026 (USD MILLION)

9.2.5 CONTRACT SERVICE ORGANIZATIONS

9.2.5.1 Increasing number of clinical trials will support the growth of this market segment

TABLE 87 LABORATORY INFORMATICS MARKET FOR CONTRACT SERVICE ORGANIZATIONS, BY REGION, 2019–2026 (USD MILLION)

TABLE 88 NORTH AMERICA: LABORATORY INFORMATICS MARKET FOR CONTRACT SERVICE ORGANIZATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 89 EUROPE: LABORATORY INFORMATICS MARKET FOR CONTRACT SERVICE ORGANIZATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 90 ASIA: LABORATORY INFORMATICS MARKET FOR CONTRACT SERVICE ORGANIZATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

9.3 CHEMICAL INDUSTRY

9.3.1 NEED TO INTEGRATE SYSTEMS AND CENTRALIZE DATABASES HAS DRIVEN THE USE OF INFORMATICS

TABLE 91 MARKET FOR THE CHEMICAL INDUSTRY, BY REGION, 2019–2026 (USD MILLION)

TABLE 92 NORTH AMERICA: LABORATORY INFORMATICS MARKET FOR THE CHEMICAL INDUSTRY, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 93 EUROPE: MARKET FOR THE CHEMICAL INDUSTRY, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 94 ASIA: MARKET FOR THE CHEMICAL INDUSTRY, BY COUNTRY, 2019–2026 (USD MILLION)

9.4 FOOD & BEVERAGE AND AGRICULTURE INDUSTRY

9.4.1 LAB INFORMATICS SOLUTIONS CAN PROVIDE DATA TRACEABILITY AND ACCESSIBILITY IN THE FOOD & BEVERAGE INDUSTRY

TABLE 95 MARKET FOR THE FOOD & BEVERAGE AND AGRICULTURE INDUSTRY, BY REGION, 2019–2026 (USD MILLION)

TABLE 96 NORTH AMERICA: LABORATORY INFORMATICS MARKET FOR THE FOOD & BEVERAGE AND AGRICULTURE INDUSTRY, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 97 EUROPE: MARKET FOR THE FOOD & BEVERAGE AND AGRICULTURE INDUSTRY, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 98 ASIA: MLABORATORY INFORMATICS ARKET FOR THE FOOD & BEVERAGE AND AGRICULTURE INDUSTRY, BY COUNTRY, 2019–2026 (USD MILLION)

9.5 PETROCHEMICAL REFINERIES AND OIL & GAS INDUSTRY

9.5.1 INTEGRATION OF OPERATIONS IS A KEY FUNCTION OF LAB INFORMATICS SOLUTIONS IN THIS SEGMENT

TABLE 99 MARKET FOR PETROCHEMICAL REFINERIES AND OIL & GAS INDUSTRY, BY REGION, 2019–2026 (USD MILLION)

TABLE 100 NORTH AMERICA: LABORATORY INFORMATICS MARKET FOR PETROCHEMICAL REFINERIES AND OIL & GAS INDUSTRY, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 101 EUROPE: LABORATORY INFORMATICS MARKET FOR PETROCHEMICAL REFINERIES AND OIL & GAS INDUSTRY, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 102 ASIA: LABORATORY INFORMATICS MARKET FOR PETROCHEMICAL REFINERIES AND OIL & GAS INDUSTRY, BY COUNTRY, 2019–2026 (USD MILLION)

9.6 ENVIRONMENTAL TESTING LABORATORIES

9.6.1 GROWING NEED TO COMPLY WITH REGULATIONS IS DRIVING THE DEMAND FOR LIMS

TABLE 103 MARKET FOR ENVIRONMENTAL TESTING LABORATORIES, BY REGION, 2019–2026 (USD MILLION)

TABLE 104 NORTH AMERICA: LABORATORY INFORMATICS MARKET FOR ENVIRONMENTAL TESTING LABORATORIES, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 105 EUROPE: MARKET FOR ENVIRONMENTAL TESTING LABORATORIES, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 106 ASIA: LABORATORY INFORMATICS MARKET FOR ENVIRONMENTAL TESTING LABORATORIES, BY COUNTRY, 2019–2026 (USD MILLION)

9.7 OTHER INDUSTRIES

TABLE 107 SOLUTIONS OFFERED BY KEY PLAYERS FOR FORENSIC LABORATORIES

TABLE 108 MARKET FOR OTHER INDUSTRIES, BY REGION, 2019–2026 (USD MILLION)

TABLE 109 NORTH AMERICA: MARKET FOR OTHER INDUSTRIES, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 110 EUROPE: MARKET FOR OTHER INDUSTRIES, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 111 ASIA: MARKET FOR OTHER INDUSTRIES, BY COUNTRY, 2019–2026 (USD MILLION)

10 LABORATORY INFORMATICS MARKET, BY REGION (Page No. - 140)

10.1 INTRODUCTION

TABLE 112 MARKET, BY REGION, 2019–2026 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 26 NORTH AMERICA: LABORATORY INFORMATICS MARKET SNAPSHOT

TABLE 113 NORTH AMERICA: MLABORATORY INFORMATICS ARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 114 NORTH AMERICA: LABORATORY INFORMATICS MARKET, BY TYPE OF SOLUTION, 2019–2026 (USD MILLION)

TABLE 115 NORTH AMERICA: LIMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 116 NORTH AMERICA: LABORATORY INFORMATICS MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 117 NORTH AMERICA: LABORATORY INFORMATICS MARKET, BY DEPLOYMENT MODEL, 2019–2026 (USD MILLION)

TABLE 118 NORTH AMERICA: LABORATORY INFORMATICS MARKET, BY INDUSTRY, 2019–2026 (USD MILLION)

TABLE 119 NORTH AMERICA: LABORATORY INFORMATICS MARKET FOR THE LIFE SCIENCES INDUSTRY, BY TYPE, 2019–2026 (USD MILLION)

10.2.1 US

10.2.1.1 Strong economy and increasing R&D expenditure are expected to drive market growth in the US

TABLE 120 US: MARKET, BY TYPE OF SOLUTION, 2019–2026 (USD MILLION)

TABLE 121 US: LIMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 122 US: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 123 US: MARKET, BY DEPLOYMENT MODEL, 2019–2026 (USD MILLION)

TABLE 124 US: MARKET, BY INDUSTRY, 2019–2026 (USD MILLION)

TABLE 125 US: MARKET FOR THE LIFE SCIENCES INDUSTRY, BY TYPE, 2019–2026 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Increasing demand for lab automation is driving market growth in Canada

TABLE 126 CANADA: MARKET, BY TYPE OF SOLUTION, 2019–2026 (USD MILLION)

TABLE 127 CANADA: LIMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 128 CANADA: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 129 CANADA: MARKET, BY DEPLOYMENT MODEL, 2019–2026 (USD MILLION)

TABLE 130 CANADA: MARKET, BY INDUSTRY, 2019–2026 (USD MILLION)

TABLE 131 CANADA: MARKET FOR THE LIFE SCIENCES INDUSTRY, BY TYPE, 2019–2026 (USD MILLION)

10.3 EUROPE

FIGURE 27 EUROPE: MARKET SNAPSHOT

TABLE 132 EUROPE: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 133 EUROPE: MARKET, BY TYPE OF SOLUTION, 2019–2026 (USD MILLION)

TABLE 134 EUROPE: LIMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 135 EUROPE: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 136 EUROPE: MARKET, BY DEPLOYMENT MODEL, 2019–2026 (USD MILLION)

TABLE 137 EUROPE: MARKET, BY INDUSTRY, 2019–2026 (USD MILLION)

TABLE 138 EUROPE: MARKET FOR THE LIFE SCIENCES INDUSTRY, BY TYPE, 2019–2026 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Germany to dominate the market in Europe

TABLE 139 GERMANY: MARKET, BY TYPE OF SOLUTION, 2019–2026 (USD MILLION)

TABLE 140 GERMANY: LIMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 141 GERMANY: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 142 GERMANY: MARKET, BY DEPLOYMENT MODEL, 2019–2026 (USD MILLION)

TABLE 143 GERMANY: MARKET, BY INDUSTRY, 2019–2026 (USD MILLION)

TABLE 144 GERMANY: MARKET FOR THE LIFE SCIENCES INDUSTRY, BY TYPE, 2019–2026 (USD MILLION)

10.3.2 UK

10.3.2.1 Increasing expenditure on pharmaceuticals is expected to drive the laboratory informatics market in the UK

TABLE 145 UK: MARKET, BY TYPE OF SOLUTION, 2019–2026 (USD MILLION)

TABLE 146 UK: LIMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 147 UK: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 148 UK: MARKET, BY DEPLOYMENT MODEL, 2019–2026 (USD MILLION)

TABLE 149 UK: MARKET, BY INDUSTRY, 2019–2026 (USD MILLION)

TABLE 150 UK: MARKET FOR THE LIFE SCIENCES INDUSTRY, BY TYPE, 2019–2026 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 Growing biotech R&D investments to drive market growth in France

TABLE 151 FRANCE: MARKET, BY TYPE OF SOLUTION, 2019–2026 (USD MILLION)

TABLE 152 FRANCE: LIMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 153 FRANCE: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 154 FRANCE: MARKET, BY DEPLOYMENT MODEL, 2019–2026 (USD MILLION)

TABLE 155 FRANCE: MARKET, BY INDUSTRY, 2019–2026 (USD MILLION)

TABLE 156 FRANCE: MARKET FOR THE LIFE SCIENCES INDUSTRY, BY TYPE, 2019–2026 (USD MILLION)

10.3.4 ITALY

10.3.4.1 High pressure on research labs due to the COVID-19 outbreak has necessitated the adoption of LIMS and other lab informatics in Italy

TABLE 157 ITALY: MARKET, BY TYPE OF SOLUTION, 2019–2026 (USD MILLION)

TABLE 158 ITALY: LIMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 159 ITALY: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 160 ITALY: MARKET, BY DEPLOYMENT MODEL, 2019–2026 (USD MILLION)

TABLE 161 ITALY: MARKET, BY INDUSTRY, 2019–2026 (USD MILLION)

TABLE 162 ITALY: MARKET FOR THE LIFE SCIENCES INDUSTRY, BY TYPE, 2019–2026 (USD MILLION)

10.3.5 SPAIN

10.3.5.1 Increase in food & beverage production has driven the adoption of laboratory informatics in Spain

TABLE 163 SPAIN: MARKET, BY TYPE OF SOLUTION, 2019–2026 (USD MILLION)

TABLE 164 SPAIN: LIMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 165 SPAIN: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 166 SPAIN: MARKET, BY DEPLOYMENT MODEL, 2019–2026 (USD MILLION)

TABLE 167 SPAIN: MARKET, BY INDUSTRY, 2019–2026 (USD MILLION)

TABLE 168 SPAIN: MARKET FOR THE LIFE SCIENCES INDUSTRY, BY TYPE, 2019–2026 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 169 REST OF EUROPE: MARKET, BY TYPE OF SOLUTION, 2019–2026 (USD MILLION)

TABLE 170 REST OF EUROPE: LIMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 171 REST OF EUROPE: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 172 REST OF EUROPE: MARKET, BY DEPLOYMENT MODEL, 2019–2026 (USD MILLION)

TABLE 173 REST OF EUROPE: MARKET, BY INDUSTRY, 2019–2026 (USD MILLION)

TABLE 174 REST OF EUROPE: MARKET FOR THE LIFE SCIENCES INDUSTRY, BY TYPE, 2019–2026 (USD MILLION)

10.4 ASIA

TABLE 175 ASIA: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 176 ASIA: MARKET, BY TYPE OF SOLUTION, 2019–2026 (USD MILLION)

TABLE 177 ASIA: LIMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 178 ASIA: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 179 ASIA: MARKET, BY DEPLOYMENT MODEL, 2019–2026 (USD MILLION)

TABLE 180 ASIA: MARKET, BY INDUSTRY, 2019–2026 (USD MILLION)

TABLE 181 ASIA: MARKET FOR THE LIFE SCIENCES INDUSTRY, BY TYPE, 2019–2026 (USD MILLION)

10.4.1 JAPAN

10.4.1.1 Growing government support for clinical R&D activities to drive market growth in Japan

TABLE 182 JAPAN: MARKET, BY TYPE OF SOLUTION, 2019–2026 (USD MILLION)

TABLE 183 JAPAN: LIMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 184 JAPAN: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 185 JAPAN: MARKET, BY DEPLOYMENT MODEL, 2019–2026 (USD MILLION)

TABLE 186 JAPAN: MARKET, BY INDUSTRY, 2019–2026 (USD MILLION)

TABLE 187 JAPAN: MARKET FOR THE LIFE SCIENCES INDUSTRY, BY TYPE, 2019–2026 (USD MILLION)

10.4.2 CHINA

10.4.2.1 In China, any software interface needs to be translated into the regional language, which makes it challenging for international players to compete in this market

TABLE 188 CHINA: MARKET, BY TYPE OF SOLUTION, 2019–2026 (USD MILLION)

TABLE 189 CHINA: LIMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 190 CHINA: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 191 CHINA: MARKET, BY DEPLOYMENT MODEL, 2019–2026 (USD MILLION)

TABLE 192 CHINA: MARKET, BY INDUSTRY, 2019–2026 (USD MILLION)

TABLE 193 CHINA: MARKET FOR THE LIFE SCIENCES INDUSTRY, BY TYPE, 2019–2026 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Growth in drug development-based research is one of the major factors boosting the market growth in India

TABLE 194 INDIA: MARKET, BY TYPE OF SOLUTION, 2019–2026 (USD MILLION)

TABLE 195 INDIA: LIMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 196 INDIA: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 197 INDIA: MARKET, BY DEPLOYMENT MODEL, 2019–2026 (USD MILLION)

TABLE 198 INDIA: MARKET, BY INDUSTRY, 2019–2026 (USD MILLION)

TABLE 199 INDIA: MARKET FOR THE LIFE SCIENCES INDUSTRY, BY TYPE, 2019–2026 (USD MILLION)

10.4.4 REST OF ASIA

TABLE 200 REST OF ASIA: MARKET, BY TYPE OF SOLUTION, 2019–2026 (USD MILLION)

TABLE 201 REST OF ASIA: LIMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 202 REST OF ASIA: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 203 REST OF ASIA: MARKET, BY DEPLOYMENT MODEL, 2019–2026 (USD MILLION)

TABLE 204 REST OF ASIA: MARKET, BY INDUSTRY, 2019–2026 (USD MILLION)

TABLE 205 REST OF ASIA: MARKET FOR THE LIFE SCIENCES INDUSTRY, BY TYPE, 2019–2026 (USD MILLION)

10.5 REST OF THE WORLD

TABLE 206 REST OF THE WORLD: MARKET, BY TYPE OF SOLUTION, 2019–2026 (USD MILLION)

TABLE 207 REST OF THE WORLD: LIMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 208 REST OF THE WORLD: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 209 REST OF THE WORLD: MARKET, BY DEPLOYMENT MODEL, 2019–2026 (USD MILLION)

TABLE 210 REST OF THE WORLD: MARKET, BY INDUSTRY, 2019–2026 (USD MILLION)

TABLE 211 REST OF THE WORLD: MARKET FOR THE LIFE SCIENCES INDUSTRY, BY TYPE, 2019–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 188)

11.1 OVERVIEW

FIGURE 28 KEY DEVELOPMENTS OF PROMINENT PLAYERS OPERATING IN THE LABORATORY INFORMATICS MARKET (2018–2021)

11.2 MARKET RANKING

FIGURE 29 MARKET RANKING OF COMPANIES OPERATING IN THE LABORATORY INFORMATICS MARKET (2020)

11.3 MARKET SHARE ANALYSIS

TABLE 212 LIMS MARKET: DEGREE OF COMPETITION

FIGURE 30 MARKET SHARE ANALYSIS: LIMS MARKET

11.4 COMPANY EVALUATION QUADRANT

11.4.1 STARS

11.4.2 EMERGING LEADERS

11.4.3 PARTICIPANTS

11.4.4 PERVASIVE PLAYERS

FIGURE 31 LABORATORY INFORMATICS MARKET: COMPANY EVALUATION QUADRANT, 2020 (OVERALL MARKET)

11.5 COMPANY EVALUATION QUADRANT FOR EMERGING PLAYERS

11.5.1 PROGRESSIVE COMPANIES

11.5.2 RESPONSIVE COMPANIES

11.5.3 STARTING BLOCKS

11.5.4 DYNAMIC COMPANIES

FIGURE 32 LABORATORY INFORMATICS MARKET: COMPANY EVALUATION QUADRANT, 2020 (EMERGING PLAYERS)

11.6 COMPETITIVE BENCHMARKING

11.6.1 OVERALL FOOTPRINT OF COMPANIES

TABLE 213 OVERALL FOOTPRINT OF COMPANIES

11.6.2 PRODUCT FOOTPRINT OF COMPANIES

TABLE 214 PRODUCT FOOTPRINT OF COMPANIES

TABLE 215 COMPONENT FOOTPRINT OF COMPANIES

11.6.3 INDUSTRY FOOTPRINT OF COMPANIES

TABLE 216 INDUSTRY FOOTPRINT OF COMPANIES

11.6.4 REGIONAL FOOTPRINT OF COMPANIES

TABLE 217 REGIONAL FOOTPRINT OF COMPANIES

11.7 COMPETITIVE SCENARIO

11.7.1 PRODUCT LAUNCHES & UPGRADES

TABLE 218 LABORATORY INFORMATICS MARKET: KEY PRODUCT LAUNCHES & UPGRADES

11.7.2 DEALS

TABLE 219 LABORATORY INFORMATICS MARKET: KEY DEALS

11.7.3 OTHER DEVELOPMENTS

TABLE 220 LABORATORY INFORMATICS MARKET: OTHER KEY DEVELOPMENTS

12 COMPANY PROFILES (Page No. - 202)

(Business Overview, Products/Solutions Offered, Recent Developments, Winning Imperatives, Current Focus and Strategies, Threat From Competition, Right to Win)*

12.1 KEY PLAYERS

12.1.1 THERMO FISHER SCIENTIFIC, INC.

TABLE 221 THERMO FISHER SCIENTIFIC, INC.: BUSINESS OVERVIEW

FIGURE 33 THERMO FISHER SCIENTIFIC, INC.: COMPANY SNAPSHOT (2020)

TABLE 222 DEALS

TABLE 223 EXPANSIONS

12.1.2 LABVANTAGE SOLUTIONS, INC.

TABLE 224 LABVANTAGE SOLUTIONS, INC.: BUSINESS OVERVIEW

12.1.3 LABWARE

TABLE 225 LABWARE: BUSINESS OVERVIEW

12.1.4 ABBOTT INFORMATICS (A SUBSIDIARY OF ABBOTT LABORATORIES)

TABLE 226 ABBOTT LABORATORIES: BUSINESS OVERVIEW

FIGURE 34 ABBOTT LABORATORIES: COMPANY SNAPSHOT (2020)

12.1.5 WATERS CORPORATION

TABLE 227 WATERS CORPORATION: BUSINESS OVERVIEW

FIGURE 35 WATERS CORPORATION: COMPANY SNAPSHOT (2020)

12.1.6 LABLYNX, INC.

TABLE 228 LABLYNX, INC.: BUSINESS OVERVIEW

12.1.7 AGILENT TECHNOLOGIES, INC.

TABLE 229 AGILENT TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 36 AGILENT TECHNOLOGIES: COMPANY SNAPSHOT (2020)

12.1.8 DASSAULT SYSTÈMES

TABLE 230 DASSAULT SYSTÈMES: BUSINESS OVERVIEW

FIGURE 37 DASSAULT SYSTÈMES: COMPANY SNAPSHOT (2020)

TABLE 231 EXCHANGE RATES

12.1.9 PERKINELMER

TABLE 232 PERKINELMER: BUSINESS OVERVIEW

FIGURE 38 PERKINELMER: COMPANY SNAPSHOT (2020)

12.1.10 ACCELERATED TECHNOLOGY LABORATORIES

TABLE 233 ACCELERATED TECHNOLOGY LABORATORIES: BUSINESS OVERVIEW

12.1.11 LABWORKS

TABLE 234 LABWORKS: BUSINESS OVERVIEW

12.1.12 IDBS

TABLE 235 IDBS: BUSINESS OVERVIEW

12.1.13 ORACLE CORPORATION

TABLE 236 ORACLE CORPORATION: BUSINESS OVERVIEW

FIGURE 39 ORACLE CORPORATION: COMPANY SNAPSHOT (2020)

12.1.14 XYBION CORPORATION

TABLE 237 XYBION CORPORATION: BUSINESS OVERVIEW

*Business Overview, Products/Solutions Offered, Recent Developments, Winning Imperatives, Current Focus and Strategies, Threat From Competition, Right to Win might not be captured in case of unlisted companies.

12.2 OTHER PLAYERS

12.2.1 CALIBER UNIVERSAL

12.2.2 AGARAM TECHNOLOGIES

12.2.3 SIEMENS

12.2.4 COMPUTING SOLUTIONS, INC.

12.2.5 NOVATEK INTERNATIONAL

12.2.6 HORIZON LIMS (A PART OF REDARROW LABS)

12.2.7 ANJU SOFTWARE (A PORTFOLIO COMPANY OF ABRY PARTNERS)

12.2.8 EUSOFT LTD.

12.2.9 PROMIUM

12.2.10 APOLLOLIMS

12.2.11 LABTRACK

12.2.12 CLOUDLIMS

12.2.13 AUTOSCRIBE INFORMATICS

12.2.14 KINEMATIK

13 APPENDIX (Page No. - 251)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

This study involved four major activities in estimating the size of laboratory informatics market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

This research study involved widespread secondary sources; directories; databases such as Bloomberg Business, Factiva, and Dun & Bradstreet; white papers; annual reports; company house documents; investor presentations; and the SEC filings of companies.

Secondary research was used to identify and collect information useful for an extensive, technical, market-oriented, and commercial study of the laboratory informatics market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources are mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess prospects. Primary research was conducted to identify segmentation types; industry trends; key players; and key market dynamics such as drivers, restraints, opportunities, challenges, industry trends, and strategies adopted by key players

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the global laboratory informatics market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The revenue generated from the sale of laboratory informatics solutions and services by leading players has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the global laboratory informatics market on the basis of type of solution, component, deployment model, industry, and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets with respect to the individual growth trends, future prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to four main regions, namely, North America, Europe, Asia, and the Rest of the World (RoW)

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such as partnerships, agreements, mergers & acquisitions, expansions, product & service launches/upgrades, and R&D activities in the global laboratory informatics market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs.

The following customization options are available for this report.

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Laboratory Informatics Market

Which are the major growth influencing factors for the Laboratory Informatics Market?

Which are the major growth boosting factors for the North American region in the Laboratory Informatics Market?

By type of solutions, which of the segment will hold the major share of the Laboratory Informatics Market?