Leukapheresis Market by Product (Devices, Filters, Membrane Separators), Leukopak (Mobilized, Non-Mobilized), Indication (ALL, NHL, Multiple Myeloma), Application (Research, Therapeutic), End User (Hospitals, Pharma, Biotech) & Region - Global Forecast to 2028

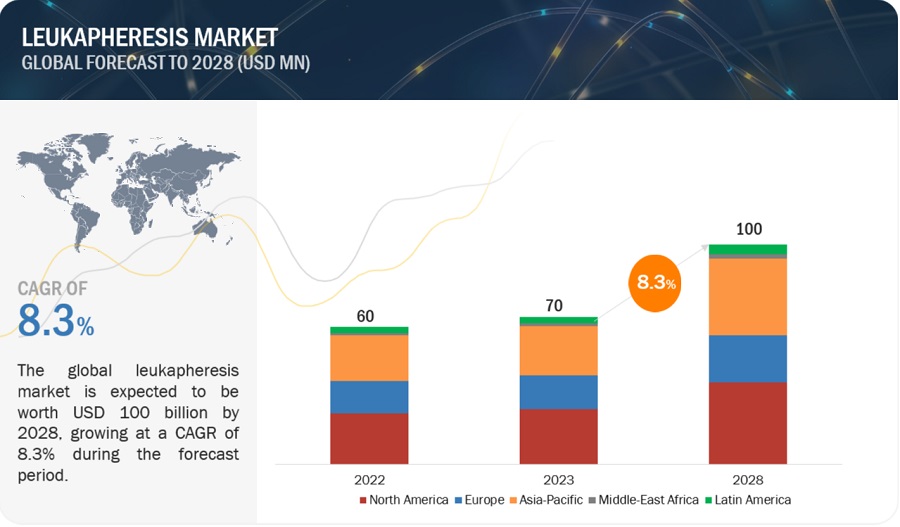

- The global leukapheresis market in terms of revenue was estimated to be worth $70 million in 2023 and is poised to reach $100 million by 2028, growing at a CAGR of 8.3% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

The global leukopaks market was estimated to be worth USD 200 million in 2023 and is poised to reach USD 1020 million by 2028, growing at a CAGR of 38.1%.

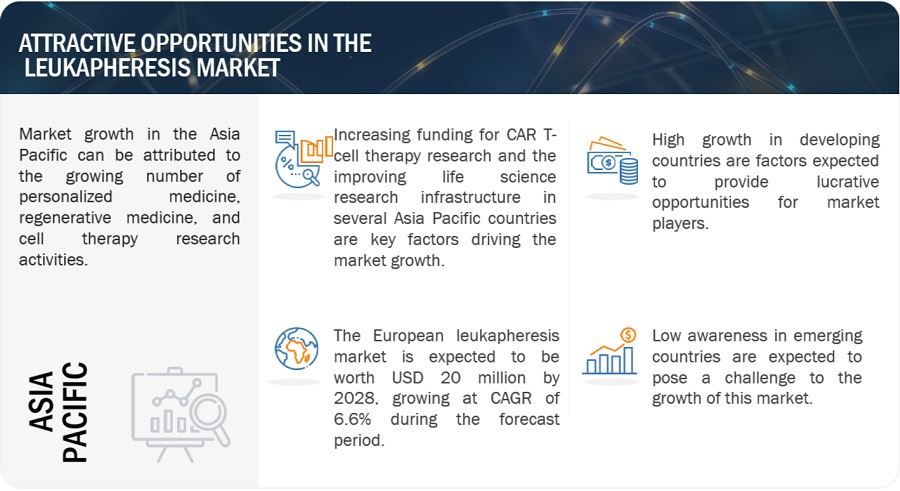

One of the key trends in the leukapheresis market is the increasing use of leukopaks in CAR T-cell therapy. CAR T-cell therapy is a type of immunotherapy that uses the patient's own immune cells to fight cancer. It is a promising new treatment for leukemia and other blood cancers. Leukopaks are used to collect the patient's immune cells, which are then modified to fight cancer. Other trends in the leukapheresis market include the increasing demand for leukopaks in personalized medicine and the development of new leukopak collection and storage methods.

Attractive Opportunities in the Leukapheresis Products Market

To know about the assumptions considered for the study, Request for Free Sample Report

Leukapheresis Market Dynamics

Driver: Increased demand for leukopaks in clinical research

Leukopaks are enriched leukapheresis products collected from peripheral blood and consist of various blood cells, including lymphocytes, monocytes, and dendritic cells. Leukopaks are a good source of a variety of immune cells. The need for human cells in any kind of research in the fields of oncology, immunotherapy, or cell biology is the key factor supporting the demand for leukopaks.

On the other hand, pharmaceutical and biotechnology companies have shown a greater focus on developing cell-based immunotherapies, such as CAR-T therapy for leukemia. CAR-T therapy involves using T-cells isolated from leukopaks for the development of genetically altered chimeric antigen receptor T-cells. Approximately 300 pharmaceutical companies are engaged in CAR-T therapy R&D. According to ClinicalTrials.gov, as of August 2023, 316 CAR T-cell-related studies are underway in the US. As of April 2023, six CAR T cell therapies have been approved, indicating unprecedented efficacy in patients with B-cell malignancies and multiple myeloma. Nonetheless, adverse events such as cytokine release syndrome and immune effector cell-associated neurotoxicity pose substantial challenges to CAR T cell therapy.

Restraint: Complications associated with therapeutic leukapheresis

Therapeutic leukapheresis is associated with certain complications, such as those arising from a decreased WBC count and the possibility of adverse interactions with anticoagulation solutions. Moreover, there may be discomfort, pain, redness, and bruising at the venipuncture site. The procedure may also cause patients to feel dizzy for a short duration and cause loss of consciousness.

Hypocalcemia, decreased calcium levels also occurs in a large volume of leukapheresis procedures. Slowing the procedure, decreasing the amount of anticoagulation, and administering oral or intravenous calcium supplementation are recommended in such conditions.

Furthermore, minor degrees of RBC or platelet loss have been reported. Apheresis systems separate WBCs and return the remaining blood to the patient according to different manufacturer settings that may influence hemoglobin or hematocrit levels. This could create major risks for donors with a history of anemia and thrombocytopenia.

WBC transfusion for the treatment of neutropenia and granulocyte deficiencies increases the risk of causing an immune response against transfused WBCs. Major complications associated with therapeutic leukapheresis procedures include pulmonary leukostasis, acute renal failure, and sometimes even death.

Opportunity: Gaps in current leukapheresis technologies

The gaps in current technologies are primarily linked to incomplete or non-cost-effective removal or separation efficiency of bio-products, potential side effects to patients and damage induced to cells during the extraction processes. According to a 2021 study published in the Royal Society of Chemistry, further research needs to take place on interfacial chemistries between the blood and the membrane materials it interacts with.

Additionally, biocompatible materials such as amphiphilic/zwitterionic polymers can also be explored as coating materials for use in leukapheresis membranes for enhanced hemocompatibility. These present opportunities areas to fill the gaps in leukapheresis technologies for the various manufacturers of various leukapheresis products and researchers in the market.

Challenge: Blood transfusion safety in developing countries

Blood transfusion is a life-saving medical procedure that involves the transfer of blood or blood products from a healthy donor to a recipient. It is used to treat a variety of medical conditions, including anemia, hemorrhage, and cancer. The risk of transfusion-transmitted infections (TTIs) is high in developing countries. TTIs are infections that can be transmitted through blood transfusion. Some of the most common TTIs include HIV, hepatitis B, and hepatitis C. The leukepheresis market is also a major concern in developing countries. This is due to the high cost of leukapheresis equipment and procedures. In addition, there is often a shortage of qualified personnel to perform leukapheresis.

Despite these challenges, there are a number of developments that are being made to improve blood transfusion safety in developing countries. These developments include the development of new blood safety technologies, the training of healthcare workers and the development of blood safety policies and regulations. The improvement of blood transfusion safety in developing countries is a complex challenge. However, the developments that are being made are helping to make blood transfusion safer for patients in these countries.

According to the World Health Organization (WHO), TTIs are responsible for an estimated 1.5 million deaths each year. The risk of TTIs is highest in developing countries, where the infrastructure and resources for blood safety are often lacking. In sub-Saharan Africa, for example, the risk of HIV transmission through blood transfusion is estimated to be 1 in 250. The WHO has set a goal of making blood transfusion safe in all countries by 2020. However, this goal is unlikely to be met, as many developing countries are still struggling to improve blood transfusion safety.

Despite the challenges, there are a number of reasons to be hopeful about the future of blood transfusion safety in developing countries. The developments that are being made, such as the development of new blood safety technologies and the training of healthcare workers, are helping to make blood transfusion safer for patients in these countries. With continued efforts, it is possible to make blood transfusion safe for everyone, regardless of where they live.

Leukapheresis Market Ecosystem

Leading players in this market include well-established and financially stable manufacturers of leukapheresis. These companies have been operating in the market for several years and possess a diversified product portfolio, advanced technologies, and strong global presence. Prominent companies in this market include Asahi Kasei Corporation (Japan), Fresenius SE & Co. KGaA (Germany), Haemonetics Corporation (US), Terumo BCT, Inc. (US), Macopharma SA (France), and Miltenyi Biotec (Germany).

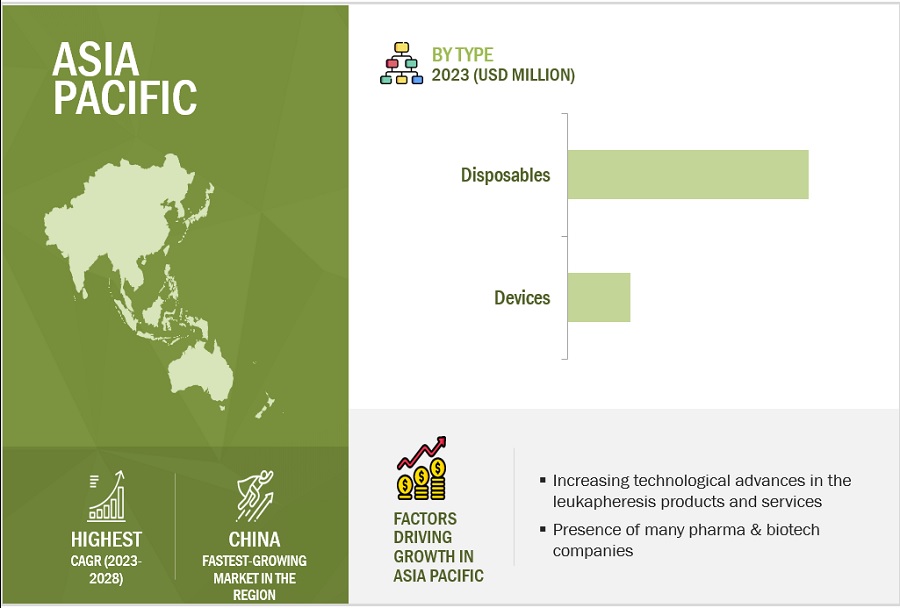

The leukapheresis devices segment is expected to register the highest CAGR during the forecast period.

The leukapheresis devices segment is projected to grow at the highest CAGR during 2023 to 2028. The growth of the leukapheresis devices market can largely be attributed to the increasing number of therapeutic leukapheresis procedures conducted for the treatment of leukemia, immune-mediated inflammatory diseases, and inflammatory bowel diseases. The increasing adoption of leukapheresis instruments by blood collection centers is another major factor supporting market growth.

The centrifugal devices segment of leukapheresis industry is expected to register the highest CAGR during the forecast period.

The centrifugal devices segment of the leukapheresis market is projected to grow at a higher CAGR during the forecast period 2023 to 2028. Centrifugal apheresis devices are widely used for leukapheresis, blood collection, automated blood component separation, therapeutic plasma exchange, and erythrocytapheresis. Some of the players offering centrifugal devices are Haemonetics Corporation (US), Nikkiso Co., Ltd. (Japan), MacoPahrma SA (France), Terumo BCT (US) and Fresenius Kabi (Germany).

APAC is estimated to be the fastest-growing regional market for leukapheresis industry.

In 2022, North America accounted for the largest share of the leukapheresis market. Factors like the developed healthcare system in the US and Canada, the presence of a large number of leukopak manufacturing companies in the region, and the easy accessibility to technologically advanced blood separation devices contribute to the growth of this region. Additionally, in 2022, APAC is estimated to be the fastest-growing regional market for leukapheresis. This growth is driven by factors such as the presence of a large number of pharma & biotech companies and research institutes in China and India and the improving life science research infrastructure in several Asia Pacific countries contribute to the growth of this region.

To know about the assumptions considered for the study, download the pdf brochure

Key players in the leukapheresis market include Asahi Kasei Corporation (Japan), Fresenius SE & Co. KGaA (Germany), Haemonetics Corporation (US), Terumo BCT, Inc. (US), Macopharma SA (France), and Miltenyi Biotec (Germany).

Some prominent players in the leukapheresis market are Discovery Life Sciences (US), StemExpress, LLC (US), Charles River Laboratories International, Inc. (US), Caltag Medsystems Limited (UK), Lonza Group AG (Switzerland), and ZenBio (US). These companies adopted strategies such as service launches, business expansions, agreements, partnerships, and acquisitions to strengthen their presence in the Leukapheresis market.

Scope of the Leukapheresis Industry:

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$70 million |

|

Estimated Value by 2028 |

$100 million |

|

Revenue Rate |

Poised to grow at a CAGR of 8.3% |

|

Market Driver |

Increased demand for leukopaks in clinical research |

|

Market Opportunity |

Gaps in current leukapheresis technologies |

The study categorizes the leukapheresis market to forecast revenue and analyze trends in each of the following submarkets:

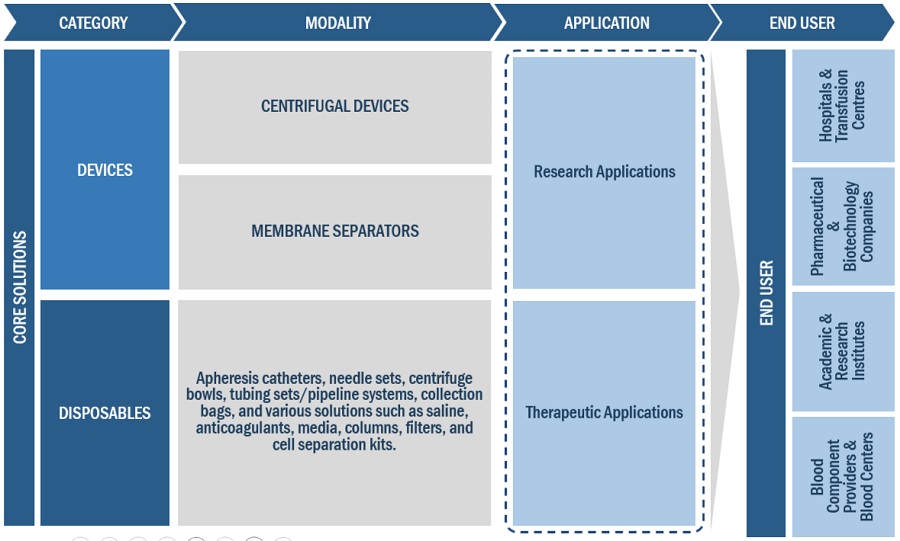

By Leukapheresis Products

By Product Type

-

Leukapheresis Devices

- Centrifugal Devices

- Membrane Separators

- Leukapheresis Disposables

By Application

- Research Applications

- Therapeutic Applications

By End User

- Hospitals & Transfusion Centers

- Component Providers & Blood Centers

- Academic & Research Institutes

- Pharmaceutical & Biotechnology Companies

By Leukopaks

By Type

- Mobilized Leukopaks

- Non-Mobilized Leukopaks

- Diseased Leukopaks

- Isolated PBMCs

By Indications

- Acute Lymphocytic Leukemia

- Chronic Lymphocytic Leukemia

- Non-Hodgkin’s Lymphoma

- Multiple Myeloma

- Hepatocellular Carcinoma

- Pancreatic Cancer

- Other Indications

By End User

- Contract Research Organizations (CROs)

- Academic & Research Institutes

- Pharmaceutical & Biotechnology Companies

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

Recent Developments of Leukapheresis Industry

- In May 2022, Fresenius Kabi (Germany) acquired Ivenix, Inc. (US). This acquisition adds a next-generation infusion therapy platform for the significant US market to Fresenius Kabi’s portfolio and provides the company with key capabilities in hospital connectivity.

- In March 2022, Charles River Laboratories International Inc. (US) acquired Retrogenix Limited (UK) to enhance the company’s scientific expertise with additional large molecule and cell therapy discovery capabilities.

- In November 2021, Discovery Life Sciences (US) announced the launch of the Discovery BIOstore, which provides real-time access to Discovery’s inventory of millions of human biospecimens to scientists.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global leukapheresis market?

The global leukapheresis market boasts a total revenue value of $100 million by 2028.

What is the estimated growth rate (CAGR) of the global leukapheresis market?

The global leukapheresis market has an estimated compound annual growth rate (CAGR) of 8.3% and a revenue size in the region of $70 million in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the leukapheresis market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the leukapheresis market. The primary sources from the demand side included industry experts, purchase & sales managers, doctors, and personnel from research organizations. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

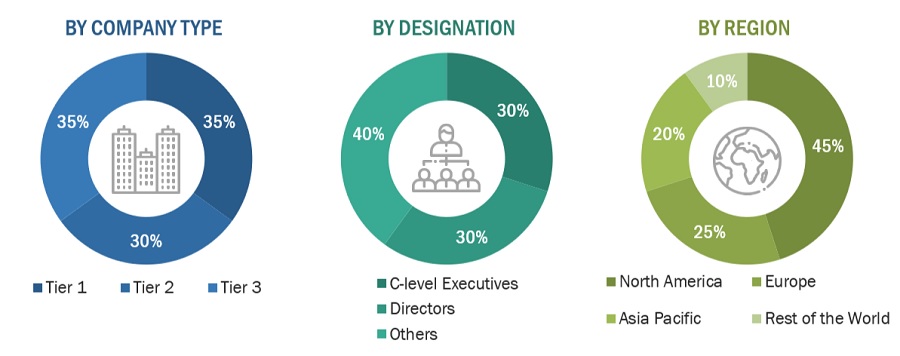

Breakdown of Primary Interviews the Leukapheresis Products Market: Supply-Side Participants by Company Type, Designation, and Region

Note 1: C-level primaries include CEOs, COOs, CTOs, and VPs.

Note 2: Other primaries include sales managers, marketing managers, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2022: Tier 1= >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3= <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

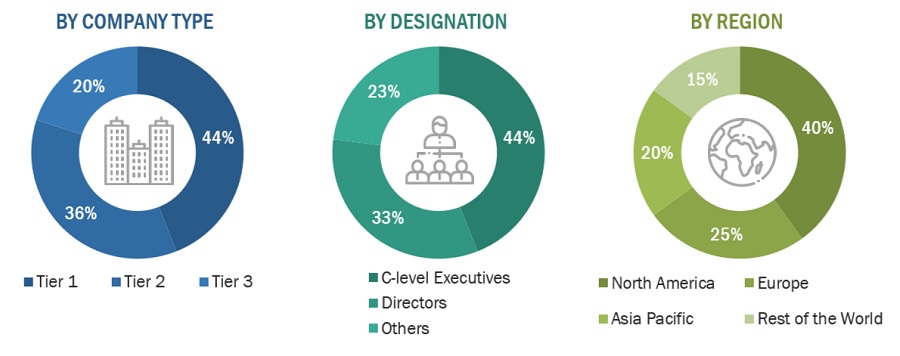

Breakdown of Primary Interviews in the Leukopaks Market: Supply-Side Participants by Company Type, Designation, and Region

Note 1: C-level primaries include CEOs, COOs, CTOs, and VPs.

Note 2: Other primaries include sales managers, marketing managers, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2022: Tier 1= >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3= <USD 500 million

Market Size Estimation

The total size of the leukapheresis market was arrived at after data triangulation from three different approaches, as mentioned below. After each approach, the weighted average of the three approaches was taken based on the level of assumptions used in each approach. The same approach was used for the leukopaks market.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Leukapheresis is the process of separating white blood cells from the whole blood. Therapeutic leukapheresis procedures are used to treat hyperleukocytosis leukemia, including acute lymphoblastic leukemia (ALL), chronic lymphocytic leukemia (CLL), multiple myeloma, and non-Hodgkin’s lymphoma.

Leukopaks are enriched leukapheresis products that contain mononuclear leukocytes (lymphocytes and monocytes) and are used to develop cell-based therapeutics.

Key Stakeholders

- Apheresis Device Manufacturers and Distributors

- Leukapheresis Product Manufacturers and Distributors

- Leukopak Manufacturers and Distributors

- Pharmaceutical and Biotechnology Companies

- Healthcare Service Providers (including Hospitals and Transfusion Centers)

- Cancer Treatment Centers

- Blood Component Providers & Blood Centers

- Contract Research Organizations (CROS)

- Academic and Research Institutes

- Government Associations

- Market Research and Consulting Firms

- Venture Capitalists and Investors

Objectives of the Study

- To define, describe, and forecast the leukapheresis products market by type, application, end-user, and region

- To define, describe, and forecast the leukopaks market by type, indication, end-user, and region

- To strategically analyze the industry trends, technology trends, pricing analysis, regulatory scenario, supply/value chain, ecosystem/market map, Porter’s Five Forces, trade & patent analysis, key stakeholders & buying criteria, and conferences & events

- To provide detailed information about the factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze micro markets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the market size based on region in Europe, North America, the Asia Pacific, Latin America, and the Middle East and Africa

- To strategically profile key players in the leukapheresis market and comprehensively analyze their core competencies

- To track and analyze competitive developments such as acquisitions, product launches, approvals, expansions, and partnerships

- To analyze the impact of the recession on the leukapheresis market

Available customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the RoE leukapheresis market into Austria, Finland, and others

- Further breakdown of the RoLATAM leukapheresis market into Brazil, Mexico, Argentina, Colombia, Chile, and others

Competitive Landscape Assessment

- Market share analysis for the North America and Europe region, which provides market shares of the top 3–5 key players in the leukapheresis market

- Competitive leadership mapping for established players in the US

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Leukapheresis Market