LED Packaging Market Size, Share, Industry Growth & Trends by Package Type (SMD, COB, CSP), Power Range (Low-&Mid-Power LED Packages, High-Power LED Packages), Wavelength (Visible & Infrared, Deep UV), Packaging Component (Equipment, Material), Application & Region - Global Forecast to 2029

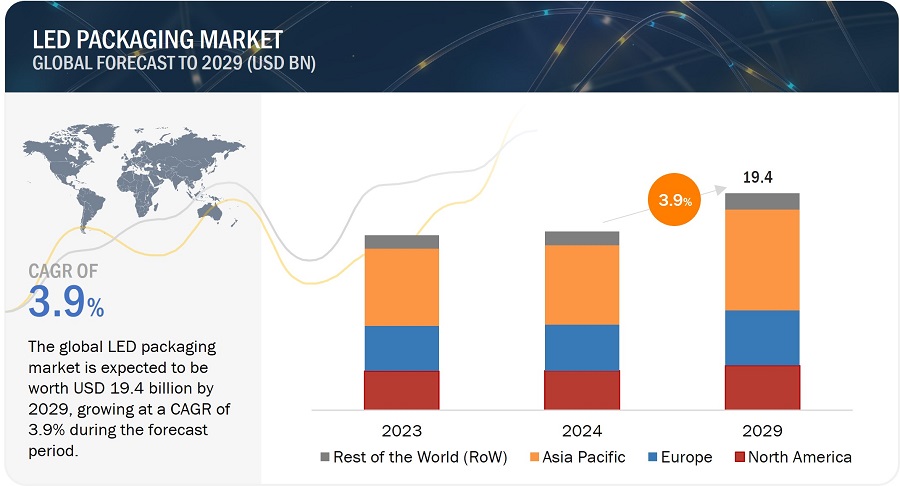

[225 Pages Report] The LED packaging market is estimated to be worth USD 16.0 billion in 2024 and is projected to reach USD 19.4 billion by 2029, at a CAGR of 3.9% during the forecast period. The acceleration adoption of mini and micro-LED technologies and growing demand for smart lighting systems are some of the major factors driving the market growth of LED packaging globally.

LED Packaging Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

LED Packaging Market Dynamics

Driver: Growing demand for smart lighting systems

The increasing demand for smart lighting solutions is expected to be a key driver in the LED packaging market. Smart lighting solutions presents a compelling proposition for businesses and homeowners as it offers substantial energy savings in comparison to traditional lighting alternatives. This energy efficiency, coupled with the growing awareness of sustainability, makes smart lighting a preferrable choice. The integration of artificial intelligence (AI) and machine learning (ML) into smart lighting systems further enhances their appeal, that provides personalized and efficient lighting solutions that can adapt to user preferences and environmental conditions. Therefore, the growing demand for smart lighting systems is expected to drive the growth of LED packaging market.

Restraint: Saturation of LED packaging market

The market saturation of LED packaging gives rise to various challenges that create challenges towards product acceptance, market growth, and profit margins. As the LED packaging market is a saturated market due to numerous manufacturers that are offering similar LED packaging solutions, the differentiation between these products may diminish. This will lead to a situation where customers may restrain themselves towards adopting new products, due to the large number of existing options that fulfill the basic requirements. This decline in product adoption is a key factor that restricts the overall growth of the LED packaging market.

Opportunity: The escalating adoption of mini and micro-LED technologies

The surge in demand for mini and micro-LED technologies is attributed to several factors such as technological advancements, energy efficiency, and IoT connectivity which propels the growth of the LED packaging market. This ongoing transition towards the adoption of mini and micro-LED technologies requires specialized packaging solutions to accommodate the smaller form factors, advanced technological features, and precise requirements. Furthermore, the technological advancements in chip design and assembly processes for mini and micro-LED have led to the growing need for innovative LED packaging.

Challenge: Absence of common open standards

The absence of common open standards for LED packaging can impact growth and adoption of the LED packaging market. The lack of standardized specifications and protocols creates a fragmented landscape wherein different component suppliers may use diverse standards or proprietary formats which leads to a lack of coordination and compatibility among various elements of LED packaging systems. This lack of coordination can result in inefficiencies in LED performance that hinders the overall advancement and acceptance of LED packaging technologies.

LED Packaging Market Ecosystem

The prominent players in the LED packaging market are NICHIA CORPORATION (Japan), ams-OSRAM AG. (Austria), Samsung (South Korea), Lumileds Holding B.V. (US), and Seoul Semiconductor Co., Ltd. (South Korea). These companies perform organic and inorganic growth strategies to expand themselves globally by providing new and advanced packaged LED solutions.

High-power LED packages to register highest CAGR in the LED packaging market during forecast period

The high-power LED packages market experiences a surge in demand driven by the increasing need from smartphone manufacturers to integrate high-power LEDs into flash lighting modules. This integration allows smartphone cameras to deliver excellent image quality in low-light environments. Additionally, factors such as lower power consumption, enhanced luminescence efficiency, and the growing prevalence of high-brightness applications contribute significantly to the expansion of the LED packaging market.

Others segment that includes applications such as disinfection, counterfeit detection, sensing devices, and keyboards is expected to have the highest CAGR in the LED packaging market during the forecast period.

The growing need for UV LEDs is anticipated to boost the market demand for LED packages in the future. UV LEDs in the UV-C band have the potential to revolutionize sterilization and disinfection practices that contribute towards safer conditions in medical facilities. Therefore, others segment that include applications such as disinfection, counterfeit detection, sensing devices, and keyboards is expected to have the highest CAGR in the LED packaging market during the forecast period.

Europe is expected to register for the second highest CAGR in the LED packaging during the forecast period

The expansion of the LED packaging market in Europe is attributed to the substantial growth in automotive and general lighting applications marked by technological advancements within these industries. Additionally, the increasing demand for emerging technologies like microLED, particularly in backlighting applications drives the market growth of LED packaging in Europe.

LED Packaging Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The major players in the LED packaging companies include NICHIA CORPORATION (Japan), ams-OSRAM AG. (Austria), Samsung (South Korea), Lumileds Holding B.V. (US), and Seoul Semiconductor Co., Ltd. (South Korea). These companies have used both organic and inorganic growth strategies such as product launches, partnerships, and agreements to strengthen their position in the market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2020–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Value (USD Million/Billion), Volume (Million Units) |

|

Segments covered |

By Packaging Component, Package Type, Power Range, Wavelength, Application, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of the World (RoW) |

|

Companies covered |

The major players in the LED packaging market are NICHIA CORPORATION (Japan), ams-OSRAM AG. (Austria), Samsung (South Korea), Lumileds Holding B.V. (US), Seoul Semiconductor Co., Ltd. (South Korea), MLS CO, LTD (China), EVERLIGHT ELECTRONICS CO., LTD. (Taiwan), SMART Global Holdings, Inc. (US), Foshan NationStar Optoelectronics Co. Ltd (China), and LITE-ON Technology, Inc. (Taiwan). |

LED Packaging Market Highlights

The study segments the LED packaging market based on packaging component, package type, power range, wavelength, application, and region at the regional and global level.

|

Segment |

Subsegment |

|

By Packaging Component |

|

|

By Package Type |

|

|

By Power Range |

|

|

By Wavelength |

|

|

By Application |

|

|

By Region |

|

Recent Developments

- In August 2021, NICHIA CORPORATION announced a joint-product development and collaboration with Zumtobel, an international supplier of holistic lighting solutions, to manufacture LED lighting with advanced human-centric lighting benefits.

- In September 2023, ams-OSRAM AG. And Malaysian Investment Development Authority (MIDA) announced a collaborative agreement in which MIDA significantly supports the initiative of ams-OSRAM AG to expand in Malaysia.

- In May 2023, Lumileds Holding B.V. announced the broadening of its CoB offerings by introducing LUXEON Core and LUXEON CX and the new LUXEON CS board sizes for enhanced design flexibility,

- In May 2023, Seoul Semiconductor Co., Ltd. announced the launch of the 2nd-generation LED technology, WICOP Pixel microLED technology, for future displays such as WICOP-Pixel-based microLED displays and Low Blue Light (LBL) displays that maintains the health of the users’ eyes.

- In September 2023, Samsung announced the launch of a new LED solution for outdoor lighting, 5050 LED. The 5050 LED possess enhanced reliability, performance, and cost efficiency.

Frequently Asked Questions (FAQs):

What is the current size of the global LED packaging market?

The LED packaging market is estimated to be worth USD 16.0 billion in 2024 and is projected to reach USD 19.4 billion by 2029, at a CAGR of 3.9% during the forecast period. The acceleration adoption of mini and micro-LED technologies and growing demand for smart lighting systems are some of the major factors driving the market growth LED packaging globally.

Who are the winners in the global LED packaging market?

Companies such as NICHIA CORPORATION (Japan), ams-OSRAM AG. (Austria), Samsung (South Korea), Lumileds Holding B.V. (US), and Seoul Semiconductor Co., Ltd. (South Korea), fall under the winners category.

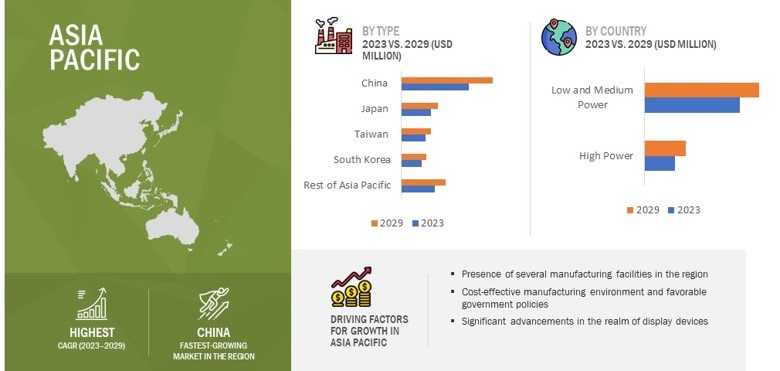

Which region is expected to hold the highest market share?

Asia Pacific is expected to dominate the LED packaging market during forecast period. Significant advancements in the realm of display devices, accompanied by swift adoptions of emerging technologies and presence of manufacturing facilities are the major factors driving the market growth in Asia Pacific.

What are the major drivers and opportunities related to the LED packaging market?

The acceleration adoption of mini and micro-LED technologies and growing demand for smart lighting systems are some of the major drivers and opportunities for LED packaging market.

What are the major strategies adopted by market players?

The key players have adopted product launches, partnerships, agreements and acquisitions to strengthen their position for the LED packaging market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

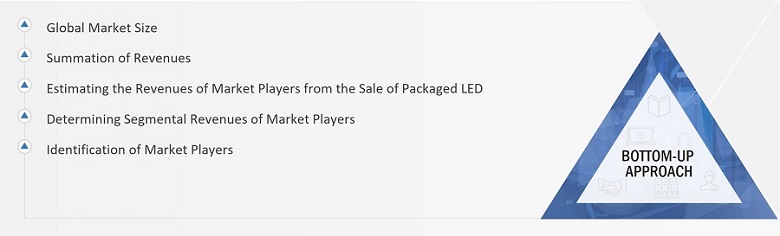

The research study involved 4 major activities in estimating the size of the LED packaging market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The validation of these findings, assumptions, and sizing with the help of primary research with industry experts across the supply chain has been the next step. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information required for this study. The secondary sources include annual reports, press releases, and investor presentations of companies, white papers, and articles from recognized authors. Secondary research has been mainly done to obtain key information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, regional outlook and developments from both market and technology perspectives.

Primary Research

In primary research, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative insights required for this report. Primary sources from supply side include experts such as CEOs, vice presidents, marketing directors, manufacturers, technology and innovation directors, end users and related executives from multiple key companies and organizations operating in the LED packaging market ecosystem.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches have been used along with data triangulation methods to estimate and validate the size of the LED packaging market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Identifying stakeholders in the LED packaging market that influence the entire market, along with participants across the value chain.

- Analyzing major manufacturers of LED packaging and studying their product portfolios

- Analyzing trends related to the adoption of LED packaging

- Tracking the recent and upcoming developments in the market that include investments, R&D activities, product launches, partnerships and agreements, as well as forecasting the market size based on these developments and other critical parameters

- Carrying out multiple discussions with key opinion leaders to identify the adoption trends of packaged LEDs

- Segmenting the overall market into various other market segments

- Validating the estimates at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts at MarketsandMarkets

Market Size Estimation Methodology-Bottom-up Approach

Market Size Estimation Methodology-Top-down Approach

Data Triangulation

After arriving at the overall market size by the market size estimation process explained in the earlier section, the overall LED packaging market has been divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures have been used, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply side perspectives. Along with data triangulation and market breakdown, the market has been validated by top-down and bottom-up approaches.

Market Definition

LED packages are defined as assemblies that house LED chip(s). Through packaging, LED chips and welded lead wires are protected from being in contact with the external environment. Also, packaging improves luminescence efficiency and ensures that diode chips function properly, and export visible light effectively. LED packages have empowered the lighting industry to overcome the challenges of high lumen maintenance and high-power consumption and helped in the extension of lifespan and reduction of carbon footprint. Various types of LED packages, including surface-mount device package (SMD), chip-on-board package (COB), chip-scale package (CSP), dual in-line package (DIP), and chip-on-flex (COF) LEDs, are available for various end-use applications. Package type refers to how LED semiconductor dies are integrated into LED technology-based devices used in different applications. Various applications of LED packages include general lighting, automotive lighting, backlighting, flash lighting, and industrial, among others.

Stakeholders

- Raw material suppliers

- Equipment manufacturers

- Material Suppliers

- Packaged LED manufacturer

- Semiconductor product designers and fabricators

- Regulatory bodies

- Semiconductor intellectual property vendors

- Assembly, testing, and packaging vendors

- Distributors and Resellers

- End Users

The main objectives of this study are as follows:

- To define, analyze and forecast the LED packaging market size, by package type, packaging component, power range, wavelength, application, and region, in terms of value.

- To define, analyze and forecast the LED packaging market size, by package type, in terms of volume

- To forecast the market size for various segments with respect to four main regions, namely, North America, Europe, Asia Pacific, and Rest of the World

- To provide detailed information regarding the major drivers, restraints, opportunities, and challenges influencing the growth of the LED packaging market

- To study the complete value chain and related industry segments for the LED packaging market

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the market ecosystem; trends/disruptions impacting customer’s business; technology analysis; pricing analysis; Porter’s five forces model; key stakeholders & buying criteria; case study analysis; trade analysis; patent analysis; key conferences & events, 2024–2025; and tariff and regulations related to the LED packaging market.

- To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the market.

- To strategically profile the key players and comprehensively analyze their market position in terms of ranking and core competencies2, along with detailing the competitive landscape for the market leaders.

- To analyze competitive developments such as product launches, partnerships, agreements, and research and development (R&D) activities carried out by players in the LED packaging market.

Customizations Options:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Information

- Detailed analysis of additional countries (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in LED Packaging Market